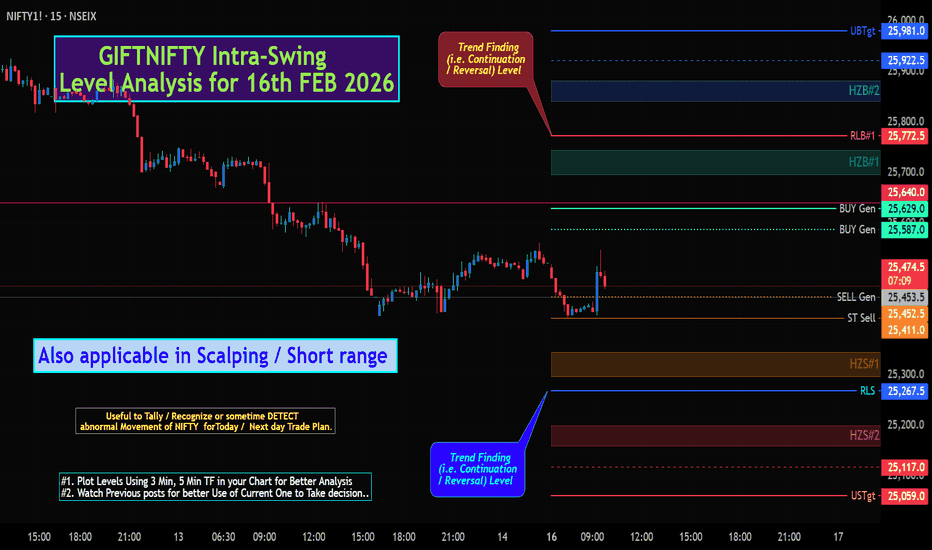

GIFTNIFTY Intra-Swing Level Analysis for 16th FEB 2026GIFTNIFTY Intra-Swing Level Analysis for 16th FEB 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

⚪Weekly PCR Analysis:

17 Feb 2026 EXP. Weekly Basis =>

PCR: 0.66 Trend Strength: 🛑 Bearish.

Intraday Change in Weekly Basis Data =>

Change OI PCR: 2.285. Trend Strength: 🛑 BULLISH.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.________________^^^^^^^^^^^^^^^^_________________

🔕🟥🟧🟨🟩🟦🟪⬛🔴🟠🟡🟢🔵🟣⚫⚪🔺🔻

Beyond Technical Analysis

NIFTY Scalping / Short Range Level Analysis for 17th FEB 2026NIFTY Scalping / Short Range Level Analysis for 17th FEB 2026

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

⚪Weekly PCR Analysis:

17 Feb 2026 EXP. Weekly Basis =>

Put OI: 30,07,563, Call OI: 28,22,123, PCR: 1.07. Trend Strength: ⚪NEUTRAL.

Intraday Change in Weekly Basis Data =>

Put OI Change: 12,12,597,Call OI Change: -11,45,868, Change OI PCR: -1.06. Trend Strength: ⚪NEUTRAL.

🟣FEB EXP. Monthly PCR Analysis:

Put OI: 10,98,791, Call OI: 11,27,430, PCR: 0.97. Trend Strength: ⚪NEUTRAL.

Intraday Change in Monthly Basis Data =>

Put OI Change: -2,24,033, Call OI Change: -12,76,400, Change OI PCR: 0.18. Trend Strength: 🔴 Bearish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

Some Technical Parameter:

🛑 VWap vs Price: Price Below.

