Bitcoin Bybit chart analysis June 25Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

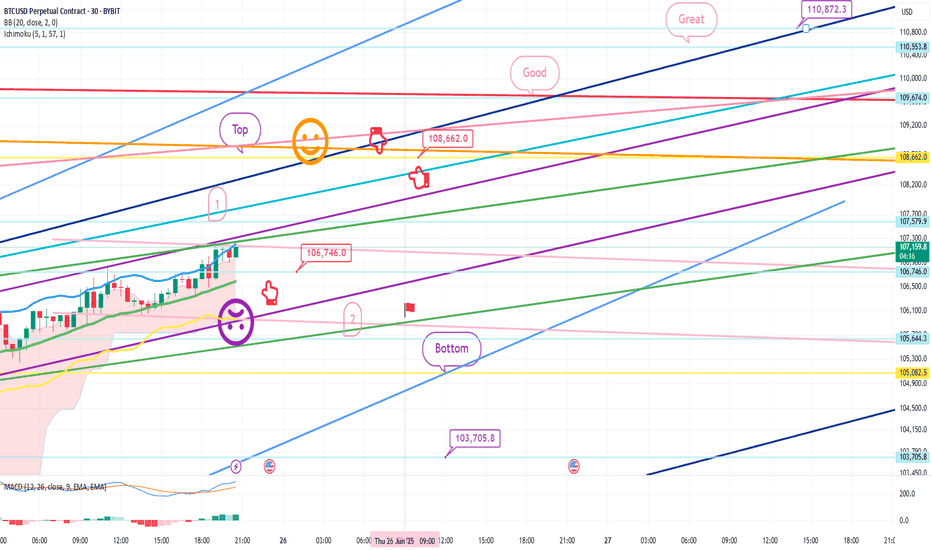

This is the Bitcoin 30-minute chart.

Nasdaq indicators will be announced at 11 o'clock shortly.

Nasdaq is rising vertically + renewing its all-time high.

Accordingly, I ignored the weekly MACD dead cross and

proposed the strategy for the pattern by substituting Tether dominance.

Although it is not visible on the screen,

I created today's strategy with the condition of maintaining the long position of $100,587.9 that was confirmed on the 23rd.

* One-way long position strategy when the red finger moves

1. $106,746 long position entry section / When the purple support line is broken

or when section 2 is touched, stop loss price

2. $108,66 long position 1st target -> Good 2nd -> Great 3rd target price

When section 1 at the top touches, it can be connected to an upward trend,

and section 2 is a sideways market.

At the very bottom and the very top,

I have indicated the maximum possible trend until tomorrow afternoon.

Up to this point, I ask that you simply use my analysis for reference and use only

I hope that you will operate safely with the principle of trading and stop loss.

Thank you.

1-BTCUSD

Bitcoin Technical Analysis for the Week of 29, June - 07, July

Here's a Bitcoin price analysis for June 29, 2025, based on available data and technical indicators from recent sources:

#Current Market Overview

Price: Bitcoin is trading around $107,331.08 as of June 28, 2025, with a slight 24-hour decrease of approximately 1.99%.

#Market Sentiment: The market shows a neutral to bullish sentiment. The Fear & Greed Index is at 65 (Greed), indicating optimism but not extreme euphoria. Technical indicators suggest a 67% bullish sentiment, with 25 bullish signals versus 5 bearish signals.

Trading Volume: 24-hour trading volume is around $43.1 billion, slightly below recent averages, suggesting cautious trading amid volatility.

~~ Technical Analysis ~~

Price Trends:

Bitcoin is currently testing support at the 20-day EMA ($106,211), with additional support at the 50-day EMA ($103,110) and 100-day EMA ($98,807). The 200-day EMA ($93,092) serves as a key macro support level.

The 50-day moving average is rising and remains above the 200-day moving average, forming a golden cross, a bullish indicator.

