Gold Price Action Update-Clean Breakout with Clear Targets AheadGold has finally broken above the falling trendline, confirming a short-term shift in momentum. The breakout is clean, and price is now holding above the breakout area, which keeps the bullish continuation scenario active.

As long as price respects the highlighted support zone, pullbacks can be used for long opportunities toward the marked upside targets. A break below the invalidation level would cancel this setup, so risk management remains key.

This is a structure-based trade, not a chase.

KEY LEVELS

Entry Zone: 4671 – 4668

1st Target: 4678

2nd Target: 4684

Final Target: 4690

Stop Loss: 4660

Disclaimer

This analysis is for educational purposes only and should not be considered financial advice. Trading involves risk. Please do your own research and use proper risk management.

Commodities

Gold Trapped in Liquidity Range – Expansion PendingGold is currently trading in a post-impulse environment after completing a clear Elliott Wave advance. With the higher-timeframe impulse exhausted, price action has transitioned into a controlled consolidation driven by liquidity, rather than trend continuation.

At this stage, the market is not trending — it is preparing.

Market Structure & Liquidity Context

Price is now boxed between a well-defined Equal High and Equal Low, forming a classic liquidity range. This structure suggests that Smart Money is engineering both sides of liquidity before committing to the next directional move.

The upper range aligns with premium pricing, where buy-side liquidity is resting.

The lower range sits in discount territory, overlapping with higher-timeframe demand.

This environment favors rotation and stop-hunt behavior, not impulsive expansion.

Key Trading Scenarios

🔴 Sell reaction at the highs

If price pushes above the Equal High and taps into the 4688–4690 premium zone , this area is expected to attract sell-side interest. A clear rejection or hesitation here would signal that buy-side liquidity has been taken, opening the door for a rotation back into the range.

🟢 Buy reaction at the lows

If price drops and reaches the 4388–4390 discount zone , this level becomes a key area to watch for support. Strong rejection or stabilization would suggest Smart Money defense, favoring a bounce back toward equilibrium.

Expectation & Bias

This is a rotation market, not a trend market.

Directional continuation should only be expected after a clear break and acceptance outside the range.

Until then:

Patience > prediction

Liquidity > indicators

Reaction > anticipation

Let price show its hand.

💬 Do you expect expansion to come from the highs or the lows first?

Your perspective matters — share your view.

MCX Silver: Healthy Dip Before Next RallyMCX Silver is in a strong long-term uptrend on the daily chart. The market has already completed wave 1, 2, and a strong wave 3 upward. After this big rise, price is now expected to make a normal correction (wave 4). This pullback can come toward the 236,000 area, which is an important support zone. As long as price stays above this support, the overall trend remains bullish. After wave 4 is completed, Silver is expected to start wave 5, which can push prices to new highs. In short, the trend is up, and any dip is a healthy correction, not weakness.

Stay Tuned :)

@Money_Dictators

Gold weekly rotation between 4682 supply and 4420 demand🟡 XAUUSD – Weekly Smart Money Plan | by Ryan_TitanTrader (17/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but weekly price action has clearly transitioned into a controlled Smart Money rotation. After delivering buy-side liquidity into premium, continuation has stalled.

This week’s hot drivers — USD volatility, U.S. yield repricing, and renewed Fed rate-cut expectations amid sticky inflation data and geopolitical hedging flows — are creating ideal conditions for inducement and liquidity engineering rather than clean trend expansion.

With risk sentiment fragile and positioning crowded, Gold is behaving typically at extremes: sweeps, fake breaks, and mean reversion, not impulsive continuation.

🔎 Technical Framework – Smart Money Structure (H4–H1)

Current Phase:

HTF bullish bias remains valid, but internal structure shows distribution from premium after liquidity delivery.

