GODREJPROP: Head & Shoulder pattern and Perfect CorrectionGODREJPROP: Head & Shoulder pattern and Perfect Correction

👉🏼 Godrej Properties Some Facts (as of January 29, 2026)

Godrej Properties, part of the Godrej Group, has been in the spotlight for its strong performance in CY 2025 and upcoming corporate updates. Here's a summary of the most recent developments based on available reports:

🌈1. Upcoming Q3 FY26 Results Announcement

The company's Board of Directors is scheduled to meet on February 5, 2026, to approve the unaudited financial results for Q3 FY26 (October-December 2025). This comes amid expectations of continued growth in bookings, though the realty sector faces headwinds from market volatility.

🌈2. Share Price Performance

As of January 28, 2026, Godrej Properties shares closed at ₹1,550.95 on the NSE, up 2.23% from the previous close, with intraday highs at ₹1,570. However, the stock has been under pressure earlier in the month, hitting a 52-week low amid a broader realty sector decline (down 2.4% on January 20). Historical data shows a dip from ₹1,706 on January 21 to ₹1,638 on January 23.

🌈3. Leadership in Residential Real Estate for CY 2025

Godrej Properties emerged as the leader in India's residential market for the second consecutive year in CY 2025, with record bookings of ₹34,171 crore, collections of ₹18,979 crore, and sales of 16,428 homes across 27.26 million sq. ft. The company launched 41 projects nationwide, reflecting resilience in demand. This positions it strongly for FY26, with new launches like the ultra-luxury Godrej Trilogy in Worli, Mumbai, projecting over ₹10,000 crore in revenue potential.

🌈4. Expansion and Land Deals

Recent expansions include entry into the Hyderabad housing market in January 2026. Earlier in November 2025, the company secured a 75-acre land deal in Nagpur, crossing its FY26 target.

🌈5. Group-Level News Impacting Properties

At the World Economic Forum in Davos (January 2026), Godrej Industries Chairman Adi Godrej indicated interest in acquisitions in consumer goods and animal feed sectors, signaling group-wide growth that could indirectly benefit the real estate arm through synergies.

The realty sector, including Godrej Properties, has faced broader market weakness in January due to FII outflows and global uncertainties, but analysts remain optimistic on its long-term prospects given strong bookings and expansions. For the latest stock updates or Q3 previews, keep an eye on the February 5 board meeting.

💯 INTRADAY & Positional Level will be Updated later. Keep following

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"🙏🏼As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

Beyond Technical Analysis

Small Cap vs. Large Cap – Visualizing Risk Cycles & Rotation PoiWhat the Lines Tell Us:

1. Small Caps (Blue): Steeper rallies in bullish phases, sharper falls in corrections. Higher beta, higher reward, higher pain.

2. Large Caps (Red): More stable, smoother trends. Acts as a defensive harbor during market stress.

Now: The gap is wide again. Historically, this signals rising risk in small caps.

Correlation with the Ratio-Based Strategy:

- The Small-Cap / Large-Cap Ratio from my earlier post is essentially the vertical distance between these two lines.

- When the blue line runs far above the red (wide gap) → Ratio is high (>1.6) → Time to rotate to large caps.

- When the lines converge (gap narrows) → Ratio is low (<1.6) → Time to enter small caps.

Current Implication:

The gap is historically wide (similar to 2008, 2018 highs). This aligns with the ratio signal, reinforcing the move toward large-cap ETFs/index funds for capital preservation. Small caps will again shine—after the gap closes.

Takeaway:

You don’t need complex indicators. Sometimes, just watching these two lines and their separation tells you when to rotate—capture small-cap upside, hide in large-cap safety.

Beating Nifty with One Ratio: The Small-Cap / Large-Cap SwitchWe all know small-cap outperforms in bull runs, but we forget to remember that it also crash harder in downturns.

On the other hand, large-caps give just moderate returns

But what if you could systematically increase your returns—using the same index funds?

The Core Idea

Track the "Small-Cap to Large-Cap Ratio" (BSE Small-Cap Index ÷ Nifty 50). This ratio shows when small-caps are overextended vs. large-caps.

