HMVL 1 Month Time Frame 📊 Current Price Snapshot (Latest Close)

- Approximate latest price: ₹70.9 – ₹72.2 per share (data from multiple live sources on 23 Jan 2026) showing HMVL trading around ~₹71–₹72 levels.

- Intraday range: ₹69.00 – ₹72.00 recently observed.

- 52‑week range: ₹61.76 (low) to ₹103.40 (high).

📈 1‑Month Performance

- Over the past 1 month, the stock’s performance shows a slight decline or mild sideways move: approx −1 % to −3 % change depending on the exact start/end dates used (TradingView indicated ~‑2.75 % monthly fall).

- Other data suggests very modest monthly change (slight positive/negative depending on source).

📅 Recent Daily Price Levels (Indicative)

From historical price data for the first half of January 2026:

01 Jan 2026: ~₹68.5

06 Jan 2026: ~₹70.4

09–12 Jan 2026: ~₹66‑₹69

16–23 Jan 2026: ~₹69‑₹72

→ This shows a 1‑month trading range roughly between ~₹65 and ~₹72.

📍 1‑Month Key Levels to Watch

Support zone: ~₹65 – ₹67 (recent lows).

Near‑term resistance: ~₹72 – ₹74 (recent highs).

Mid‑range pivot: ~₹69 – ₹71 — recent close vicinity area.

Chartsneverlie

PAYTM 1 Day Time Frame 📌 Live/Recent Price:

Around ₹1,240 – ₹1,300 range intra‑day (varying by source/time) — showing recent session weakness.

📊 Daily Pivot & Support/Resistance Levels

These levels are typical pivot analysis (daily frame) used by traders to identify short‑term sell/buy pressure points:

Pivot Zone (Daily): ~₹1,307–1,325

Resistances:

R1: ₹1,325–₹1,330

R2: ₹1,354–₹1,355

R3: ₹1,372–₹1,373

Supports:

S1: ~₹1,278–₹1,280

S2: ~₹1,259–₹1,260

S3: ~₹1,231–₹1,232**

📌 Interpretation:

Above Pivot (₹1,307–₹1,325) ➜ short‑term bullish bias.

Below Pivot ➜ bearish bias with S1→S2 as key downside zones today.

🧠 Key Daily Zones to Watch

🎯 Bullish Break Zones

Strong intraday upside trigger: RSI/Vol can push price back above ₹1,307 pivot

Next upside targets: ₹1,325 → ₹1,354 → ₹1,372

⚠️ Bearish Breakdown Zones

If drops below S1 (~₹1,278), next key downside to watch is ₹1,259 (S2)

Breaking below ₹1,231 (S3) may accelerate intraday selling

MMTC 1 Week Time Frame 📌 Current Price Snapshot

Latest traded price: ~₹71.5 – ₹72.7 on NSE today with strong intraday volatility. Daily high ~₹72.70 and low ~₹63.86.

This wide daily range suggests higher volatility this week — at least through the next few sessions.

📊 Short‑Term Weekly Levels

🔹 Resistance (Upside)

These are levels where price may face selling pressure or slow gains:

1. ₹72.5 – ₹73.0 — Immediate resistance area (today’s local high).

2. ₹75.0 – ₹76.0 — Next bullish pivot region if the stock holds above ₹72.5 (based on momentum models).

3. ₹78.0 – ₹80.0 — Stronger weekly upward pull target if bullish continuation holds.

👉 Closing above ₹75 on the weekly timeframe would indicate stronger short‑term bullish structure.

🔻 Support (Downside)

Levels where buyers may step in on pullbacks:

1. ₹66.0 – ₹67.0 — First dynamic support (near shorter moving averages).

2. ₹62.0 – ₹63.5 — Key lower support zone (recent daily lows).

3. ₹60.0 – ₹61.0 — Deeper weekly support — important to watch if breakdown accelerates.

