Bitcoin gearing for upmoveBitcoin has formed a base around its earlier resistance. Now, in the higher time frame, it has started up move while in lower time frame, it's showing a possible retracement. Either path '1' or '2' can be taken, where it will dip on its trendline first (removing weak hands) and rise.

Beyond Technical Analysis

XAUUSD Weekly Analysis (H4)Gold is looking strong and bullish right now.

Last week, the price moved up with good momentum and created a clear imbalance. After that, it came back down into the FVG zone and filled the gap properly, which is a healthy sign in a trending market. That retracement looks like a normal pullback, not weakness.

Now that the imbalance is filled, gold is likely preparing for the next push higher.

What I’m expecting this week

The main target for this week is the ERL zone (PWH). That level is sitting above current price, and it’s a common place where price goes to collect liquidity. So overall, the idea is simple:

✅ Gold may continue moving up toward PWH.

What to watch when price reaches ERL (PWH)

This is the important part — don’t blindly buy at the top.

When gold reaches the ERL level, one of two things can happen:

Price raids the level and reacts down

It touches or slightly breaks above PWH

Then gives a rejection and starts pulling back

(very common in gold)

Price breaks above strongly and continues

Clean breakout

Strong bullish candles

Trend continues upward

RELIANCE: Analysis after Q3 FY26 Earnings with levels🔥 Reliance Industries Analysis AFTER Q3 FY26 Earnings

Reliance Industries Q3 FY26 Earnings Analysis (Announced January 16, 2026)

Reliance Industries Limited (RIL) reported a steady but mixed Q3 FY26 (October-December 2025) performance, with revenue growth driven by the oil-to-chemicals (O2C) and digital services segments, offsetting weaknesses in retail and upstream oil & gas. Consolidated revenue beat estimates, but net profit missed street expectations slightly due to higher depreciation, interest costs, and segment-specific pressures like lower gas realizations and retail margin squeezes. The results highlight resilience amid global challenges (e.g., US tariff fears, volatile crude prices), with management emphasizing AI integration, new energy initiatives, and consumer business expansion for long-term growth.

Key Financial Highlights

RIL's results showed modest YoY growth, with O2C recovery as a standout. Here's a summary table comparing actuals to estimates (median from 6-7 brokerages) and YoY/QoQ changes:

Table on Chart.

Beat/Miss Analysis: Revenue and EBITDA exceeded estimates, buoyed by higher O2C volumes and refining margins (GRMs at ~$11-13/bbl vs. estimates of $10-12). However, PAT missed due to elevated costs (depreciation up on capex, interest on higher debt) and upstream drags. Overall, a "stable" quarter per analysts, with no major surprises but signals of recovery in key areas.

✅Segment-Wise Analysis

✅O2C (Oil-to-Chemicals): Strong performer with revenue up 8.4% YoY to ₹1.62 lakh Cr and EBITDA up 15% YoY to ₹16,507 Cr. Gains from higher fuel cracks (diesel/petrol up 62-106% YoY), increased throughput (2% YoY), and favorable ethane cracking offset petchem weakness and freight hikes. Jio-bp outlets grew 14% YoY to 2,125, with fuel volumes +24% YoY. Positive: Domestic focus amid Russian supply issues; outlook robust on refining demand.

☔Jio (Digital Services): Revenue +12.7% YoY to ₹43,683 Cr; EBITDA +16.4% YoY to ₹19,303 Cr (margin +170 bps). ARPU rose 5.1% YoY to ₹213.7 on premium offerings; subscribers at 515.3 Mn, with 5G at 253 Mn (53% traffic). JioAirFiber at 11.5 Mn homes; Jio Hotstar MAUs 450 Mn. Management highlighted AI partnerships (e.g., Google) and enterprise monetization; no tariff hikes impacted ARPU yet. Strength: 5G leadership (65% market share); future growth in fixed wireless and AI.

☂️Retail: Revenue +8.1% YoY to ₹97,605 Cr; EBITDA up to ₹6,915 Cr. Growth tempered by festive shift, demerger effects, and GST changes; hyper-local orders ~5x YoY. Ajio bill value +20% YoY; JioMart customers +43% YoY to base; Shein app 6.5 Mn installs. Challenges: Margin pressure from offers, investments, and labor costs; snacks/beverages expanding with new capacities.

Upstream Oil & Gas : Revenue -8.4% YoY to ₹5,833 Cr; EBITDA -12.7% YoY to ₹4,857 Cr, hit by lower KG D6 volumes/realizations and maintenance costs. Positives: Increased LNG exports from North America; strong India gas demand.

✍🏼✅Management and ⁉️ Analyst Commentary

✍🏼Management: Mukesh Ambani stressed "consistent delivery" and AI/New Energy focus for sustainability. Akash Ambani on Jio's digital revolution; Isha Ambani on retail innovation. O2C emphasized domestic outperformance; E&P noted LNG trends.

]⁉️ Analysts: Views mixed—steady earnings with O2C uplift, but retail/upstream drags. Goldman Sachs/Yes Securities positive on refining recovery; ICICI sees consumer resilience. Overall rating: Buy/Hold, with targets ₹1,600-1,800, citing long-term value from diversification.

⁉️ Impact on Stock Price for Incoming Days📊as per So called Analyst Community & Social Community views, though not fully agreed. Reason behind is: High short term VOLATILITY

❎Immediate Reaction: Post-results (after-hours on Jan 16), RIL's GDRs slipped ~2% in US trading, signaling mild disappointment over PAT miss and retail softness. Domestic shares closed flat (+0.15%) at ₹1,461 pre-results; expect flat to gap-down opening on Monday (Jan 19, markets closed Jan 17-18 for weekend). Volume spiked 20-30% on Jan 16 amid anticipation.

