Dollar IndexHello and welcome to this analysis

With FED all set to start the rate cut cycle from today's FOMC meet, DXY is expected to enter the potential reversal zone (PRZ) of not one but two bullish Harmonic patterns, namely, bullish AB=CD and bullish Crab, likely forming a triple bottom in the weekly time frame.

The PRZ is between 100 - 99.60 while the patterns would be considered invalid below 99.50, for a possible bounce (if not reversal) till 103.

When will it enter the PRZ by? Will depend totally on hawkish/dovish, FED Chairman Jeremy Powell is in his statement today.

Regards

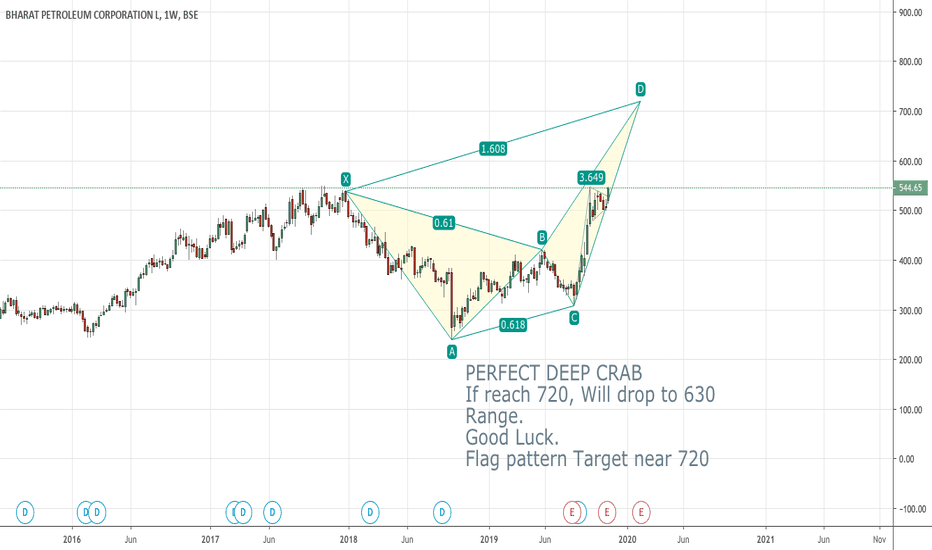

Crabpatterns

#AARTIIND LongAARTI INDUSTRIES creating a wonderful opportunity for a LRHR trade setup with only one down leg pending. Considerable buying range is 450-440 with a stoploss of 425. The Double zig-zag corrective waves is in its final leg supported by a classic Gartley harmonic pattern and also a classic crab in DTF.

ASIAN PAINTS PRICE ACTION ANALYSIS. Asian Paints has crossed 3163 levels with high volumes after breaking the demand zone 2. For a better risk-reward ratio, we can wait for a pullback until 3163, which is expected to act as good support.

Place your stop loss level below the demand zone 2.

The XABCD bearish crab pattern sets a 1.618 fib extension level as a profit booking level for longs. Book your profits here and wait for the price action for a new position.

All the levels and information is mentioned on the chart as well.

Happy trading :)

This is just for educational purposes. Trade responsibly with proper financial advice.

Berger Paint good short candidate.Berger Paints Spot CMP :- 735

Bearish Crab Pattern formation :-

PRZ zone :- 726-738 levels.

SLZ zone :- 760 levels

1.618 XA :- 726 level

2.618 BC :- 738

Elliot Wave Study :- Currently counter is trading in impulse wave 3 of impulse phase.. At the moment wave 3 have extension of 2% of wave 1 which is around 745 levels.. if wave 4 unfolds from this levels retracement till levels of 660-620 possible.

Chart Pattern :- Rising parallel channel , Currently counter is trading around resistance trend line of rising channel pattern,, if unable to sustain around this levels and fall to mid line and lower support line of channel.

RSI :- Price is making higher high and RSI is making lower high, bearish divergence..

Good short candidate.....