Eurusd-4

USDCHF ANALYSISTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 3

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

EURUSD Long Wave Analysis:

The EURUSD pair is showing signs of a favorable long opportunity based on wave analysis. An ABC correction pattern appears to be forming, with the market completing the A and B waves. The C wave, which typically follows, presents a potential long setup.

Wave Pattern: A completed A-wave followed by a corrective B-wave suggests an imminent C-wave rally.

RRR: This setup offers an appealing risk-reward ratio, as the C-wave often covers a substantial distance compared to the B-wave.

Support Confluence: The C-wave's projected starting point aligns with key support levels, enhancing the trade's probability.

Fibonacci Retracements: The C-wave's target aligns with common Fibonacci retracement levels, adding to the technical confluence.

Momentum Indicator: Positive divergence on a momentum indicator supports the idea of a potential upward move.

Dollar Weakness: Considering potential dollar weakness, the EURUSD upward movement could be amplified.

News Impact: Upcoming positive economic releases may further support the long thesis.

Time Horizon: The projected C-wave duration aligns with a medium-term trading horizon.

Risk Management: Place stop-loss below the recent B-wave low to mitigate downside risk.

Monitoring: Continuously monitor price action and adapt to any changing market dynamics.

Remember that trading involves risks, and analysis is based on historical patterns. Stay updated with market developments and adjust the trade plan accordingly.

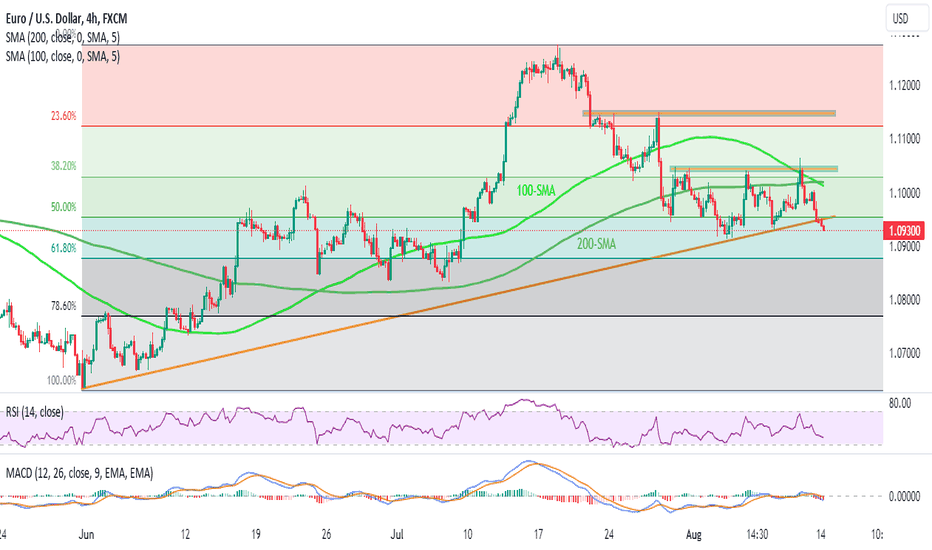

EURUSD drops within bearish channel with eyes on Jackson HoleEURUSD prepares for the sixth consecutive weekly fall as ECB and Federal Reserve bosses prepare for the annual showdown at the Jackson Hole Symposium. That said, the Euro pair remains pressured within a one-month-old descending trend channel amid downbeat RSI and MACD conditions, which in turn suggest less downside room and highlights the stated channel’s bottom line of around 1.0785 as the key support. In a case where the sellers dominate past 1.0790, the 78.6% Fibonacci retracement of May-July upside, near 1.0770, will act as the final defense of the buyers, a break of which will direct the prices toward May’s bottom of 1.0635.

On the contrary, a fortnight-long falling resistance line, close to 1.0880 at the latest, guards immediate EURUSD recovery within the bearish channel formation. Following that, the mentioned channel’s top line of near 1.0980 and the 200-SMA surrounding 1.1015-20 could test the Euro buyers before giving them a charge. In that case, the monthly high of 1.1065 and the late July peak of 1.1150 may check the upside moves ahead of directing the quote to the yearly top of 1.1275.

Overall, EURUSD bears appear running out of steam but the buyers need strong reasons to retake control, which in turn highlights the central bankers’ speeches at the key event for the pair traders to watch.

EURUSD → Slips as euro zone PMIs give ECB pauseThe Initial reaction to the data saw EURUSD spike 50 pips lower before hovering around the 1.0820 handle at the time of writing. Key area at present with the 200-day MA resting just below the 1.0800 handle and could cap further losses.

EURUSD did face selling pressure as a stronger US Dollar and rising US yields saw the pair fall to support around the 1.0840 handle and print a fresh 7-week low. There is potential for further downside with a break below the 1.0840 support handle opening up a run toward the 200-day MA resting just a smidge below the 1.0800 handle. For now, though much like the majority of major pairs the range between the 100 and 200-day MAs could continue to hold firm keeping EURUSD confined to the 220 odd pip range.

Key Levels to Keep an Eye On:

Support levels:

1.0840

1.0797 (200-day MA)

1.0747

Resistance levels:

1.0900

1.0930 (100-day MA)

1.1000 (psychological level)

EURUSD → At the beginning of a broader Bearish reversal ?On the 4-hour chart, the EUR/USD has broken short-term support levels from June, confirming an upward trend. However, resistance levels from July have maintained a downward technical trend. Immediate support can be seen at the 1.0833 - 1.0859 range.

If this area holds, prices could rise and test the downward trend line from July, potentially sustaining a short-term downward technical trend. Otherwise, a higher breakout will reveal the Fibonacci retracement level of 23.6% at 1.1124. On the other hand, a breakout and immediate support confirmation will expose the 78.6% level at 1.0771 as prices fall to 1.0634.

