GODREJIND - Inverse Head and Shoulders Breakout Pattern Overview:

A classic Inverse Head and Shoulders pattern has formed on the Godrej Industries chart. This is a strong bullish reversal pattern, indicating a possible trend change from downtrend to uptrend.

What is an Inverse Head and Shoulders Pattern?

This pattern consists of three troughs:

Left Shoulder: Price declines, then rebounds.

Head: Price declines more deeply, then rebounds.

Right Shoulder: Price again declines but not as much as the head.

A neckline connects the peaks between the troughs.

A breakout happens when the price moves above the neckline.

This formation signals selling pressure is reducing and buyers are gaining strength.

How to Trade This Pattern:

Entry: After a confirmed breakout above the neckline.

Stop-Loss: Slightly below the right shoulder or neckline.

Target Price: Measure the distance from the neckline to the head, and project that above the neckline

.

Godrej Industries – Key Points:

Diversified holdings across chemicals, real estate, FMCG, agri-business, and financial services.

Strong portfolio of listed subsidiaries like Godrej Consumer, Godrej Properties, and Godrej Agrovet.

Backed by the trusted and time-tested Godrej Group with over 125 years of legacy.

Generates stable cash flows through dividends and investments in high-growth businesses.

Long-term value creation potential as a holding company with exposure to multiple growth sectors.

Disclaimer : Trade only if you have a written Trading Plan and aware of your risk reward setup

Community ideas

SHAKTI PUMP : A text book break out• Stock broke a 4 month long short term trendline on 06th Jun25.

• Taken support from long term trendline.

• Big boys took position for the last 2 months without disturbing the price.

• An increase in volume is the testament of the hypothesis.

• Go long on positional/swing basis.

• Target 1: 1029.5

• Target 2: 1192

• Target 3: 1356.5

• SL for Swing traders: 878

• SL for positional trader: 839

• A RR of 1:4.75. A classical textbook breakout.

• Enjoy the show!!!

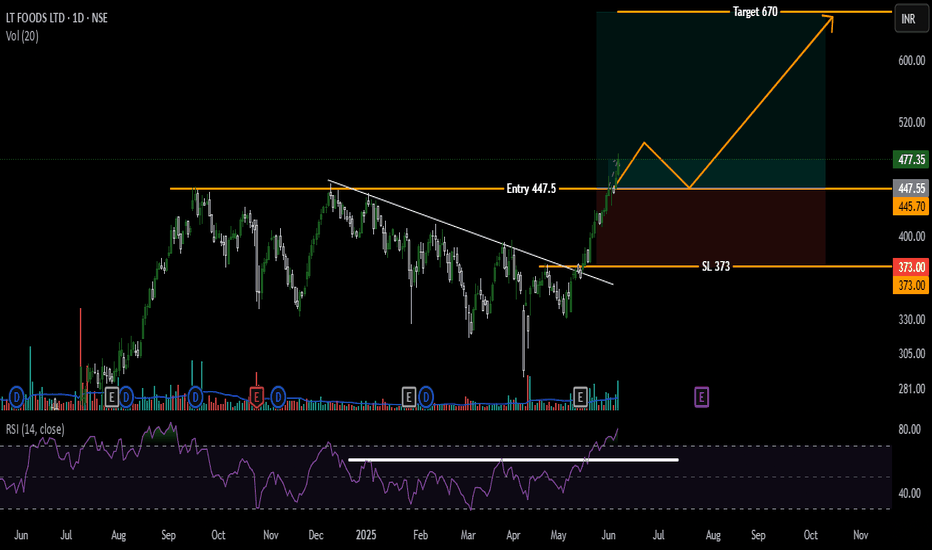

LT Foods | Fresh Breakout Above 52-Week High | Swing Trade SetupLT Foods Ltd (DAAWAT) has given a strong breakout above its multi-month resistance zone around ₹447.5, backed by rising volume and momentum. This marks a fresh 52-week high, supported by bullish RSI strength (above 80).

📈 Trade Setup:

🔹 Entry: ₹447.5 (Breakout Retest Zone)

🔹 Target: ₹670

🔹 Stop Loss: ₹373

🔹 Risk-Reward Ratio: ~3:1

✅ Why I Like This Setup:

Clean breakout from consolidation

Strong volume confirms participation

RSI above 80 indicates trend strength

Bullish price structure across daily chart

⚠️ CMP is currently above entry zone; ideal entry would be on a retest of ₹447–455 range.

Position sizing is key due to SL distance (~16%).

