Crypto

BTCUSD Long Setup – Trend Continuation Play📌 Trade Details

Entry: 113,256.5

Target: 115,317.7

Stop Loss: 111,874.4

📊 Trade Rationale

✅ Trend Continuation: Price has respected the ascending trendline multiple times, indicating strong buyer interest.

✅ Break of Structure: Recent higher highs and higher lows confirm bullish momentum.

✅ Support Flip: Zone around 113,050 acted as resistance earlier and is now being retested as support.

✅ Volume Confirmation: Rising volume supports the bullish continuation bias.

✅ Clean Risk–Reward: With SL below structure and TP near major resistance, this setup offers a favorable RRR.

🎯 Target Zone

The target aligns with the next strong supply zone at 115,300+, where sellers may re-enter.

⚠️ Risk Management

Always size positions wisely, as crypto remains highly volatile. Protect your capital first.

Disclaimer:

This idea is for educational purposes only and not financial advice. Do your own research before entering any trade.

BNB/USDT – Bullish Breakout Trade Idea✅ Entry: 871.564

🎯 Target: 890.455

⛔ Stop Loss: 862.304

🔎 Trade Rationale:

Ascending Triangle Breakout – Price has respected the rising trendline and finally broken above the neckline resistance, signaling bullish continuation.

Volume Confirmation – A notable increase in buying volume supports the breakout strength.

Resistance Flip – The previous supply zone around 870 has turned into support, adding confluence.

📊 With a strong bullish structure and favorable RRR, this setup aims to capture the next push towards 890 zone.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk before trading.

Bitcoin – Bullish Setup Forming After FVG Retest!Hello Traders!

Bitcoin is currently showing signs of forming a bullish setup after rejecting lower levels. The price has created a clean FVG (Fair Value Gap) zone and is moving within a falling channel, suggesting a possible accumulation before the next leg up.

Key Observations:

FVG Support: Price is likely to retest the FVG zone before a strong upward move.

Falling Channel: The structure indicates potential breakout to the upside.

RSI Divergence: Momentum indicators are showing signs of strength, supporting a bullish reversal case.

Targets: The upside targets are marked at 116,360 – 117,380 – 118,394 levels.

Invalidation: A breakdown below 111,627 would negate this bullish setup.

Rahul’s Tip:

Always wait for confirmation around the FVG zone. Entering too early may expose you to false breakouts. Risk management is crucial, especially in volatile assets like Bitcoin.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Please do your own research before making any trading decisions.

Bitcoin at a Critical Support – Breakout Toward $119K or ?Ascending Channel Breakdown – Price previously respected a rising green channel but broke below, showing weakness.

Critical Support Zone: Around $111,946 – $114,000 (black trendline + yellow support area).

Resistance Levels:

Near-term: $115,100 – $115,582

Strong: $119,582 (highlighted as major upside target)

Volume Profile: Declining volume with recent dip → signals possible accumulation before the next move.

Ichimoku Cloud: Price is slightly below cloud, indicating short-term bearish bias but with potential rebound if reclaimed.

Scenarios:

Bullish Case (Blue/White Arrows): If BTC holds above $114,000 support and breaks $115,500, a rally toward $119,500+ is possible.

Bearish Case: Failure to hold $114,000 may trigger a drop toward $111,946 (major demand zone).

ILV Setup – Consolidation at Major SupportAfter a strong rally, ILV has pulled back and is now consolidating within a major support zone — setting the stage for a potential next leg higher.

Trade Setup:

• Entry Zone: $17.00 – $18.00

• Take Profit Targets:

🥇 $20.00 – $24.00

🥈 $29.00 – $35.00

• Stop Loss: Just below $16.00

$ENA Up 243% From My $0.25 Entry And I’m Still BullishMIL:ENA Up 243% From My $0.25 Entry And I’m Still Bullish

Now MIL:ENA is trading at $0.75 and up 243% from our $0.25 entry ✅

TP1 and TP2 hit ✅ and I’m still super bullish, eyeing $1 / $2 / $5 next.