Bitcoin is within a descending triangle pattern, which could resolve by July 1, 2025. A breakout above $110,000 could signal a new bull run, while failure to hold $102,000–$104,000 may lead to a drop toward $95,000–$98,000. even to $90,000.

Key Levels:

Support: $100,000 (recently held), $98,000 (psychological), $95,000 (flag pattern lower border).

Resistance: $108,700 (recent high), $110,000 (key psychological level), $112,000 (all-time high from May 2025)

Trend Bullish - Chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

BTCUSDT – Is a Breakout Imminent?Bitcoin is once again testing the descending trendline that previously triggered three strong rejections, hovering around the 106,500–106,600 USDT zone. A clear rounded bottom has formed, with strong support holding around 104,200–104,700, fueling the recent rebound.

Price action is now consolidating just below the key resistance, setting the stage for a potential bullish continuation pattern. A clean breakout above this zone could open the door for a rally toward 108,600 and even 110,200 – both previous highs.

However, if the trendline holds again, the highlighted support zone is likely to attract fresh buying interest. The overall market bias leans bullish, but confirmation via breakout is crucial for the next move.

Are you ready to ride the next BTC wave?

Bitcoin Bybit chart analysis June 23Hello

This is Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

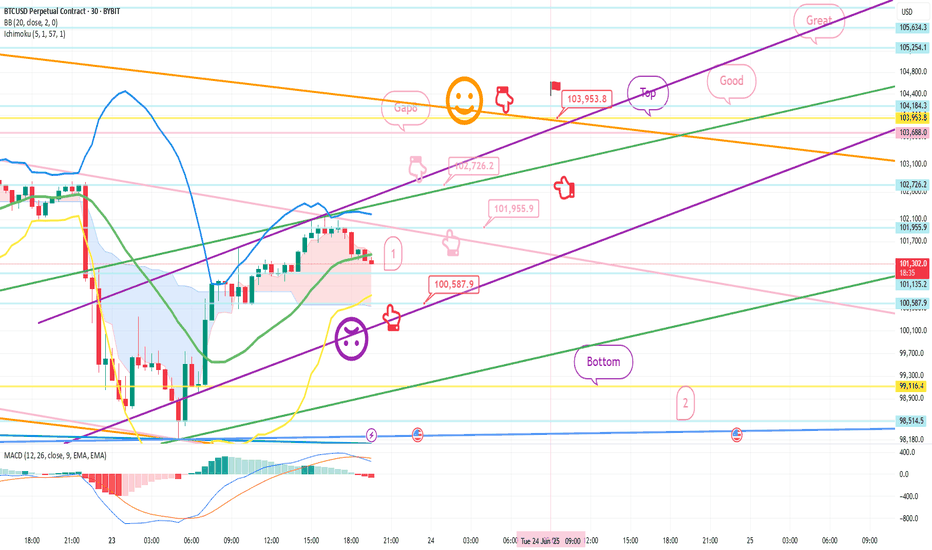

This is the Bitcoin 30-minute chart.

The Nasdaq seems to be rising without any problems,

but Bitcoin is under pressure from the MACD dead cross on the weekly chart as it has been adjusted strongly over the weekend.

Depending on the real-time situation, it seems advantageous to operate safely

short-term trading or both-way trading this week.

I created today's strategy based on the Nasdaq movement and the Tether dominance pattern.

*One-way long position strategy when the red finger moves

1. $100,587.9 long position entry section / hand drop when the purple support line is broken

2. $103,953.8 long position target price / Good 2nd target price thereafter

From the purple support line breakout, the weekly chart

candle low point created this week is broken, so it is better to maintain it without breaking out from the long position position.

If it breaks out, it can be pushed to the bottom -> 2nd section.

The 1st section marked in the middle

If it doesn't come down to the long entry point today

It is a vertical rise section

And the pink finger in the middle indicates the short-term target price -> additional long entry section

And the Gap8 section was created at the top due to last week's movement

I think it would be good to refer to it while trading.