This setup is ideal for swing traders with a short-to-medium term view (2–4 months).

📊 Disclaimer: Not financial advice. Do your own research before investing.

Swing/Positional Trade Idea: Jamna Auto (NSE: JAMNAAUTO)Pattern Alert: Rounding Bottom Nears Breakout!

📈 Technical Setup

Daily Chart Pattern: Price is completing a multi-month rounding bottom (bullish reversal pattern), signaling accumulation.

Current Price: Consolidating near ₹88.80, approaching the crucial breakout zone of ₹94.25–95.60.

Confirmation Trigger: A decisive close above ₹95.60 on rising volume validates the breakout.

🎯 Trade Strategy

Entry: Buy on breakout confirmation above ₹95.60 (close basis).

Stop Loss: ₹86.36 (below the recent swing low & pattern support).

Targets:

T1: ₹106 (+11% from breakout)

T2: ₹113 (+18%)

T3: ₹123 (+29%)

T4: ₹133 (+39%)

Final Target: ₹149 (all-time high, +56%)

Risk-Reward: 1:5+ (based on SL to T1).

⚠️ Key Notes

Patience Required: This is a positional trade with a 3–6 month horizon. Hold through minor pullbacks.

Volume Confirmation: Breakout must be backed by +50% above average volume for conviction.

💡 Why This Works

Rounding bottoms indicate long-term trend reversal with high follow-through probability.

Targets align with Fibonacci extensions & prior swing highs.

Low-risk entry: Tight SL (8% risk) for asymmetric upside.

Trade smart. Track volume. Patience pays!

🔥 Like this idea? Hit "Boost" to increase visibility!

-------------------------------------------------------------------------------------------------------------

📜 GENERAL DISCLAIMER

This analysis is for educational purposes only and does not constitute financial advice, a recommendation, or an offer to buy/sell securities. Trading involves substantial risk of loss and is not suitable for every investor.

❗ KEY RISK ACKNOWLEDGMENTS

Not Personalized Advice: This idea is based on technical analysis and may not align with your risk profile, capital, or goals.

Past Performance ≠ Future Results: Patterns may fail due to market volatility, news, or sector weakness.

Capital Risk: You may lose all or more than your initial investment. Use only risk capital.

Stop Loss Execution: SL orders may trigger below ₹86.36 during gaps or low liquidity.

Holding Period: Positional trades require monitoring. Unforeseen events (earnings, regulations, global shocks) could invalidate the setup.

Bias Alert: This is a bullish bias idea. Always assess bearish scenarios.

🔍 Verify Independently

Cross-verify with fundamentals (debt, earnings, management).

Check broader market trends (Nifty Auto, Nifty 500).

Consult a SEBI-registered advisor before acting.

⚠️ YOUR RESPONSIBILITY

You alone are accountable for trading decisions. The author/platform assumes no liability for losses.

NOCIL LTD

Breakout Confirmation:

Strong bullish breakout above the ₹195–₹198 resistance zone.

Volume & Strength:

A breakout after a multi-week sideways range indicates potential trend reversal from the previous downtrend.

Resistance Ahead:

Immediate resistance near ₹208–₹212, which coincides with March swing highs.

Major resistance at ₹225, then ₹240.

Support Levels: New support at breakout zone: ₹195–₹198.

Stronger base at ₹185-170.

Trend Shift: The chart shows a base formation between ₹170–₹195, now breaking out.

If price sustains above ₹198 for 1–2 sessions, it confirms a short-term uptrend.

Conclusion:

Bullish bias above ₹198 with upside targets of ₹208 → ₹225.

Watch for retest of ₹198 for fresh entries with SL below ₹193.

Avoid if it dips below ₹190 with volume – that would invalidate the breakout.

SRF Ltd Breaks Out Above 2022 High — Is ₹3,300 the Next DestinatSRF Ltd has officially broken above its previous all-time high of ₹2,865 (from 2022), closing strong at ₹3,112, with an impressive weekly gain of +8.78%. Backed by increasing volume and a strong RSI of 66.70, the breakout looks technically significant.

• ✅ Breakout above life high of ₹2,865 (2022)

• 📈 Weekly High: ₹3,127

• 💰 Closing Price: ₹3,112

• 📉 50 EMA Support: ₹2,673

• 🔰 Major Support Zone: ₹2,050–₹2,080

• 📊 RSI (Weekly): 66.70 — bullish momentum building

• 🔄 Volume: 3.66M — above average

With price sustaining above the key breakout zone, the path could open toward the next resistance levels around ₹3,300–₹3,350. Watch for consolidation or retest around ₹2,865 for stronger conviction.

