Varun Beverages Ltd (VBL)VBL in monthly chart completed wave 3rd

and corrective 4th wave's min target 432 too done on down side.

38% 432

50% 357

Expecting it to start the 5th wave up for 700++ target

VBL : Varun Beverages Limited is an Indian multinational company that manufactures, bottles and distributes beverages. It is one of the largest bottling company of PepsiCo's beverages in the world outside the United States.

The Company manufactures, distributes and sells a wide range of carbonated soft drinks (CSDs), as well as a large selection of non-carbonated beverages (NCBs), including packaged drinking water sold under trademarks owned by PepsiCo.

Disclaimer : I AM NOT SEBI REGISTERED . NO BUYING / SELLING RECOMMENDATION. VIEWS ARE JUST FOR STUDY PURPOSE and learning Elliott wave Analysis.

Elliotwaveanalysis

VIPIND: Unlocking Potential After Downtrend

VIP Industries has demonstrated robust bullish momentum over the past few trading sessions, signaling a notable shift in market sentiment. This upward trajectory is particularly significant given the stock's prolonged downtrend since October 2024.

From an Elliott Wave perspective, the recent price action suggests the potential completion of a corrective phase. The retracement from what appears to be Wave 1 to Wave 2 aligns closely with the 61.8% Fibonacci retracement level, which often precedes the initiation of a strong Wave 3 impulse. This potential wave structure, if confirmed, could indicate further upside potential.

A key development supporting this bullish outlook is the stock's recent decisive close above its 200-day EMA, accompanied by a significant surge in trading volume. This confluence of price action and volume confirms strong buying interest and suggests a potential long-term trend reversal. The increased volume further validates the strength of the breakout, indicating broader market participation.

While the immediate outlook appears constructive, traders should be mindful of potential profit-taking around the ₹446 level. This area may present a temporary resistance zone where some short-term corrections or consolidation could occur. However, should the stock successfully navigate this level, the next significant upside resistance target to monitor is ₹492 . This level aligns with prior price highs and could represent a more substantial challenge for further upward movement.

For risk management purposes, a prudent approach would involve considering a stop-loss order positioned below the identified support zone, as depicted on the chart. This strategy aims to mitigate potential downside risk in the event of an unexpected reversal in market sentiment.

Disclaimer: The information provided in this technical analysis is for informational and educational purposes only and should not be construed as financial advice. It is based on observations from the provided chart and commonly used technical indicators. Market conditions can change rapidly, and past performance is not indicative of future results. Always conduct your own comprehensive due diligence and consult with a qualified financial advisor before making any investment decisions.

Sun Pharma: A Bullish OutlookHello Friends,

Welcome to RK_Chaarts,

Let's analyze the Sun Pharmaceuticals chart using technical analysis, specifically the Elliott Wave Theory. According to this theory, the September 2024 top marked the end of Wave III cycle degree in red, and the March 2025 bottom marked the end of Wave IV cycle degree in red Now, Wave V of cycle degree in red has begun, which will move upward.

Within Wave V, we should have five sub-divisions of Primary degree in black, with Wave ((1)) & Wave ((2)) already completed. Wave ((3)) has started, with five further sub-divisions of one lower degree intermediate degree, We've marked these in blue, with Wave (1) and Wave (2) completed, and Wave (3) started. Within Wave (3), we have minor degree waves in red, with Wave 1 and Wave 2 completed, and Wave 3 breaking out today with good intensity of volumes.

We can see that the wave counts are super bullish, and so is the RSI, which is above 60. The MACD is also positive, and the price is above the 50-day and 200-day EMAs on the daily and weekly time frames. There's no moving average hurdle, which is another super bullish sign.

We can also see a higher high and higher low formation, which is a bullish sign according to Dow Theory. Additionally, an inverted head and shoulders pattern is forming, with the right shoulder being made. When it breaks out above the neckline, it will give us a target, which aligns with the Elliott Wave Target projection.

All these indicators – technical analysis, price action, and Elliott Wave – point to a bullish trend. However, there's an invalidation level at 1550; if the price falls below this level, our wave counts will be invalidated.

We're projecting targets between 2000-2200 based on Elliott Wave theory projections. Please note that this analysis is for educational purposes only and should not be considered as investment advice.

