What Makes Crypto Different from Traditional AssetsIntroduction

Cryptocurrencies have emerged over the last decade as a revolutionary form of digital asset, capturing global attention for their potential to redefine finance, investment, and even societal trust. Unlike traditional assets such as stocks, bonds, and fiat currencies, crypto operates on decentralized networks and utilizes cryptographic principles. While traditional assets have been the cornerstone of financial markets for centuries, crypto introduces novel features and risks that set it apart. Understanding these differences is crucial for investors, policymakers, and anyone interested in the evolution of financial markets.

1. Nature of the Asset

Traditional Assets: Traditional financial assets represent ownership in a tangible or legal entity. For example, stocks signify a share of ownership in a company, bonds are debt instruments promising future repayment, and real estate represents physical property. Their value is often tied to cash flows, earnings, or physical utility.

Cryptocurrencies: Cryptocurrencies are purely digital assets, existing only on a blockchain—a distributed ledger maintained by a network of computers. They do not inherently represent ownership of a company or tangible goods (except for certain tokenized assets). Their value derives from scarcity (like Bitcoin’s capped supply), network adoption, and market sentiment rather than conventional cash flows.

Key Difference: Crypto is an intangible, digital-only asset whose value is largely determined by market perception, adoption, and underlying blockchain technology, unlike traditional assets which are tied to tangible ownership or income streams.

2. Decentralization and Control

Traditional Assets: Traditional assets are regulated and controlled by central authorities such as governments, central banks, and regulatory bodies. For instance, stock markets operate under oversight from institutions like the SEC in the United States. Transactions are intermediated by banks, brokers, and clearinghouses, ensuring compliance with legal frameworks.

Cryptocurrencies: Most cryptocurrencies operate on decentralized networks, meaning no single entity controls the system. Transactions are verified by a distributed network of nodes using consensus mechanisms such as proof-of-work or proof-of-stake. Users can transact peer-to-peer without intermediaries, reducing reliance on centralized authorities.

Key Difference: Crypto offers decentralization and autonomy, whereas traditional assets rely heavily on centralized intermediaries for governance and transaction verification.

3. Supply and Inflation Mechanisms

Traditional Assets: Fiat currencies are subject to monetary policy, with central banks controlling supply to influence inflation, interest rates, and economic growth. Stocks are issued at the discretion of companies, and bonds follow government or corporate debt issuance schedules. The supply can be increased or adjusted according to policy or corporate strategy.

Cryptocurrencies: Cryptos like Bitcoin have fixed supplies encoded in their protocols (Bitcoin’s maximum supply is 21 million coins). Other cryptocurrencies use algorithms to control issuance and incentivize network participation. This scarcity is designed to emulate deflationary characteristics, contrasting with the often inflationary nature of fiat currencies.

Key Difference: Crypto supply is usually pre-determined and algorithmically enforced, whereas traditional assets are subject to discretionary management and central control.

4. Liquidity and Market Accessibility

Traditional Assets: Stocks and bonds are traded on regulated exchanges with established liquidity and market hours. Investors often require brokerage accounts, and trading may be limited by jurisdictional regulations. While liquidity is generally high for large-cap assets, small markets may suffer from limited participants.

Cryptocurrencies: Crypto markets operate 24/7 globally with virtually no geographic restrictions. Anyone with internet access can buy, sell, or hold crypto, often without the need for traditional intermediaries. However, liquidity can vary widely between coins; while Bitcoin and Ethereum are highly liquid, smaller tokens may be subject to high volatility and thin markets.

Key Difference: Crypto markets are continuously accessible and globally decentralized, unlike traditional markets with operational hours and regional constraints.

5. Volatility and Risk Profile

Traditional Assets: Traditional assets tend to have established risk-return profiles. While stocks can be volatile, especially in emerging sectors, they are generally less erratic compared to crypto. Bonds provide predictable returns with lower volatility, and commodities fluctuate based on supply-demand fundamentals.

Cryptocurrencies: Cryptos are highly volatile. Prices can swing 10–20% in a single day due to market sentiment, regulatory news, or technical developments. While volatility offers opportunities for high returns, it also carries substantial risk. Crypto markets are less mature and less predictable than traditional markets.