Analysis By Mayur Jayant Takalikar -- For LEARNING & OBSERVATIONAL USE ONLY.

⚠️ Disclaimer:

This chart analysis is purely for educational and informational purposes only.

I am not a SEBI-registered investment advisor.

Please do your own research or consult a certified financial advisor before making any investment decisions. Stock markets are subject to risk.

FXHUNTER / XAUUSDHello, I am FXHUNTER. In this post, we will analyze the XAUUSD symbol. As you can see, the structure of the gold symbol is bullish. In this situation, the block order candle that I have identified as the last block order is bearish before a strong upward move. You can wait and enter the trade when the price reaches it with confirmations such as choch, pin bar candle or trend line breakout on the 1-minute timeframe. The target is set on the higher timeframe.

DYCL STRONG BREAKOUT CANDIDATENSE:DYCL

Cable and WIre Industry Stock Good for Swing

#DYCL Strong Conviction - Increasing day by day.

Study the Price and Volume action closely.

Spikes are grabbing supplies from top and low volatility closing showing - accumulation.

Today price respected the previous day close and formed a higher high higher low structure.

All Major Levels are marked on chart.

Keep Learning,

Happy Trading.

Nifty June Iron Condor Strategy–Range is Back Premiums are JuicyHello Traders!

Here’s a plan for calm minds who want to generate passive monthly income by leveraging the power of non-directional option selling. Based on the current Nifty structure and OI data, I’ve spotted a new range-bound opportunity — perfect for executing a safe, hedged Iron Condor setup.

Why This Strategy Now? (Based on Chart Analysis)

Resistance Zone: 25400-25500 (Heavy supply, multiple rejection visible)

Support Zone: 23400-23500 (Major bounce levels, strong OI support)

Nifty is currently trading near 24500, well inside this range — perfect for deploying a neutral premium-selling setup.

Strategy Setup (Iron Condor – 26 June 2025 Monthly Expiry)

Sell 25400 CE @ ₹123

(to protect upside move rejection)

Buy 25800 CE @ ₹56

(risk protection on breakout)

Sell 23650 PE @ ₹99

(to protect downside move rejection)

Buy 23200 PE @ ₹51.4

(risk protection on breakdown)

Strategy Highlights

(Screenshot – )

Why This Works? (OI Logic + Technical View)

Strong resistance visible at 25400–25500 zone with rising CE OI

Solid put writing zone at 23400–23500 — confirms downside support

Volatility is stable, time decay is in our favor — perfect for Iron Condor writers

Risk Management & Exit Plans

Exit early if either side breaks with volume

Don’t hold till expiry — aim to exit around 70–80% max profit

Always keep SL alert at breakdown range breaches

Rahul’s Tip

"Option writing is not for thrill, it’s for discipline. Iron Condor is a weapon when range is visible — use it like a sniper, not like a gambler."

Conclusion

If your view is Nifty likely to stay between 23400–25400 for the next few weeks, this Iron Condor setup offers high-quality time-based potential. Use proper lot sizing and risk control — let the theta do the work for you!

Have you ever deployed an Iron Condor on Nifty? What was your experience? Drop your thoughts in the comments!

If you liked this post, don’t forget to LIKE and FOLLOW!

I regularly share high-quality trading setups based on real analysis, OI data, and smart risk-managed strategies.

Disclaimer: This analysis is for educational purposes only. Please consult a financial advisor before making investment decisions.

YESBANK: Riding the Bullish WaveYes Bank has exhibited a notable breakout above the resistance level established in December 2024. This breakout is accompanied by a classic flag pattern formation, which has resolved to the upside—typically interpreted by technical analysts as a continuation signal within an existing trend.

A significant increase in trading volume during the breakout phase adds weight to the move, suggesting heightened market participation. Furthermore, the 20-day EMA has crossed above the 200-day EMA, a crossover often referred to as a "Golden Cross" , which is generally viewed as a bullish signal indicating potential for continued upward momentum.

The RSI is currently positioned above 60, reflecting sustained buying interest without yet entering overbought territory.

From a structural perspective:

Immediate resistance may be encountered near the 24.75 level.

A secondary resistance zone appears around 28.54.

On the downside, the stock seems to have established a support base near 19.54, which could act as a cushion in the event of a pullback.

Disclaimer:

This analysis is intended solely for informational and educational purposes. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change rapidly, and all trading involves risk. Individuals should conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions.