The Simple Rule (Backtested 2006-2024)

1. Go Small-Cap when ratio < 1.6

2. Switch to Large-Cap when ratio > 1.6

Why It Works

It’s not market timing—it’s risk timing. The ratio peaks (1.8–2.2) near market tops and bottoms near 1.0. Switching at 1.6 avoids the worst drawdowns while staying invested.

Backtested Results

1. Nifty Buy & Hold: ~12.1% CAGR (₹10L → ~₹70L)

2. Small-Cap Buy & Hold: ~12.3% CAGR (₹10L → ~₹75L)

3. Switch Strategy (Pre-tax): ~18.6% CAGR (₹10L → ~₹2.3Cr)

How to Implement

1. Use ETFs: Nifty Bees for large-cap, a Small-Cap ETF for small-cap.

2. Check ratio monthly; switches occur ~every 2 years.

3. For SIPs, direct new money per the current signal.

Graphite India Ltd | Monthly Timeframe | Structure-Based ViewHi all,

Graphite India is currently trading inside a long-term contracting structure after a multi-year correction. Price has respected both descending resistance and ascending support, indicating compression.

• Strong Base / Demand Zone:

Price has formed a solid base around the ₹430–₹480 zone, which has acted as reliable support multiple times.

• Descending Trendline (Major Supply):

The long-term descending trendline continues to cap price.

Recent candles show price retesting this supply area, but without a confirmed breakout yet.

• Current Phase – Retest, Not Breakout:

The highlighted candle represents a retest of resistance, not confirmation.

➡️ Monthly close is critical to validate strength.

What's next:

✔️ A strong monthly close above the descending trendline

✔️ Acceptance above previous swing highs

✔️ Follow-through volume (optional confirmation)

Until then, this remains a wait-and-watch structure, not a prediction setup.

#GraphiteIndia

#MonthlyChart

#MarketStructure

#PriceAction

#SupportResistance

#TrendlineAnalysis

#IndianStocks

#SwingTrading

#BullManAcademy

TATACONSUMER | Daily TF – RISING WEDGE BreakdownTATACONSUMER is showing short-term weakness after breaking below the rising trendline and failing to hold above 1160.

As long as price stays below this level, the probability increases for a move towards 1120–1100, which aligns with a higher time-frame Bullish Order Block (Demand Zone) and Fibonacci support.

This zone is important because it previously showed strong buying interest.

Plan: No aggressive longs yet.

Wait for price reaction, structure shift, or confirmation inside the demand zone before considering fresh buys.

Market always gives confirmation—patience pays.

Not investment advice.

Regards

Bull Man

NIFTY Analysis for 29th JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 29th JAN 2026: IntraSwing Spot levels

For coming Days 25270 - 25316 Looks Crucial.

Todays Close above that Zone suggests Bull Power.

If Breaks Below 25270 & Sustain for 15 - 30 mins, Bears can take Advantage.

Due to SENSEX Last EXP before BUDGET, Volatility must have Crucial role.

CAUSIOUS TRADE ADVISABLE.

👇🏼Screenshot of NIFTY Spot All-day(27th Jan 2026) in 5 min TF.

🚀Follow GIFTNIFTY Post for NF levels

_________________:::__________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

SOLARINDS — Clean Trendline Breakout After Multiple RejectionsPrice respected the descending resistance trendline multiple times, showing strong selling pressure at higher levels.

Over time, buyers kept stepping in with higher lows, compressing price into a tight range — a classic sign of accumulation.

The recent strong breakout above the trendline confirms a shift in control from sellers to buyers.

This kind of simple structure-based breakout often leads to fresh momentum when followed by good volume and follow-through.

No indicators.

Just price doing what it always does.

BANKNIFTY at Channel Resistance Ahead of Budget — Volatility BankNifty is moving inside a well-defined downward channel and has once again reached the upper resistance trendline.

Historically, every touch of this zone has either triggered a sharp rejection or a strong breakout with momentum — making this a high-impact reaction area.

With the Union Budget approaching, volatility is expected to expand.

Price may attempt a brief push higher, but as long as the channel resistance holds, the broader structure still favors pullbacks toward the lower boundary.

👉 This is not a prediction zone — it’s a reaction zone.

The direction will be decided by how price behaves near resistance during the event-driven volatility.

