Eurusdprediction

EUR/USD to Target $1.09 on Easing Bank Jitters and ECB ChatterThis morning, the EUR/USD was up 0.13% to $1.08107. A mixed start to the day saw the EUR/USD fall to an early low of $1.07949 before rising to a high of $1.08195. The First Major Resistance Level (R1) at $1.0817 capped the upside.

The EUR/USD needs to avoid a fall through the $1.0781 pivot to retarget the First Major Resistance Level (R1) at $1.0817 and the morning high of $1.08195. A move through the morning high would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected business survey numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0836 and resistance at $1.0850. The Third Major Resistance Level (R3) sits at $1.0891.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0761 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.07. The Second Major Support Level (S2) at $1.0725 should limit the downside. The Third Major Support Level (S3) sits at $1.0670.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07576). The 50-day EMA pulled away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above S1 ($1.0761) and the 50-day EMA ($1.07576) would support a breakout from R1 ($1.0817) to give the bulls a run at R2 ($1.0836) and $1.0850. However, a fall through S1 ($1.0761) and the 50-day EMA ($1.07576) would bring S2 ($1.0725) into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD 27TH MARCH FORECAST The EUR/USD needs to avoid a fall through the $1.0770 pivot to target the First Major Resistance Level (R1) at $1.0828. A return to $1.08 would signal a bullish session. However, the EUR/USD needs hawkish ECB chatter and better-than-expected business survey numbers to support a breakout session.

In the case of an extended rally, the bulls will likely test resistance at the Friday high of $1.08386 but fall short of the Second Major Resistance Level (R2) at $1.0896. The Third Major Resistance Level (R3) sits at $1.1022.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0702 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0650 and the Second Major Support Level (S2) at $1.0645. The Third Major Support Level (S3) sits at $1.0519.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 50-day EMA ($1.07479). The 50-day EMA moved away from the 100-day EMA, with the 100-day EMA widening from the 200-day EMA, delivering bullish signals.

A hold above the 50-day EMA ($1.07479) would support a breakout from R1 ($1.0828) to give the bulls a run at the Friday high of $1.08386 and R2 ($1.0896). However, a fall through the 50-day EMA ($1.0479) would bring the 100-day EMA ($1.07102) and S1 ($1.0702) into play. A fall through the 50-day EMA would send a bearish signal.

EURUSD FORECAST 22ST MARCH 2023 As per the chart pattern we can easily see that EURUSD is forming a Bearish Pattern On 1 Hour Time Frame.

If we take a Short Position now we can easily Achieve a target till 1.06653.

PS: If you like our Updates please follow , Share and support us .

Also if you want personalized Signals on EURUSD , you can also Message Us here . Thanks

EURUSD HIGH POI ZONE FOR NEXT MOVE 15.03.23*In 4hr time frame there was a liquidity sweep

*Body close below previous move thats call high poi zone IFC candel

*IFC candel forms by sweeping previous high or low

*Due to one positive and neutral cpi report of Doller market not giving confirmation of selling or buying

*So as depends only on SMC concept try to catch big moves with small sl

*So take a risk of selling on uptrend looks fool but setup giving a selling trade.

*My Ep - 1.07853

Sl - 1.08123

Target- 1.05440

EURUSD FORECASE 13TH MARCH 2023This morning, the EUR/USD was up 0.73% to $1.07169. A bullish start to the day saw the EUR/USD rally from an early low of $1.06638 to a high of $1.07369. The EUR/USD broke through the First Major Resistance Level (R1) at $1.0702.

The EUR/USD needs to avoid a fall through R1 and the $1.0638 pivot to target the Second Major Resistance Level (R2) at $1.0765. A move through the morning high of $1.07369 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and risk-on sentiment to support a breakout session.

In the case of an extended rally, the bulls will likely test resistance at $1.08. The Third Major Resistance Level (R3) sits at $1.0892.