Key Idea:

Sell reactions from premium supply, or wait patiently for a deeper pullback into HTF demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already taken above highs

• Clear rotation channel forming

• Liquidity shortage zone acting as magnet

• Discount demand aligns with prior OB + channel support

💧 Liquidity Zones & Key Levels

• 🔴 SELL GOLD 4680 – 4682 | SL 4690

• 🟢 OB BUY GOLD 4420 – 4418 | SL 4410

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB / FVG retest → expansion or deeper rotation

🎯 Execution Rules

🔴 SELL GOLD 4680 – 4682 | SL 4690

Rules:

✔ Price taps premium channel supply

✔ Buy-side liquidity taken above recent highs

✔ Bearish MSS / CHoCH on H1–M15

✔ Downside BOS confirms distribution

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4560 — liquidity shortage

• 4480 — deeper weekly rotation

• Trail aggressively (distribution play)

🟢 OB BUY GOLD 4420 – 4418 | SL 4410

Rules:

✔ Sweep into weekly discount zone

✔ Strong confluence: HTF OB + channel support

✔ Bullish MSS / CHoCH on M15–H1

✔ Impulsive BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4560 — first reaction

• 4620 — mid-range liquidity

• 4680+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect false breaks during macro headlines

• No entry without MSS + BOS

• Reduce risk near HTF extremes

📍 Summary

Gold is bullish by structure, but this week is about precision execution, not prediction:

• Premium may deliver a Smart Money sell from 4680–4682, or

• Discount at 4420–4418 may reload longs for the next impulsive leg.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for weekly Smart Money gold breakdowns.

Gold fluctuates between 4672 resistance and 4560 support.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (16/01)

📈 Market Context

Gold remains structurally bullish on the higher timeframe, but intraday price action has shifted into controlled rotation. With today’s hot drivers — USD volatility, U.S. yield fluctuations, and ongoing Fed rate-cut speculation — Smart Money is no longer pushing continuation. Instead, liquidity is being engineered around premium and discount zones.

Ahead of U.S. macro headlines and inflation-linked expectations, Gold is behaving typically at extremes: inducement, stop-hunts, and mean reversion rather than impulsive trend extension.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was taken.

Key Idea:

Look for distribution from premium supply or a deeper pullback into discount demand for buying/entry reloads.

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already delivered

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with prior OB support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4670 – 4672 | SL 4680

• 🟢 BUY GOLD 4561 – 4559 | SL 4551

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4670 – 4672 | SL 4680

Rules:

✔ Price taps premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4620 — internal reaction

• 4585 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4561 – 4559 | SL 4551

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4670 — internal liquidity

• 4700+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones = liquidity traps

• Expect fake breaks during news volatility

• No entry without MSS + BOS

• Reduce size near extremes

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4670–4672, or

• Discount at 4561–4559 may reload buying/entry for the next leg higher.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD No breakout today, only liquidity and structure🟡 XAUUSD – Intraday Smart Money Plan

📈 Market Context

Gold remains structurally bullish on the higher timeframe (HTF), but intraday price action is currently transitioning into a controlled corrective phase after buy-side liquidity has already been delivered.

With ongoing USD volatility, U.S. yield fluctuations, and Fed rate-cut speculation, Smart Money is not pushing aggressive continuation today. Instead, price is being engineered around premium and discount liquidity zones.

Ahead of U.S. macro events, Gold is behaving typically near extremes:

inducement → liquidity sweep → mean reversion, rather than impulsive trend extension.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias remains intact, while intraday structure shows rotation and consolidation following the completion of buy-side liquidity grabs.

Key Idea:

• Look for short opportunities from premium supply

• Or long re-entries from discount demand aligned with the higher-timeframe trend

Structural Notes:

• HTF BOS confirms bullish dominance

• Buy-side liquidity already taken

• Price is rotating, not expanding impulsively

• Internal FVG acting as a downside magnet

• Discount demand aligns with prior order block (OB) support

💧 Liquidity Zones & Trade Ideas

🔴 SELL GOLD 4618 – 4620 | SL 4628

🟢 BUY GOLD 4578 – 4576 | SL 4568

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4618 – 4620 | SL 4628

Entry Conditions:

✔ Price taps premium supply

✔ Buy-side liquidity taken above recent highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4595 — internal reaction

• 4578 — liquidity pool

• Trail aggressively (distribution setup)

