Chart Patterns

Gold (XAUUSD) ABCD Completion Near 5000 – Major Sell Zone Ahead

Gold has been in a strong long-term bullish trend, driven by macro uncertainty and persistent demand. However, from a structural and harmonic perspective, price is now approaching a critical long-term resistance zone near the 5000 level, where a bearish ABCD pattern is nearing completion.

The current rally appears to be the final leg (CD) of the ABCD structure. Completion around the psychological 5000 round number also aligns with historical extension behavior and potential exhaustion after an extended impulsive move.

Primary Scenario:

Watch for price rejection, reversal patterns, or bearish confirmation near the 5000 region.

A confirmed rejection could open the door for a long-term corrective move, potentially targeting the previous demand / consolidation zone.

Invalidation:

A strong acceptance and sustained close well above 5000 would invalidate the bearish ABCD outlook and suggest continuation higher.

XAUUSD 45-Minute Chart – Strong Uptrend with Overbought MomentumMarket Structure & Trend

XAUUSD is in a clear bullish trend, respecting a rising trendline on the 45-minute timeframe.

Price is making higher highs and higher lows, confirming strong upside momentum.

Recent candles show continuation strength, not a reversal pattern yet.

2. RSI (14)

RSI is around 75.8, firmly in overbought territory.

Multiple bearish divergence labels are visible:

Price makes higher highs

RSI makes lower or flat highs

This suggests bullish momentum is weakening, not that price must immediately fall.

Interpretation:

Overbought + divergence = risk of pullback or consolidation, especially near resistance.

3. Awesome Oscillator (AO)

AO is strongly positive (~88) and rising.

Green histogram dominance confirms bullish momentum is still active.

Slight flattening at the top hints momentum may be peaking.

4. MACD (12,26)

MACD line above signal line → bullish continuation

Histogram is positive but losing expansion, aligning with RSI divergence.

This often precedes pause or shallow correction, not an instant reversal.

5. Price Behavior

Price is still above trendline support

No decisive bearish engulfing or breakdown candle yet

Buyers remain in control, but late buyers face higher risk

GBPUSD – Breakout Retest Looks Healthy, Bulls in ControlGBP/USD has been trading below a falling resistance trendline for quite some time. Recently, price managed to break above this trendline, which is the first sign that selling pressure is weakening.

After the breakout, price did not continue straight up. Instead, it came back for a retest, and that retest is holding well so far. This is usually a healthy sign, showing that buyers are willing to step in at higher levels instead of letting price fall back below structure.

What Price Is Telling Us:

Price is respecting the previous resistance as support and forming higher lows. Sellers are trying, but they are unable to push price back below the trendline. This behavior often appears when the market is preparing for continuation rather than reversal.

As long as price holds above this zone, the bullish bias remains intact, with upside levels marked on the chart. A clean breakdown below the structure would invalidate this view.

This is a structure-based idea, not a prediction. Let price do the work.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Nifty - What happens next?The price has broken the 25500 zone and the lower trend line of the channel. Now the important support levels as per the daily chart are 25020, 24900, 24600 and 24500. The price has to bounce from the 24600 or 24500 zone.

In the smaller time frame, the price is testing the lower trend line, and I expect 25400 to act as resistance if the price has a pullback.

25000 is a psychological level, and the price will be volatile at that level.

As of now bank Nifty and Metal index have not fallen much and had a small pullback. But if these indices show more bearishness, then the fall will be fast.

Always do your analysis before taking any trade.

USDCHF – Gap Down From Resistance, Price Testing Key Support!USD/CHF was trading near a well-defined resistance zone where price has faced repeated rejection in the past. This clearly showed that sellers were active at higher levels and the market was struggling to sustain upside momentum.

From this resistance, the market opened with a gap down, which often signals aggressive selling and position unwinding rather than a slow intraday move. The gap was also supported by short-term U.S. dollar weakness, as the market adjusted expectations around risk sentiment and interest rates. When dollar weakness aligns with technical resistance, price usually reacts sharply.

