FLAG

INDIAN HOTELS (INDHOTEL) – Swing Trade SetupINDIAN HOTELS (INDHOTEL): CMP: 748.65; RSI: 51.47

✅ Trend: Strong Bullish (Weekly Golden Cross)

📐 Pattern: Flag consolidation → Breakout setup

🔔 Entry:

• Above ₹770 (weekly close / breakout confirmation)

⛔ Stop Loss:

• ₹700 (below flag support & recent swing low)

🎯 Targets:

• T1: ₹820–830 (partial profit)

• T2: ₹880–900 (flag pole projection / Wave-V zone)

📌 Risk–Reward: ~1:2.5 to 1:3

⚠️ Note:

• Enter only on breakout with volume

• Trail SL once T1 is achieved

📈 Trend is up. Consolidation is healthy. Breakout can lead to next expansion leg.

📌 Thanks a ton for checking out my idea! Hope it sparked some value for you.

🙏 Follow for more insights

👍 Boost if you found it helpful

✍️ Drop a comment with your thoughts below!

RBL Bank on the Verge: Weekly Chart Signals a Fresh Trend BreakRBL Bank has shown strong bullish momentum in its weekly chart, supported by rising price, strong moving averages, and a robust uptrend. The stock is currently trading near its 52-week high at around ₹326, indicating significant strength in the ongoing trend.

Technical Indicator Analysis

• Price and Trend: The stock has risen over 42% in the past year and over 7% in the last month, supported by strong volume and positive sentiment.

• Moving Averages: The 50-week and 200-week moving averages are sloping upwards, and the price is trading well above both, which is a bullish sign.

• Relative Strength: RSI (implied by the breakout and new highs) likely remains in bullish territory, confirming momentum.

• Support and Resistance: The stock has immediate support near ₹300 and strong resistance is seen at the recent high of ₹331.50.

Chart Pattern and Target

• Pattern Observed: A continuation breakout, possibly following a flag or rounding bottom pattern, is implied. The price action has broken past key resistances, and the trend remains strong.

• Entry Point: New entries can be considered on minor pullbacks toward ₹310-315, or on a weekly close above ₹331.50 for momentum traders.

• Target: Immediate target is the all-time range toward ₹350 . If momentum continues, longer-term targets could be in the ₹380–400 zone, using previous swing projections and extension from current levels.

• Stop Loss: Suggested stop-loss for positional trades is below ₹296 on a closing basis to protect gains and manage downside risk.

Overall, the weekly technical for RBL Bank support a bullish stance with buy-on-dip and breakout strategies, as long as the price remains above the key moving averages and stop-loss.

📌 Thanks a ton for checking out my idea! Hope it sparked some value for you.

🙏 Follow for more insights

👍 Boost if you found it helpful

✍️ Drop a comment with your thoughts below!

Jio Financial Services (JIOFIN)Pattern: Bullish Flag

Breakout Zone: Above ₹312

Structure: Flag developing after a strong pole; EMAs supportive and flattening upward

Momentum: RSI recovering above 50, MACD histogram turning positive

Plan:

Buy Trigger: Close above ₹312

Stoploss: ATR-based (~₹298)

Targets: ₹360 → ₹388

View: Post-consolidation breakout potential; improving sentiment in Financials sector.

Silver Bullish Breakout on Monthly & Weekly CharPattern Formed: Symmetrical Triangle (Long-Term Consolidation)

Breakout Type: Bullish Breakout on Monthly & Weekly Chart

Volume Confirmation: Strength in breakout with price expansion

Measured Move Target: ~$44 (based on triangle height projection)

Immediate Resistance Zone: $44.11 (Historical supply zone)

Support Levels Post-Breakout:

Immediate Support: $34.78

Strong Support: $33.28

Havells Bullish Flag Breakout: Can We See a Rally to 1680+?Havells India Ltd. is currently showing a classic bullish technical setup—a Bullish Flag Pattern—that could lead to a potential breakout and strong upside movement in the short term. Traders who favor breakout-based strategies should pay close attention to this chart, especially considering the structured parallel channel and previous rally that preceded it.

1. Bullish Flag Pattern: Anatomy of the Setup

A bull flag is a continuation pattern that occurs after a sharp price rise (flagpole), followed by a period of consolidation within a narrow parallel channel (the flag). This structure typically suggests that the bullish trend will resume once the price breaks out of the flag range.

