RELINFRA 1 Month Time Frame 📉 What’s Happening Now

As of 8–9 December 2025, Reliance Infrastructure is trading near ₹ 146–147 — its 52‑week low.

Over the past month the stock has seen a sharp drop of ~15–20%.

On 9 Dec it hit a fresh intraday low of ~₹ 139.6‑140, triggering lower‑circuit (i.e. trading halt for the day) — indicating heavy selling pressure.

🔎 Why the Weakness

The recent decline reflects broad selling pressure, partly driven by negative sentiment in its sector and possibly concerns over group‑level regulatory/legal issues.

While the company has been in distress compared with its earlier 52‑week high (~₹ 425), volatility remains high, with the share trading well below major moving averages.

Chatanalysis

AIAENG 1 Day Time Frame Last close: ₹ 3,693.00.

Day’s range: Approx ₹ 3,665.50 to ₹ 3,740.30.

52-week high/low: ~ ₹ 3,774.60 / ₹ 3,001.10.

⚠️ Risks / Things to Watch Today (Intraday)

If price drops below the pivot ~ ₹3,311, it could test support around ₹3,280 or even further.

Strong intraday resistance around mid-MA levels — especially if it rejects around the ₹3,600+ mark.

Volume risk: without strong buying volume, momentum might fade later in the day.

Macro or sector news (mining, cement) could sharply influence this stock intraday.

EUR/USD Long Opportunity – Entry at Support ZoneEntry Zone (Buy Area): Between 1.12729 and 1.13101

Stop Loss: 1.12100

Target (TP1): 1.16950

Risk-Reward Ratio (R:R):

Risk: 1.13101 - 1.12100 = 101 pips

Reward: 1.16950 - 1.13101 = ~385 pips

R:R ≈ 1:3.8 — excellent risk-to-reward

📈 Technical Observations

Bullish Momentum: Strong bullish candles leading into the setup suggest buyers are currently in control.

Support Zone (Entry Area):

The purple zone has acted as a previous resistance, now turned support.

Price may retest this zone before moving higher (as indicated by the blue path on the chart).

Moving Averages:

Red (likely 50 EMA) and blue (possibly 200 EMA) are showing a bullish crossover.

Price is above both MAs, reinforcing a bullish trend.

Projected Move:

The setup anticipates a pullback before a continuation to the upside toward 1.16950.

🧠 Trade Idea Summary

This is a buy-the-dip strategy within a bullish trend.

Entering on the pullback allows for:

Tighter stop loss

Better entry price

Higher R:R ratio

⚠️ Risk Considerations

A break below 1.12100 would invalidate the setup.

Monitor for bearish reversal patterns or news around the EUR/USD that might shift sentiment.

Bitcoin (BTC/USD) Long Trade Setup –with Target 88,573,60Current Price: $80,724.28

Entry Point: $80,671.23 (just above current price)

Stop Loss: $78,052.44

Target Point: $88,573.60

Resistance Point: $82,260.90

📈 Trend & Moving Averages

EMA 30 (red): $80,220.87 — Short-term trend.

EMA 200 (blue): $80,788.61 — Long-term trend.

The price is currently between the EMAs, indicating potential indecision or a shift in trend. A break above both EMAs with momentum would confirm bullish strength.

🔑 Trade Setup Summary

Element Level

Entry 80,671.23

Stop Loss 78,052.44

Target (TP) 88,573.60

Resistance 82,260.90

Risk-Reward ~1:2.7 (approx)

📊 Analysis & Expectations

Bullish Bias: The chart suggests a long trade with a breakout strategy.

Volume and momentum confirmation will be key above resistance.

Resistance at 82,260.90 may cause a brief pullback before continuation to the target.

The stop loss is well-placed below a support zone and the most recent swing low.

✅ What to Watch For

Break and close above EMA 200 and resistance at 82.2K.

Bullish volume increase on breakout.