After the gap down, price moved lower toward a major support zone, an area where buyers have previously stepped in. This makes the current zone a key decision point, either buyers defend again, or further downside continuation opens up.

This move is a result of both technical rejection and fundamental pressure, not random price action.

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

NIFTY : Trading levels and Plan for 21-Jan-2025📘 NIFTY Trading Plan – 21 Jan 2026

Timeframe: 15-minute

Gap Considered: 100+ points

Market Context: Strong sell-off followed by base formation; market trading near a decision / no-trade zone after sharp momentum move

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,316, it indicates short-covering after the recent decline.

Immediate hurdle lies at 25,388 – 25,415 (Opening / Last Intraday Resistance).

Sustained 15-min close above 25,415 is required for bullish continuation.

Upside targets to watch:

• 25,485

• 25,540+ (only if momentum expands)

Any rejection from resistance with weak candles = profit-booking zone.

Avoid aggressive long entries exactly at resistance; wait for pullback & hold.

📌 Options Thought (Gap Up):

• Prefer Bull Call Spread instead of naked CE

• Book partial profits near resistance zones

• Trail SL aggressively 📈

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

If NIFTY opens inside 25,227 – 25,316, market is likely to remain range-bound initially.

This entire zone acts as a NO TRADE / Balance Zone.

Expect whipsaws and false breakouts.

Upside trade triggers only above 25,415.

Downside pressure resumes below 25,227.

Patience is key — let price show intent first.

📌 Options Thought (Flat Market):

• Ideal environment for Theta-based strategies ⏳

• Short strangle / Iron Condor only with strict SL

• Avoid overtrading inside the range

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,227, bears remain in control.

First important support lies at 25,043 (Last Intraday Support).

A bounce is possible, but trend remains weak below 25,316.

Breakdown below 25,043 opens downside toward:

• 24,900 – 24,890 (Major Buyer / Trend Reversal Zone)

Avoid bottom-fishing unless strong reversal structure forms.

📌 Options Thought (Gap Down):

• Prefer Bear Put Spread or directional PE with tight SL

• Avoid selling PE in trending markets

• Focus on quick scalps & disciplined exits 📉

🧠 Risk Management Tips for Options Trading 🛡️

Risk only 1–2% capital per trade.

Avoid revenge trading after SL.

Expiry proximity = faster decay & sharper moves.

Use spreads to control volatility risk.

No confirmation = no trade.

📌 Summary & Conclusion ✨

NIFTY is currently trading near a key balance zone after a sharp fall.

📍 25,227 – 25,316 remains the critical decision area.

📍 Strength only above 25,415 with acceptance.

📍 Weakness continues below 25,227, with eyes on 25,043 → 24,900.

Trade light, respect levels, and let the market confirm direction.

⚠️ Disclaimer

This analysis is for educational purposes only.

I am not a SEBI registered analyst.

Markets are uncertain and I may be wrong.

Please consult your financial advisor before trading.

NIFTY : Trading levels and Plan for 20-Jan📘 NIFTY Trading Plan – 20 Jan 2026

Timeframe: 15-minute

Gap Criteria Considered: 100+ points

Market Structure: Short-term corrective phase after rejection from upper range, base formation near intraday support

🔼 SCENARIO 1: GAP UP OPENING (100+ points) 🚀

If NIFTY opens above 25,667, it signals bullish intent with short-covering momentum.

Immediate resistance zone lies at 25,667 – 25,682 (Opening / Last Resistance).

Sustained price acceptance above 25,682 on a 15-min close can trigger upside continuation.

Upside targets to watch:

• 25,740

• 25,791

Expect minor pullbacks near resistance; fresh longs only on pullback + hold above broken levels.

Avoid chasing gap-up candles without retest confirmation.

📌 Options Strategy (Gap Up):

• Bull Call Spread (ATM Buy + OTM Sell)

• Avoid naked CE buying near resistance

• Trail profits aggressively as volatility expands 📈

➡️ SCENARIO 2: FLAT / RANGE OPENING ⚖️

If NIFTY opens within 25,529 – 25,568, market enters a balance / no-trade zone.

