CCL Price Action CCL Products (India) Ltd is currently trading around ₹852 to ₹890 as of early August 2025, with a market capitalization near ₹11,370–₹12,000 crore. The stock has shown strong recent momentum, rising about 37% over six months and around 50% in the past three months, reflecting robust investor confidence.

The company reported consolidated quarterly revenues of approximately ₹835 crore and profits around ₹100 crore, with annual figures showing about ₹3,100 crore in total income and ₹310 crore in net profit, indicating solid operational performance and growth.

Valuation metrics show a price-to-earnings (P/E) ratio near 37 and price-to-book (P/B) ratio above 6, which reflect a premium valuation consistent with the company's growth trajectory and market position in the agri and agri inputs sector.

CCL Products pays a modest dividend with a yield below 1%, while costs related to employee expenses and interest are well managed relative to revenues. Technical signals recently indicate bullish trends, suggesting potential short-term upside, though the stock price remains near its recent highs.

In summary, CCL Products (India) Ltd is exhibiting strong price appreciation backed by solid revenue and profit growth. Its premium valuation highlights investor expectations for continued growth, but potential buyers should consider the high multiples and the cyclicality of the agri inputs sector when assessing near-term risk and reward.

Bullishpattern

PGHL Price ActionProcter & Gamble Health Ltd (PGHL) is currently trading around ₹5,900 as of early August 2025. The stock has shown decent upward momentum, with a price range around ₹5,700 to ₹6,000 in recent weeks, though it has experienced some volatility within this band.

PGHL has delivered solid returns over the past year, roughly 15%, and longer-term growth is also positive with a multi-year compounded annual growth rate in the double digits. The company maintains a market capitalization close to ₹9,850 crore and offers a dividend yield around 4.4%, providing steady income to shareholders.

Valuation metrics indicate PGHL trades at a premium, justified by its stable revenue growth and presence in the health and pharmaceutical segment. While short-term price fluctuations occur, the overall outlook remains favorable, supported by consistent operational performance and dividend payouts.

In summary, PGHL is a fundamentally sound health sector stock with solid past returns, moderate volatility, and reasonable dividend income, suitable for investors looking for stable growth in the healthcare industry.

Narayana Hrudayalaya Ltd Price ActionNarayana Hrudayalaya Ltd (NH) is trading around ₹1,946 as of August 1, 2025, after hitting a record high of ₹2,370 in late June. The stock has gained over 53% in the past year and about 44% in the last six months, showing strong long-term momentum, though it has corrected nearly 10% over the previous month and 2% in the past week.

Financially, NH remains robust. For the trailing twelve months, revenue stands at approximately ₹5,483 crore and net profit at ₹791 crore, giving a net profit margin of about 14.4%. The company’s market capitalization is close to ₹39,900 crore, making it one of the largest listed hospital operators in India. Key financial ratios include a price-to-earnings (P/E) ratio of about 49.5 and a price-to-book (P/B) ratio nearing 18—both substantially above the sector average, reflecting strong premium and optimistic growth expectations.

Operating performance continues to impress: sales growth for the March quarter was up 15% year-on-year, while margins are stable and efficient. The most recent dividend declared is ₹4.50 per share, maintaining a rising payout trend.

Technically, momentum is slightly negative in the short term, with bearish signals on daily moving averages and a recent drop below key short-term exponential averages, suggesting the possibility of near-term consolidation or mild pullback after a strong prior rally.

In summary, NH remains a growth leader in the hospital and healthcare space, combining strong recent price performance and operational strength. The stock is trading at a substantial premium, justified by consistent growth and sector leadership, but near-term upside may be limited as the price consolidates from recent highs and digest valuation multiples, especially if no further earnings acceleration materializes.

Hester Price ActionAs of July 31, 2025, Hester Biosciences Ltd is trading near ₹1,950 after a recent rebound, though it has experienced a significant decline over the past year, down roughly 37% from its 52-week high above ₹3,250. The stock’s recovery in the last three months has been moderate, with gains of about 9%, and short-term sentiment appears slightly positive given the recent upward movement.