But remember, Greed has no limits.

Smart traders book partial profits and ride the rest with house money.

NFA & DYOR

Will Dogecoin hit $2 in Coming rally ?DOGE/USDT – Technical Analysis Update

CRYPTOCAP:DOGE is maintaining a solid structural support above the $0.150 key demand zone, with price action showing consistent defense of this level. As long as this zone remains protected on higher timeframes, bullish market structure remains intact for the current bull cycle and altseason.

Accumulation Zone: $0.230 – $0.180

This range aligns with prior demand imbalances and marks an optimal spot entry zone for long-term positioning.

A sustained hold and breakout from this accumulation range could open the path toward higher liquidity targets.

Upside Targets:

Target 1: $0.50 (mid-cycle resistance & liquidity pool)

Target 2: $1.00 (psychological level)

Target 3: $2.00 (macro cycle extension)

Bias: Bullish – Favoring spot accumulation within range

Invalidation: Daily close below $0.150 would shift bias to neutral/bearish

Price structure suggests CRYPTOCAP:DOGE is coiling for a high-momentum breakout once key liquidity levels are breached.

NFA & DYOR

Trend Reversal Rejection Strategy | Higher High + Candle Confirm🔍 Idea Summary:

This strategy focuses on identifying trend reversal zones using classic Higher High (HH) and Lower Low (LL) structures followed by rejection confirmation candles.

🔻 Short Setup:

Price forms a Higher High.

Wait for a rejection candle (long wick, body closes inside previous range).

Confirm structure break and take short entry on confirmation.

✅ Example: On the left side of the chart, price printed a HH, followed by a strong rejection candle. That led to a clean move downward.

🔺 Long Setup:

Price forms a Lower Low.

Watch for a rejection candle near key support.

Enter long trade after confirmation.

✅ Example: Mid-chart shows price breaking to LL, then instantly rejecting with a strong bullish candle. Followed by a sustained move up.

🔴 Current Price Action:

Price is testing a potential new Higher High.

📌 Strategy suggests: Wait for a bearish rejection candle before shorting!

📈 Strategy Benefits:

Avoids impulsive entries

Combines structure with candle logic

Great for reversal traders and range scalpers

🔥 Like & follow for more real-time trading ideas!

💬 Drop your thoughts or questions below – let’s grow together, traders! 💪

#ETHUSDT #PriceAction #RejectionCandle #TrendReversal #SupportResistance #Scalping #TradingStrategy #Crypto #ChartPatterns #TechnicalAnalysis

Algo-Based Options Trading & AutomationIn the modern trading landscape, technology is not just a supporting tool—it’s the central force reshaping how markets function. Nowhere is this more visible than in options trading, where algorithmic trading (or “algo trading”) is taking over traditional manual strategies. With increased speed, accuracy, and scalability, automation in options trading is transforming retail and institutional participation alike.

This guide breaks down everything you need to know about algo-based options trading: what it is, how it works, what strategies are used, its pros and cons, and how automation is practically implemented in today's markets.

1. What is Algo-Based Options Trading?

Algo-based options trading involves using computer programs to execute options trades based on pre-defined rules and mathematical models. These programs analyze market data, identify trading signals, and place orders automatically—often much faster and more accurately than humans can.

The key components include:

Predefined logic or strategy (e.g., "Buy a call option when RSI < 30 and price is above 50-DMA")

Real-time market data feed

Execution engines that place and manage orders without manual intervention

Risk management modules to monitor exposure, margin, and stop-losses

2. Why Use Algo Trading in Options Instead of Manual Trading?

Options are complex instruments. Their prices are influenced by multiple variables like time decay, implied volatility, strike price, delta, gamma, and more.