This zone acts as Opening Support Zone for flat markets.

Expect whipsaws and fake breakouts initially.

Upside trade activates only above 25,682.

Downside pressure increases below 25,529.

Best environment for patience and structure-based entries.

📌 Options Strategy (Flat Market):

• Short Strangle / Iron Condor (only for experienced traders)

• Focus on theta decay ⏳

• Keep strict SL on breakout from range

🔽 SCENARIO 3: GAP DOWN OPENING (100+ points) 📉

If NIFTY opens below 25,529, bears gain control early.

First support zone is 25,422 – 25,364 (Intraday Demand Zone).

Expect a technical bounce, but trend remains weak below resistance.

Breakdown below 25,364 can open deeper downside.

Avoid bottom fishing until strong bullish reversal candle appears.

📌 Options Strategy (Gap Down):

• Bear Put Spread preferred

• Avoid aggressive PE selling in trending markets

• Quick scalps only, book fast 📉

🧠 Risk Management Tips for Options Trading 🛡️

Risk only 1–2% of capital per trade.

Expiry week = faster premium decay & sharp moves.

Prefer spreads over naked option buying.

No revenge trading after SL hits.

Always wait for 15-min structure confirmation before entry.

📌 Summary & Conclusion ✨

NIFTY is currently trading near a short-term balance zone.

📍 25,529 – 25,568 is the key decision-making area.

📍 Sustained move above 25,682 may revive bullish momentum.

📍 Below 25,529, downside risk increases sharply toward 25,422.

Trade light, respect levels, and let price confirm direction.

⚠️ Disclaimer

This content is for educational purposes only.

I am not a SEBI registered analyst.

Markets are uncertain, and I can be wrong.

Please consult your financial advisor before trading.

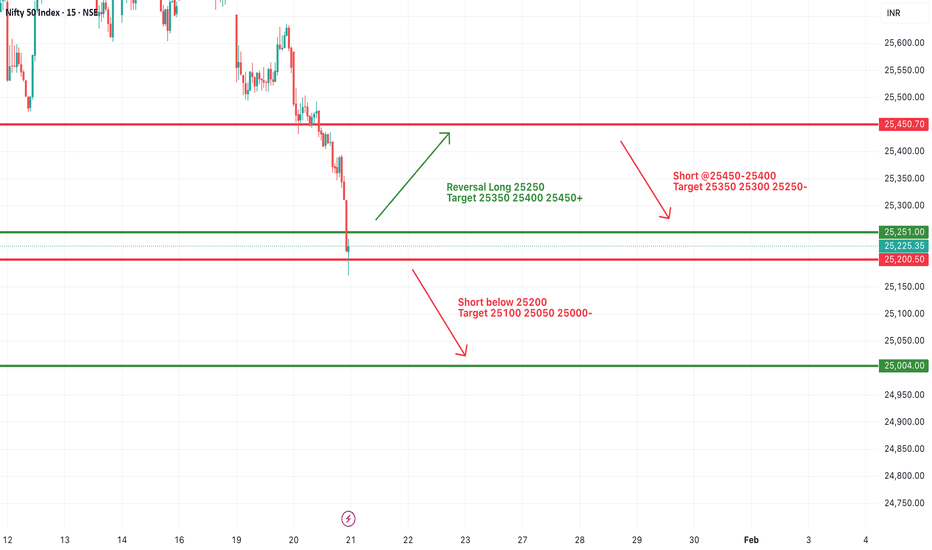

#NIFTY Intraday Support and Resistance Levels - 21/01/2026A flat opening is expected in Nifty, indicating continued consolidation after the recent sharp decline and volatile price action near lower demand zones. The index has shown strong selling pressure from higher levels and is now hovering close to a critical support area, suggesting that the market is at an important decision point. Early trade is likely to remain range-bound with heightened volatility, as both buyers and sellers assess whether the recent support will hold or break further.