🟢 BUY GOLD 4578 – 4576 | SL 4568

Entry Conditions:

✔ Liquidity sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish order block

Targets:

• 4618 – 4620 — first reaction

• 4670 — internal liquidity

• 4700+ — continuation if expansion resumes

⚠️ Risk Notes

• Premium zones are liquidity traps

• Expect fake breaks during news volatility

• No entry without MSS + BOS confirmation

• Reduce position size near extremes

📍 Summary

Gold remains bullish by structure, but today is about execution, not prediction:

• 4618 – 4620 may offer a Smart Money distribution short

• 4578 – 4576 is the key discount zone for long reloads

XAUUSD (Gold) – 15M Risk-Reward Based Long SetupGold is currently reacting from a key intraday demand zone after a corrective move within the broader structure. Price has shown rejection from lower levels and is attempting to reclaim structure support.

🔹 Bias: Bullish (Intraday)

🔹 Timeframe: 15 Minutes

🔹 Entry Zone: Demand / Support area

🔹 Stop Loss: Below demand zone (structure invalidation)

🔹 Target: Previous highs / Upper resistance

🔹 RR: Favorable risk-to-reward setup

📌 Confluence Used:

Demand zone support

Previous price reaction area

Structure alignment

Trend channel context

📈 If price holds above the marked support and shows continuation, upside momentum towards the target zone is expected.

⚠️ Invalidation if price closes decisively below the demand zone.

💡 Trade with proper risk management. This is a technical view, not financial advice.

Gold isn’t trending today — it’s rotating to engineer liquidity.🟡 XAUUSD – Intraday Smart Money Trading Plan

📈 Market Context

Gold remains structurally bullish on the higher timeframes, following a strong expansion into previous highs. However, today’s price action is not impulsive. Momentum has slowed, and the market is transitioning into a rotation and rebalancing phase.

With USD volatility, shifting Treasury yields, and ongoing rate-cut speculation, Smart Money is no longer chasing price. Instead, liquidity is being manufactured between premium and discount zones through inducement, stop hunts, and controlled pullbacks.

Today is about execution, not prediction.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Market Phase:

HTF bias: Bullish (BOS confirmed)

Intraday: Corrective rotation after buy-side liquidity delivery

Key Observations:

Buy-side liquidity has already been taken

Price is rotating, not expanding impulsively

Internal FVG acts as a downside magnet

Discount demand aligns with HTF EMA + order blocks

💧 Liquidity Zones & Trade Scenarios

🔴 SELL XAUUSD 4643 | SL 4648

Narrative: Premium Distribution

Price may retrace into a premium zone where Smart Money looks to distribute positions after inducing late buyers.

Entry Conditions:

✔ Price taps the 4643 premium zone

✔ Liquidity sweep above recent highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

4610 — internal reaction

4585 — main liquidity pool

Trail aggressively (distribution setup)

🟢 BUY XAUUSD 4580 | SL 4574

Narrative: Discount Accumulation

A deeper pullback into discount may be used to reload long positions before the next expansion phase.

Entry Conditions:

✔ Sell-side liquidity sweep into 4580

✔ Confluence with discount zone + OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish order block

Targets:

4620 — first reaction

4680 — internal liquidity

4720+ — ATH continuation if expansion resumes

🧠 Expected Institutional Flow

Liquidity sweep → MSS / CHoCH → BOS → Displacement → OB/FVG retest → Expansion

No sweep → no trade

No structure → no entry

⚠️ Risk Management Notes

Highs are liquidity traps, not breakout zones

Expect false breaks during news volatility

No entry without confirmation (MSS + BOS)

Reduce size near premium extremes

📍 Summary

Gold is bullish by structure, but today’s movement is rotational:

4643 may deliver a Smart Money sell

4580 may reload longs for the next push higher

Let liquidity move first.

Let structure confirm second.

Smart Money controls the game. ⚡️

XAUUSD | 15M | Channel Resistance Rejection – Short SetupGold price is trading inside a well-defined ascending channel. Price has now reached the upper channel resistance, aligning with a previous intraday high / supply zone, where selling pressure is visible.

