Bajaj Auto enjoying a momentum time out.The stock is taking its time out at the 60 levels on RSI. After a unstoppable rally from August it has moved sideways and have consolidated. As of now he prices are resting on KS/TS support line, if a breakout is not registered within a session or two then some serious momentum loss may be grip up thereby pushing the stock into some sharp corrections.

Bharatjhunjhunwala

The tri start doji story in INFYInfy is plaing hide & seek with traders, in the last 3 sessions it formed 3 dojis (tri star doji) these formations comes close to a very high intensity supply zone. While all other IT stocks were faltering infy kept itself tightly clinged to the range, if the range is not taken out buy the buyers in a session or two, it will result into some fast corrections. The RSI is into neutral zone with MACD into bearish territory.

Bank Nifty close to 31000. It's a important support level.In my last Friday’s update I mentioned that we may see banknifty trading at 31000 levels. The index registered a close at 31160 today. Now it’s trading close to a support level the KS line. A major support is at 30600. Most of the time KS acts as a very good support for prices, so a bounce from it is not ruled out. 31600 will be the decider level for coming sessions, a strong close above it will only result in trend resumption. The RSI is pointing down while MACD lags upside momentum.

Nifty breaks below an important pivot support. 11700 may supportNifty left behind an important support level. After giving away 12000 levels which was a physiological support level this will act as an important pivot in the coming sessions. Next support can be seen at 11700 (Lead 1) on the charts, expecting some bounce from these levels. Major area of demand is 11420 (hopefully we may visit it). RSI is moving towards 40 levels & MACD as turned neutral with positive bias.

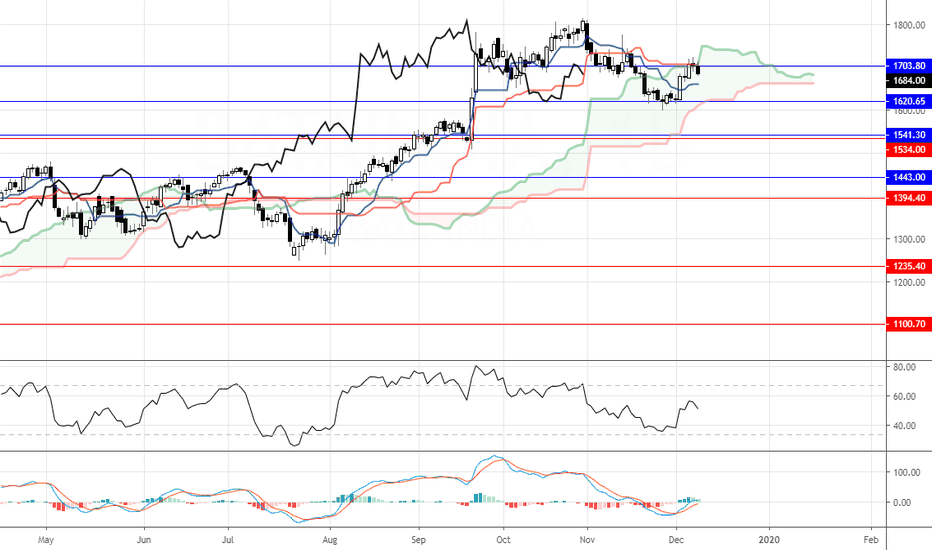

Bata India: Has the trend bent?The stock was into dominant trend up, last few months the stock hasn’t displayed any zeal to move up. Now at a high intensity resistance level, the price consolidated and formed a negative candle pattern. The RSI is into neutral zones creating bearish signs. Macd is into bearish zone. The stock is expected to correct to 1620-1540 levels where it may find support. Above 1735 the bearish analysis is negated.

Maruti's break failed at 7000! MARUTI SUZUKI: The stock was holding support levels for last few sessions, in today’s move it broke down from an important pivot and negated the bullish view. Now the stock is expected to remain sideways to down for a couple of weeks. The RSI is close to 40, which may result into some bounce, till 7000 levels. This level will now serve as a resistance instead of a support. The stock may head to 6600 levels in the coming weeks.

Trading close to a very important level. NIFTY: Nifty took beating from the bears in the last two sessions. Now at a very key juncture, a break and close below the 12000 levels have shattered the physiological support levels, still the bullish nature is not wiped out fully, if the fall continues the index may tumble to 11420 levels, again the levels I am mentioning may be vague & outrageous but still they are valid as long as selling in prominent. A minor support may be seen at 11790 below which the above targets on the downside is open.

If bulls don't come to rescue then 29500 is quite evident. BANKNIFTY: Selloff was dominant on the last two sessions on daily charts. After the RBI policy, weakness took over resulting in a sell off. Prices closed below the TS line almost after 45 days of holding it. A minor support has been given away. The next key support zone is close to 30790 levels, the index is expected to take support here, breaking this key level will push the banknifty into deeper corrections and it may drag itself towards 29500 levels. Giving such deep targets is not feasible as of now, the important thing to consider is the key levels mentioned above. On the weekly charts RSI is just at 60, the price action in the coming week will be decide the final fate of the index.

Infy is facing a mammoth resistance pressure.Infosys took resistance at a very strong pivot point and fell back. The stock is still into down trend and the move up may be classified as a mere pullback. The last bar is a bear bar. A small support is at 694 levels, breaking this will result in sell off and infy may travel down towards 656 zones.