👉 A break below ₹62 on weekly closes would weaken the bullish outlook and could open the door toward deeper supports.

📈 Technical Indicator Context

Technical breadth is largely bullish/momentum supportive:

📌 Moving Averages:

5, 10, 20, 50, 100, and 200‑day MAs all skew Buy — suggesting bullish trend alignment.

📌 RSI (14): ~65 — trending up but not yet extremely overbought.

📌 Stoch/RSI: Overbought on shorter timeframes — may hint at near‑term consolidation before higher breakout.

Summary: Momentum still skewed bullish overall, but short‑term traders should watch for near‑term pullbacks or consolidations due to overbought signals.

Nifty 50 1 Week Time Frame📌 Current Weekly Price (Live)

Nifty 50 approx ~25,730–25,740 (latest live level) — slight downside bias today.

📈 Weekly Resistance Levels (Upside)

1. 25,900 – 26,000 zone

• Immediate resistance above current price — key psychological barrier.

2. 26,100 – 26,200 zone

• Strong technical resistance (previous weekly highs & upper band).

3. 26,300+

• If breakout above 26,200 sustains, next upper resistance.

📉 Weekly Support Levels (Downside)

1. 25,600–25,650

• Near-term support from recent weekly structure.

2. 25,300–25,350

• Secondary support; zone where price has bounced previously on weekly charts.

3. 24,800–24,700

• Major structural support — breach here opens deeper correction risk.

📊 Weekly Technical Range to Watch

Neutral/Range-Bound View (Weekly):

⬆️ Bullish: Break & weekly close above 26,000–26,200

⬇️ Bearish: Break & close below 25,300–25,350

Between these levels, the index may consolidate before a clear directional move.

📌 Summary Weekly Levels (2026)

Resistance Zones

• 26,000 (key psychological)

• 26,100–26,200 (secondary)

• 26,300+ (extended)

Support Zones

• 25,600–25,650 (immediate)

• 25,300–25,350 (secondary)

• 24,800–24,700 (major)

ELECON 1 Day Time Frame 📊 Live/Recent Price (India Market)

Approx. share price: ~₹479–₹515 range today (prices vary across live sources/delays).

Previous close was around ₹497–₹499.

Intraday price range seen: ~₹480 (low) to ₹517 (high).

📈 Key One‑Day Pivot & Levels

(Useful for short‑term trading/entry‑exit zones)

Pivot Points (daily):

Pivot (central) ~ ₹485–₹494 — reference mid‑point for today’s trend.

Resistance Levels:

R1: ~ ₹495–₹500 — first hurdle above current price.

R2: ~ ₹509–₹510 — next resistance / potential target on upside.

R3: ~ ₹518–₹524 — stronger upside barrier.

Support Levels:

S1: ~ ₹476–₹477 — nearest intraday support.

S2: ~ ₹470–₹471 — next downside buffer.

S3: ~ ₹461–₹462 — deeper support zone.

Pivot and fib levels are often calculated using previous day’s high‑low‑close prices to forecast intraday turning points.

📌 Summary for Today’s 1‑Day View

Bullish bias

✔ Close above R1 (~₹495) could push price toward R2 (~₹509–₹510) and R3 (~₹518–₹524).

Bearish caution

✘ A break below S1 (~₹476) might expose S2 (~₹470) and then S3 (~₹461) supports.

CGPOWER 1 Day Time Frame📊 Daily Price Levels (1D Time Frame)

Current price range (recent session)

• Day’s trading range ~ ₹634–₹651 approx on NSE (latest close ~ ₹637–₹647) (as per recent data)

Pivot / Pivot‑based levels

• Daily Pivot: ~ ₹662 (central reference)

(use this as a neutral baseline — above favors bullish bias, below favors bearish bias)

Immediate Resistance

1️⃣ R1 ~ ₹665–₹668 (zone of immediate selling pressure)

2️⃣ R2 ~ ₹675–₹680 (next upside barrier)

3️⃣ Higher resistance (secondary) ~ ₹685–₹695+ (seen in other pivot data)

Immediate Support

1️⃣ S1 ~ ₹656–₹650 (first support zone)

2️⃣ S2 ~ ₹644–₹640 (next downside support)

3️⃣ S3 ~ ₹627–₹630 (deeper support)

📌 Interpretation (1‑Day)

If price holds above ₹656–₹650, the bias may stabilize and test ₹665–₹675 on the upside.

