Djianalysis

US 30 Price Behaviour Analysis - Dow Jones is currently trading at 40,2584

- DOW showed us a major sell-off as well where all its major constituents getting slaughtered

- Dow still has a better price action when compared to SPX & NAS

- Dow is also waiting for the CPI print to be laid out and then only we will see a possible bounce back

DJI Intraday Prediction Levels for 29 Nov 2023DJI Intraday Prediction Levels for 29 Nov 2023

The chart indicates 15 min time frame. These Levels act as Support or Resistance according to price. They are strictly for Intraday Trading only. Execution only after break and close above the Resistance zone or below the Support zone.

Major Resistances- 35495,35555,35610,35640,35703,35780,35860,….

Major Supports-35350,35280,35230,35175,35115,35065,3500,…

These levels act as support and resistance. You have to trade according to level breakout or breakdown. First target is immediate next level. When first target is achieved go for the next one and so on.

If You are a new trader then just watch ( No Trade) these levels for some days.

Happy trading.

Disclaimer:

I am not a SEBI Registered Analyst. Anything posted here is my own analysis and views. This is created for educational purposes only. Always consult your Financial Advisor before taking any decision or trade.

DJI - Likely to start a wave 3 upwards? To make a new high?DJI has formed three sub-fractal i,ii, i,ii, i,ii since the impulse upwards since the Oct 22 bottom.

It should eventually materialize in a wave iii upwards i.e. 3 sub-fractals of iii,iv, iii,iv, iii,iv.

In all possibility the recent wave ii is complete in a five wave C downwards. Today's price action at NYSE opening would be crucial.

DJI AnalysisDJI technically downtrend

Analysis 1

DJI doesn't break the DAY and 1HR Trend line.

seems sell retracement.

once cross down and sustain 33500 means the fall down to 33350.... 33350 to 33200 is demand zone...if the demand zone invalided means the price fall down to 33000...

(a) sell stop risk entry 33600 safe entry 33450

targets 33350/33250/33150/33050

buy stop 33800.

Analysis 2

DJI breaks the trend line and sustain means.

Rally continues up to 34300.

there will be a 2 Supply zones.

1st Supply zone 33950 to 34050

2nd Supply zone 34160 to 34250

(b) buy stop risk entry 33820... Safe entry also same but after retracement from the trend line

targets 33950/34050/34150/34250/34320/34500

Stop loss 33650.

DJI DOW BOTTOM CONFIRMATIONDOW THEORY RULES:

1. How to Identify Significant bottom(valley)?

We need two parameters

1. Width:- Should be more than 31 days(≈ 4 weeks)

2. Depth:- Should be more than 4%, in the valley we measure Depth by looking from top to the bottom (visualizing as seeing a pool of water from the surface and measuring its depth).

AS PER DOW THEORY, NEW BOTTOM CAN BE CONFIRMED TOMORROW IN DJI IF IT SUSTAINS ABOVE 30K LEVEL, TOP IS AT 34856 UNTIL THAT IS NOT TAKEN OUT DJI IS STILL IN A DOWNTREND. BUT THE BOTTOM CREATION WILL BE A GREAT PLUS POINT FOR THE BULLS TO KEEP A SL. ONLY IF TOMORROW (WEEKLY BASIS) IT CLOSES ABOVE 30K.

Bullish Divergence in Dow Jones Industrial AverageRSI Bullish Convergence was there on weekly charts of Dow Jones only 5 times in last 20 years, which was always followed by average 15-18% market rally

similar RSI convergence is visible on weekly Dow Jones chart Right now, pre-covid highs are acting as a support

Disclaimer: Chart, data and levels for study purpose only. I am not a financial advisor. Use your intelligence before investing.

Comparison of leading markets to anticipate the future movementAn attempt to anticipate the future movement of different markets over next 5 to 10 years. If we see the movement of 6 markets, we can have some insights.

Among the 6, Germany (DAX- purple) and India (NIFTY50 - red) look like being in the middle zone of the direction of movement since 1991.

Hong Kong (HSI - green ) came down gradually from around early 2018 to 2022, now looks at a fair level (may fall further to form a bottom).