Short-Term (Next 5-10 Days): Potential 2-5% downside if sentiment focuses on misses (e.g., flat PAT, retail slowdown), dragging Nifty (RIL ~10-12% weight). Support at ₹1,440-1,450; resistance ₹1,500. Volatility likely amid global cues (e.g., US tariffs), but bargain buying could cap losses—experts see dips as entry points.

✅Medium-Term Outlook: Positive, with analysts forecasting 10-15% upside in 3-6 months on O2C rebound, Jio 5G monetization, and retail recovery (e.g., festive Q4). Risks: Crude volatility, consumer slowdown; catalysts: AI announcements, capex updates. Bias: Accumulate on weakness for long-term holders.

🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

EURUSD: PWH liquidity raid → reversal confirmed.Price grabbed stops above PWH, then dumped hard = classic smart money behavior.

Now the FVG zone becomes sell-side mitigation, with PWL as the next magnet.

✅ Sell retracement

🎯 Target: PWL

⚠️ Invalidation: strong reclaim above FVG

#forextrading #ict #smc #gbpusd #liquidity #fvg

"Bitcoin: A calculated, long-term strategic asset, not a bubbleBitcoin is not a bubble, but a serious and strategic asset that has been created with careful consideration and a long-term vision.

The entire history of BTCUSD (Bitcoin price) is a fascinating journey – starting in 03/01/2009 and continuing to today (January 2026).

2009 → Bitcoin's inception (whitepaper by Satoshi Nakamoto in 2008, genesis block in January,

Price: ~$0 (literally pennies or less, there was no real market). First transaction: 10,000 BTC for 2 pizzas (the famous Pizza Day, May 2010). 2010 → Price: from $0.003 to $0.30. First exchange (Mt. Gox) launched. Year-end: ~$0.30.

2025 → All-time high mania. Peak ~$126,000+ (October 2025) . Institutional inflows, treasury companies buying BTC heavily. Then a correction → year-end ~$88,000–95,000.

2026 (So far – January) → Current price around ~$94,000–$96,000 (January 18, 2026). The market is consolidating, but the long-term outlook is bullish (institutional adoption, policy changes such as the Trump administration's crypto-friendly moves).

In short, the pattern is:

Bitcoin experiences a bull run around every 4-year halving event → peak → 70–85% correction → then a new cycle begins.

Volatility has been very high – 50–80% crashes are common, but the long-term trend is upward.

Growth from 2009 to 2026: ~$0 to ~$95,000+ → meaning approximately 9–10 million times return (for early adopters).

Friends, I have found that Jupiter is the life-giving planet in astrology, and its transits or movements in the sky cause astro-karmic reactions. Based on this, changes occur in a person's(jive) life cycle.

(You may have noticed that when Jupiter transits through Saturn's sign in your birth chart, changes occur in your home that year, such as moving to a new house or renovating your current one.)

Similarly, when Jupiter transits through an Air Sign, the price of Bitcoin surges, reaching a new all-time high. You will observe that every four years, when Jupiter enters that sign, Bitcoin experiences a bull run and reaches a new peak. Following this peak, you will also see a price decline or correction for at least about a year.

Air Signs (Air Element) Characteristics

In astrology, the air element is associated with networks, communication, technology, and the dissemination of ideas.The Air Element is directly connected to the internet and the digital revolution, which is the foundation of BTC.

Gemini : Business and data.

Libra : Market balance and partnerships.

Aquarius: Innovation, the internet, and future technologies.

1. When Jupiter (the planet of expansion) enters these signs, it multiplies the "Network Effect" many times over. Since Bitcoin is a network-based asset, Jupiter's presence in an air sign causes an explosion in its user base, leading to price peaks.

2. The 'Every 4th Years' Math (Jupiter Cycle)

Jupiter stays in one sign for approximately 1 year and takes about 12 years to complete a full cycle (12 signs).

There are three air signs (Gemini, Libra, Aquarius).

It takes Jupiter approximately 4 years to move from one air sign to another.

For example:

2013 (Gemini - Air Sign): Now Jupiter is entering Gemini,

2017 (Libra - Air Sign): BTC made a major top at that time.

2021 (Aquarius - Air Sign): BTC touched the all-time high of $69,000.

2025/26 (Gemini - Air Sign): Now Jupiter is entering Gemini, completing the same 4-year cycle again.

Logic: Jupiter is the significator of wealth, and the air signs represent "information." When money and information spread rapidly together, it creates "FOMO" (fear of missing out), which helps in forming a market top.

From an astrological perspective, BTC (Bitcoin) is considered to be influenced not by a single planet, but by a combination of several planets. According to financial astrology, its main influencing planets are the following:

1. Uranus - The Main Factor

According to astrologers, Bitcoin has the deepest connection with Uranus.

Reason: Uranus symbolizes technology, revolution, and sudden changes. Since Bitcoin is a decentralized and new technology, it is called a 'Uranian Asset'.

2. Rahu

In Indian Vedic astrology, Rahu is considered the significator of virtual things and illusions.

Reason: Rahu is associated with things that are not physically visible (like digital currency). Bitcoin's highly volatile nature aligns with the nature of Rahu.

3. Saturn and Jupiter

Saturn: It represents discipline and government regulations in the market. When Saturn's influence is strong, significant market downturns or consolidation are often observed.

Jupiter: It is the significator of expansion and wealth. When Jupiter's influence is auspicious, a long bull run is seen in Bitcoin prices.

4. Mercury

Reason: Mercury is the planet of trade and communication. Bitcoin transactions and the network are entirely based on digital data and coding, which falls under Mercury's domain. Uncertainty is often observed in the crypto market during Mercury Retrograde.

Astro- Cycles simply provide you with a good opportunity and the chance to make successful trades. How effective it is, only time will tell, friends.

RSI Indicator: Sector-Wise Analysis and Its Importance in MarketUnderstanding RSI in Brief

RSI is plotted on a scale of 0 to 100. Traditionally:

An RSI above 70 indicates an overbought condition.