Break below ₹640–₹630 increases risk of further weakness in the short run.

Daily pivot at ~₹662 helps gauge short‑term trend — sustaining above it hints at short‑term buying interest, below it suggests continued pressure.

(These levels are typical pivot/sr zones used by traders; use live charts for exact current quotes.)

🧠 Extra Context (Technical Indicators)

Short‑term technical indicators (RSI & moving averages) have shown mixed to bearish signals recently, with several daily sell signals noted in external analysis.

Chart Patterns (Macro Structure + Psychology + Trading)Chart patterns arise over larger timeframes from the interaction of supply and demand. They help identify continuation or reversal of trends.

⭐ Advantages of Chart Patterns

Helps predict market direction – Shows whether price may continue or reverse.

Easy to understand visually – Patterns are simple shapes (triangles, flags, head & shoulders).

Gives clear entry and exit points – Breakouts and breakdowns guide trading decisions.

Works on all timeframes – Useful for intraday, swing, and long-term trading.

Useful for trend analysis – Helps identify strong or weak trends.

Improves accuracy when combined with volume – Volume confirms true breakouts.

MARUTI 1 Month time Frame 📌 Current Price Context

The stock is trading near ₹16,600–₹16,750 levels (approximate latest market price).

52‑week high: ~₹16,818.

52‑week low: ~₹10,800.

📊 1‑Month Time Frame Key Levels (Support & Resistance)

🔺 Resistance Levels (Upside Targets)

Daily / Short‑Term

• R1: ~₹16,649–₹16,650 – First resistance zone based on pivot.

• R2: ~₹16,757–₹16,760 – Next upside likely supply area.

• R3: ~₹16,832–₹16,833 – Higher resistance near recent swing highs/upper pivot.

📈 Key level to watch: Above ₹16,830 could signal breakout continuation.

🔻 Support Levels (Downside Floors)

Daily / Short‑Term

• S1: ~₹16,466–₹16,470 – Immediate support zone.

• S2: ~₹16,390–₹16,420 – Secondary support cluster if first breaks.

• S3: ~₹16,320–₹16,330 – Lower pivot support for deeper pullbacks.

📉 Key breakdown area: Below ~₹16,320 may open deeper retracement into lower 1‑month range.

📊 Pivot Point (Central Reference)

Pivot (Daily/Short‑Term): ~₹16,574–₹16,576 – This mid‑point acts as neutral zone around current price action.

📌 1‑Month Outlook (What to Watch)

📊 Bullish Scenario

✔ Above ₹16,750–₹16,830 → Next focus towards ₹16,900+ range.

✔ Strong rejection off back‑to‑back support levels indicates buyers stepping in.

📉 Bearish Scenario

✔ Break & close below ₹16,400–₹16,320 → sellers gain edge, could test lower support near ₹16,200–₹16,000.