This post is shared purely for educational purpose & it’s Not a trading advice.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Best Possible Elliott Wave Counts: ETHUSDHello friends,

Welcome RK_Chaarts.

Today we're attempting to analyze Ethereum's chart from an Elliott Wave perspective. Looking at the monthly timeframe chart, we can see that from the beginning, around 2015-2016, when data is available, to the top in 2021 we have a Super Cycle degree Wave (I) marked in blue, which has completed.

Next, June 2022 we have a bottom around $874, marking the end of Super Cycle Wave (II) in blue.

We are now unfolding Wave (III), which should have five sub-divisions. Within this, the red Cycle degree Wave I and Wave II have completed, and we have possibly started the third of third wave.

Monthly:

Moving to a lower timeframe (Weekly) where we observed the completion of blue Wave (II) and the start of Wave (III), we notice that within this, the red Cycle degree Wave I and Wave II have completed, and we've possibly started Wave III of cycle degree marked in Red.

Furthermore, friends, within this third wave, we've marked the black Primary degree Waves ((1)) and ((2)), which we've labeled as Rounded ((1)) and Rounded ((2)). We're assuming these are complete, and Wave ((3)) has started, which is our current working hypothesis.

Weekly:

Now, if we move to a lower timeframe, such as the daily chart, we can see that the Cycle degree Wave II, which ended at 1385.70, has been followed by a Primary degree black Wave ((1)) in Black & Wave ((2)) has pulled back, completing Waves ((1)) and ((2)), and now Primary degree Wave ((3)) has started.

Possible wave counts on Daily

Within Wave ((3)), we expect five Intermediate degree waves. We've marked the first Intermediate degree Wave (1) in blue, which is currently unfolding. If we move to an even lower timeframe, such as the 4-hour chart, we can see that within the Intermediate degree blue Wave (1), there are five Minor degree sub-divisions marked in red. Waves 1 and 2 are complete, and Wave 3 is nearing completion.

Possible wave counts on 4 Hours:

Once Wave 3 is complete, we expect Waves 4 and 5 to follow, completing the Intermediate degree blue Wave (1). After that, we may see a dip in the form of Wave (2), followed by a continuation of the bullish trend as blue Wave (3).

Possible wave counts on 60 Min:

Friends, based on our multi-timeframe analysis, the overall wave structure appears bullish. We've provided snapshots of each timeframe, and you can see the nearest invalidation level marked with a red line.

In this study, we're using Elliott Wave theory and structure, which involves multiple possibilities. The scenario we're presenting seems plausible because it's aligned across multiple timeframes and adheres to Elliott Wave principles. However, please remember that this analysis can be wrong, and you should consult with a financial advisor before making any investment decisions.

This post is shared purely for educational purposes, to illustrate possible Elliott Waves.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Chaarts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

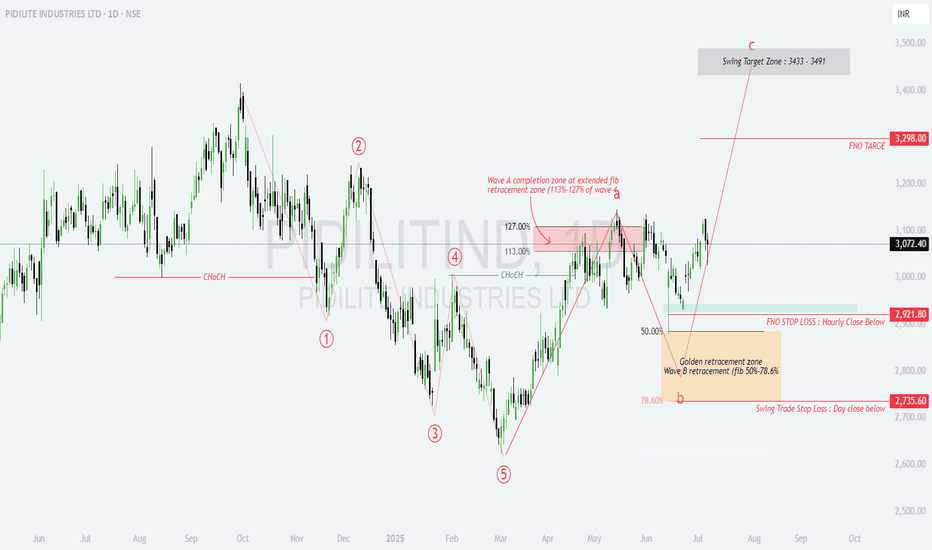

Hidden in Plain Sight – This PIDILITE Setup Screams Opportunity!📊 PIDILITE – Post 5-Wave Fall, ABC Recovery In Progress

Golden Fib confluence + strong structure = high-confidence swing setup

Wave structure aligns with ideal retracements; Wave C potential unfolding with swing targets ahead.