Key Difference: Crypto’s extreme volatility distinguishes it as a high-risk, high-reward asset class, unlike the relatively stable behavior of traditional financial assets.

6. Regulation and Legal Framework

Traditional Assets: Traditional financial assets operate under well-established legal frameworks and are protected by investor safeguards. Securities laws, accounting standards, and regulatory oversight aim to reduce fraud and systemic risk.

Cryptocurrencies: Crypto regulation is still evolving. Some countries have embraced it, creating frameworks for trading, taxation, and custody, while others ban or restrict usage. Lack of regulation can lead to fraud, hacking, and market manipulation. Investor protections are often minimal compared to traditional markets.

Key Difference: Traditional assets are highly regulated with legal recourse for investors, whereas crypto operates in a more ambiguous and evolving regulatory environment.

7. Transparency and Verification

Traditional Assets: Transparency in traditional assets is often limited to financial reporting, audits, and regulatory filings. Verification of ownership or transactions usually requires intermediaries like banks or clearinghouses.

Cryptocurrencies: Blockchains provide public, immutable ledgers where anyone can verify transactions without intermediaries. Smart contracts enable automatic execution of agreements. This transparency reduces the need for trust in centralized authorities but requires understanding of blockchain technology.

Key Difference: Crypto enables direct, verifiable transparency of transactions, while traditional assets rely on intermediaries for reporting and verification.

8. Divisibility and Portability

Traditional Assets: While fiat currencies are divisible and easily transferable, assets like real estate or certain bonds are not easily fractioned or transferred. Stocks can be subdivided through shares, but some physical assets remain illiquid or cumbersome.

Cryptocurrencies: Cryptos are highly divisible; for example, Bitcoin can be split into 100 million units called satoshis. Digital nature makes them extremely portable and transferrable across borders instantly with minimal fees compared to traditional banking systems.

Key Difference: Cryptos offer unmatched divisibility and portability, enhancing flexibility for small and large investors alike.

9. Innovation and Utility

Traditional Assets: The utility of traditional assets is relatively straightforward—stocks provide ownership, bonds offer interest, and commodities have industrial or consumption uses. Innovation in traditional finance occurs, but structural changes are slow due to regulatory and institutional constraints.

Cryptocurrencies: Cryptos are more than just assets; they enable decentralized finance (DeFi), tokenization, programmable money, and novel applications like NFTs. They offer utility within their ecosystems, such as participating in governance, staking, and decentralized applications.

Key Difference: Cryptos combine financial value with technological utility, whereas traditional assets primarily serve as stores of value or income generation tools.

10. Security and Custody

Traditional Assets: Security in traditional finance depends on trusted intermediaries—banks, brokers, and clearinghouses. Physical assets can be insured, and digital assets in broker accounts are protected by legal frameworks.

Cryptocurrencies: Crypto security is decentralized but relies heavily on private key management. Loss of keys can mean permanent loss of funds. While blockchain is secure by design, exchanges and wallets have been hacked, emphasizing the importance of personal custody practices.

Key Difference: Crypto security shifts responsibility to the individual, unlike traditional assets where intermediaries shoulder the protection burden.

11. Global Accessibility and Inclusivity

Traditional Assets: Access to traditional assets often requires citizenship, residency, or local bank accounts. Emerging markets may face barriers due to infrastructure limitations or regulatory constraints.

Cryptocurrencies: Crypto allows anyone with internet access to participate in global markets. It can provide financial inclusion to unbanked populations, bypassing traditional barriers.

Key Difference: Cryptos are inherently borderless and democratizing, while traditional assets are constrained by geography and regulatory frameworks.

Conclusion

Cryptocurrencies fundamentally differ from traditional assets across multiple dimensions: nature, control, supply mechanisms, liquidity, risk, regulation, transparency, divisibility, innovation, security, and accessibility. Traditional assets are backed by tangible entities or cash flows, regulated by authorities, and generally stable, while crypto thrives on decentralization, digital scarcity, and technological innovation.

These differences create opportunities and challenges. On one hand, crypto democratizes finance, allows for 24/7 global markets, and enables programmable financial tools. On the other hand, it introduces high volatility, regulatory uncertainty, and security risks. As the financial landscape evolves, understanding these distinctions is critical for investors, regulators, and innovators aiming to navigate both traditional and digital asset ecosystems.

