Reliance Industries Limited (RIL)Reliance is looking Good near 1380-1400 Rs support zone. RSI is also at oversold zone (26.70). Considering it for short term move with upside potential of 8 - 11 %.

1560 - 1575 Rs is a strong supply zone for it.

Target 1 : 1500-1510 RS

Target 2 : 1550 - 1560 Rs

Disclaimer : The Above shared Content is for information and education purposes only and should not be treated as investment or trading advice. Im not SEBI registered, Contact your financial advisor before any investment.

Beyond Technical Analysis

Aarti Drugs reversal trade and Fundamental Trigger is in placedReversal Trade in aarti Drugs :

For FY27: management believes mid-teens to 20% growth is feasible: “we can try for 15%-20% growth for next year” aided by stabilized pricing and new capacities—but explicitly contingent on salicylic acid ramp-up: “The key challenge will remain… ramp up of salicylic acid.”

NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026📊 NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026

🚀Follow & Compare NIFTY spot daily Postas well as

💥GIFTNIFTY Post for NF levelsfor Taking Trade

🚀Follow GIFTNIFTY Post for NF levels

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

NIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levelsNIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levels

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

^^^^^^^^^^^______________^^^^^^^^^^^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

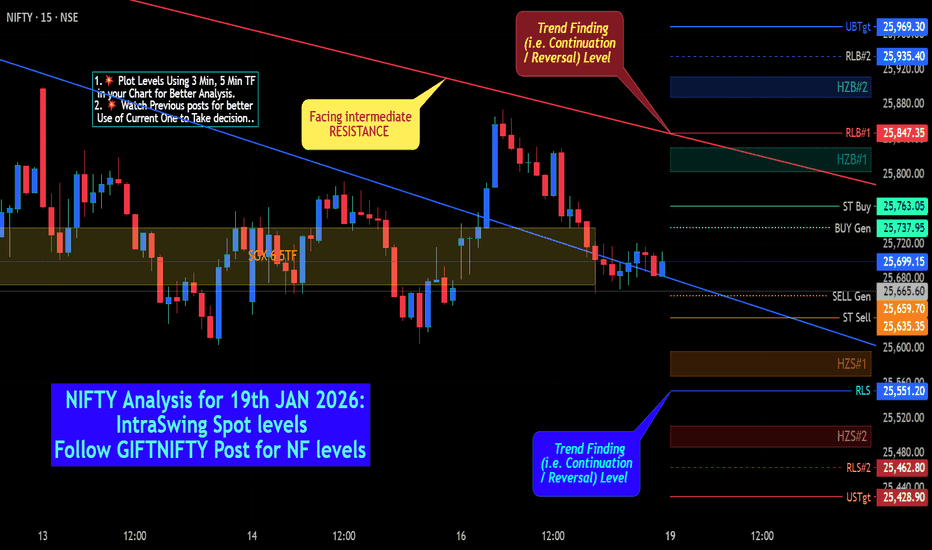

NIFTY Analysis for 19th JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 19th JAN 2026: IntraSwing Spot levels

🚀Follow GIFTNIFTY Post for NF levels

^^^___❇️❇️❇️❇️❇️❇️❇️❇️❇️___^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

POLICYBZR – Textbook Tweezer Bottom at Trendline SupportPOLICYBZR has formed a perfect Tweezer Bottom exactly at a rising demand / support trendline, indicating strong buying interest at lower levels. Sellers tried to push price below this zone but failed twice, which confirms absorption of supply.

This reaction is not random — it’s happening:

At a well-defined support trendline

After a controlled decline

With immediate bullish response, showing rejection of lower prices

What this means structurally:

As long as price holds above the tweezer low, downside risk remains limited

The first upside test will be the nearby supply zone / previous consolidation area

A sustained move above that zone can shift the structure back toward higher highs

This is a low-risk observation zone, where price action confirmation matters more than speed.

No indicators needed — pure price behavior is speaking.

COLPAL – Compression Near Lower Channel | Early Strength EmerginCOLPAL has been moving inside a long-term falling channel, respecting both the upper resistance and lower support trendlines. Recently, price has rebounded from the lower channel support, indicating demand at lower levels.

The structure shows gradual compression near the support zone, suggesting selling pressure is reducing. Today’s move signals early strength, but the trend is not confirmed yet.

As long as price holds above the lower trendline, the structure remains constructive.

A decisive breakout above the falling channel would be the real confirmation of trend reversal.

Until then, this remains a wait-and-watch zone, where price behavior matters more than prediction.

Simple chart. Clear structure. Patience required.

