Banknifty key levels for this year 2026Banknifty key levels for this year 2026.

These levels are derived from past 52 weeks data of Banknifty.

These key levels will act as major support and resistance for the coming weeks.

100% candles are not correct, it can be deceiving, don`t fall into traps.

Line chart might help.

Plot these levels and check yourself.

Have Green New Year (2+0+2+6=1)

Fibonacci

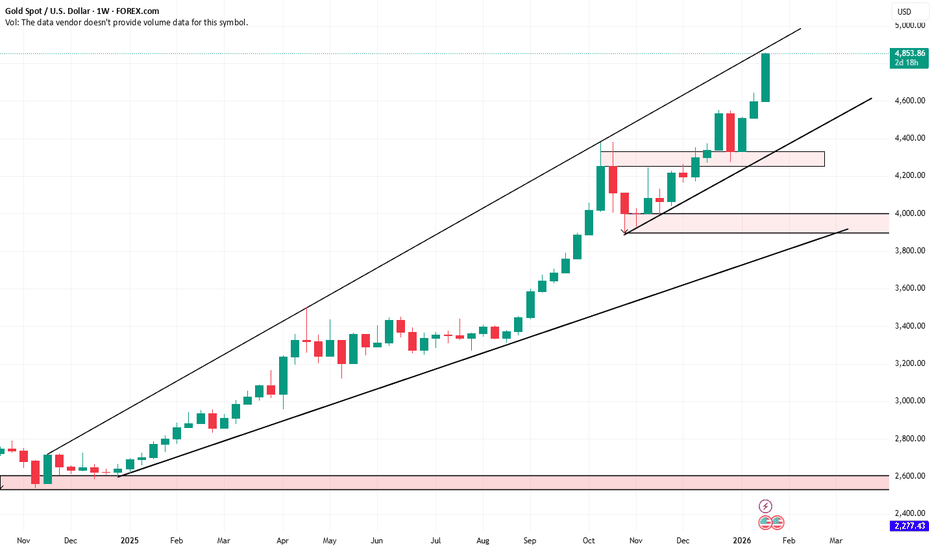

XAUUSD - Brian | H2 Technical AnalysisGold remains constructive and continues to hold a bullish structure despite last night’s sharp cross-market volatility. The main driver behind the larger moves was heavy selling pressure in U.S. equities, which briefly accelerated safe-haven demand and helped support gold.

On the macro side, tensions linked to Greenland and renewed tariff rhetoric have increased uncertainty across markets. The USD weakened in the short term, while the EUR appears more exposed to medium-term geopolitical and policy risks. This backdrop generally remains supportive for gold, especially on pullbacks into key support.

Technical Structure & Key Zones (H2)

On the H2 timeframe, XAUUSD is still trading within a clear uptrend: price respects the rising trendline and continues to print higher highs and higher lows, confirming buyers remain in control of the primary structure.

The latest impulse leg has left several important technical areas:

A Fair Value Gap (FVG) below current price, which may be revisited if a technical retracement develops.

The 0.618 Fibonacci retracement zone at 4750–4755, aligned with the rising trendline — a strong confluence support for a deeper pullback scenario.

A higher, near-term demand area around 4812, suitable for shallow pullbacks during strong momentum conditions.

As long as price holds above these demand zones, the medium-term bullish structure remains intact.

Liquidity & Forward Expectations

To the upside, the market still has room to expand toward prior highs and the ATH liquidity area. Any short-term pullback, if it occurs, may simply act as a reset before continuation — especially while macro volatility remains elevated.

Reminder: strong trends rarely move in a straight line. Pauses and retracements are normal and often offer better participation than chasing price at the highs.

Trading Bias

Primary bias: Buy pullbacks in line with the trend; avoid FOMO entries near the top.

Key zones to watch:

4812: shallow pullback / momentum continuation zone

4750–4755: deeper pullback into 0.618 + trendline confluence

Preferred monitoring timeframe: H1–H4 to reduce noise

Risk management remains critical given the market’s sensitivity to news flow and cross-asset swings.

Refer to the accompanying chart for a detailed view of the structure, FVG, and key pullback zones.

Follow the TradingView channel to get early updates and join the discussion on market structure and trade ideas.