The company’s current price-to-earnings ratio is elevated, close to 58, and the price-to-book ratio is about 4.9, indicating a premium valuation compared to its book value. Hester Biosciences maintains a market capitalization near ₹1,650 crore, placing it among smaller specialty pharma and agri-biotech firms. While the core fundamentals show resilience, the firm recently reported a contraction in sales for the first time in three years, which led to some investor caution.

Technically, Hester Biosciences is recovering from its yearly lows near ₹1,240 and is showing renewed buying interest at current levels, confirmed by an uptick in volumes and momentum. However, given the sharply reduced returns over the past year, sentiment is mixed, and further upside will likely depend on improvement in financial result trends and any breakout above resistance points established during its downtrend.

Overall, the near-term outlook is cautiously constructive with recent stabilization, but investors should monitor for sustained improvements in revenue and earnings to confirm a continued reversal.

RHIM Price ActionRHI Magnesita India Ltd (RHIM) is trading around ₹529 in early August 2025, having shown notable volatility over the past several months. The stock has ranged between a recent low of about ₹503 and a high near ₹538 in the last few days. The annual performance indicates a mild decline over the last year but double-digit gains in the last three to six months, pointing to a marked recovery from earlier lows.

Financially, RHIM carries a relatively high valuation, with a price-to-earnings ratio close to 54 and a price-to-book value of about 2.8. Operating fundamentals are decent but not exceptional: return on equity remains moderate, and promoter holdings have slightly decreased over the past few years. The company offers a modest dividend yield of about 0.5%, providing limited income support to investors.

In terms of recent momentum, trading volumes have spiked, indicating renewed interest, and short-term technicals suggest the possibility of continued oscillation within the current price band. The stock’s long-term prospects remain tied to trends in the refractories and industrial materials sector, where growth has been consistent but not rapid.

In summary, RHIM is exhibiting renewed price momentum but continues to trade at elevated valuation multiples. The company’s stable position in its sector and improving sentiment support the stock at current levels, though further substantial upside will likely depend on sustained earnings growth and sector expansion.

Kajaria Ceramics Price ActionKajaria Ceramics is currently trading around ₹1,177, with a market capitalization close to ₹18,750 crore as of the end of July 2025. The stock has shown solid performance in recent months—up about 46% over the last quarter and nearly 19% in the past six months, although it experienced a mild 0.2% dip over the last week. Despite this rally, the stock is valued at a relatively high price-to-earnings (P/E) ratio of around 59 and a price-to-book (P/B) ratio of approximately 6.6, suggesting that it is trading at a premium to its asset base and compared to industry averages.

Profit growth has lagged sales growth, with annual sales increasing modestly but profit growth remaining subdued. The 52-week price range is quite wide, with a high of ₹1,579 and a low of ₹759, reflecting periods of both volatility and strong recoveries.

Analyst outlook remains moderately positive, with one-year price targets averaging near ₹1,259 but estimates ranging widely from ₹731 to ₹1,716. Near-term forecasts mostly see the price consolidating between ₹1,150–₹1,200, with oscillations rather than sustained moves upward or downward.

In summary, Kajaria Ceramics stands out for its recent price momentum and market strength. However, its stretched valuation multiples and only moderate earnings growth highlight the need for careful consideration if expecting further near-term appreciation. The company's premium valuation is reliant on continued improvement in industry demand and profitability. Its financial position and recent run-up make it a stable but potentially fully valued pick at present levels.

TIINDIA Price ActionTata Investment Corporation Ltd (TIINDIA) is mainly an investment holding company, and its share price reflects both its portfolio performance and market sentiment. At present, the company maintains a very strong financial position with almost no debt, providing security for shareholders. Its stock is trading at a valuation close to its book value, suggesting a fair price relative to its underlying assets.

However, the actual returns from TIINDIA’s own operations remain modest. Return on equity is low and profit growth has been muted in recent years, which indicates limited profitability from its core business. The company’s strong dividend history provides stable income to investors, but earnings growth remains subdued.