A rejection from this area suggests a potential short-term bearish move, with price likely to rotate back toward the mid / lower channel support.

Technical Structure

Overall structure: Ascending channel

Entry zone: Upper channel resistance

Confirmation: Rejection wicks + loss of momentum

Bias: Short / Pullback trade

Trade Idea

Sell near resistance after confirmation

Stop-loss above channel high

Targets toward channel support / demand area

This setup is based purely on price action and market structure.

Wait for proper confirmation before entering.

⚠️ Not financial advice. Manage risk accordingly.

Gold oscillates between 4690 supply and 4576 demand.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (14/01)

📈 Market Context

Gold remains structurally bullish after printing fresh ATH territory, but price action has clearly slowed into rotation. With markets reacting to today’s hot drivers — U.S. inflation expectations, USD volatility, and shifting Treasury yields — Smart Money is no longer chasing upside. Instead, liquidity is being engineered around premium and discount zones.

Ahead of key U.S. data and rate-cut speculation, Gold is behaving exactly as expected at extremes: stop hunts, inducement, and controlled rebalancing rather than clean continuation.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish bias intact, while intraday structure shows corrective rotation after buy-side liquidity was delivered near ATH.

Key Idea:

Expect distribution from premium supply near ATH, or a deeper pullback into discount demand to reload longs.

Structural Notes:

• HTF BOS confirms bullish dominance

• ATH zone has delivered buy-side liquidity

• Price rotating, not expanding impulsively

• Internal FVG acting as downside magnet

• Discount demand aligns with HTF EMA support

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4688 – 4690 | SL 4700

• 🟢 BUY GOLD 4578 – 4576 | SL 4568

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4688 – 4690 | SL 4700

Rules:

✔ Price taps premium ATH supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS

✔ Entry via bearish FVG or supply OB

Targets:

• 4635 — internal reaction

• 4600 — liquidity pool

• Trail aggressively (distribution play)

🟢 BUY GOLD 4578 – 4576 | SL 4568

Rules:

✔ Sweep into discount demand

✔ Confluence with OB + FVG

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB

Targets:

• 4620 — first reaction

• 4680 — internal liquidity

• 4720+ — ATH extension if expansion resumes

⚠️ Risk Notes

• ATH zones are liquidity traps

• Expect false breaks during news volatility

• No entry without MSS + BOS

• Reduce size near ATH — range expansion risk

📍 Summary

Gold is bullish by structure, but today is about execution, not prediction:

• Premium may deliver a Smart Money sell from 4688–4690, or

• Discount at 4578–4576 may reload longs for the next ATH push.

Let liquidity move first.

Let structure confirm second.

Smart Money controls — patience pays. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

Market Update: Gold The Battle at 4600After an explosive breakout to new all time highs, Gold is currently in a classic breather phase, sustaining its position remarkably well above the previous ATH. We are seeing a high-tight consolidation essentially a Bullish Flag forming on the daily chart. This suggests that the market is merely digesting recent gains and building the necessary energy for the next leg higher. Despite the broader bullish sentiment fueled by recent geopolitical tensions in Iran and the "Powell Probe" investigation into the Fed, the bulls have hit a temporary ceiling.

The 4600 level has emerged as the immediate line in the sand. On a daily closing basis, we are seeing consistent rejection here; the price is struggling to print a solid candle body above this psychological milestone. For a high conviction continuation, we need to see a clear daily close above 4600. Once this horizontal resistance is cleared, the structural path opens up toward the Monthly R2 at 4731.

On the flip side, the downside remains well protected. The Monthly R1 (4526) area is our primary support zone. As long as we hold above this on a daily close basis, the buy the dip mentality remains the dominant play. The mix of sticky CPI data and safe haven rotation keeps the floor solid, even if the bullish wave continuation requires a bit more patience.

Gold reaches new ATH — Smart Money rotates.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (13/01)

📈 Market Context

Gold has officially printed a new All-Time High (ATH), confirming higher-timeframe bullish dominance. However, after delivering buy-side liquidity into premium, price action is no longer impulsive. Instead, Smart Money is transitioning into controlled distribution and rotation, engineering liquidity rather than chasing continuation.