On the support side, the immediate demand zone is placed around 25,250–25,200. This area has already witnessed a sharp reaction, indicating short-term buying interest and the possibility of a technical bounce. If Nifty manages to hold above 25,250, a reversal long setup may come into play with upside targets of 25,350, 25,400, and 25,450+. Any pullback followed by strong bullish candles or higher low formation near this zone can be used as a confirmation for intraday or short-term long trades, keeping strict stop-losses below the support.

On the upside, the immediate resistance lies near 25,450–25,400, which is a previous breakdown zone. Sustaining above this level is crucial for bulls to regain control. Failure to cross this resistance may again attract selling pressure, keeping the index trapped in a sideways-to-bearish structure. Hence, profit booking is advised near resistance levels for long positions, and fresh longs should be considered only on a decisive breakout with volume confirmation.

On the downside, a clear break below 25,200 would weaken the structure further and open the door for fresh short trades. In such a scenario, downside targets are placed at 25,100, 25,050, and 25,000, which are the next major psychological and technical support levels. Below 25,000, the selling momentum can accelerate, so traders should be cautious and trail profits aggressively in short positions.

Overall, the broader trend remains bearish with short-term consolidation, and today’s flat opening suggests a wait-and-watch approach during the initial phase of the session. Traders should focus on level-based trading, avoid chasing moves, and strictly follow risk management. Directional clarity is expected only after a confirmed breakout above resistance or a breakdown below the key support zone.

Part 6 Learn Institutional TradingWhy Traders Use Options

Options allow traders to benefit from multiple market views:

Directional trading (up or down)

Non-directional trading (markets stay range-bound)

Volatility trading (IV expansion/contraction)

Hedging (protect portfolios)

Income generation (selling options)

NIFTY – Price Returns to Structure as Budget ApproachesThis is a structural pullback within a well-defined rising channel, not a random fall.

Price has respected this channel multiple times in the past, and the current move is a return toward the lower trendline support, which has historically acted as a demand zone.

Such pullbacks are normal and healthy in trending markets. They help reset sentiment, shake out weak hands, and rebuild structure before the next directional move.

The Union Budget is approaching, which naturally increases volatility and uncertainty. During such events, markets often move first and explain later. That’s why reacting is more important than predicting here.

If price holds and stabilizes near this trend support, it keeps the broader trend intact and opens the door for continuation once clarity returns.

If the structure fails decisively, the chart itself will signal that—no assumptions needed.

For now, this is a wait-and-watch zone, where patience, structure, and price behavior matter more than opinions or headlines.

Nifty - Expiry day analysis Jan 20The price rejected the 25600 zone in the opening and fall towards 25500. In the afternoon session, it tested 25600 again. This movement has created a descending channel. The channel has zig zag movement, so trade carefully.

Buy above 25680 with the stop loss of 25620 for the targets 25720, 25760, 25820 and 25860.

Sell below 25580 with the stop loss of 25630 for the targets 25540, 25500, 25460 and 25400.

Expected expiry day range is 25400 to 25800.

Always do your analysis before taking any trade,

BHEL : Price action update

📊 Bharat Heavy Electricals Limited – UPDATE

Timeframe: 1D

Trend Structure: Impulsive uptrend with Wave-4 corrective phase

Current Price Zone: ~₹263

Market Phase: Corrective pause after strong momentum rally

🔍 Big Picture Structure (What the Chart Is Telling Us)

BHEL has already completed a strong impulsive move (Wave 1–3), followed by a healthy correction (Wave 4).

This correction is time-consuming, not price-damaging, which is a bullish characteristic.

📘 Strong stocks correct sideways or shallow — weak stocks collapse.

🟦 Wave-4 Completion Zone: ₹243–267 (High-Probability Demand)

This zone is crucial and not random.

🧠 Why price reacts here (Trading Psychology):

Traders who missed the rally are waiting for a pullback to value

Early buyers defend this zone to protect unrealised profits

Short sellers start booking profits near prior breakout areas

👉 This creates a demand cluster, often leading to trend resumption

📌 That’s why this zone is marked as Correction Wave-4 completion area.