🟢 Rsi(14): 50.87

🟡 Stoch Rsi(14): 62.79, 61.15 (Down but Neutral though Bearish Cross Over)

🟢 MACD Bias (12,26): 13.81 (Bullish)

🟡 Williams %R: -37.21 (Perfect Reversal Point Near -80)

🟠 ROC: 1.34

Time Frame basis Trend:

🟢1 Min: Bear, 🟢5 Min: Bear, 🟢15 Min: Bear, 🟢30 Min: Bear, 🛑1 Hour Bear,

🛑2 Hour: Bear, 🟢4 Hour: Bullish, 🟢Daily : Bullish, 🟢Weekly: : Bullish, 🟢Monthly: Bullish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

MA (Moving Averages) Analysis:

⬛Period - 🟨SMA - 🟦EMA

🟥 MA 9 - 25758.87 - 🟩 25679.28

🟩 MA 20 - 25472.87 - 25635.14

🟥 MA 50 - 25765.06 - 🟩 25677.64

🟩 MA 100 - 25688.76 - 25583.76

🟩 MA 200 - 25299.65 - 25220.75

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

👇🏼Screenshot of NIFTY Spot All-day(16th FEB 2026) in 5 min TF with perodical update.

🚀Follow GIFTNIFTY Post for NF levels

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"🔔As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.________________^^^^^^^^^^^^^^^^_________________

Tata Power at Decision Zone — Breakdown or Breakout Loading?Price has been trading inside a clear descending channel, respecting both resistance and support trendlines with precision.

Recently, the stock bounced from lower channel support with strong buying interest and is now approaching the upper supply trendline, which historically acted as rejection zone.

This level is critical because:

• Upper trendline = dynamic resistance

• Previous breakdown zone = supply area

• Volume expansion during bounce = accumulation sign

XAUUSD (H1) – Weekly Analysis | Geopolitical FactorsXAUUSD (H1) – Weekly Outlook | Geopolitics Back in Focus

Gold opens the week holding above short-term support after last week’s sharp sell-off and recovery. Price is now rotating beneath the 5,100 supply zone while geopolitical risk re-enters the narrative.

Netanyahu’s firm stance on Iran’s nuclear infrastructure and visible tension ahead of US–Iran talks increase uncertainty. Historically, when geopolitical risk premiums rise, gold attracts defensive flows — especially when price is technically positioned near liquidity zones.

Right now, structure and macro are aligning at a decision point.

Technical Structure (H1)

Major supply: 5,080 – 5,105

Current price rotating around: 4,980 – 5,000

Intraday support: 4,930 – 4,950

Higher-timeframe demand: 4,658 – 4,685

After sweeping lows near 4,900, price reclaimed 5,000 but failed to break 5,100. This signals unfinished business on both sides of liquidity.

The market is compressing — and compression leads to expansion.

Weekly Scenarios

Scenario A – Liquidity Sweep Above 5,100 (Bullish Expansion)

If price accepts above 5,105, stops above range highs become fuel.

Upside continuation toward 5,150+ becomes likely.

Geopolitical headlines could accelerate this move.

Scenario B – Rejection From Supply (Corrective Rotation Lower)

Failure to reclaim 5,100 followed by weakness under 4,980 opens retracement toward:

4,930 liquidity

4,850 mid support

4,680 higher-timeframe demand

This would be a technical correction, not necessarily macro bearish.

Flow Perspective

Sell-side liquidity was cleared last week.

Now buy-side liquidity above 5,100 remains untouched.

Markets rarely leave equal highs untested for long.

Next week is likely a liquidity week — not a sideways week.

Execution Mindset

Watch reaction at 5,080–5,105.

Above it → expansion.

Rejection → rotation first, then reassess.

Trade the level.

Let structure confirm.

OBEROIRLTY 1 Week Time Frame 📍 Current Price (approx): ~₹1,560 – ₹1,565 on Feb 16 (based on latest exchange data)

📈 Weekly Support & Resistance Levels

1-Week (16 – 20 Feb 2026)

🔹 Immediate Resistance Levels

R1: ₹1,581.83 — near-term upside barrier

R2: ₹1,616.07 — next bullish test

R3: ₹1,649.33 — extended resistance if breakout sustains

🔸 Immediate Support Levels

S1: ₹1,514.33 — key near-term support

S2: ₹1,481.07 — secondary downside level

S3: ₹1,446.83 — deeper support range for weak price action

📊 Weekly Expected Trading Range:

₹1,447 – ₹1,649 (typical range without strong news impact).