BAJFINANCE Weekly Level Analysis: PositionalSwing: 19th-23rd JANContinuation of early last night "Intraswing level" post

in early post mentioned Max level "UBTgt => 969" made high @ 969.95 i.e Hit all Levels.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

BAJFINANCE Nearer to Bottoming out-Intraswing Leve 19th JAN 2026BAJFINANCE Level Analysis: Intraswing for 19th JAN 2026

IS NEARER TO BOTTOMINGOUT?

🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔

👇🏼Screen shot of Daily Analysis

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Understanding Ownership, Value, and Investment in Stock MarketWhat Are Shares?

A share is a unit of ownership in a company. When a company needs capital to start, expand, or modernize its operations, it may choose to raise funds by issuing shares to the public or to private investors. Each share represents a small portion of the company’s ownership. Shareholders, therefore, become part-owners of the business.

For example, if a company issues one million shares and an investor owns ten thousand of them, that investor owns one percent of the company. Ownership through shares can entitle investors to certain rights, such as voting on major company decisions and receiving a portion of the company’s profits.

Why Companies Issue Shares

Companies issue shares primarily to raise capital without taking on debt. Unlike loans, the money raised through shares does not need to be repaid. Instead, shareholders share in the risks and rewards of the business. This capital can be used for various purposes such as launching new products, expanding into new markets, upgrading technology, or paying off existing liabilities.

Issuing shares also helps companies improve their credibility and visibility, especially when they are listed on a stock exchange. Publicly listed companies are often perceived as more transparent and reliable due to regulatory requirements and regular disclosures.

Types of Shares

Shares can be broadly classified into two main types: equity shares and preference shares.

Equity shares are the most common form of shares. Equity shareholders are the true owners of the company and have voting rights. They benefit from capital appreciation when the company grows and may receive dividends when profits are distributed. However, equity shareholders are last in line to receive assets if the company is liquidated, making these shares riskier.

Preference shares offer preferential treatment in terms of dividend payments and capital repayment during liquidation. Preference shareholders usually receive a fixed dividend, regardless of the company’s profitability, but they generally do not have voting rights. These shares are considered less risky than equity shares but offer limited growth potential.

How Share Prices Are Determined

The price of a share is determined by supply and demand in the stock market. When more investors want to buy a share than sell it, the price rises. Conversely, when more investors want to sell than buy, the price falls. Several factors influence this demand and supply dynamic, including company performance, earnings reports, industry trends, economic conditions, interest rates, and investor sentiment.

Fundamental factors such as revenue growth, profitability, management quality, and future prospects play a crucial role in determining a company’s intrinsic value. Technical factors, such as market trends and trading volumes, also influence short-term price movements.

Benefits of Investing in Shares

Investing in shares offers several advantages. One of the most important benefits is the potential for high returns over the long term. Historically, equities have outperformed many other asset classes such as fixed deposits and bonds, especially when investments are held for extended periods.

Shares also provide an opportunity to earn dividends, which can serve as a regular income stream. Additionally, investing in shares helps protect wealth against inflation, as growing companies tend to increase their revenues and profits over time, which is reflected in rising share prices.

Another key benefit is liquidity. Shares listed on stock exchanges can be easily bought and sold, allowing investors to convert their investments into cash relatively quickly.

Risks Associated with Shares

While shares offer attractive returns, they also come with risks. Market risk is the most common, where share prices fluctuate due to economic changes, political events, or global developments. Company-specific risks, such as poor management decisions, increased competition, or regulatory issues, can also negatively impact share prices.

Volatility is another risk, particularly in the short term. Share prices can rise or fall sharply, which may be unsettling for new investors. In extreme cases, if a company goes bankrupt, shareholders may lose their entire investment.

Role of Shares in Wealth Creation

Shares play a vital role in long-term wealth creation. By investing in fundamentally strong companies and holding shares over time, investors can benefit from compounding returns. Reinvesting dividends further enhances wealth accumulation.

Shares also contribute to economic growth by channeling savings into productive investments. The capital raised through shares enables companies to innovate, create jobs, and expand operations, which in turn supports overall economic development.

Shares and the Stock Market

The stock market acts as a platform where shares are issued, bought, and sold. Primary markets allow companies to issue new shares through initial public offerings (IPOs), while secondary markets enable investors to trade existing shares. Stock exchanges ensure transparency, liquidity, and fair pricing through regulated trading mechanisms.

Conclusion

Shares represent a powerful financial instrument that connects investors with businesses and economic growth. They offer ownership, the potential for high returns, and participation in a company’s success, while also carrying risks that require careful evaluation. Understanding shares—how they are issued, priced, and traded—helps investors make informed decisions and build long-term wealth. For anyone aiming to grow their financial knowledge or investment portfolio, shares remain a cornerstone of modern finance and an essential component of the global economic system.

