A trading opportunity to buy in VERIUSDTechnical analysis:

. VERITASEUM/DOLLAE is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 61.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (38.00 to 30.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (38.00)

Ending of entry zone (30.00)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 54.00

TP2= @ 67.00

TP3= @ 85.00

TP4= @ 100.00

TP5= @ 144.00

TP6= @ 219.00

TP7= @ 314.00

TP8= @ 435.00

TP9= @ 544.00

TP10= Free

E-DOLLAR

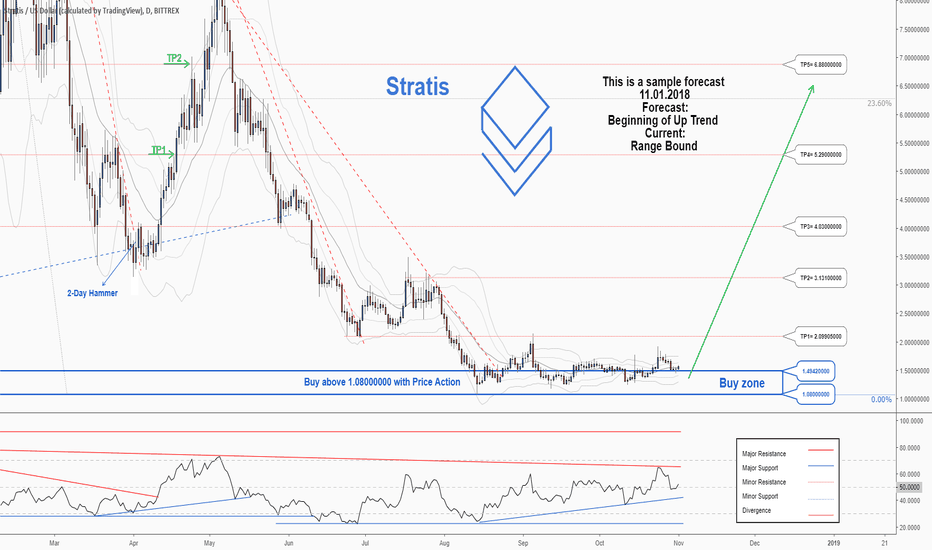

A trading opportunity to buy in STRATUSDTechnical analysis:

. STRATIS/USDOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 51.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.08220000 to 1.08000000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.08220000)

Ending of entry zone (1.08000000)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 2.09905000

TP2= @ 3.13100000

TP3= @ 4.03000000

TP4= @ 5.29000000

TP5= @ 6.88000000

TP6= @ 8.39000000

TP7= @ 9.50000000

TP8= @ 12.10000000

TP9= @ 14.70000000

TP10= @23.10000000

TP11= Free

There is a trading opportunity to buy in DCRUSDTechnical analysis:

. DECRED/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 47.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (39.00 to 31.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (39.00)

Ending of entry zone (31.00)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 54.58

TP2= @ 58.52

TP3= @ 72.15

TP4= @ 83.18

TP5= @ 94.32

TP6= @ 110.07

TP7= @ 130.05

TP8= Free

GBPUSD Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=1.2725.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=1.2815.

TP4: R2=1.2845.

Set the stoploss of these orders at breakout of S2=1.2695.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=1.2695.

In this situation, there is an expectation to reach the target S3=1.2595.

Set the stoploss of reverse orders at breakout of S1=1.2725.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

A great opportunity to buy in Turkish Lira.Midterm forecast:

There is no trend in the market and the price is in a range bound, but we forecast an uptrend wave above 5.0000 would begin in Midterm.

We will close our open trades, if the Midterm level 5.0000 is broken.

Technical analysis:

While the RSI downtrend #1 is not broken, bearish wave in price would continue.

Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

Relative strength index (RSI) is 33.

Trading suggestion:

There is a possibility of temporary retracement to suggested Buy Zone (5.51550 to 5.19000). if so, we would set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (5.51550)

Ending of entry zone (5.19000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1 : @5.6870

TP2 : @5.9015

TP3 : @6.2090

TP4 : @6.4820

TP5 : @6.8320

TP6 : @7.0000

TP7 : @7.1200

TP8 : Free

A trading opportunity to buy in NXSUSDTechnical analysis:

. NEXUS/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 42.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.682 to 0.549). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.682)

Ending of entry zone (0.549)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 1.19

TP2= @ 1.69

TP3= @ 2.59

TP4= @ 3.60

TP5= @ 5.43

TP6= @ 6.92

TP7= @ 8.40

TP8= @ 10.50

TP9= @ 13.19

TP10= Free

NZDUSD Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=0.6535.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=0.658.