Despite a substantial rise in the stock price over the past several years, more recent performance has slowed, aligning with weaker earnings growth. The high price-to-earnings ratio, when compared to its limited profit generation, implies that the stock may be fully valued or even expensive at current levels. Future upside for TIINDIA is likely to depend heavily on a significant rebound in the market value or profits of its investment portfolio. Overall, TIINDIA offers stability and low financial risk, but prospects for sharp appreciation are currently limited unless there’s a meaningful turnaround in its earnings or portfolio companies.

Zuari Price ActionAs of July 24, 2025, Zuari Agro Chemicals Ltd is trading around ₹215 to ₹218 per share. The stock has shown a recent slight decline of about 1.27% on that day. Its market capitalization is approximately ₹900 crore, placing it among the mid-sized chemical and fertilizer companies.

The 52-week price range for Zuari Agro Chemicals is between ₹169 and ₹268, reflecting moderate volatility over the past year. The stock is trading closer to the lower-middle part of this range, about 18–20% below its 52-week high.

Fundamentally, the company demonstrates reasonable valuation metrics, with a price-to-earnings (P/E) ratio near 5.5, which is quite attractive compared to the sector average, and a price-to-book (P/B) ratio below 0.5, indicating it is trading at a significant discount to book value. Recent earnings per share show solid growth, contributing to strong profitability metrics.

Operationally, Zuari Agro Chemicals continues to build stable revenues within the fertilizers segment, benefitting from sectoral demand and government policies supporting agriculture inputs. The company maintains average financial strength with ongoing measures to reduce debt and improve operational efficiency.

On the technical front, the stock has experienced some consolidation after modest gains over recent months but remains vulnerable to market sentiment shifts in the commodity and fertilizer sectors.

Overall, Zuari Agro Chemicals offers a fair valuation entry for investors seeking exposure to the fertilizer industry with moderate risk. The current price implies value relative to its historical range, supported by steady earnings, though the stock price is subject to volatility driven by agricultural commodity cycles and sector-specific factors.

International Gem Ins cmp 397 by Daily Chart view since listedInternational Gem Ins cmp 397 by Daily Chart view since listed

- Support Zone 379 to 395 Price Band

- Resistance Zone 440 to 459 Price Band

- Price traversing by Higher High Higher Low channel

- Support Zone been tested retested for probable upside momentum

- Volumes seem to be going in close sync with average traded quantity

- Price Breakout from Falling Resistance Trendline has been well sustained

Infobean – Triangle Consolidation with Volume SpikeAfter a sharp one-sided rally, the price entered a prolonged consolidation phase.

Instead of the usual parallel-channel flag formation, the structure has evolved into a descending triangle with slightly lower highs and marginally lower lows.

What stands out is the recent significant volume expansion—often called a “volume buster.” While the shape resembles a pole-then-consolidation setup, the breakout structure and volume shift highlight an important phase change in market activity.

I have only created how I would Draw it and try to get some information out of it.

(This is a structural observation, not a buy/sell recommendation.)

CAPLIPOINT Price ActionAs of July 31, 2025, Caplin Point Laboratories Ltd (CAPLIPOINT) is trading near ₹2,085, showing a mixed but steady performance with some recent price fluctuations around this level. The stock briefly touched intraday highs around ₹2,095 and lows near ₹2,030, maintaining support in the ₹2,030–₹2,055 range. Market capitalization stands broadly near ₹15,590 crore.

Caplin Point benefits from solid fundamentals in the pharmaceutical sector, supported by consistent revenue growth and operational efficiencies. The price-to-earnings ratio sits around 29, while the price-to-book ratio is approximately 5.5, indicating premium valuation relative to book but in line with sector expectations. Dividend yield is low at about 0.15%, reflecting the company’s focus on growth over payout.