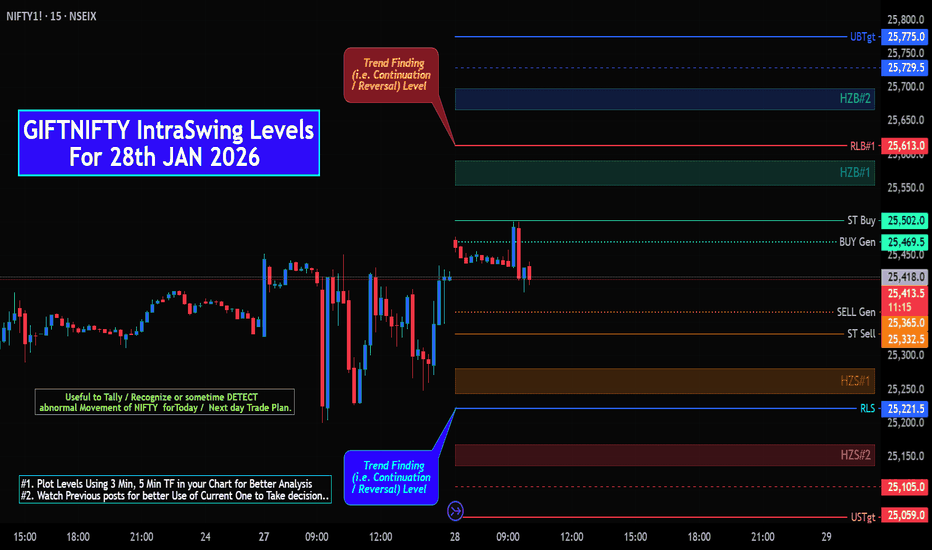

GIFTNIFTY IntraSwing Levels for 28th JAN 2026GIFTNIFTY IntraSwing Levels for 28th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

________________________________________________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━:===:━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━:===:━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

METROBRAND at Major Demand ZoneMETROBRAND is trading inside a well-defined range for months, with price repeatedly respecting both resistance and support zones.

The upper trendline continues to act as supply, while the horizontal base around 1000–1050 has consistently attracted buyers.

Once again, price has returned to this major demand zone — a level that has historically triggered strong reactions.

From here:

• A hold and bounce keeps the broader structure intact

• A clean breakdown would signal a shift in trend and open lower levels

This is not a random price area — it’s a key decision zone where smart money activity is usually visible.

Nifty closed around its 200DMANifty amidst volatility managed to close around its 200DMA of 25154, this would act as pivot for next few sessions. Fiis unwinded 29% of their net positions on expiry day, they still holds heavy short positions of 88% among total net open positions.

For Nifty to bounce back further it has to hold above 200DMA.

HDFCLIFE: Potential Stock for Feb EXP. & Positional LevelsHDFCLIFE: Potential Stock for Feb EXP. & also an Investment Idea

👇🏼 Comparative Study of some of leading Insurance compaanies.

👇🏼 Screenshot of HDFCLIFE Intraday Level for 28th Jan 2026

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

DXY Breaks a Multi-Year SPT — A Structural Shift in the Dollar📉 Why the U.S. Dollar Is Falling – The Bigger Picture Behind DXY

The recent weakness in the U.S. Dollar (DXY) is not a random move or just a short-term reaction. It’s a result of a deeper shift in market expectations and global capital flows.

Markets are now pricing in a slower U.S. economy and a softer Federal Reserve stance ahead. As inflation pressures ease and rate cut expectations rise, U.S. bond yields have started losing momentum. Since global money always moves toward better relative returns, this has reduced the attractiveness of holding U.S. dollar assets.

At the same time, capital is gradually rotating toward emerging markets, commodities, and risk assets — areas that typically benefit when the dollar weakens. This flow shift is also being accelerated by hedge fund positioning and technical unwinding, making the decline sharper and faster.

A weaker dollar often supports:

• Emerging market equities and currencies (including India)

• Commodities like oil, metals, and gold

• Export-oriented companies

This is not about one news event — it’s about markets repricing the future path of money, interest rates, and growth.

If U.S. yields continue to soften and risk appetite remains strong, DXY may stay under pressure. A reversal would likely need either rising yields again or a renewed hawkish shift from the Fed.

