NIFTY50 // BULLISH ENGULFING // 4HR TFHey folks,

I am looking here at the 4hr TF of Nifty 50 with EMA 50.

A visible Bullish engulfing on the 4hr tf has formed today above 50EMA, confirming the support of the moving average.

I know it is not a perfect bullish engulfing some of you might say, because of current 4hr candle open was not below previous one close. But in Chart analysis there is a rule that you to be versatile and flexible regarding these patterns, so it can be said that the two said price points are marginally close to consider this a engulfing.

Also, seeing little angle of the previous candle lower wick ( a good long one) it can be interpreted that the buy orders absorbed the good qty of sellers.

thus, I am going for a small long position in Nifty CE for next 4hrs candles till expiry of 10feb.

NIFTY 10FEB 26000CE.

Now just hoping for the "TRUMP" element to stay put down over the weekend.🤞🏼

:) Thanks. Happy Trading.

Engulfing Candle

SUPREMEIND – STWP Equity Snapshot 📊 SUPREMEIND – Technical & Educational Snapshot

Ticker: NSE: SUPREMEIND

Sector: 🧪 Chemicals / Plastics

CMP: 3,500.80 ▲ (+4.15% | 22 Jan 2026)

Learning Rating: ⭐⭐⭐⭐☆ (Neutral–Range with Recovery Bias)

Chart Pattern Observed: 📊 Range Structure with Recovery from Demand

Candlestick Pattern Observed: Bullish Engulfing

📊 Technical Snapshot

SUPREMEIND is attempting a short-term stabilisation after a sharp corrective phase, with the latest daily candle showing a strong bullish response from lower demand zones. RSI is placed near 52.5, indicating neutral momentum with early signs of internal strength but no overbought pressure yet. Stochastic is around the mid-zone, suggesting recovery from oversold conditions rather than trend exhaustion. Bollinger Bands remain wide, reflecting elevated volatility and a market still adjusting after the decline, while price continues to trade below major supply zones — keeping the broader structure range-bound with recovery bias. MACD remains subdued, highlighting that momentum improvement is still developing rather than fully established. Price is currently interacting near the CPR band, which is relatively wide, typically associated with range-bound or two-sided price action. As long as price remains within or below the CPR zone, upside moves may face supply pressure, while sustained acceptance above the CPR pivot would be required to signal any meaningful directional shift.

📊 Volume Analysis

🔹 Current Volume: ~536K

🔹 Average Volume (20-period): ~252K ✅

💥 Volume is running at more than 2× the recent average, confirming active participation during the rebound from demand.

💡 Interpretation: Higher-than-average volume near support zones suggests genuine buying interest and supply absorption. However, for any sustained move toward upper range resistance, similar volume expansion will be required near higher levels to confirm acceptance.

🔑 Key Levels – Daily Timeframe

Support Areas: 3373 | 3258 | 3194

Resistance Areas: 3552 | 3616 | 3731

These are zones where price has paused or reacted earlier.

What’s Catching Our Eye: Sharp demand-led rebound with strong participation.

What to Watch For: Acceptance above CPR and nearby resistance.

Failure Zone: Loss of the recent demand base.

Risks to Watch: Overhead supply and wide CPR.

What to Expect Next: Range-bound move with recovery bias.

Bullish Case: Sustained Demand absorption may support recovery.

Bearish Case: Failure to hold Demand base risks deeper reversion.

Momentum Case: Strong Rebound momentum, needs follow-through.

STWP Equity Snapshot – SUPREMEIND

Intraday Setup:

Entry: 3,500.8

Invalidation level: 3,237.11

Reference 1: 3,817.23

Reference 2: 4,028.18

Swing Setup (Hybrid Model – 2–5 days):

Entry: 3,500.8

Invalidation level: 3,151.67

Reference 1: 4,199.06

Reference 2: 4,722.75

STWP View: Momentum: Strong | Trend: Range | Risk: High |Volume: High

Learning Note: Focus on structure, risk per trade and clean reviews – not prediction.

Disclaimer:

Educational view only. Not a Buy/Sell recommendation. Please consult a SEBI-registered advisor before making any decision. STWP is not responsible for trading decisions based on this post.

💬 Did this help you read the chart better?

🔼 Boost | ✍️ Comment | 🔁 Share with a learner

👉 Follow STWP for clean chart-reading insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

ZOTA - STWP Equity Snapshot📊 STWP Equity Snapshot – Zota Health Care Ltd

(Educational | Chart-Based Interpretation)

Market Structure

ZOTA witnessed a sharp corrective phase from higher levels, followed by a strong rebound from a well-defined demand zone. The recent candle stands out as a decisive bullish reaction, indicating aggressive buying interest after prolonged selling pressure. Despite the strength of the bounce, price is still trading within a broader range, and the larger trend structure has not yet shifted into a clear uptrend.

Demand–Supply Structure

Price moved deeply into a historical demand zone where buyers stepped in with conviction. The strong bullish candle suggests absorption of selling pressure and short-term buyer dominance. However, overhead supply zones remain active, meaning the current move should be viewed as a recovery from demand rather than a confirmed breakout. Sustained strength is required for further range expansion.

Key Levels – Daily Timeframe

Immediate demand zones are placed near 1376, followed by lower structural supports around 1290 and 1250. These are areas where buyers have previously defended price. On the upside, resistance zones are visible near 1451, 1526, and 1652, where selling pressure has historically emerged. These levels act as reaction zones and help define the current range.

What the Chart is Saying

Momentum has improved significantly after the recent bullish expansion, supported by strong volume participation. RSI is recovering from lower levels, indicating improving internal strength, but it is still not in a trending zone. The structure remains range-bound, suggesting that price may consolidate or oscillate between demand and supply zones before showing directional clarity.

CPR Impact

ZOTA is currently interacting with a wide CPR structure, which typically signals indecision and range-bound behavior. Earlier price action stayed below CPR resistance, reinforcing the lack of strong directional bias. For any sustained bullish shift, price would need to show acceptance above the CPR pivot with follow-through. Until then, the CPR structure supports a cautious, range-based view.

Additional Structure Observations

The rebound candle carries added significance as it formed with an open equal to the low, indicating immediate buyer control and minimal intraday selling pressure. This move was supported by clear volume expansion, suggesting participation beyond short-term traders and pointing toward stronger hands absorbing supply near demand. Short-term moving averages are attempting to turn up, reflecting improving momentum, while price remains below longer-term averages, keeping the broader structure neutral. RSI has recovered from lower levels but is still below bullish expansion zones, indicating support without trend confirmation. Additionally, the projected wide CPR for the next session reinforces the probability of consolidation or two-sided activity rather than immediate directional continuation. Overall, the move reflects strength from demand, but structural acceptance above nearby supply is still required for confirmation.