Humans can’t always process this data fast enough, especially during high-volatility events. Here’s where algos shine:

Manual Trading Algo Trading

Emotion-driven Emotionless and consistent

Slower execution Millisecond-level speed

Prone to fatigue Runs 24/7 without breaks

Hard to backtest Easily backtested and optimized

Limited scalability Can manage thousands of trades simultaneously

3. Core Components of an Options Algo Trading System

To build or understand an automated options trading system, it’s essential to know its primary components:

A. Strategy Engine

This is the brain of the system. It defines:

Entry/Exit conditions (based on indicators like RSI, MACD, IV percentile, etc.)

Type of options to trade (call, put, spreads, straddles, etc.)

Timeframe (intraday, weekly, monthly)

Underlying asset and strike price selection logic

B. Data Feed & Market Scanner

Live option chain data from exchanges like NSE or brokers like Zerodha, Upstox

IV, OI, delta, gamma, theta, vega data

Historical data for backtesting

C. Order Management System (OMS)

This handles:

Order placement

Modifications (e.g., SL changes)

Cancel/re-entry logic

Smart order routing (SOR)

D. Risk Management Module

Risk management is critical. The automation should enforce:

Maximum daily loss limits

Exposure per trade

Position sizing based on capital

Portfolio hedging logic

E. Logging and Monitoring

Every trade, price, and action is logged for audit and improvement. Some systems send alerts via Telegram, email, or SMS.

4. Common Algo Strategies Used in Options Trading

1. Delta-Neutral Strategies

Goal: Profit from volatility while maintaining a neutral directional view.

Examples: Straddle, Strangle, Iron Condor

How Algos Help: Adjust delta automatically by hedging with futures or adding more legs

2. Trend Following with Options

Algos can detect breakouts and directional momentum and buy/sell options accordingly.

Example: Buy call when price crosses above 20-DMA and volume spikes

Add-ons: Use trailing SLs, exit when RSI > 70

3. Option Scalping

Used in very short timeframes (1m, 5m candles). Algo enters/exits trades rapidly to capture small moves.

Needs: Super-fast execution and co-location

Popular in: Weekly expiry trading

4. IV-Based Mean Reversion

Buy when Implied Volatility (IV) is abnormally low or sell when it’s high.

Algos monitor: IV percentile, skew, vega exposure

5. Open Interest & Volume Based Strategies

Breakout Strategy: Detect long buildup or short covering using OI change + price movement

Algo filters trades: Where volume > 2x average and OI shows new positions being created

5. Platforms and Tools for Algo Options Trading

Even retail traders can now access automation tools without knowing how to code.

No-Code Platforms:

Tradetron

Streak by Zerodha

AlgoTest

Quantiply

These platforms offer:

Drag-and-drop strategy builders

Live market connections

Backtesting features

Broker integrations

Custom Python/C++ Based Systems

Used by advanced retail or prop firms. These offer:

Full control and flexibility

Integration with APIs like:

Zerodha Kite Connect

Upstox API

Interactive Brokers

Summary and Final Thoughts

Algo-based options trading is not just for hedge funds anymore. With accessible platforms, cloud computing, and APIs, even retail traders can build, test, and deploy automated strategies.

However, success in algo trading depends on:

Solid strategy design (math + market logic)

Risk management above all

Continuous monitoring and iteration

Avoiding over-reliance on backtests

Staying compliant with broker and SEBI norms

BTCUSD-Eyes 120000 after Liquidity Sweep & Support RetestPrice action on the 15-min chart shows Bitcoin forming a potential bullish continuation after a liquidity sweep below short-term support. Here’s what stands out:

🔹 Triple Tap Support: Price respected a key zone multiple times, hinting at strong buyer interest.

🔹 Post-Sweep Reaction: Sharp recovery followed by consolidation suggests demand re-entered the market.

🔹 SignalPro Context: Leola Lens™ SignalPro highlighted key zones (yellow + orange), offering caution and trend context.

🔹 Projected Path: With price stabilizing above the reclaimed zone, potential upside target aligns with the 120000 region.

📌 Educational Note:

This setup highlights how liquidity collection below support and subsequent recovery can offer clues to short-term directional intent. Always manage risk based on volatility and session context.