Cryptocurrency is not merely an alternative investment; it represents a paradigm shift in how value, trust, and financial transactions are conceived. While traditional assets remain foundational to wealth creation, crypto pushes the boundaries of what constitutes money, ownership, and economic participation in the 21st century.

Crypotrading

Crypto Trading Guide1. Introduction to Crypto Trading

Cryptocurrency trading involves buying, selling, and exchanging digital assets in order to profit from price fluctuations. Unlike traditional markets, crypto trading operates 24/7 due to the decentralized nature of blockchain technology. The crypto market is highly volatile, which presents both opportunities and risks for traders. Popular cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cardano (ADA), and many more altcoins.

Crypto trading is divided into two main categories:

Spot Trading: Buying and selling cryptocurrencies for immediate settlement.

Derivatives Trading: Using financial contracts like futures and options to speculate on price movements without owning the underlying asset.

2. Understanding the Crypto Market

2.1 Market Structure

The crypto market is unique in its decentralized, borderless structure. Unlike traditional markets with centralized exchanges, crypto operates via:

Centralized Exchanges (CEX): Platforms like Binance, Coinbase, and Kraken. These offer high liquidity but require trust in the platform.

Decentralized Exchanges (DEX): Platforms like Uniswap and SushiSwap. These run on smart contracts and allow peer-to-peer trading.

2.2 Market Participants

Crypto market participants include:

Retail Traders: Individual traders buying or selling for personal gain.

Institutional Traders: Hedge funds, banks, and large investors.

Market Makers: Entities that provide liquidity by simultaneously placing buy and sell orders.

2.3 Market Hours

Unlike stock markets, crypto markets operate 24/7, which allows traders to react to news and events instantly. However, this also increases the risk of impulsive decisions.

3. Types of Crypto Trading

3.1 Spot Trading

Spot trading is the simplest form of crypto trading where traders buy crypto at current market prices. Key considerations include:

Order Types: Market orders (buy/sell immediately), limit orders (buy/sell at a specific price), and stop-loss orders (automated exit at a set loss level).

Portfolio Diversification: Spreading investments across multiple assets reduces risk.

Risk Management: Setting strict entry and exit rules is critical due to high volatility.

3.2 Margin Trading

Margin trading allows traders to borrow funds to increase exposure. For example, with 10x leverage, a $100 trade controls $1000 worth of assets.

Risks: Margin trading amplifies both profits and losses. Liquidation occurs if losses exceed collateral.

3.3 Futures and Options Trading

Derivatives trading enables speculation on price movements:

Futures Contracts: Agreements to buy or sell an asset at a future date at a predetermined price.

Options Contracts: Rights (but not obligations) to buy or sell at a fixed price within a certain time.

Perpetual Contracts: Futures with no expiry, commonly used in crypto derivatives markets.

3.4 Algorithmic and Bot Trading

Automated trading uses algorithms to execute trades based on predefined strategies:

Trend-following bots: Buy in uptrends, sell in downtrends.

Arbitrage bots: Exploit price differences between exchanges.

Market-making bots: Provide liquidity while capturing spreads.

4. Fundamental Analysis (FA) in Crypto

FA evaluates a cryptocurrency’s intrinsic value based on technology, adoption, and market dynamics. Key factors include:

Whitepapers: Technical documents explaining the coin’s purpose, roadmap, and use cases.

Development Activity: Active GitHub commits and project updates indicate sustainability.

Network Metrics: On-chain data like transaction volume, wallet addresses, and staking rates.

Regulatory Environment: Government policies can significantly affect prices.

5. Technical Analysis (TA) in Crypto

TA uses historical price data to predict future trends. Key tools and concepts include:

5.1 Chart Patterns

Triangles, Head & Shoulders, Double Tops/Bottoms: Patterns indicate potential reversals or continuations.

Support and Resistance Levels: Price points where buying or selling pressure is strong.

5.2 Indicators and Oscillators

Moving Averages (MA): SMA, EMA help identify trends.

Relative Strength Index (RSI): Measures overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Trend and momentum indicator.

Bollinger Bands: Measure volatility and potential breakout points.

5.3 Volume Analysis

High trading volume confirms price trends, while low volume may indicate weak moves.