Intraday Reference Levels (Structure-Based)

The reference price zone near 1400 acts as a short-term decision area. Weakness below this zone may expose price toward lower demand regions around 1290. On the upside, reaction zones near 1450 and above are areas where price may pause or face selling pressure. These are observational levels, not predictions.

Swing Reference Levels (Hybrid Model | 2–5 Days)

For the short swing perspective, the 1400 zone remains the structural reference. Failure to hold demand increases downside risk toward deeper support zones. If strength sustains, higher range-expansion zones above previous resistance come into focus, but only as conditional possibilities within the broader range.

Final Outlook (Condition-Based)

Momentum is strong in the short term, supported by volume expansion. The trend remains range-bound, with no confirmed directional control yet. Risk remains high due to the counter-trend nature of the recovery and nearby supply zones. Volume is elevated, indicating participation, but structure confirmation is still pending.

💡 STWP Learning Note

Strong rebounds from demand show intent — not confirmation.

Let structure and acceptance guide bias, not candle size.

📘 STWP Approach

Observe price. Respect risk.

Trade structure, not excitement.

⚠️ Disclaimer

This post is shared strictly for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

🚀 Stay Calm. Stay Clean. Trade With Patience.

PGIL - STWP Equity Snapshot

📊 STWP Equity Snapshot – PGIL (Pearl Global Industries Ltd)

(Educational | Chart-Based Interpretation)

Market Structure:

Price fell sharply from the recent high and moved into a known demand zone where buyers usually step in. From this area, buying interest appeared, highlighted by a bullish engulfing candle. This shows that buyers are active and willing to defend this level. However, price is still moving inside a broader range, so the overall trend has not yet changed. Strength is visible from support, but clear trend confirmation is still awaited.

Demand–Supply Structure:

Price declined strongly into a previous demand zone, where buyers reacted immediately and pushed prices higher. The bullish engulfing candle reflects short-term buying interest from this support area. However, price is still facing resistance at higher levels, which limits upside for now. This move should be seen as a reaction from demand rather than a confirmed breakout.

Key Levels – Daily Timeframe:

The support zones around 1398, 1349, and 1321 are areas where buyers have previously stepped in and defended price. The resistance zones near 1475, 1502, and 1552 are levels where selling pressure has appeared in the past. These levels are important because price has reacted here earlier and may do so again.

What the Chart is Saying:

The overall trend is still range-bound, meaning price is moving sideways rather than trending clearly. Momentum is slowly recovering from oversold levels, showing some improvement in buying interest. Buyers have successfully defended the demand zone, which has helped stop the recent fall. However, price may now spend some time consolidating before it decides the next clear direction.

CPR Impact:

PGIL is trading below a wide CPR, which shows that the market lacks strong directional confidence. Earlier attempts to move above the CPR did not hold, and this zone is now acting as resistance. A wide CPR usually leads to range-bound or corrective price action, which fits well with the current chart structure. As long as price remains below the CPR pivot, upside moves may face selling pressure. A sustained move and acceptance above CPR would be needed to signal any meaningful bullish shift.

Intraday Reference Levels (Structure-based):

The reference price zone near 1453 acts as the key area to watch in the short term. If support weakens, the risk area lies around 1356, where the structure may start failing. On the upside, zones between 1570 and 1648 are areas where price may react or pause. These levels indicate possible reactions, not predictions.

Swing Reference Levels (Hybrid Model | 2–5 days):

For the short swing view, the reference price zone remains around 1453. If demand fails, risk increases below 1353. If strength continues, higher zones between 1654 and 1805 come into focus as possible range expansion areas. These zones reflect potential movement within the range, not certainty.

Final Outlook (Condition-Based):

Momentum is moderate, showing some recovery but not strong acceleration. The trend remains range-bound, with no clear directional control yet. Risk is high because the move is a counter-trend recovery and price is also facing resistance from the CPR zone. Volume is moderate, supporting the move but not strong enough to confirm a trend change.

💡 STWP Learning Note

A strong candle at support shows interest, not confirmation.

Let price accept above resistance and CPR before assuming a trend change.

📘 STWP Approach

Observe price. Respect risk.

Let structure guide decisions — not emotions.

🚀 Stay Calm. Stay Clean. Trade With Patience.

⚠️ Disclaimer

This post is shared only for educational and informational purposes.

It is not investment advice or a recommendation.

Please consult a SEBI-registered financial advisor before making any financial decision.

OFSS - STWP Equity SnapshotSTWP Equity Snapshot – OFSS (Educational | Chart-Based Interpretation)

📌 Intraday Reference Levels (Structure-based)

Reference Price Zone: 7,841

Risk Reference (Structure Invalidation): 7,432.87

Observed Upside Zones: 8,330.75 → 8,657.26

📌 Swing Reference Levels (Hybrid Model | 2–5 days | Observational)

Reference Price Zone: 7,841

Risk Reference (Structural Breakdown): 7,324.35

Higher Range Projection (If structure sustains): 8,874.29 → 9,649.27

Key Levels – Daily TF

Support: 7,643 | 7,455 | 7,356

Resistance: 7,931 | 8,030 | 8,219

🔍 STWP Market Read

Oracle Financial Services Software Ltd is attempting a base-building recovery after a prolonged corrective phase. Price has recently reacted positively from a defined demand zone, while overhead supply remains visible across clustered resistance bands. The latest rebound reflects improving participation, though confirmation is still evolving.

Momentum indicators are balanced rather than aggressive, with RSI near 48.48, suggesting stabilization without overextension. Volume remains around average (Vol X ~1.46), indicating participation but not yet a decisive expansion. Overall, the structure points to early stabilization with conditional upside, while risk remains elevated until price sustains beyond nearby supply.

📊 Chart Structure & Indicator Summary

Structure: Corrective base with early rebound

Trend: Improving, not yet dominant

Momentum: Strong recovery attempt, still developing

RSI: Healthy zone — neither stretched nor weak

MACD & ADX: Gradual improvement, trend strength building

Volume: Moderate, awaiting confirmation

📈 Final Outlook (Condition-Based)

Momentum: Strong (developing)

Trend: Improving / Early up-bias

Risk: High (overhead supply & confirmation pending)

Volume: Moderate

💡 STWP Learning Note

Recoveries are processes, not events. Strong outcomes emerge when price structure, momentum, and volume align over time — patience and risk discipline remain essential.

⚠️ Disclaimer:

This is an educational market interpretation based on chart structure and publicly available data. It is not a recommendation, advice, or solicitation. Equity markets involve risk. Please consult a SEBI-registered financial advisor before taking any investment or trading decision.

📘 STWP Approach:

Observe momentum. Respect risk. Let structure guide decisions.

💬 Did this add value?

🔼 Boost to support structured learning

✍️ Share your views or questions in the comments

🔁 Forward to traders who value disciplined analysis

👉 Follow for clean, probability-driven STWP insights

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

$NVDA – Weekly Bearish Signal Triggering?CMP: $184

NVDA has formed a Bearish Engulfing on the weekly chart and is currently trading inside the engulfed candle.

A WCB / sustained break below $178.91 will confirm the pattern → likely dragging price toward $164 and the major $153–$148 breakout-retest zone . 🔻

A WCB above the ATH $212.19 will invalidate the pattern and signal a fresh uptrend. 🚀

📌 Note: Q3 earnings to be announced post-market. 🕒

Bias: Short-term bearish, HTF bullish if $148–$153 holds. 💚

#USMarket #NVDA #Stocks #TechnicalAnalysis #PriceAction #BearishEngulfing

📌 #Disclaimer: This analysis is shared for educational purposes only. It is not a buy/sell recommendation. Please do your own research before making any trading decisions.

$Gold: Breakdown or Bounce?🔻 #Gold Breakdown or Bounce? 🔺

Price tested a critical level (upward sloping trendline - Breakdown Retest ) after a bearish engulfing and is now pulling back. Will the breakdown continue, or can bulls reclaim control? 👀

Trendline break 🚨

Breakdown retest ⚠️

Key levels to watch:

🚧 Resistance: $4099.40 - $4126.08 / $4185.91 - $4195.21 / $4355.80 - $4381.44

🛡 Support: $4024.53 / $3932.10 - $3930.62 / $3953.00

Below $3953 → opens downside toward $3500.20–$3432.84 📉

Between ATH & $3953 → market likely stays trendless/choppy ⚖️

TVC:GOLD #Gold #XAUUSD #Forex #BearishEngulfing #CandleStickPatterns #BreakdownRetest #BearishReversal #PriceAction #ForexTrading

📌 #Disclaimer: This analysis is shared for educational purposes only. It is not a buy/sell recommendation. Please do your own research before making any trading decisions.

#Silver Alert: Double Top Breakdown Incoming?🚨 Double Top on XAGUSD daily chart:

1️⃣ First Top: Bearish Engulfing

2️⃣ Second Top: Dark Cloud Cover

Pattern confirms DCB 🔻 below $45.55 , 🎯 targeting $36.71 .

🚧 Resistance: $52.32 - $54.49

🛡 Support: $50.62, $49.38 - $48.91, $47.17 - $46.90

⚠️ Major sell-off potential. Longs only above Double Top high after 2 consecutive closes.

#Silver #XAGUSD #DoubleTop #TechnicalAnalysis #BearishReversal #ChartPatterns #CandlestickPatterns #PriceAction

📌 #Disclaimer: This analysis is shared for educational purposes only. It is not a buy/sell recommendation. Please do your own research before making any trading decisions.

BRITANNIA - Falling Wedge + Bullish Engulfing Combo💹 Britannia Industries Ltd (NSE: BRITANNIA)

Sector: FMCG | CMP: ₹5,892.50 | View: Falling Wedge + Bullish Engulfing Reversal Setup

📊 Price Action:

Britannia is currently displaying a strong confluence setup where both a chart pattern and a candlestick pattern align perfectly to signal a potential trend reversal.

After weeks of consolidation within a downward-sloping structure, the stock has formed a Falling Wedge pattern — a classic bullish reversal formation.

Adding strength to this structure, a Bullish Engulfing Candle on 4 Nov 2025 emerged from the wedge’s lower boundary, confirming buyer dominance and hinting at a near-term trend reversal.

📉 Chart Pattern Analysis – Falling Wedge (Bullish Setup):

The Falling Wedge pattern is marked by two converging downward trendlines, each connecting a series of lower highs and lower lows.

This structure reflects seller exhaustion and early buying interest.

Britannia’s wedge formation is now reaching its apex, where breakout probability is highest.

Volume contraction throughout the wedge also supports the notion that supply is drying up, preparing for a breakout above the upper trendline.

📈 Candlestick Pattern – Bullish Engulfing Confirmation:

The Bullish Engulfing Candle formed on 4 Nov 2025 precisely at the lower support line of the wedge, validating the pattern with strong timing. It represents a shift in control from sellers to buyers, with the green candle completely engulfing the prior red body. Volume expansion on that session further confirmed active participation by institutions ahead of the upcoming news catalysts. This one-day reversal candle acts as the first technical confirmation, while a breakout above the upper trendline will serve as the structural confirmation for the wedge pattern.

📏 Fibonacci Analysis:

From swing low ₹5,298 to swing high ₹5,930:

78.6% retracement @ ₹5,795 → Key reversal level defended.

61.8% retracement @ ₹5,888 → Currently reclaimed zone.

100% extension @ ₹5,930 → Short-term breakout threshold.

The Fibonacci structure aligns beautifully with the wedge’s geometry, implying that the reversal zone is complete and buyers are regaining momentum.

🧭 STWP Support & Resistance:

Resistances: ₹5,940 | ₹5,987 | ₹6,055

Supports: ₹5,825 | ₹5,775 | ₹5,710

The ₹5,775–₹5,825 range is acting as a high-confidence accumulation base, while ₹6,090–₹6,150 represents the key breakout trigger zone.

📊 STWP Volume & Technical Setup:

Volume on 4 Nov surged to 363.4K vs 248.7K average, confirming institutional interest at lower levels. VWAP recovery and improving RSI (47→52+) show that momentum is gradually returning.

MACD is approaching a bullish crossover, while Stochastic and CCI have both turned upward — all aligning with a reversal confirmation setup.

Trend Direction: UPTREND (Transitioning) | Volume Confirmation: Possible Accumulation in Progress

🧩 STWP Summary View:

Final Outlook:

Momentum: Strengthening | Pattern: Falling Wedge + Bullish Engulfing | Risk: Moderate | Volume: Increasing

Britannia’s technical structure now showcases dual confirmation — a chart pattern (Falling Wedge) supported by a candlestick reversal (Bullish Engulfing).

This confluence enhances the reliability of the reversal signal and increases the probability of an upside breakout. As long as the price holds above ₹5,825, the bias remains bullish with potential continuation toward ₹6,150–₹6,250.

⚠️ Disclosure & Disclaimer – Please Read Carefully

This analysis is for educational purposes only and should not be treated as financial or investment advice.

I am not a SEBI-registered investment adviser. All views are based on technical observations and publicly available information.

Trading involves risk; please assess your financial suitability, position size, and stop-loss levels before entering any trade.

Always consult a SEBI-registered financial adviser for personalized guidance.

Position Status: No active position in (BRITANNIA) at the time of this analysis.

Data Source: TradingView & NSE India

💬 Found this useful?

🔼 Give this post a Boost if you value clean technical confluence studies.

💭 Comment your thoughts — does this wedge-breakout setup look convincing to you?

🔁 Share this post to help others understand pattern + candlestick synergy.

👉 Follow for more institutional-style technical breakdowns built on clarity and patience.