An RSI below 30 suggests an oversold condition.

RSI around 50 reflects a neutral or balanced momentum.

At the sector level, RSI does not focus on a single stock but instead represents the collective momentum of a group of stocks belonging to the same industry, such as banking, IT, pharmaceuticals, metals, FMCG, or energy.

Concept of Sector-Wise RSI

Sector-wise RSI measures the strength or weakness of an entire sector relative to its recent price performance. For example, if the banking sector index shows an RSI of 75, it implies strong bullish momentum and possibly overheating conditions across banking stocks. Conversely, if the IT sector RSI is at 28, it signals sector-wide weakness and potential undervaluation.

This approach helps market participants move beyond stock-specific noise and understand where institutional money is flowing. Since large investors often rotate capital between sectors rather than individual stocks, sector RSI becomes a powerful indicator of market rotation.

Importance of Sector RSI in Market Analysis

One of the biggest advantages of sector-wise RSI is its ability to identify leading and lagging sectors. When a sector’s RSI consistently remains above 60, it indicates sustained strength and leadership. Sectors with RSI stuck below 40 often represent laggards, showing weak demand or bearish sentiment.

Sector RSI also helps traders avoid false signals. A stock may show bullish RSI, but if its sector RSI is weak, the rally might be short-lived. On the other hand, when both stock RSI and sector RSI align, the probability of a successful trade increases significantly.

Sector RSI and Market Cycles

Markets move in cycles, and sector RSI plays a crucial role in identifying different phases of these cycles. During the early stage of a bull market, cyclical sectors like metals, capital goods, and banking often show rising RSI values. In the mid-phase, sectors such as IT and infrastructure may gain momentum. In the late phase, defensive sectors like FMCG and pharmaceuticals usually display stronger RSI as investors seek stability.

Similarly, during bear markets, sector RSI helps identify which sectors are experiencing aggressive selling and which ones are showing resilience. Defensive sectors often maintain higher RSI levels even during broader market corrections.

Overbought and Oversold Conditions at Sector Level

While overbought and oversold levels are useful, they should not be interpreted in isolation. A sector RSI above 70 does not always mean an immediate reversal. In strong bull markets, sectors can remain overbought for extended periods. In such cases, RSI staying between 60 and 80 is a sign of healthy strength rather than weakness.

Likewise, an oversold sector RSI below 30 may indicate panic selling or extreme pessimism. Long-term investors often use these zones to identify value opportunities, especially when supported by strong fundamentals.

Sector RSI and Relative Strength Comparison

Sector RSI is also used to compare relative strength between different sectors. For instance, if the auto sector RSI is 65 while the FMCG sector RSI is 45, it suggests that autos are outperforming FMCG in terms of momentum. This comparison helps investors allocate capital more efficiently toward sectors with better risk-reward potential.

Portfolio managers frequently rebalance portfolios based on sector RSI trends, increasing exposure to strong sectors and reducing allocation in weak ones.

Combining Sector RSI with Other Indicators

Although sector RSI is powerful, it works best when combined with other technical and fundamental tools. Trend indicators like moving averages help confirm whether a sector is in an uptrend or downtrend. Volume analysis reveals whether RSI movements are supported by strong participation. Macroeconomic factors such as interest rates, inflation, and government policies also influence sector performance and should be considered alongside RSI.

For example, a rising RSI in the banking sector combined with improving credit growth and stable interest rates strengthens the bullish case. Similarly, a falling RSI in the metal sector alongside declining global commodity prices reinforces bearish sentiment.

Sector RSI for Different Market Participants

Short-term traders use sector RSI to identify momentum trades and sector-based breakouts. Swing traders look for RSI reversals near key support or resistance levels. Long-term investors use sector RSI to time entry and exit points within broader asset allocation strategies.

For beginners, sector RSI provides a simplified view of the market by reducing the complexity of tracking hundreds of stocks individually. It allows them to focus on broader trends and make more informed decisions.

Limitations of Sector RSI

Despite its usefulness, sector RSI has limitations. It is a lagging indicator and reflects past price movements rather than future certainty. Sudden news events, policy changes, or global shocks can quickly invalidate RSI signals. Additionally, sector indices may be dominated by a few heavyweight stocks, which can skew RSI readings.

Therefore, relying solely on sector RSI without context can lead to incorrect conclusions. It should always be used as part of a comprehensive analysis framework.

Conclusion

The RSI indicator at the sector level is a valuable tool for understanding market momentum, identifying sector rotation, and improving decision-making across trading and investment horizons. By analyzing sector-wise RSI, market participants gain clarity on which industries are gaining strength, which are losing momentum, and where potential opportunities or risks lie. When combined with trend analysis, volume, and fundamental insights, sector RSI becomes a powerful guide in navigating dynamic financial markets. In an environment where sector performance often drives overall market direction, sector-wise RSI analysis is not just useful—it is essential.

How I use Water Element Zodiac in Time Cycle (Cipla)First of all, Lord Dhanvantari is considered the god of Ayurveda and medicine, not Brihaspati (Jupiter). but in astrology, the role of Jupiter is very important in the field of medicine and pharmaceuticals.

The 'Jiva' factor (the factor of life)

In astrology, Jupiter is called 'Jiva'. This means that the vital energy or 'life force' in the body is under the control of Jupiter.

Dhanvantari provides medicine (treatment).

However, whether that medicine will be effective or not is determined by the position of Jupiter. If Jupiter is strong, the person's 'healing power' is good.

Knowledge and Expertise

The pharmaceutical and medical fields are not limited to simply manufacturing medicines; they require profound knowledge.

Jupiter is the significator of wisdom.

The "discernment" that a doctor or scientist needs to create the right formula and diagnose the correct illness comes from Jupiter.

Growth and Expansion

The pharmaceutical industry is vast. Jupiter's nature is to expand.

