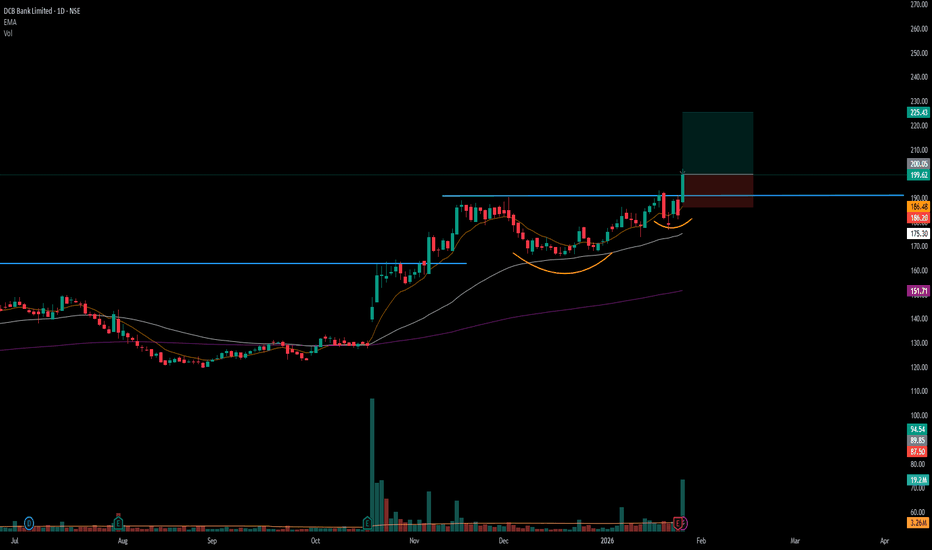

#DCBBANK - BreakOut in DTF with Volume Script: DCBBANK

Key highlights: 💡⚡

📈 C&H BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Base BreakOut

📈 RS Line making 52WH

📈 MACD Crossover

BUY ONLY ABOVE 200 DCB

⏱️ C.M.P 📑💰- 199.62

🟢 Target 🎯🏆 – 12%

⚠️ Stoploss ☠️🚫 – 6%

⚠️ Important: Market conditions are BAD, Avoid entering any Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅ Boost and Follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes. Not a BUY or SELL recommendation.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Breakouttrade

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in AVANTIFEED

BUY TODAY SELL TOMORROW for 5%

#IDBI - VCP BO in WTFScript: IDBI

Key highlights: 💡⚡

📈 VCP BO in WTF

📈 Volume spike seen during Breakout

📈 MACD Bounce

📈 RS Line making 52WH

📈 Sector is strong

If you have any doubts about the setup, drop a comment and I’ll reply.

✅Boost and follow to never miss a new idea! ✅

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

⚠️Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

#CRAFTSMAN - VCP BO in DTFScript: CRAFTSMAN

Key highlights: 💡⚡

📈 VCP BO in DTF

📈 Volume spike seen during Breakout

📈 MACD Bounce

📈 RS Line making 52WH

✅Boost and follow to never miss a new idea! ✅

✅ If you have any doubts about the setup, drop a comment and I’ll reply.

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

⚠️Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Piramal Enterprises – Swing Trade Idea🟢 Trade Setup (Swing)

Buy Zone:

➡️ Near ₹1640 (support + demand area)

Targets:

🎯 T1: ₹1783

🎯 T2: ₹1840

Stop Loss:

⛔ ₹1600

🔍 Technical Reasons

Price respecting 20 & 50 EMA

Recent pullback with low selling volume

RSI holding above 50 → strength intact

Previous resistance now acting as support

Risk–Reward ≈ 1:4

#SAKAR - VCP BO in WTFScript: SAKAR

Key highlights: 💡⚡

📈 VCP BO in WTF

📈 Volume spike seen during Breakout

📈 MACD Bounce

📈 RS Line making 52WH

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Boost and follow to never miss a new idea! ✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

NESTLEIND – Symmetrical Triangle Breakout Setup (1D Chart)I’m watching Nestle India for a potential bullish breakout from a symmetrical triangle on the daily timeframe. Price has been consolidating after a strong impulsive move, and it is now respecting both trendline support and triangle resistance.