Up to this point, I ask that you simply use my analysis for reference and use

I hope that you operate safely with principle trading and stop loss prices.

Thank you.

Bitcoin Bounce Alert: Holding the $100K Fortress! 📉 Market Context & Technical Levels

Key support at ~$100K: As the chart shows and multiple analysts confirm, this level continues to act as a strong defence zone. Cointelegraph noted bulls have been “defending the $100K key support level strongly,” triggering bounces during dips

Descending channel overhead: Bitcoin has retraced into a downward channel. A clean breakout above ~107K–109K (past recent peaks) is needed to signal a bullish shift .

Liquidity target at ~106K: Plenty of orders await in that region—flipping it to support may pave the way for another push higher .

📊 Indicators & Momentum

RSI dip near 25 during the latest drop indicates oversold conditions—often a precursor to rebounds

.

Volume surge on rebounds suggests absorbing sell pressure and strong accumulation interest at lower levels.

🚩 Key Price Zones to Watch

Level Significance

$100K Crucial support; losing it risks a slide toward $95K–97K or even $92K

.

$105K–106K Liquidity zone; flipping here as support could confirm upward momentum .

$107K–109K Resistance from channel tops and prior highs; a successful break is key to next leg up .

$112K–$112K+ If breakout occurs, upside targets extend toward prior ATH near $112K and beyond .

🎯 Chart Analysis Summary

Your chart shows three distinct bounces from the $100K–100.7K supply zone (highlighted in blue) and the latest one includes a sharp wick and rebound. This aligns with broader market dynamics emphasizing support at $100K and building liquidity at $106K. The arrow projection signals a probable retest of ~106K, with room to challenge ~107–109K after consolidation.

🧭 Trade Outlook

Bullish scenario: Hold above $100K → reclaim $106K → trendline breakout → potential rally to $112K+.

Bearish risk: Fails support at $100K → breakdown toward $95K–92K region.

📌 Bottom Line

Support $100K is alive and well. Bounces have been crisp and volume-backed.

Next test lies at $105–106K. That’s the battleground—flip it, and we may see bitcoin reclaim recent highs.

Watch the channel overhead (~107K–109K). A breakout could open the door to fresh records.

✅ Conclusion: BTC is defending its psychological base firmly. If this zone holds once more, the path to $106K and beyond is in focus. Breaking above demands conviction, but it’s the pivot to watch.

Bitcoin 1D Technical Analysis Bearish Bias- Bitcoin is currently trading at 99,453$, down almost 11% from its ATH

- Bitcoin trapped many buyers above 110,000$, and now they have become aggressive trapped sellers

- We have origin fill left and a large inefficient gap left for Bitcoin to fill at 88,765$ to flip bullish I will sit and wait for BTC to start a consolidation there, and then I will look for aggressive spot buys

- Avoid leverage at all cost, it makes no sense to lose money until the price behaviour of BTC settles We can see BTC repurging 73,000, it's in the playbook as well

- Market Structure shift in BTC is highly bearish unless we see a structure shift on a 4h or 1d TF

- Manage your risk and try to avoid leverage at all cost

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capital follow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

GBPUSD - 15M OUTLOOKFOREXCOM:GBPUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any position . I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied...

Keep trading

Hustle hard

Markets can be Unpredictable, research before trading.

Disclaimer: This trade idea is based on Smart money concept and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions. Informational only!!!

Compression Before Expansion: Market Awaits Its Next MoveBTCUSD – Compression Before Expansion: Market Awaits Its Next Move

Bitcoin is trading within a compressed structure after rejecting key resistance and retesting support. While the overall sentiment remains cautious, the technical setup is beginning to show signs of strength — if buyers can reclaim control.

🧭 Macro Check-In: Calm Before the Crypto Storm?

No rate cut from the Fed yet, but markets are starting to price in the possibility of a pause in Q3 or Q4.

ETF inflows slowing, but institutional positions are not closing — suggesting long-term conviction remains.