The "bounty" or far-reaching impact, from the research and discovery of a medicine to its distribution worldwide, would not be possible without Jupiter.

Jupiter is considered a symbol of auspiciousness, and the purpose of medicine is also to promote the well-being of humanity.

The water element governs respiration (hydration and breathing).

In astrology, the sign of Cancer (water element) governs the chest and upper parts of the lungs. The lungs require moisture to function properly.

Most of Cipla's focus is on the respiratory tract and maintaining airflow.

Cough syrups and asthma medications work to restore the body's fluid balance.

Formulation of Medicines

In the pharmaceutical field, "aqueous element" refers not only to water but also to liquids and chemicals.

Cipla's Expertise: Cipla is known worldwide for its nebulizers, inhalers, and syrups.

In inhalers, the medicine is delivered to the lungs as a mist or vapor, which is a finely dispersed form of the aqueous element.

The zodiac sign Cancer governs the upper parts of the body, specifically the chest and respiratory system (chest and lungs).

Cipla's strength: Cipla is one of the world's largest pharmaceutical companies, specializing in respiratory medicines, respiratory inhalers, and treatments for respiratory conditions.

There is a direct and profound connection between the zodiac sign Cancer (chest) and Cipla's core business (respiratory treatments).

Cipla's Respules are entirely liquid solutions.But in astrology, the role of Jupiter is very important in the field of medicine and pharmaceuticals.

The water element governs respiration (hydration and breathing).

In astrology, the sign of Cancer (water element) governs the chest and upper parts of the lungs. The lungs require moisture to function properly.

Most of Cipla's focus is on the respiratory tract and maintaining airflow.

Cough syrups and asthma medications work to restore the body's fluid balance.

Formulation of Medicines:-

In the pharmaceutical field, "aqueous element" refers not only to water but also to liquids and chemicals.

Cipla's Expertise: Cipla is known worldwide for its nebulizers, inhalers, and syrups.

In inhalers, the medicine is delivered to the lungs as a mist or vapor, which is a finely dispersed form of the aqueous element.

The zodiac sign Cancer governs the upper parts of the body, specifically the chest and respiratory system (chest and lungs).

Cipla's strength: Cipla is one of the world's largest pharmaceutical companies, specializing in respiratory medicines, respiratory inhalers, and treatments for respiratory conditions.

There is a direct and profound connection between the zodiac sign Cancer (chest) and Cipla's core business (respiratory treatments).Cipla's Respules are entirely liquid solutions.

Now let's talk about the time cycle. As you can see that every fourth or eighth year, either a top or a bottom is marked on Cipla's chart, and this happens when Jupiter enters a water sign.

However, financial astrology is not that simple, and it involves many other factors. My aim is not to overwhelm you with a vast subject like astrology, but rather to help you understand things by focusing on the positional changes of a major planet.

And if you understand the concept, don't forget to like it!

UJJIVANSFB – Cup & Handle at Multi-Year ResistanceThe stock has formed a well-defined long-term Cup & Handle structure after an extended base. Price is now testing a multi-year resistance zone, where repeated attempts suggest gradual absorption of supply. The rounded base reflects accumulation, while the handle shows controlled consolidation. This area remains a key decision zone, and price acceptance here will be important to watch.

Apollo Hospitals — Long-Term Uptrend in FocusApollo Hospitals continues to respect a clean, long-term rising trendline that has guided price for several years. The recent pullback has brought price back into this high-importance demand zone, where multiple past reactions are clearly visible.

Price is currently holding within the rising channel, closer to the lower boundary — a zone that has historically acted as a balance area between buyers and sellers.

With the Union Budget approaching, any healthcare-related announcements could act as a near-term trigger, but structurally the chart already offers clarity:

Holding above the long-term trendline keeps the primary uptrend intact

Failure to hold may invite further consolidation within the channel

This is a wait-and-watch zone, not a chase. The chart itself will reveal the next move through price acceptance or rejection around this trendline.

Axis Bank — Inverse Head & Shoulders at Key StructurePrice is currently forming an Inverse Head & Shoulders (IHNS) structure within a well-defined rising channel. The neckline zone is clearly visible and has become the decision area on the chart.

If price holds above the neckline and sustains acceptance, the structure remains valid, opening the path for further upside within the channel.

If the breakout fails and price slips back below the neckline, the structure weakens, and price may revisit the lower trendline support of the channel.

At this stage, it’s not about prediction but reaction. This zone will decide whether momentum continues or price rotates back into the range.

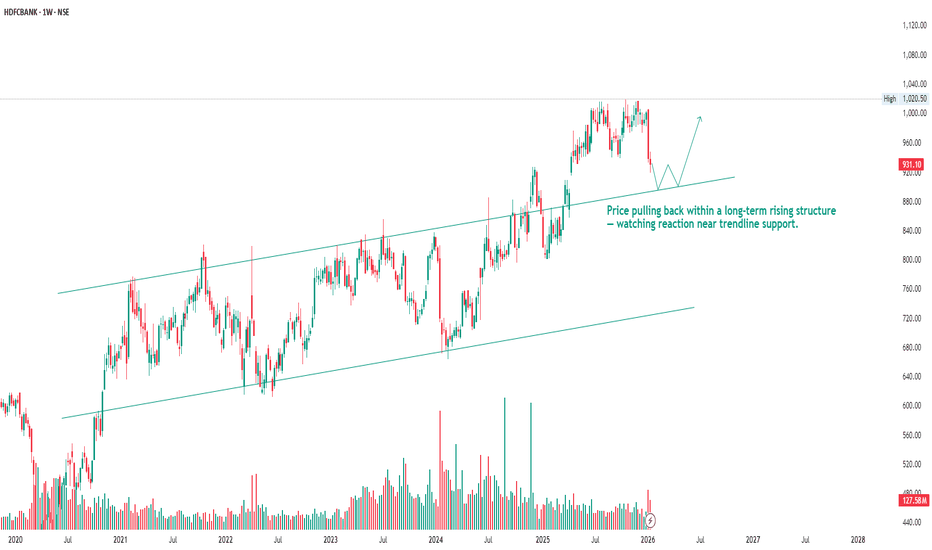

HDFC Bank — Respecting a Long-Term Rising StructureOn the weekly timeframe, price continues to respect a well-defined rising structure, marked by higher highs and higher lows over an extended period.

