Most of us watch the stock first and everything else later.

But with Oracle, the first warning didn’t come from the chart at all — it came from the credit market.

A quick explanation for anyone new to this:

A Credit Default Swap (CDS) is just insurance on a company’s debt.

If people feel the company is getting riskier, the cost of that insurance goes up.

That’s it. Nothing fancy.

Over the last year, Oracle’s CDS cost has been climbing way faster than you’d expect for a big, steady name. It wasn’t front-page news, but it was unusual enough to pay attention to.

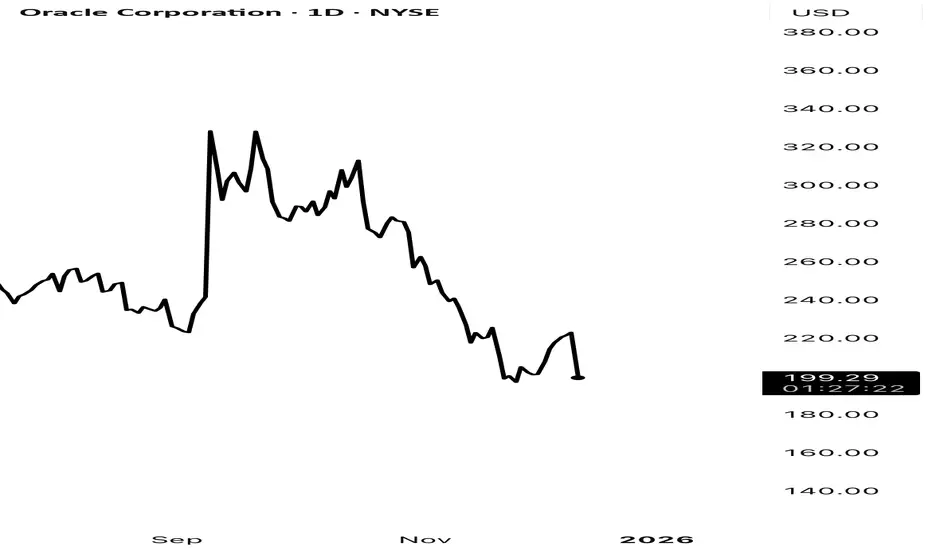

And then today’s 11% drop happened.

It honestly reminded me of that moment in The Big Short when Burry kept pointing at the CDS market while everyone else stared at the stock prices. He wasn’t predicting a disaster — he just noticed that the credit market was reacting long before the stock market cared.

Oracle isn’t a “Big Short” situation, obviously.

But the pattern is familiar: credit markets usually move first, stocks catch up later.

That’s really all there is to it.

No drama — just a quiet signal finally showing up on the chart.

Disclaimer: Educational only. Not investment advice. DYOR

But with Oracle, the first warning didn’t come from the chart at all — it came from the credit market.

A quick explanation for anyone new to this:

A Credit Default Swap (CDS) is just insurance on a company’s debt.

If people feel the company is getting riskier, the cost of that insurance goes up.

That’s it. Nothing fancy.

Over the last year, Oracle’s CDS cost has been climbing way faster than you’d expect for a big, steady name. It wasn’t front-page news, but it was unusual enough to pay attention to.

And then today’s 11% drop happened.

It honestly reminded me of that moment in The Big Short when Burry kept pointing at the CDS market while everyone else stared at the stock prices. He wasn’t predicting a disaster — he just noticed that the credit market was reacting long before the stock market cared.

Oracle isn’t a “Big Short” situation, obviously.

But the pattern is familiar: credit markets usually move first, stocks catch up later.

That’s really all there is to it.

No drama — just a quiet signal finally showing up on the chart.

Disclaimer: Educational only. Not investment advice. DYOR

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.