A fall through R1 and the pivot would bring the First Major Support Level (S1) at $1.0575 into play. However, barring a risk-off-fueled sell-off, the EUR/USD pair should avoid sub-$1.0550 and the Second Major Support Level (S2) at $1.0511. The Third Major Support Level (S3) sits at $1.0384.

Looking at the EMAs and the 4-hourly chart, the EMAs send bullish signals. The EUR/USD sits above the 200-day EMA ($1.06609). The 50-day EMA closed in on the 100-day EMA, with the 100-day EMA narrowing to the 200-day EMA, delivering bullish signals.

A hold above R1 ($1.0702) and the 200-day EMA ($1.06609) would give the bulls a run at R2 ($1.0765) and $1.08. However, a fall through the 200-day ($1.06609) and 100-day ($1.06324) EMAs would bring the 50-day EMA ($1.06117) and S1 ($1.0575) into play. A fall through the 50-day EMA would send a bearish signal.

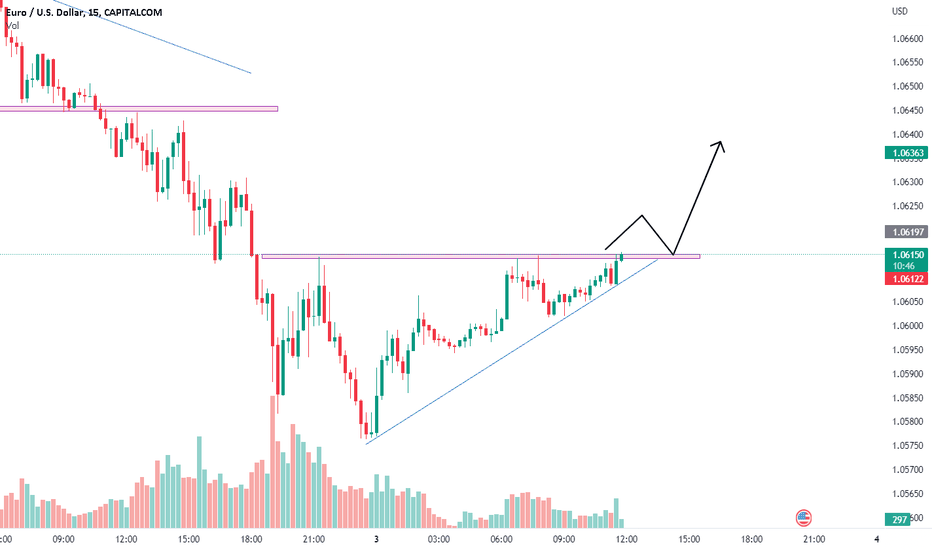

#EURUSD Retake of BUY call with risk:reward 3.2I made a video on when to retake the trade and how many times. As per the video, I explained 2 conditions.

The first one is, there should be an increase in volume

second condition is, the price has to cross the buying point.

now, for eur/usd, both the conditions are met, so we can take the buy call with risk: reward 3

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, Hit like button or boost our ideas. Thank you.

EURUSD 10TH MARCH 2023The EUR/USD needs to avoid the $1.0569 pivot to target the First Major Resistance Level (R1) at $1.0601. A return to $1.06 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0623 and resistance at $1.0650. The Third Major Resistance Level (R3) sits at $1.0678.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0547 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.05. The Second Major Support Level (S2) at $1.0515 should limit the downside. The Third Major Support Level (S3) sits at $1.0460.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06006). The 50-day EMA eased back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06006) and R1 ($1.06010) would give the bulls a run at R2 (1.0623) and the 100-day EMA ($1.06300). However, failure to move through the 50-day EMA ($1.06006) would leave S1 ($1.0547) in play. A move through the 50-day EMA would send a bullish signal.

EURUSD FORECAST 9TH MARCH,2023The EUR/USD needs to avoid the $1.0547 pivot to target the First Major Resistance Level (R1) at $1.0569 and the Wednesday high of $1.05739. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need hawkish ECB chatter and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test the Second Major Resistance Level (R2) at $1.0596 and resistance at $1.06. The Third Major Resistance Level (R3) sits at $1.0646.