GIFTNIFTY IntraSwing Levels for 19th JAN 2026GIFTNIFTY IntraSwing Levels for 19th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

__________________^^^^^^^^^______________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Screenshot (as of now at 9.56 am) of NIFTY spot Shows Consolidation at REVERSAL / TF level Near @ 25555. Witnessing RSI Bullish Divergence ib 5 min TF.

NEXT GOLD PEAK (XAUUSDFriends, this is the gold chart, and it's a monthly chart. Let's not beat around the bush and get straight to the point: when does gold reach its top and when does it hit its bottom? So, let me tell you.

The price of gold is highest when Jupiter is in a fire sign, that is, Aries, Leo, and Sagittarius. This surge in gold prices occurs when Jupiter transits through these fire signs. And at the same time, either Rahu or Ketu is in a water sign. If you look at the historical charts around the dates when these surges occurred, you will see this pattern.(Friends, this combination hasn't appeared since 2016. We will see this combination again in 2027, and in my opinion, that will be the next gold pick.)

Friends, astrology is a profound and complex subject (Gurumukhi), like the legal profession. It takes a lot of time to study and understand, and there are many aspects that can be quite confusing. So, I'll get straight to the point. Try to meet with an astrologer and try to understand it. Remember, nothing ever works 100 percent of the time.

HDFCBANK Level Analysis: Intraswing for 19th JAN 2026✈️ HDFCBANK Level Analysis: Intraswing for 19th JAN 2026

🚀Follow & Compare Daily Intraswing Post for Positioning much accurate level to Take Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

HDFC Bank Q3 FY26 Earnings Analysis (Announced January 17, 2026)🌈HDFC Bank Q3 FY26 Earnings Analysis (Announced January 17, 2026)

✅ HDFC Bank, India's largest private sector lender by assets, reported a solid Q3 FY26 (October-December 2025) performance, with net profit beating analyst estimates amid stable asset quality, moderate deposit growth, and improving lending margins. The results reflect resilience in a challenging environment marked by deposit mobilization pressures, regulatory scrutiny on unsecured loans, and global uncertainties like potential US tariffs on remittances. Key positives include double-digit loan growth, NPA improvements, and controlled costs, though deposit growth lagged peers, leading to a slight liquidity drag. Management emphasized profitable growth, digital advancements, and LDR (loan-to-deposit ratio) reduction toward FY27 targets.

📢Key Financial Highlights

The bank delivered YoY profit growth ahead of expectations, with asset quality holding steady. Here's a summary table comparing actuals to estimates (median from 6-8 brokerages) and YoY/QoQ changes👇🏼:

in Table format on Chart.

🔔Beat/Miss Analysis: PAT beat estimates by ~1-2% on better-than-expected NIM stability and fee income, despite higher opex from labor code provisions (₹800 Cr one-off). NII met low-end estimates, reflecting deposit cost pressures. Overall, a "better-than-feared" quarter, with no major slippages in unsecured portfolios.

🏹Segment-Wise Analysis

HDFC Bank's diversified model showed balanced growth, with wholesale and SME segments outperforming retail amid regulatory curbs on consumer loans.

☂️Advances (Loans): Gross advances at ₹28.45 lakh Cr, up 11.9% YoY (from ₹25.42 lakh Cr); advances under management +9.8% YoY. Segment breakdown: Retail +6.9% (muted due to unsecured slowdown), SME +17.2%, Corporate/Wholesale +10.3%, Overseas +1.7% of total. Growth beat estimates of 12-14%, signaling tailwinds from economic recovery.

☔Deposits: Average deposits ₹27.52 lakh Cr, +12.2% YoY; CASA ₹8.98 lakh Cr, +9.9% YoY (+2.4% QoQ). LDR remains elevated at ~85-90%, with plans to reduce to 85% by FY27 through deposit mobilization. Lagged estimates of 10-12% YoY, highlighting industry-wide challenges.

✅Asset Quality: Gross NPA ratio stable at 1.24% (0.97% ex-agri), down from 1.42% YoY; Net NPA at 0.42%. No major deteriorations; provisions controlled, aiding PAT beat. Management noted proactive risk management in unsecured segments.

🕸️Other Income & Costs: Fee income supported revenue; core cost-to-income ratio at 39.2% (stable). Opex up due to employee benefits under New Labour Code, but adjusted figures show efficiency.

