📌OPUSDT | Long Setup | Ascending-Channel Reclaim vs. Unlock Overhang | Sep 3, 2025

🔹 Thesis Summary

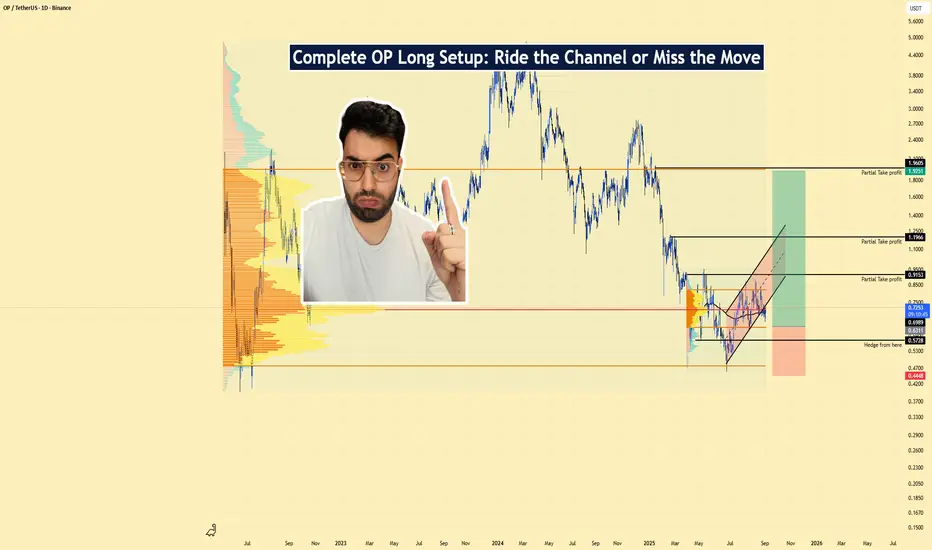

OP is basing after a deep drawdown while price grinds higher inside a rising channel. With >50% of supply already unlocked and TVL near $500M supporting 97 protocols (UNI, SNX, VELO), the risk/reward favors a defined-risk long into resistance reclaim.

🔹 Trade Setup

Bias: Long

Entry Zone: $0.68 – $0.75 (pullbacks into channel support/VWAP cluster)

Stop Loss (invalidation): $0.5728 (loss of channel + “hedge from here” level)

Hard Backstop (catastrophic): $0.4468

Take-Profits:

TP1: $0.9153

TP2: $1.1956

TP3 / Max: $1.9525 – $2.00

Indicative R:R from $0.715 midpoint → $0.5728 stop:

TP1 ≈ 1.41x, TP2 ≈ 3.38x, TP3 ≈ 8.70x.

🔹 Narrative & Context

Structure: OP reclaimed a higher-low structure inside a clean ascending channel. Volume profile shows acceptance in the $0.60–$0.75 band; above $0.80–$0.92 sits a low-resistance pocket into $1.20, then the prior breakdown shelf near $1.95–$2.00.

Sector positioning: As an Ethereum L2 using optimistic rollups, Optimism inherits L1 security while offering cheaper throughput—key into any ETH-led rotation.

Seasonality/performance context: 2023 delivered a late-year impulse (~+301%), while 2024–2025 have been distribution years (~-56% / -61% YTD). Mean path favors relief rallies when flows return; average path sits near ~4%.

Tokenomics & unlocks (supply map): ~50.33% of OP is unlocked; Core Contributors ~33.35%, Future Airdrops ~24.57%, Ecosystem funds ~25%. Unlocks continue toward 2026—supply overhang is known and increasingly priced.

Where this fits technically: The chart’s labeled targets ($0.915 / $1.196 / $1.953) line up with prior HVNs/inefficiencies. Keeping risk below $0.5728 respects the current value area.

🔹 Valuation & Context

MC/TVL ≈ 3.1x (Unlocked Mkt Cap ~$1.55B ÷ TVL ~$0.50B) → Market pays ~$3 for each $1 secured on OP → Reasonable if TVL and sequencer revenues expand with an ETH up-cycle → Supports a re-rating toward prior shelves.

Inflation ≈ 2% / yr → Predictable dilution vs. many higher-emission assets → Puts focus on unlock schedule rather than ongoing issuance → Aligns with staged take-profits.

Unlock Progress ~50% → Overhang persists but more than half is circulating → Weakens marginal unlock impact over time → Favors buying liquidity sweeps into support rather than chasing breakouts.

🔹 Contrarian Angle (Your Edge)

Consensus fixates on unlock supply and the 2024–2025 drawdown. The structure + acceptance above $0.68 argues the overhang is largely priced. If ETH volatility compresses then expands upward, OP can revisit $0.92 / $1.20 quickly and test $1.95–$2.00 on a broader L2 rotation.

🔹 Risks

Unlock overhang / treasury distribution timing compresses rallies.

Sector rotation away from L2s toward alt-L1s or BTC dominance.

ETH beta risk: ETH weakness or elevated gas stagnates activity/revenues.

🔹 Macro Considerations

Track BTC/ETH trend, ETH volatility regime, and risk-on breadth.

Flows & incentives: Any L2 incentive programs or airdrop cycles can accelerate TVL/usage.

Calendar: Monitor OP unlock dates and major ETH events; fade into those if positioning is crowded.

🔹 Bottom Line

This is a defined-risk long into a constructive channel with clearly mapped targets. Supply risks are known; structural reclaim plus sector beta argues for measured exposure and staged exits. Above $0.92, momentum can extend toward $1.20 and potentially $1.95–$2.00.

🔹 Forward Path

If this post gains traction, I’ll follow up with: weekly structure map, confirmation triggers above $0.92, and updates around unlock windows.

Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out.

⚠️ Disclaimer: This is not financial advice. Do your own research. Charts may include AI-assisted visuals.

🔹 Footnote

Forward P/E: Price divided by expected earnings over the next 12 months. Lower = cheaper relative to profits.

P/FCF (Price-to-Free-Cash-Flow): Price vs. the cash left after investments. A measure of efficiency.

FCF Yield: Free cash flow per share ÷ price per share. Higher = more cash returned for each dollar invested.

ROE (Return on Equity): Net income ÷ shareholder equity. Shows management efficiency with investor capital.

ROIC (Return on Invested Capital): Net income ÷ all invested capital (equity + debt). A purer profitability gauge.

Debt/Equity: Debt divided by equity. <1 usually means balance sheet is conservative.

R:R (Risk-to-Reward): Ratio of expected upside vs. downside. 3:1 = you risk $1 to make $3.

🔹 Thesis Summary

OP is basing after a deep drawdown while price grinds higher inside a rising channel. With >50% of supply already unlocked and TVL near $500M supporting 97 protocols (UNI, SNX, VELO), the risk/reward favors a defined-risk long into resistance reclaim.

🔹 Trade Setup

Bias: Long

Entry Zone: $0.68 – $0.75 (pullbacks into channel support/VWAP cluster)

Stop Loss (invalidation): $0.5728 (loss of channel + “hedge from here” level)

Hard Backstop (catastrophic): $0.4468

Take-Profits:

TP1: $0.9153

TP2: $1.1956

TP3 / Max: $1.9525 – $2.00

Indicative R:R from $0.715 midpoint → $0.5728 stop:

TP1 ≈ 1.41x, TP2 ≈ 3.38x, TP3 ≈ 8.70x.

🔹 Narrative & Context

Structure: OP reclaimed a higher-low structure inside a clean ascending channel. Volume profile shows acceptance in the $0.60–$0.75 band; above $0.80–$0.92 sits a low-resistance pocket into $1.20, then the prior breakdown shelf near $1.95–$2.00.

Sector positioning: As an Ethereum L2 using optimistic rollups, Optimism inherits L1 security while offering cheaper throughput—key into any ETH-led rotation.

Seasonality/performance context: 2023 delivered a late-year impulse (~+301%), while 2024–2025 have been distribution years (~-56% / -61% YTD). Mean path favors relief rallies when flows return; average path sits near ~4%.

Tokenomics & unlocks (supply map): ~50.33% of OP is unlocked; Core Contributors ~33.35%, Future Airdrops ~24.57%, Ecosystem funds ~25%. Unlocks continue toward 2026—supply overhang is known and increasingly priced.

Where this fits technically: The chart’s labeled targets ($0.915 / $1.196 / $1.953) line up with prior HVNs/inefficiencies. Keeping risk below $0.5728 respects the current value area.

🔹 Valuation & Context

MC/TVL ≈ 3.1x (Unlocked Mkt Cap ~$1.55B ÷ TVL ~$0.50B) → Market pays ~$3 for each $1 secured on OP → Reasonable if TVL and sequencer revenues expand with an ETH up-cycle → Supports a re-rating toward prior shelves.

Inflation ≈ 2% / yr → Predictable dilution vs. many higher-emission assets → Puts focus on unlock schedule rather than ongoing issuance → Aligns with staged take-profits.

Unlock Progress ~50% → Overhang persists but more than half is circulating → Weakens marginal unlock impact over time → Favors buying liquidity sweeps into support rather than chasing breakouts.

🔹 Contrarian Angle (Your Edge)

Consensus fixates on unlock supply and the 2024–2025 drawdown. The structure + acceptance above $0.68 argues the overhang is largely priced. If ETH volatility compresses then expands upward, OP can revisit $0.92 / $1.20 quickly and test $1.95–$2.00 on a broader L2 rotation.

🔹 Risks

Unlock overhang / treasury distribution timing compresses rallies.

Sector rotation away from L2s toward alt-L1s or BTC dominance.

ETH beta risk: ETH weakness or elevated gas stagnates activity/revenues.

🔹 Macro Considerations

Track BTC/ETH trend, ETH volatility regime, and risk-on breadth.

Flows & incentives: Any L2 incentive programs or airdrop cycles can accelerate TVL/usage.

Calendar: Monitor OP unlock dates and major ETH events; fade into those if positioning is crowded.

🔹 Bottom Line

This is a defined-risk long into a constructive channel with clearly mapped targets. Supply risks are known; structural reclaim plus sector beta argues for measured exposure and staged exits. Above $0.92, momentum can extend toward $1.20 and potentially $1.95–$2.00.

🔹 Forward Path

If this post gains traction, I’ll follow up with: weekly structure map, confirmation triggers above $0.92, and updates around unlock windows.

Like & Follow for structured ideas, not signals. I post high-conviction setups here before broader narratives play out.

⚠️ Disclaimer: This is not financial advice. Do your own research. Charts may include AI-assisted visuals.

🔹 Footnote

Forward P/E: Price divided by expected earnings over the next 12 months. Lower = cheaper relative to profits.

P/FCF (Price-to-Free-Cash-Flow): Price vs. the cash left after investments. A measure of efficiency.

FCF Yield: Free cash flow per share ÷ price per share. Higher = more cash returned for each dollar invested.

ROE (Return on Equity): Net income ÷ shareholder equity. Shows management efficiency with investor capital.

ROIC (Return on Invested Capital): Net income ÷ all invested capital (equity + debt). A purer profitability gauge.

Debt/Equity: Debt divided by equity. <1 usually means balance sheet is conservative.

R:R (Risk-to-Reward): Ratio of expected upside vs. downside. 3:1 = you risk $1 to make $3.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.