Bank Of Baroda on Demand Zone Range 220 to 235

Bank Of Baroda on Demand Zone Range 220 to 235

Previous ALL TIME HIGH 228 may act as support

Trading at Fib Golden ratio

Stock is trading at Demandzone with trendline Support

Trading near its Book Value ₹ 231

PE Ratio is near by 2022 level, Current PE is 6.34

Keep Stoplose on weekly Closing Below 220

NIFTY Analysis for 21st JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 21st JAN 2026: IntraSwing Spot levels

🚀Follow & Compare NIFTY spot Post for Taking Trade

👇🏼Screenshot of NIFTY Spot All-day(20 Jan 2026) in 5 min TF.

Till now GIFTNIFTY recovered from Day LOW and also taking Support at short term TF Trend line (Orange Color) mentioned in Screen shot

📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊📊

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

GIFTNIFTY IntraSwing Levels for 21st JAN 2026GIFTNIFTY IntraSwing Levels for 21st JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

____^^^^^^^^^_____^^^^^^^^^_____

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

LT: Vibration Stock (2-4 days) Intra- Positional - Swing Levels.LT: Vibration Stock (2-4 days): Intra- Positional - Swing Levels. EXp. View

💥Now @ 3841 - Near Gann Support Level / Zone @ 3840 -3848

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

SENSEX Analysis for 20th JAN 2026 IntraSwing Spot leveSENSEX @ 82853 (Data Delayed in Chart) Looks Good compare to NIFTY.

One can enter LONG Strategy Likr Bull Call spread, Protective PUT etc.

Screenshot of near CALL & PUT option shows Premium is more in Call side compare to PUT Side.

Screenshot of Bull Call spread LONG 82900 CE & SHORT 83200PE. Risk Max 130 points

🚀Follow & Compare NIFTY spot Post for Taking Trade

_______________^^^^^^^^^_________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

HAL: Vibration Stock - Intraswing Levels.HAL: Vibration Stock - Intraswing Levels.

Looking good at this level @ 4435. Intra-Swing limited DN-Side with much more upside (i.e. Favourable RR)

🚀Follow & Compare NIFTY spot Post for Taking Trade

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions..

GIFTNIFTY IntraSwing Levels for 20th JAN 2026GIFTNIFTY IntraSwing Levels for 20th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

________^^^^^^^____________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART & want for Level and ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart Levels, patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026📊 NIFTY WEEKLY Level analysis from 19th - 23rd JAN 2026

🚀Follow & Compare NIFTY spot daily Postas well as

💥GIFTNIFTY Post for NF levelsfor Taking Trade

🚀Follow GIFTNIFTY Post for NF levels

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

NIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levelsNIFTY Analysis for 20th JAN 2026: Weekly Exp. IntraSwing levels

🚀Follow GIFTNIFTY Post for NF levels

👇🏼Screenshot of NIFTY Spot Allday(19 Jan 2026) in 1 min TF.

^^^^^^^^^^^______________^^^^^^^^^^^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