📌 How to Use These Levels (Weekly Context)

Bullish Scenario

If Oberoi Realty closes above ₹1,581.83 on weekly basis → bullish continuation likely

Break above ₹1,616–₹1,649 increases probability of further upside momentum.

Bearish Scenario

If price breaks below ₹1,514.33 → downside might accelerate

Sustained weakness could target ₹1,481 then ₹1,447.

🧠 Intermediate Technical Context

Daily support/resistance (classic pivot method) also suggests shorter intraday levels (good for trade timing):

S1: ~₹1,545–₹1,550

S2: ~₹1,526–₹1,514

Pivot: ~₹1,558–₹1,560

R1: ~₹1,577–₹1,589

R2: ~₹1,589–₹1,608

This daily pivot cluster feeds into broader weekly zones.

📊 Technical Indicator Snapshot (Recent)

Moving averages (20/50/100/200) around current price — trading mostly neutral with slight resistance overhead.

Oscillators like RSI near neutral (~50), suggesting neither strongly overbought nor oversold conditions.

Can Jupiter's transit give a big move to Godrej Properties?Friends, trading on time cycle charts, especially long-term ones, is beyond imagination! Let me share a chart with you. This is the weekly chart of Godrej Properties. In this chart, I'll try to illustrate how much returns it has generated each time the cycle is in an uptrend. Let's get started.

Friends, you are seeing this weekly chart of Godrej Property and if you look at it carefully, it has a cycle of one and a half year, it has given more than 150% profit in the cycle every 1.5 years cycle and every uptrend cycle.

The lighter side is that we all know that Rahu and Ketu stay in one zodiac sign for many years, but the property sector is not influenced by Rahu. And one more thing to note, whenever Jupiter has entered the water sign, this stock has seen a huge jump.

Now friends, I will tell you something about the birth of Godrej Properties. So that you can correlate why Jupiter i am using here. Yes friends Godrej Properties was born in February 8, 1985 (Note: It was originally incorporated as Sea Breeze Constructions and Investments Private Limited.)

Listing Date (Trading "Birth" on NSE/BSE) January 5, 2010

When you look at the Astro charts for these dates, you will see that Mars, the significator of this stock chart, was in a Water sign. and With the change of sign of Jupiter, changes start taking place in your life, I would like to tell you a little about it, when a child is born, in the first year he starts learning on his own and tries to sit, stand and stand straight, the second year means the second house which shows your food, so the child of that year keeps searching for taste in his food, he does not like milk and normal food, in the third year he tries to call his parents, (3rd house - Communicative) and when Jupiter reaches the fourth year, emotions come in the 4 year old child, he gets scared, angry, he learns, in the 5th year he learns to read and write (5th house education).

This is why calculations begin with Jupiter transits, and Jupiter transits are observed to identify major changes. I hope you all understand what I'm trying to say.

Now that Jupiter is about to move from Cancer to Water, we'll be waiting for the major move that will occur in Godrej Properties.

Expecting sell delivery in GBPUSDThe first and foremost which promotes my idea is "Daily and weekly structure where all Buyside liquidity is taken above , then price faile to make a high and close below the daily inversion (I-fvg) which indicates the bearish flow , and then made structure shift in 4H TF , afterwards it retested the orderblock and makes a sell side expansion which indicates it's weakness and increases its tendency to go for liquidity down below!!

Even if you plan to execute, only execute if the price didn't breach the target area frst , only execute if price triggers entry before price going to Target!!

Wish you all luck, that's just educational..try in demo .

XAU-USD Analysis on 30 Min TFXAUUSD has just broken the Pattern of Flat-Top and retest has already been confirmed through a Ascending Channel . All the Patterns refers to Bearish movement . If Price action Follows then there is a possibility of Double bottom Patten Formation at the levels mentioned.