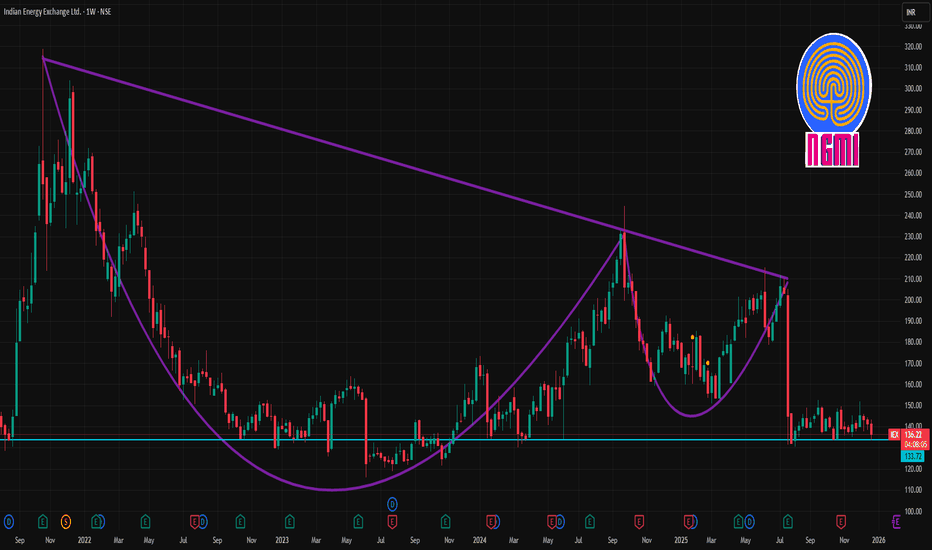

IEX 1 Week Time Frame 📊 Current Context

IEX is trading around ₹138–₹142 range recently.

Short‑term technical indicators show bearish bias but mixed signals overall.

📌 1‑Week Key Levels (Support & Resistance)

📈 Resistance Levels

1. ~₹142–₹143 — Immediate resistance / pivot cluster (key short term)

2. ~₹144–₹145 — Next resistance barrier, breakout level for bullish bias

3. ~₹147–₹150 — Major weekly resistance region (higher breakout zone)

📉 Support Levels

1. ~₹138–₹140 — Immediate support zone (near current value)

2. ~₹135–₹136 — Secondary support if breakdown below immediate zone

3. ~₹133–₹132 — Stronger lower support / swing lows for the week

📍 Short‑Term Technical Sentiment

Weekly ratings suggest a sell/neutral bias, indicating pressure below key resistances.

Oscillators (RSI/MACD) also point to bearish momentum on short timeframes.

📈 Actionable Levels to Watch

Bullish scenario

A clean daily close above ₹144–₹145 increases the likelihood of an upside toward ₹147–₹150.

Bearish scenario

Sustained trading below ₹138 could accelerate selling toward ₹135–₹132.

Neutral/Consolidation

Between ₹138–₹144 may remain a tight range unless triggered by a breakout move.

COCHINSHIP 1 Day Time Frame Current Price (approx)

• Around ₹1,640–₹1,650 on NSE/BSE.

📈 Daily Pivot / Support & Resistance Levels

(from classic pivot / daily pivot calculations)

Pivot Point (Daily)

• 1653–1654 – central pivot reference.

Resistance Levels (Daily)

• R1: ~₹1,565–1,570

• R2: ~₹1,580–1,585

• R3: ~₹1,600–1,610

Support Levels (Daily)

• S1: ~₹1,520–1,525

• S2: ~₹1,490–1,495

• S3: ~₹1,475–1,480

These pivot‑based levels are useful for short‑term intraday or next‑session trading ranges.

📊 Alternate Daily S/R (from NSE pivot style)

(from other common pivot indicators)

Immediate Support:

✔ ₹1,530–₹1,540 zone

✔ ₹1,500–₹1,510 lower cushion

Immediate Resistance:

✔ ₹1,570–₹1,580 near‑term cap

✔ ₹1,600+ stronger barrier above

📌 How to Use These for 1‑Day Trading

Bullish setups:

• Watch for break & close above ~₹1,580–1,600 for short‑term upside continuation.

Bearish setups:

• If price breaks ₹1,520 major support, next down near ₹1,490–1,475.

360ONE 1 Day Time Frame 📊 Daily Price Range

Typical intraday range: ~₹1,124–₹1,150 (varies per session) — recent daily highs/lows seen in this band.

📈 Important Daily Support Levels

Support 1: ~₹1,134–₹1,135 — near recent intraday lows.