🔥Management and Analyst Commentary

💯Management: In the earnings call, CEO Sashidhar Jagdishan highlighted "profitable growth" tailwinds from falling funding costs and CASA recovery. Emphasis on digital/cross-sell for retail revival, SME/corporate momentum, and LDR reduction to 85-90% by FY27. Outlook: Loan growth targeted at 12-15% for FY27, NIM expansion to 3.6-3.7%; cautious on unsecured amid regulations, but optimistic on remittances despite tariffs.

📢Analysts: Positive reactions—beat on PAT/asset quality seen as confidence booster. Motilal Oswal/Yes Securities maintain 'Buy' with targets ₹1,050-1,200 (20-30% upside from current ~₹930). Concerns: Deposit lag could pressure NIM if rates rise; positives: SME growth and NPA stability. Consensus: Q3 as "trough," with FY27 PAT growth 15-20%.

🏹🎯⁉️✍🏼❎☂️✅❌🌈💯🔥👇🏼🐢📢🔔

🌈Impact on Stock Price for Incoming Days

✅Immediate Reaction: Post-results (after-hours on Jan 17), HDFC Bank shares (HDFCBANK.NS) saw mild positive sentiment in extended trading, with ADRs up ~1-2% in US sessions. Domestic close on Jan 17: +0.56% at ₹931.15 (pre-results), but analysts expect a gap-up on Monday (Jan 19) due to PAT beat and stable NPAs. Volume surged 15-20% on Jan 17 amid anticipation.

✅Short-Term (Next 5-10 Days): Likely 3-7% upside if market digests positives (e.g., NIM tailwinds, growth outlook), pushing toward ₹950-1,000. Support at ₹900-920; resistance ₹950. Banking sector (Bank Nifty) could rally 1-2%, as HDFC's ~30% weight amplifies impact. Risks: Broader market weakness from FII outflows or tariff news could cap gains; sentiment on Social Network Discussions/forums positive, viewing results as "reassuring."

💯Medium-Term Outlook: Bullish, with 15-25% potential upside in 3-6 months to targets ₹1,100-1,200, driven by FY27 growth acceleration and valuation re-rating (current P/B ~2.5x vs. historical 3x). Stock down ~6% YTD amid deposit concerns, but results alleviate fears—bias: Buy on dips for long-term investors. Catalysts: Q4 festive lending; risks: Regulatory tightening on unsecured.

✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅

🚀Follow & Compare Daily pot Post for Day Trading Levels.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

Bitcoin gearing for upmoveBitcoin has formed a base around its earlier resistance. Now, in the higher time frame, it has started up move while in lower time frame, it's showing a possible retracement. Either path '1' or '2' can be taken, where it will dip on its trendline first (removing weak hands) and rise.

XAUUSD Weekly Analysis (H4)Gold is looking strong and bullish right now.

Last week, the price moved up with good momentum and created a clear imbalance. After that, it came back down into the FVG zone and filled the gap properly, which is a healthy sign in a trending market. That retracement looks like a normal pullback, not weakness.

Now that the imbalance is filled, gold is likely preparing for the next push higher.

What I’m expecting this week

The main target for this week is the ERL zone (PWH). That level is sitting above current price, and it’s a common place where price goes to collect liquidity. So overall, the idea is simple:

✅ Gold may continue moving up toward PWH.

What to watch when price reaches ERL (PWH)

This is the important part — don’t blindly buy at the top.

When gold reaches the ERL level, one of two things can happen:

Price raids the level and reacts down

It touches or slightly breaks above PWH

Then gives a rejection and starts pulling back

(very common in gold)

Price breaks above strongly and continues

Clean breakout

Strong bullish candles

Trend continues upward

RELIANCE: Analysis after Q3 FY26 Earnings with levels🔥 Reliance Industries Analysis AFTER Q3 FY26 Earnings

Reliance Industries Q3 FY26 Earnings Analysis (Announced January 16, 2026)

Reliance Industries Limited (RIL) reported a steady but mixed Q3 FY26 (October-December 2025) performance, with revenue growth driven by the oil-to-chemicals (O2C) and digital services segments, offsetting weaknesses in retail and upstream oil & gas. Consolidated revenue beat estimates, but net profit missed street expectations slightly due to higher depreciation, interest costs, and segment-specific pressures like lower gas realizations and retail margin squeezes. The results highlight resilience amid global challenges (e.g., US tariff fears, volatile crude prices), with management emphasizing AI integration, new energy initiatives, and consumer business expansion for long-term growth.

Key Financial Highlights

RIL's results showed modest YoY growth, with O2C recovery as a standout. Here's a summary table comparing actuals to estimates (median from 6-7 brokerages) and YoY/QoQ changes:

Table on Chart.