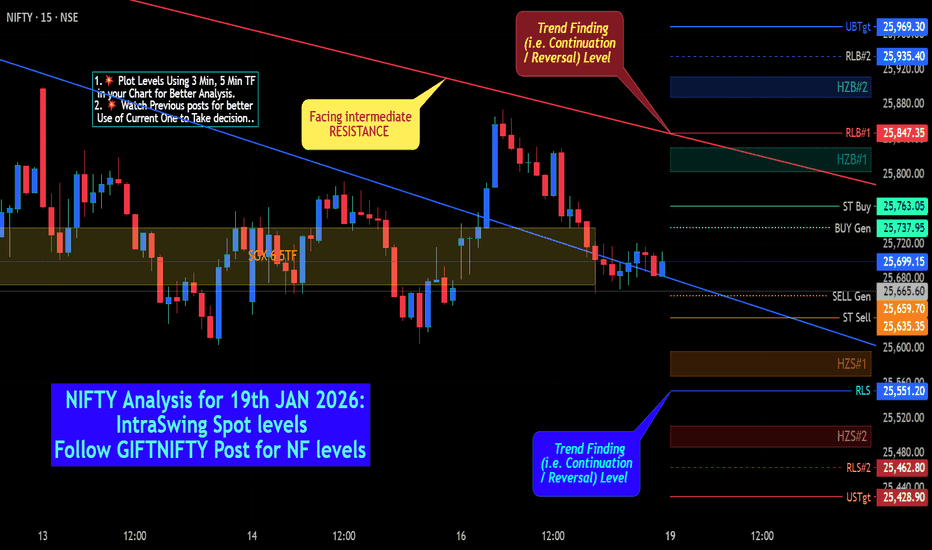

NIFTY Analysis for 19th JAN 2026: IntraSwing Spot levelsNIFTY Analysis for 19th JAN 2026: IntraSwing Spot levels

🚀Follow GIFTNIFTY Post for NF levels

^^^___❇️❇️❇️❇️❇️❇️❇️❇️❇️___^^^

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

BAJFINANCE Weekly Level Analysis: PositionalSwing: 19th-23rd JANContinuation of early last night "Intraswing level" post

in early post mentioned Max level "UBTgt => 969" made high @ 969.95 i.e Hit all Levels.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

BAJFINANCE Nearer to Bottoming out-Intraswing Leve 19th JAN 2026BAJFINANCE Level Analysis: Intraswing for 19th JAN 2026

IS NEARER TO BOTTOMINGOUT?

🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔🔔

👇🏼Screen shot of Daily Analysis

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

GIFTNIFTY IntraSwing Levels for 19th JAN 2026GIFTNIFTY IntraSwing Levels for 19th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

__________________^^^^^^^^^______________________

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 If You LOOKING any CHART, You want me to ANALYZE?

Share your desired stock names in the comments below! I will try to analyze the chart patterns and share my technical view (so far my Knowledge).

If Viewers think It can identify meaningful setups. Looking forward to hearing from all of you — let's keep this discussion going and help each other make better trading decisions.

Screenshot (as of now at 9.56 am) of NIFTY spot Shows Consolidation at REVERSAL / TF level Near @ 25555. Witnessing RSI Bullish Divergence ib 5 min TF.

Bullish Flag Brewing in Bandhan BankBandhan Bank is consolidating after a sharp decline, forming what appears to be a potential bullish flag on the chart. The ongoing pullback is overlapping and corrective , suggesting digestion rather than a fresh impulsive sell-off.

As long as price holds above the 141 support zone , the bullish flag structure remains valid. A decisive breakout above the upper channel boundary would confirm continuation and open the door for higher levels.

Until then, this remains a wait-for-confirmation setup , with clearly defined risk and invalidation.

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Please do your own research (DYOR) before making any trading decisions.

HDFCBANK Level Analysis: Intraswing for 19th JAN 2026✈️ HDFCBANK Level Analysis: Intraswing for 19th JAN 2026

🚀Follow & Compare Daily Intraswing Post for Positioning much accurate level to Take Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

HDFC Bank Q3 FY26 Earnings Analysis (Announced January 17, 2026)🌈HDFC Bank Q3 FY26 Earnings Analysis (Announced January 17, 2026)

✅ HDFC Bank, India's largest private sector lender by assets, reported a solid Q3 FY26 (October-December 2025) performance, with net profit beating analyst estimates amid stable asset quality, moderate deposit growth, and improving lending margins. The results reflect resilience in a challenging environment marked by deposit mobilization pressures, regulatory scrutiny on unsecured loans, and global uncertainties like potential US tariffs on remittances. Key positives include double-digit loan growth, NPA improvements, and controlled costs, though deposit growth lagged peers, leading to a slight liquidity drag. Management emphasized profitable growth, digital advancements, and LDR (loan-to-deposit ratio) reduction toward FY27 targets.

📢Key Financial Highlights

The bank delivered YoY profit growth ahead of expectations, with asset quality holding steady. Here's a summary table comparing actuals to estimates (median from 6-8 brokerages) and YoY/QoQ changes👇🏼:

in Table format on Chart.

🔔Beat/Miss Analysis: PAT beat estimates by ~1-2% on better-than-expected NIM stability and fee income, despite higher opex from labor code provisions (₹800 Cr one-off). NII met low-end estimates, reflecting deposit cost pressures. Overall, a "better-than-feared" quarter, with no major slippages in unsecured portfolios.

