MOTISONS : Breakout Stock#MOTISONS #swingtrade #vcppattern #breakout #trendingstock

MOTISONS : Swing Trade

>> Trending Stock

>> Breakout Candidate

>> VCP pattern

>> Good strength & Volume Buildup

>> Good Upside Potential

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings.

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

Breakouttrading

APARINDS : Stage 3 Candidate#APARINDS #stage3 #swingtrade #breakoutstock #trendingstock #patternbreakout

APARINDS : Swing trade

>> Stock in stage3

>> Breakout Candidate

>> Cup & Handle pattern

>> Good strength in Stock

>> Good Recent Buildup

>> Risk Reward Favorable

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings.

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

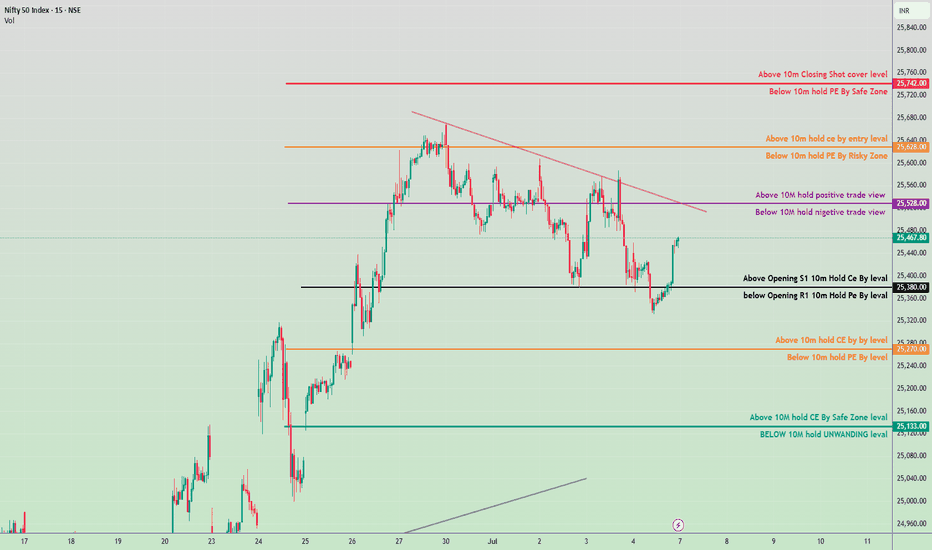

Nifty 50 Intraday Trade Plan - 7 July 2025✅ Bullish Zones (Call Option - CE Buy Levels):

Above 25,133 ➤ Hold CE by Safe Zone level

Above 25,270 ➤ Hold CE by key level

Above 25,380 ➤ Opening S1 Breakout – Hold CE

Above 25,528 ➤ Positive Trade View (10M volume base)

Above 25,628 ➤ Entry level for CE holding

Above 25,742 ➤ Closing Shot – Cover Short Positions

🔻 Bearish Zones (Put Option - PE Buy Levels):

Below 25,133 ➤ Unwinding Level – Hold PE

Below 25,270 ➤ Key level – Hold PE

Below 25,380 ➤ Opening R1 Breakdown – Hold PE

Below 25,528 ➤ Negative Trade View

Below 25,628 ➤ Risky Zone for holding PE

Below 25,742 ➤ Safe Zone for holding PE

🔁 Trendline & Structure Notes:

Downtrend resistance visible around 25,528–25,628 zone.

If price breaks above trendline and sustains, expect bullish momentum.

Support near 25,133 and strong base seen around 25,000 zone.

Gabriel India Limited - Breakout Setup, Move is ON..#GABRIEL trading above Resistance of 518

Next Resistance is at 673

Support is at 415

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

NYKAA - Breakout from DTFNYKAA has resistance weakening on the Daily charts and has given a breakout with good volume.

The target of this pattern signals an upside potential of 10% from the current price level in the medium term.

The stock is trading above its 50- and 100-day simple moving averages (SMAs). The range is more than >1.2X, and the Volume is also >2X the average.

CMP- Rs. 108

Target Price- Rs228 ( 10% upside)

SL -202

Disclaimer: This is not a buy/sell recommendation. For educational purpose only. Kindly consult your financial advisor before entering a trade.

TRANSRAILL - Breakout from Daily TFTRANSRAILL has resistance weakening on the Daily charts and has given a breakout with good volume.

The target of this pattern signals an upside potential of ~10% from the current price level in the medium term.

The stock is trading above its 50- and 100-day simple moving averages (SMAs). The range is more than >2X, and the Volume is also >6X the average.

CMP- Rs. 727

Target Price- Rs.805( ~10% upside)

SL -859

Note- The breakout candle has gone up, extended, so be mindful of your position.