A fall through the pivot would bring the First Major Support Level (S1) at $1.0519 into play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450. The Second Major Support Level (S2) at $1.0497 should limit the downside. The Third Major Support Level (S3) sits at $1.0447.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06058). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through R1 ($1.0569) would give the bulls a run at R2 (1.0596) and the 50-day EMA ($1.06058). However, failure to move through the 50-day EMA ($1.06058) would leave S1 ($1.0519) in play. A move through the 50-day EMA would send a bullish signal.

EURUSD FORECAST 8th MARCH 2023The EUR/USD needs to move through the $1.0597 pivot to target the First Major Resistance Level (R1) at $1.0647. A return to $1.0550 would signal a bullish session. However, the EUR/USD would need the German and US stats to support a breakout session.

In the case of an extended rally, the bulls will likely test resistance at $1.07 but fall short of the Second Major Resistance Level (R2) at $1.0745. The Third Major Resistance Level (R3) sits at $1.0893.

Failure to move through the pivot would leave the First Major Support Level (S1) at $1.0499 in play. However, barring a data-fueled sell-off, the EUR/USD pair should avoid sub-$1.0450 and the Second Major Support Level (S2) at $1.0448. The Third Major Support Level (S3) sits at $1.0300.

Looking at the EMAs and the 4-hourly chart, the EMAs send bearish signals. The EUR/USD sits below the 50-day EMA ($1.06231). The 50-day EMA slid back from the 100-day EMA, with the 100-day EMA pulling back from the 200-day EMA, delivering bearish signals.

A move through the 50-day EMA ($1.06231) would support a breakout from R1 ($1.0647) to give the bulls a run at $1.07. However, failure to move through the 50-day EMA ($1.06231) would leave S1 ($1.0499) in play. A move through the 50-day EMA would send a bullish signal.

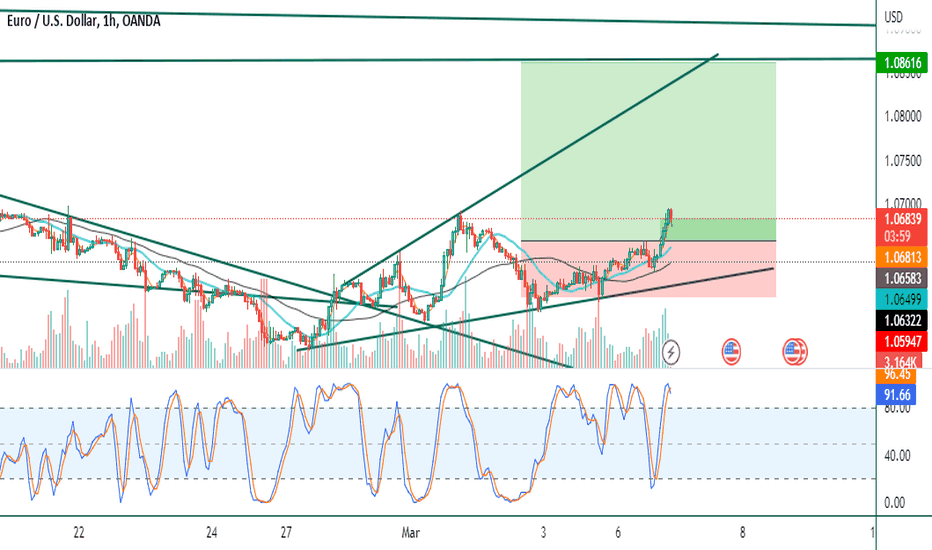

#EUR/USD Upward Movement potential with RIsk:reward =3 #FOREX#FOREX #EUR/USD Buy at 1.06583, SL 1.05933, Target 1.08489

RISK:REWARD 3

ANalysis: Broadening Triangle.

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading