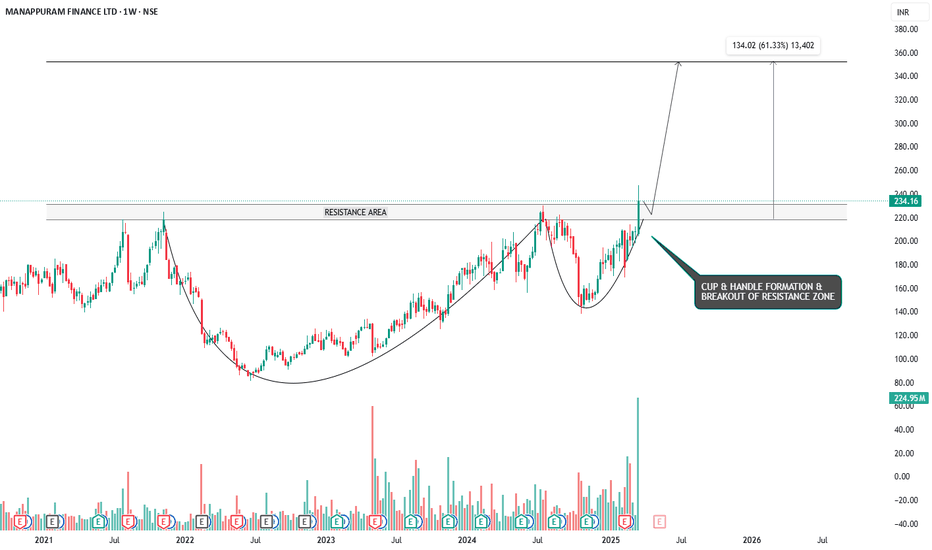

RIDING THE WAVE - CUP & HANDLE BREAKOUT IN MANAPPURAM FINANCESymbol - MANAPPURAM

CMP - 234.16

Manappuram Finance is a Non-Banking Finance Company (NBFC), which provides a wide range of fund based and fee based services including gold loans, money exchange facilities, etc. The Company is a Systemically Important Non-Deposit taking NBFC.

Manappuram Finance Ltd. has recently demonstrated a significant bullish breakout, having formed a classic cup and handle pattern on a larger time frame and breaking out with strong volume. The cup and handle pattern is a well-regarded bullish breakout formation, and when it occurs on weekly or larger time frames, it tends to be highly reliable, indicating a robust upward momentum.

Currently, the stock price may retest the breakout zone, which coincides with the previous resistance area; now turned support - around the 230 to 217 range. This retest is a natural price action behavior and offers an attractive entry point for long positions before the stock continues its upward trajectory.

The target for this breakout, based on technical projections, is around 350, representing a 60% upside from the current market price. Given the strength of the breakout and the established pattern, this target appears achievable over the medium term.

For risk management, a stop loss can be placed around the 197 level, providing a reasonable cushion in case of a price reversal.

From a broader perspective, the formation of a cup and handle pattern coupled with a successful breakout on higher time frames adds a significant bullish bias to the stock. Investors looking for a favorable risk-to-reward setup may find this an opportune time to initiate or add to their positions in Manappuram Finance.

Disclaimer: The information provided here should not be construed as a buy or sell recommendation. It reflects my personal analysis and my trading position. Please consider this trading idea for educational purposes only. Thank you!

Breakouttrading

US30 Locked in Tight Range — Breakout ImminentDow Jones (US30) is currently trapped inside a tight consolidation box between ~40,400 and ~40,200. Price action has been flat for hours with no strong directional bias, hinting at an upcoming breakout move. Traders should stay alert for volatility spikes.

🔼 Breakout above the range opens up targets toward 41,437 and 41,476

🔽 Breakdown below the support could push price down to 39,309 or even test the key zone near 39,276

With key U.S. data around the corner (noted on the chart), the move could be news-driven. Stay reactive and don’t pre-empt the breakout. Let price lead.

Plan the breakout. Don’t get trapped in the chop. ✅

#HCG - VCP Break Out in Daily Time Frame📊 Script: HCG

Key highlights: 💡⚡

📈 VCP Break Out in Daily Time Frame.

📈 Okish Price consolidation near Resistance.

📈 BO with Volume spike.

📈 MACD Bounce

📈 RS making 52WH

📈 One can go for Swing Trade.

BUY ONLY ABOVE 570 DCB

⏱️ C.M.P 📑💰- 574

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are bad, Position size 20% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Patanjali Food - Near BreakoutPatanjali Food looks like near the breakout. NSE:PATANJALI

We can see sharp up-move when give the ATH breakout and good to hold for the long time.

Market cap also good, also available in F&O.

Fundamentals are strong and we know FMCG sector is going to spike soon.