Disclaimer: This is not a buy/sell recommendation. For educational purpose only. Kindly consult your financial advisor before entering a trade.

TRANSRAILL : Breakout Stock (Swing Trading) #TRANSRAILL #breakoutstock #swingtrading #chartpattern #cupandhandlepattern #patternbreakout #patterntrading

TRANSRAILL : Swing Trading

>> Breakout Stock

>> Cup and Handle pattern

>> Breakout with Volume

>> Good Strength in Stock

>> Risk Reward Favorable

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

Latent view possible breakout after long consolidationLatent view might give a possible breakout as it is showing a long consolidation with flag and pole pattern, high volume was also seen a week back.

Also 55 Ema is below 8, 13, and 21 ema, which shows potential up movement

Buy around 415-420

Target - 508

Duration - 2-3 months

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________

Indian Overseas Bank (IOB) - Falling Channel Breakout Setup📈 Indian Overseas Bank (IOB) – Falling Channel Breakout Setup

Watching a classic falling channel on the daily timeframe with multiple touches on both trendlines. Recent breakout above ~38.8 confirms the channel break.

✅ Planned Trade Details:

- Entry above 38.8 (confirmation)

- Stop-loss: 35.90

- ATR-based stop option: ~37.45 for tighter risk control

- Target zone: 48.80 based on channel height projection

Volume confirmation and follow-through will be key for validating the breakout. Tracking this for a positional swing trade.

Rounding Bottom Breakout – HUGE 8:1 R/R Setup!NSE: BLUESTARCO | Timeframe: Daily

🔥 Key Observation:

BlueStar is painting a textbook Rounding Bottom reversal pattern – a bullish signal indicating exhaustion of sellers and accumulation by smart money. Current price (1624.50) is coiling near the make-or-break resistance at 1656. A breakout here could ignite a massive rally!

🎯 Trade Plan: Precision Execution

⏱️ TRIGGER:

BUY ONLY ON CONFIRMED BREAKOUT ABOVE 1656

Must see: Strong green candle + Volume > 20% above average

NO BREAKOUT = NO TRADE. Period.

🧯 STOP LOSS (SL):

1521 (swing low below pattern – technical invalidation)

Risk: Just 8.1% from 1656 entry.

🎯 TARGETS:

TP1: 1744 (minor resistance – book 50% here)

TP2: 2100 (measured move target – 27%+ from breakout)

Reward/Risk: 8.4x (Rare asymmetry!)

📊 Why This Works:

Rounding Bottom: Classic reversal pattern after a downtrend – signals long-term trend shift.

Volume Confirmation: Breakout with rising volume = institutional participation.

SL Placement: Below the pattern’s trough (1521) invalidates the setup.

Target Rationale: 2100 aligns with the historical liquidity zone.

🚨 Critical Risk Controls

❗ NO BREAKOUT = NO TRADE.

❗ If breakout lacks volume, REJECT the trade.

❗ Partial exit at 1744: Trail SL to 1650 (breakeven) for remainder.

💡 Trader Psychology Edge

FOMO KILLS: Chasing before 1656 risks getting trapped in fakeouts.

Patience = Profit: Wait for the market’s confirmation – this is where pros separate from amateurs.

Trade Like a Sniper: One clean shot at 1656+volume, or walk away.

Disclaimer: This is not financial advice. Always do your own research. Charts are for educational purposes.

How to Trade ATH Stocks: Harness Explosive Trends with ADX !(BEL Case Study)

NSE:BEL (Daily) - Bull Flag at All-Time Highs

📈 Key Observations

ATH Breakout Confirmed:

Price smashed through ₹340.50 previos ATH, hitting a historic high of ₹393.50.

Consolidation in a tight bull flag (₹378.50–393.50) after a 28.97% surge – classic bullish continuation setup.

ADX: Your Trend Compass 🧭

ADX at 43.95 signals a powerful, directional trend (Readings >25 = strong trend; >40 = explosive momentum).

Ignore oscillator noise: Trends trump RSI/MACD in parabolic moves.

Pattern > Oscillators:

Bull Flag Priority: The pattern’s integrity (lower volume consolidation) outweighs short-term RSI(79)/MACD wobbles.

🚀 Trade Strategy: Trend-First Framework

✅ Entry & Targets

Trigger: Daily close above ₹393.50 (flag resistance).

Add: Retest of ₹393.50 as support.

Targets:

Short-term: ₹420 (5% above ATH)

Measured Move: ₹482 (ATH + pole height: 393.50 + 88.20)

⚔️ Stop-Loss

Conservative: ₹378.50 (flag low breach).

Aggressive: ₹385 (tight stop, honors consolidation structure).