6. Risk Management

Effective risk management is crucial in crypto due to volatility:

Position Sizing: Risk only a small percentage (1–3%) of your capital per trade.

Stop-loss Orders: Limit potential losses automatically.

Diversification: Spread investments across multiple coins and strategies.

Avoid Overleveraging: Using excessive leverage increases the chance of liquidation.

7. Trading Strategies

7.1 Day Trading

Traders buy and sell within the same day to profit from short-term price movements. Requires constant monitoring.

7.2 Swing Trading

Holding positions for days or weeks to capture medium-term trends. Combines TA and FA.

7.3 Scalping

Quick trades lasting seconds to minutes. Focuses on small price changes with high frequency.

7.4 HODLing

Long-term strategy where traders hold assets regardless of market fluctuations. Common with Bitcoin and Ethereum.

8. Psychology of Crypto Trading

Emotional discipline separates successful traders from losers:

Avoid FOMO (Fear of Missing Out): Impulsive buying during rapid price surges can lead to losses.

Control Greed: Exiting trades too late can reverse profits.

Patience and Discipline: Following a strategy consistently is more important than predicting the market perfectly.

9. Security and Safety

Crypto security is critical due to hacks and scams:

Wallets:

Hot Wallets: Online wallets for active trading; convenient but vulnerable.

Cold Wallets: Offline storage; highly secure for long-term holdings.

Two-Factor Authentication (2FA): Adds an extra security layer.

Exchange Reputation: Use reputable exchanges with insurance and strong security protocols.

10. Taxes and Regulations

Crypto trading is subject to tax in most countries. Regulations vary widely:

Taxable Events: Selling crypto, converting to fiat, or trading one coin for another.

Reporting Requirements: Maintain transaction records for audits.

Regulatory Compliance: Know your country’s laws to avoid legal issues.

11. Tools and Resources

Traders rely on tools for research, trading, and risk management:

Trading Platforms: Binance, Coinbase, Kraken.

Charting Tools: TradingView, Coinigy.

News Sources: CoinDesk, CoinTelegraph, CryptoSlate.

Portfolio Trackers: Blockfolio, Delta App.

12. Common Mistakes to Avoid

Ignoring risk management rules.

Overtrading or excessive leverage.

Falling for pump-and-dump schemes.

Neglecting security practices.

Blindly following social media tips.

13. Emerging Trends in Crypto Trading

DeFi (Decentralized Finance): Lending, borrowing, and yield farming.

NFTs (Non-Fungible Tokens): Digital collectibles and gaming assets.

Layer 2 Solutions: Faster, cheaper transactions on Ethereum (e.g., Polygon).

AI-Powered Trading: Leveraging artificial intelligence for predictive analytics.

14. Conclusion

Crypto trading offers immense profit potential but comes with high risk. Success requires a combination of:

Strong technical and fundamental analysis skills.

Effective risk and money management.

Psychological discipline and patience.

Staying updated with market trends, news, and regulatory changes.

By developing a systematic trading plan, diversifying strategies, and prioritizing security, traders can navigate the volatile crypto markets more confidently.