Beat/Miss Analysis: Revenue and EBITDA exceeded estimates, buoyed by higher O2C volumes and refining margins (GRMs at ~$11-13/bbl vs. estimates of $10-12). However, PAT missed due to elevated costs (depreciation up on capex, interest on higher debt) and upstream drags. Overall, a "stable" quarter per analysts, with no major surprises but signals of recovery in key areas.

✅Segment-Wise Analysis

✅O2C (Oil-to-Chemicals): Strong performer with revenue up 8.4% YoY to ₹1.62 lakh Cr and EBITDA up 15% YoY to ₹16,507 Cr. Gains from higher fuel cracks (diesel/petrol up 62-106% YoY), increased throughput (2% YoY), and favorable ethane cracking offset petchem weakness and freight hikes. Jio-bp outlets grew 14% YoY to 2,125, with fuel volumes +24% YoY. Positive: Domestic focus amid Russian supply issues; outlook robust on refining demand.

☔Jio (Digital Services): Revenue +12.7% YoY to ₹43,683 Cr; EBITDA +16.4% YoY to ₹19,303 Cr (margin +170 bps). ARPU rose 5.1% YoY to ₹213.7 on premium offerings; subscribers at 515.3 Mn, with 5G at 253 Mn (53% traffic). JioAirFiber at 11.5 Mn homes; Jio Hotstar MAUs 450 Mn. Management highlighted AI partnerships (e.g., Google) and enterprise monetization; no tariff hikes impacted ARPU yet. Strength: 5G leadership (65% market share); future growth in fixed wireless and AI.

☂️Retail: Revenue +8.1% YoY to ₹97,605 Cr; EBITDA up to ₹6,915 Cr. Growth tempered by festive shift, demerger effects, and GST changes; hyper-local orders ~5x YoY. Ajio bill value +20% YoY; JioMart customers +43% YoY to base; Shein app 6.5 Mn installs. Challenges: Margin pressure from offers, investments, and labor costs; snacks/beverages expanding with new capacities.

Upstream Oil & Gas : Revenue -8.4% YoY to ₹5,833 Cr; EBITDA -12.7% YoY to ₹4,857 Cr, hit by lower KG D6 volumes/realizations and maintenance costs. Positives: Increased LNG exports from North America; strong India gas demand.

✍🏼✅Management and ⁉️ Analyst Commentary

✍🏼Management: Mukesh Ambani stressed "consistent delivery" and AI/New Energy focus for sustainability. Akash Ambani on Jio's digital revolution; Isha Ambani on retail innovation. O2C emphasized domestic outperformance; E&P noted LNG trends.

]⁉️ Analysts: Views mixed—steady earnings with O2C uplift, but retail/upstream drags. Goldman Sachs/Yes Securities positive on refining recovery; ICICI sees consumer resilience. Overall rating: Buy/Hold, with targets ₹1,600-1,800, citing long-term value from diversification.

⁉️ Impact on Stock Price for Incoming Days📊as per So called Analyst Community & Social Community views, though not fully agreed. Reason behind is: High short term VOLATILITY

❎Immediate Reaction: Post-results (after-hours on Jan 16), RIL's GDRs slipped ~2% in US trading, signaling mild disappointment over PAT miss and retail softness. Domestic shares closed flat (+0.15%) at ₹1,461 pre-results; expect flat to gap-down opening on Monday (Jan 19, markets closed Jan 17-18 for weekend). Volume spiked 20-30% on Jan 16 amid anticipation.

Short-Term (Next 5-10 Days): Potential 2-5% downside if sentiment focuses on misses (e.g., flat PAT, retail slowdown), dragging Nifty (RIL ~10-12% weight). Support at ₹1,440-1,450; resistance ₹1,500. Volatility likely amid global cues (e.g., US tariffs), but bargain buying could cap losses—experts see dips as entry points.

✅Medium-Term Outlook: Positive, with analysts forecasting 10-15% upside in 3-6 months on O2C rebound, Jio 5G monetization, and retail recovery (e.g., festive Q4). Risks: Crude volatility, consumer slowdown; catalysts: AI announcements, capex updates. Bias: Accumulate on weakness for long-term holders.

🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

EURUSD: PWH liquidity raid → reversal confirmed.Price grabbed stops above PWH, then dumped hard = classic smart money behavior.

Now the FVG zone becomes sell-side mitigation, with PWL as the next magnet.

✅ Sell retracement

🎯 Target: PWL

⚠️ Invalidation: strong reclaim above FVG

#forextrading #ict #smc #gbpusd #liquidity #fvg

"Bitcoin: A calculated, long-term strategic asset, not a bubbleBitcoin is not a bubble, but a serious and strategic asset that has been created with careful consideration and a long-term vision.