CONCOR gaped up with forming bullish candle & closing at highs.CONCOR: The stock opened with a gap up and the prices continued up during the day. The prices closed near the highs. The prices have been making a falling wedge pattern with falling volumes. The RSI took support at the 40 levels and bounced up, MACD turned positive (though it is below zero line) there is a minor resistance at 585 levels, the stock is expected to retrace to 565 – 570 levels, watching price action entries can be planned for higher targets of 604, 619 & 625 levels. However a move below 540 will negate the bullish view.

HUL retraced from an importan resistance zone. Fall to continue?HINDUSTAN UNILEVER LIMITED: The stock had a fabulous run in the last few months. In the last few weeks, the stock displayed a loss of momentum and correction occurred. Now the stock took a hit at an important pivot and corrected. The stock has minor support at 1995 – 2000 levels below which there may be a further correction to 1920 levels. However, a move above 2100 will negate the corrective view and the stock may continue the trend up.

USDINR gaining strength! Will it further perturb stocks?USDINR: The currency pair has pulled back in the past week, the last two sessions were positive and the prices managed to close above all resistance and pivot levels. The RSI is into a bullish zone and bounced from the bullish extreme zones. The MACD is positive and above zero. The pair is expected to move higher in the coming sessions. The pair may move to 72.25 – 72.55 in the coming weeks.

Nifty at an important point. Holding 12000 will be positive!NIFTY: The index corrected in the last session and closed just at a support level. The TS line serves as a good support to strong trends, in the coming sessions 12000 will play an important role for the index, as long as the level is safe the index is expected to move higher however giving away 12000 may install weakness in Nifty and drag it to 11800, this is another strong support level. On the positive side, Nifty is expected to move to 12270 – 12440 if the support levels hold.

Canbank has approached an important zone! Watch HereCANBANK: Recent rally in public sectors banks have been good and strong. Almost every public sector bank rallied more than 20% from their recent lows. Canbank is now hovering at a resistance point. There is a strong supply area ahead, if the stock fumbles here, there may be a small correction which may rest close to 208 -205 levels, if a breakout is successful then it can scale to 275 levels in coming months. The overall trend & sentiment is positive and healthy. RSI and MACD has not displayed any signs of weakness.

Symmetrical Triangle & NR formation indicating weaknessAPOLLO HOSPITALS: Prices are ranging between a symmetrical triangle pattern, this leg up missed the upper boundary of the pattern indicating weakness probably. Symmetrical patterns are neutral patterns, let’s have cues from the indicators. The RSI is into neutral zone has formed a NR, MACD is just at neutral zone. The prices have faced resistance at important levels forming a bearish candle pattern on the chart. Any push below 1440 will be sign of further weakness and the stock may start to descend down. A close above 1490 is required for the bulls to get control.

Tri Star Doji! Will it allow nifty to make a new high? 11800 ...The movement of Nifty was directionless this week. From last three weeks Nifty has kept traders on the edge and has been teasing both buyers and sellers. We can see a tri star doji formation on the weekly charts at resistance, tough doji does not mean outright sell, it depicts chaos and confusion. We should not discount the fact that the trend is up and yet no confirmation of any selling pressure is seen on the charts. 11800 will be acting as a strong support breaking it may lead to correction to 11570 – 11370 levels. The RSI is flat on the weekly charts, though on the daily charts we notice RSI taking a hit at the 60 levels.

Taking support a very important level. Price action positiveThe stock has made healthy retracement and have now it’s resting on the Kumo. Today’s price action was quite convincing to re-establish the buyers into the stock. The RSI is taking support on the bullish extreme levels with MACD curling up indicating momentum is picking up. If ONCG gets overall support from Nifty, the stock is expected to pull up strongly from these levels the short term targets may be set at 149-154 zones. 125 levels are important support levels for the stock.

Further Selling may lead to deep correctionsThe stock witnessed sell off during the last session. The prices have closed below the kumo making a big black candle, indicating weakness. The momentum has lost strength RSI is not at all excited to move up plus macd has fallen below zero. There is a minor support at 550 levels, failing that support the stock may fumble and fall down to 460 – 415 levels.

Hovering near a very important support zone. Make or BreakThe stock has witnessed sell off during past few weeks. Currently the stock is at an very important support level – 1670. A move down from this level will not be a good sign for the buyers and the stock may fall down further and test 1560 levels. The RSI is just at the support levels, a pull back here has to be monitored and seen for bullish continuation signals. In short Asian Paints is at a Make or Break level.

A very crucial price action bar formed on BPCL todayBPCL: An important candle formation has been printed on the BPCL daily chart. It’s a bear engulfing candle along with a “double key reversal” action. This is a very prominent signal in shift of control from bulls to bears. Also RSI has taken resistance at 60 levels with a bear divergence, a strong loss of momentum! Any further decline especially below 500 can will not be a good news for BPCL bulls.

Asian Paint at an minor support! Watch the prices hereAsian Paints: After extended north run the stock corrected. The RSI has moved into neutral zone. The prices are now hovering around a minor support at the kumo. There has been a negative TK cross with CS drifting below the prices. The correction seems not over yet, a small pullback can be followed by a correction further pushing the prices to 1670 levels (very strong support area)