AUD/USD Wave Analysis

📈🌊

Description:

🤑 Get ready to ride the NZD/USD profit waves! We're breaking down recent moves (1-2-3-4-5) and diving into the next big thing: correction wave time! Let's get into Wave ABC and grab those gains! 💰

🔍 Highlights:

Wave Rundown: We're zooming into NZD/USD moves, uncovering the cool five-wave setup (12345). You'll know each wave's vibe and how they roll together for the big picture.

Correcting the Course: Time to talk about the comeback waves. Check out what might pop in Wave ABC – levels, patterns, and when it might hit.

Cash In on Corrections: We're spilling the tea on scoring profit during correction waves. See how to time your moves right for max cash – enter and exit like a pro.

Wave-riding BC: Dive into Wave BC, the sequel to correction moves. We'll break down the who's and what's that shape it, so you ride it smooth for gains.

Risk Boss Moves: Master risk moves during corrections. Learn slick tricks to shield your bankroll while scooping up mad profits.

Tech Tools FTW: Check out tools and tricks to up your AUD/USD game. Use them to back up your insights and fine-tune your moves.

Real Deal Stories: Dig into past AUD/USD waves. It's like learning from OG wave riders – see patterns, scores, and what went down.

NZD/USD's on stage, so gear up for the profit ride! Correction wave (Wave ABC) is where the fun's at, packed with big potential wins. Stay sharp, trade bold, and get the scoop from our full analysis!

(Note: Trading's got risks, and past wins don't promise future fortune. This is about learning, not financial advice. Do your research and chat with money experts before making moves.) 🚀🤑

EUR/USD Wave Analysis:LONG

📈🌍 Uncover the intricacies of EUR/USD price action through an insightful wave analysis. We dissect the evolving wave patterns to reveal the potential opportunities that lie ahead. Join us as we delve into the afterwaves of 12345 and prepare for the upcoming correction wave, setting the stage for a profitable journey through Wave ABC!

🔍 Key Points:

Deconstructing Wave Sequence: Embark on a journey through the recent EUR/USD price movements, meticulously breaking down the quintessential five-wave pattern (12345). Gain a comprehensive understanding of each wave's characteristics and its contribution to the overall market trend.

Approaching the Correction Wave: Unveil the significance of corrective waves within the realm of forex trading. We examine the various scenarios and projections for the impending Wave ABC, shedding light on potential price levels, patterns, and timing.

Profitable Potential: Learn to harness the power of correction waves for profitable trading. We lay out strategies that empower traders to identify optimal entry and exit points, enabling them to capitalize on the market's risk-reward dynamics.

Capturing Wave BC: Dive into the heart of Wave BC, the second phase of the corrective pattern. Understand the external factors influencing its formation and acquire the insights needed to align your trading strategy for potential gains.

Risk Management Mastery: Master the art of risk management during correction waves. Explore effective techniques to safeguard your trading capital while maximizing profit potential, ensuring a balanced approach to your trading endeavors.

Leveraging Technical Indicators: Discover an arsenal of technical indicators and tools that bolster your EUR/USD analysis. Utilize these tools to validate your insights and fine-tune trading decisions during this pivotal phase.

Real-life Case Studies: Immerse yourself in historical instances of correction waves within the EUR/USD pair. Draw parallels between past patterns and outcomes to enhance your decision-making prowess.

📊💰 As EUR/USD takes center stage, equip yourself with the knowledge and strategies required to navigate these exciting waves of opportunity. Embark on a journey of profit potential during the correction wave – Wave ABC has the potential to unlock lucrative trades. Stay informed, trade with confidence, and make well-informed decisions with our comprehensive analysis!

(Note: Trading carries inherent risks, and historical performance does not guarantee future results. This analysis is for educational purposes and should not replace professional financial advice. Always conduct thorough research and consider seeking guidance from financial experts before executing trading decisions.)

EURUSD 2h analysis long Trade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

USDCAD D Trade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 5

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

eurusd 1DTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

AUDUSD ANALYSIS FOR TODAY Trade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 3

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

GBPUSD NEW ANALYSIS Trade Idea: SELL

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

EURUSD sellers tighten grips ahead of a busy weekIn addition to posting the fourth consecutive weekly losses, the EURUSD also ended the week on a negative note while piercing a 10-week-old rising support line, now immediate resistance around 1.0950. Also keeping the Euro sellers hopeful are the bearish MACD signals. However, the RSI (14) line is below 50.0 and suggests bottom-picking, which in turn highlights the monthly low of around 1.0910 as short-term key support. Following that, July’s bottom surrounding 1.0830 and the 78.6% Fibonacci retracement of May-July upside, near 1.0770, can check the downside moves targeting May’s trough close to 1.0635.

Meanwhile, a corrective bounce needs to cross a convergence of the 100-SMA and the 200-SMA to convince the intraday buyers of the EURUSD pair. Even so, a fortnight-old horizontal resistance area surrounding 1.1045-50 could test the bulls before giving them control. Even so, the tops marked during late July may offer breathing space to the buyers near 1.1150. In a case where the Euro pair remains firmer past 1.1150, the odds of witnessing a run-up towards challenging the yearly top marked in July around 1.1275 can’t be ruled out.

Overall, EURUSD is on the bear’s radar as traders await more details of EU/US growth and inflation.

GBPCAD ANALYSIS Trade Idea:

📍

DIRECTION

ANALYSIS

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

GBPUSD NEW ANALYSISTrade Idea: BUY

PAITENTLY WAIT TO SAFEPLAY

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

eurusd long Trade Idea: buy .

.

.

.

.

.

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

gbpaud sl updateTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

usdcad sl update in profit Trade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

eurusd update sl in profitTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!