With price stretched deep into premium and resting above prior structure, today’s environment favors liquidity sweeps, inducement, and mean reversion, not blind breakout trading. Execution must be precise, level-based, and confirmation-driven.

🔎 Technical Framework – Smart Money Structure (H1–M15)

Current Phase:

HTF bullish structure intact, but intraday corrective rotation active from premium after ATH print.

Key Idea:

Expect Smart Money to distribute near ATH supply (4630–4632), or rebalance deeply into discount (4492–4490) before the next expansion leg.

Structural Notes:

• Clear HTF BOS confirms bullish dominance

• New ATH delivered buy-side liquidity

• Price reacting from premium with corrective characteristics

• Internal FVG + liquidity pocket acting as magnet below

• Discount OB zone aligns with higher-timeframe demand

💧 Liquidity Zones & Triggers

• 🔴 SELL GOLD 4630 – 4632 | SL 4640

• 🟢 BUY GOLD 4492 – 4490 | SL 4482

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → OB/FVG retest → expansion

🎯 Execution Rules

🔴 SELL GOLD 4630 – 4632 | SL 4640

Rules:

✔ Price taps ATH premium supply

✔ Buy-side liquidity taken above highs

✔ Bearish MSS / CHoCH on M5–M15

✔ Clear downside BOS confirming distribution

✔ Entry via bearish FVG refill or supply OB

Targets:

• 4588 — internal reaction

• 4560 — FVG mitigation

• Trail aggressively (intraday distribution play)

🟢 BUY GOLD 4492 – 4490 | SL 4482

Rules:

✔ Liquidity sweep into discount demand

✔ Confluence with OB + FVG + strong liquidity pool

✔ Bullish MSS / CHoCH on M5–M15

✔ Strong upside BOS with displacement

✔ Entry via refined bullish OB or FVG mitigation

Targets:

• 4520 — first reaction

• 4580 — internal liquidity

• 4630+ — ATH retest if expansion resumes

⚠️ Risk Notes

• New ATH zones are liquidity traps by nature

• Expect false breakouts and aggressive stop hunts

• No trades without MSS + BOS confirmation

• Size down near ATH — volatility can expand rapidly

📍 Summary

Gold is bullish by structure, but today is about rotation, not continuation:

• A reaction at 4630–4632 may deliver a Smart Money sell back into liquidity, or

• A sweep into 4492–4490 may reload longs for the next ATH extension.

Let liquidity move first.

Let structure confirm second.

Smart Money engineers — patience profits. ⚡️

📌 Follow Ryan_TitanTrader for daily Smart Money gold breakdowns.

XAUUSD H4 – Correction, then ExpansionXAUUSD H4 – Pullback Then Continuation Using Fibonacci and Key Levels

Gold remains in a strong bullish trend on H4, but the current structure suggests the market needs a pullback into liquidity before the next expansion leg.

Market View

The recent rally has pushed price into premium territory, which often triggers short-term profit-taking.

Fibonacci extensions are acting as liquidity magnets: 2.618 is a key reaction zone, while 3.618 is the next expansion target.

Main approach: wait for the pullback into support/buy zones, then follow the trend.

Key Levels to Watch

Near resistance: 4546–4550 (reaction zone / key resistance)

Sell reaction zone: 4632–4637 (Fibonacci 2.618, likely to cause volatility)

Expansion target: 4707 (Fibonacci 3.618)

Buy liquidity zone: 4445–4449 (best buy area in this structure)

Strong support: 4408 (critical defensive support)

Scenario 1 – Shallow Pullback, Then Push Higher

Idea: price pulls back lightly, holds structure, and resumes the uptrend quickly.

Preferred pullback zone: 4546–4550

Expectation: move back up toward 4632–4637, and if absorbed, extend toward 4707

Confirmation to watch: H4 candles hold above 4546–4550 with clear buying response (rejection wicks, strong closes, momentum return)

Scenario 2 – Deeper Pullback to Sweep Liquidity, Then Strong Rally

Idea: price sweeps deeper into the best demand zone before the next major leg.