🧩 Elliott Wave Breakdown:

Complete 5-wave decline from swing highs → Wave 5 bottom confirmed

Wave A completed at extended fib zone (113%–127% of wave a)

Wave B retraced to Golden Zone: 50%–78.6% of Wave A

Wave C now progressing toward swing target zone

🔍 Technical Confluences:

Wave A Completion: ₹3130–₹3180 (113–127% extension)

Wave B Golden Zone: ₹2735–₹2921

Strong bullish rejection and follow-through from Wave B lows

CHoCH break confirms trend reversal from Wave 5 low

🎯 Target Zone for Wave C:

Primary Swing Target: ₹3433–₹3491

FNO Upside Level: ₹3298

🛑 Stop-Loss Levels:

Intraday SL: Hourly close below ₹2921.80

Positional SL: Day close below ₹2735.60

📈 Setup Summary:

Clear ABC corrective recovery in play

Ideal Fib alignment at both Wave A and B

Structure favors low-risk, high-reward long opportunity

Entry near ₹3070–3080 offers excellent positioning

A technically sound swing setup with defined structure and reward zones – great candidate for Wave C riders.

#Pidilite #ElliottWave #SwingSetup #WaveTheory #Nifty200 #TradingViewIndia

DLF: Elliott Wave AnalysisWe will soon get an excellent buying opportunity in DLF.

As we can see, I have marked DLF using Elliott Wave theory and Fibonacci.

You can see that, after forming wave (1), the market falls to form wave (2). In wave (2), we can see Flat Correction marked with ABC counting.

Price then moved fast, indicating a clear impulse to form wave (3).

Currently, we are in wave (4) in DLF.

As per the rule, we can expect wave (4) to terminate between 23.6% and 38.2%

This is the most probable zone where we can expect a new impulse, i.e., wave (5), to start.

One has to wait for the market to fall in this Buying zone to get a good buying opportunity.

This analysis is based on Elliott Wave theory and Fibonacci.

This analysis is for educational purposes only.

This is not a buying recommendation.

TATA CONSUMER — The Calm Before Wave 5TATA Consumer has completed a textbook corrective structure from its recent high of 1180.50. The entire correction unfolded as an ABC zigzag, neatly contained within a falling channel. Within wave C of this zigzag, price action formed an ending diagonal, with wave 4 overlapping wave 1—confirming the diagonal structure and marking the completion of higher-degree wave 4 at 1059.

This 1059 level also becomes the key invalidation point for the current bullish outlook.

Following this, price broke out impulsively to 1150, forming what appears to be wave 1 of the next leg higher—wave 5. The current pullback is likely wave 2 of 5, and as per Elliott Wave rules, it must remain above 1059 to keep this count valid.

Wave 5 targets are projected using a 100% extension of wave 1 from the end of wave 4, which gives a potential upside zone around 1250.90. This forms the ideal target range if the wave count unfolds as expected. The targets could as well extend to 1.618x of wave 1.

From a higher-degree perspective, since wave 4 overlaps with wave 1 (at 1075), the entire advance is best seen as a leading diagonal. This pattern often appears as the first wave of a new impulse, reinforcing the view that one more leg higher is likely to complete wave 5 and mark the end of wave 1 or A of a larger degree.

RSI had peaked near 70 during subwave 1 of 5 and has now cooled to the 40s, which aligns well with a wave 2 retracement. Earlier, RSI had dipped closer to oversold levels at the Wave 4 low, adding further support to the case for a completed correction.

Conclusion:

We are in prime low-risk, high-reward territory.

Setup is textbook Elliott bullish continuation — tight invalidation and defined structure.

Disclaimer:

This analysis is for educational purposes only and not investment advice. Always do your own research before making trading decisions.

ONGC: A Triangle, a Setup, and a Launchpad for Wave 5Following the completion of Wave 3 — an impulsive rally from the 205 low — ONGC entered what looks like a classic Wave 4 triangle. The internal structure — labeled A through E — unfolded in a controlled, converging fashion, respecting the triangle boundaries. Wave E recently ended near 241.54, right on top of the 100-day simple moving average, which has acted as dynamic support.

Interestingly, we saw strong volume come in during the rally into Wave D, indicating buying interest. This was followed by a period of low volume and sideways drift during Wave E, which fits the expected behavior for the final leg of a triangle. RSI also cooled off during this period, resetting from overbought levels, and currently hovers just below the 50 mark.

The invalidation for this triangle setup is placed below the Wave C low, around 235.5. A decisive break below this level would nullify the triangle structure and open the door for a deeper, more complex correction. But as long as price respects this zone and begins to push upward with volume, the case for a Wave 5 rally remains strong.

Fibonacci projections place the 100% extension of Wave 1 through 3 near 263.75 and the 1.618 extension near 277.50 — a likely zone for Wave 5 termination. If ONGC can break above the D-wave high with momentum, it may very well be headed toward those levels in the coming weeks.

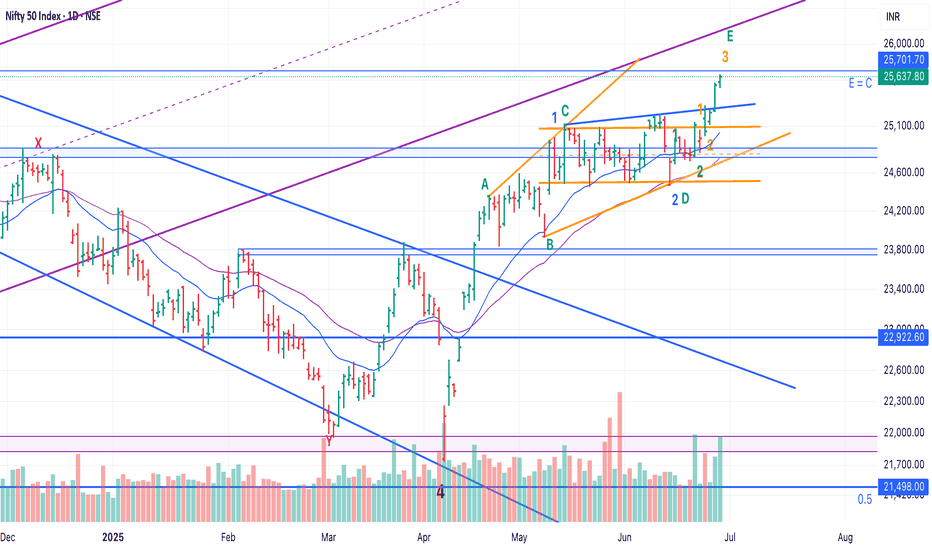

Nifty - Elliot Wave - Update - Stay long till proven otherwise!Our view that at least one more leg up was pending has held out well.

View shared here:

Now, Since it took longer in consolidation, I am open to considering that we did a sideways 2 and are heading up in 3.

Crossing 25700 will invalidate LD and hence increase probability that 3 up has started.

P.S.: If we are actually in 3, then 28k - 30k possible in this year. So, hold on :)

Nifty 50 Daily Wave Count - Trend - PatternHi, friends

Today we saw negative gap down opening and market recover very positively after a one deep.

But at the end of the day Nifty index gave negative close.

After impulsive move , we can see running flat type of corrective pattern that follows the 3-3-5 wave structure. It's similar to an expanded flat, where Wave B extends beyond the start of Wave A, but unlike the expanded flat, Wave C fails to reach the end of Wave A. This means the price retraces beyond the 100% level of Wave A in Wave B, but the subsequent Wave C doesn't complete the correction by exceeding Wave A's end point.

here i am assuming wave c is over . here i marked bottom of wave A, if low of wave A breaks then the running flat pattern will be invalided.