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

NUVAMA | Bullish Engulfing + VWAP Alignment📈 NUVAMA | Bullish Engulfing + VWAP Alignment + Strong Momentum Reversal 🚀

🔹 Entry Zone: ₹7,420.50 – ₹7,436.00

🔹 Stop Loss: ₹7,151.90 (Risk ~284 pts)

🔹 Supports: 7,244.33 / 7,068.17 / 6,972.33

🔹 Resistances: 7,516.33 / 7,612.17 / 7,788.33

🔹 Swing Demand Zone: ₹7,086 – ₹6,998.50

🔹 Intraday Demand Zone: ₹7,253.50 – ₹7,223

🔑 Key Highlights

✅ Bullish Engulfing Candle – powerful reversal confirmation

✅ VWAP Alignment – institutional bias turning bullish

✅ Momentum Strength – bullish follow-up after base formation

✅ Bollinger Squeeze-Off – volatility expansion expected

✅ Volume near average – healthy buyer participation, stable accumulation

🎯 STWP Trade View

📊 Strong bullish momentum supports a near-term rally toward ₹7,516–₹7,612. Sustaining above ₹7,612 could open upside potential to ₹7,788.

⚠️ The ₹7,253–₹7,223 zone provides intraday support, while ₹7,190–₹7,165 acts as a swing base for positional buyers to watch.

💡 Learning Note

This setup demonstrates how a Bullish Engulfing pattern with VWAP confirmation offers a reliable multi-signal entry. When aligned with tight demand zones, it allows traders to manage risk effectively while capitalizing on short-term breakouts.

Final Outlook: Momentum: Strong, Trend: Bullish, Risk: Low, Volume: High

________________________________________

________________________________________

⚠️ Disclosure & Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment adviser, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading—whether in stocks or options—carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works and practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial adviser before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

Position Status: No active position in NUVAMA at the time of analysis.

Data Source: TradingView & NSE India (Past Chart Reference) (Historical levels)

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

TITAN - Bullish Reversal & Long-Term Growth StoryTITAN | Bullish Reversal & Long-Term Growth Story

Stock: Titan Company Ltd (NSE: TITAN)

Timeframe: Daily Chart

Pattern: Bullish Reversal from Key Support(Bullish Engulfing)

🏷️ Stock Intro

Titan is India’s leading lifestyle & jewellery retailer with brands like Tanishq, CaratLane and Fastrack. Strong brand equity and robust consumer demand keep Titan a long-term structural growth story.

🔎 Price Action

Current Price: ₹3,401.20

After a sharp fall from the 3,740 zone, Titan bounced off the bottom range near ₹3,303 with a strong bullish candle & above-average volume (see chart).

Key Fibonacci levels: 23.6% at 3,406, 38.2% at 3,470, and 61.8% at 3,573.

🧮 Technical Analysis

Trend: Medium-term uptrend remains intact despite recent correction.

Volume: Spike to 1.45M signals aggressive buying near support.

Momentum: Bullish engulfing candle with open = low indicates strong intraday demand.

🎯 Key Levels

Support: 3,346 / 3,297 / 3,255

Resistance: 3,437 / 3,473 / 3,528

Top Range: 3,740 (major breakout level)

📊 Volume & Indicators

Bullish VWAP confirmation with BBSqueeze OFF → potential breakout if liquidity holds.

🆕 Latest Update & Growth Outlook

FY28 EPS projected ~₹75–76 (21% CAGR).

High ROE (~35%) and sustained jewellery demand keep Titan a premium growth play.

💹 STWP Educational Trade Illustration

This illustration is only for learning purposes and not a recommendation to trade or invest.

Chart Observation: Price action shows a recent bullish reversal near the ₹3,300 support zone with strong volume.

Illustrative Setup: A trader studying this pattern might observe a potential entry area around ₹3,418 with a protective stop near ₹3,300 to manage risk.

Potential Price Zones: Key resistance zones lie near ₹3,740 and ₹3,850, which could act as future reference levels if the bullish momentum continues.

Valuation Outlook: Based on projected FY28 EPS of about ₹75–76 and an illustrative P/E multiple of 70×, some analysts estimate a theoretical long-term fair value band of around ₹5,300–₹5,500, provided growth assumptions hold.

⚠️ Risk Reminder

Gold price volatility and discretionary slowdown can impact margins.

Premium valuation (~80× trailing P/E) requires consistent earnings growth.

🏁 Final Outlook

Titan shows a strong reversal setup backed by robust fundamentals and premium brand positioning. Ideal for positional swing traders and long-term investors seeking compounding stories.

💡 Learning Note:

This setup demonstrates how price action + Fibonacci levels + surge in volume can signal a high-conviction reversal trade when aligned with long-term growth fundamentals.

⚠️ Disclosure & Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment adviser, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading—whether in stocks or options—carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works and practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial adviser before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

Silver: Bearish Engulfing – Is the Top In?#Silver View:

Just like Gold, Silver has formed a strong Bearish Engulfing pattern on the daily chart, potentially signaling a temporary top in the current trend. While it’s still early to confirm a full reversal, the price action suggests caution for bulls.

✅ Confirmation:

A daily close below 143,900

(today's low), especially with increased volume, would confirm the pattern and likely trigger further downside momentum.

❌ Negation:

If Silver manages to close above 153,388 (today’s high), the bearish structure will be invalidated.

🎯 Key Levels to Watch:

Resistance: 153,388 (pattern high)

Support: 143,900 (pattern low)

Stay alert for follow-through candles and volume spikes in coming sessions.

#Silver | #XAGUSD | #BearishEngulfing | #CandlestickPatterns | #TechnicalAnalysis | #PriceAction | #SilverAnalysis

📌 Disclaimer: This analysis is shared for educational purposes only. It is not a buy/sell recommendation. Please do your own research before making any trading decisions.

Gold: Bearish Engulfing – Is the Top In?Gold View:

Potential temporary top may be forming in Gold, marked by a strong Bearish Engulfing pattern on the daily chart. While it’s still early to confirm a full reversal, price action suggests caution for bulls.

✅ Confirmation:

A daily close below today's low 120,218 , especially with increased volume, would confirm the pattern and likely trigger further downside momentum.

❌ Negation:

If Gold manages to close above 123,677 (today’s high), the bearish structure will be invalidated.

🎯 Key Levels to Watch:

Resistance: 123,677 (pattern high)

Support: 120,218 (pattern low)

Stay alert for follow-through candles and volume spikes in coming sessions.

#Gold | #XAUUSD | #BearishEngulfing | #CandlestickPatterns | #TechnicalAnalysis | #PriceAction | #GoldAnalysis

📌 Disclaimer: This analysis is shared for educational purposes only. It is not a buy/sell recommendation. Please do your own research before making any trading decisions.

