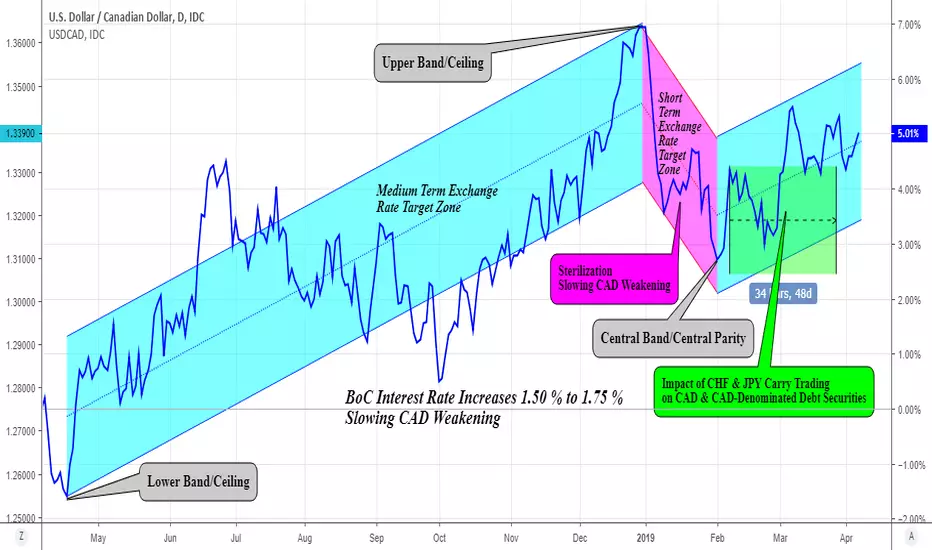

The Fed and BoC managed the USDCAD target zone for 10 % width of medium term exchange rate target zone in compliance to Louvre Accord but wider and narrower subject to the actual average traded weighted rate of USDCAD to JPY, CHF and EUR at upper band/ceiling and at lower band/ceiling by their price stabilization/compression rate. The pair moved from their disequilibrium to equilibrium in compliance to equilibrium exchange rate.

At upper band/ceiling, BoC undertook sterilization to slower the weakening of CAD against USD as permitted by the central banks' consensus in addition to the strengthening by the BoC increases on interest rate from 1.5 % to 1.75 %. The consensus allow for BoC to sterilize up to 50 % of the medium term exchange rate target zone to central band/central parity. In the past I estimated that the sterilization will be up to 1.3100 and ended at this level. This sterilization was opportunity for CHF and JPY carry traders for carry trading on CAD and ACD-denominated debt securities and to drive the CADJPY and CADCHF to upward wider than 5 % or wider than USDCAD. However, both Fed and BoC maintained the USDCAD to be sterilized up to estimated 50 % of the medium term target zone as permitted by the consensus, ended at 1.3100.

The impact of the CHF and JPY carry trading activity however to put the USDCAD to be prolonged at central band/central parity for the benefit of BoC, also called the honeymoon affect. However, should the JPY and CHF carry trading activity to be dismissed then the USDCAD will be jumped sharply to upward to visit her new upper band/ceiling of medium term exchange rate target zone. The pair however may pauses at current actual upper band/ceiling before bullish back for another 5 % from the current actual upper band/ceiling. At what exchange rate the new upper band/ceiling is measured by the average weighted rate on the USDCAD to JPY, CHF and EUR. However, the combination of price and percentage charting by this TradingViews could be useful to gauge the next 5 % price bullish .

This methodology is based on the guidelines and procedures for the assessment and measurement of target zone and sterilization by the Fed and global central banks in compliance to Plaza, Louvre and EMS agreements. It was also publicated by CEPR (Center for Economic Policy Research) and NBER (National Bureau of Economic Research).

At upper band/ceiling, BoC undertook sterilization to slower the weakening of CAD against USD as permitted by the central banks' consensus in addition to the strengthening by the BoC increases on interest rate from 1.5 % to 1.75 %. The consensus allow for BoC to sterilize up to 50 % of the medium term exchange rate target zone to central band/central parity. In the past I estimated that the sterilization will be up to 1.3100 and ended at this level. This sterilization was opportunity for CHF and JPY carry traders for carry trading on CAD and ACD-denominated debt securities and to drive the CADJPY and CADCHF to upward wider than 5 % or wider than USDCAD. However, both Fed and BoC maintained the USDCAD to be sterilized up to estimated 50 % of the medium term target zone as permitted by the consensus, ended at 1.3100.

The impact of the CHF and JPY carry trading activity however to put the USDCAD to be prolonged at central band/central parity for the benefit of BoC, also called the honeymoon affect. However, should the JPY and CHF carry trading activity to be dismissed then the USDCAD will be jumped sharply to upward to visit her new upper band/ceiling of medium term exchange rate target zone. The pair however may pauses at current actual upper band/ceiling before bullish back for another 5 % from the current actual upper band/ceiling. At what exchange rate the new upper band/ceiling is measured by the average weighted rate on the USDCAD to JPY, CHF and EUR. However, the combination of price and percentage charting by this TradingViews could be useful to gauge the next 5 % price bullish .

This methodology is based on the guidelines and procedures for the assessment and measurement of target zone and sterilization by the Fed and global central banks in compliance to Plaza, Louvre and EMS agreements. It was also publicated by CEPR (Center for Economic Policy Research) and NBER (National Bureau of Economic Research).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.