It may be in Uptrend at the earliest possible that is Target Supply else it will complete the Full supply and then there will be strong Move on Up Direction

Now it is in a Consolidation Zone before any Big Rally.

BANKNIFTY Scalping / Short Range Level analysis: 17th FEB 2026As mentioned Y'Day BANKNIFTY : Bullish.

Notice one thing How Levels are Tested

👇🏼Screenshot of BANKNIFTY Spot All-day(16th FEB 2026) in 5 min TF.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

🟣FEB EXP. Monthly PCR Analysis:

Put OI: 5,27,016, Call OI: 4,62,049, PCR: 1.14. Trend Strength: 🟠Neutral.

Intraday Change in Monthly Basis Data =>

Put OI Change: 91,786, Call OI Change: -40,249, Change OI PCR: -2.28. Trend Strength: 🟠Neutral.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

Some Technical Parameter:

🛑 VWap vs Price: Price Below.

🟢 Rsi(14): 60.40

🟧 Stoch Rsi(14): 79.51, 71.38 (Down but Neutral though Bearish Cross Over)

🟢 MACD Bias (12,26): 252.46 (Bullish)

🟡 Williams %R: -20.49 (Perfect Reversal Point Near -80)

🟠 ROC: 2.27

Time Frame basis Trend:

🟢1 Min: Bear, 🟢5 Min: Bear, 🟢15 Min: Bear, 🟢30 Min: Bear, 🟢1 Hour Bear,

🟢2 Hour: Bear, 🟢4 Hour: Bullish, 🟢Daily : Bullish, 🟢Weekly: : Bullish, 🟢Monthly: Bullish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

MA (Moving Averages) Analysis:

🟩 Period 🟩 SMA 🟩 EMA

🟩 MA 9 - 60482.11 - 60410.89

🟩 MA 20 - 59783.34 - 60053.19

🟩 MA 50 - 59578.08 - 59525.61

🟩 MA 100 - 58596.64 - 58639.69

🟩 MA 200 - 57134.14 - 57026.51

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"🔔As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.________________^^^^^^^^^^^^^^^^_________________

🔔🔕🟥🟧🟨🟩🟦🟪⬛🔴🟠🟡🟢🔵🟣⚫⚪🔺🔻

BANKNIFTY Scalping / Short Range Level analysis -16th FEB 2026+BANKNIFTY Scalping / Short Range Level analysis for 16th FEB 2026+

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

🔵FEB EXP. Monthly PCR Analysis:

Put OI: 4,38,519, Call OI: 5,01,661, PCR: 0.87. Trend Strength: 🟠Neutral.

Intraday Change in Monthly Basis Data =>

Put OI Change: -70,764, Call OI Change: 36,273, Change OI PCR: -1.95. Trend Strength: 🛑 Extreme Bearish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

Some Technical Parameter:

🛑 VWap vs Price: Price Below.

🟠 Rsi(14): 53.83

🟡 Stoch Rsi(14): 60.35, 69.67 (Down but Neutral though Bearish Cross Over)

🟢 MACD Bias (12,26): 313.10 (Bullish)

🟡 Williams %R: -39.64 (Perfect Reversal Point Near -80)

🟠 ROC: 1.66

Time Frame basis Trend:

🛑1 Min: Bear, 🛑5 Min: Bear, 🛑15 Min: Bear, 🛑30 Min: Bear, 🛑1 Hour Bear,

🟢2 Hour: Bear, 🟢4 Hour: Bullish, 🟢Daily : Bullish, 🟢Weekly: : Bullish, 🟢Monthly: Bullish.