📊 Position Sizing

Risk ≤1% capital per trade.

Reward/Risk Ratio: 4:1 (₹482 target vs. ₹378.50 stop).

💡 Why ADX Trumps RSI/MACD at ATHs

RSI/MACD are lagging in strong trends:

RSI overbought ≠ reversal – it’s fuel for momentum stocks.

MACD crosses often "whipsaw" in high-ADX environments (BEL’s ADX >40 invalidates bearish MACD signals).

ADX is proactive:

"Trends persist until ADX rolls below 30" – Focus on price, not oscillator fears.

🌐 Sector & Fundamental Tailwinds

Defense Sector Strength: India’s capex boost; BEL’s order book increasing.

Institutional Conviction: FIIs increasing stake.

🛡️ Risk Management Checklist

✅ Trade only on confirmed close above ATH.

✅ Use ADX >40 as a momentum green light.

✅ Trail stops at 20-DMA (₹365) once +10% profit.

Chart Markup:

Blue line: Bull flag Resistance at ₹393.50.

Red Line: Bull Flag Support ₹378.50

ADX(14) subchart with 40+ threshold highlighted.

💎 Final Thought: ATH breakouts are trend accelerators, not tops. BEL’s bull flag + ADX >40 frames a high-probability continuation play. Stick with the trend until ADX says otherwise.

Boost this idea if you’re tracking BEL’s breakout!

Follow for high-probability ATH trade setups.

⚠️ Disclaimer

"This is NOT financial advice. Trade at your own risk. Past performance ≠ future results. Always conduct independent research and consult a SEBI-registered advisor. The author holds no position in BEL at time of publication."

Adani power breakout anytime Adani power price hover just above resistance can give breakout anytime, earlier it was showing head and shoulder pattern and now changed into cup and handle pattern, also the support is also moving up.

Can expect a breakout anytime.

Entry around - 600

Target - 750

Duration 1-2 month

CHOLAFIN- Breakout from DTFCHOLAFIN has resistance weakening on the Daily charts and has given a breakout with good volume.

The target of this pattern signals an upside potential of ~10% from the current price level in the medium term.

The stock is trading above its 50- and 100-day simple moving averages (SMAs). The range is more than >1X, and the Volume is also >1X the average.

CMP- Rs. 1628

Est. Entry price ~ 1670

Target Price- Rs1813 ( ~10% upside)

SL -1610

Note- The candle closed isn't very promising, so we have to wait for a stronger move. The promising move should be able to close above 1670.

Disclaimer: This is not a buy/sell recommendation. For educational purpose only. Kindly consult your financial advisor before entering a trade.

Laurus Labs Limited - Breakout Setup, Move is ON...#LAURUSLABS trading above Resistance of 553

Next Resistance is at 699

Support is at 420

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Voltas breakout soon cup and handle patternVoltas will soon be flying, cup and handle breakout pattern, pattern is very prominent, high chances of breakout in short term 15% profit.

Also reaching golden crossover

Buying range - 1310 - 1330

Target - 1507 (15%)

Hold duration - 1-2 month

Voltas belongs to Tata groups and have good fundamentals.

JAMNAAUTO - VCP Pattern Near Breakout📊 JAMNA AUTO (JAMNAAUTO) – VCP Pattern Near Breakout | RSI Momentum | Volume Surge | Daily Chart

📅 Chart Date: June 26, 2025

📈 CMP: ₹94.32 (+4.60%)

📍 Ticker: NSE:JAMNAAUTO

🔍 Technical Analysis Summary

☕ Cup & Handle Formation

The chart shows a well-formed Cup & Handle pattern

Neckline resistance at ₹94.48 – a break above this zone could trigger bullish continuation

Pattern suggests accumulation and breakout setup after prolonged downtrend reversal

📈 Volume

Rising volume on recent candles, supporting strength of potential breakout

Volume above 3.3M confirms strong buying interest

📊 RSI Indicator (14)

RSI currently at 63.87 and rising

Multiple historical RSI Bullish crossovers visible during base and handle formation

RSI > 60 indicates momentum is favoring bulls

📍 Key Price Levels

✅ Breakout Zone (Neckline): ₹94.48

🚀 Upside Targets (Post-breakout estimate):

₹102

₹110

₹120+

🛡️ Support Zones:

₹90 (immediate)

₹85 (handle base)

₹80 (cup base)

📌 Trade Setup Idea

Entry: On breakout above ₹94.50 with volume

SL: Below ₹89

Targets: ₹102 → ₹110 → ₹120+

Risk-Reward: Good, considering rounded base and handle plus RSI confirmation

⚠️ Disclaimer

This chart analysis is for educational purposes only. Always DYOR (Do Your Own Research) and consult a financial advisor before making investment decisions.