Natural Gas Futures: Triangle Breakout and New Impulse UnfoldingNatural Gas Futures (MCX) is showing an interesting Elliott Wave structure unfolding. After completing a corrective Y wave near 133.6, prices started a well-defined impulsive advance. The initial advance took shape as a 5-wave structure (yellow degree), completing wave 1 at 261.2, followed by a healthy correction into wave 2 at 156.7. The subsequent rally carved out another 5-wave pattern (green degree), pushing prices toward 407.8, marking a likely completion of wave 3.

The corrective wave 4 unfolded as a typical contracting triangle (ABCDE), finding support around 297.3. This triangle structure respected the Elliott guidelines quite well and indicates a potential setup for the next impulsive leg higher.

Post-triangle, the initial move up to 359.2 can be counted as wave i of the next larger impulse. The ongoing retracement has pulled back close to 61.8%–78.6% Fibonacci levels, a common zone for wave ii corrections. The RSI continues to print higher lows, supporting the underlying bullish sequence.

The invalidation zone is clearly marked around 297.3. As long as price remains above this level, the possibility of an ongoing bullish impulse remains valid, with eventual targets extending much higher toward the 1.618 projection zone near 503.

This remains a developing wave count, with structure still unfolding. Monitoring how price reacts around current levels will provide further clues whether the larger bullish sequence resumes or deeper correction emerges.

Disclaimer:

This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

Low-Risk Entry Zones Emerging in TCS and CANARA BANKTCS - Potential Nested 1-2 / 1-2 Setup

After completing a higher-degree corrective phase, TCS has likely begun a new impulse sequence. The structure so far suggests a nested 1-2 / 1-2 setup:

Higher-degree Wave 1 peaked near 3630.50, followed by a corrective Wave 2 into 3358.70.

Inside the new sequence, minor wave i topped at 3538.00, with a minor wave ii correction down to 3370.00.

This leaves the door open for a sharp upside move if the structure unfolds as a Wave 3 acceleration phase. The invalidation for this scenario remains tight below 3358.70 . As long as price holds above this level, the nested setup remains intact with Fibonacci projection targets at:

3549 (1.0x)

3660 (1.618x)

3839 (2.618x)

Risk Management Note:

The tight invalidation allows for a favorable risk-reward profile. If price breaks below 3358.70, the nested count would be invalidated and a larger degree corrective structure may still be unfolding.

CANARA BANK - Impulse in Progress with Minor Wave 5 Pending

CANARA BANK presents a slightly different but equally interesting structure. Here, we observe a clean five-wave impulse unfolding from the March low of 78.60:

Major Wave 1: 95.19

Major Wave 2: 83.70 (deep but typical retracement)

Minor Wave 1: 102.63

Minor Wave 2: 90.95

Minor Wave 3: 119.30 (strong extension)

Minor Wave 4: 104.60 (respecting 50% retracement of Minor 3)

Price is now in the early stages of Minor Wave 5, which could complete the larger degree Wave 3. Fibonacci projections for the higher degree Wave 3 stand between 123.5 and 135.2.

Risk Management Note:

The invalidation for the immediate setup lies below 104.60. As long as this level holds, the path higher remains favored.

Summary:

Both TCS and CANARA BANK are showcasing clean Elliott Wave setups with well-defined invalidation zones. Traders following these patterns should monitor the invalidation levels closely, as failure to hold these zones will require a reassessment of the wave counts. However, while price respects these structures, the potential for sharp impulsive advances remains on the table.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

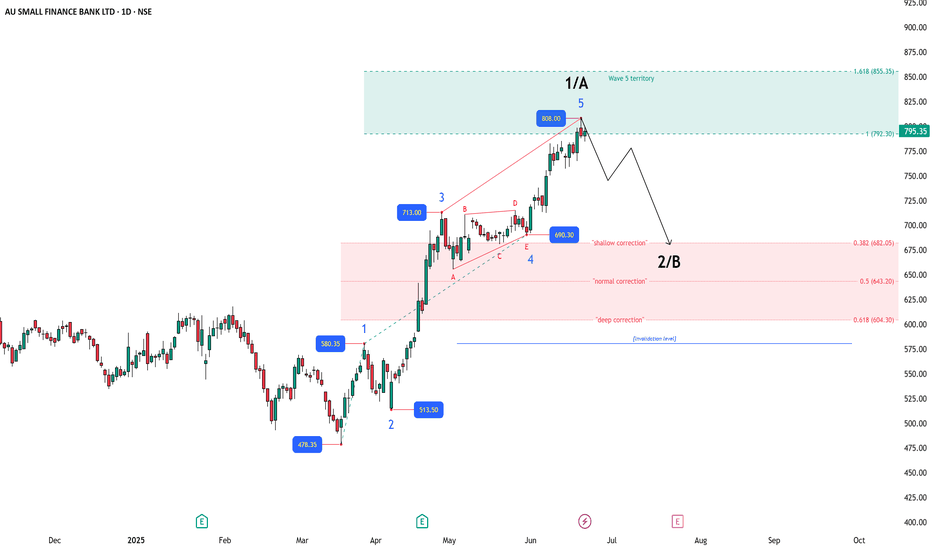

AU Small Finance: Final Push or Start of a Pause?AU Small Finance Bank has delivered a impulsive rally over the last few months. Starting from the March lows near 478, price unfolded into a clean 5-wave structure that carries all the classical Elliott Wave characteristics. Each leg followed the rules beautifully — with Wave 3 extending nicely, Wave 4 forming a triangle, and Wave 5 launching higher from there.

At present, Wave 5 has already reached 808, which satisfies the minimum Fibonacci projection of 1.0 (792) measured from Waves 1 through 3. However, it remains slightly open whether this fifth wave has fully matured. The upper target zone extends toward 1.618 projection, near 855, and price action in the coming sessions will be crucial in determining if there's a final push left before the larger corrective phase kicks in.

Should Wave 5 be complete — or once it completes — the market would likely transition into a corrective phase labeled here as Wave 2 or B, depending on whether this rally was the beginning of a larger impulsive sequence or part of a more complex corrective structure. Typically, corrections following a full 5-wave impulse retrace deeper than most traders expect. The initial shallow support may emerge near the 0.382 retracement around 682, but more meaningful supports sit at 0.5 retracement near 643 and potentially even 0.618 near 604. These zones will be critical to watch as the structure unfolds.

Invalidation for this entire bullish structure would sit below the origin of Wave 1, meaning any sustained breakdown below 580 would negate the bullish scenario entirely. But for now, the focus remains on watching how price behaves inside this final leg of Wave 5 — whether it's already done, or teasing a last-minute extension toward 855 before correcting.

As always, market structure will continue to guide the next moves, and updates will be made as price action evolves.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

IDFC FIRST BANKIDFCFIRSTBANK.

Anything above 112 should be part of euphoria that may extend upto 164.17 (if sentiment allows); corrective 5th may end around 50-53 and then final thrust towards new high (5th) should begin. (If , moves past 80-83 without 5th correction , corrective wave count will be invalid).

Labelling of counts can be wrong in this, but you get the idea.

BDL | Long | Swing Setup | Wave AnalysisBDL is either in Wave C of abc

or Wave 3 of 1-5 as shown in chart

both cases suggest a bullish up-move towards target one in case of wave C and towards target 2 in case of wave 3.

SL would be 1090- 1130 zone. If looks weak in this zone we will exit.

Increasing volume suggests a good momentum long setup.

Just my 0.02$

GOLD: Further levels using Elliott Wave TheoryWe successfully forecasted the path of gold in our post on May 12th.

Now, GOLD is looking like it's entering an impulse wave.

Wave (1) of this impulse was completed on 23rd May. The price then falls between the zone 38.2% and 50% to form wave (2). This was also predicted by us.

Currently, GOLD is in wave (3).

Now, to get the targets of wave (3), we have two possibilities.

1. Wave (3) goes to 100% and then reverses. This case is of the Terminal impulse. And the further path of GOLD can be predicted later.

2. Wave (3) goes to 161.8% (minimum). This is the case of Trending or normal impulse. And further path of GOLD can be predicted accordingly.

For now, GOLD is looking like going to touch at least the 100% (3490.81) level.

This analysis is based on Elliott Wave theory and Fibonacci.

This analysis is for educational purposes only.

This is not any buying recommendations.

Nifty Mid_Select IndexHello & welcome to this analysis

From July 2022 to Sep 2024 it appears to have completed an impulse 5 waves up structure forming a Primary Wave 1

From Sep 2024 to Apr 2025 is a corrective ABC wave that has done a 38 Fibonacci retracement.

While it is too early to suggest whether that zigzag fall was a Primary Wave 2 or Wave A of B. The unfolding in the daily time frame suggest the probability of the former and start of a Primary Wave 3.

A weekly close above 13250 would increase the conviction of an impulse wave for probable levels where it could make swing highs along its path at approx 14300, 15000, 18000 & 20000.

Keep in mind where I have plotted Intermediate Wave 3 could also be an expanded Wave B. Therefore, keep an alternate count in hand till it gives more and more confirmation for bullishness.

I am going with the probability of this being a bullish structure as of now

All the best

Apollo Tyres: Navigating the WavesWelcome to RK_Chaarts.

Today, we're analysing the daily time frame chart of Apollo Tyres from Elliott waves perspective. Here, we can clearly see that the intermediate-degree Wave (3) (blue) formed a high around ₹555 in February 2024. After that, an A-B-C corrective pattern unfolded in a 3-3-5 expanded flat structure, which is Wave (4) blue intermediate-degree. We can say that Wave (4) possibly ended at the March 2025 low around ₹370.

Now, we're possibly unfolding Wave (5) in blue of the intermediate degree, which will have five sub-divisions: of minor-degree Waves 1-5 (red). Possibly, Wave 1 (red) has ended, and Wave 2 (red) is currently unfolding. After Wave 2 ends, the price may reverse upwards, forming Wave 3, followed by Wave 4's retracement and then Wave 5's high.

Where can be next possible reversal

On the weekly timeframe, the price is moving within the upper Bollinger Band zone. The weekly 20-Weekly simple moving average (or 20-week simple moving average), which is the mid-Bollinger Band, is around ₹440-₹437. It's possible that Wave 2 will find support around this level and then reverse upward.

Invalidation level

Note that Wave 2 cannot retreat more than 100% of Wave 1, according to wave theory principles. The low of ₹371, where Wave 1 began, is the invalidation level. If the price breaks below this level, it may trigger an invalidation, and we might be looking at a double correction or a double three structure instead.

Projected Targets

However, if the invalidation level holds, the upward movement will likely continue. The projected target for Wave 5 could be around ₹555-₹603, based on the ratio analysis of Waves (3) and (4).

Important Notes

- Breaking below the invalidation level would require re-evaluation of the wave count.

- Sustaining above the invalidation level increases confidence in the projected target.

Let's see how the market unfolds. This entire study is shared solely for educational purposes. Thank you so much.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Nifty - Elliot Wave UpdateNifty has been testing patience and not letting anyone take positional trades since mid of May.

24500 has acted as a crucial support - and as we come to re-test it today for the 3rd time, I thought of updating the view after my last post on May 15th, as we have a good RR long trade here.

We had two alternates:

1. We are in 5th up/ which got done, is about to be done. In this case we head down to 23500 or so and then we review if this bounce was corrective or we are going to ATH.

2. We did 1 and 2 and have started 3 up. Within 3 we started the 3rd up today. If this is true, the run up should continue for next few days.

Now, possibility 2 remains as it is, but possibility 1 has changed to look like a leading diagonal.

So, instead of 12345 (where 1 and 4 cannot overlap), we are moving up in ABCDE (where A and D can overlap).

My view is that we have E up pending - and since we have taken so much time in D, more room is getting opened in E up (top of the wedge structure) - which was 25300 earlier, and is now looking at around 25700 - which is a good 1200 points from here.

This move up will also test the bottom of the longer channel we followed from March 2023 and broke in Jan 2025. So, a first test of that channel would mark as a good point for wave 1 to end and a correction to begin till 24000-23800.

24500 breaking and sustaining should act as SL. So, we have a good trade set-up at hand to play till 25500 or 5 wave up, whichever happens first

All the best!

TTML: Unlocking Potential with Elliott WavesHello friends, Welcome to RK Chaarts.!

Let’s analyse the chart of Tata Teleservices Maharashtra Limited from an Elliott wave perspective.

We can see that in March 2023, the stock formed a bottom around 49.65 and then moved upwards in an impulse wave. We can identify wave one as complete, ending around the July 2024 high.

After that, there was a sudden fall to the April 2025 low, which we assume to be the end of wave two. We expected it to reverse around the previous low, because wave II cannot retrace more than 100% of wave I (Elliott wave principles), and Same happened, it had reversed from that low to upside.

Looking at the weekly chart, we can see that post wave II, price has broken the 0-B trend line with strong volume intensity. If our wave counts are correct, we can measure wave I and project wave III’s target using Trend based Fib extensions as per Elliott wave theory.

According to the theory, wave III target could be around 150.70, which is 1.618 times the length of wave I.

Projected Targets as per Elliott waves:

So, friends, from an Elliott wave perspective, Tata Teleservices has strong potential to move upwards to around 150 rupees, with potential targets at 88, 112, 127, and 150 rupees.

Invalidation levels:

Please note that this analysis is for educational purposes only and involves multiple possibilities. The scenario presented focuses on one potential outcome, assuming the invalidation level of 49.65 is not triggered. If it is triggered, the chart would need to be reassessed, and wave counts would need to be reevaluated.

This is not a tip or advisory, but rather a educational analysis.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

JIO FINANCIAL SERVICESHello & welcome to this analysis

The decline from May 2024 till Mar 2025 appears to be an Elliott Wave corrective ABC that went on to make its all time lows breaking the previous one made in Oct 2023.

The rally in Mar 2025 was a Leading Diagonal Impulse Wave 1

It was followed by Wave 2 - a corrective ABC which did a 88% retracement giving a double bottom in early April 2025.

From there started the strongest & most reliable Elliott Wave - 3 that lasted the full month of April 2025.

Since Wave 2 was deep the corrective Wave 4 did a zigzag and ended quickly mid May 2025.

The terminal wave 5 of the larger Wave I is coming to an end around 275 - 280.

This could lead to another round of corrective ABC which could be the larger Wave II in the making. Likely levels till where it could retrace its formation could be 255 at least, 240 probable & 205 hopefully maximum. Anything below Mar 2025 lows will make the Impulse wave rise as invalid.

On the other hand, if the current wave continues to sustain beyond 285-290 then it could be unfolding a Wave 3 extension that could lead to much higher levels.

Conclusion

For buyers - wait for it to sustain above 285-290 to add, else wait for a dip to 255 - 240 and then review

For sellers - between 275-280 wait for a bearish candle follow through keeping 285-290 as a stop loss.

All the best

EURUSD Chart Analysis : An Elliott Wave Approach Hello friends, welcome to RK Charts!

Today, we'll analyse the EURUSD chart using Elliot Waves. This study is based on Elliot Wave theory and structure, which enables multiple possibilities. Please note that the possibilities outlined here are not definitive predictions, but rather potential scenarios.

The provided information is for educational purposes only and should not be considered trading advice. There is a risk of being completely wrong, and users are warned not to trade or invest solely based on this study.

We are not responsible for any profits or losses incurred. Individuals should consult a financial advisor before making any trading or investment decisions.

Now, let's dive into the analysis. According to Elliot Wave principles, we're currently in a corrective pattern, which consists of ((A)), ((B)) and ((C)) patterns. We've completed ((A)) and ((B)) and are now unfolding ((C)).

Within ((C)) we expect five sub-divisions, labeled as intermediate waves (blue bracketed): blue (1), (2), (3), (4) & (5). Almost four of these sub-divisions are completed, and we've just begun the (5).

We've set an invalidation point at 1.1065, which is the recent low. If this low is not breached, we'll likely continue unfolding the (5) wave of ((C)), which should break above the high of wave (3).

However, if the low is breached, it's possible that wave (4) is undergoing a double correction.

Both scenarios are possible, and we'll continue to monitor the market's unfold.

Scenario 1

Scenario 2

This study is a deep dive into Elliot Wave counts, aligned with the rules and principles of Elliot Wave theory, as well as higher time frame and higher degree analysis.

I hope this analysis based on Elliot Wave theory has helped you understand the chart better and learn something new. Please keep in mind that this is for educational purposes only.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com/u/RK_Charts/ is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Bearish short-term strategy for XAUUSDShort-term Elliott wave 4th should be 382% of wave 3, and the price is finding resistance at this level. From here, XAUUSD finds a downside target of $3141 as the 5th wave finishes this entire wave pattern.

This pattern invalidates if the price breaks the resistance of $3186.50 and entire elliot wave invalidates if it crosses above low of 1st wave.