M&M | How to Trade a Bullish Engulfing in a Rising Channel🚘 M&M | How to Trade a Bullish Engulfing in a Rising Channel

📊 Stock: Mahindra & Mahindra Ltd (M&M)

⏳ Timeframe: Daily

📈 Chart Pattern: Rising Channel

🕯 Candlestick Pattern: Bullish Engulfing

________________________________________

🔹 Pattern Overview

M&M is currently trading within a Rising Channel, a structure that often reflects sustained bullish momentum. On the latest daily chart, a Bullish Engulfing candlestick has been formed, signaling renewed buying interest after a brief phase of consolidation.

________________________________________

The setup looks stronger with a Bullish Marubozu and an Open = Low candle, showing aggressive demand from the open. Price is holding well above VWAP, confirming bullish bias. A BB Squeeze Off signals volatility expansion ahead, while the recent false breakdown indicates sellers got trapped and buyers are back in control.

________________________________________

🔹 Key Levels to Watch

Resistance Zones: 3335 – 3374 – 3445

Support Zones: 3224 – 3152 – 3113

________________________________________

🔹 Technical Indicators Snapshot

RSI is at 52, sitting in the neutral zone but leaving room for upside momentum if buying picks up. The MACD shows a bearish crossover, which is an early caution signal to watch. CCI at -14 indicates neutral sentiment with no strong bias, while Stochastic at 55 is mid-range, suggesting neither overbought nor oversold conditions at the moment.

________________________________________

🔹 Candle Analysis

Candle 1 (Yesterday): High 3280 | Low 3187

Candle 2 (Today): High 3302.10 | Low 3191.10

👉 The today’s candle engulfed the previous session’s body, confirming the Bullish Engulfing pattern.

________________________________________

🔹 Trading View (Educational Insight Only)

A Bullish Engulfing inside a Rising Channel generally indicates continuation of the prevailing uptrend. If price manages to probably sustain above the 3335–3374 zone, it may signal strength for further upside. On the other hand, if the stock probably slips below the 3224–3152 support zone, it could lead to short-term profit booking.

________________________________________

📌 “All price levels mentioned are as observed at the time of writing and may change with market movements. Readers are advised to track live prices before making any trading or investment decision.”

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial advisor before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

CAMS | Reversal in Sight? How to Trade a Double Bottom📈 CAMS | How to Trade a Double Bottom

Stock: Computer Age Management Services Ltd (CAMS)

Timeframe: Daily

Pattern: Possible Double Bottom (bullish reversal structure)

________________________________________

🔹 Pattern Identification

Bottom-1: 3632.40

Bottom-2: 3645

Neckline (Breakout Point): 3918

Candle Confirmation: Bullish Engulfing/Piercing on the second bottom

Volume: Improving on bounce, needs stronger confirmation on breakout

________________________________________

📘 Regular Trading Strategy (Conservative)

The Double Bottom is confirmed only when price closes above the neckline with strong volume.

Entry: Go long on close > 3918 preferred with volume ≥ 1.5–2× 20-DMA

Measured Height: 3918 − 3632 = 286 pts

Targets:

🎯 4094 (62% move)

🎯 4204 (full measured move)

🎯 4380 (161.8% Fibonacci extension)

Stoploss: Below 3630 (pattern invalidation)

Invalidation: Daily close below the bottoms

________________________________________

🔹 Alternative Entries

1️⃣ Retest Entry (Safer):

After breakout >3918, buy the pullback to neckline (3918–3925) if reversal candle appears.

SL below retest low.

2️⃣ Early Entry (Aggressive):

Trigger already seen at 3758.90 (bullish engulfing/piercing).

SL below 3668.

Add position if 3918 breakout confirms.

________________________________________

📊 Key Levels

Supports: 3668 | 3599 | 3554

Resistances: 3783 | 3827 | 3895

Fibonacci Zones: 3821 (23.6%) | 3921 (38.2%) | 4009 (50%) | 4096 (61.8%) | 4221(78.6%) | 4380 (100%)

________________________________________

💡 Trading View

CAMS is forming a potential Double Bottom reversal near major support.

Early signs of buying are visible at 3758.9, but real confirmation will come only above 3918 neckline.

Breakout with strong volume can open upside towards 4094 → 4204 → 4380.

📌 Bias: Bullish above 3750; stronger confirmation only on breakout above 3918.

📌 Risk: Invalidation below 3630.

👉 The Bullish Engulfing/Piercing candle at the second bottom MUST hold at daily close for the setup to remain valid.

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial advisor before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

COLPAL | Double Bottom Retest + Volume Breakout🚀 COLPAL | Double Bottom Retest + Volume Breakout

📌 Pattern Setup:

🔹 Double Bottom retest spotted

🔹 Bullish Engulfing candle at support

🔹 Breakout candle with strong volume surge

📊 Technical Snapshot:

RSI: 58 → Healthy momentum

MACD: Bullish crossover

CCI: 107 → Strong positive bias

Stochastic: 89 → Overbought but strong

Volume: 1.22M vs 626k avg → ⚡ Breakout confirmed

🛠 Levels to Watch:

🔼 Long Entry: Above 2357.9

🔽 Stoploss: Below 2243

🎯 Targets: 2472 | 2587

📉 Pullback Buy Zone: 2291–2273

❌ Invalidation: Below 2207

⚡ Resistance Levels: 2382 | 2424 | 2490

⚡ Support Levels: 2274 | 2208 | 2167

🎯 Fibonacci Zones: 2378 → 2449 → 2519 → 2619 → 2747

💡 View:

COLPAL is breaking out from a Double Bottom Retest with strong volume & bullish signals. Sustaining above 2358 could open the gates towards 2472 – 2587 in the short term.

👉 Bias: Bullish till 2207 holds.

⚠️ Disclaimer – Please Read Carefully

The information shared here is meant purely for learning and awareness. It is not a buy or sell recommendation and should not be taken as investment advice. I am not a SEBI-registered investment advisor, and all views expressed are based on personal study, chart patterns, and publicly available market data.

Trading — whether in stocks or options — carries risk. Markets can move unexpectedly, and losses can sometimes exceed the money you have invested. Past performance or past setups do not guarantee future results.

If you are a beginner, treat this as a guide to understand how the market works — practice on paper trades before risking real money. If you are experienced, always assess your own risk, position sizing, and strategy suitability before entering trades.

Consult a SEBI-registered financial advisor before making any real trading decision. By engaging with this content, you acknowledge full responsibility for your trades and investments.

💬 Found this useful?

🔼 Give this post a Boost to help more traders discover clean, structured learning.

✍️ Drop your thoughts, questions, or setups in the comments — let’s grow together!

🔁 Share with fellow traders and beginners to spread awareness.

👉 “If you liked this breakdown, follow for more clean, structured setups with discipline at the core.”

🚀 Stay Calm. Stay Clean. Trade With Patience.