Political momentum in the US is shifting towards crypto adoption, with Bitcoin emerging as a talking point in election debates.

Dollar index (DXY) continues to chop, giving crypto room to breathe if inflation data remains mild.

In short: liquidity is building, but the trigger hasn’t fired — yet.

📊 Chart Structure (H1–H4): Levels That Matter

BTC is holding just above 103,100, a key level where previous demand stepped in.

The mid-range resistance lies at 104,184 — this needs to break for bulls to gain short-term control.

Above that, eyes are on 106,047, then 107,586 (top of the descending channel).

EMA alignment is still bearish → wait for structure shift, not FOMO.

📌 Trade Map

🔵 Buy Setup

Zone: 103,100 – 103,300

Condition: Bullish reaction + rejection wick / engulfing

SL: 102,600

TP: 104,184 → 106,047 → 107,586

🔴 Sell Setup (Only if trap triggers)

Zone: 107,500 – 107,800

Condition: Rejection + volume fade

SL: 108,200

TP: 106,000 → 104,500

🧠 Trader Insight

“When the chart compresses, smart money positions early.”

Bitcoin is not trending — it's accumulating or distributing. Retail is waiting for breakout. Smart traders are preparing for both scenarios.

Watch the reaction, not the prediction.

Stay objective. Let levels lead the logic.

Bitcoin Bybit chart analysis June 17Hello

This is Bitcoin Guide.

It's been a while.

I took a break recently because the participation rate was not good.

Since it's been a while since I did an analysis, I did it in a short form,

I hope you enjoy it.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

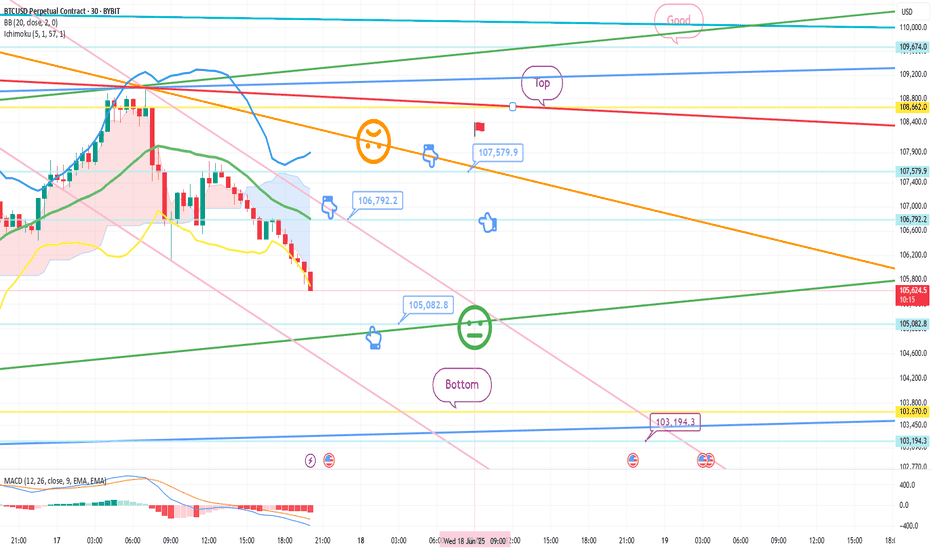

Here is the Bitcoin 30-minute chart.

I created a strategy based on the possibility of sideways movement in Nasdaq and the rebound of Tether Dominance.

* When the blue finger moves,

It is a two-way neutral short->long switching strategy.

1. $106,792.2 short position entry point / stop loss price when orange resistance line is broken

2. $105,082.8 long position switching / stop loss price when green support line is broken

3. $107,579.9 long position 1st target -> Top 2nd target price

If it goes down from the current position,

Check the bottom section -> up to $103,194.3.

Please use my analysis as a reference only

I hope you operate safely with principle trading and stop loss price.

Thank you.