Technically, the stock tends to hover above its medium-term moving averages like the 50-day and 200-day SMAs, showing cautious bullish momentum, although near-term volatility remains. Trading volumes are moderate, and the relative strength index is near mid-range levels, suggesting balanced momentum without overbought or oversold extremes.

Overall, Caplin Point Laboratories currently reflects steady fundamentals with a valuation premium typical of its pharma peer group, supported by stable trading ranges and positive medium-term technical signals. The near-term outlook remains cautiously optimistic, with key support near ₹2,030 and potential resistance around ₹2,100–₹2,120.

Jubilant Price ActionAs of July 31, 2025, Jubilant Pharmova Ltd is trading around ₹1,236, showing strong bullish momentum with gains of over 7% in recent sessions. The stock has recovered well from lower levels near ₹1,170 seen earlier, with sustained buyer interest and solid volume support. Technical indicators reveal that the price is above its short-term moving averages, reflecting positive market sentiment.

Fundamentally, Jubilant Pharmova maintains a robust position in the pharmaceutical and life sciences sector with steady revenue growth and improving profitability. The company benefits from a diversified business model and ongoing operational efficiencies, which have helped it sustain earnings growth amid industry challenges. Valuation metrics like the price-to-earnings ratio are moderate, reflecting reasonable investor confidence relative to sector peers.

The near-term outlook for Jubilant Pharmova appears constructive, with potential for further upside provided it holds above key support levels around ₹1,170–₹1,180. Momentum indicators and volume trends support the continuation of the uptrend, although investors should remain cautious of profit-booking risks after sharp rallies.

In summary, Jubilant Pharmova demonstrates solid fundamental strength and positive technical signs, making it an appealing choice for investors seeking exposure to the pharmaceutical sector with a growth orientation.

Refex Price ActionAs of July 31, 2025, Refex Industries is trading near ₹448, showing strong bullish momentum with recent gains of about 10% in the last day. The stock has held well above key support levels near ₹400–₹430, indicating solid buyer interest. It has a market capitalization close to ₹5,800 crore.

Fundamentally, Refex Industries carries a price-to-earnings ratio around 33 and a price-to-book ratio above 4, which suggests a premium valuation supported by solid profitability—the return on equity stands near 30%. Technically, the stock trades above short- and medium-term moving averages such as the 5-day, 10-day, and 20-day SMAs, with some resistance expected around ₹450–₹465. Breaking above this level could open further upside potential toward ₹480–₹500. Volume trends in recent sessions confirm the strength of the price move, and the relative strength index (RSI) indicates room for further upside before becoming overbought.

In summary, Refex Industries exhibits strong upward price action backed by healthy fundamentals and volume support. Key levels to watch include support near ₹400–₹430 and resistance at ₹450–₹465, with the near-term outlook remaining constructive on sustained momentum.

GVT&D Price ActionGE Vernova T&D India Ltd (GVT&D) has experienced a significant surge, with its stock price around ₹2,597 as of July 30, 2025. Over the past year, the stock delivered an impressive return of about 61%. Over three years, the returns are even more dramatic, exceeding 2,100%. However, the broader financials reveal a company with mixed metrics.

The stock’s high price-to-earnings (P/E) ratio and price-to-book value suggest it is currently overvalued compared to peers and the market average. Analyst forecasts for the next 12 months range between ₹2,005 and ₹3,000, with a consensus target near ₹2,450. Most analysts continue to view the stock favorably and assign it a “strong buy” outlook, though with caution about its rich valuation.

GVT&D’s profitability stands out; it has shown robust growth in both operating profit and earnings per share recently. Return on equity has climbed above 40% in the past year, indicating efficiency in generating returns for shareholders. The company is also almost debt-free and maintains stable cash flows, which reduces financial risk.

Volatility for GVT&D is slightly higher than the market average, but price movement has been relatively stable, with no extreme swings in recent months. Still, investors should be aware that such high past returns may not be sustainable, especially with modest sales growth and valuation multiples well above industry norms.

In summary, GVT&D remains a high-performing and highly-valued stock in the Indian power equipment sector, with strong recent momentum, robust profitability, and a largely positive market outlook—albeit with potential risk due to elevated pricing and slower sales growth compared to its historic surge.