The entire history of BTCUSD (Bitcoin price) is a fascinating journey – starting in 03/01/2009 and continuing to today (January 2026).

2009 → Bitcoin's inception (whitepaper by Satoshi Nakamoto in 2008, genesis block in January,

Price: ~$0 (literally pennies or less, there was no real market). First transaction: 10,000 BTC for 2 pizzas (the famous Pizza Day, May 2010). 2010 → Price: from $0.003 to $0.30. First exchange (Mt. Gox) launched. Year-end: ~$0.30.

2025 → All-time high mania. Peak ~$126,000+ (October 2025) . Institutional inflows, treasury companies buying BTC heavily. Then a correction → year-end ~$88,000–95,000.

2026 (So far – January) → Current price around ~$94,000–$96,000 (January 18, 2026). The market is consolidating, but the long-term outlook is bullish (institutional adoption, policy changes such as the Trump administration's crypto-friendly moves).

In short, the pattern is:

Bitcoin experiences a bull run around every 4-year halving event → peak → 70–85% correction → then a new cycle begins.

Volatility has been very high – 50–80% crashes are common, but the long-term trend is upward.

Growth from 2009 to 2026: ~$0 to ~$95,000+ → meaning approximately 9–10 million times return (for early adopters).

Friends, I have found that Jupiter is the life-giving planet in astrology, and its transits or movements in the sky cause astro-karmic reactions. Based on this, changes occur in a person's(jive) life cycle.

(You may have noticed that when Jupiter transits through Saturn's sign in your birth chart, changes occur in your home that year, such as moving to a new house or renovating your current one.)

Similarly, when Jupiter transits through an Air Sign, the price of Bitcoin surges, reaching a new all-time high. You will observe that every four years, when Jupiter enters that sign, Bitcoin experiences a bull run and reaches a new peak. Following this peak, you will also see a price decline or correction for at least about a year.

Air Signs (Air Element) Characteristics

In astrology, the air element is associated with networks, communication, technology, and the dissemination of ideas.The Air Element is directly connected to the internet and the digital revolution, which is the foundation of BTC.

Gemini : Business and data.

Libra : Market balance and partnerships.

Aquarius: Innovation, the internet, and future technologies.

1. When Jupiter (the planet of expansion) enters these signs, it multiplies the "Network Effect" many times over. Since Bitcoin is a network-based asset, Jupiter's presence in an air sign causes an explosion in its user base, leading to price peaks.

2. The 'Every 4th Years' Math (Jupiter Cycle)

Jupiter stays in one sign for approximately 1 year and takes about 12 years to complete a full cycle (12 signs).

There are three air signs (Gemini, Libra, Aquarius).

It takes Jupiter approximately 4 years to move from one air sign to another.

For example:

2013 (Gemini - Air Sign): Now Jupiter is entering Gemini,

2017 (Libra - Air Sign): BTC made a major top at that time.

2021 (Aquarius - Air Sign): BTC touched the all-time high of $69,000.

2025/26 (Gemini - Air Sign): Now Jupiter is entering Gemini, completing the same 4-year cycle again.

Logic: Jupiter is the significator of wealth, and the air signs represent "information." When money and information spread rapidly together, it creates "FOMO" (fear of missing out), which helps in forming a market top.

From an astrological perspective, BTC (Bitcoin) is considered to be influenced not by a single planet, but by a combination of several planets. According to financial astrology, its main influencing planets are the following:

1. Uranus - The Main Factor

According to astrologers, Bitcoin has the deepest connection with Uranus.

Reason: Uranus symbolizes technology, revolution, and sudden changes. Since Bitcoin is a decentralized and new technology, it is called a 'Uranian Asset'.

2. Rahu

In Indian Vedic astrology, Rahu is considered the significator of virtual things and illusions.

Reason: Rahu is associated with things that are not physically visible (like digital currency). Bitcoin's highly volatile nature aligns with the nature of Rahu.

3. Saturn and Jupiter

Saturn: It represents discipline and government regulations in the market. When Saturn's influence is strong, significant market downturns or consolidation are often observed.

Jupiter: It is the significator of expansion and wealth. When Jupiter's influence is auspicious, a long bull run is seen in Bitcoin prices.

4. Mercury

Reason: Mercury is the planet of trade and communication. Bitcoin transactions and the network are entirely based on digital data and coding, which falls under Mercury's domain. Uncertainty is often observed in the crypto market during Mercury Retrograde.

Astro- Cycles simply provide you with a good opportunity and the chance to make successful trades. How effective it is, only time will tell, friends.