BirlaSoft : Giving another Multibagger Opportunity of ~145% ?Hi Friends,

BirlaSoft a looking very good in terms of chart formation at this junture. Though The fundamentals are yet to reflect.

It usually corrects by 55-75% from the top. This time it has corrected by 60% almost .

Now the Target comes out to be around ~600 level (~145%) from the current levels .

How Target was calculated :

----------------------------------

yellow parallel lines are for channel which is respected by the stock . The same lower yellow channel line should be treated as stoploss (5-8% below the lower Yellow channel line must be stoploss).

Target is Upper yellow line of the channel.

Please feel free to share your thoughts & ask if any query related to any analysis done by me .

Note : I am not a SEBI registered advisor . Please consider my analysis only for Education purpose .

LIC of India cmp 954.45 by Weekly Chart view since listedLIC of India cmp 954.45 by Weekly Chart view since listed

- Support Zone 865 to 900 Price Band

- Resistance Zone 1010 to 1055 Price Band

- Bullish Rounding Bottom under Resistance Zone

- Heavy Volume surge by demand based buying last week

- Rising Support Trendline respected and Falling Resistance Trendline Breakout, both seem well sustained

Ambuja Cement Chart Analysis with Confirm Targets 2025 Cement Industry: A Strong Pillar of India’s Growing Economy

India remains the world’s second-largest cement producer as of 2025, and the pace of its growth continues to accelerate.

The demand for cement has surged due to infrastructure development projects such as housing construction, road expansion, railways, metro projects, and Smart Cities initiatives.

To boost infrastructure development, the Indian government has announced an interest-free assistance package of approximately ₹1.5 lakh crore.

Schemes like "Housing for All" and rural-urban housing programs have intensified construction activities across the country.

In this dynamic environment, the cement sector is receiving solid support and is expected to grow significantly in the coming years.

Ambuja Cement Company Profile

Ambuja Cements is one of India’s leading cement companies, established in 1983. It is now a part of the **Adani Group, a diversified and rapidly expanding conglomerate. The company primarily manufactures and sells grey cement and ready-mix concrete (RMC).

As the Smart City Mission, metro rail networks, expressways, flyovers, and industrial corridors progress rapidly, cement consumption continues to rise. Several large-scale cement road and railway infrastructure projects are underway across the country, expected to sustain the sector’s momentum over the next few years.

Ambuja Cement Technical Analysis

Major Resistance Zone: ₹590 – ₹700

₹590 acts as a strong resistance level, where the stock has previously faced multiple rejections.

A weekly candle closing above ₹590 would signal a strong bullish breakout.

Once this level is breached convincingly, the stock may **quickly move towards ₹700, testing its previous all-time high.

Trading Plan:

1.If the stock gives a weekly close above ₹590, it could be a buy signal.

2. The next potential target would be ₹700** based on the breakout confirmation.

Strong Demand Zone: ₹450 – ₹460

Significance of this zone:

1.The range of ₹450–₹460 has consistently shown bounce-back behavior, indicating strong buying interest.

2.Swing traders and investors** can consider accumulating when the stock nears this zone, as historical data shows this level has acted as **strong support**.

Stop-loss Strategy:

If any **weekly candle closes below ₹445, it could indicate a breakdown of support, and exiting the position would be advisable.

Support Zone Trading Plan

If the stock drops to ₹450–₹460 and **buying volume** increases, it could present a good buying opportunity.

Short-Term Potential Targets

First Target: ₹578

Second Target: ₹640

Manoj Strengthen Support – ₹413.50

The level of ₹413.50 is recognized on the chart as a strong psychological and emotional support, named “Manoj Strengthen Support.”

Why is this level important?

1. In case of a sudden market correction due to war, global recession, or political instability, this level may act as a temporary strong support.

2. It may prevent further decline and hold price levels in such events.

Investor Tip:

1. If the stock declines but this level holds, it becomes a **critical risk-management zone**.

2. Investors can look for potential **bounce-back** opportunities and strengthen their conviction around this level.

Ambuja Cement Long-Term Targets (2025–2028)

The long-term structure of Ambuja Cement appears bullish, and based on technical charts, the following major targets have been identified:

First Target: ₹700

Expected during 2025–26 if the stock gives a strong closing confirmation above ₹590.

Second Target: ₹840

If the stock decisively breaks above ₹700 (its all-time high), this target could be achievable in 2026.

Third Target: ₹1040

In the long term, if the stock sustains above ₹840, a move towards ₹1040 is likely by 2027–2028.

This analysis is based on technical breakouts, price action, and support-resistance principles, and can serve as a strategic guideline for long-term investors.

CANARA BANK (50% with in 3 Months Public Sector Banks (PSBs)CANARA BANK (CANBK) has been trading within a 3-month Bullish Megaphone pattern whose latest bottom was on the Merch 03 2025 Low. Since then, the pattern has started its new Bullish Leg, which has been confirmed by the break-out above its 1D EMA20 (Red trend-line) and the 1D RSI's above 60.

The previous three crosscover (5-20EMA) hit 10% above move. 1st 5EMA above was +10%, 2nd 20EMA restest Bullish was +16% more than 3rd Bullish move +23% , the stock achieves a +50% gain from bottom with in 3 months,

Right now stock near uper channel & Resistance zone (114-118)

Still, all candles closed above the previous Resistance 113 level. so we need to seek a confirmation of the bearish continuation and that is the Last big green candle low(109). If rejected then expect an instant drop up 105

level . If not, the last Resistance(118) is the top of the Channel . In both cases, our short-term Target is 105.

***The coming next quarter may prove to be tough for banking services and NBFCs.

The upcoming quarter may present challenges for banking and NBFCs due to factors like seasonal shifts in collections, elevated credit costs, and potential stress in microfinance and unsecured loan portfolios. While some sectors like auto loans may see seasonal improvements, others, especially microfinance, may face continued pressure.

Potential Challenges:

Seasonal Impact: Collections and recoveries are expected to improve due to seasonal factors, but credit costs are projected to remain high, particularly in the microfinance sector.

Microfinance Stress: Stress in the microfinance sector, a key concern for NBFCs, is expected to persist, potentially delaying full recovery.

Unsecured Loan Portfolio Stress: Stress in unsecured loan portfolios and credit card segments may also continue.

Regulatory Changes: Recent regulatory changes, like the Tamil Nadu ordinance, may impact the microfinance sector and potentially distort moral credit discipline.

Credit Growth Moderation:

The credit growth of NBFCs is expected to moderate in the coming year, indicating a potential slowdown.

DEN NETWORK-- REVERSAL WITH DOUBLE BOTTOM- educational purposeBOUNCED FROM WEEKLY DEMAND ZONE-- BULLISH VIEW -- EDUCATIONAL PURPOSE

Double bottom formation seen

enter on slight correction near 36

TARGET 1 : 64 (78%) 24-30 months

TARGET 2 : 83.5 (132%) --48-60 months

RR Ratio: 1:4.3

Only long term view

Technical Analysis Report: SMS Pharmaceuticals Ltd1. Bullish Flag with Pole (June–July 2024)

Bullish Flag with Pole: A continuation pattern formed after a strong upward price move (the pole), followed by a short-term consolidation (the flag), signaling the potential for another breakout upward.

Price Action: Strong impulsive rally formed the flagpole, followed by a tight consolidation forming the flag 🚩.

Breakout: Confirmed with a high-volume breakout to the upside.

Target: Achieved a massive 40% gain in under a month.

Analysis: A textbook bullish continuation pattern; traders capitalized on early entry post-breakout.

2. Distribution Phase (August–October 2024)

Distribution Phase: A sideways trading range after an uptrend where smart money or institutions start offloading their holdings. Typically a precursor to a market reversal or downtrend.

Market Structure: After the sharp uptrend, price entered into a horizontal range.

Phase Characteristics: Low volatility, repeated rejections at resistance, high volume on down days—signs of distribution.

Interpretation: Institutions likely booking profits, signaling a potential trend reversal.

Trader Sentiment: Shifted from bullish to neutral/bearish.

3. Triple Top Formation (Within Distribution Phase)

Triple Top Pattern: A bearish reversal pattern marked by three failed attempts to break above a resistance level, indicating weakening momentum and a potential downtrend.

Resistance Level: Same peak tested three times without breaking.

Breakdown: Confirmed after the third top with a decisive drop.

Target: Achieved a "30% downside" move via "short selling", all within a month.

Insight: Classic reversal pattern, effectively timed with distribution.

4. Bearish Flag with Pole (During Triple Top Breakdown)

Bearish Flag with Pole: A continuation pattern during a downtrend. It starts with a sharp decline (pole), followed by a minor upward consolidation (flag), suggesting further downside.

Formation: Sharp decline (pole) followed by a brief upward consolidation (flag).

Breakdown: Continuation to the downside, achieving projected target.

Target: Fully achieved within the same downtrend cycle.

Conclusion: Reinforced the bearish sentiment and amplified the down move.

