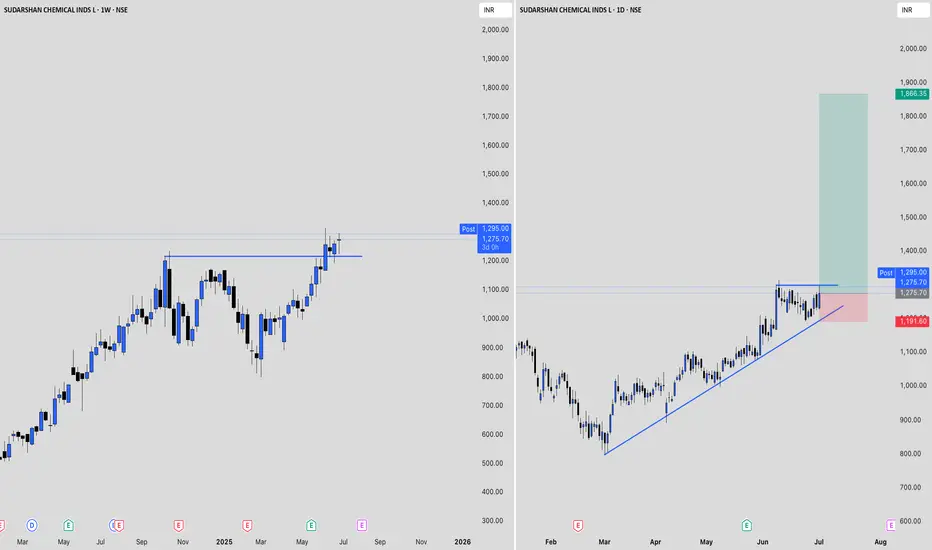

Sudarshan Chemical Industries is currently trading around ₹1,256, having gained nearly 5% in the past week and over 6% in the last month. The stock has delivered a strong 10% return over six months and nearly 40% over the past year, reflecting robust momentum. Its 52-week high is ₹1,315, while the low stands at ₹796, placing the current price close to its yearly peak.

Valuation-wise, Sudarshan Chemical trades at a high price-to-earnings ratio above 80 and a price-to-book ratio above 8, signaling that the stock is richly valued compared to sector norms. Despite the premium valuation, the company has attracted positive sentiment, with most analysts maintaining a buy or hold stance, though the average target price is slightly below current levels, suggesting limited near-term upside.

Financially, the company has shown steady revenue growth and improved profitability in recent quarters, with net profit margins expanding from previous periods. However, promoter holding has decreased recently, and the company’s sales growth over the past year has been modest. The stock’s low beta indicates relatively lower volatility compared to the broader market.

In summary, Sudarshan Chemical Industries is exhibiting strong price momentum and positive investor sentiment but is trading at expensive valuations. While its recent financial performance has improved, the high valuation and reduced promoter holding may warrant caution for new investors.

Valuation-wise, Sudarshan Chemical trades at a high price-to-earnings ratio above 80 and a price-to-book ratio above 8, signaling that the stock is richly valued compared to sector norms. Despite the premium valuation, the company has attracted positive sentiment, with most analysts maintaining a buy or hold stance, though the average target price is slightly below current levels, suggesting limited near-term upside.

Financially, the company has shown steady revenue growth and improved profitability in recent quarters, with net profit margins expanding from previous periods. However, promoter holding has decreased recently, and the company’s sales growth over the past year has been modest. The stock’s low beta indicates relatively lower volatility compared to the broader market.

In summary, Sudarshan Chemical Industries is exhibiting strong price momentum and positive investor sentiment but is trading at expensive valuations. While its recent financial performance has improved, the high valuation and reduced promoter holding may warrant caution for new investors.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.