🔍 What I'm Seeing

Price created a strong rally, followed by a healthy consolidation.

A symmetrical triangle pattern has formed — showing tight price compression.

Price is currently sitting near the trendline support, indicating buyers are still active.

A breakout above the triangle could trigger the next bullish leg.

📈 Trade Idea

Entry Zone: Around current levels near the triangle breakout

Stop Loss: Placed below the trendline + recent swing lows

Target: Previous strong resistance zone near ₹1383

This gives a clean risk-to-reward setup with a logical structure: risk below support, target at the next major supply zone.

🎯 Why This Setup Makes Sense

Triangle breakout often leads to strong directional moves.

Trendline support confirms buyer strength.

Market structure is shifting bullish after breaking the downtrend earlier.

⚠️ Risk Note

This is not financial advice. Always manage risk properly and wait for a confirmed breakout candle before entering.

#DREDGECORP - VCP + Large Base BreakOut Script: DREDGECORP

Key highlights: 💡⚡

📈 VCP BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Large Base BreakOut

📈 MACD Crossover

BUY ONLY ABOVE 970 DCB

⏱️ C.M.P 📑💰- 968

🟢 Target 🎯🏆 – 22%

⚠️ Stoploss ☠️🚫 – 11%

⚠️ Important: Market conditions are Okish, Position size 25% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅ Boost and Follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes. Not a BUY or SELL recommendation.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in WELSPUNLIV

BUY TODAY SELL TOMORROW for 5%

#SMSPHARMA - VCP BO in DTFScript: SMSPHARMA

Key highlights: 💡⚡

📈 VCP BO in DTF

📈 Volume spike seen during Breakout

📈 MACD CrossOver

📈 RS Line making 52WH

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Boost and follow to never miss a new idea! ✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in PRIVISCL

BUY TODAY SELL TOMORROW for 5%

BTCUSDT SHORT I was sitting in Short after a good bearish candle formed at resistance with very good volume, i just took 1:2 and i was out of the trade.

Logic :- Price was too stretched and bears were gaining control, bulls were trapped

But still the trend is bullish for me, lets see 🚀

Happy profits 🥂 enjoy guys, sorry i didn’t posted this trade earlier

LIKE AND FOLLOW FOR MORE TRADE IDEAS

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in SCI

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in BHAGERIA

BUY TODAY SELL TOMORROW for 5%

IESC- Long The chart shows a clear uptrend over the past year.

Price formed a rounded bottom (cup-shaped base) and has broken above the neckline near $320–$330, confirming a bullish continuation pattern. Current price around $381 indicates sustained bullish strength.

Volume rose meaningfully during the breakout above $330, confirming the validity of the breakout. Prior to the breakout, volume was lower during consolidation, which is typical before a strong move.

Cup and Handle breakout confirmed above $330 neckline.

Current breakout is clean, backed by momentum and volume.

The stock is in a confirmed uptrend, backed by strong momentum and volume. Best strategy: Buy on dips near $340–$350 or add above $390–$400 with confirmation. Targets: $450 short-term, $500–$520 long-term. Maintain disciplined stop-loss placement to manage risk.

Godfry Philips Double Every Year Godfrey Philips is Such a Wonderful Stocks its Getting Double Every Year in last 4 Year . It's Given more than 80% CAGR IN LAST 5 year u can Check it's CAGR on Screener . No buy sell Reccomendation. My Views is for Educational purposes only. Consult your financial advisor before making any position in stock market.

For more information Check my Profile. Thanks 👍

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in ROHLTD

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Round Bottom Breakout in SEAMECLTD

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in SUMMITS

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Cup and Handle Breakout in GEPIL

BUY TODAY SELL TOMORROW for 5%

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in TGVSL

BUY TODAY SELL TOMORROW for 5%