Gallantt price ActionGallantt Ispat Ltd has shown notable price momentum in 2025, with the stock trading in the ₹524–₹555 range and reaching an all-time high of ₹568.65 in late June. Over the past year, the stock has delivered strong returns, nearly doubling from its 52-week low. The last three and six months have seen particularly robust gains, though the past month has included some profit booking and mild declines.

On the financial front, Gallantt Ispat reported a full-year net income of over ₹400 crore for FY25, almost doubling from the previous year. Revenue growth has been steady, but the latest quarter saw a sequential decline in profit after tax, reflecting higher expenses and some variability in operational efficiency. The company’s earnings per share for the year also improved significantly.

Recent quarters have seen an increase in non-operating income, which has contributed to profit growth but raises questions about the sustainability of these gains if operating performance does not keep pace. The company is trading at a high valuation relative to its book value, and its return on equity over the last three years has been moderate.

Technically, the stock has found support near ₹520 and faces resistance at its recent high. Sustained movement above this level could lead to a fresh breakout, while a drop below support may prompt further consolidation. Overall, Gallantt Ispat remains in a positive trend but is subject to volatility and the need for continued operational improvement to justify its elevated valuation.

Gravita Price ActionAs of July 29, 2025, Gravita India Ltd is trading near ₹1,860, supported by a recent rally following the release of strong first-quarter earnings. The company reached an intraday high of ₹1,884.90 and holds a market capitalization of around ₹13,736 crore. The past week has seen outperformance versus sector benchmarks, aided by upbeat financial results and positive management commentary.

Gravita India’s Q1 FY26 results highlight robust growth:

- Net profit for the quarter rose 36–37% year-on-year to ₹93 crore.

- Revenue from operations climbed about 14–17% year-on-year, reaching over ₹1,039 crore.

- EBITDA jumped 22–39% compared to last year’s figures, driven by margin expansion and higher volumes in the lead recycling segment.

- Core lead business continues to anchor performance, with improved EBIT margins and rise in volumes.

The company maintains a strong operational outlook, emphasizing 25%+ compound annual growth in volumes and over 35% growth in profitability as medium-term targets. Management continues to focus on expanding value-added products and ramping up its non-lead business, supported by domestic and global demand.

On the valuation front, Gravita trades at a price-to-earnings ratio above 44 (TTM basis) and a price-to-book multiple of roughly 6.7, reflecting investor confidence but also a significant premium over peers. The stock has outperformed the broader market over recent years but stands technically in a mildly bearish to sideways trend in the very short term, with some indicators suggesting caution after its strong run.

Financially, Gravita boasts a high return on capital employed (around 21%) and a low debt-to-EBITDA ratio, signifying both profitability and balance sheet efficiency. Dividend payments remain healthy, with a recent payout exceeding ₹6 per share.

In summary, Gravita India exhibits strong earnings momentum, expanding profits, and an ambitious growth outlook, but trades at elevated valuation multiples. Its long-term prospects appear solid, though near-term price action may reflect consolidation after recent gains. Investors should pay attention to future project execution, sector trends, and management’s ability to sustain margins to gauge further upside potential.

Vimta Labs Ltd (Weekly Timeframe) - Potential BreakoutThis week, the stock has breached the resistance zone and made a new All Time High with huge volume. In Daily Timeframe, the stock has clearly been forming an Ascending Triangle Pattern which is a Bullish pattern. If the stock breaches the resistance zone with good volume, then it may reach new All Time Highs of 780 range.

Awaiting further Price Action.