🏹Segment-Wise Analysis

HDFC Bank's diversified model showed balanced growth, with wholesale and SME segments outperforming retail amid regulatory curbs on consumer loans.

☂️Advances (Loans): Gross advances at ₹28.45 lakh Cr, up 11.9% YoY (from ₹25.42 lakh Cr); advances under management +9.8% YoY. Segment breakdown: Retail +6.9% (muted due to unsecured slowdown), SME +17.2%, Corporate/Wholesale +10.3%, Overseas +1.7% of total. Growth beat estimates of 12-14%, signaling tailwinds from economic recovery.

☔Deposits: Average deposits ₹27.52 lakh Cr, +12.2% YoY; CASA ₹8.98 lakh Cr, +9.9% YoY (+2.4% QoQ). LDR remains elevated at ~85-90%, with plans to reduce to 85% by FY27 through deposit mobilization. Lagged estimates of 10-12% YoY, highlighting industry-wide challenges.

✅Asset Quality: Gross NPA ratio stable at 1.24% (0.97% ex-agri), down from 1.42% YoY; Net NPA at 0.42%. No major deteriorations; provisions controlled, aiding PAT beat. Management noted proactive risk management in unsecured segments.

🕸️Other Income & Costs: Fee income supported revenue; core cost-to-income ratio at 39.2% (stable). Opex up due to employee benefits under New Labour Code, but adjusted figures show efficiency.

🔥Management and Analyst Commentary

💯Management: In the earnings call, CEO Sashidhar Jagdishan highlighted "profitable growth" tailwinds from falling funding costs and CASA recovery. Emphasis on digital/cross-sell for retail revival, SME/corporate momentum, and LDR reduction to 85-90% by FY27. Outlook: Loan growth targeted at 12-15% for FY27, NIM expansion to 3.6-3.7%; cautious on unsecured amid regulations, but optimistic on remittances despite tariffs.

📢Analysts: Positive reactions—beat on PAT/asset quality seen as confidence booster. Motilal Oswal/Yes Securities maintain 'Buy' with targets ₹1,050-1,200 (20-30% upside from current ~₹930). Concerns: Deposit lag could pressure NIM if rates rise; positives: SME growth and NPA stability. Consensus: Q3 as "trough," with FY27 PAT growth 15-20%.

🏹🎯⁉️✍🏼❎☂️✅❌🌈💯🔥👇🏼🐢📢🔔

🌈Impact on Stock Price for Incoming Days

✅Immediate Reaction: Post-results (after-hours on Jan 17), HDFC Bank shares (HDFCBANK.NS) saw mild positive sentiment in extended trading, with ADRs up ~1-2% in US sessions. Domestic close on Jan 17: +0.56% at ₹931.15 (pre-results), but analysts expect a gap-up on Monday (Jan 19) due to PAT beat and stable NPAs. Volume surged 15-20% on Jan 17 amid anticipation.

✅Short-Term (Next 5-10 Days): Likely 3-7% upside if market digests positives (e.g., NIM tailwinds, growth outlook), pushing toward ₹950-1,000. Support at ₹900-920; resistance ₹950. Banking sector (Bank Nifty) could rally 1-2%, as HDFC's ~30% weight amplifies impact. Risks: Broader market weakness from FII outflows or tariff news could cap gains; sentiment on Social Network Discussions/forums positive, viewing results as "reassuring."

💯Medium-Term Outlook: Bullish, with 15-25% potential upside in 3-6 months to targets ₹1,100-1,200, driven by FY27 growth acceleration and valuation re-rating (current P/B ~2.5x vs. historical 3x). Stock down ~6% YTD amid deposit concerns, but results alleviate fears—bias: Buy on dips for long-term investors. Catalysts: Q4 festive lending; risks: Regulatory tightening on unsecured.

✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅✅

🚀Follow & Compare Daily pot Post for Day Trading Levels.

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.

Chumtrades XAUUSD H2 | Is the Liquidity Sweep Over?Chumtrades – XAUUSD H2 | Has the Liquidity Sweep Finished, or Is There More Downside Ahead?

On Friday, the market reacted strongly after Trump’s comments regarding Kevin Hassett, when Trump expressed his preference for Hassett to remain in his current role rather than taking a new position.