Deep pullback zone: 4445–4449

Expectation: bounce back to 4546–4550 → then push to 4632–4637 → and potentially extend to 4707

Confirmation to watch: strong reaction at 4445–4449 (buyers absorb, structure holds, no clean breakdown)

Important Notes

4632–4637 is a sensitive zone where profit-taking and sharp swings can appear before continuation.

If price breaks and holds below 4445–4449, shift focus to 4408 to judge whether the bullish structure is still being defended.

Conclusion

The main trend is still bullish, but the best edge comes from waiting for a pullback and buying at key levels. Focus zones: 4546–4550 (shallow pullback) and 4445–4449 (deep pullback with better R:R). If Fibonacci expansion continues, the next upside target is 4707.

If you share the same view, follow me to get the next updates earlier.

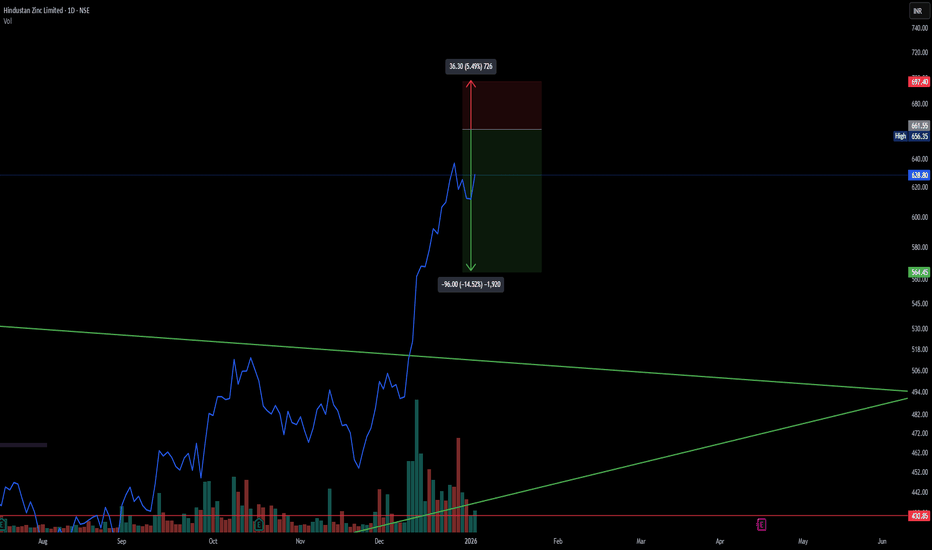

HIND ZINC SHORT TRADE -RISKYTechnical Analysis

Parabolic Extension: The stock has seen a massive, nearly vertical rally from the ~400 levels to highs near 670 in a very short span. Such parabolic moves are rarely sustainable without a significant correction or consolidation phase.

Rejection at Highs: The price action shows a sharp pullback from the recent high of 661.55, indicating that profit booking is kicking in and buyers are exhausted at these elevated levels.

Risk/Reward Ratio: The current setup offers a favorable Risk/Reward ratio for a short position. The stop loss is tight relative to the potential downside move as the stock attempts to revert to the mean.

Volume Profile: High volume during the ascent suggests strong participation, but upcoming sessions should be watched for distribution volume (selling pressure) to confirm the top.

Trade Setup (Short)

Entry Zone: 661 (Looking for rejection near the highs)

Stop Loss: 697.40 (Strict SL above recent swing high to protect against a "blow-off top")

Target: 564.45 (Targeting the gap fill/retracement to previous structure support)

Potential R:R: ~ 1:2.6

⚠️ Disclaimer: This chart analysis is shared for educational and informational purposes only. It does not constitute financial or investment advice. I am not a SEBI registered research analyst. Trading in the stock market involves a high degree of risk. Please consult with a certified financial advisor and perform your own due diligence before making any trading decisions.

RELIANCE: Major Weekly Breakout & Long SetupTechnical Analysis

Structure Breakout: The stock has successfully broken out above a key multi-month resistance level at 1592.30 (marked by the green horizontal line). This level previously acted as a significant supply zone, forming the rim of a potential bullish consolidation pattern (resembling a Cup & Handle or Rounding Bottom).