TP4: R2=0.6605.

Set the stoploss of these orders at breakout of S2=0.652.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=0.652.

In this situation, there is an expectation to reach the target S3=0.645.

Set the stoploss of reverse orders at breakout of S1=0.6535.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

There is a trading opportunity to buy in REQUSDTechnical analysis:

. RequestNetwork/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 48.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.0470 to 0.0290). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.0470)

Ending of entry zone (0.0290)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.0913

TP2= @ 0.1328

TP3= @ 0.1934

TP4= @ 0.3155

TP5= @ 0.4931

TP6= @ 0.6071

TP7= @ 0.7804

TP8= @ 0.9850

TP9= @ 1.2450

TP10= Free

A trading opportunity to buy in ARKUSDTechnical analysis:

. ARK/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 56.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.7000 to 0.5000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (00.7000)

Ending of entry zone (0.5000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 1.0013

TP2= @ 1.1925

TP3= @ 1.6547

TP4= @ 2.6470

TP5= @ 3.9757

TP6= @ 5.0473

TP7= @ 6.1170

TP8= @ 7.6428

TP9= @ 9.5830

TP10= @ 11.4100

TP11= Free

There is a possibility for the beginning of an uptrend in RDDUSDTechnical analysis:

. Reddcoin/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 37.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00231 to 0.00175). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00231)

Ending of entry zone (0.00175)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00368

TP2= @ 0.00507

TP3= @ 0.00598

TP4= @ 0.00714

TP5= @ 0.00924

TP6= @ 0.01110

TP7= @ 0.01763

TP8= Free

USDJPY Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=112.15.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=112.55.

TP4: R2=112.9.

Set the stoploss of these orders at breakout of S2=112.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=112.

In this situation, there is an expectation to reach the target S3=111.4.

Set the stoploss of reverse orders at breakout of S1=112.15.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

There is a trading opportunity to buy in SYSUSDTechnical analysis:

. SysCoin/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

. While the price downtrend in the daily chart is not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.090 to 0.059). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.090)

Ending of entry zone (0.059)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.140

TP2= @ 0.190

TP3= @ 0.250

TP4= @ 0.304

TP5= @ 0.34

TP6= @ 0.453

TP7= @ 0.584

TP8= @ 0.740

TP9= Free

There is a possibility for the beginning of an uptrend in BTGUSDTechnical analysis:

. BitcoinGold/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 52.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (27.00 to 22.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (27.00)

Ending of entry zone (22.00)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 39.00

TP2= @ 47.00

TP3= @ 56.00

TP4= @ 68.00

TP5= @ 84.00

TP6= @ 109.28

TP7= @ 146.00

TP8= @ 168.79

TP9= @ 216.75

TP10= @ 264.75

TP11= @ 333.27

TP12= @ 420.31

TP13= Free

There is a trading opportunity to buy in DGBUSDTechnical analysis:

. DigiByte/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 38.

. While the RSI downtrend is not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.022 to 0.015). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.022)

Ending of entry zone (0.015)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.031

TP2= @ 0.037

TP3= @ 0.049

TP4= @ 0.068

TP5= @ 0.089

TP6= @ 0.109

TP7= @ 0.136

TP8= Free

A great opportunity to buy in XAUUSD.Midterm forecast:

There is no trend in the market and the price is in a range bound, but we forecast an uptrend wave above 1183.15 would begin in Midterm.

Technical analysis:

The RSI resistance #1 at 53 is broken, so the probability of beginning of uptrend is increased.

While the RSI uptrend #2 is not broken, bullish wave in price would continue.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 62.

Trading suggestion:

There is possibility of temporary retracement to suggested Buy Zone (1217.25 to 1204.15). We wait during the retracement, until the price tests the zone, whether approaching, touching or entering the zone.

We would set buy orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (1217.25)

Ending of entry zone (1204.15)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1 : @1240.00

TP2 : @1262.50

TP3 : @1287.00

TP4 : @1308.85

TP5 : @1324.15

TP6 : @1366.05

TP7 : Free

There is a trading opportunity to buy in NEOUSDTechnical analysis:

. NEO/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 40.