Trade Smart | Learn Zones | Be Self-Reliant 📊

TITAN – Cup & Handle Breakout Retest📊 TITAN – Technical & Fundamental Educational Snapshot

Ticker: NSE: TITAN | Sector: Consumer – Lifestyle & Jewellery

CMP: ₹3,637.70

Rating: ⭐⭐⭐⭐ (Bullish Setup – For Educational Purposes Only)

Pattern Observed: ☕📈 Cup & Handle Breakout Retest

📊 Technical Observations

Titan Company Ltd. (CMP: ₹3,637.7) is presently exhibiting a Cup & Handle formation, with the price recently retesting the handle zone around ₹3,550–₹3,600 and showing signs of strength supported by healthy volumes. On the technical front, important resistance levels are noted around ₹3,675, ₹3,712, and ₹3,773, while support levels lie near ₹3,576, ₹3,515, and ₹3,477. Key indicators currently reflect positive momentum, with RSI around 65, MACD showing bullish signals on multiple timeframes, and CCI at 92, while the Stochastic indicator is in the higher zone (88–94), suggesting overbought but trending conditions. Volumes stood at ~989K, higher than the 20-day average of ~740K, indicating increased participation. Price action is also holding above VWAP, with Bollinger Band dynamics hinting at the possibility of trend continuation.

📰 Fundamental & News Flow

In its Q1 FY26 results, Titan Company Ltd. reported around 11% year-on-year revenue growth, primarily supported by sustained jewellery demand, although margins were modestly affected due to gold price volatility. The company continues to witness healthy traction in its Tanishq jewellery and Titan Eye+ businesses, alongside a recovery trend in watches and wearables. Titan has also been pursuing aggressive retail expansion, and the upcoming festive season is expected to support consumer demand further. From a structural perspective, the company is often highlighted for its premium brand positioning, robust balance sheet, and long-term jewellery demand drivers, which are considered key strengths in its sector.

📊 STWP Trade Analysis (Educational Purpose Only):

The recent price action indicates a Bullish Engulfing pattern followed by a Bullish Piercing formation, which are generally studied as signs of positive sentiment when supported by volumes. After the retest, a reference level around ₹3,726.50 may be noted, while the Bullish Piercing structure also highlights an observation zone near ₹3,650.90, with further upward reference levels around ₹3,752 and ₹3,854, and a protective support reference near ₹3,549. From a Fibonacci retracement perspective, a pullback level is visible near ₹3,566, with an invalidation reference around ₹3,516.

Gold form double top bearish pattern,Bearish Patterns Annotated:

Double Top: A classic bearish reversal pattern resembling an "M" shape. It occurs when price hits resistance twice at similar levels (here, approximately $3,437 and $3,448 in July and August) and fails to break higher. This signals potential exhaustion of buyers and a shift to sellers.

Evening Star: A three-candle bearish reversal pattern marked near the recent high. It typically consists of a large green candle (up day), followed by a small-bodied candle (indecision), and then a large red candle closing below the midpoint of the first candle. This suggests bulls are losing control.

Engulf Candle (Bearish Engulfing): A red candle that completely "engulfs" the body of the prior green candle, indicating strong selling pressure overriding previous buying. It's marked near the top, reinforcing the reversal theme.

Opportunity: - As per chart it can short 3380-3350 with stop loss 3400 above for the targets of double bottom pattern 3260 and 3160.

EMAMI LTD – Strong Bullish Breakout | Volume Spike________________________________________________________________________________

📈 EMAMI LTD – Strong Bullish Breakout | Volume Spike | Structure-Based Trade Idea

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

EMAMI LTD has delivered a decisive breakout from its recent compression phase after trading sideways between 570–585 for several sessions. On July 9, the stock posted a wide-range bullish candle, closing at 609.15, backed by high delivery and breakout volume. The candle formed with an open = low structure, a strong intraday move, and solid closing near the high, confirming buyer dominance. This marks a shift in control from range-bound consolidation to potential momentum continuation.

________________________________________________________________________________

📊 Chart Pattern:

This breakout is from a Box Compression Zone, where the stock had been moving within a tight band. This is a textbook bullish compression breakout, often seen before short-term trend expansions. The range contraction, followed by a sudden expansion with volume, signals that smart money may be entering. Though not a VCP, the narrowing of ranges followed by a strong candle reflects controlled buildup and release of bullish pressure.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Bullish Engulfing

Open = Low Candle

Momentum Continuation Candle

The current candle also fits the "Buy Today, Sell Tomorrow" setup logic, especially useful for short-term intraday/momentum traders from an educational lens.

________________________________________________________________________________

🔊 Volume Analysis:

Volume on July 9 crossed 3x the 20-day average, showing an institutional-grade breakout. What's more important is that this move comes after multiple low-volume sessions, which indicates that the base was silent before this burst — classic sign of accumulation followed by breakout. The presence of a BB squeeze and volume compression breakout confirms the start of a volatility expansion phase.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 65 – strong and rising

MACD: Bullish crossover on Daily, but flat on Weekly/Monthly

CCI: 319 – strong bullish momentum reading

Stochastic: 85 – in a bullish zone, showing follow-through possibility

SuperTrend & VWAP: Bullish bias confirmed

BB Squeeze: Compression off, likely start of expansion

These indicators align well to show a breakout backed by momentum and volume expansion.

________________________________________________________________________________

🧱 Support & Resistance:

🔺 Resistance Zones to Watch:

629.23 – First key level where supply may come in

649.32 – Major resistance from previous swing

678.63 – Long-term resistance zone

Top Range: 653.35 – Official top of the recent consolidation base

🔻 Support Levels:

579.83 – Immediate support post-breakout

550.52 – Minor swing base

530.43 – Deeper demand level from which recent trend started

Bottom Range (Demand Zone): 507.70 – Long-term structural support

________________________________________________________________________________

👀 What’s Catching Our Eye:

What stands out in this chart is the confluence of breakout signals — RSI breakout, engulfing candle, Bollinger squeeze off, and high delivery volume — all firing together. The open-low bullish bar is not just random price movement; it's a statement from buyers that they're ready to defend this zone.

________________________________________________________________________________

🔍 What We’re Watching For:

We’re watching if EMAMI can sustain above 609–620 for the next couple of sessions. A consolidation above this zone will indicate strength. On the flip side, any rejection and close back below 579.83 will raise flags. We're also watching for any mild retest toward 580–585 on low volume, which can offer a secondary low-risk entry opportunity.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Breakout Entry: Above 620 with follow-through or retest confirmation

Pullback Buy: Into the 579.83–585 support zone with a strong bounce candle

Stop Loss: 560.33 (structure-based, on closing basis)

Risk-Reward Lens: Start with a 1:1 target; trail for 1:2+ based on structure — avoid fixed upside projections

________________________________________________________________________________

💼 Sector Tailwinds:

The FMCG and personal care space is seeing renewed demand due to rising rural consumption, price stability in raw materials, and stronger brand-led companies gaining market share. EMAMI, with a wide product portfolio, is well-positioned to benefit. Fundamentally, the stock is also recovering from long-term price compression — aligning well with the recent breakout.

