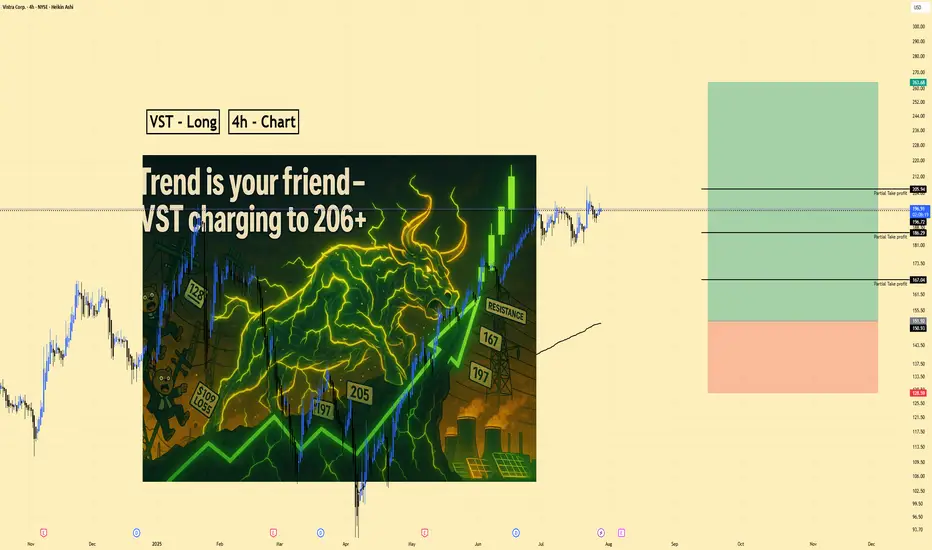

VST | Long | Trend Continuation with Correction Setup (Aug 2025)

1️⃣ Quick Insight: Vistra Corp. has been in a strong uptrend, making new highs. We are now looking for a healthy correction to position for continuation, as "the trend is your friend."

2️⃣ Trade Parameters:

Bias: Long

Entry: $151 (waiting for a corrective pullback)

Stop Loss: $128

Take Profits:

TP1: $167

TP2: $197

TP3: $205

Extended Target: $206+ if momentum sustains through the trend channel

3️⃣ Key Notes:

Vistra is a leading U.S. integrated electricity and power generation company with ~41,000 MW of generation capacity. The stock has surged over 175% in the past year, currently near its 52‑week high of $207. Analysts’ 12‑month consensus price target is $185, though recent developments like the PJM capacity auction results and Perry nuclear plant extension could fuel more upside.

The company is heavily investing in renewables and storage ($700M+ in 2025), growing nuclear capacity, and expanding credit facilities. Despite its high P/E (~30× vs sector avg. 12–13×), its strong ROE (>80%), buybacks, and utility-scale investments support long-term upside.

4️⃣ What to Watch:

Q2 2025 earnings on Aug 7, 2025 for forward guidance

Progress in solar, battery storage, and nuclear expansions

Market reaction to any correction or consolidation near highs

Macro utility sector sentiment and commodity price trends

📊 Outlook: The near-term consensus suggests a pullback toward $185 is possible, but the longer-term uptrend remains intact, especially if growth momentum continues.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research.

1️⃣ Quick Insight: Vistra Corp. has been in a strong uptrend, making new highs. We are now looking for a healthy correction to position for continuation, as "the trend is your friend."

2️⃣ Trade Parameters:

Bias: Long

Entry: $151 (waiting for a corrective pullback)

Stop Loss: $128

Take Profits:

TP1: $167

TP2: $197

TP3: $205

Extended Target: $206+ if momentum sustains through the trend channel

3️⃣ Key Notes:

Vistra is a leading U.S. integrated electricity and power generation company with ~41,000 MW of generation capacity. The stock has surged over 175% in the past year, currently near its 52‑week high of $207. Analysts’ 12‑month consensus price target is $185, though recent developments like the PJM capacity auction results and Perry nuclear plant extension could fuel more upside.

The company is heavily investing in renewables and storage ($700M+ in 2025), growing nuclear capacity, and expanding credit facilities. Despite its high P/E (~30× vs sector avg. 12–13×), its strong ROE (>80%), buybacks, and utility-scale investments support long-term upside.

4️⃣ What to Watch:

Q2 2025 earnings on Aug 7, 2025 for forward guidance

Progress in solar, battery storage, and nuclear expansions

Market reaction to any correction or consolidation near highs

Macro utility sector sentiment and commodity price trends

📊 Outlook: The near-term consensus suggests a pullback toward $185 is possible, but the longer-term uptrend remains intact, especially if growth momentum continues.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research.

I work with busy founders and executives who are tired of ad hoc trading results. I give you a clear, rules based trading system built from my own years in the market, so you can protect capital, compound it, and understand trading like a real business.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I work with busy founders and executives who are tired of ad hoc trading results. I give you a clear, rules based trading system built from my own years in the market, so you can protect capital, compound it, and understand trading like a real business.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.