Bitcoin Bounce & Breakout PlayChart Analysis:

🔹 Support Holding Strong:

BTC is respecting a key support area (~$105,600), which previously acted as resistance (marked by recent ATH).

🔹 EMA 70 (Blue Line):

Price is hovering above the EMA, adding bullish confirmation.

🔹 Bullish Projection Path:

The chart shows a projected bullish move toward the sell zone near $113,200 – $113,300, representing a potential 4.4% gain from the breakout.

🔹 Key Zones:

Support Zone: $105,600

Supply Zone: $100,500

Sell Zone (TP Zone): $113,200+

📌 Outlook:

If BTC breaks and holds above the resistance (~$107,000), a strong upward rally could follow.

Entry near support or on breakout, with tight risk management, offers a favorable risk/reward.

✅ Entry Options:

Breakout Entry:

Trigger: Break and close above $107,200

Confirmation: Retest and hold above the breakout zone

Entry: $107,300 – $107,500

Support Bounce Entry:

Trigger: Pullback to support zone (~$105,600) with bullish reversal candle

Entry: $105,600 – $105,800

🎯 Target Zones (TP):

TP1: $110,400 (minor resistance)

TP2: $113,200 – $113,300 (major sell zone)

TP3 (aggressive): $114,000+

🔻 Stop Loss (SL):

For breakout entry: SL below $106,200

For bounce entry: SL below $105,200 or $104,800 (structure break)

📈 Risk–Reward Ratio:

Approx. 1:2.5 to 1:3+ depending on entry and target

🧠 Trade Management:

Move SL to breakeven after hitting TP1

Partial profit booking at TP1

Trail remaining with manual or dynamic SL (e.g., below EMA or recent low)

⚠️ Risk Notes:

Avoid chasing price without breakout confirmation

Watch for fakeouts and heavy selling near TP zones

Adjust position size based on your risk tolerance

BTC/USDT Bullish Reversal Zone AnalysisSupport Zone:

The horizontal purple box (~104,000 USDT area) has acted as a strong support/resistance flip zone multiple times.

Falling Wedge Breakout:

The price action broke out of a falling wedge pattern earlier, confirming bullish momentum.

Flag Formation (Current):

A smaller bullish flag/pennant appears to be forming, and a breakout above could trigger a strong upward move.

Projected Move:

The black arrow indicates a potential bounce from this support zone, with the price targeting the 111,000–112,000 USDT zone (highlighted in the top purple box).

Volume Spike:

Notable volume spike near the bottom supports the idea of accumulation and possible reversal.

📈 Conclusion:

If the support zone holds and price breaks above the minor flag, a bullish continuation is likely toward the 111,000–112,000 resistance area. Traders should watch for confirmation of a breakout and volume increase for validation.

Bullish Falling Wedge Breakout Within Ascending ChannelBitcoin is currently presenting a strong bullish setup on the 4H chart. Price has bounced from the lower boundary of a long-standing ascending channel, forming a falling wedge — a classic bullish continuation pattern.

The breakout from this wedge aligns with a key support level and suggests a potential move toward the upper resistance zone at $111.5K–$112.7K, which also aligns with the upper trendline of the broader ascending structure.

Momentum confirmation above $106K could accelerate the upside move.

Target zone: $111.5K–$112K

Invalid if price breaks below $104.5K

BTC Near $100K – Breakdown or Bounce?BTC Near $100K – Breakdown or Bounce?

BTCUSD – Will Bitcoin Hold ₹100K Support Equivalent? Signs of Weakness Amid Global Caution

🧭 Global Market Context

Bitcoin is facing some serious resistance after failing to hold above the $108K zone. And just as Indian markets react to global cues, BTC is showing signs of stress too.

🔺 US bond yields are climbing again – bad news for crypto risk appetite

🧊 Spot Bitcoin ETFs continue to attract inflows, but not strong enough to push new highs

💵 The US Dollar (DXY) is gaining strength again as investors flee risk — and that puts pressure on Bitcoin

Add to that the recent institutional sell-off, and it’s clear: BTC may need to “cool off” before another rally.

