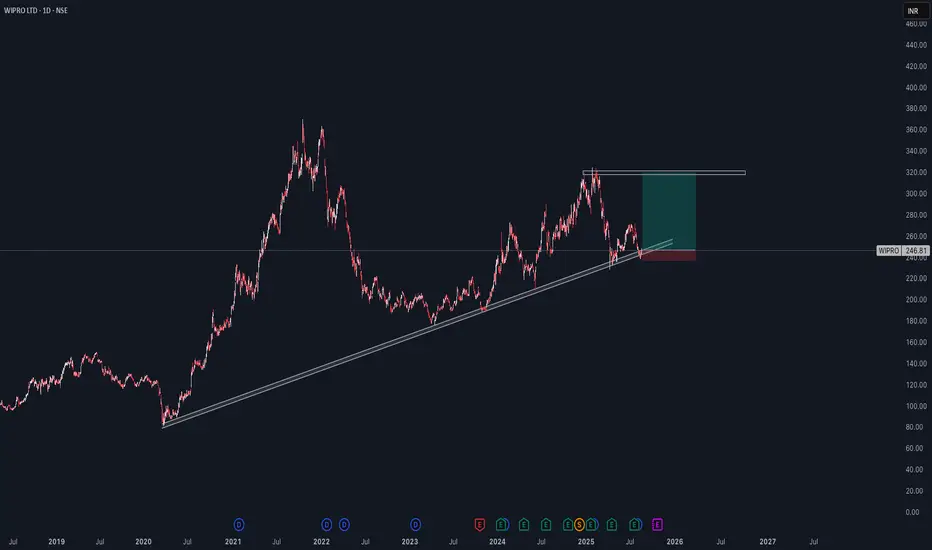

Wipro has been respecting a long-term trendline since 2020.

Price recently bounced from this trendline support near ₹240, showing strong buying interest.

The current structure suggests a possible trend continuation towards the higher resistance zone.

Trade Setup

Entry Zone: Around ₹245–250 (near trendline support)

Stop Loss: Below ₹230 (trendline breakdown level)

Target: ₹320 (previous supply zone / resistance level)

This gives a risk-to-reward ratio of approx. 1:3, which is favorable.

🔍 Technical Factors Supporting Bullish View

Price is consolidating above the long-term support trendline.

Multiple rejections from the downside show strong demand zone near ₹240.

If the momentum continues, buyers may push price towards the ₹320 resistance area.

⚠️ Risk Management

A daily close below ₹230 will invalidate this setup.

This is a positional swing trade, so patience is required.

Price recently bounced from this trendline support near ₹240, showing strong buying interest.

The current structure suggests a possible trend continuation towards the higher resistance zone.

Trade Setup

Entry Zone: Around ₹245–250 (near trendline support)

Stop Loss: Below ₹230 (trendline breakdown level)

Target: ₹320 (previous supply zone / resistance level)

This gives a risk-to-reward ratio of approx. 1:3, which is favorable.

🔍 Technical Factors Supporting Bullish View

Price is consolidating above the long-term support trendline.

Multiple rejections from the downside show strong demand zone near ₹240.

If the momentum continues, buyers may push price towards the ₹320 resistance area.

⚠️ Risk Management

A daily close below ₹230 will invalidate this setup.

This is a positional swing trade, so patience is required.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.