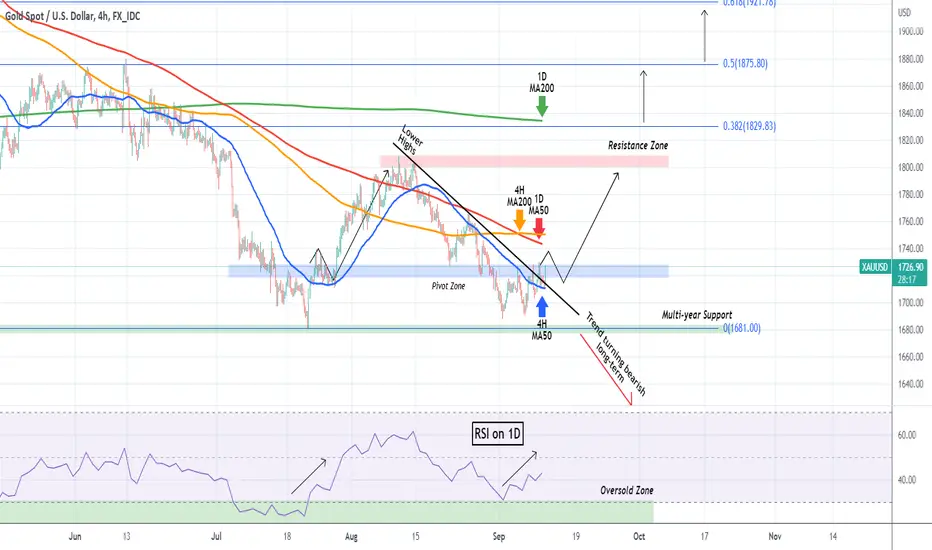

Gold (XAUUSD) offered us a great double trade following our previous analysis, as first it was rejected on the 4H MA50 (blue trend-line) back near the multi-year Support and the rebounded back to the Lower Highs trend-line of the August High:

Now the price broke above both the 4H MA50 and the Lower Highs trend-line and as expected, is consolidating around the Pivot Zone. The last time it did so for that long was from July 22 to July 27. With the 4H MA50 holding as Support, the price then had a 2-week aggressive rally to the 1808 High, which is now our Resistance.

We expect a similar consolidation before another strong rally. The 1D MA50 (red trend-line) is now the Resistance to beat which will break that consolidation. Notice also how the RSI on the 1D time-frame has been rising since the September 01 low on the Oversold Zone.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

Now the price broke above both the 4H MA50 and the Lower Highs trend-line and as expected, is consolidating around the Pivot Zone. The last time it did so for that long was from July 22 to July 27. With the 4H MA50 holding as Support, the price then had a 2-week aggressive rally to the 1808 High, which is now our Resistance.

We expect a similar consolidation before another strong rally. The 1D MA50 (red trend-line) is now the Resistance to beat which will break that consolidation. Notice also how the RSI on the 1D time-frame has been rising since the September 01 low on the Oversold Zone.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.