📉 Technical Picture (1H)

Bitcoin is showing a classic lower-high, lower-low pattern. A clear downtrend is in motion:

Price is below all key EMAs (34/89/200), with every rally being sold off

Important resistance sits at 106,000 – 107,000

Major support levels are now at 102,821, then 101,539, and if pressure continues — 100,419 (₹83+ lakh level for reference)

Momentum indicators like RSI are flat. No strength yet. And without a solid bullish candle from support, buyers may stay away.

🔎 Strategy Plan for Indian Traders

🔻 Short-term SELL Setup

Entry: 106,000 – 107,000

SL: 107,500

Targets: 102,821 → 101,539 → 100,419

🧠 Ideal for short-term traders looking to follow the trend

🔹 Medium-term BUY Setup (only if price reacts from 100K zone)

Entry: 100,500 – 100,800

SL: 99,800

Targets: 102,800 → 104,400 → 106,000

⚠️ Wait for bullish confirmation — avoid bottom fishing blindly

📌 Final Thought

Bitcoin is in a danger zone right now. If it loses grip on $100K support, we may see panic selling from leveraged traders. But this zone also holds opportunity — a strong bounce could spark a fresh rally.

🧘 Trade with patience. Don't chase. Let the market come to you.

BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD BTCUSD SHOWING A GOOD DOWN MOVE WITH 1:7 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

Inverse Head and Shoulders Breakout Signals Bullish The chart under review presents a classic Inverse Head and Shoulders pattern, a reliable and widely recognized bullish reversal formation in technical analysis. This structure typically forms after a downtrend, indicating a potential shift in market sentiment from bearish to bullish.

The pattern is composed of:

Left Shoulder: A modest price decline followed by a temporary upward correction.

Head: A deeper price decline forming the lowest point in the pattern.

Right Shoulder: A higher low that mirrors the left shoulder, followed by another upward movement.

The neckline, which acts as a critical resistance level, is clearly illustrated at approximately 106,840.37 USDT. A confirmed breakout above this neckline suggests the completion of the reversal pattern and validates the potential for a sustained bullish movement.

---

2. Breakout Confirmation

The current price action confirms a successful breakout above the neckline, with the market currently trading around 107,586.58 USDT. This breakout is a key signal for bullish continuation, provided it is supported by increased volume and follow-through price action.

From a technical standpoint, the breakout is reinforced by:

A clean violation of neckline resistance

Price consolidation near breakout zone before a strong upward thrust

Higher lows preceding the breakout, indicative of growing buying pressure

This confluence of technical signals strengthens the case for an upward price trajectory in the near term.

3. Projected Price Targets

Upon confirmation of the Inverse Head and Shoulders breakout, target levels can be derived using the measured move technique. This involves projecting the vertical distance from the head to the neckline upward from the breakout point.

Target 1 (Initial Resistance):

108,878.29 USDT – This level represents a potential short-term resistance where price may consolidate or retrace slightly before continuing.

Target 2 (Measured Move Completion):

110,752.24 USDT – This is the ultimate price target derived from the height of the head-to-neckline structure. Reaching this level would represent the full realization of the reversal patt

4. Key Support and Risk Levels

Risk management is a critical component of any trading strategy. The following support levels should be closely monitored:

106,840.37 USDT (Neckline Support):

Former resistance turned support. Holding above this level post-breakout is essential for sustaining bullish momentum.

105,997.09 USDT:

Acts as a secondary support level and potential stop-loss region for conservative traders.

If price fails to hold above the neckline and falls back below these levels, the breakout could be classified as a false breakout, warranting caution.