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

MA (Moving Averages) Analysis:

⚪Period - SMA - EMA

🟨 MA 9 - 60381.24 - 60276.34

🟩 MA 20 - 59730.45 - 59958.89

🟩 MA 50 - 59544.87 - 59467.51

🟩 MA 100 - 58540.00 - 58593.03

🟩 MA 200 - 57104.83 - 56987.09

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"🟥 As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.________________^^^^^^^^^^^^^^^^_________________

🔕🟥🟧🟨🟩🟦🟪⬛🔴🟠🟡🟢🔵🟣⚫⚪🔺🔻

Axis Bank | Gann Square of 9 Intraday Observation | 18 August 20Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 18 August 2023

Time Frame: 15-Minute Chart

Study Used: Gann Square of 9 (Normal Price Capacity)

This idea shares a historical intraday observation where Axis Bank’s price movement stayed within a normal Square of 9 price range, followed by a visible reaction after price–time alignment.

📊 Market Context & Reference Selection

During the session, price showed gradual upward movement starting later in the morning.

In upward conditions, the low of the reference candle (~931) was treated as the 0-degree level, following commonly used Gann principles.

From this reference, the Square of 9 was applied to observe expected intraday price expansion.

This process focuses on structure and measurement, not forecasting.

🔢 Square of 9 Levels Observed

Based on the selected reference:

0 Degree: ~931

45 Degree (Observed Normal Upside Capacity): ~946

The 45-degree level is monitored as a potential reaction zone when reached early in the session.

⏱️ Observed Price–Time Behavior

Price moved upward from the reference area and interacted with the 45-degree zone around 10:30 AM.

This interaction occurred well before typical intraday time thresholds.

After reaching this zone, the market showed temporary selling pressure.

Similar reactions have been historically observed when normal intraday capacity is completed early.

The entire session’s range remained within this capacity, reflecting balanced price behavior.

📘 Educational Takeaways

Importance of selecting a valid 0-degree reference

Measuring normal intraday price range using Square of 9

Observing time alignment along with price levels

Recognizing reaction zones rather than fixed turning points

Maintaining a disciplined, rule-based analytical approach

This example illustrates how price-time tools can be used to interpret intraday behavior objectively.

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis #RuleBasedStudy

Axis Bank | Gann Square of 9 Intraday Observation | 28 June 2023Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 28 June 2023

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Normal Price Capacity Study)

This idea presents a historical intraday observation where Axis Bank’s price action aligned with a normal Square of 9 upside capacity level, followed by a visible reaction once price and time came into balance.

📊 Market Context & Reference Selection

During the session, Axis Bank showed upward momentum starting after the early candles.

In rising conditions, the low of the reference candle (~967) was treated as the 0-degree level, following commonly used Gann principles.

This reference was used to study the stock’s expected intraday price expansion, based on historical behavior.

The focus remains on measurement and observation, not prediction.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~967

45 Degree (Observed Normal Upside Capacity): ~983

The 45-degree level is often monitored as a potential reaction zone when price reaches it earlier in the session.

⏱️ Observed Price–Time Behavior

Price moved upward steadily from the reference area.

The 45-degree zone was reached around the later part of the session but still before the typical intraday time threshold.

After interacting with this zone, the market showed temporary selling pressure.

Such reactions have been historically observed when normal price capacity is completed early.

This behavior reflects the price–time balance concept, where movement completion can coincide with short-term pauses or reversals.

📘 Educational Takeaways

Importance of identifying a valid 0-degree reference

Measuring normal intraday price capacity using Square of 9

Observing time alignment along with price levels

Understanding reaction zones rather than fixed turning points

Maintaining a rule-based and emotion-free approach

This example demonstrates how structured analysis can help interpret intraday behavior objectively.

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis #RuleBasedStudy

Currency Wars and Forex Trading🌍 What Are Currency Wars?

A currency war—sometimes called “competitive devaluation”—occurs when countries deliberately try to weaken their own currency to gain economic advantages over other nations. The term became widely popular after Brazil’s former finance minister Guido Mantega used it in 2010 to describe global monetary tensions following the 2008 financial crisis.

In a currency war, governments or central banks lower the value of their currency to:

Boost exports (cheaper goods abroad)

Reduce trade deficits

Stimulate domestic economic growth

Increase inflation when facing deflation risks

Major central banks involved in such policies have included the Federal Reserve, the European Central Bank, and the Bank of Japan.

