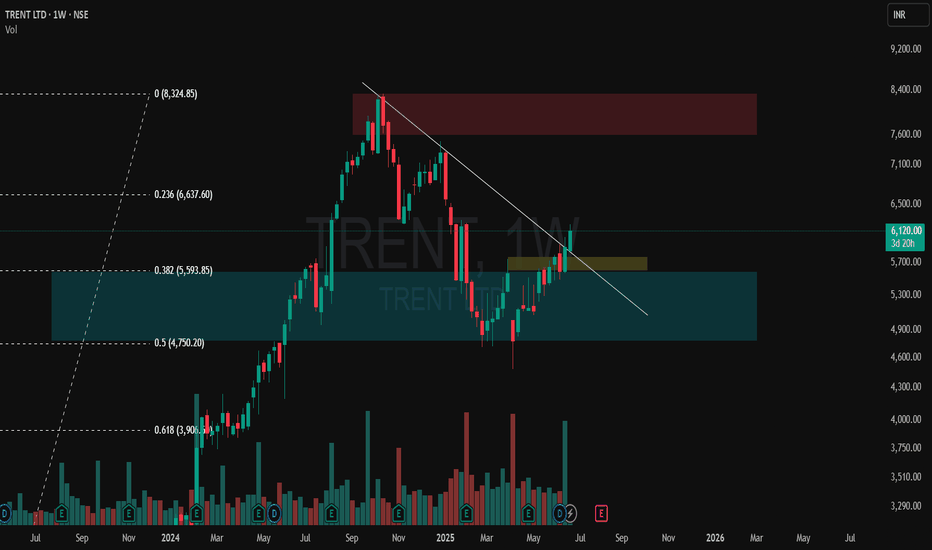

Fibonacci

Multi-Confirmation Price Action: Fibonacci Zones, Base BreakoutsExplore multi-confirmation techniques using Fibonacci retracement to identify high-probability base breakout zones. Learn how to spot double bottom and inverted head & shoulders patterns at demand levels and execute confirmation trades for precision entries

Database in trading SQL remains a fundamental tool for querying and managing data. SQL's simplicity and power make it accessible to both beginners and experts. In trading systems, SQL enables efficient data retrieval and manipulation. Users can write SQL queries to analyze market trends and execute trading strategies.

Postgres is an open-source production-ready database with lots of use cases. Mongo is a NoSQL alternative that can sometimes be much faster than SQL databases. Arctic is built upon Mongo to make it even more helpful for those who work with market data, as Arctic supports pandas dataframes and NumPy arrays by default.

Nifty Almost Hits 25000, Bank Nifty Faces 52K ResistanceNifty hit a new ATH today as well but failed to hold on to the highest level possibly on account of profit booking.

Bank Nifty remained very volatile during the day and fell almost 1000 points to end the day just above 51400.

Please watch the video to know more about it.

Thank you,

Umesh

HINDOILEXP: opportunity for steep rise.🔍 Technical Analysis Update for NSE:HINDOILEXP - Week Starting January 23, 2024

📊 Current Status: The stock closed at a high of ₹186.85 on the last trading day. It has been range-bound since August 2023 but recently breached a six-month high before closing just below it.

📈 Entry Point: Consider entering the trade if the price crosses and sustains above ₹189.80 in the next day or two. This could signal the start of a bullish trend.

🎯 Target: The first target is set at ₹196.40.

🛑 Stop Loss: A key stop loss point is at ₹172.85, aligning with a critical Fibonacci level of 0.5 at ₹172.75. This acts as a strong support level.

💹 Key Indicators:

Volume: Increasing volume supports the potential bullish trend.

Percentage R: Positioned at the upper band, indicating bullishness.

Stochastic RSI: A buying crossover has occurred in an oversold situation, further supporting bullish prospects.

🚦 Overall Outlook: The stock is showing signs of breaking out of its long-term range with increasing volume and positive technical indicators. Monitoring the stock's ability to maintain above ₹189.80 will be crucial for confirming the bullish trend.

⚠️ Disclaimer: This analysis is for informational purposes only and is not financial advice. Investors should conduct their own research and consult a financial advisor before making any investment decisions .

🔖 #HindustanOilExploration #StockAnalysis #BullishTrends #TradingStrategy #StockMarket #InvestmentTips

🌟 Stay informed and trade wisely! 🌟

An overview of the marketAn overview of the full crypto market with my perspective , its my first time recording a video and trying to explain people through a video , Hope you all appreciate and I will try to make it better the next time.

I showed the CRYPTOCAP:TOTAL3 (alt market cap) , and you areas to NOT take trades on , and areas to EXIT / TAKE PARTIAL / TAKE PROFIT on and the areas to OPEN LONG positions.

I also discussed CRYPTOCAP:BTC.D (BTC Dominance) , and showed you how I expect the money flow in alts from BTC , money flow from BTC to alts doesn't mean that BTC will fall nor does the area I marked as target for the BTC dominance shall be achieved , there are many supports to break , with each support I will try to update you all , these are merely short term Ideas over the full crypto market.

Discussed CRYPTOCAP:ETH.D , BINANCE:ETHBTC & CRYPTO:ETHUSD and showed targets for them and where to expect corrections.

ETH , I believe we are going to have a run to 3k before any big correction.

Discussed some alt coins to hold and showed 2 large cap coins to have spot bags in which are

CRYPTO:DOGEUSD & CRYPTO:XRPUSD

Hope the basic knowledge and update I wanted to provide to you was understood clearly despite being with my background noise and not having proper setup for the video lecture , I will try to do better with each video.

Thankyou All ! Trade safe and be safe. 💚

INDUSIND BANKHello and welcome to this analysis

Bank appears to be in a lower time frame triangle suggesting the probability of a potential breakout.

Off late has been an underperformer compared to other large private banks in the recent run in the banking sector.

Extreme narrow range 1480-1540, broader range 1350-1775

Good opportunity to buy the dip and / or the breakout for probable decent upside in the medium to long term.