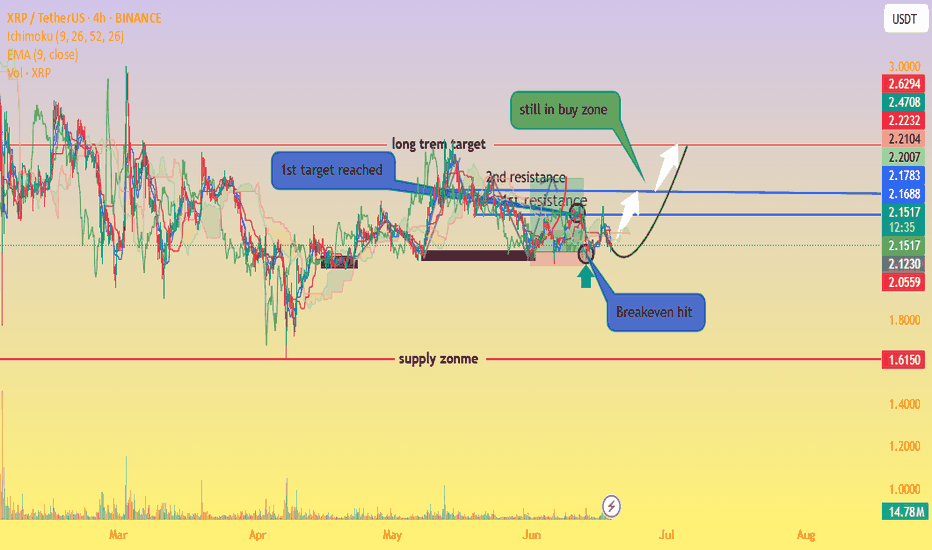

XRP Still in Buy Zone – Eyes on $2.50+our chart clearly marks that XRP has bounced off a strong buy zone (around the $2.10–$2.15 range), aligning well with a classic setup: price hitting support, creating a small base, and starting an upward rotation. 👇

Support area respected – The highlighted circle shows XRP revisiting the demand zone and quickly rebounding, very bullish behavior.

Lower wicks & volume spike – Indicate absorption of selling pressure and possible institutional interest.

Green arrow projection – Suggests a break above the immediate resistance (~$2.17 EMA/Ichimoku levels) could trigger a rally toward the next resistances around $2.22, $2.47, and potentially $2.63.

“Still in buy zone” annotation – Absolutely valid: as long as XRP stays above that key base ($≈$2.10), the bullish case holds.

🔍 Market Context

Range consolidation between ~$2.10–$2.30 has been the dominant theme, awaiting a breakout catalyst (e.g., ETF approvals or legal clarity)

thecryptobasic.com

+14

fxempire.com

+14

crypto.news

+14

.

Analysts highlight a falling wedge and support zone between $2.00–$2.20—if price holds, a move toward $3–$4 is plausible .

A range-bound weekly outlook anticipates a push toward $2.50 resistance before exploring higher targets .

✔️ Summary

Buy zone holding: Bullish pattern confirmed with rebound from support.

Key resistance levels: Watch for a breakout above $2.17/EMA and then $2.22–$2.30/$2.50.

Ideal strategy: Maintain position above support; add on breakout, targeting $2.50–$3.00.

Risk points: A drop below $2.10 could test $2.00 or even $1.85 support.

Is Bitcoin on the Verge of a Massive Breakout?Bitcoin's wave ((4)) has successfully completed a W-X-Y corrective formation. If Bitcoin manages to decisively break above the key resistance level of 88,826, it could trigger a powerful impulsive rally, potentially driving prices toward the next major targets at 95,250 - 99,508 - 109,176.

Additionally, the parallel channel's lower trendline is offering substantial support, preventing further downside movement. A strong breakout above this channel could significantly enhance bullish momentum, increasing the probability of Bitcoin reaching new all-time highs. We will update you soon!

BTC Update as on Jan 02, 2025BTC Swing Trade View :

As per the current price action Support Area around 91800-95000. This is where the price has found some stability after the recent pullback. It's a level where buyers have stepped in to prevent further price drops.

from the current market sentiments and from the time cycle perspective I am considering the following moves :

High Probability: This is what I am expecting ,Given the current trend, price is going to re test the recent ATH and can create new ATH if price able to form base at the marked support area after confirmation.

Mid Probability: This is a less certain move but still within a reasonable expectation for price movement in case price failed to hold the support area.

Low Probability: This move indicates areas where the price is less likely to go based on current trends, which seems to be below the support area.

Areas with darker shades on volume profile (purple) is where a lot of trading activity happened and price need to claim High of this area to validated my High probability move .I am waiting for confirmation of Low on BTC also as I am waiting on GOLD , I am going to update my trade as soon as I will get the confirmation.

M

XRPUSDGo for long it's an asset for Long-term investment.

as per the Fibonacci series, it took support from 50% level.

XLong

#singulardtv huge potentialIf you didn't see my previous idea on singulardtv, here is the link. This coin has already given 3x returns in a couple of months since my last idea shared on it. The potential is still huge and can give massive upside movement in the coming few months. The previous idea was SNGLBTC and this is SNGLUSD, both will give the similar results almost. Invest accordingly and still manage your risk as per your appetite.

Chart below.

Regards

S

F

Ever played with fire? Here we go! #MKRUSDTThe Whole crypto market is bleeding red today.

This is a highly risky trade, but after having good last few trades, risk toh banta hai!

Regards

M

MLong