5. Strategic Implications for Traders

This setup provides a favorable risk-to-reward ratio for long entries, particularly for traders seeking to capitalize on momentum-based patterns. An optimal trading approach could involve:

Entry: Near the neckline breakout or on a minor retest of 106,840.37 USDT

Stop-Loss: Below 105,997.09 USDT or under the right shoulder to account for volatility

Take-Profit Zones: Partial profits near 108,878.29 USDT, with final target at 110,752.24 USDT

6. Final Remarks

This chart illustrates a textbook example of a bullish reversal pattern in play. While the technical outlook is favorable, traders should remain cautious of potential invalidation scenarios, especially in highly volatile or news-driven markets. Confirmation through volume analysis and supportive macro/fundamental conditions can further enhance confidence in the bullish thesis.

Overall, the current setup indicates a well-structured opportunity for upward price movement, with a clearly defined entry, risk, and reward framework.

Let me know if you'd like this tailored for a trading journal, client report, or automated strategy setup.

Bitcoin (BTC) Technical Analysis for the Week of Jue 10 -June 16~~ Technical Analysis ~~

- Trend: Bitcoin is in a bullish trend on higher time frames (3-day and above), forming higher highs and higher lows. However, short-term signals are mixed, with some indicators suggesting consolidation or a potential pullback.

4-Hour Chart: Bullish, with the 50-day moving average (MA) sloping up, but the 200-day MA is sloping down since December 27, 2024, indicating a weaker short-term trend.

Daily Chart: Bullish, with the 50-day MA rising and below the current price, potentially acting as support. The 200-day MA has been rising since June 5, 2025, signalling a strong long-term trend.

Weekly Chart: Bullish, with the 50-day MA below the price and the 200-day MA sloping up since July 9, 2024.

Monthly Chart : Bullish which has a potential to hit All Time High

# Support, resistance and Targets marked in the chart for your reference

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

Bitcoin (BTC/USDT) 2-hour chart, focused on the buy side only!📊 Chart Overview

The chart shows BTC/USDT on the 2-hour timeframe, featuring clear levels of resistance, mini-resistance, and target zones. Let’s break down the buy idea:

🚀 Key Zones & Levels

💜 Resistance Zone (Purple Box):

Historical price ceiling.

Price dropped from this area several times.

🟦 Target Zone (Blue Line):

106,691 - 106,683 USDT.

Target for the next bullish move!

🟧 Mini Resistance (Yellow Box):

Around 102,000 USDT.

Acting as support (buy zone!) now.

💰 Buy Setup & Entry Area

✅ Buy Zone:

Just below 103,000 USDT, aligning with the mini resistance / support box (yellow).

✅ Entry Level:

Between 102,000 - 103,000 USDT.

Best if price consolidates or forms a reversal candle here.

🟢 Target:

First target: 106,000 USDT

Next major target: 106,683 - 106,691 USDT.

📉 Stop Loss:

Below 101,000 USDT for protection.

🎯 Trading Plan

1️⃣ Wait for a bullish reversal candlestick at the mini resistance box (~102,000 - 103,000 USDT).

2️⃣ Enter long (buy) position.

3️⃣ Target profit at 106,000 and 106,691 USDT.

4️⃣ Stop below 101,000 to manage risk.

⚡️ Summary

🟢 Buy: At mini resistance (~102,000 - 103,000).

🎯 Targets: 106,000 - 106,691.

❌ Stop: 101,000.

🚀 Let's ride the bullish wave! 💹📈🟢

Bitcoin (BTC) Technical Analysis for the Week of Jue 02 -June 09Technical Analysis

Price Action: Bitcoin is consolidating around $105,000–$108,000 after a sharp rally from April lows (~$74,000) and a peak near $112,000. A recent 3% correction was driven by profit-taking, with BTC stabilising near $106,000.

Trend: Medium-term trend remains bullish, but momentum is slowing. BTC has broken the previous resistance , indicating a potential slower rise or horizontal movement.

Note : Indicator MACD making bearish diversions in my view its not strong .

