GBP/JPY Trading Strategy - Buy to 194GBP/JPY Trading Strategy - Buy to 194

I. Technical Analysis

1. Overall Trend

On the H4 timeframe, GBP/JPY shows signs of a bullish reversal:

The price has broken through the previous resistance zone 190.4 - 191.0 and is holding above it.

EMA 33 & EMA 50 are starting to slope upwards, indicating an uptrend.

Volume is increasing as the price bounces off the support zone.

On the D1 timeframe, GBP/JPY is recovering from a correction, aiming for the next resistance zone 194.0 - 194.2.

2. Key Support & Resistance Levels

✅ Strong Support (Potential Buy Zone):

190.2 - 190.4: Newly established support after the breakout.

189.2: Strong support; if broken, the uptrend may be invalidated.

✅ Target Resistance (Take Profit - TP):

194.0 - 194.2: Significant resistance on H4 & D1 charts.

✅ Trend Confirmation Indicators:

RSI > 55, not overbought, still has room to rise.

Volume increasing on price rise, confirming buyers' control.

II. Trade Setup

1. Entry Point

BUY entry when price retraces to 190.4 - 191.0.

Split orders:

50% of the position at 190.4.

Remaining 50% at 190.0 if the price continues to correct.

2. Stop Loss (SL)

189.2: If the price breaks this level, the uptrend is invalidated.

3. Take Profit (TP)

TP1: 192.5 → Close 50% of the position and move SL to breakeven.

TP2: 194.0 - 194.2 → Close the remaining position.

4. Risk/Reward Ratio (R:R)

Average Entry: 190.7

SL: 189.2 (-1.5 pips)

TP: 194.0 (+3.3 pips)

R:R = 2.2:1 → Favorable risk-reward ratio for swing trading.

III. Risk Management & Market Scenarios

🔸 If price moves in our favor:

✅ When the price reaches 192.5, move SL to breakeven to secure capital.

🔸 If price drops to 189.2:

❌ Exit all positions as the uptrend is invalidated.

🔸 Key signals to watch:

⚠️ If price surges past 191.8 without a pullback, consider waiting for a retracement before entering.

IV. Conc......

BUY GBP/JPY at 190.4 - 190.0, TP 194.0, SL 189.2.

Good R:R ratio (2.2:1), suitable for swing trading.

Holding period: Within this week, monitor closely.

Welcome Follow Me, Thanks!

#gbpjpy#forex

GBPJPY Trading Plan - 25/Nov/2022Hello Traders,

Hope you all are doing good!!

I expect GJ to go Down after finishing this wave.

Look for your SELL setups.

My charts explains the reason if you are aware of the wave analysis. If not, then contact me and I can patch you up with the right people.

Please follow me and like if you agree or this idea helps you out in your trading plan.

Disclaimer: This is just an idea. Please do your own analysis before opening a position. Always use SL & proper risk management.

Market can evolve anytime, hence, always do your analysis and learn trade management before following any idea.

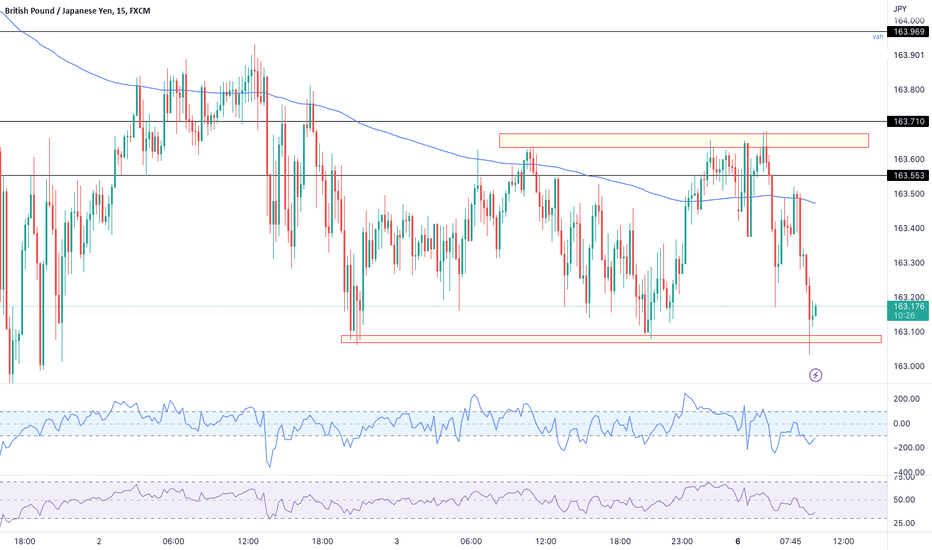

GBPJPY SMALL TF SETUPGbp Jpy is making a pullback to support and demand orderblock,marked in the purple box. A hold of this area can send GBPJPY to supply zone marked on charts. This setup has a good R/R and multiple confluences that it will play out. Please note: Do not risk more then 2% of capital on this trade.

GBPJPY IDEAGJ tried and failed at breaking a key weekly support area and has now rejected heavily off of the Weekly Support Zone and has gone bullish with a strong momentum moving almost approx. 200 pips in a day on Thursday. Today is a weekend and I would be cautious trading the pair. Though past data shows that momentum did continue the next day with reference to the July 22nd move earlier. We are also fast approaching a bearish tend line on the Daily. If we respect the Trendline then we can expect bearish correction due to the extreme impulsive up move or break the trendline and do a retest and continue moving upwards as we would then have a break of structure.

GBPJPY Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=136.85.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=137.85.

TP4: R2=138.15.

Set the stoploss of these orders at breakout of S2=136.55.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=136.55.

In this situation, there is an expectation to reach the target S3=135.4.

Set the stoploss of reverse orders at breakout of S1=136.85.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!