After reaching the upper zone of this structure, the stock has moved into a controlled pullback, which is now approaching the rising trendline support.

This zone is structurally important, as it has acted as a reference area multiple times in the past. At this stage, the focus is not on prediction but on observing price behaviour near the trendline — whether price stabilizes, consolidates, or shows renewed participation.

As long as the broader structure remains intact, patience and clarity around price reaction at support are key. Letting the market confirm intent is more important than anticipation.

Kotak Mahindra Bank — Price Trading Within a Broad Rising StructPrice continues to move within a well-defined broad structure, with the upper trendline acting as resistance and the lower trendline providing structural support.

At the moment, price is consolidating near the mid-range of this structure, showing no clear directional commitment.

Until major event-driven triggers like the budget, the focus remains on observing how price behaves within this range, especially near the lower trendline support.

Patience is key here — letting price reveal intent before taking any action.

CDSL — Price Respecting a Falling ChannelPrice is trading within a well-defined falling channel, marked by lower highs and lower lows.

Multiple touches on both the upper and lower trendlines confirm the validity of this structure.

Recently, price has reacted near the lower boundary of the channel, indicating demand emerging at this zone.

The overall focus remains on how price behaves within this channel and near its boundaries.

Trading Plan for SuccessUnderstanding the Purpose of a Trading Plan

The primary purpose of a trading plan is to bring structure and clarity to your trading activities. Markets are unpredictable, and no strategy works all the time. A trading plan does not eliminate losses, but it ensures that losses are controlled and gains are maximized when the market moves in your favor. It defines what you trade, when you trade, how much you trade, and why you trade. By following predefined rules, traders avoid emotional decisions such as overtrading, revenge trading, or holding losing positions for too long.

A trading plan also helps in maintaining consistency. Consistency is more important than occasional big profits. When you apply the same rules repeatedly, you can evaluate your performance objectively and make data-driven improvements.

Defining Clear Trading Goals

Every successful trading plan begins with clear and realistic goals. These goals should align with your financial situation, risk tolerance, and time commitment. Instead of focusing only on profits, goals should emphasize process-oriented objectives such as maintaining discipline, following risk management rules, and improving accuracy over time.

Short-term goals may include learning a specific strategy, reducing impulsive trades, or achieving consistent monthly returns. Long-term goals might involve building capital steadily, transitioning to full-time trading, or generating supplemental income. Clearly defined goals provide motivation and direction while keeping expectations realistic.

Choosing the Right Market and Time Frame

A good trading plan specifies the markets you will trade, such as stocks, indices, commodities, forex, or options. It is important to focus on a limited number of instruments rather than trading everything available. Specialization allows you to understand the behavior, volatility, and patterns of specific markets.

Time frame selection is equally important. Intraday traders focus on shorter time frames like 5-minute or 15-minute charts, while swing traders may use daily or weekly charts. Long-term investors rely on monthly or weekly time frames. Your choice should match your personality, lifestyle, and available time. A plan that does not fit your routine is difficult to follow consistently.

Developing a Trading Strategy

The trading strategy is the core of your trading plan. It defines the conditions under which you enter and exit trades. A strategy may be based on technical analysis, price action, indicators, volume analysis, or a combination of these. Regardless of the method, the strategy must have clear, objective rules.

Entry rules should specify the exact conditions that trigger a trade. Exit rules should define profit targets and stop-loss levels before entering the trade. A successful trading plan never leaves exits to guesswork. Risk-to-reward ratio plays a critical role here. Many professional traders aim for trades where potential reward is at least twice the potential risk, ensuring profitability even with a moderate win rate.

Risk Management: The Key to Survival

Risk management is the most critical component of a trading plan. Even the best strategy can fail without proper risk control. A trading plan must define how much capital you are willing to risk on each trade. Most successful traders risk only a small percentage of their trading capital, typically 1–2% per trade.

Position sizing is directly linked to risk management. It ensures that no single trade can cause significant damage to your account. Stop-loss placement must be logical and based on market structure rather than emotional comfort. Risk management protects traders from large drawdowns and helps them stay in the game during unfavorable market phases.

Emotional Discipline and Trading Psychology

Trading success is not just about strategy; it is also about mindset. Fear and greed are the biggest enemies of traders. A trading plan helps manage emotions by providing predefined rules, but discipline is required to follow those rules consistently.

Traders must accept that losses are part of the process. A loss does not mean failure; it means the plan is working as intended. Overconfidence after winning streaks and frustration after losses can lead to deviation from the plan. Maintaining emotional balance and trusting the process are essential for long-term success.

Maintaining a Trading Journal

A trading journal is an integral part of a successful trading plan. It records every trade, including entry, exit, reasoning, emotional state, and outcome. Over time, the journal becomes a powerful tool for self-analysis. It helps identify strengths, weaknesses, and recurring mistakes.

Reviewing the journal regularly allows traders to refine their strategies, eliminate bad habits, and reinforce good behavior. Continuous improvement is only possible when performance is measured and analyzed objectively.

Continuous Learning and Adaptation

Markets evolve, and a trading plan should be flexible enough to adapt to changing conditions. Continuous learning through market observation, backtesting, and performance review is necessary. However, frequent strategy changes should be avoided. Adjustments should be based on data and experience, not short-term results.

Successful traders treat trading as a business, not a gamble. They invest time in education, stay updated with market developments, and continuously work on improving their skills.