RSI Indicator: Sector-Wise Analysis and Its Importance in MarketUnderstanding RSI in Brief

RSI is plotted on a scale of 0 to 100. Traditionally:

An RSI above 70 indicates an overbought condition.

An RSI below 30 suggests an oversold condition.

RSI around 50 reflects a neutral or balanced momentum.

At the sector level, RSI does not focus on a single stock but instead represents the collective momentum of a group of stocks belonging to the same industry, such as banking, IT, pharmaceuticals, metals, FMCG, or energy.

Concept of Sector-Wise RSI

Sector-wise RSI measures the strength or weakness of an entire sector relative to its recent price performance. For example, if the banking sector index shows an RSI of 75, it implies strong bullish momentum and possibly overheating conditions across banking stocks. Conversely, if the IT sector RSI is at 28, it signals sector-wide weakness and potential undervaluation.

This approach helps market participants move beyond stock-specific noise and understand where institutional money is flowing. Since large investors often rotate capital between sectors rather than individual stocks, sector RSI becomes a powerful indicator of market rotation.

Importance of Sector RSI in Market Analysis

One of the biggest advantages of sector-wise RSI is its ability to identify leading and lagging sectors. When a sector’s RSI consistently remains above 60, it indicates sustained strength and leadership. Sectors with RSI stuck below 40 often represent laggards, showing weak demand or bearish sentiment.

Sector RSI also helps traders avoid false signals. A stock may show bullish RSI, but if its sector RSI is weak, the rally might be short-lived. On the other hand, when both stock RSI and sector RSI align, the probability of a successful trade increases significantly.

Sector RSI and Market Cycles

Markets move in cycles, and sector RSI plays a crucial role in identifying different phases of these cycles. During the early stage of a bull market, cyclical sectors like metals, capital goods, and banking often show rising RSI values. In the mid-phase, sectors such as IT and infrastructure may gain momentum. In the late phase, defensive sectors like FMCG and pharmaceuticals usually display stronger RSI as investors seek stability.

Similarly, during bear markets, sector RSI helps identify which sectors are experiencing aggressive selling and which ones are showing resilience. Defensive sectors often maintain higher RSI levels even during broader market corrections.

Overbought and Oversold Conditions at Sector Level

While overbought and oversold levels are useful, they should not be interpreted in isolation. A sector RSI above 70 does not always mean an immediate reversal. In strong bull markets, sectors can remain overbought for extended periods. In such cases, RSI staying between 60 and 80 is a sign of healthy strength rather than weakness.

Likewise, an oversold sector RSI below 30 may indicate panic selling or extreme pessimism. Long-term investors often use these zones to identify value opportunities, especially when supported by strong fundamentals.

Sector RSI and Relative Strength Comparison

Sector RSI is also used to compare relative strength between different sectors. For instance, if the auto sector RSI is 65 while the FMCG sector RSI is 45, it suggests that autos are outperforming FMCG in terms of momentum. This comparison helps investors allocate capital more efficiently toward sectors with better risk-reward potential.

Portfolio managers frequently rebalance portfolios based on sector RSI trends, increasing exposure to strong sectors and reducing allocation in weak ones.

Combining Sector RSI with Other Indicators

Although sector RSI is powerful, it works best when combined with other technical and fundamental tools. Trend indicators like moving averages help confirm whether a sector is in an uptrend or downtrend. Volume analysis reveals whether RSI movements are supported by strong participation. Macroeconomic factors such as interest rates, inflation, and government policies also influence sector performance and should be considered alongside RSI.

For example, a rising RSI in the banking sector combined with improving credit growth and stable interest rates strengthens the bullish case. Similarly, a falling RSI in the metal sector alongside declining global commodity prices reinforces bearish sentiment.

Sector RSI for Different Market Participants

Short-term traders use sector RSI to identify momentum trades and sector-based breakouts. Swing traders look for RSI reversals near key support or resistance levels. Long-term investors use sector RSI to time entry and exit points within broader asset allocation strategies.

For beginners, sector RSI provides a simplified view of the market by reducing the complexity of tracking hundreds of stocks individually. It allows them to focus on broader trends and make more informed decisions.

Limitations of Sector RSI

Despite its usefulness, sector RSI has limitations. It is a lagging indicator and reflects past price movements rather than future certainty. Sudden news events, policy changes, or global shocks can quickly invalidate RSI signals. Additionally, sector indices may be dominated by a few heavyweight stocks, which can skew RSI readings.

Therefore, relying solely on sector RSI without context can lead to incorrect conclusions. It should always be used as part of a comprehensive analysis framework.