---

5. Accumulation Phase + Triple Bottom (December 2024–April 2025)

Accumulation Phase: A market phase where a stock trades in a range after a downtrend, as buyers (often smart money) gradually build positions, typically leading to a bullish reversal.

A Triple Bottom is a bullish reversal chart pattern that forms after a downtrend, marked by three equal lows indicating strong support and a potential trend reversal to the upside.

Phase: 5-month Accumulation Phase

Pattern: Triple Bottom during this period indicated strong support and buyer presence.

Breakout: Occurred with a bullish breakout post third bottom.

Target: 20% upside achieved within a month post-breakout.

Observation: Long-term investors and smart money potentially entering positions.

6. Rounding Bottom in Progress (May 2025)

Pattern: Rounding Bottom (Still Forming)

Current Price Action: Gradual curve formation with decreasing volume on the left and increasing volume near the neckline— a bullish sign.

Expectation: Anticipated upside breakout in the coming days.

Outlook: If confirmed, this could mark the start of a new bullish cycle.

📌 Summary:

SMS Pharmaceuticals Ltd. has shown a textbook series of technical patterns—from trend continuations to reversals, distribution to accumulation, and now a potential new uptrend. Each phase was actionable, with clear breakout/breakdown points and well-achieved targets.

Who Should Avoid Trading? Is That You? Ask YourselfThere is no doubt that trading is the simplest business in the world. You just need to do a small paperwork which is online these days, need a laptop or PC and an internet connection. Besides that, all you need is time. But here the simplest should not be confused with the Easy. Although you just need a mouse click for execution yet the decision-making process in the background confuses you and leads to hasty or delayed mouse clicks most of the time.

Perhaps anybody can start trading at will but in my opinion, followings are a few cases where short term trading should be avoided.

If you are not Rich then avoid...

Yes, you read it correct. It is rich people’s game. If you don’t have huge money to back you up, you have less probability of success in this business. A small example. I know these days index option trading is in trend. You can buy an option in under 10,000 rupees but the darker reality is that most people starting with small capital are losing money. All brokers in India warns you about this when you open your trading terminal and that is for a reason.

Options are hedging instruments, if you are buying them naked with a small capital then you are going to lose because of Greeks- Theta to be more precise.

If you don’t have 5 to 10 lakh spares that you are willing to lose without a strain on head, then don’t do this business. Depositing small capital again and again in your trading account is not going to work.

If you want to get rich quick then avoid...

Everybody choosing short term trading wants to be rich overnight- dreaming of buying a tradable instrument at 10 rupees and selling at 1000. Sadly, most of those thinkers are getting poor and poor day by day. Trading is not a ‘get rich quick’ business, it is all about slow and gradual learning and execution with discipline. This is not lottery or casino, you need to build your capital gradually. This way you learn at each and every step.

Even if you make huge money in a few trades or a few days, there are higher chances that you will lose it in lesser number of trades or days. Money earned in haste leads to hasty decisions. Excitement and lack of experience kills. Experience is not about -how many trades you made in a year, it’s about - on how many mistakes you worked in a year.

If you are stubborn to change your mindset then avoid...

Mindset matters the most in trading. If the following runs in your mind while trading, then you have a lot of work to do on your mindset.

I am always correct, I can never be wrong, this trade must work, this strategy must work…

I can never be correct, I am always wrong, this trade is going to lose, this strategy is not going to work…

In reality, market does not care what you think. It keeps doing what it has to. You just need an Edge and a focus on its execution. This is all what you have in your hands. Neither the market is not going to trend because you are riding that trend, nor it is going to reverse because you think it is going to reverse. It's all about trades going Right and trades going Wrong. Thinking about those in terms of probability might work.

If you are new, start working on your mindset right away but if you are in this business for a decent amount of time and still losing then you are stubborn to change.

If you do not have a side income then avoid...

This business demands money. Initially you are bound to lose. It’s a learning process or fee that you need to pay to the market. You can’t pay your bills from trading, at least in your initial phase. I am not talking about those with the beginner’s luck.

These losses can go for even for months and you need a backup which could be any side business or support that can feed your monthly expenditures and refill your trading account as well. Paper trading could be a solution, but real trading is truly different. Emotions play their role when real money is involved and that often lead to unwanted results.

Also, always have a Plan B. Give some stipulated time to trading and if it does not work in that much time, move to your side business.

If you are not willing to lose then avoid...

Aspiring for short term trading and not willing to lose? Then sorry my friend, don’t even give it a try.