Conclusion

A trading plan for success is a combination of strategy, risk management, discipline, and self-awareness. It provides structure in an uncertain environment and transforms trading from an emotional activity into a systematic process. While profits are the ultimate goal, consistency, discipline, and risk control are the true pillars of long-term success. By creating, following, and refining a well-defined trading plan, traders significantly increase their chances of achieving sustainable success in the financial markets.

W. D. Gann TIME CYCLE VS ASTRO-TIME CYCLE (Real Estate Boom)W. D. GANN TIME CYCLE VS ASTRO TIME CYCLE

W. D. Gann and "Astro Time Cycles" are not actually opposing forces; rather, astrology was the secret engine behind Gann’s most famous time cycles.

While modern technical analysis often separates "Gann Angles" (math) from "Astro Cycles" (planets), Gann himself viewed them as the same thing. He believed the "Law of Vibration" governed both the movement of planets and the movement of stocks.

Here is the breakdown of how these two concepts relate and where they differ in application.

The Core Relationship : Geometry vs. Astronomy

Gann used geometry and math to "hide" his astrological findings. He often spoke in "code" because astrology was controversial in the early 20th-century financial world.

Gann’s "Fixed" Time Cycles

Gann identified several specific time intervals that he claimed were "natural" cycles of the market. While these look like simple math, they are almost all derived from the movement of the Earth or other planets.

The 1-Year Cycle (365 days): One full orbit of the Earth around the Sun.

The 10-Year & 20-Year Cycles: Closely linked to the Jupiter-Saturn cycle (which meets every ~20 years).

The 30-Year Cycle: Based on the orbit of Saturn (~29.5 years).

The 60-Year Cycle: Gann’s "Great Cycle," which is three Saturn orbits or one full cycle of the Chinese Sexagenary system.

The 90-Day Cycle: A "Square" in astrology (90° aspect), representing a period of seasonal change and market friction.

Modern "Astro Time Cycles" vs. Gann

Today, traders who use "Astro Cycles" without the Gann label focus strictly on:

Planetary Retrogrades: Specifically Mercury and Venus, often linked to market reversals or "fake-outs."

Inversion/Ingress : When a planet moves into a new zodiac sign (e.g., Sun entering Aries).

Eclipses : Used as "wildcard" markers for extreme volatility.

This was a topic for an astro-cycle discussion, but today we'll talk about what happens to real estate when Jupiter is in a water sign and how rallies begin.

For example, I am using the chart for Godrej Properties Ltd stock.

The water signs in the zodiac are as follows: (Cancer, Scorpio, and Pisces).

Jupiter is considered 'Guru' (teacher) in Vedic astrology, symbolizing expansion, wealth, and wisdom. When it comes to the stock market, Jupiter governs sectors that form the backbone of the economy. Jupiter is the planet of wealth.Wealth includes assets/property as well.Real Estate & Housing Finance (The 4th House Connection). Cancer traditionally rules the 4th House—the domain of land, buildings, and comfort.

We are likely to see a "Housing Super-Cycle." This isn't just about luxury condos, but Affordable Housing and Housing Finance Companies (HFCs).

Friends, whenever Jupiter begins its transit through a water sign, just look at the kind of surge we see in the stock market! It's incredible. This realization comes when you learn to correlate the charts with the planetary positions according to astrology. And this technique goes far beyond chart patterns and price action. We hesitate to use astrological methods, even though it is a part of our own heritage.

The difference between WD Gann cycle and Astro cycles(DRREDDY)Friends, when we were sharing the W.D. Gann time cycle charts with you, we observed several cycles, such as daily, weekly, monthly, and yearly cycles, and we saw good reversals and continuations in the patterns.

However, when we talk about Astro-Cycles, they are slightly different from normal cycles. They don't occur after a fixed period; they depend to some extent on when the astrological cycles change, and there can be a difference of a few days or months. For this, you need to use an astrological chart.

For example, I will use the chart from Dr Reddys Laboratories Ltd here.

Here you can see that every 5 years, the unfavorable Jupiter transits into a fire sign .But each fire sign has its own story.

We can also observe that when it starts moving from Sagittarius and reaches Aries (in 5 years), its speed increases, and therefore, when it moves from Aries towards Leo, it is in a very strong phase. After reaching a new peak in the next 5 years, it starts to decline again, and by the time it reaches Sagittarius (like points A/B/C), this 15-year cycle.

Now Jupiter has once again moved towards Aries and Leo. It remains to be seen what the next two years will be like for the pharmaceutical sector.

Silver Tired for few Weeks - Exit for the time beingIn my earlier post of 3rd December 2025 I had talked about a BLAST in Gold including Silver. It has happened. But remember, in the AI model, rise can not be one sided for ever. I am not saying that TREND has turned negative. But for the time being it has a run up too fast and tiredness is visible on the Chart. 1 Day Fisher has made Lower High when Price has made a Higher High. So tiredness in pace is clear.

Beware at this point to get temped for Long. It may punish you.

wait for few weeks for better entry point.

Long Term Trend - Intact (Few Months)

Short Term Trend - Negative (Few Weeks)

XAUUSD (ONDA) IntraSwing Levels for 16th - 17th JAN2026(3.30 am)XAUUSD (ONDA) IntraSwing Levels for 16th - 17th JAN2026(3.30 am)

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

Technical Analysis and Chart PatternsUnderstanding Technical Analysis

At its foundation, technical analysis relies on three key assumptions. First, the market discounts everything, meaning price reflects all known information. Second, prices move in trends—once a trend starts, it is more likely to continue than reverse immediately. Third, history tends to repeat itself, as market participants often react similarly to comparable situations due to human psychology such as fear, greed, and herd behavior.

