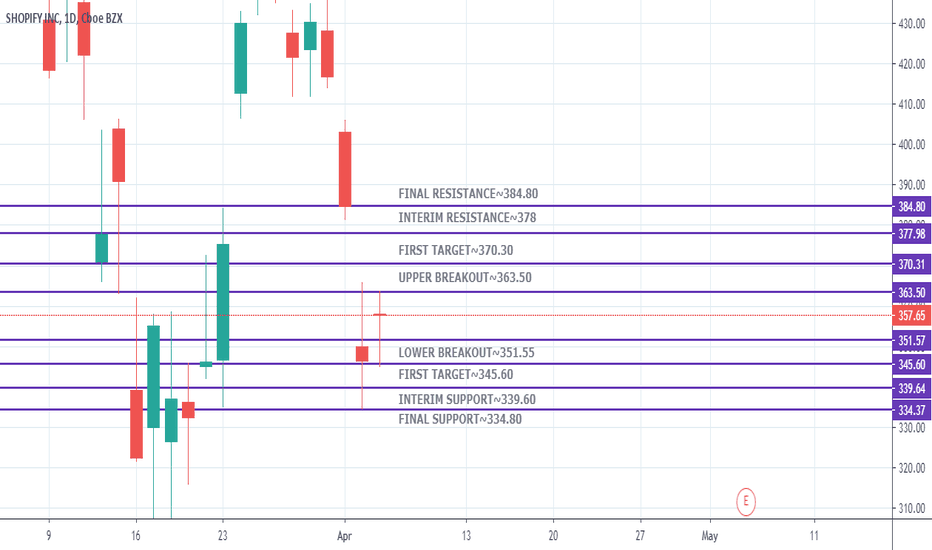

SHOPIFY KEY LEVELS SUPPORT AND RESISTANCE 04/06/2020Key Levels for SHOPIFY INC NYSE for INTRADAY TRADING are :

Upper Breakout~363.50

First Target~370.30

Interim Resistance~378

Final Resistance~384.80

**Lower Levels**

Lower Breakout~351.55

First Target~345.60

Interim Support~339.60

Final Support~334.80

Please trade with caution and consult your financial adviser before trading.

Djia

Nifty Weekly chart analysis - Bulls need not worry about Corona As observed on the weekly chart of Nifty 50 bulls have nothing to worry as of now as the uptrend is intact.

The previous swing low (10637+) is is intact and its still trading above 200 Wk SMA (which is currently at 10290)

Nifty is currently at 61.8% retracement level from the March 2018 low to Jan 2020 high (all time high)

Bulls who are going long now without worrying about Corona Virus will most likely get coronated later part of the year! As I said we are in good position as long as preious swing low and 200 Wk SMA are still intact.

Cheers,

tRex

GE is at a very important juncture! The stock is trading at a very crucial juncture. The RSI is indicating a sideways trend, important support pivot level is 8.75, below this point the stock may falter and selling may set in as the stock may start to move down in A-B-C pattern. On the flip side a good close above 9.30 may change the course of the trend GE may start trending up. For greater insight on RSI do visit www.prorsi.com

facebook I am bullish on the counter till its holding 115, sl fir me is 115 while upside i see upto 160 zones

DJI NIFTY Big moves heads upThe price action in global equities has been interesting lately and we are at a fantastic inflection point.

There are multiple triggers to support reasonably big move in either direction and traders would do well to take a notice.

My bias is on the downside but as I explain in the video, yours doesn't have to be.

Watch the video for short term targets

Melt upMost overbought ever...at least till 1970's

If that's not enough please humor me.

What's funny is everyone in the mainstream is defending. Including Warren Buffett.

www.cnbc.com

And this is the response from Cliff Asness

twitter.com

You know where I stand. Make up your own mind.

This is a global equity story. Not just the US.

Indian benchmark indices touched all time highs today.

Watching ETNOW and CNBC in India is funny. Their condescending opinions about markets are the daily dose of entertainment for me.

Even more amusing is how the opinions turn on a dime day over day.

With all due respect though. It's a tough job they have. I wouldn't fair better in all honesty.

But investors should.

Are we heading towards a NASTY GLOBAL CRASH! #DJI # NIFTYI have been tracking the DOW JONES weekly chart from the last couple of months when it started showing consecutive green days regardless of global factors, earning reports, etc.

So what intrigues me out of the weekly chart is the hastiness of the DOW towards the upper band of what appears to be a forming RISING WEDGE.

DOWs rise recently has been crazy to say the least. Last month would make even the dumb money feel like a Buffett or a Jesse.

Its been on a continuous rise, plain and simple, no matter what.

Now according to the chart we can take the spot levels of anywhere between 23450-23650 to be the reversal zone for DOW and it might retrace all the way down towards the lower band of the RISING WEDGE and by that time if the relevant factors are weak then it might fall down and then we'll be looking for a new support level but that would be a big downfall(CRASH) and also the global markets will follow the pattern.

And as far as our markets are concerned what I found interesting was that Nifty is also making the same pattern of RISING WEDGE on the weekly chart.

Investors should keep an eye on these things and should be aware, whereas for the traders, you know how we do it!

SNAPSHOT OF NIFTY RISING WEDGE on WEEKLY CHART