Ruchi Soya Industries Limited is engaged primarily in the business of processing of oil-seeds and refining of oil for edible use.

Amazing breakout on WEEKLY Timeframe - AADHARHFCCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - TATACONSUMCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - DEEPAKFERTCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - BHARTIHEXACheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - PNBHOUSINGCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

#HDFCBANK - Potential Breakout / Keep in WL 📊 Script: HDFCBANK

Key highlights: 💡⚡

📈 Cup & Handel Break Out in Daily Time Frame.

📈 Price consolidation near Resistance

📈 Enter only if Volume spike is seen.

📈 One can go for Swing Trade.

BUY ONLY ABOVE 1838 DCB

⏱️ C.M.P 📑💰- 1806

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are bad, Position size 20% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

ULTRACEMCO-4hr/1day Long tradeThe stock has corrected within the recent fall and fully recovered. Almost trading near ATH.

Current high has tested multiple times.

On next trading session it has to open above 11400 good opportunity for long, if gap down avoid.

Any confusion, feel free to drop msg. Happy to help :)

This is only for educational purpose, please manage your risk accordingly.

ONEPOINT - Trendline Breakout near support line with Good VolumeView : Bullish

Entry Zone- 55 - 60

Exit Zone - Based on Trader mindset.

Stoploss : Close below 45 in weekly timeframe

Trading Edge: Price action

Risk/Reward Ratio: 1:2

Timeframe: Weekly

Notes: Price consolidate since November 2023 and now it breakout the trend line with good volume. Also, price is near the support line.

Ice Cream King Ready to Melt Resistance & Fly High!Hello everyone, i have Brought a stock which has given neat & clean breakout of a consolidation period with huge volume spurt, this is a ICEMAKER stock, as we all know summer almost has been started so these type of stocks will start roaring up let's start with discussing about the company.

About the Company:

Vadilal Industries Ltd , founded in 1907, is India’s 2nd largest ice cream brand , holding a 16% market share in the organized ice cream market. The company dominates the cones, cups, and candy segments and also exports frozen fruits, vegetables, and ready-to-eat products worldwide.

Technical Setup & Trade Plan

The stock is showing bullish momentum, breaking out from consolidation with strong volume confirmation. Historically, Vadilal sees increased demand in summer, making this a favorable seasonal play. Please check chart above for the Levels like entry, exit stop loss and targets!

Why i found This Stock impressive?

Seasonal Upside: Peak demand for ice cream during summer boosts sales .

Market Leader: Strong position in India's growing frozen food segment.

Technical Breakout: Bullish price action with volume support.

Fundamental ratio:

Market Cap

₹ 3,071 Cr.

Current Price

₹ 4,272

High / Low

₹ 5,143 / 3,164

Stock P/E

19.7

Book Value

₹ 915

Dividend Yield

0.04 %

ROCE

27.1 %

ROE

31.0 %

Face Value

₹ 10.0

Industry PE

28.7

Debt

₹ 155 Cr.

EPS

₹ 217

Promoter holding

64.7 %

Intrinsic Value

₹ 2,125

Return over 5years

40.8 %

Debt to equity

0.24

Net profit

₹ 156 Cr.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

If you Found this helpful? Don’t forget to like, share, and drop your thoughts in the comments below.

AKZO NOBEL INDIA LTD – Technical Analysis Update📈 Chart Overview:

The stock is forming a cup and handle pattern, with a breakout attempt.

A descending trendline was broken, leading to a sharp upward movement.

Currently, the price is retesting the breakout level.

🔍 Key Levels:

Resistance: ₹3,912, ₹4,585

Support: ₹3,400, ₹3,294

📊 Observations:

A successful retest and bounce from the breakout zone could signal further upside.

Volume analysis suggests increasing interest from buyers.

🚀 Trading View:

A close above ₹3,912 could trigger bullish momentum toward ₹4,585.

If the price fails to hold above ₹3,400, we may see a pullback to ₹3,294.

📌 Disclaimer: This is not financial advice. Do your research before making any trades.

#SHYAMMETL - Cup & Handel Break Out in Daily Time Frame. 📊 Script: SHYAMMETL

Key highlights: 💡⚡

📈 Cup & Handel Break Out in Daily Time Frame.

📈 Price consolidation near Resistance & gave a BO with Volume

📈 Volume spike seen.

📈 MACD Bounce

📈 RS making 52WH

📈 One can go for Swing Trade.

BUY ONLY ABOVE 915 DCB

⏱️ C.M.P 📑💰- 914

🟢 Target 🎯🏆 – 14%

⚠️ Stoploss ☠️🚫 – 7%

️⚠️ Important: Market conditions are getting better, Position size 50% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

NACL Industries - Range Breakout Trade Setup🔥 NACL Industries - Range Breakout Trade Setup 🚀

📍 Breakout Level: ₹116

📍 Current Market Price (CMP): ₹121

📍 Stop Loss (SL): ₹96.5 (📉 Closing basis)

📍 Target 1 (T1): ₹166 🎯

📍 Target 2 (T2) (Positional): ₹255 🎯🎯

🔍 Why This Trade?

✅ Range Breakout 📈: Stock has broken out of a 3-year-old consolidation range!

✅ Big Money Inflow 💰: Breakout supported by high volume, indicating institutional buying.

✅ Bullish Pattern 📊: Formation of 3 White Soldiers on March 25 in DTF– a strong bullish signal! 🚀

✅ Sector Strength 🌱: Agrochemical sector is gaining momentum, boosting the stock.

✅ Price Action 🏆: Stock consolidated at all-time high levels before breaking out.

✅ Technical Strength 🛠️: Trading above key moving averages – momentum is on our side!

✅ No Overhead Resistance 🚧: No major hurdles ahead, potential smooth uptrend!

📊 Risk-Reward Calculation

🔹 Risk (SL at ₹96.5): ₹121 - ₹96.5 = ₹24.5

🔹 Reward 1 (T1 at ₹166): ₹166 - ₹121 = ₹45 🎯

🔹 Reward 2 (T2 at ₹255): ₹255 - ₹121 = ₹134 🎯🎯

🎯 Target 📏 Risk: Reward Ratio

T1 (₹166) 1:1.8

T2 (₹255) 1:5.4

📌 Trade Plan

👨💻 For Conservative Traders:

🔹 Entry: Small quantity at CMP (₹121) and add on successful retest of ₹116.

🔹 SL: ₹96.5 (Closing basis).

🔹 Target 1: ₹166 (Partial profit booking 📈).

🔹 Target 2: ₹255 (Hold for positional gain 🏆).

⚡ For Aggressive Traders:

🔹 Entry: Full deployment at CMP (₹121) if risk is well managed.

🔹 SL: ₹96.5 (Closing basis).

🔹 Exit Strategy: Trailing SL or partial booking at T1 (₹166), hold for T2 (₹255) 🚀.

⚠️ Key Risks to Consider

🔴 Fundamental Weakness: Poor ROCE (-0.04%) and ROE (-10.8%) → Purely technical trade!

🔴 Market Condition: 📉 Nifty still below 200 DMA, caution required!

🔴 Macroeconomic Factors: 🌍 Global uncertainties (e.g., Trump tariffs) may impact sentiment.

🚨 Final Note

📌 This is a high-risk, high-reward trade. Strict SL adherence is crucial! 🚨

💡 If you’re not comfortable with deep SLs, stay on the sidelines or enter lightly.

📈 Market remains uncertain—trade cautiously & manage risk wisely! 🛑

💬 What’s your take on this trade? Drop your thoughts below! ⬇️

🔹 Disclaimer: This is NOT financial advice. Do your own research before making any trade decisions. 📊

#SBILIFE – Weekly Timeframe Reversal in Play!📊 Script: SBILIFE

Key highlights: 💡⚡

📈 Double Bottom Formation in Weekly Time Frame.

📈 Price consolidation near Resistance in Daily Time Frame.

📈 Can Enter Breakout on if price sustains with volume.

📈 One can go for Swing Trade.

BUY ONLY ABOVE 1600 DCB

⏱️ C.M.P 📑💰- 1545

🟢 Target 🎯🏆 – NA%

⚠️ Stoploss ☠️🚫 – NA%

️⚠️ Important: Market conditions are not great, Position size 25% per Trade. Protect Capital Always

⚠️ Important: Always Exit the trade before any Event.

⚠️ Important: Always maintain your Risk:Reward Ratio as 1:2, with this RR, you only need a 33% win rate to Breakeven.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with MMT. Cheers!🥂

Punjab Chemicals and Crop Protection Ltd**PUNJABCHEM:**

A one-day breakout has occurred, accompanied by a significant spike in volume. You can consider adding to your position at the current level of 928 until the retest is complete. Start by adding 50% now, and if the price falls to 850, add another 15%.

The support level is at 822.20 based on the daily close, while the resistance levels are at 1013.90 and 1084.60.

Cummins India : Ready to Blast#cumminsind #consolidation #breakout #rangebreakout

Cumminsind : Swing / Momentum Trade

>> Consolidation Breakout

>> Stage 1 Breakout

>> Low Risk High Reward Trade

>> Good Upside Potential

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings.

Note : Markets are still Tricky and can go either ways so don't be over aggressive while choosing & planning your Trades, Calculate your Position sizing as per the Risk Reward you see and most importantly don't go all in

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

Amazing breakout on WEEKLY Timeframe - ABCAPITALCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

Amazing breakout on WEEKLY Timeframe - LUMAXINDCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!