🔧 How Countries Devalue Their Currency

Countries typically devalue their currency using:

Lower Interest Rates

When interest rates fall, investors earn less from holding that currency, so demand drops, and the currency weakens.

Quantitative Easing (QE)

Central banks increase the money supply by purchasing bonds or financial assets, which can reduce currency value.

Direct Market Intervention

Governments may directly sell their currency in foreign exchange markets.

Verbal Intervention

Policymakers may influence markets through public statements signaling a preference for a weaker currency.

⚔️ Historical Example: Japan’s Monetary Policy

In 2013, under Prime Minister Shinzo Abe, Japan implemented aggressive monetary easing through the Bank of Japan. The policy—known as “Abenomics”—aimed to end decades of deflation by weakening the Japanese yen.

As the yen fell sharply against the U.S. dollar:

Japanese exports became more competitive.

Other Asian economies worried about losing trade advantages.

Global markets experienced increased volatility.

This episode is often cited as a modern example of currency war dynamics.

📈 What Is Forex Trading?

Forex (Foreign Exchange) trading is the global marketplace for buying and selling currencies. It is the largest financial market in the world, with daily trading volumes exceeding $6 trillion.

Currencies are traded in pairs, such as:

EUR/USD

USD/JPY

GBP/USD

Traders speculate on whether one currency will strengthen or weaken relative to another.

Major currency pairs often include:

United States dollar (USD)

Euro (EUR)

Japanese yen (JPY)

British pound sterling (GBP)

🏦 How Currency Wars Affect Forex Markets

Currency wars create significant volatility in forex markets. Since forex traders profit from price movements, central bank interventions can create both opportunities and risks.

1️⃣ Increased Volatility

Unexpected rate cuts or monetary easing cause rapid price swings.

2️⃣ Trend Formation

Sustained devaluation policies can create long-term currency trends.

3️⃣ Safe-Haven Flows

In times of currency tension, investors may shift to perceived safe-haven currencies like the U.S. dollar or Japanese yen.

📊 Example: Quantitative Easing in the U.S.

After the 2008 global financial crisis, the Federal Reserve launched multiple rounds of quantitative easing. The increase in money supply initially weakened the U.S. dollar.

Forex traders responded by:

Selling USD during early QE phases

Buying commodities priced in USD

Shifting funds into emerging markets

However, as the U.S. economy recovered faster than others, the dollar later strengthened—showing how currency wars can have complex, long-term effects.

💼 Who Participates in Forex Markets?

Forex participants include:

Central Banks – Influence currency value through monetary policy.

Commercial Banks – Facilitate global trade and large transactions.

Hedge Funds and Institutions – Trade currencies for profit.

Corporations – Hedge currency risk in international trade.

Retail Traders – Individual traders using online platforms.

Unlike stock markets, forex markets operate 24 hours a day, five days a week.

🧠 Strategies Used in Forex Trading During Currency Wars

When currency wars intensify, traders adjust their strategies:

🔹 Carry Trade

Borrow in low-interest-rate currencies and invest in higher-yield currencies.

🔹 Trend Following

Ride sustained devaluation trends triggered by policy changes.

🔹 News-Based Trading

Trade immediately after central bank announcements.

🔹 Hedging

Protect investments from sudden currency fluctuations.

However, these strategies carry risk. Currency interventions can reverse quickly if governments change policy.

⚖️ Risks of Currency Wars

Currency wars can create global instability:

Trade tensions may escalate.

Inflation can rise unpredictably.

Asset bubbles may form.

Emerging markets may suffer capital outflows.

For forex traders, the biggest risks include:

Sudden policy reversals

Geopolitical shocks

Excessive leverage

High leverage is common in forex trading, amplifying both profits and losses.

🌐 The Global Impact

When multiple countries attempt to devalue simultaneously, the result can be global economic imbalance. If every country weakens its currency, no nation gains lasting trade advantage.

