BAJAJFINSV

BAJAJ FIN is downward trend expected by channel.By looking at the daily chart shows a lot more clear vision of the next moment for investors' activities. The price is trading between value high to control price 1. I am thinking here profit booking and price can stay in condition if fall is not started but hard to move upside from here.

If the price starts to fall then the next target will be at previous resistance in 8595 and the gravitating target can be easy 8400.

We are thinking first target 9500 nearby is easy and then 9300-9200 possible. Taking a short position is not wrong now.

Buying in 9500 strikes put option in step is not bad,

buy @ 95 and another buy @70 for

targets 132-189

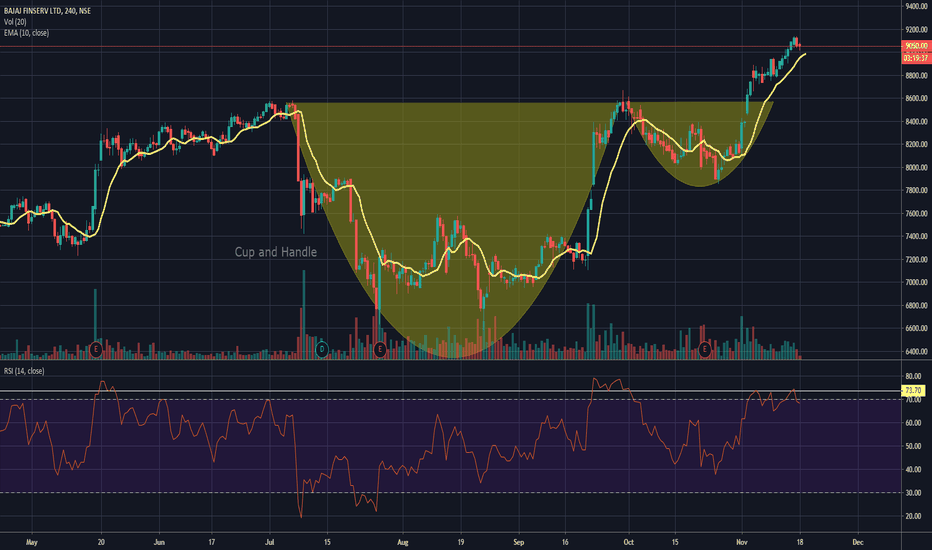

cup and handle on weekly chart - BAJAJFINSVa clean cup and handle pattern on weekly chart for bajajfinsv

Its going to re-test the neck line on chart soon .

after touching the neck line while re-testing its difficult to tell if its going to bounce or drop from there as doesnt have a very clear volume during breakout

suggestions - welcome - how do you read this chart ?

Thanks