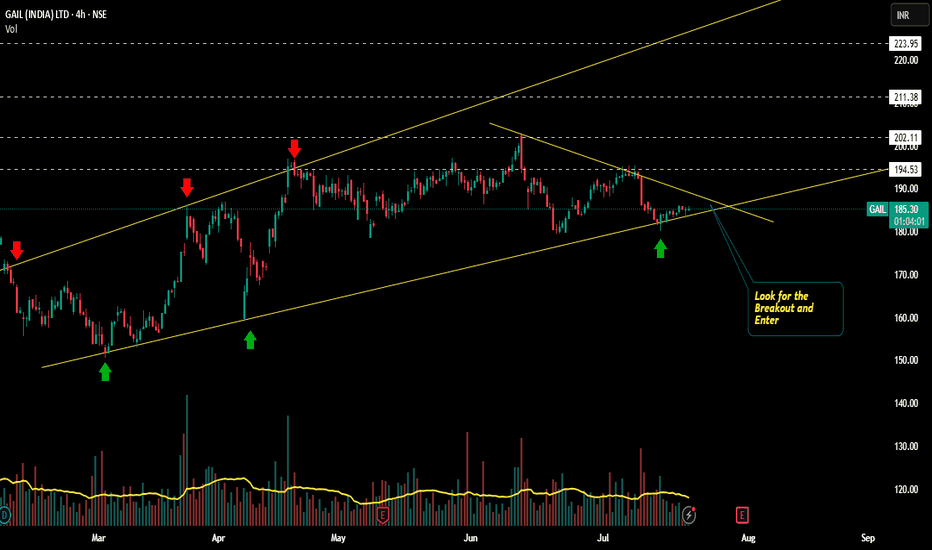

GAIL Bullish way ahead?!!!Chart patterns suggest me the above titled opinion

1. Its is travelling in a Ascending channel pattern making Higher highs and higher lows .

2. Now it is at the bottom support loading for the explosive move ahead.

3. Let's wait for the Breakout and enter.

Target levels mentioned in chart...SL update after breakout.

Longer time frames also shows the bullish edge in GAIL

This is just my opinion..... not a tip nor advice!!!!

Thank you!!!

City Union Bank Price ActionAs of July 2025, City Union Bank (CUB) continues to demonstrate steady growth and operational strength. The stock is supported by robust business expansion and stable profitability.

The bank’s annual financials for FY 2025 show a 14% year-on-year growth in both deposits and advances, with deposits rising to over ₹63,500 crore and advances to approximately ₹53,000 crore. Total business crossed ₹1.16 lakh crore. Net profit for the year reached ₹1,124 crore, up 11% from the previous year. The return on assets (ROA) stands at 1.55%, while return on equity (ROE) is 12.63%, indicating efficient use of both assets and capital.

Asset quality remains healthy and improved, with gross non-performing assets (NPA) at 3.09% and net NPA at 1.25%, both lower than the previous year, while the provision coverage ratio is strong at 78%. The bank’s net interest margin is stable at 3.6%, reflecting consistent core banking profitability.

The cost-to-income ratio is 47.8%, at the higher end of the management’s guidance, reflecting ongoing investments in retail expansion. Capital adequacy (CRAR) remains robust at 23.75%, providing ample buffer for future growth.

Overall, CUB combines above-industry growth, improving asset quality, solid margins, and prudent capital management. The stock’s outlook is supported by management’s consistent delivery across business and profitability metrics, though investors should monitor sector-wide risks and the impact of retail investment costs on near-term efficiency.

CHEMFAB Price ActionAs of late July 2025, Chemfab Alkalis Ltd is trading near ₹789 with recent price movements signaling some short-term recovery after a significant correction from the past year’s highs. The stock’s 52-week range is ₹650 to ₹1,230, reflecting substantial volatility over the past twelve months.

Chemfab’s market capitalization stands close to ₹1,130 crore, classifying it as a small-cap chemical manufacturer. The company specializes in basic inorganic chemicals and PVC-O pipes, mainly serving industries that require chlor alkali products.

Financially, recent results show net sales of about ₹92 crore for the March 2025 quarter, a year-on-year increase of roughly 12%. Despite this sales growth, profitability is under pressure, with negative trailing earnings; the latest EPS is around –₹4.8, resulting in a negative P/E ratio. The price-to-book ratio is almost 3, indicating the stock is priced at a premium to its book value. Return on capital employed and return on equity remain low, consistent with current profit margins.