Institutions like the International Monetary Fund monitor exchange rate policies to reduce destabilizing competitive devaluations.

Currency wars often reflect deeper economic struggles:

Slow growth

High unemployment

Debt burdens

Trade imbalances

In extreme cases, prolonged currency conflicts can contribute to broader financial crises.

📌 Key Differences: Currency Wars vs Forex Trading

Currency Wars Forex Trading

Government-driven Market-driven

Policy-based Profit-based

Long-term economic impact Short- to medium-term trading

Affects entire economies Affects individual portfolios

Currency wars are macroeconomic events, while forex trading is a financial activity reacting to those events.

🔮 The Future of Currency Competition

As global economies become more interconnected, currency competition remains a persistent risk. Factors influencing future currency tensions include:

Digital currencies and central bank digital currencies (CBDCs)

Trade conflicts

Geopolitical rivalry

Monetary policy divergence

For forex traders, understanding macroeconomics is essential. Currency wars are not just political events—they create the trends, volatility, and opportunities that drive forex markets.

📘 Conclusion

Currency wars and forex trading are deeply interconnected. When governments attempt to manipulate exchange rates to gain economic advantages, they reshape global financial markets. Forex traders monitor central bank decisions, economic indicators, and geopolitical developments to anticipate currency movements.

While currency wars can stimulate domestic economies in the short term, they risk global instability if pursued aggressively. For traders, they offer both opportunity and danger. Success in forex trading during currency conflicts requires disciplined risk management, deep macroeconomic understanding, and awareness of how policy decisions ripple through global markets.

In the modern global economy, currency value is not just a reflection of supply and demand—it is also a powerful political and economic tool.

Understanding Arbitrage Opportunities Across World Exchanges What Is Arbitrage?

Arbitrage occurs when an identical or equivalent asset is priced differently in two or more markets. A trader simultaneously buys the asset at a lower price in one market and sells it at a higher price in another market, locking in a profit from the price discrepancy.

In theory, arbitrage is risk-free. In practice, however, transaction costs, execution delays, currency fluctuations, and regulatory constraints introduce risks.

Why Do Arbitrage Opportunities Exist?

Even in today’s highly connected global financial system, price discrepancies can occur due to:

Differences in supply and demand across regions

Currency exchange rate fluctuations

Market inefficiencies

Transaction delays

Regulatory or capital controls

Information asymmetry

While technology has reduced many arbitrage gaps, opportunities still arise—especially during periods of volatility or when markets open and close at different times.

1. Stock Market Arbitrage

One of the most common types of global arbitrage occurs between stock exchanges.

Example: Dual-Listed Companies

Some companies are listed on more than one exchange. For example:

Alibaba Group is listed on:

New York Stock Exchange (NYSE)

Hong Kong Stock Exchange (HKEX)

If Alibaba shares are trading at an equivalent of $80 in New York and $82 in Hong Kong (after currency conversion), a trader could:

Buy shares on NYSE

Sell shares on HKEX

Capture the $2 difference (minus fees)

This is known as cross-listing arbitrage.

However, settlement rules, capital movement restrictions, and time zone differences complicate the process.

2. Currency (Forex) Arbitrage

The foreign exchange market is the largest financial market in the world. Arbitrage in forex typically involves triangular arbitrage across three currencies.

For example:

USD → EUR

EUR → GBP

GBP → USD

If the implied exchange rates don’t perfectly align, traders can cycle through currencies and end up with more than they started.

Triangular Arbitrage Example

Suppose:

1 USD = 0.90 EUR

1 EUR = 0.80 GBP

1 GBP = 1.50 USD

If the mathematical relationships don’t perfectly match, a trader might exploit the imbalance.

These opportunities are extremely short-lived—often lasting milliseconds—and are usually captured by high-frequency trading systems.

3. Cryptocurrency Arbitrage

Cryptocurrency markets provide some of the most visible arbitrage opportunities due to fragmentation across global exchanges.