Conclusion

The RSI indicator at the sector level is a valuable tool for understanding market momentum, identifying sector rotation, and improving decision-making across trading and investment horizons. By analyzing sector-wise RSI, market participants gain clarity on which industries are gaining strength, which are losing momentum, and where potential opportunities or risks lie. When combined with trend analysis, volume, and fundamental insights, sector RSI becomes a powerful guide in navigating dynamic financial markets. In an environment where sector performance often drives overall market direction, sector-wise RSI analysis is not just useful—it is essential.

How I use Water Element Zodiac in Time Cycle (Cipla)First of all, Lord Dhanvantari is considered the god of Ayurveda and medicine, not Brihaspati (Jupiter). but in astrology, the role of Jupiter is very important in the field of medicine and pharmaceuticals.

The 'Jiva' factor (the factor of life)

In astrology, Jupiter is called 'Jiva'. This means that the vital energy or 'life force' in the body is under the control of Jupiter.

Dhanvantari provides medicine (treatment).

However, whether that medicine will be effective or not is determined by the position of Jupiter. If Jupiter is strong, the person's 'healing power' is good.

Knowledge and Expertise

The pharmaceutical and medical fields are not limited to simply manufacturing medicines; they require profound knowledge.

Jupiter is the significator of wisdom.

The "discernment" that a doctor or scientist needs to create the right formula and diagnose the correct illness comes from Jupiter.

Growth and Expansion

The pharmaceutical industry is vast. Jupiter's nature is to expand.

The "bounty" or far-reaching impact, from the research and discovery of a medicine to its distribution worldwide, would not be possible without Jupiter.

Jupiter is considered a symbol of auspiciousness, and the purpose of medicine is also to promote the well-being of humanity.

The water element governs respiration (hydration and breathing).

In astrology, the sign of Cancer (water element) governs the chest and upper parts of the lungs. The lungs require moisture to function properly.

Most of Cipla's focus is on the respiratory tract and maintaining airflow.

Cough syrups and asthma medications work to restore the body's fluid balance.

Formulation of Medicines

In the pharmaceutical field, "aqueous element" refers not only to water but also to liquids and chemicals.

Cipla's Expertise: Cipla is known worldwide for its nebulizers, inhalers, and syrups.

In inhalers, the medicine is delivered to the lungs as a mist or vapor, which is a finely dispersed form of the aqueous element.

The zodiac sign Cancer governs the upper parts of the body, specifically the chest and respiratory system (chest and lungs).

Cipla's strength: Cipla is one of the world's largest pharmaceutical companies, specializing in respiratory medicines, respiratory inhalers, and treatments for respiratory conditions.

There is a direct and profound connection between the zodiac sign Cancer (chest) and Cipla's core business (respiratory treatments).

Cipla's Respules are entirely liquid solutions.But in astrology, the role of Jupiter is very important in the field of medicine and pharmaceuticals.

The water element governs respiration (hydration and breathing).

In astrology, the sign of Cancer (water element) governs the chest and upper parts of the lungs. The lungs require moisture to function properly.

Most of Cipla's focus is on the respiratory tract and maintaining airflow.

Cough syrups and asthma medications work to restore the body's fluid balance.

Formulation of Medicines:-

In the pharmaceutical field, "aqueous element" refers not only to water but also to liquids and chemicals.

Cipla's Expertise: Cipla is known worldwide for its nebulizers, inhalers, and syrups.

In inhalers, the medicine is delivered to the lungs as a mist or vapor, which is a finely dispersed form of the aqueous element.

The zodiac sign Cancer governs the upper parts of the body, specifically the chest and respiratory system (chest and lungs).

Cipla's strength: Cipla is one of the world's largest pharmaceutical companies, specializing in respiratory medicines, respiratory inhalers, and treatments for respiratory conditions.

There is a direct and profound connection between the zodiac sign Cancer (chest) and Cipla's core business (respiratory treatments).Cipla's Respules are entirely liquid solutions.

Now let's talk about the time cycle. As you can see that every fourth or eighth year, either a top or a bottom is marked on Cipla's chart, and this happens when Jupiter enters a water sign.

However, financial astrology is not that simple, and it involves many other factors. My aim is not to overwhelm you with a vast subject like astrology, but rather to help you understand things by focusing on the positional changes of a major planet.

And if you understand the concept, don't forget to like it!

UJJIVANSFB – Cup & Handle at Multi-Year ResistanceThe stock has formed a well-defined long-term Cup & Handle structure after an extended base. Price is now testing a multi-year resistance zone, where repeated attempts suggest gradual absorption of supply. The rounded base reflects accumulation, while the handle shows controlled consolidation. This area remains a key decision zone, and price acceptance here will be important to watch.