Price action around the entry zone (wait for confirmation candle if unsure).

Gold (XAU/USD) Intraday Buy Setup – Demand Zone Reversal with 3.Timeframe: Appears to be intraday (possibly 5-15 minutes).

Indicators:

EMA 30 (red): Showing recent bearish momentum.

EMA 200 (blue): Positioned above, indicating a longer-term bearish trend.

Candlestick Pattern: After a steep drop, price shows signs of consolidation and potential reversal.

📌 Trade Setup (Long/Bullish Bias)

Entry Zone: Around $2,963.2

Price is expected to pull back into this purple demand zone before moving up.

Stop Loss (SL): $2,956.1

Placed below the support zone to limit downside risk.

Take Profit (TP / Target Point): $2,988.2

A previous supply zone near the EMA 30, where selling pressure could return.

📊 Risk-Reward Ratio

Risk: $2,963.2 - $2,956.1 = $7.1

Reward: $2,988.2 - $2,963.2 = $25

RRR (Reward-to-Risk Ratio): ~3.5:1

This is a solid ratio, suggesting a high-potential trade if the setup plays out.

📈 Bullish Scenario

Price pulls back into the demand zone (entry).

A bullish candlestick confirmation or wick rejection could trigger a buy.

Target is the previous structure + EMA zone.

EUR/USD Short Setup – Entry at Resistance, Targeting 1.08942"Entry Point: ~1.10456

Resistance Point: ~1.10151

Stop Loss: ~1.10833

Target Point: ~1.08942

Risk/Reward:

Risk: ~37.7 pips

Reward: ~111.4 pips

Approx. R:R = 1:3

Indicators Used:

EMA 30 (red): ~1.09966

EMA 200 (blue): ~1.09607

Price is currently above both EMAs → Generally bullish in the short term, but you seem to be anticipating a reversal from resistance.

Setup Type:

This appears to be a sell setup based on price reaching a key resistance area with rejection signs, possibly a fake-out above resistance before a move down to the target.

⚠️ What to Watch For:

Confirmation Candle: If you're not in the trade yet, look for strong bearish confirmation below resistance to validate the short.

Stop-Loss Placement: It’s placed above the last high in the purple zone – a good defensive move.

EMA Alignment: Since price is above both EMAs, you’re trading against the trend – more aggressive, so extra confirmation is crucial.

EUR/CHF Bullish Reversal Setup – Support Zone Entry with 1:4 RisThe EMA 200 (blue) and EMA 30 (red) are displayed.

Price is below both EMAs, indicating a bearish trend overall.

However, there's a potential reversal or retracement trade being considered.

2. Trade Setup (Long Position):

Entry Point: 0.92750

Stop Loss: 0.92526 (about 22.4 pips below entry)

Target (Take Profit): 0.93643 (about 89.3 pips above entry)

Risk-Reward Ratio (RRR): Approx. 1:4, which is favorable

3. Support & Resistance:

The entry zone is based on a demand/support area where price previously bounced.

The target

Gold (XAUUSD) Reversal Setup: Buy Opportunity from Demand Zone t GOLD (XAUUSD)

Timeframe: 30-minute

Indicators:

EMA 30 (Red): 3,000.22

EMA 200 (Blue): 3,042.92

🔍 Price Action & Zones

Current Price: 2,982.27

Support Zone (Demand Zone): ~2,940.27 (highlighted in purple, labeled as STOP LOSS)

Resistance Zone (Supply Zone): ~3,040.17–3,042.92 (labeled as EA TARGET POINT)

📈 Trade Idea (Based on Drawing)

Strategy: Buy from demand zone, targeting supply zone

Entry: Near 2,940.27

Stop Loss: Slightly below 2,940.27

Target: ~3,040.17

Risk to Reward: ~1:2.6 (visually)

📊 EMA Dynamics

Bearish Bias in the Medium Term: Price is trading below the 200 EMA, indicating an overall bearish trend.

Short-Term Weakness: The price has also dropped below the 30 EMA, confirming bearish momentum in the short run.

🔄 Possible Scenario

Price is currently heading back down toward the demand zone, where a bounce is anticipated.

If it respects that zone, we may see a reversal toward the target zone at ~3,040.

If it breaks below 2,940, the setup would be invalidated (stop loss hit).

⚠️ Things to Watch

Rejection or support confirmation at 2,940 zone is key before entry.

Be cautious of continued bearish momentum if economic news or global risk sentiment shifts.

Look for bullish reversal patterns (e.g. hammer, bullish engulfing) at the demand zone for confirmation.

JPY/USD 30-Min Chart – Bearish Setup from Resistance Zone with 2200 EMA (blue): 0.0067930

30 EMA (red): 0.0068478

Current Price: 0.0068313

Price Position: Currently between the EMAs, showing consolidation and potential indecision.

🟪 Key Zones Identified

Entry Zone (Sell Area): Around 0.0068740

Stop Loss Zone: Above the resistance area at 0.0069118

First Target Zone (EA Resistance Point Target): Around 0.0067636

Final Target Zone (EA Target Point): Around 0.0066745

📉 Short Trade Plan

Entry Point: Price re-tests the resistance zone at 0.0068740

Stop Loss: Above key resistance at 0.0069118

Target 1 (TP1): 0.0067636

Target 2 (TP2): 0.0066745

Risk-to-Reward: Approx. 2.89x, with a -2.89% drop expected from entry to final target.

📊 Price Structure & Trend Insight

The chart shows bearish intent, with repeated rejections from the resistance zone.

A break below the 200 EMA and the support near 0.0067930 would signal stronger downside momentum.

The downward arrow and projection reflect a swing short setup based on market structure and key zones.

✅ Strategy Confirmation

Watch for:

Price rejection from the 0.0068740 level.

Bearish candlestick patterns in that zone (like bearish engulfing or shooting star).

Volume confirmation or momentum slowdown at resistance.

Bullish Reversal Trade Setup for BTC/USD – 4H Chart AnalysisZone: Around 76,094 USD

This zone aligns with a demand/support area, highlighted by the purple rectangle.

Price has sharply dropped into this zone, suggesting a potential reversal or bounce opportunity.

⛔ Stop Loss

Level: Around 73,312 USD

Placed below the support zone to allow some volatility wiggle room.

A break below this could invalidate the bullish setup.

🎯 Target Point (Take Profit)

Level: 87,271 USD

Risk-to-reward ratio is approximately 1:3+, offering solid trade potential.

This level corresponds to a previously established resistance zone or supply area.

📊 Indicators

EMA 50 (red): ~82,106 USD

EMA 200 (blue): ~85,250 USD

Current price is below both EMAs, suggesting short-term bearish momentum, but this setup banks on a mean reversion or swing back up.

📈 Trade Idea Summary

Parameter Value

Entry 76,094 USD

Stop Loss 73,312 USD

Take Profit 87,271 USD

Risk/Reward ~1:3

Setup Type Bullish Reversal

🧠 Extra Notes

Wait for confirmation (candle reversal pattern) in the demand zone before entering.

Be cautious of fake-outs or breakdowns below support, especially with broader market weakness.

Gold (XAU/USD) Technical Analysis: Key Resistance Test Before BrThis chart represents a Gold (XAU/USD) 30-minute timeframe analysis from TradingView. Here are the key takeaways:

Technical Indicators & Levels

Exponential Moving Averages (EMAs)

200 EMA (Blue Line): 3,110.97 – A long-term trend indicator.

30 EMA (Red Line): 3,134.65 – A short-term trend indicator.

Key Levels

Resistance Point: Around 3,136.56.

Support Zone (Stop Loss Level): 3,103.16.

Target Point: 3,167.44, indicating a potential 1.62% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (3,136.56) and holds, the next target is 3,167.44.

A bullish breakout could indicate further momentum.

Scenario 2 (Bearish Case):

If price fails to break resistance and drops, it could test the support zone around 3,103.16.

A break below this level might lead to further downside.

Pattern Analysis:

The chart suggests a potential retest of resistance before a breakout.

A possible accumulation phase before a strong move.

Conclusion

Bullish above 3,136.56, targeting 3,167.44.

Bearish below 3,103.16, watching for downside risk.

The 200 EMA (3,110.97) could act as dynamic support.

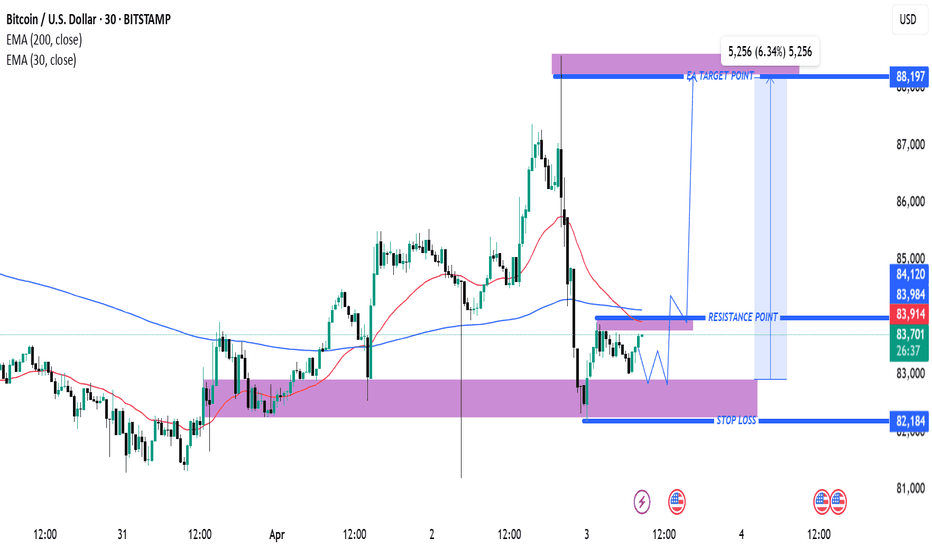

Bitcoin (BTC/USD) Technical Analysis: Breakout or Rejection at K200 EMA (Blue Line): 84,124 – This is a long-term trend indicator.

30 EMA (Red Line): 83,925 – A short-term trend indicator.

Key Levels

Resistance Point: Around 83,925 (marked in blue).

Support Zone: Around 82,184 (Stop Loss zone).

Target Point: 88,197, indicating a potential 6.34% upside.

Potential Trade Setup

Scenario 1 (Bullish Case):

If price breaks above resistance (83,925) and EMA 200, then a move towards 88,197 is expected.

A breakout confirmation might lead to an uptrend continuation.

Scenario 2 (Bearish Case):

If price rejects at resistance (83,925) and falls back below the support zone (82,184), a downward move could happen.

Pattern Analysis:

The chart suggests a potential accumulation phase before a breakout.

Possible retest of resistance before a rally.

Conclusion

Bullish above 83,925, targeting 88,197.

Bearish below 82,184, with potential downside.

Price action near the 200 EMA is crucial for the next move.

Gold (XAUUSD) 30-Minute Trade Setup: Bullish Reversal from SuppoThis chart represents a trading analysis for Gold (XAUUSD) on a 30-minute timeframe. Here are the key points from the chart:

Technical Indicators:

EMA (30, close) - Red Line: 3,124.52 (shorter-term trend)

EMA (200, close) - Blue Line: 3,090.41 (longer-term trend)

Trade Setup:

Entry Point: 3,108.21

Stop Loss: 3,098.52 (just below the support zone)

Target Point: 3,149.04 (potential profit level)

Analysis:

The price is currently bouncing from a purple support zone, which aligns with a short-term retracement.

The 30 EMA (red) is currently above the price, indicating short-term resistance.

The 200 EMA (blue) is significantly lower, showing that the overall trend is still bullish.

A potential long (buy) trade is suggested, as price is expected to reverse from the support level towards the target point of 3,149.04.

Risk-to-Reward Ratio:

The stop loss is set below the key support level to minimize risk.

The target price provides a significant profit potential.

Conclusion:

If price holds above 3,108.21, there is a strong bullish case.

If price breaks below 3,098.52, the bullish setup may become invalid.

Monitoring the 30 EMA resistance will be crucial for confirmation.

Gold (XAUUSD) Bullish Trade Setup: Demand Zone Entry & Target PrThis is a gold (XAUUSD) trading chart from TradingView, showing a technical analysis setup on the 1-hour timeframe.

Key Observations:

Uptrend: The chart shows a strong bullish trend, with price making higher highs and higher lows.

Demand Zone (Entry Point):

A highlighted yellow zone around $3,121.38 indicates a demand area where price is expected to bounce.

This could be a support level or a key order block.

Stop Loss: Placed at $3,112.40, below the demand zone, to minimize risk in case the trade fails.

Target Point:

Set at $3,177.94, which is 1.69% above the entry point.

The expected reward is 52.77 points.

Risk-Reward Ratio: This setup follows a risk-reward strategy, aiming for a potential gain significantly higher than the risk taken.

Trading Strategy:

If the price retraces into the demand zone, a long position (buy) is expected.

A bounce from this zone could lead to a price surge towards the target.

If price falls below the stop-loss level, the trade is invalidated.

Conclusion:

This is a bullish setup relying on a pullback to a key support zone before continuation. Traders may monitor price action in the yellow zone for confirmation before entering a trade

USD/CAD Bullish Trade Setup: Key Support, Entry, and Target AnalThis chart is a technical analysis of the USD/CAD currency pair on a 3-hour timeframe. Here’s a breakdown of the key elements:

Key Observations:

1. Exponential Moving Averages (EMAs):

200 EMA (Blue Line) at 1.43318 – A long-term trend indicator.

30 EMA (Red Line) at 1.43135 – A short-term trend indicator.

The price is currently trading above both EMAs, suggesting a bullish bias.

2. Support and Resistance Levels:

A support zone (purple box) around 1.43010 to 1.43141 has been identified, which the price is expected to respect.

The target level (EA TARGET POINT) is set at 1.44511, indicating a bullish price movement expectation.

3. Entry, Stop Loss & Take Profit:

Entry Point: Near the 1.43318 level (current price area).

Stop Loss: Placed below the supp

GBP/USD 1-Hour Chart Analysis: Bearish Setup with Key ResistanceGBP/USD 1-Hour Chart Analysis: Bearish Setup with Key Levels

Key Technical Indicators:

Current Price: $1.29427

30 EMA (Red Line): $1.29453 (Short-term trend)

200 EMA (Blue Line): $1.29351 (Long-term trend)

Key Resistance Zone: $1.29663 - $1.29851 (shaded purple)

Support & Target Levels:

TP 1: $1.29358

TP 2: $1.29153

TP 3: $1.28895

Final Target: $1.28662

Analysis:

Trend:

The price is struggling around the 30 EMA and 200 EMA, showing indecision.

The shaded resistance zone ($1.29663 - $1.29851) is a key area where sellers may take control.

Trade Setup:

Entry: Expected near $1.29663 (potential rejection from resistance).

Stop Loss: Above $1.29851 (to minimize risk if price breaks higher).

Take Profit Targets: Multiple levels, with the final target at $1.28662.

Bearish Confirmation:

If price gets rejected at resistance, a downside move toward support levels is likely.

A break below 1.29358 could accelerate selling pressure.

Conclusion:

The chart suggests a potential bearish trade setup, with resistance acting as a key rejection point.

Watch for confirmation signals at the resistance zone before entering a short trade.

A break above $1.29851 would invalidate the bearish outlook.

Bitcoin (BTC/USD) 3H Analysis: Key Support & Potential 12% UpsidSupport and Entry Zone (Purple Area at ~$80,253.41)

A significant support zone is marked in purple, indicating a potential area for entry.

This is an area where buying interest is expected.

Stop Loss (~$77,784.92)

A stop loss level is defined below the support zone, which is a risk management strategy.

Target Price (~$90,275.48)

The chart suggests a bullish move if the price bounces from the support.

The expected price increase is around 12.25% from the entry level.

Exponential Moving Averages (EMA)

30 EMA (Red Line, $85,290.12): Short-term trend indicator.

200 EMA (Blue Line, $86,061.21): Long-term trend indicator.

The price is currently below both EMAs, suggesting a bearish trend in the short term.

Market Outlook

The price has recently rejected resistance (purple zone above).

If it holds support at ~$80,253.41, a reversal to the upside is expected.

If the support breaks, further downside could follow.

Gold (XAU/USD) Trade Setup & Analysis – March 28, 2025Gold (XAU/USD) Trade Analysis – March 28, 2025

Current Market Overview:

Price: $3,073.77

Recent High: $3,074.00

Recent Low: $3,070.29

EMA (30): $3,073.71 (Short-term trend)

EMA (200): $3,047.40 (Long-term trend)

Technical Analysis:

Support & Demand Zone:

The highlighted purple area represents a strong support zone around $3,050 - $3,058, where buyers may step in.

The price is currently pulling back into this area, indicating a potential bullish reversal opportunity.

Bullish Projection:

The chart suggests a retracement to the demand zone, followed by a strong bullish continuation.

A breakout from the minor resistance zone around $3,073 - $3,075 would confirm the uptrend.

Target & Stop Loss:

Entry Zone: Around $3,058.86 (near the demand zone).

Stop Loss: Below $3,047.40 (under the key support and EMA 200).

Target: $3,109.54 (significant resistance level and profit-taking point).

Trade Strategy:

Wait for confirmation of a bullish rejection at the support zone before entering.

If price breaks above the minor resistance, it could indicate momentum toward the target.

Risk-to-reward ratio looks favorable with a potential upside move of +50 points if the trend continues.

Conclusion:

The setup favors a bullish continuation after a pullback.

Key Levels to Watch: $3,058 (entry), $3,047 (stop loss), and $3,109 (target).

Traders should monitor price action at the demand zone before entering a long position.

USD/CAD Bullish Breakout: Trade Hits Target Successfully200 EMA (Blue) at 1.43070: Represents long-term trend resistance.

30 EMA (Red) at 1.42660: Represents short-term trend direction.

Price has strongly surged above the 30 EMA, indicating bullish momentum.

Support and Resistance Levels:

Support Zone (Red area at the bottom): Marked near 1.42150, where the price reversed.

Target Resistance (Blue at the top) at 1.43672: Marking the expected profit zone.

Trade Setup:

Entry Point: Near the support zone at 1.42451-1.42660.

Stop Loss: Placed below 1.42150, to minimize risk.

Target Point: 1.43672, aligning with a previous resistance level.

Price Movement: A strong bullish breakout occurred, moving rapidly toward the target.

Trade Analysis:

✅ Successful Long Trade: Price moved sharply upward after consolidating at support.

📈 Momentum Confirmation: The strong bullish candles indicate aggressive buying.

🎯 Target Achieved: The trade reached the projected 1.43672 level, generating a solid risk-to-reward outcome.

Potential Future Outlook:

If the price sustains above 1.43672, further upside could be seen toward 1.44000.

If it faces resistance, a pullback toward 1.43070 (200 EMA) may occur before another move.