As I said in the above paragraphs, you will lose money when you trade for short term because trades will go against you several times. If you keep on holding those losing trades in hope, you will lose more by the end of day or week. A simple stop loss could be a solution. Calculate how much you can risk on a trade and identify your SL and position size according to that. Put a hard SL in the system and that’s it.

If you have 'don’t want to lose' attitude, then short term trading is not for you.

I just hope this article would help some aspiring buds in their trading journy.

Do like and comment to motivate for more writeups in future.

Regards

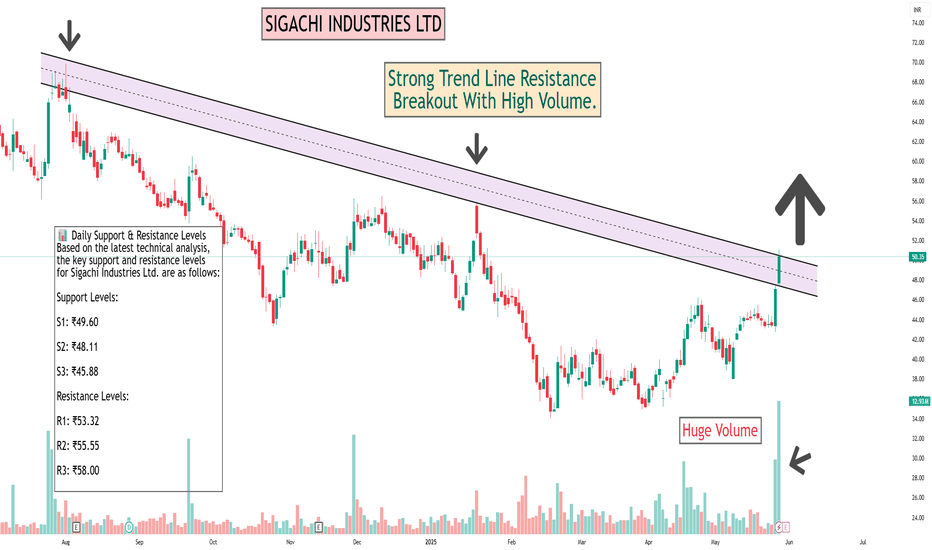

SIGACHI INDUSTRIES LTDAs of May 29, 2025, Sigachi Industries Ltd. (NSE: SIGACHI) is trading at ₹50.35, reflecting a 6.95% increase over the previous close.

📊 Daily Support & Resistance Levels

Based on the latest technical analysis, the key support and resistance levels for Sigachi Industries Ltd. are as follows:

Support Levels:

S1: ₹49.60

S2: ₹48.11

S3: ₹45.88

Resistance Levels:

R1: ₹53.32

R2: ₹55.55

R3: ₹58.00

These levels are derived from pivot point calculations based on the previous trading day's price range.

🔍 Technical Indicators Overview

Relative Strength Index (RSI): The RSI is currently at 87, indicating that the stock is in overbought territory. This suggests that the stock may be due for a short-term correction.

Moving Averages: Sigachi Industries is trading above its 5-day, 10-day, 20-day, 50-day, 100-day, and 200-day simple and exponential moving averages, indicating a strong bullish trend.

MACD (12,26): The MACD is currently at 2.15, suggesting bullish momentum.

📈 Market Sentiment

The technical indicators collectively suggest a strong bullish sentiment for Sigachi Industries Ltd. However, the RSI indicates that the stock is in overbought territory, which may lead to a short-term correction. Investors should monitor the support and resistance levels closely for potential breakout or pullback scenarios.

Please note that stock market investments are subject to market risks, and it's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

INDIAN TELEPHONE INDUSTRIED LTD - NSE | Daily Chart📊 INDIAN TELEPHONE INDUSTRIES LTD (ITI) – NSE | Daily Chart

📅 Date: May 28, 2025

📈 Current Price: ₹309.25 (+9.99%)

📌 Ticker: NSE:ITI

🧠 Technical Analysis Overview

✅ Cup & Handle Breakout 🍵📈

Price action has formed a classic Cup & Handle pattern — a bullish continuation setup indicating a potential uptrend continuation. The breakout is confirmed with a strong bullish candle and significant volume surge today.

✅ Volume Confirmation 📊

Today’s breakout above the ₹288 resistance comes with massive volume (~11.6M), validating strong buyer interest and momentum behind the move.