In recent months, the stock’s price trend has been weak, down nearly 17% over six months and over 5% for the past three months, despite a near 7% rise in the last week. Liquidity and trade volumes are moderate and typical for its peer group.

Key risks include limited profit momentum, historically low return ratios, and high valuation multiples given the negative earnings. However, the company maintains a stable balance sheet, low financial leverage, and gradual growth in its core segment.

Chemfab Alkalis is best suited for investors interested in turnaround or deep value plays within the specialty chemicals sector, but caution is warranted because of volatile earnings and the stock’s premium to book value even amid operational challenges.

# ADVENZYMES Price Analysis (July 2025)Current Price and Trading Pattern

Advanced Enzyme Technologies Ltd (ADVENZYMES) is trading near ₹335 in late July 2025. The price range for recent sessions is ₹331–₹346, with daily swings generally limited to 1–2%. Trading volumes are average for its segment, indicating steady, if unspectacular, investor interest. The 52-week price band extends from a low of ₹258 to a high of almost ₹571, showing that the stock has experienced significant volatility and a substantial correction from last year’s peak.

## Performance Overview

- **1-Month:** The stock has been consolidating, exhibiting minimal directional bias and relatively stable prices.

- **6-Month:** There has been a notable decline, significantly underperforming its sector benchmarks. The price remains below important moving averages, indicating sustained technical weakness.

- **12-Month:** ADVENZYMES has declined approximately 30% over the past year, in marked contrast to the modest gains seen in broader equity indices.

## Financials and Valuation

- **Market Capitalization:** Approximately ₹3,750–3,800 crore.

- **Earnings per Share (TTM):** About ₹11.7.

- **P/E Ratio:** Nearly 28, somewhat below the specialty chemicals sector average, likely reflecting recent challenges in growth and profitability.

- **P/B Ratio:** Close to 2.6.

- **Dividend Yield:** Roughly 1.5–1.6%, with an interim dividend of ₹4 per share recently declared.

## Business Health

ADVENZYMES is a leading manufacturer of enzymes and probiotics with global clients across healthcare, food processing, and specialty industrial markets. The latest financial results show minor revenue growth but declining net profits and operating margins, primarily due to increased costs and a shift in the product mix. Earnings per share have reached multi-quarter lows, prompting concern about operational efficiency and cost management.

## Shareholder Structure

- **Promoters:** Hold about 43% of shares.

- **Institutional Investors (FII/DII):** Approximately 26%.

- **Retail/Public:** The remaining shares.

## Risk and Volatility

- The stock is roughly three times as volatile as major market indices, making it a high-beta investment.

- Liquidity is sufficient for the usual investment sizes, but price performance has lagged sector peers over the past year.

## Technical and Sector Comparison

ADVENZYMES is trading below its major short-, medium-, and long-term moving averages, highlighting a bearish trend. In comparison, the specialty chemicals sector has had mild positive momentum, which makes ADVENZYMES a notable underperformer in its peer group.

## Outlook

The company’s fundamentals remain sound from a market positioning perspective, bolstered by a track record of dividend payment and global reach. However, the recent deterioration in revenue growth, margins, and earnings clouds the short-term outlook. The technical setup stays negative, and further consolidation or downside is possible unless there is clear operational improvement or sector-wide momentum. Investors should keep a close watch on margin trends, revenue acceleration, and cost control initiatives as signals for recovery.

UPL LTD BREAKOUTUPL LTD has broken through its weekly trend line and is now showing bullish momentum after a short period of consolidation. The next target is the all-time high, which traders may aim for. A suitable stop-loss could be placed at either 650 or 600, depending on individual risk appetite.

On the financial front, UPL's latest quarterly results for the period ending March 2025 show solid performance. The company reported a revenue of Rs 15,573 crore, along with a net profit of Rs 1,106 crore. Its Earnings Per Share (EPS) for the quarter stood at Rs 11.42.