DOGE Long Swing Setup – Institutional Narrative Heating UpThe Dogecoin narrative is back in focus! Bit Origin ( NASDAQ:BTOG ) is raising $500M to build one of the world’s largest DOGE treasuries—becoming the first U.S.-listed company to treat CRYPTOCAP:DOGE as a core asset. With institutional interest rising, DOGE could see renewed momentum. Our last trade surged 50%—here’s the next entry:

📌 Trade Setup:

• Entry Zone: $0.20 – $0.21

• Take Profit Targets:

o 🥇 $0.23 – $0.24

o 🥈 $0.27 – $0.28

• Stop Loss: Daily close below $0.18

#crypto #DOGE #BTOG

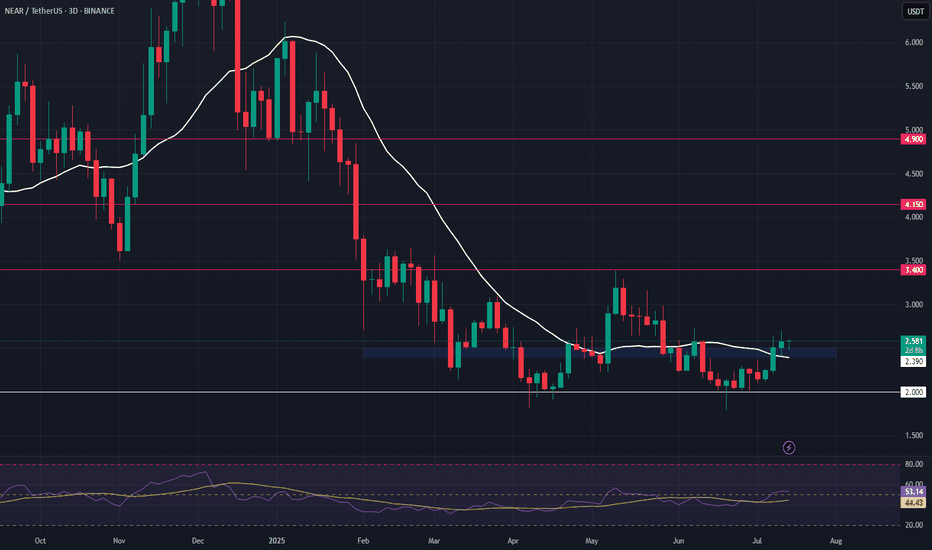

NEAR – High-Timeframe Double Bottom & Bullish DivergenceNEAR is showing strong signs of support, forming a high-timeframe double bottom with bullish divergence after a clean sweep of the $1.80 level. Price has now reclaimed the 20-day SMA, adding confidence to the setup.

📌 Trade Setup:

• Entry Zone: $2.40 – $2.50

• Take Profit Targets:

o 🥇 $3.40

o 🥈 $4.15

o 🥉 $4.90

• Stop Loss: Daily close below $2.00

THETA Long Swing Setup – Bullish Divergence & Range Low ReclaimTHETA has formed a strong bullish divergence off a double bottom, following a deep liquidity sweep to $0.56. With price now reclaiming the 20-day SMA, signs point to a local bottom and potential range low deviation.

📌 Trade Setup:

• Entry Zone: $0.70 – $0.75

• Take Profit Targets:

o 🥇 $0.95 – $1.00

o 🥈 $1.60 – $1.72

o 🥉 $2.13 – $2.25

• Stop Loss: Daily close below $0.65

AERO Long Swing Setup – Retest of Range Low SupportAERO has pulled back to test the bottom of its range, now sitting at a key support zone. This offers a potential long swing entry as buyers look to defend the $0.66–$0.80 area.