🔑 Key Levels & Their Psychological Importance

🟢 Support / Buy Zone: ₹243–267

• Prior consolidation + retracement value

• Risk-reward becomes favorable for positional buyers

🔴 Invalidation / Stop-Loss: ₹194

• Deep retracement beyond acceptable Wave-4 limits

• Below this, structure weakens and confidence breaks

📉 Below this level, buyers turn into sellers.

🔵 First Resistance / Target: ₹300–308

• Previous supply & liquidity zone

• Swing traders book profits here

• Causes temporary pullbacks

🟢 Breakout / Expansion Zone: ₹330–368

• Fresh highs attract momentum traders

• Stop-losses of shorts fuel upside

• Psychological FOMO zone

📈 New highs = emotional acceleration.

🔥 Extended Target: ₹345+

• Trend continuation zone

• Only achievable if volume supports price

🟢 Bullish Scenario (Primary Probability)

If price:

Holds above ₹243–267

Shows stabilization or higher-low formation

Then:

First move toward ₹300–308

Break & sustain → ₹330–368

Momentum extension possible toward ₹345+

📘 This is classic Wave-5 behavior after a healthy Wave-4 correction.

🔴 Bearish Risk Scenario (Low Probability but Important)

If price:

Breaks below ₹243 decisively

Fails to reclaim support quickly

Then:

Selling pressure may increase

Next major demand near ₹194

Structure becomes range-bound or corrective for longer

📉 This reflects loss of conviction, not trend reversal immediately.

🎓 Educational Takeaways (Very Important)

Corrections are where wealth is built, not breakouts

Strong stocks give second chances, weak ones don’t

Levels work because traders remember pain & opportunity

Price moves when crowd psychology aligns, not indicators

🧠 Why This Setup Is Educationally Powerful

Zone Crowd Emotion

Highs Greed & FOMO

Pullback Hope & Fear

Support zone Opportunity

Breakdown Panic

New highs Momentum chase

📘 Charts are a map of emotions, not lines.

🔮 Price Outlook (Educational Projection)

Above ₹267: Bullish bias intact

Above ₹308: Momentum resumes

Above ₹330: Expansion phase begins

Below ₹243: Patience required

Below ₹194: Structure weakens

🧾 Conclusion

BHEL is undergoing a textbook Wave-4 correction within a larger uptrend.

The ₹243–267 zone is a make-or-break region that can define the next multi-week move.

📌 Strong trends pause to shake weak hands — not to reverse.

⚠️ Disclaimer

This analysis is for educational purposes only.

I am not a SEBI registered analyst. Markets involve risk, and I may be wrong.

Please consult your financial advisor before making any trading or investment decisions.

Gold (XAUUSD) – 1H | Short AnalysisTrend: Short-term bullish, strong impulsive move from ~4660 → 4745.

Current: Mild pullback / profit booking near highs (~4725).

Resistance: 4745–4760 zone (supply visible).

Support: 4700–4685 (immediate), deeper 4660.

Bias:

Above 4700 → pullback buy possible, trend intact.

Below 4685 → deeper correction likely.

View: Bullish structure, but expect consolidation or shallow retrace before next move.

HINDCOPPER 1 Month Time Frame 📊 Current Reference Price

The stock is trading around ₹540 – ₹560 on the NSE today.

🧠 1‑Month Timeframe Key Levels

📈 Resistance (Upside Barriers)

These are levels where the stock might face selling pressure or pauses if it continues higher:

1. ₹570 – ₹575 — Immediate near‑term resistance zone (recent highs).

2. ₹580 – ₹585 — Next resistance cluster above current price — psychological plus pivot area.

3. ₹595 – ₹600+ — Extended upside target if price breaks above the near zone.

Interpretation: A daily/weekly close above ~₹575–₹580 can confirm strength on the 1‑month chart and open the move toward ~₹600+.

📉 Support (Downside Floors)

These are levels where buyers may step in if price corrects:

1. ₹522 – ₹525 — Near pivot support on medium timeframe.