📍 Key Price Levels

📌 Breakout Level:

✅ ₹288.05 (Previous resistance flipped into support)

📌 Immediate Resistance / Targets

🎯 ₹340 – ₹360 (Short-term target based on pattern projection)

🎯 ₹400+ (Medium-term upside potential if momentum sustains)

📌 Support

🟨 ₹288 (Breakout retest zone)

🟥 ₹270 (Handle support)

📈 Trade Idea

Breakout Entry: ₹290–₹305

Retest Entry: Near ₹288 (if price revisits)

Stop Loss: Below ₹270

Target 1: ₹340

Target 2: ₹360

Target 3: ₹400

⚠️ Disclaimer

This chart analysis is for educational and informational purposes only. Not financial advice. Always do your own research before investing.

A Classic Case of Accumulation Turning into Momentum📈 SUPREME INDUSTRIES LTD – TECHNICAL ANALYSIS

📆 Date: May 27, 2025

🔍 Timeframe: Daily

Price Action:

Supreme Industries surged over 4% today and delivered a clean breakout after forming a consolidation triangle. The strong bullish candle closed near the day’s high with significant volume, confirming momentum on the upside.

Chart Pattern / Candlestick Pattern:

Symmetrical Triangle Breakout

Pullback Entry Zone Tested

Breakout Candle – wide range, strong body

Volume Surge – institutional interest visible

Technical Indicators:

RSI (Daily): 77 – strong bullish zone

MACD: Bullish crossover active

Stochastic: 98 – overbought but confirming strength

CCI: Above 200 – high momentum phase

Volume: 791.75K – supportive of breakout

Support & Resistance Levels:

Immediate Resistance: 4277.93

Next Resistance: 4355.47

Major Resistance: 4490.43

Immediate Support: 4065.43

Secondary Support: 3930.47

Major Support: 3852.93

Possible Fresh Demand Zone: 3837.60 – 3750.90

Chart Overview:

This visual clearly shows:

🔸 The symmetrical triangle pattern

🔸 Breakout + retest zone

🔸 Marked fresh demand zone for potential pullback opportunity

Educational Breakdown:

This setup combines:

Price Action: Triangle + Breakout

Volume Confirmation: Institutional participation

Momentum Indicators: Strong alignment

Demand Zone Mapping: Pre-breakout base

This is a classic trend continuation setup with clearly defined zones of interest. Risk control is key as price enters overbought territory.

Over the past few months, Supreme Industries displayed classic signs of an accumulation zone — a period marked by sideways movement, controlled volatility, and relatively stable volumes. This range-bound behavior typically indicates that long-term investors are quietly building positions while retail participation remains low. Recently, a strong bullish move supported by a significant rise in volume suggests the stock may have exited accumulation and entered the mark-up phase. This phase is often characterized by increased demand, higher price swings, and a clear shift in sentiment from neutral to bullish. The sharp breakout from the range, along with volume confirmation, signals the possible beginning of a new directional trend — where price tends to move swiftly as broader market participants join in.

How to Trade Supreme Industries (for learning purpose):

Entry Example: 4220.50

Stop Loss: 3781.50 (Risk: 439.00)

Target Example: 4659.50 (Reward: 439)

Sample Quantity: 50 shares

RR Ratio: ~1:1/1:2 etc.

Aggressive Traders: May consider riding the trend with trailing stop

Conservative Traders: Can wait for a pullback into the fresh demand zone (3837.60–3750.90)

⚠️ Risk Management Tip: Always trade with a clearly defined stop loss. Avoid entering positions impulsively. It is advisable to start with a smaller quantity and increase your exposure only if the price action confirms the continuation of the trend. Capital protection should always be the priority.

📢 Disclaimer

This content is created purely for educational and informational purposes. It is not intended as investment advice, stock recommendations, or trading tips. Trading and investing in the stock market involves risk. Please consult with a SEBI-registered financial advisor before making any investment decisions. The author/creator is not registered with SEBI and shall not be held responsible for any losses incurred based on this information. Always do your own research and use proper risk management.

👉 If you found this analysis helpful, don’t forget to Follow, so you never miss out on a trade-worthy setup, breakout opportunity, or valuable educational insight again. Stay updated and trade smarter! 💡📈

End of correction in Hinduja Global SolutionsElliott wave analysis:-

A long bear trend has been almost over and we may expect a slight fall from here or the Candle may rise to stars from here. if you wish to be cautious then wait for a pullback for almost 65% to 78%. keep the previous low as your stop loss go for a long ride.

i am not a SEBI registered advisor. Before taking a trade do your own analysis or consult a financial advisor. I share chart for education purpose only. I share my trade setup.