. While the RSI downtrend and the price downtrend in the daily chart are not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (16.259 to 13.665). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (16.259)

Ending of entry zone (13.665)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00019800

TP2= @ 0.00021500

TP3= @ 0.00025500

TP4= @ 0.00031580

TP5= @ 0.00049700

TP6= @ 0.00051700

TP7= @ 0.00060700

TP8= @ 0.00073500

TP9= @ 0.00089900

TP10= Free

A great opportunity to buy in AUDUSDMidterm forecast:

0.7160 is a major resistance, while this level is not broken, the Midterm wave will be downtrend.

Technical analysis:

While the RSI resistance #1 at 55 is not broken, the probability of price increase would be too low.

A peak is formed in daily chart at 0.7160 on 10/17/2018, so more losses minimum to Buy Zone (0.7085 to 0.7020) is expected.

Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

Relative strength index (RSI) is 43.

Trading suggestion:

There is possibility of temporary retracement to suggested Buy Zone (0.7085 to 0.7020). We wait during the retracement, until the price tests the zone, whether approaching, touching or entering the zone.

While the price is below the level 0.7105, the probability of beginning of uptrend is too weak, so we would enter the market with buy trades based on Daily-Trading-Opportunities and a day close price above 0.7105 and expect to reach short-term targets.

Beginning of entry zone (0.7085)

Ending of entry zone (0.7020)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1 : @0.7160

TP2 : @0.7230

TP3 : @0.7320

TP4 : @0.7445

TP5 : @0.7575

TP6 : @0.7655

TP7 : @0.7805

TP8 : @0.8135

TP9 : Free

A trading opportunity to buy in BATUSDTechnical analysis:

. BasicAttentionToken/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 51.

. The price downtrend and the RSI downtrend in the daily chart are broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.175 to 0.130). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.175)

Ending of entry zone (0.130)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.242

TP2= @ 0.278

TP3= @ 0.312

TP4= @ 0.362

TP5= @ 0.424

TP6= @ 0.516

TP7= @ 0.676

TP8= @ 0.903

TP9= @ 1.043

TP10= Free

There is a possibility for the beginning of an uptrend in LSKUSDTechnical analysis:

. Lisk/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 41.

. While the RSI downtrend is not broken, bearish wave in price would continue.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (2.79 to 1.70). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (2.79)

Ending of entry zone (1.70)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 4.72

TP2= @ 6.00

TP3= @ 7.19

TP4= @ 9.95

TP5= @ 11.63

TP6= @ 14.57

TP7= @ 17.31

TP8= @ 33.05

TP9= Free

GBPUSD Intraday ForecastAs we forecast downtrend for this day, so Forecast City suggests sell (limit) below R1=1.288.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: S1=1.28.

TP4: S2=1.275.

Set the stoploss of these orders at breakout of R2=1.292.

Stop and reverse:

If trend gets reversed, buy (stop) orders will be opened at breakout of R2=1.292.

In this situation, there is an expectation to reach the target R3=1.303.

Set the stoploss of reverse orders at breakout of R1=1.288.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

USDJPY Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=112.3.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=112.8.

TP4: R2=113.25.

Set the stoploss of these orders at breakout of S2=112.1.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=112.1.

In this situation, there is an expectation to reach the target S3=111.45.

Set the stoploss of reverse orders at breakout of S1=112.3.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

NZDUSD Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=0.652.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=0.656.

TP4: R2=0.6575.

Set the stoploss of these orders at breakout of S2=0.6505.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=0.6505.

In this situation, there is an expectation to reach the target S3=0.6435.

Set the stoploss of reverse orders at breakout of S1=0.652.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.

NZDUSD Intraday ForecastAs we forecast uptrend for this day, so Forecast City suggests buy (limit) above S1=0.6495.

But the short term forecast is range bound, so we expect to reach the following targets:

TP3: R1=0.654.

TP4: R2=0.657.

Set the stoploss of these orders at breakout of S2=0.648.

Stop and reverse:

If trend gets reversed, sell (stop) orders will be opened at breakout of S2=0.648.

In this situation, there is an expectation to reach the target S3=0.641.

Set the stoploss of reverse orders at breakout of S1=0.6495.

If you would like to trade in the next 24 hours , the intraday forecasts of ForecastCity will show you the most accurate and the most likely actions and swings of the market. Our intraday forecasts are available before those of all the other sites. Our intraday forecasts are available very early in the day. It is one of ForecastCity’s glorious and positive qualities. This quality has made us the first forecaster that forecast tomorrow for you!

ALL OF OUR INTRADAY FORECASTS ARE VALID FOR 24 HOURS FROM RELEASE TIME.