2. ₹500 – ₹510 — Secondary support zone that has seen demand historically on pullbacks.

3. ₹480 – ₹490 — Deeper short‑term support — a key level if price weakens further.

Interpretation: Holds above ~₹520–₹525 are bullish for the 1‑month swing; breaks below that raise risk of deeper pullback toward ₹500 or lower.

✍️ 1‑Month Trading Perspective (Short Summary)

📌 Bullish Scenario

Sustained daily closes above ~₹575–₹580 → watch ₹590–₹600+ as next short‑term targets.

📌 Neutral / Range Scenario

Price consolidates between ₹525 and ₹575 — likely choppy movement before next directional breakout.

📌 Bearish / Correction Scenario

Close below ~₹522–₹525 → deeper support zones around ₹500–₹490 may get tested.

⚠️ Important Notes

✅ These are technical reference levels, not buy/sell recommendations.

✅ Price action can change quickly with market news, global copper trends, or broader index moves (e.g., Nifty/commodity dynamics).

TATASTEEL 1 Week Time Frame 📌 Current Price Snapshot

Tata Steel is trading around ₹183–₹185 on the NSE.

📊 Weekly Technical Levels (Support & Resistance)

🟢 Resistance Levels (Upside Targets)

These are zones where price may face selling pressure or struggle to break above on a weekly basis:

1. ₹188 – ₹190 — Immediate key resistance, near recent highs/52-week high zone.

2. ₹192 – ₹195 — Next resistance if the stock decisively clears ₹190 on weekly closes.

3. ₹195 + — Higher psychological area and extended targets for bullish continuation.

👉 Bullish trigger: Weekly close above ₹188–₹190 strengthens upside momentum.

🔴 Support Levels (Downside Zones)

These act as buying interest zones if the stock pulls back:

1. ₹181 – ₹182 — Immediate support keeping the uptrend intact.

2. ₹178 – ₹180 — Stronger base zone from recent swing lows & pivot cluster.

3. ₹174 – ₹176 — Deeper support if the key zones above break.

👉 Bearish risk: Weekly close below ₹178 could lead to tests around the ₹172–₹175 zone.

📉 Weekly Trend & Indicators

Long-term trend on weekly appears neutral–bullish with moving averages generally supportive and RSI around neutral–positive.

Market news also shows price recently hitting or near 52-week highs, indicating strong sector interest.

📌 How to Use These Levels on Weekly Timeframe

Bullish Scenario

Stay above ₹181–₹182 on weekly close → strengthens chance towards ₹188–₹190 resistance.

Above ₹190 weekly → next targets ₹192–₹195 and beyond.

Neutral/Range Scenario

Trading between ₹178–₹188 → range-bound movement likely; buy near support, sell near resistance.

Bearish Scenario

Weekly close below ₹178 → risk testing lower supports ₹174–₹176 / ₹172–₹175 area.

XAUUSD H1 – Liquidity Grab Completed, Buy the DipMarket Context

Gold has just completed a strong impulsive rally, leaving behind multiple liquidity pockets and imbalance zones below. The current pullback is technical in nature, serving as a rebalancing phase after expansion rather than a trend reversal.

From a macro perspective, safe-haven demand and a cautious Fed outlook continue to support Gold, keeping the broader bias tilted to the upside.

Technical Structure (H1 – MMF)

Market structure remains bullish with higher highs and higher lows.

The recent sell-off is a liquidity grab into previous demand zones.

No confirmed bearish CHoCH at this stage.

Price is still holding above the major H1 GAP liquidity zone.

Trading Plan – MMF Style

Primary Scenario – Trend-Following BUY

Prefer BUY setups on pullbacks into:

BUY zone 1: 4,759 – 4,729

BUY zone 2 (deep): 4,669 – 4,600

Only execute BUYs after clear bullish reaction and structure hold.

Avoid FOMO at premium levels.

Upside Targets

TP1: 4,817

TP2: 4,892

TP3: 4,898 (liquidity sweep zone)

Alternative Scenario

If price fails to hold above 4,729 and sweeps deeper liquidity into the GAP H1 zone, wait for re-accumulation signals before re-entering BUYs.