Technical analysis uses tools like price charts, indicators, and oscillators to identify trends, momentum, volatility, and potential reversal points. Charts visually represent price movements over time, making them the backbone of technical analysis. Common chart types include line charts, bar charts, and candlestick charts, with candlesticks being the most popular due to their detailed representation of price action.

Role of Charts in Technical Analysis

Charts help traders understand how price behaves over different time frames. Short-term traders may focus on minute or hourly charts, while swing traders prefer daily charts, and long-term investors may analyze weekly or monthly charts. Regardless of the time frame, the principles of technical analysis remain the same.

Key elements observed on charts include support and resistance levels, trendlines, moving averages, and volume patterns. Support represents a price level where demand is strong enough to prevent further decline, while resistance is where selling pressure prevents further price increases. These levels often act as decision points for traders.

What Are Chart Patterns?

Chart patterns are specific formations created by price movements on a chart. They represent the collective psychology of market participants and often signal continuation or reversal of trends. Chart patterns do not guarantee outcomes, but they increase the probability of a particular move when combined with other technical tools.

Chart patterns are broadly classified into three categories:

Reversal Patterns

Continuation Patterns

Bilateral Patterns

Understanding these patterns allows traders to anticipate potential breakouts, breakdowns, or trend changes.

Reversal Chart Patterns

Reversal patterns indicate a possible change in the prevailing trend. They form after a sustained upward or downward move and suggest that momentum is weakening.

One of the most well-known reversal patterns is the Head and Shoulders pattern. It consists of three peaks: a higher middle peak (the head) flanked by two lower peaks (the shoulders). When price breaks below the neckline, it signals a potential reversal from an uptrend to a downtrend. The inverse head and shoulders pattern works similarly but indicates a reversal from a downtrend to an uptrend.

Another important reversal pattern is the Double Top and Double Bottom. A double top forms when price tests a resistance level twice and fails to break higher, signaling bearish reversal. A double bottom forms when price tests a support level twice and fails to break lower, signaling bullish reversal. These patterns reflect exhaustion of buyers or sellers at critical levels.

Continuation Chart Patterns

Continuation patterns suggest a temporary pause in the market before the prevailing trend resumes. They often occur during periods of consolidation, where the market gathers strength for the next move.

Flags and Pennants are common continuation patterns. Flags appear as small rectangular consolidations sloping against the prevailing trend, while pennants resemble small symmetrical triangles. Both patterns indicate strong momentum prior to consolidation and usually resolve in the direction of the original trend.

Triangles are another popular continuation pattern, including ascending, descending, and symmetrical triangles. An ascending triangle forms with a flat resistance line and rising support, signaling bullish continuation. A descending triangle has flat support and falling resistance, signaling bearish continuation. Symmetrical triangles show contracting price action and can break in either direction, often continuing the previous trend.

Bilateral Chart Patterns

Bilateral patterns indicate uncertainty in the market and can break in either direction. Traders usually wait for confirmation before taking a position.

The Symmetrical Triangle is a prime example of a bilateral pattern. It reflects a balance between buyers and sellers, with lower highs and higher lows converging toward an apex. A breakout above resistance suggests bullish continuation, while a breakdown below support suggests bearish continuation.

Importance of Volume in Chart Patterns

Volume plays a crucial role in validating chart patterns. A breakout or breakdown accompanied by high volume is considered more reliable than one with low volume. Volume confirms the strength of market participation behind a move. For example, in a head and shoulders pattern, increasing volume on the breakdown of the neckline strengthens the bearish signal.

Combining Chart Patterns with Indicators

While chart patterns are powerful, relying on them alone can be risky. Successful traders often combine chart patterns with technical indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and moving averages. These indicators help confirm momentum, trend strength, and overbought or oversold conditions.

For instance, a bullish breakout from a triangle pattern combined with RSI moving above 50 and price crossing above a moving average provides stronger confirmation. This multi-tool approach reduces false signals and improves decision-making.

Limitations of Technical Analysis and Chart Patterns

Despite their usefulness, technical analysis and chart patterns have limitations. Markets can behave unpredictably due to sudden news, economic events, or geopolitical factors. False breakouts are common, especially in low-volume or highly volatile markets. Additionally, chart patterns are subjective—different traders may interpret the same pattern differently.

Discipline, risk management, and proper position sizing are essential to handle these limitations. Stop-loss orders help protect capital when a pattern fails.

Conclusion

Technical analysis and chart patterns form the backbone of modern trading strategies. By studying price behavior, identifying recurring patterns, and understanding market psychology, traders can gain valuable insights into potential future movements. Chart patterns such as head and shoulders, double tops and bottoms, flags, and triangles help traders anticipate reversals and continuations with higher probability.

However, technical analysis is not a magic formula. Its true power lies in consistent practice, combining multiple tools, and disciplined risk management. When used correctly, technical analysis and chart patterns become a powerful framework for navigating financial markets and making informed, strategic trading decisions.

Derivatives Explained: Meaning, Types, Uses, and Its ImpactsWhat Are Derivatives?

A derivative is a financial contract between two or more parties that derives its value from the price movement of an underlying asset. The contract itself has no independent value; instead, its worth depends entirely on how the underlying asset performs in the market. For example, a futures contract on crude oil depends on the future price of crude oil, while an options contract on a stock depends on that stock’s price movement.

Derivatives are typically used for three main purposes: hedging risk, speculation, and arbitrage. While they are powerful tools, they can also amplify losses if used without proper understanding or risk management.

Types of Derivatives

There are four major types of derivatives commonly traded in financial markets:

Futures Contracts

Futures are standardized contracts traded on exchanges where two parties agree to buy or sell an underlying asset at a predetermined price on a specific future date. These contracts are legally binding and require margin payments. Futures are widely used in commodities, stock indices, currencies, and interest rates. For example, a farmer may use futures to lock in a price for crops, protecting against price fluctuations.

