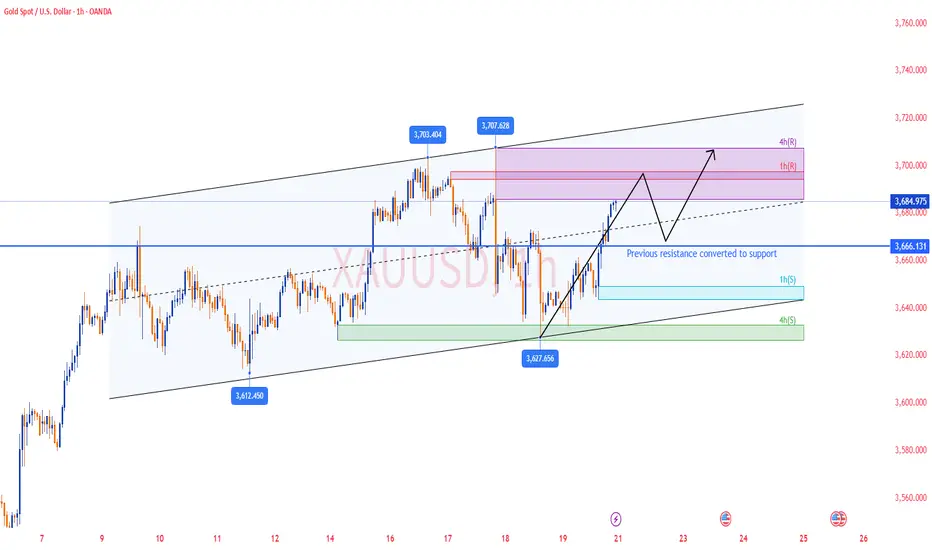

✅ On Friday's US trading session, gold saw a strong upward movement and successfully broke the downward trendline on the 1-hour chart, indicating that bulls are in control of the market. The current short-term pullback is merely a correction and has not changed the overall uptrend. Due to the strong bullish momentum, the short-term pullback does not indicate a trend reversal and, in fact, provides an opportunity for buying on dips.

✅ On the 4-hour chart, gold has experienced short-term consolidation, but the overall trend remains bullish. The MACD is in a strong zone, and the KDJ indicator is still in a bullish zone, suggesting that the price may continue to rise in the short term.

In the short term, there is support around the 3660-3670 region. If the price pulls back to this level, consider buying. If the price breaks above 3685, further bullish movement can be expected.

🔴 Resistance levels: 3702-3707 / 3720-3730

🟢 Support levels: 3660-3670 / 3636-3640

✅ Trading strategy reference:

🔰 If gold price rebounds to the 3702-3705 area, consider selling in batches with a target of 3690-3680, and if broken, look for a further move to 3670.

🔰 If gold price pulls back to the 3665-3670 area, consider buying in batches with a target of 3685-3695, and if broken, look for a further move to 3705.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions.

✅ On the 4-hour chart, gold has experienced short-term consolidation, but the overall trend remains bullish. The MACD is in a strong zone, and the KDJ indicator is still in a bullish zone, suggesting that the price may continue to rise in the short term.

In the short term, there is support around the 3660-3670 region. If the price pulls back to this level, consider buying. If the price breaks above 3685, further bullish movement can be expected.

🔴 Resistance levels: 3702-3707 / 3720-3730

🟢 Support levels: 3660-3670 / 3636-3640

✅ Trading strategy reference:

🔰 If gold price rebounds to the 3702-3705 area, consider selling in batches with a target of 3690-3680, and if broken, look for a further move to 3670.

🔰 If gold price pulls back to the 3665-3670 area, consider buying in batches with a target of 3685-3695, and if broken, look for a further move to 3705.

🔥Trading Reminder: Trading strategies are time-sensitive, and market conditions can change rapidly. Please adjust your trading plan based on real-time market conditions.

🔥𝐁𝐞𝐬𝐭 𝐆𝐨𝐥𝐝 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐂𝐥𝐮𝐛

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

👉VIP Channel :t.me/+WLaSyGdb7LkzODBl

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

👉VIP Channel :t.me/+WLaSyGdb7LkzODBl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥𝐁𝐞𝐬𝐭 𝐆𝐨𝐥𝐝 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐂𝐥𝐮𝐛

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

👉VIP Channel :t.me/+WLaSyGdb7LkzODBl

✅𝐃𝐚𝐢𝐥𝐲 𝟐-𝟒 𝐓𝐫𝐚𝐝𝐢𝐧𝐠 𝐒𝐢𝐠𝐧𝐚𝐥𝐬🔥

✅𝐇𝐢𝐠𝐡 𝐀𝐜𝐜𝐮𝐫𝐚𝐜𝐲 𝟗𝟎%-𝟗𝟓% 🔥

👉VIP Channel :t.me/+WLaSyGdb7LkzODBl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.