Invalidation

An H1 close below 4,600 invalidates the bullish setup and requires a full structure reassessment.

Summary

The broader trend remains bullish. The current move is a corrective pullback into liquidity, offering high-quality buy-the-dip opportunities. Patience and confirmation remain key — let price come to you.

Part 2 Institutional Option Trading VS. Technical Analysis What Is an Option?

An option is a financial contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, on or before a specific date.

There are two types of options:

Call Option

Put Option

Each option contract is defined by:

Underlying asset

Strike price

Expiry date

Premium (price of the option)

Part 2 Ride The Big Moves How Options Work – Strike Price, Premium, Expiry

Every option contract contains three essential components:

A. Strike Price

The strike price is the predetermined price at which the buyer can buy (CE) or sell (PE) the underlying.

Example:

Nifty Spot = 22,000

You buy Nifty 22,100 CE, meaning you can buy Nifty at 22,100.

B. Premium

Premium is the price you pay (buyer) or receive (seller) to enter the contract. Option prices change based on demand, volatility, time, and underlying movement.

C. Expiry

Options do not last forever. Every option expires:

Weekly (Most popular in Nifty/Bank Nifty)

Monthly

Quarterly (some stocks)

Yearly (LEAPS) in some markets

At expiry, the option will either:

Become In the Money (ITM) → It has intrinsic value.

Become Out of the Money (OTM) → It becomes worthless.

SEBI Trading Regulations and Derivatives Curbs (F&O Clampdowns)1. Introduction: What Is SEBI and Why Regulate Derivatives?

The Securities and Exchange Board of India (SEBI) is India’s capital markets regulator. It’s tasked with protecting investors’ interests, developing markets, and regulating securities trading—including equities, bonds, and derivatives (futures and options). Derivatives are financial contracts whose value is linked to an underlying asset (e.g., stocks, indices). They offer benefits like risk management, price discovery, and market liquidity. But because these instruments involve leverage, they can also amplify risks and attract speculative trading that may destabilize markets, particularly when retail participation surges.

In recent years, the rapid growth of derivatives trading in India—especially retail participation in Futures & Options (F&O)—has prompted SEBI to tighten regulations. Regulators have expressed concerns about excessive speculation, high loss rates among individual traders, volatile expiry days, and possible manipulation by sophisticated players. The steps SEBI has taken are designed to balance market efficiency with investor protection and financial stability.

2. Scope of SEBI’s Regulatory Framework

SEBI’s derivatives regulations cover the entire lifecycle of F&O trading, including:

Contract design and eligibility (what can be traded, and under what conditions)

Position limits and surveillance (how much exposure any participant can hold)

Margin and risk management frameworks

Monitoring and enforcement protocols

These rules apply to all market participants—retail investors, brokers, proprietary traders, foreign portfolio investors (FPIs), and exchanges.

3. Key Derivatives Curbs (“F&O Clampdowns”)

Below are the major regulatory reforms SEBI has introduced since late 2024 and through 2025 to control excessive speculation and safeguard the markets:

3.1 Increase in Contract Size

One of SEBI’s most significant changes was to raise the minimum contract size of index derivatives. Previously, most index futures and options contracts had values between ₹5–10 lakh. SEBI increased this to at least ₹15 lakh, with lot sizes adjusted so that the contract value on review falls between ₹15–20 lakh. This applies when new contracts are introduced.

Why? Larger contract sizes mean traders must commit more capital to participate. This raises the entry barrier for highly leveraged retail speculation and encourages more responsible positioning.

3.2 Upfront Collection of Option Premiums

Under earlier practices, brokers could offer credit or allow traders to pay part of the premium or margins later. SEBI mandated that for options trading, premiums must be collected upfront from buyers by trading or clearing members.

Impact: This reduces unrealistic leverage and ensures traders can cover potential losses. It protects both individual traders and the broader clearing ecosystem from defaults.

