Bullion

Long MCX SILVERSILVER was trading under the Resistance trendline since mid May (shown in black in chart), but today it gave a breakthrough opening in the morning on MCX.

If it closes above 63800, then we can make a long position in current contract for a major profit.

LOGN SILVER @ 64800.

Silver has a major resistance at ₹ 65800, if it gives a closing above this level, then we can expect an upper movement of 5000-6000 in silver.

GOLDJune was a brutal month for Golf bugs. The Inflation news along with political developments stopped the rally of April -May, which resulted in Gold posting again of 14% in 2 months.

Trend is bullish for Gold, however 2-3% slide cannot be ruled out from 1810 levels. 200DMA resistance at 1825, is important to be monitored before any fresh long buying.

Gold Resumes it's bullish MoveGold Resumes it's bullish Move and Big Mutual Funds are Backing it.

Gold has recovered from the support level of 44000 and now it has resumed its bullish move Indicators are confirming this trend too.

Add gold to your portfolio now.

Major Multi assets funds are betting on gold more than the top equity market stocks.

Time to Buy gold? Gold in Technical has been respecting trendline and resistance on weekly.

We should see a surge upwards if it sees a losing above the rectangle zone/trendline.

Gold is yet 20% from the ATH.

Global economics should give an early sign for gold price to go up

Disclaimer - Just my View and not an advice

#Gold

#XAU

#Bullion

GOLD "BIG GAINS"I dont know what to say, please see my all posts of gold, Gold sell call given at 52320 with sl of 52550 which was ascending channels high when i posted the chart previously, it made high of 52520 and touched the lower level of channel, infact it tried to make low around the level where the channel actually started, which was the final target of ascending channels breakdown. BOOM..

GOLDIt has been trading within a triangle ever since it activated a Bearish Alt Bat. Above $1735 the triangle breakout suggest $1785 which is the 2nd target of a Bullish Dragon. As per Ichimoku study, the momentum for upside has a decent probability to start tomorrow. It should be noted that triangle breakouts tend to be the last of a trend, this could turn out to be an unwinding one.

GOLDGOLD had a sharp sell off like equities in the 1st week of March due to Central Banks across the globe pumping liquidity and reducing rates. Besides the domino principle of one pulling the other (losses in equities globally being cleared via unwinding of long gold positions) as one asset manages the other in a systematic risk environment.

Current set up suggest $1675 where it would complete its minimum Bullish Dragon (trigger - hourly close above $1630). Only if it sustains above that $1800 is the next level with some resistance near $1735. Else a dip till $1575 before it attempts another up move.

From a medium to long term prospective this could be the last leg of the rally from 2016, post this Gold could start a fresh downside cycle.

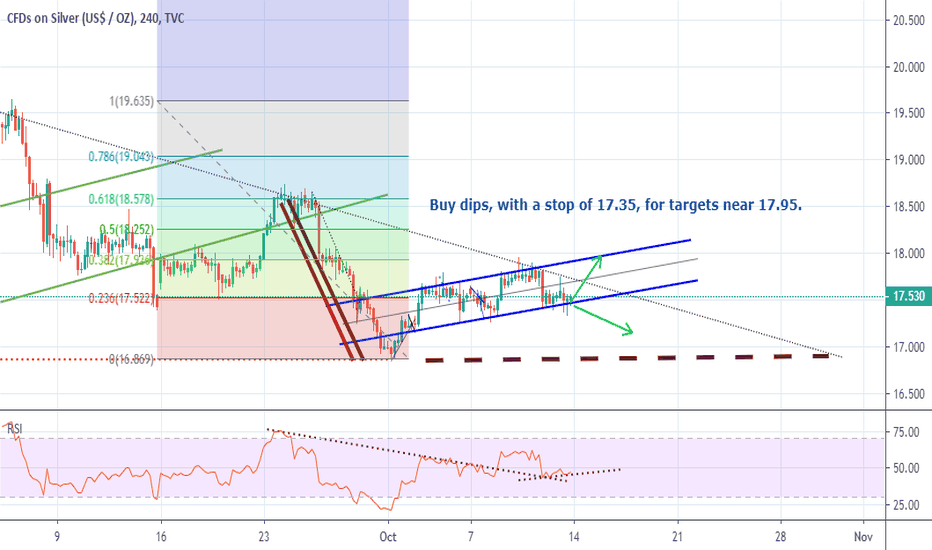

Silver - the news is out, is it absorbed in the prices ?Silver moving in a flag pattern, in on the lower point of the channel. If the channel is broken on the downside, a slide upto 16.82 can be expected.

It has been correcting for some time, there is a possibility that after all the news flow, the short positions will start to unwind and push the prices higher.

Since my ideas can be seen in India only, by the time our exchanges will open, prices will probably settle down. 16.80 is an important support while a breach of 17.8 will aid the bulls to push the prices higher.