📌 Trade Setup:

• Entry Zone: $0.66 – $0.80

• Take Profit Targets:

o 🥇 $1.04 – $1.32

o 🥈 $1.60 – $2.05

• Stop Loss: Daily close below $0.60

Bitcoin Eyes Breakout — Bullish Setup Gathers StrengthConsolidation Above Key Support:

Bitcoin continues to hold firmly above the $100,000–$105,000 support zone, a critical area that acted as major resistance earlier in 2025. This sustained price action reinforces the prevailing bullish momentum and signals strength beneath the surface.

Wedge Formation Nearing Resolution:

The prolonged wedge pattern now taking shape suggests a substantial move is imminent. The structure supports a breakout scenario, with an initial target of $130,000–$135,000 in play.

Uptrend Intact, No Signs of Exhaustion:

Despite recent weeks of sideways action, Bitcoin continues to consolidate near its highs—a pattern that historically favors continuation, not reversal. The broader trend remains upward and firmly intact.

Focus & Opportunity:

Bitcoin's technical setup justifies close attention in the days ahead. At the same time, traders and investors should keep an eye on select altcoins, which could offer amplified upside as capital rotation picks up momentum.

#Bitcoin #BTC #Crypto #TechnicalAnalysis #BullishSetup #WedgeBreakout #PriceAction #Altcoins #CryptoMarket #MarketUpdate #AllTimeHigh

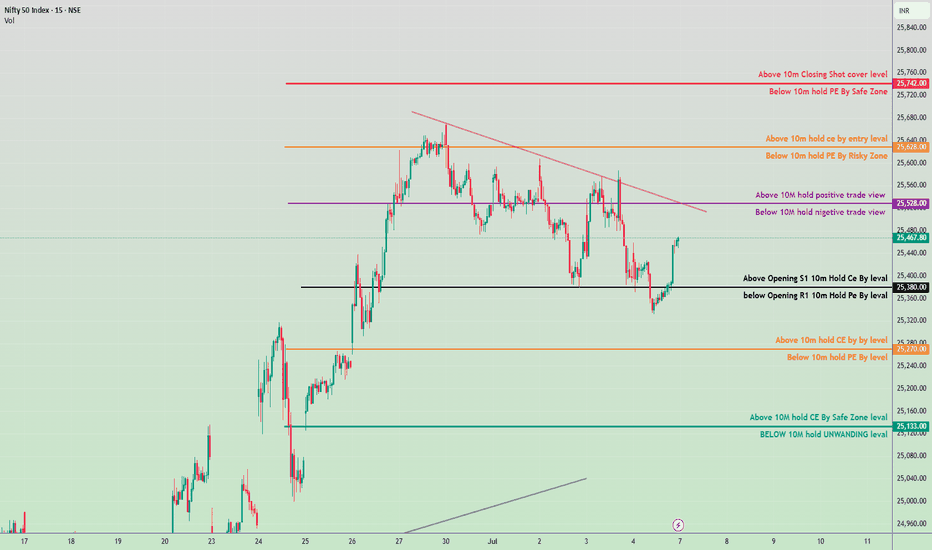

Nifty 50 Intraday Trade Plan - 7 July 2025✅ Bullish Zones (Call Option - CE Buy Levels):

Above 25,133 ➤ Hold CE by Safe Zone level

Above 25,270 ➤ Hold CE by key level

Above 25,380 ➤ Opening S1 Breakout – Hold CE

Above 25,528 ➤ Positive Trade View (10M volume base)

Above 25,628 ➤ Entry level for CE holding

Above 25,742 ➤ Closing Shot – Cover Short Positions

🔻 Bearish Zones (Put Option - PE Buy Levels):

Below 25,133 ➤ Unwinding Level – Hold PE

Below 25,270 ➤ Key level – Hold PE

Below 25,380 ➤ Opening R1 Breakdown – Hold PE

Below 25,528 ➤ Negative Trade View

Below 25,628 ➤ Risky Zone for holding PE

Below 25,742 ➤ Safe Zone for holding PE

🔁 Trendline & Structure Notes:

Downtrend resistance visible around 25,528–25,628 zone.

If price breaks above trendline and sustains, expect bullish momentum.