3.3 Removal of Calendar Spread Benefits

Calendar spreads involve holding positions in two different expiry months and benefit from regulatory margin offsets. SEBI eliminated these benefits on the day a contract expires.

Purpose: This curbs complex strategies often used for speculative gains during volatile expiry periods and simplifies risk calculations. It also prevents traders from taking disproportionate positions near expiry.

3.4 Rationalisation of Weekly Expiry Contracts

Weekly expiry options—contracts that expire every week—were increasingly popular among retail traders due to frequent rollover opportunities. SEBI limited each exchange to offering weekly derivatives on only one benchmark index.

The regulator also later mandated that all equity derivatives must expire only on Tuesdays or Thursdays to reduce “hyperactivity” and speculating across multiple days.

Goal: Reducing speculative volume spikes and concentrating trading activity to manageable expiries eases operational risk and volatility.

3.5 Intraday Monitoring of Position Limits

Historically, position limits were checked only at the end of the trading day. SEBI changed this by requiring stock exchanges to take multiple random intraday snapshots (typically at least four during the trading session) to monitor open interest and cap positions.

In 2025, SEBI also introduced specific entity-level intraday limits for index derivatives—for example, capping net exposure at ₹5,000 crore and gross exposure at ₹10,000 crore per entity, with monitoring across the day and penalties for breaches.

Effect: Real-time monitoring prevents traders from building up excessive positions unnoticed and enhances market discipline and risk control.

3.6 Revised Market Wide Position Limits (MWPL)

SEBI revised how Market Wide Position Limits (MWPL) are calculated by using more realistic measures such as delta-adjusted open interest (FutEq OI), which accounts for actual risk exposure rather than nominal contract volumes. It also tied limits more closely to cash market liquidity and free float data.

Result: Position limits now reflect true market risk, reducing the likelihood of manipulation and sudden bans on derivative trading in individual stocks.

3.7 Rules During Ban Periods

Under the revised ban framework, if a stock reaches a high proportion (e.g., 95%) of its MWPL, it enters a ban period. In such cases, traders cannot increase net positions and must reduce exposure periodically. This prevents “flipping” or speculative attacks designed to influence prices.

4. Broader Surveillance and Enforcement

SEBI has also strengthened surveillance norms in the derivatives markets, including:

Heightened scrutiny of price and volume anomalies

Greater transparency from brokers and exchanges

Penalties for breaches of limits and non-compliance

Actions against manipulation (e.g., banning firms for manipulative practices)

These actions signal SEBI’s intent not only to set rules but enforce them rigorously.

5. Objectives Behind F&O Clampdowns

SEBI’s reforms aim to address multiple structural issues:

5.1 Protect Retail Investors

Data show that a large majority of individual traders in derivatives incur losses, often due to leverage and speculation without adequate risk management. SEBI’s rules seek to protect such traders from unsustainable risk exposure.

5.2 Enhance Market Stability

By curbing speculative excesses—especially around expiry days when volumes can spike—SEBI wants to reduce extreme volatility that can undermine confidence in the markets.

5.3 Improve Risk Monitoring and Transparency

Real-time monitoring and more accurate measurement of exposure provide better risk oversight across market participants, protecting the clearing ecosystem and broader financial system.

6. Criticisms and Responses

Some market participants argue that SEBI’s “clampdowns” may reduce liquidity, discourage legitimate trading strategies, and make markets less attractive, especially for smaller participants or algorithmic traders. SEBI’s chairperson has emphasized the need to strike a balance between regulation and innovation, warning against overly restrictive, threshold-based approaches that might stifle market activity.

7. Conclusion: The Future of Derivatives in India

SEBI’s trading regulations and derivatives curbs reflect a broader trend of tightening oversight in financial markets globally. India’s experience shows a regulator adjusting rules in response to market behavior, risk trends, and investor outcomes. While these measures may dampen speculative frenzy and protect vulnerable investors, they also require market participants to adapt through better risk management, informed strategy, and compliance diligence.

In essence, SEBI’s approach balances market development with investor protection and stability, steering the derivatives ecosystem toward more sustainable growth.