Support 2: ~₹1,102 — secondary downside support.

Support 3: ~₹1,084 — deeper support level if broader sell‑off unfolds.

👉 These are key levels where the stock has found buying interest on the daily chart. Breach below them may indicate more downside pressure.

📉 Important Daily Resistance Levels

Resistance 1: ~₹1,184 — immediate upside barrier.

Resistance 2: ~₹1,202 — next layer of sellers.

Resistance 3: ~₹1,234 — stronger upside pivot.

👉 These are areas where the stock may struggle to move higher on the daily timeframe.

🔧 Technical Bias on Daily Timeframe

Daily indicators (RSI, MACD, moving averages) are currently showing buy/strong‑buy signals, meaning short‑term trend is tilted bullish.

📌 Daily Pivot Reference (Approximate)

Pivot ~₹1,152–₹1,155 — central daily pivot based on recent session price action.

Chart Patterns CHART PATTERNS

Chart patterns represent big-picture market structures formed over dozens or hundreds of candles. They reveal accumulation, distribution, reversal, and continuation phases.

Patterns are grouped into:

A. Reversal Chart Patterns

B. Continuation Chart Patterns

C. Bilateral / Indecisive Patterns

Chart Patterns

Larger structures for strong trades

Indicate trend continuation or reversal

Higher reliability when combined with candles

Help set clear targets & stop-loss levels

Real Knowledge of Chart Patterns CHART PATTERNS (Market Structure Patterns)

Chart patterns are formed by price movements over a longer period and help traders understand the bigger picture. They indicate whether the trend is likely to continue, reverse, or break out after consolidation. These patterns can be grouped into three major categories:

1. Continuation Patterns

These suggest that the existing trend (uptrend or downtrend) will likely continue after a temporary pause.

2. Reversal Patterns

These indicate a possible change in trend direction.

3. Bilateral Patterns

These can break either up or down, signaling indecision.

Let’s study them in detail.

JSWENERGY 1 Day Time Frame📌 Live Price (Approx Latest)

Current price: ~ ₹478.2 – ₹478.3 per share (latest close/near real‑time) on the NSE.

Today’s range: Low ~ ₹468.3 | High ~ ₹479.9 (intraday range).

📊 Daily Key Levels (1‑Day Time Frame)

🔹 Pivot (Daily Reference)

Pivot Point: ~ ₹475.5 – central reference for daily trend.

📈 Resistance Levels

R1: ~ ₹482.7

R2: ~ ₹487.1

R3: ~ ₹494.3

(Higher resistances mark potential upside targets if the price moves up today.)

📉 Support Levels

S1: ~ ₹471.1

S2: ~ ₹463.9

S3: ~ ₹459.5

(Below these, risk of deeper pullbacks increases.)

📌 What These Levels Mean Today

✅ Bullish scenario:

A sustained trade above ₹482–₹487 could push toward ₹494+ resistance zones.

❌ Bearish scenario:

A break below ₹471 may open the path to ₹464–₹459 support.

📊 Pivot reference:

Trading above the pivot ~₹475–₹476 suggests positive short‑term bias; below it leans bearish.

JAINREC 1 Day Time Frame 📌 Latest price context:

• The stock has been trading around ₹400–₹410 in recent sessions (range today ~396.5–409) with latest close near ₹401.30.

📊 Daily Technical Levels (Approximations)

🔵 Resistance Levels

R1: ~₹418–₹420 — 1st key upside hurdle — pay attention for breakout.

R2: ~₹425–₹430 — Secondary resistance at previous reaction highs.

R3: ~₹435–₹440+ — Strong supply zone from past tops/52‑wk range.

🔴 Support Levels

S1: ~₹400–₹401 — Immediate floor pivot area around current price.

S2: ~₹390–₹392 — Near short‑term support from recent pullbacks.

S3: ~₹383–₹385 — Deeper support zone below recent correction lows.

S4: ~₹370–₹375 — Major support if price loses the current range.

📍 Daily Pivot (approx)

• Pivot ~ ₹400–₹402 — Price around this level gives neutral bias until breakout.

PFC 1 Day Time Frame 📊 Daily Pivot Levels

Pivot Point (Daily): ~₹343.00–₹343.30

Central Pivot (CPR):

• Top: ₹343.60

• Mid: ₹343.00

• Bottom: ₹342.40

📈 Resistance Levels (Daily)

R1: ~₹344–₹346

R2: ~₹347–₹348

R3: ~₹350–₹351

📉 Support Levels (Daily)

S1: ~₹338–₹341 (minor support)

S2: ~₹335–₹337

S3: ~₹332–₹334

🔍 Intraday Range to Watch

Near‑term range: ₹337–₹354, with crucial rejection/resume zones at ~₹337 (support) and ~₹352–₹354 (upper resistance).

📌 How to Use These Levels

Bullish breakout: Sustained close above the pivot ~₹343 with volume could target R1 → R2 (~₹347–₹350).

Bearish continuation: Failure below S1 (~₹338–₹341) increases odds of a drop toward S2/S3 (~₹335 / ₹332).

Pivot flips: Pivot pivots often act as support if price stays above, and as resistance if below.

RIL 1 Day Time Frame 📊 Current Price Context (approx):

RIL is trading near ₹1,540 – ₹1,550 intraday range today.

📈 1‑Day Resistance Levels

These are levels where the stock may face selling pressure or pause on the upside:

Intraday Daily Resistances (Pivots & Speed Levels):

R1: ~₹1,549 – ₹1,550

R2: ~₹1,557 – ₹1,557

R3: ~₹1,562 – ₹1,563

(above current price)

Extended intraday pivot R4 (if breakout):

~₹1,570+ (from broader pivot series)

📉 1‑Day Support Levels

Key levels where buyers may step in on dips:

Intraday Daily Supports:

S1: ~₹1,536 – ₹1,537

S2: ~₹1,531 – ₹1,532

S3: ~₹1,523 – ₹1,524

(below current price)

Weekly pivot support band (if selling accelerates):

Around ₹1,531 – ₹1,505+ (broader support zone)

IOC 1 Month Time Frame 📊 Current Context

IOC is trading around the ₹166–₹168 range as of mid‑December 2025.

Over the last month, the stock has seen a slight decline (~‑2.7% to ‑3.6% depending on source).

🟢 Key 1‑Month Support Levels

These are levels where the price may find buying interest if the stock pulls back:

✅ Primary Support: ~₹164–₹162

➡️ Near recent lows and pivot zone where short‑term buyers could step in.

✅ Lower Support: ~₹160–₹158

➡️ Broader support band from slight chart congestion.

⚠️ Deep Support: ~₹138–₹135

➡️ A deeper correction zone identified by longer‑term indicators — likely only relevant if broader markets turn very weak.

🔴 Key 1‑Month Resistance Levels

These are price points that may cap upside near‑term:

🚧 Immediate Resistance: ~₹170–₹171

➡️ Short‑term hurdle around recent highs.

🚧 Next Resistance: ~₹172–₹173

➡️ Slightly stronger resistance if stock breaks above ₹171.

🚧 Higher Resistance: ~₹176–₹177+

➡️ Breakout zone toward the upper end of the near‑term range.

BPCL 1 Week Time Frame 📌 Current Price Context (approx):

BPCL is trading around ₹360–₹366 on NSE in recent sessions.

📈 1-Week Key Levels (Weekly Timeframe)

🔹 Resistance Levels (Upside Targets)

These are important zones where price may pause or reverse if buying pressure weakens:

~₹370–₹372 — Immediate weekly resistance zone where bulls face first hurdle.

~₹374–₹378 — Secondary resistance range on strength.

~₹380+ — Major resistance (also near recent 52-week highs).