In Havells:

Flag Pole: The stock surged sharply from the 1517 zone to near 1610, forming a vertical rise.

Flag/Channel: Price moved sideways within a narrow support at ~1570 and resistance at ~1610, creating a clean parallel channel.

This shows price compression after a strong move, typically a sign of healthy consolidation before another leg up.

2. Breakout Levels and Price Action Confirmation

As per the current chart:

Havells has broken above the resistance zone around 1610, signaling a potential breakout.

The breakout candle is attempting to close above the red resistance band, and follow-up candles will be crucial to confirm strength.

A retest of this breakout zone could offer ideal long entries.

3. Projected Targets from the Pattern

Using the flagpole height, we can project upside targets from the breakout point:

Initial Target: ₹1630.15

A conservative target based on minor resistance and pole extension.

Final Projected Target: ₹1680.45

This marks the full measured move and could be achieved if the rally sustains momentum.

4. Ideal Trading Plan (For Traders)

Entry:

After confirmed breakout above ₹1610

Or on retest near ₹1600–1610 zone with bullish price action.

Stop Loss:

Below the flag support zone at around ₹1570

Aggressive traders can keep it below ₹1585.

Targets:

T1: ₹1630

T2: ₹1680+

Risk-Reward Ratio:

Minimum 1:2 depending on entry price.

5. Risk Scenarios to Watch For

False Breakouts: If the breakout doesn’t sustain and price falls back into the channel, it may trap early longs.

Macro Events: Broader market volatility (Nifty moves or global cues) can impact momentum.

Volume: Lack of volume on breakout candles can reduce conviction—always monitor volume to confirm strength.

Conclusion: Havells Looks Set for a Fresh Rally

This is a textbook bullish flag breakout in formation, with clear upside potential. If the momentum sustains, Havells could very well reach 1680+ in the coming sessions. However, traders must practice disciplined risk management, wait for confirmation, and avoid chasing without a proper plan.

MAFANG | Excellent bull flag setup in top class index fundMAFANG 🏁| Strong buy in top class index fund 👌

-Strong uptrend supported by volume

-Consolidation near all-time highs — bullish structure

-Global tech dominance + AI tailwinds

MAFANG (Meta, Apple, Facebook, Amazon, Netflix, Google) is showing solid momentum and forming a strong technical base in a top-tier index fund.

Nifty appears to be repeating price pattern of 7th April.Nifty appears to be repeating a similar price pattern witnessed on 7th April 2025, where the index responded positively to negative news — specifically the US tariff announcement. Despite adverse global cues, the index formed a bullish candle, indicating strong buying interest and possible short-covering activity.

This kind of bullish price action on negative news is typically seen as a sign of underlying market strength. If Nifty sustains above the key support zone of 24,500–24,600, it is likely to build further momentum and retest the recent swing high of 25,080 in the near term.

Key Levels to Watch

Support Zone: 24,500 – 24,600

Resistance Zone: 25,080 – 25,200

Breakout Trigger: Sustained move above 25,088 may open up further upside toward 25,500+