For example, Bitcoin might trade at:

$30,000 on one exchange

$30,400 on another

Bitcoin is traded globally across hundreds of platforms.

Why Crypto Arbitrage Exists

No centralized global pricing mechanism

Capital restrictions in certain countries

Differences in liquidity

Exchange withdrawal delays

A famous example is the “Kimchi Premium” in South Korea, where Bitcoin historically traded at significantly higher prices on Korean exchanges compared to U.S. exchanges.

Crypto arbitrage includes:

Spatial arbitrage (between exchanges)

Statistical arbitrage

Funding rate arbitrage (in futures markets)

Cross-border arbitrage

However, blockchain transfer times and transaction fees reduce profitability.

4. Commodity Arbitrage

Commodity arbitrage occurs across different exchanges or geographic locations.

For example, gold may trade on:

COMEX in the United States

London Metal Exchange in the UK

If gold prices differ beyond shipping and storage costs, traders can buy gold in one market and sell in another.

There are also:

Futures vs. spot arbitrage

Calendar arbitrage (between contract months)

Geographic arbitrage (physical commodities)

Physical commodity arbitrage requires logistics, storage, and insurance considerations.

5. Futures and Derivatives Arbitrage

Futures prices should theoretically reflect the spot price plus carrying costs (cost-of-carry model). When discrepancies occur, arbitrage becomes possible.

For example:

Buy underlying asset in spot market

Sell futures contract

Deliver asset at contract expiration

If futures are overpriced relative to spot, traders profit from the convergence.

This type of arbitrage is common in stock index futures and commodity futures markets.

6. ETF Arbitrage

Exchange-Traded Funds (ETFs) track baskets of assets. If an ETF’s price deviates from its net asset value (NAV), authorized participants step in.

For example:

SPDR S&P 500 ETF Trust tracks the S&P 500 index.

If the ETF trades above its NAV:

Buy underlying stocks

Create new ETF shares

Sell ETF at higher price

This arbitrage mechanism helps keep ETF prices aligned with the underlying index.

Risks in Global Arbitrage

Though often described as risk-free, real-world arbitrage involves several risks:

1. Execution Risk

Price differences may disappear before trades complete.

2. Currency Risk

Exchange rate fluctuations can erode profits.

3. Regulatory Risk

Some countries restrict capital flows.

4. Transfer Delays

Crypto transfers or settlement cycles may take time.

5. Transaction Costs

Fees can eliminate thin profit margins.

Role of Technology

Modern arbitrage is dominated by:

High-Frequency Trading (HFT)

Algorithmic trading

Low-latency infrastructure

Co-location servers

Large financial institutions invest heavily in infrastructure to capture microsecond-level opportunities.

Market Efficiency and Arbitrage

Arbitrage contributes to market efficiency. When traders exploit price differences:

Cheap markets see increased demand → price rises

Expensive markets see increased supply → price falls

This process quickly equalizes prices globally.

Thus, arbitrageurs serve as a stabilizing force in financial systems.

Legal and Ethical Considerations

Arbitrage itself is legal in most jurisdictions. However:

Insider trading is illegal

Market manipulation is illegal

Certain cross-border capital movements may be restricted

Educational understanding should focus on the mechanics and risks rather than attempting unsophisticated real-world execution.

Conclusion

Arbitrage across world exchanges is a cornerstone of global finance. From stocks and currencies to cryptocurrencies and commodities, price differences arise due to market fragmentation, liquidity imbalances, and information delays.

While theoretically risk-free, practical arbitrage requires speed, capital, infrastructure, and deep market knowledge. Most opportunities are short-lived and dominated by institutional traders using advanced algorithms.

For educational purposes, arbitrage illustrates powerful economic principles:

Law of One Price

Market efficiency

Global financial integration

Risk management

Understanding arbitrage provides insight into how modern financial markets remain interconnected and how pricing discrepancies are corrected almost instantly in today’s digital world.