Key Levels:

Support: ~$102,600–$103,500 (recently tested)

Resistance: ~$106,000 (current resistance) and $110,500–$123,000 (next major target).

-- Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

BTCUSDT Trade Analysis📊 BTCUSDT Trade Analysis

Previous Move (Sell)

✅ Sell executed successfully – target reached (🎯).

📈 New Trade Setup (Buy)

💡 Current Plan:

Switching to buy now as the market has reached the previous sell target.

New Target:

Next major resistance area near 111,025 – 111,072 USDT range (🟩 target box at the top).

📍 Key Levels:

Entry Zone: Above 105,000 USDT mini-resistance area (🟧 mini-resistance box).

Support: Around 102,999 USDT (blue support line).

Current Target (Buy):

Target zone: 111,025 – 111,072 USDT.

📌 Trade Plan Summary

Entry: Above 105,000 mini-resistance area break.

Target Point: 111,025 – 111,072 USDT 🟩.

Stop Loss: Suggested below 102,999 USDT to limit downside (🔴 red zone).

🎯 Conclusion:

🔵 Target for the buy move is well-defined and positioned above current resistance levels.

🟢 Awaiting price action above mini-resistance area for a safe entry for the next bullish leg!

Intraday Long Setup | June 2nd 2025 | Valid Until Daily ClosePrice is retracing to a strong pivot zone (marked by the red box).

Structure remains bullish with potential for continuation after pullback.

The green box represents a high-probability long opportunity with tight risk control.

Watch for price reaction within the red zone. Entry only if confirmation (e.g., bullish engulfing, strong wick rejections) appears.

The setup expires at end of the daily candle close.

Price is coiling. But I already know where it wants to go.15-minute chart, but the logic is macro.

We just printed a double top above 104,800 — but Smart Money didn’t take that high for fun. That was a clean liquidity raid followed by immediate rejection. The reaction wasn’t retail panic. It was engineered.

What followed was a controlled pullback into a micro-dealing range. I’m expecting one more sweep — a stab into the 103,728.4 zone. Why?

Because that’s where the 0.5 retracement meets the upper bound of a low-volume node. If price wants to rebalance, it’ll do it there — not randomly in mid-air.

If price respects that level and prints bullish structure, I’ll step in. First objective? 104,865. That’s the true inefficiency gap above the raid high — and the last unfilled void in this leg.

Execution logic:

🔑 Anticipated long trigger: 103,728.4

🧠 Deep discount final bid: 103,581–103,247 sweep (last grab)

🎯 Immediate TP: 104,865

❌ Invalidation: Full body break below 103,101

I don’t need candles to line up perfectly.

I just need price to return to value.

I trade what price must do — not what it might do.

BTC/USD Technical OutlookTechnical Analysis Summary:

1. Support & Resistance Zones:

Support Zone: ~$102,600–$103,500

✅ Price recently tested and bounced from this zone, supported by the 200 EMA (blue line).

Resistance Zone: ~$110,500–$112,000

🔼 This is the next major target area for bulls.

Mid-level Supply: ~$106,500–$107,500

⚠️ Price may face short-term resistance here (near the 50 EMA in red).

🔄 Moving Averages:

200 EMA (blue) at $102,648: Acts as strong dynamic support. Price bounce reinforces bullish sentiment.

50 EMA (red) at $106,798: Currently acting as dynamic resistance. A breakout above it would strengthen bullish continuation.

🕯️ Candlestick Behavior:

Multiple rejection wicks from the support zone indicate buyer strength.

Recent candle shows a bullish reaction, potentially forming a reversal pattern.

📈 Price Projection (as per the chart path):

Short-term pullback may lead into the $106,500–$107,500 zone.

If bulls maintain momentum and break above, we can expect a push toward $111K–$112K resistance.

✅ Conclusion:

Bias: Bullish

Trigger: Confirmed bounce from support + price reclaiming 50 EMA

Invalidation: Break below $102,600 with high volume would invalidate the bullish scenario.