👉 As a result, gold printed a long wick liquidity sweep back into the prior ATH zone, around 4530–453X, before closing back above 456X.

This brings us to the key question:

Was this sweep enough for the BUY side, or is the market still looking to test lower levels?

Political developments will be a key driver for gold direction in the coming week.

📰 Key Political Factors to Monitor

1. Trump – Greenland

The US has imposed 10% tariffs, with the possibility of increasing them to 25% on countries that do not support the annexation of Greenland

No fixed deadline, tariffs remain until Greenland becomes part of the US

→ This is a supportive factor for gold, especially amid rising geopolitical uncertainty

→ This news may directly impact the market open

→ If price reacts strongly, avoid SELLs near resistance

2. Iran – Protests

Monitor the risk of Trump returning to direct intervention

→ A potential headline-driven volatility trigger

🟢 Key Support Zones to Watch

4530 – 4535

4515 – 4510

4480 – 4482

4462

4410 – 4407

🔴 Key Resistance Zones to Monitor

4618 – 4628

4648 – 4650

4655 – 4660

4698 – 4699

⚠️ Trading Notes

Price levels are zones for observation, not instant entry points

SELL setups around 462X must be evaluated based on news reaction

If momentum accelerates on headlines → stay flat and avoid trading against strength

💬 Question for the New Week

Is the market finishing its liquidity collection on the BUY side,

or was Friday’s sweep the final test before the next leg higher?

📌 Follow Chumtrades for proactive market analysis, structured trade planning, and risk management insights.

RELIANCE: Analysis after Q3 FY26 Earnings with levels🔥 Reliance Industries Analysis AFTER Q3 FY26 Earnings

Reliance Industries Q3 FY26 Earnings Analysis (Announced January 16, 2026)

Reliance Industries Limited (RIL) reported a steady but mixed Q3 FY26 (October-December 2025) performance, with revenue growth driven by the oil-to-chemicals (O2C) and digital services segments, offsetting weaknesses in retail and upstream oil & gas. Consolidated revenue beat estimates, but net profit missed street expectations slightly due to higher depreciation, interest costs, and segment-specific pressures like lower gas realizations and retail margin squeezes. The results highlight resilience amid global challenges (e.g., US tariff fears, volatile crude prices), with management emphasizing AI integration, new energy initiatives, and consumer business expansion for long-term growth.

Key Financial Highlights

RIL's results showed modest YoY growth, with O2C recovery as a standout. Here's a summary table comparing actuals to estimates (median from 6-7 brokerages) and YoY/QoQ changes:

Table on Chart.

Beat/Miss Analysis: Revenue and EBITDA exceeded estimates, buoyed by higher O2C volumes and refining margins (GRMs at ~$11-13/bbl vs. estimates of $10-12). However, PAT missed due to elevated costs (depreciation up on capex, interest on higher debt) and upstream drags. Overall, a "stable" quarter per analysts, with no major surprises but signals of recovery in key areas.

✅Segment-Wise Analysis

✅O2C (Oil-to-Chemicals): Strong performer with revenue up 8.4% YoY to ₹1.62 lakh Cr and EBITDA up 15% YoY to ₹16,507 Cr. Gains from higher fuel cracks (diesel/petrol up 62-106% YoY), increased throughput (2% YoY), and favorable ethane cracking offset petchem weakness and freight hikes. Jio-bp outlets grew 14% YoY to 2,125, with fuel volumes +24% YoY. Positive: Domestic focus amid Russian supply issues; outlook robust on refining demand.

☔Jio (Digital Services): Revenue +12.7% YoY to ₹43,683 Cr; EBITDA +16.4% YoY to ₹19,303 Cr (margin +170 bps). ARPU rose 5.1% YoY to ₹213.7 on premium offerings; subscribers at 515.3 Mn, with 5G at 253 Mn (53% traffic). JioAirFiber at 11.5 Mn homes; Jio Hotstar MAUs 450 Mn. Management highlighted AI partnerships (e.g., Google) and enterprise monetization; no tariff hikes impacted ARPU yet. Strength: 5G leadership (65% market share); future growth in fixed wireless and AI.