________________________________________________________________________________

⚠️ Risk to Watch:

A close below 579 will invalidate the breakout setup

Indicators are strong but slightly stretched, so chasing blindly can invite volatility

The price must confirm above 620+ for the trend to gain broader legs

Always wait for follow-through before committing fresh capital

________________________________________________________________________________

🔮 What to Expect Next:

If EMAMI sustains above 609–620, the stock could gradually move toward 629.23 and test higher levels like 649.32. But if it fails to hold above the breakout candle, we may see a pullback to 580–585. Either way, price and volume in the next 2–3 sessions will confirm whether this is a false breakout or the start of a real trend.

________________________________________________________________________________

🧠 How to Trade EMAMI LTD (For Educational Use Only):

Breakout Plan (Hypothetical Setup):

🔹 Entry: Above 620 only if follow-through confirmation candle appears

🔹 Stop Loss: 560.33 (on closing basis)

🔹 Pullback Buy: Into 580–585 with same SL, if bullish reversal shows

🔹 Risk-Reward: 1:1 minimum; trail for more

🔹 Position Sizing: Use capital allocation based on risk tolerance — never go all-in on breakout

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

What would be your ideal trade in EMAMI — breakout follow-through or support pullback?

Drop your thoughts in the comments below ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

PG ELECTROPLAST – Volume Breakout from Tight Base________________________________________________________________________________

📈 PG ELECTROPLAST – Volume Breakout from Tight Base | Bullish Momentum Brewing

🕒 Chart Type: Daily Chart

📆 Date: July 9, 2025

________________________________________________________________________________

📌 Price Action:

PG ELECTROPLAST LTD has shown an impressive breakout from a tight base, rising from the 735–755 congestion zone with a wide-range bullish candle on July 9. The candle had an open = low structure, closed near the high, and was backed by massive volume. This signals clear buying strength and suggests that bulls are stepping in after a period of low volatility and sideways movement. The stock had been trading in a narrow band and has now broken out with strong conviction, hinting at the beginning of a possible trend reversal or a short-term momentum rally.

________________________________________________________________________________

📊 Chart Pattern:

The chart displays a tight base breakout from a multi-week compression zone. While not a textbook wedge or flag, the narrowing range combined with flat moving averages suggested the stock was coiling up for a move. The breakout candle pierced the upper end of the range, with volume confirming that it wasn't a false push. This kind of price behaviour often leads to trend expansion — especially when confirmed by broader volume activity.

________________________________________________________________________________

🕯️ Candlestick Pattern:

Bullish Engulfing Candle

Open = Low Structure

Strong Bullish Range Candle

This combination, particularly when seen after a base, is a strong signal of fresh buying interest. It also fits the “Buy Today, Sell Tomorrow” short-term momentum logic, especially for educational model trades.

________________________________________________________________________________

🔊 Volume Analysis:

The breakout was supported by a 10-day volume breakout, with volumes spiking over 3x the average. This is not just intraday noise — it reflects strong delivery participation and genuine interest. Volume spike at breakout is a key sign of smart money involvement. Moreover, the spike occurred from a compressed base, which adds further weight to the strength of the breakout.

________________________________________________________________________________

📈 Technical Indicators:

RSI (Daily): 56 — rising from neutral territory, not yet overbought

MACD: Bullish crossover active on Daily & Monthly

Stochastic: 90 on Daily – indicates strong upward momentum

CCI: 155 – overbought but in a bullish continuation zone

Bollinger Bands: Price broke out of a tight squeeze zone — start of volatility expansion phase

BB Squeeze + Bullish VWAP: Adds confirmation that the trend is beginning to expand

________________________________________________________________________________

🧱 Support & Resistance:

🔺 Resistance Levels:

810.43 – First resistance to watch above current price

832.12 – Prior swing level; price may pause or consolidate here if momentum continues

867.33 – Longer-term resistance zone, marked as a level of interest

Top Range: 1054.2 – Long-term weak resistance zone that triggered the previous major selloff

🔻 Support Levels:

753.53 – Closest support below breakout

718.32 – Well-tested swing level; acted as floor in recent range

696.63 – Important structural support

Bottom Range (Demand Zone): 597.05 – Major long-term support, last zone from where price rallied strongly

________________________________________________________________________________

👀 What’s Catching Our Eye:

The combination of price compression, bullish engulfing breakout, and high volume participation makes this setup stand out. Volume is not just high — it’s clean and backed by structure. The candle formation, RSI breakout, and BB squeeze all come together, creating a powerful setup for momentum continuation. This kind of alignment is rare and usually signals smart money entry.

________________________________________________________________________________

🔍 What We’re Watching For:

The most critical zone is the 796.90 breakout level. If price sustains above it for the next couple of sessions, the structure remains intact. We’re also watching for a possible retest toward the 753–755 zone — if the stock pulls back there on low volume and bounces again, it may offer a low-risk entry setup. Continuation beyond 810 could build momentum, but we will rely on risk-reward and price behaviour — not predictions.

________________________________________________________________________________

✅ Best Buy Level for Equity (Low Risk Idea):

Breakout Entry: Above 796.90, only on follow-through or sustained closing above breakout zone

Pullback Entry: Into the 753.53–755 support zone if the price stabilizes and shows a bullish reversal

Stop Loss: Structure-based, below 736.95 (on closing basis)

Risk-Reward Thinking: Look for 1:1 initially, then trail the stop as the move develops; no fixed projections — price action will guide the outcome

________________________________________________________________________________

💼 Sector Tailwinds:

PG ELECTROPLAST operates in the electronics and contract manufacturing sector — two spaces getting a major boost from PLI schemes, China+1 shift, and rising domestic demand. India’s push toward import substitution, rising middle-class consumption, and government incentives are all helping businesses like PG scale up. This provides a strong macro tailwind to any technical strength seen on charts.

________________________________________________________________________________

⚠️ Risk to Watch:

If price slips back below 753, the breakout weakens

A close below 736.95 negates the breakout setup and could invite selling pressure

Indicators are showing strength, but slightly stretched — so expect volatility and avoid over positioning

Never trade based only on breakout excitement — always wait for confirmation and manage risk first

________________________________________________________________________________

🔮 What to Expect Next:

If the price holds above 796.90, the path toward 810.43 may open up quickly. Sustained volume and consolidation near highs would indicate strength, while sharp rejection could signal a trap. A minor pullback to support zones (753–755) could offer a second opportunity if structure holds. The next few candles will tell us whether this breakout becomes a trend or just a temporary spike.

________________________________________________________________________________

🧠 How to Trade PG ELECTROPLAST (For Educational Use Only):

Breakout Plan (Hypothetical):

🔹 Entry: Above 796.90 (only if price sustains)

🔹 Stop Loss: 736.95 (closing basis; risk-controlled)

🔹 Trade Logic: Use position sizing as per capital and SL distance

🔹 Risk-Reward: Look for 1:1 minimum, trail for 1:2+ if structure expands — don’t fix targets, let the chart lead

🔹 Pullback Buy: Into 753–755 zone with same SL (if structure supports)

________________________________________________________________________________

⚠️ Disclaimer (Please Read):

• This chart is shared for educational purposes only and is not investment advice.