Momentum: The recent weekly candles show strong bullish momentum, pushing through the resistance with conviction. The price is now sustaining above this breakout point, which validates the bullish thesis.

Trend Continuation: After a period of correction and consolidation, the primary uptrend seems to be resuming. The Higher High (HH) formation on the weekly chart confirms the strength of buyers.

Risk/Reward: The setup offers an excellent Risk-to-Reward ratio (approximately 1:3), making it a high-probability trade for positional traders.

Trade Setup (Long)

Entry Zone: 1592 - 1600 (On the retest or continuation above the breakout level)

Stop Loss: 1509.15 (Placed below the breakout candle and recent swing structure to invalidate the thesis)

Target: 1855.60 (Projected measured move based on the depth of the previous consolidation)

Potential R:R: ~ 1:3.1

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. I am not a SEBI registered analyst. Trading involves risk; please consult your financial advisor and conduct your own analysis before executing any trades.

XAUUSD: Bullish Breakout Confirmed? New ATH in Play!As anticipated in our weekly analysis, Gold started the week with a bang, opening with a positive gap and aggressively smashing through the previous All Time High of 4550. We are currently trading in "uncharted territory," and the price action is screaming bullish across all major timeframes.

🔍 Market Context & Drivers

The surge isn't just technical; the fundamental backdrop is fueling this "fear trade":

Geopolitical Flare-up: Tensions are peaking as the U.S. considers military options in Iran following recent unrest, alongside ongoing frictions in Venezuela.

Safe-Haven Inflow: Growing concerns over the Federal Reserve’s independence and the U.S. Supreme Court’s upcoming ruling on tariffs (expected Wednesday) are pushing investors toward the safety of gold.

Dovish Tailwinds: Last Friday's soft NFP data (only 50k jobs added) has cemented expectations for further Fed rate cuts, lowering the opportunity cost for holding Gold.

🛠 Trading Strategy

The trend is clearly your friend here. Since we have successfully breached the 4550 barrier, the focus shifts to the Daily Close.

The Confirmation: We need a solid Daily candle closing above 4550. This validates the breakout and traps the late sellers.

Buy the Dip: If we see a retest of the 4550-4540 area, it’s a high-probability "buy on dip" zone.

The Target: Once the breakout is confirmed, our primary objective is the Monthly R2 at 4731, with a secondary long-term target eyeing the 5000 milestone.

Immediate Target// 4731 Monthly R2 Pivot & psychological extension.

Breakout Zone// 4550 Previous ATH; Must close above this on the Daily to confirm.

Primary Support// 4550 - 4540 The "Flip Zone" (Old Resistance becoming New Support).

Major Support// 4500 Psychological handle & secondary structural floor.

My Entry Setup 4

Before Trade Entry Follow the Step:-(check list)

Step 1:- Identify the Trend

Step 2:- Bullish Trend Wait for Support Price & Reversal Candlestick(Take Buy)

Step 3:- Bearish Trend Wait for Resistance & Reversal Candlestick(Take Sell)

Step 4:- Fibonacci retracement confirm

Step 5:- Wait for Reversal candlestick

My Trading Role:-

1. Don't Lose capital

2. Trade less Earn More

Focus On:-

1. Quality Trades

2. Risk Management

3. Self - Discipline

RISK WARNING:- All trading involves risk. Only risk capital you're prepared to lose. This video has not given any investment advice, only for educational purposes.

Why breakout entries fail (and how I wait for confirmation)Most breakout losses happen because entries are too early.

Instead of chasing the breakout, I wait for:

1) A clearly defined range

2) A clean breakout

3) Pullback / acceptance into the range

4) Continuation confirmation

This simple framework helps avoid fake moves and improves risk–reward.

I later automated this process into a private tool to remove subjectivity,

but the logic itself is what matters most.

This chart shows one example on XAUUSD using a higher timeframe.