Support near 25,133 and strong base seen around 25,000 zone.

Did you FOMO into $BANANAS31USDT after the 250% pump?Did you FOMO into BINANCE:BANANAS31USDT after the 250% pump? You might want to hit pause… 🛑

$BANANAS31 pumped 250% in just 10 days, including a vertical spike. But the chart now looks top-heavy — consolidation is weakening, and momentum is fading.

I'm expecting a 30–50% retracement if support breaks. Fresh entries here? Extremely risky. High-risk traders may eye shorts — but it's a dangerous game.

Are you riding it or fading it from here? Comment your strategy 👇

NFA & DYOR

JTO Long Setup – Range Low Accumulation with Bottom PotentialJTO remains range-bound and is showing signs of a potential bottom, with downside liquidity largely cleared. We’re watching the $1.80–$1.90 zone for a long entry, as long as price holds above the key $1.65 invalidation level.

📌 Trade Setup:

• Entry Zone: $1.80 – $1.90

• Take Profit Targets:

o 🥇 $2.60 – $2.80

o 🥈 $3.80 – $4.00

• Stop Loss: Daily close below $1.65

Compression Before Expansion: Market Awaits Its Next MoveBTCUSD – Compression Before Expansion: Market Awaits Its Next Move

Bitcoin is trading within a compressed structure after rejecting key resistance and retesting support. While the overall sentiment remains cautious, the technical setup is beginning to show signs of strength — if buyers can reclaim control.

🧭 Macro Check-In: Calm Before the Crypto Storm?

No rate cut from the Fed yet, but markets are starting to price in the possibility of a pause in Q3 or Q4.

ETF inflows slowing, but institutional positions are not closing — suggesting long-term conviction remains.

Political momentum in the US is shifting towards crypto adoption, with Bitcoin emerging as a talking point in election debates.

Dollar index (DXY) continues to chop, giving crypto room to breathe if inflation data remains mild.

In short: liquidity is building, but the trigger hasn’t fired — yet.

📊 Chart Structure (H1–H4): Levels That Matter

BTC is holding just above 103,100, a key level where previous demand stepped in.

The mid-range resistance lies at 104,184 — this needs to break for bulls to gain short-term control.

Above that, eyes are on 106,047, then 107,586 (top of the descending channel).

EMA alignment is still bearish → wait for structure shift, not FOMO.

📌 Trade Map

🔵 Buy Setup

Zone: 103,100 – 103,300

Condition: Bullish reaction + rejection wick / engulfing

SL: 102,600

TP: 104,184 → 106,047 → 107,586

🔴 Sell Setup (Only if trap triggers)

Zone: 107,500 – 107,800

Condition: Rejection + volume fade

SL: 108,200

TP: 106,000 → 104,500

🧠 Trader Insight

“When the chart compresses, smart money positions early.”

Bitcoin is not trending — it's accumulating or distributing. Retail is waiting for breakout. Smart traders are preparing for both scenarios.

Watch the reaction, not the prediction.

Stay objective. Let levels lead the logic.

INJ Long Swing Setup – Approaching Fibonacci & Major SupportInjective (INJ) is nearing a key support zone that aligns with the 61.8% Fibonacci retracement level. This confluence area around $10.20–$11.30 offers a strong setup for a potential long swing trade.

📌 Trade Setup:

• Entry Zone: $10.20 – $11.30

• Take Profit Targets:

o 🥇 $14.00 – $16.00

o 🥈 $20.00 – $23.00

• Stop Loss: Daily close below $9.00

HYPE Long Swing Setup – Approaching Key Support ZoneHYPE is under pressure but now nearing a major support level, presenting a potential opportunity for a bounce. We’re eyeing the $39.00–$40.00 zone for a long entry as buyers may step in at this key area.

📌 Trade Setup:

• Entry Zone: $39.00 – $40.00

• Take Profit Targets:

o 🥇 $42.18

o 🥈 $43.90

• Stop Loss: Daily close below $38.31