👉 In simple terms:

The dollar is falling because the world is adjusting to a future where U.S. money is no longer becoming more expensive — and global capital is flowing accordingly.

MFSL at Channel Support — Bounce or Breakdown?MFSL is moving inside a well-defined rising channel, showing a healthy and controlled uptrend.

The stock has respected this structure multiple times, with buyers stepping in near the lower support and selling pressure appearing near the upper resistance.

Currently, price is approaching the lower boundary of the channel — a crucial zone where trend continuation usually happens if buyers defend it.

As long as this support holds, the overall trend remains positive.

A clear breakdown below the channel could signal further weakness.

TCS Forming a Classic Bullish Flag — Pause Before the Next Move?TCS witnessed a strong impulsive rally, indicating solid buying momentum.

After the sharp move, the price has entered a controlled downward-sloping channel — a classic bullish flag pattern.

This consolidation phase suggests that the market is taking a healthy pause rather than showing weakness. Sellers are not aggressive, and price is respecting the flag boundaries well.

A decisive breakout above the upper trendline could signal continuation of the previous uptrend with renewed momentum.

However, a breakdown below the lower boundary would invalidate the pattern and may invite further downside.

For now, structure favors a bullish continuation as long as the flag holds.

📌 Key focus: Watch for volume expansion on breakout for confirmation.

RELIANCE Set for 2026 Catalysts-Intraswing for 28th JAN 2026🔥Reliance Industries Set for 2026 Catalysts.

💯ARPU Skyrockets, and Mahakal New Energy Domination – 💥 ₹1,800 Target Locked!"

SCreenshot: Reliance Industries Ignites 2026 Boom - RELIANCE Positional Level Analysis

++++++++$$$$$$$$$$$++++++++

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correction looks weak and corrective, suggesting sellers are still in control. As long as price remains below the invalidation level around 2.0050 , the bearish bias stays valid. The expectation is for the correction to finish soon, followed by Wave 5 to the downside, targeting the lower channel area and the 1.96–1.95 zone. Overall, the trend remains bearish, and any short-term bounce is likely a selling opportunity before the next leg lower.

Stay tuned!

@Money_Dictators

Thank you :)

HDFCBANK Lead the Pre-Budget Rally - Lead Turnover Stock HDFCBANK Lead Turnover Stock Level analysis for 28th JAN 2026

Lead the Pre-Budget Rally.

👇🏼Screenshot: All-day (27th Jan 2026) in 5 min TF..

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

BIKAJI 1 Week View 📌 Current Price Snapshot (Weekly Context)

Current trading price: ~₹645 – ₹651 (NSE) — price has been trending lower recently.

1‑week return: down ~6–7% (indicating short‑term bearish momentum).

📊 Weekly Support & Resistance Levels (Key Zones)

🔹 Resistance (Upside)

These are levels where price may face selling pressure if it tries to rebound:

R1: ~₹680 – ₹686

R2: ~₹695 – ₹700

R3: ~₹710 – ₹722

(these are key weekly/week pivot‑type resistance zones)

🔸 Current Pivot / Short‑Term Reference

Pivot zone: ~₹668 – ₹670 (central bias level)

This is useful for gauging bullish vs bearish bias for the week.

🔻 Support (Downside)

These are levels where buyers could step in on weakness:

S1: ~₹650 – ₹642

S2: ~₹635 – ₹630

S3: ~₹620 – ₹619

(weekly support zones below current price)

📈 How to Interpret These Levels (1‑Week Lens)

🎯 Bearish scenario

If price closes below ~₹640–₹635 on weekly candles → next support around ₹620 becomes important. Continuous closes below that could see deeper pullbacks.

📈 Bullish/Recovery scenario

For a bullish shift at this 1‑week timeframe:

Break above ₹680–₹690 zone convincingly → next upside toward ₹700+

Weekly close above ₹700–₹710 strengthens the reversal thesis.

🟡 Neutral/Range scenario

Between approx ₹650–₹690, expect sideways movement / consolidation with likely choppy action.

GIFTNIFTY Feb 2026 Fut Roll-Over Levels For 27th JAN 2026GIFTNIFTY Feb 2026 Fut Roll-Over Levels For 27th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

===============================================

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.