XAUUSD (H1) – Following the bullish channelpatience before continuation ✨

Market structure

Gold remains in a well-defined ascending channel on the H1 timeframe. Despite recent intraday pullbacks, the overall structure is still bullish with higher highs and higher lows preserved. Current price action shows consolidation inside the channel rather than any sign of trend reversal.

Technical outlook (Lana’s view)

Price is rotating around the midline of the rising channel, indicating healthy digestion after the previous impulsive leg.

The recent pullback appears to be a controlled correction, likely aimed at collecting buy-side liquidity before the next expansion.

Market is still respecting structure and trendline support — no breakdown confirmed so far.

Key levels to watch

Buy-side focus

FVG Buy zone: 4434 – 4437

A clean reaction here could offer a good continuation entry within the trend.

Major buy zone: 4400 – 4404

This is the stronger demand area aligned with channel support and previous structure.

Sell-side reaction (short-term only)

4512 – 4515

This zone aligns with Fibonacci extension and channel resistance, where short-term profit-taking or reactions may appear.

Scenario outlook

As long as price holds above the lower channel boundary, bullish continuation remains the primary scenario.

A pullback into FVG or the lower buy zone followed by confirmation would favor another push toward channel highs and liquidity above.

Only a clean break and acceptance below 4400 would force a reassessment of the bullish bias.

Lana’s trading mindset 💛

No chasing price near resistance.

Let price come back into value zones inside the channel.

Trade reactions, not predictions.

Trend is your friend — until structure says otherwise.

This analysis reflects a personal technical perspective for educational purposes only. Always manage risk carefully.

How does today’s gold top compare to the 1980 and 2011 peaks?Gold is not just at a nominal high — it is trading at the highest real (inflation-adjusted) price in modern history.

How does today’s gold top compare to the 1980 and 2011 peaks?

1️⃣ GOLD MAJOR TOPS — NOMINAL vs REAL (TODAY’S MONEY)

🔴 1980 GOLD TOP (true panic peak)

Nominal price (1980): ~$850/oz

Inflation-adjusted to today: ~$3,200–3,400/oz

What the world looked like:

Double-digit inflation

Oil crisis

Cold War escalation

Dollar confidence collapse

Real rates deeply negative

Monetary panic

Meaning: This was a once-in-a-generation monetary crisis peak.

🟠 2011 GOLD TOP (QE / crisis fear)

Nominal price (2011) : ~$1,920/oz

Inflation-adjusted to today : ~$2,600–2,700/oz

What the world looked like:

Global Financial Crisis aftermath

QE everywhere

Eurozone debt crisis

Fear of currency debasement

Inflation still relatively controlled

Meaning: This was a financial-system fear peak, not a currency collapse.

🟡 TODAY (2025–26) GOLD ~ $4,584

Nominal price : ~$4,584/oz (new high)

Inflation-adjusted: $4,584 (today’s dollars by definition)

Compared to past real peaks:

~35–45% above the 1980 real peak (~$3,300 mid-range)

~70–75% above the 2011 real peak (~$2,650 mid-range)

This is extremely important : today’s gold price is already the highest real gold price in modern history.

2️⃣ TABLE SUMMARY

| Gold Peak | Nominal Then | Real Value Today |

| 1980 panic | ~$850 | ~$3,200–3,400 |

| 2011 QE | ~$1,920 | ~$2,600–2,700 |

| Today | ~$4,584 | $4,584 |

3️⃣ WHAT MAKES TODAY DIFFERENT FROM 1980 & 2011

Today:

Inflation already happened

Debt far higher than 1980 or 2011

Central banks trapped

Geopolitical fragmentation

De-dollarization pressure

Central banks buying gold aggressively

Takeaway: Today’s price reflects structural distrust , not just panic.

4️⃣ WHAT A REAL GOLD TOP USUALLY MEANS NEXT

Historically, after gold peaks in real terms:

Nominal price may still go higher briefly

Then:

Long consolidation

Sharp correction

Or years of underperformance vs inflation

Gold doesn’t crash like silver — it bleeds purchasing power over time . That’s how tops resolve.

Disclaimer:

This post is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Readers should conduct their own research or consult a professional before making any financial decisions.