Break above ~372–378 with volume could lead to continuation toward higher weekly targets.

🔻 Support Levels (Downside Floors)

These are key support zones where buying interest may emerge:

~₹357–₹360 — Immediate first support — closely aligned with current trading range.

~₹353–₹355 — Next support zone if price dips further.

~₹347–₹350 — Stronger weekly support — break below here could signal deeper correction.

Sustained holds above ~357–360 reinforce bullish/momentum bias on the weekly chart.

Chart Patterns Financial markets speak a language of price. Every movement on a chart represents the collective psychology of millions of participants—institutions, traders, investors, algorithms, and speculators. Chart patterns and candlestick patterns are the visual translation of this psychology. They do not predict the future with certainty, but they provide probabilistic insights into market behavior, trend continuation, reversals, and momentum shifts. Mastering them allows traders to read price action with clarity, discipline, and confidence.

IDFCFIRSTB 1 Week Time Frame 📊 Weekly Support & Resistance Levels

Weekly Resistance Levels

R1: ~₹83.96 — immediate weekly resistance (key breakout level)

R2: ~₹85.63 — next major resistance

R3: ~₹88.44 — extended upside if trend is strong

Weekly Support Levels

S1: ~₹79.48 — first strong weekly support

S2: ~₹76.67 — secondary support zone

S3: ~₹75.00 — deeper support if weakness accelerates

Weekly Pivot (approx central point)

Around ₹81.15–₹81.72 based on weekly pivot analysis

📌 Key Reference Price Context

The stock is currently trading around ₹83‑₹84 on the NSE (Dec 16, 2025).

52‑week range is roughly ₹52.46 low to ~₹84.4 high; price is near its yearly peak.

JINDALSTEL 1 Day Time Frame 📊 Daily Pivot & Key Levels

Pivot Point (Reference): ~₹1,010–₹1,010.27

(This is the central level where direction bias flips intraday.)

🔼 Resistance Levels

R1: ~₹1,017.9 – ₹1,018 📈

R2: ~₹1,022.9 – ₹1,041 📈

R3: ~₹1,030.6 – ₹1,049.9 📈

(Breaking and holding above these can signal bullish strength.)

🔽 Support Levels

S1: ~₹1,005.2 – ₹1,006.2 📉

S2: ~₹997.5 – ₹1,012 📉

S3: ~₹992.5 – ₹1,006 📉

(These act as downside cushions — watch for bounces or breakdowns.)

📈 Short‑Term Bias & Indicators

Moving Averages: Near current price, shorter and medium SMAs/EMAs are tight — indicating potential range trading unless breakout occurs.

RSI: Around neutral (~49), not strongly overbought/oversold.

📊 How Traders Use These

Bullish Scenario: Price sustaining above Pivot → target R1 ➜ R2 ➜ R3.

Bearish Scenario: Price breaking below Pivot → test S1 ➜ S2 ➜ S3.

Range Trades: Buy near supports with stop just below; sell near resistance with stop just above.

ADANIPOWER 1 Week Time Frame 📊 Current price context

• Share price is around ₹144–₹146 per share (as of latest session).

📈 Resistance Levels (Upside)

These are prices where the stock may face selling pressure or pause before further upmove:

1. ~₹147–₹149 — near short-term resistance cluster.

2. ~₹150–₹153 — pivot/fib resistance from short-term charts.

3. ~₹160–₹165/₹170 — higher target zone if bullish momentum strengthens.

➡️ If the price breaks above ₹150–₹153 with good volume, next upside could test ₹160+ over the week.

📉 Support Levels (Downside)

These are price zones that might act as demand zones if declines occur:

1. ~₹142–₹143 — immediate support from recent pivot levels.

2. ~₹140–₹139 — deeper support if weakness persists.

3. ₹135–₹134 (Lower) — secondary support seen in broader fib/pivot analysis.

➡️ A close below ₹142–₹140 could open the path toward ₹135+ on short-term weakness.