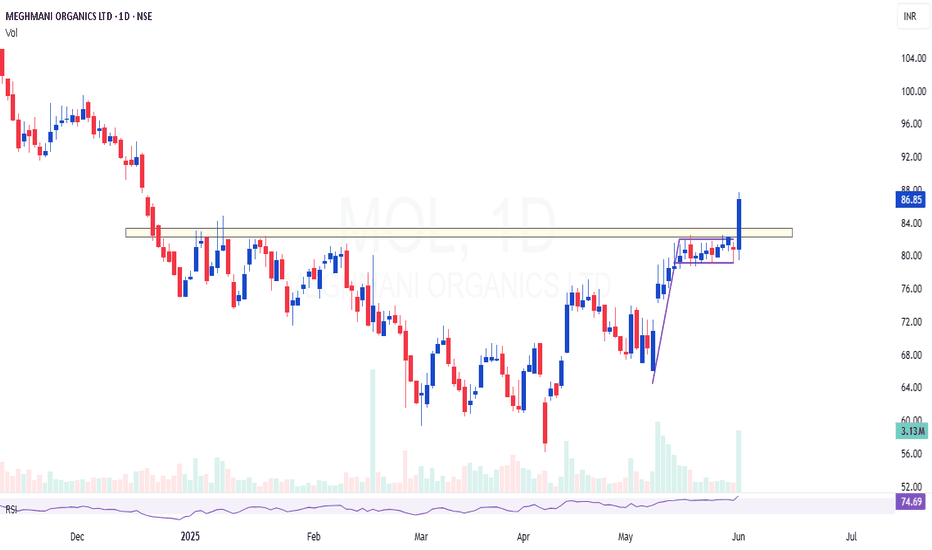

MOL | Breakout Above Supply Zone | Flag + 200 EMA ConfluenceMOL | Strong Breakout Above Supply Zone | Flag + 200 EMA Confluence

Previously shared around the ₹70 level — now showing clear strength with a decisive breakout above the supply zone, backed by strong volume.

✅ Breakout Confirmation: Price has convincingly breached previous resistance, which now acts as support. The volume accompanying this move adds weight to the breakout.

📈 Flag Formation (Daily Timeframe): A clean bull flag is visible on the daily chart — a classic continuation pattern indicating further upside potential.

📉 200 EMA Support: The 200 EMA is holding well and aligns perfectly as a dynamic support, reinforcing the current bullish structure.

🧾 Fundamentals Supporting the Technicals: Recent quarterly results suggest the bottom may already be in place, adding a fundamental tailwind to the technical setup.

🟢 Conclusion: This zone offers an excellent area of value for swing traders and position holders. Watch for sustained momentum and retests as potential entries.

MIDHANI – Bullish Flag Breakout📊 Pattern Analysis

1. Pole Formation:

The initial rally forming the flagpole is marked by high-momentum bullish candles rising at approximately a 60° angle, supported by increasing volume, indicating strong institutional buying and trend conviction.

2. Flag Formation:

Following the pole, the stock entered a consolidation phase forming a downward-sloping parallel channel (the flag). This retracement occurred on declining volume, a classic sign of a healthy correction with no aggressive selling pressure — reinforcing the validity of a bullish flag.

3. Breakout Confirmation:

The stock has now broken out above the flag resistance with a large bullish candle and surge in volume, confirming the continuation of the prior uptrend. The breakout candle shows a decisive close above the flag range, indicating strong buyer interest.

📈 Technical Indicators

Volume: Volume has spiked significantly on the breakout day, validating the move.

50 EMA: Price has respected the 50-day EMA, which has acted as dynamic support throughout the flag formation.

RSI: The Relative Strength Index is currently above 65, indicating strong bullish momentum but still below overbought levels, allowing room for further upside.

🎯 Trade Setup

Parameter Level

Entry On breakout confirmation or minor pullback

Target Height of the pole added to breakout point

Stop-Loss Below the recent swing low (bottom of flag) or trailing SL aligned with the 50 EMA

Risk-Reward Favorable – allows strategic trailing of profits

📌 Example Calculation:

If the pole is ₹80 high and the breakout occurred at ₹320, target = ₹400.

📌 Conclusion

MIDHANI has confirmed a textbook bullish flag breakout with strong technicals in place:

High-angle pole on volume,

Shallow flag pullback with weak volume,

Breakout with rising momentum and EMA support.

This setup suggests a strong trend continuation and offers an attractive opportunity for momentum traders and swing positions.

🔁 Call to Action

✅ Follow for more updates

👍 Like if you found this analysis helpful

📤 Share with your friends and fellow traders

Alembic Ltd – Inverted Flag Pattern Forming | Breakout Trade SetAlembic Ltd appears to be forming a classic inverted flag pattern on the daily chart:

Bearish Flagpole: A strong and sharp downward move from ~₹148 to ₹88 established the flagpole.

Bullish Flag (Retracement Channel): Since March, the price has been moving in a parallel rising channel — a typical retracement phase.

The price is currently near the lower trendline of the flag, suggesting a potential entry point for a breakout trade.

Support zone : Around ₹100–₹101 near the lower channel boundary.

Target: ₹113–₹115 (upper boundary of the flag channel).

Stop-Loss: Below the lower trendline of the flag (~₹96), or tighter based on risk preference.

Bias:

Neutral to slightly bullish in the short term as long as price stays within the flag.

Watch for a volume-supported breakout above recent swing highs (~₹105) to confirm momentum toward the target.