USA(DJI - blue ) has recently started falling after forming a sharp peak, I am expecting a fall probably to 27500 levels or may go to 22000.

India (Nifty50 - red ) looks bullish for long term but may see a pullback to 15000 levels or even to 12000 levels in coming years.

UK (UKX - yellow) looks sideways and lacks long term strength as evident in the economy in recent times for United Kingdom.

France (CAC40-brown) looks sideways from a long term perspective.

Germany(Dax-purple) looks the most balanced in terms of bear and bull phases.

Overall it looks like the bear phase has started for most markets and it may take several years for healthy bull phase to be back.

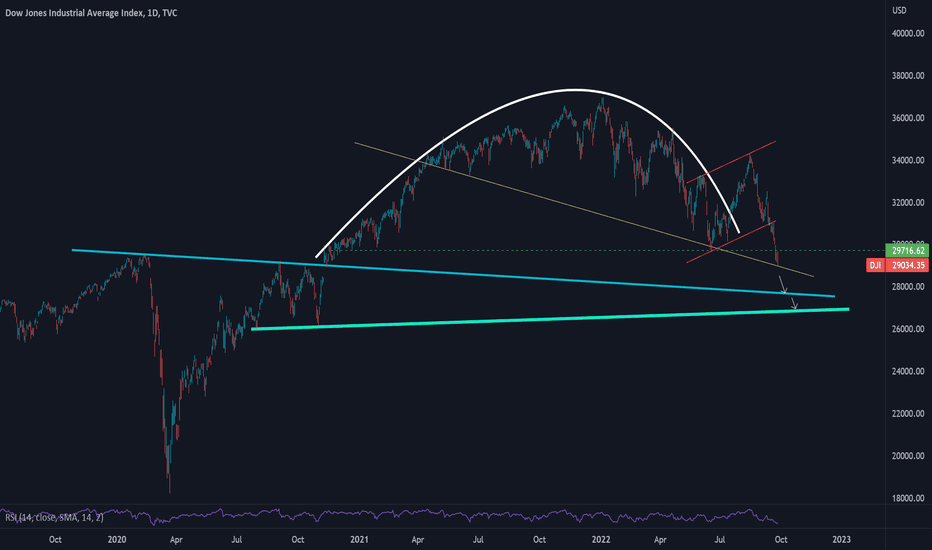

Inverted Cup & Handle pattern in monthly timeframeHello All,

Market is at very important point where it can take support and go higher and if rejection we have big fall.

My expectation is at least 3000 points if cup and handle broke.

FED hike warnings really bothering the market and on Friday it broke previous low and touches 20% fall from Jan 2022. However if it closed with the same momentum on Friday then we would’ve seen big gap down on Monday opening.

Please note this is just my observation only and for purely for educational purposes.

Trade at your own risk.

Dow Jones technical analysis ahead of FOMCThe US headline CPI data released last week surprised the market with a smaller drop than expected. As such, a higher chance is being given to a 75-basis-points rate hike in the upcoming September FOMC meeting. The US stock market reacted with a major sell-off last week, signalling that the summer rally has overstayed its welcome.

The Dow Jones plunged by 1,300 points or 4.2% last week. The S&P500 dropped by 5.2%, while the NASDAQ declined by 6.0%.

The interest rate decision from the Fed due this Wednesday (UTC -4) will be a significant event for US markets this week. The market is currently pricing in an 85% chance of a 75bps rate hike and a 15% chance of a 100bps hike.

Looking at the current price action for the Dow Jones in combination with the Schaff Trend Cycle indicator, indicates that the downside's strength still present and may continue to stick around. The Schaff Trend Cycle is currently sitting far below the 25 level at sub-5.

However, this indicator’s current condition may also be a sign that the Dow Jones may be oversold. In such a case, we might expect the index to perform a reversal and retest the 31,200 level, before continuing the downtrend. Traders looking for a counter-trend trade might want to watch and wait for the Schaff Trend Cycle to close above the 25 levels.

With the upcoming FOMC meeting and the expectation of a 75bps or greater rate hike, we may expect a reaction to the downside during the day and a hitting of the 30,000-support area. Breaking below the 30,000-demand zone will open up the 29,500 to 29,000 targets.