☂️Retail: Revenue +8.1% YoY to ₹97,605 Cr; EBITDA up to ₹6,915 Cr. Growth tempered by festive shift, demerger effects, and GST changes; hyper-local orders ~5x YoY. Ajio bill value +20% YoY; JioMart customers +43% YoY to base; Shein app 6.5 Mn installs. Challenges: Margin pressure from offers, investments, and labor costs; snacks/beverages expanding with new capacities.

Upstream Oil & Gas : Revenue -8.4% YoY to ₹5,833 Cr; EBITDA -12.7% YoY to ₹4,857 Cr, hit by lower KG D6 volumes/realizations and maintenance costs. Positives: Increased LNG exports from North America; strong India gas demand.

✍🏼✅Management and ⁉️ Analyst Commentary

✍🏼Management: Mukesh Ambani stressed "consistent delivery" and AI/New Energy focus for sustainability. Akash Ambani on Jio's digital revolution; Isha Ambani on retail innovation. O2C emphasized domestic outperformance; E&P noted LNG trends.

]⁉️ Analysts: Views mixed—steady earnings with O2C uplift, but retail/upstream drags. Goldman Sachs/Yes Securities positive on refining recovery; ICICI sees consumer resilience. Overall rating: Buy/Hold, with targets ₹1,600-1,800, citing long-term value from diversification.

⁉️ Impact on Stock Price for Incoming Days📊as per So called Analyst Community & Social Community views, though not fully agreed. Reason behind is: High short term VOLATILITY

❎Immediate Reaction: Post-results (after-hours on Jan 16), RIL's GDRs slipped ~2% in US trading, signaling mild disappointment over PAT miss and retail softness. Domestic shares closed flat (+0.15%) at ₹1,461 pre-results; expect flat to gap-down opening on Monday (Jan 19, markets closed Jan 17-18 for weekend). Volume spiked 20-30% on Jan 16 amid anticipation.

Short-Term (Next 5-10 Days): Potential 2-5% downside if sentiment focuses on misses (e.g., flat PAT, retail slowdown), dragging Nifty (RIL ~10-12% weight). Support at ₹1,440-1,450; resistance ₹1,500. Volatility likely amid global cues (e.g., US tariffs), but bargain buying could cap losses—experts see dips as entry points.

✅Medium-Term Outlook: Positive, with analysts forecasting 10-15% upside in 3-6 months on O2C rebound, Jio 5G monetization, and retail recovery (e.g., festive Q4). Risks: Crude volatility, consumer slowdown; catalysts: AI announcements, capex updates. Bias: Accumulate on weakness for long-term holders.

🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯🏹🎯

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell Gen” but below “Buy Gen”, it is treated / considered as Sidewise. Aggressive Traders can take Long position near “Sell Gen” either retesting or crossed from Below & vice-versa i.e. can take Short position near “Buy Gen” either retesting or crossed downward from Above.

L#4: If the candle crossed & stays below the “Sell Gen”, it is treated / considered a Bearish bias.

L#5: Possibility / Probability of REVERSAL near RLS#1 & USTgt

HZB (Buy side) & HZS (Sell side) => Hurdle Zone,

*** Specialty of “HZB#1, HZB#2 HZS#1 & HZS#2” is Sidewise (behaviour in Nature)

Rest Plotted and Mentioned on Chart

Color code Used:

Green =. Positive bias.

Red =. Negative bias.

RED in Between Green means Trend Finder / Momentum Change

/ CYCLE Change and Vice Versa.

Notice One thing: HOW LEVELS are Working.

Use any Momentum Indicator / Oscillator or as you "USED to" to Take entry.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ DISCLAIMER:

The information, views, and ideas shared here are purely for educational and informational purposes only. They are not intended as investment advice or a recommendation to buy, sell, or hold any financial instruments. I am not a SEBI-registered financial adviser.

Trading and investing in the stock market involves risk, and you should do your own research and analysis. You are solely responsible for any decisions made based on this research.

"As HARD EARNED MONEY IS YOUR's, So DECISION SHOULD HAVE TO BE YOUR's".

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

❇️ Follow notification about periodical View

💥 Do Comment for Stock WEEKLY Level Analysis.🚀

📊 Do you agree with this view?

✈️ HIT THE PLANE ICON if this technical observation resonates with you. It will Motivate me.