• I am not a SEBI-registered advisor.

• The information provided here is based on personal market observation.

• No buy/sell recommendations are being made.

• Please do your own research or consult a registered financial advisor before making any trading decisions.

• Trading involves risk. Always use proper risk management.

________________________________________________________________________________

💬 Found this helpful?

Where would you look for a trade in PG — breakout follow-through or pullback into the support zone?

Share your thoughts or questions in the comments ⬇️

🔁 Share this with your trading community

✅ Follow STWP for clean technical setups backed by price action and volume

🚀 Let’s trade with patience, logic, and clarity!

Be Self-Reliant | Trade with Patience | Learn with Logic

________________________________________________________________________________

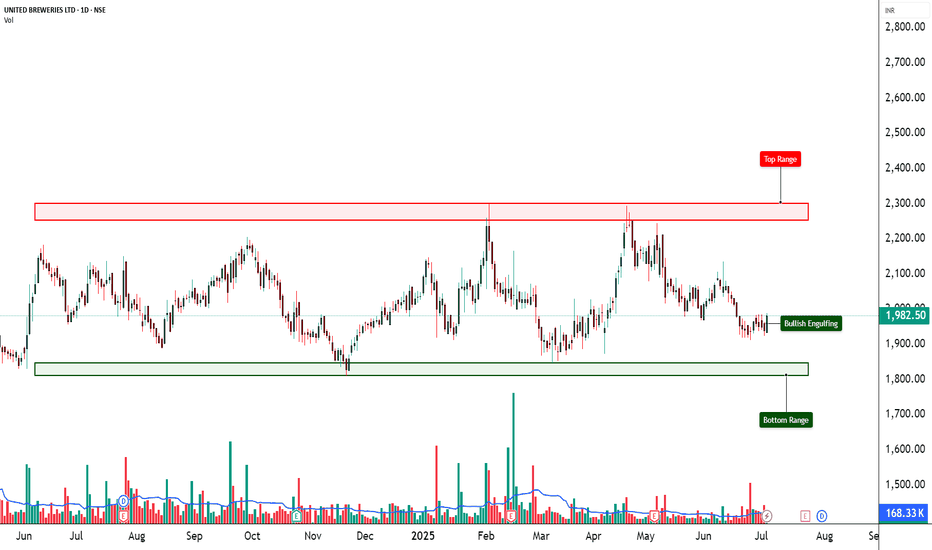

UNITED BREWERIES LTD. (UBL) – Bullish Setup from Demand Zone📈 UNITED BREWERIES LTD. (UBL) – Bullish Setup from Demand Zone | Price Action + Volume Analysis

🕒 Chart Type: Daily

📆 Date: July 3, 2025

🔍 What’s Catching Our Eye:

UBL has printed a strong bullish engulfing candle from the bottom range of ₹1,848, a zone that has historically acted as demand support. This move is happening after multiple tight sessions, suggesting potential breakout energy. While the candle shows strength, volume is unusually low, indicating the need for confirmation before high-conviction entries.

📊 Volume Footprint:

Despite the bullish candle, volume is not supportive. The breakout attempt lacks wide participation. This could either be a low-volume trap or a smart money accumulation zone. Look for a follow-up candle with higher volume for confirmation.

🧠 Technical Outlook & Trade Reasoning:

UBL has rebounded from its demand zone with a textbook bullish engulfing. Price action suggests momentum may follow, but the lack of volume signals a need for patience. Ideal scenario would be a high-volume green candle in the next session for breakout confirmation.

If volume picks up, swing traders can look for entries near ₹1,985–1,995, keeping SL at ₹1,922, and targeting ₹2,080–2,150 in the short term. A sustained move toward ₹2,300 is possible only if the intermediate zones are taken out with strength.

📌 Current Setup Details:

Entry Level: ₹1,988.00

Stop-Loss (SL): ₹1,922.20 (Risk per share: ₹65.80)

Master Level Confidence: 89.91% (as per STWP system)

⚠️ Invalidation Levels:

Close below ₹1,922 (SL level)

Breakdown below ₹1,848 (Demand Zone) on high volume

⚠️ Disclaimer:

This analysis is shared for educational and informational purposes only.

STWP is not a SEBI-registered advisor.

This is not a buy/sell recommendation.

Always consult your financial advisor before making investment decisions.

💬 Found this helpful?

Share your thoughts in the comments ⬇️

🔁 Spread the insight with fellow traders

✅ Follow STWP for smart technical setups backed by volume and price action

🚀 Let’s trade with patience, logic, and clarity!

BLUE STAR LTD. – TECHNICAL ANALYSIS📈 BLUE STAR LTD. – TECHNICAL ANALYSIS

📆 Date: July 1, 2025 | ⏱ Timeframe: Daily Chart

🔍 Educational Breakdown – For Learning & Study Use Only

________________________________________________________________________________

🔹 Price Action Zones

• 🔴 Top Range (Resistance): 2417

• 🟢 Bottom Range (Support): 1521

________________________________________________________________________________

🔹 Chart Pattern: ✅

Rectangle/Box Consolidation Breakout – Price was range-bound in a tight zone and has given a strong breakout on high volume, indicating bullish intent.

________________________________________________________________________________

🔹 Reversal Candlestick Patterns

• Top Range (2417): ⛔ No recent candlestick activity visible at the top range.

• Bottom Range (1521): Todays Candle

✅ Bullish Engulfing + Strong Bullish Candle

✅ RSI Bounce + Volume Spike

✅ Confirmed by Price Action and Momentum Indicators

________________________________________________________________________________

📊 Trade Plan (Based on Reason and Logic)

🔼 Bullish Trade Setup:

• Entry: 1715 (Breakout Candle Close)

• Stop Loss: 1614.45 (Below consolidation and bullish candle)

• Target 1: 1850

• Target 2: 1980

• Reason:

o Strong breakout with above-average volume

o Multiple confirmations (RSI, Bollinger Band, Supertrend)

o Box breakout with previous supply cleared

________________________________________________________________________________

🔽 Bearish Trade Setup:

• If price fails to sustain above 1715 and closes back below 1680 zone

• Entry: Below 1665 (Fakeout confirmation)

• SL: Above 1715

• Target: 1615 / 1550

• Reason: Potential failed breakout & liquidity trap

________________________________________________________________________________

📌 Disclaimer

This analysis is shared for educational and study purposes only. It does not constitute investment advice. The author is not SEBI-registered. Please consult a SEBI-registered advisor before making trading decisions. Always use proper risk management and trade only with confirmation.

________________________________________________________________________________

💬 Comments

What’s your view on Britannia?

Drop your thoughts and chart setups

________________________________________________________________________________