Forward Contracts

Forwards are similar to futures but are privately negotiated (over-the-counter) contracts rather than exchange-traded. They are customized according to the needs of the parties involved. However, forwards carry higher counterparty risk because they are not regulated or guaranteed by an exchange.

Options Contracts

Options give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a certain time period. A call option gives the right to buy, while a put option gives the right to sell. Options are widely used for hedging and strategic trading due to their flexibility and limited risk for buyers.

Swaps

Swaps are agreements between two parties to exchange cash flows or financial obligations. The most common types are interest rate swaps and currency swaps. These instruments are mainly used by large institutions to manage interest rate or currency risk.

Role of Derivatives in Risk Management

One of the primary purposes of derivatives is hedging. Hedging involves reducing or eliminating the risk of adverse price movements. For instance, an airline company may use fuel futures to lock in fuel prices and protect itself from rising oil costs. Similarly, exporters and importers use currency derivatives to hedge against exchange rate volatility.

By allowing market participants to transfer risk to those willing to bear it, derivatives contribute to financial stability when used responsibly. They help businesses plan future costs and revenues with greater certainty.

Derivatives as a Tool for Speculation

Speculators use derivatives to profit from expected price movements in underlying assets. Because derivatives often require a relatively small initial investment (margin or premium), they offer high leverage. This means that even small price changes can result in significant profits—or losses.

Speculation adds liquidity to markets, making it easier for hedgers to enter and exit positions. However, excessive speculation without proper risk control can lead to sharp market volatility and financial instability.

Arbitrage and Market Efficiency

Arbitrage involves taking advantage of price differences in different markets to earn risk-free profits. Derivatives enable arbitrage by linking prices across markets and time periods. For example, if a futures price deviates significantly from the spot price, arbitrageurs step in to exploit the difference, helping bring prices back into alignment.

This process improves price discovery and overall market efficiency. As a result, derivatives markets often reflect expectations about future prices, interest rates, and economic conditions.

Advantages of Derivatives

Derivatives offer several benefits to financial markets:

Risk Management: Effective tools for hedging price, interest rate, and currency risks.

Leverage: Allows traders to control large positions with limited capital.

Liquidity: High trading volumes improve market depth and efficiency.

Price Discovery: Futures and options markets provide insights into future price expectations.

Risks Associated with Derivatives

Despite their advantages, derivatives carry significant risks:

Leverage Risk: Small market movements can lead to large losses.

Counterparty Risk: Especially in over-the-counter derivatives like forwards and swaps.

Complexity: Misunderstanding contract terms can result in unexpected outcomes.

Systemic Risk: Excessive or poorly regulated use of derivatives can threaten financial stability, as seen during the 2008 global financial crisis.

Derivatives in the Indian Financial Market

In India, derivatives trading is well-established and regulated by the Securities and Exchange Board of India (SEBI). The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) offer a wide range of derivative products, including index futures, stock options, and currency derivatives. These instruments have significantly increased market participation, liquidity, and transparency in the Indian financial system.

Conclusion

Derivatives are indispensable instruments in today’s global financial markets. When used correctly, they help manage risk, improve market efficiency, and support economic growth. However, their complexity and leverage require a deep understanding and disciplined risk management. For traders and investors, derivatives should not be seen merely as tools for quick profits, but as strategic instruments that demand knowledge, planning, and responsibility. In essence, derivatives are neither inherently good nor bad—their impact depends on how wisely they are used.

GIFTNIFTY IntraSwing Levels for 16th JAN 2026GIFTNIFTY IntraSwing Levels For 16th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

Does History Repeat Itself Every Time(RADICO)My Dear Friends, Radico Khaitan Limited is a leading company in the alcoholic beverage industry, known for brands like 'Magic Moments' vodka and '8 PM' whisky. According to astrology, this company is entirely under the influence of Venus and Rahu .

Rahu : Rahu is the lord of excitement and intoxication. In the alcoholic beverage industry, Rahu is the planet that makes a brand trendy and popular among young people.

This is a very serious astrological warning for the history and future of Radico Khaitan . A very precise correlation is observed between Rahu's transit in the Shatabhisha Nakshatra and the decline in the stock price.

Here is a detailed analysis of the chart and cautionary signals for 2026:

The historic crash of 2007-2008 (78% decline)

According to the chart, when Rahu entered Aquarius under the Shatabhisha Nakshatra (October 2007), the stock reached its peak, and subsequently:

Decline : A massive drop of approximately -78.36% occurred.

Duration: This lasted for about 399 days.

Reason: Rahu is the ruling planet of the Shatabhisha Nakshatra, and Aquarius is also ruled by Rahu. This creates "irrational exuberance," followed by the bursting of the BUBBLE ".

2025-2026 की वर्तमान स्थिति (The Second Cycle) ( Astro Cycle)

The chart shows that from November 3, 2025, Rahu has once again come under the influence of Aquarius and the Shatabhisha nakshatra.

Similarity: The stock is currently at the ₹2,900+ level, and the chart shows an almost "triple top" or "exhaustion" pattern, similar to what was observed in 2007.

Warning: If history repeats itself (as often happens in Rahu's 18-year cycle), the stock is at risk of another major decline. The projected -78.36% drop shown in the chart is very concerning and could send the stock plummeting.

Will history repeat itself in 2026? (Analysis)

Although the Rahu's nakshatra & zodic is the same in 2007 and 2025(after 18 years), there is a significant astrological difference that might prevent a 78% decline this time:

Difference in Jupiter's position : In 2007-08, Jupiter was struggling in a water sign (Scorpio). In 2026, Jupiter will be exalted in a water sign (Cancer). An exalted Jupiter often transforms a major "crash" into a "correction."

Nature of Shatabhisha : The Shatabhisha Nakshatra is associated with "mystery" and "sudden changes." The stock market might not experience a crash like in 2007, but instead move sideways (within a range), tiring out investors.

And as you all know, time is more important than price, so let's see what time tells us.