Infosys - Bullish Flag and Head & Shoulder Patterns🔍 1. Infosys Current Price Range and Key Levels

Since January 2021, Infosys has been trading in a broad range between ₹1300 and ₹2000, consolidating for over 4 years. Within this range, there are three key support and resistance levels to watch closely:

Support: ₹1300 (major floor)

Intermediate Resistance/Support Zone: ₹1600 – ₹1650

Strong Resistance: ₹2000 (upper bound)

📈 2. Bullish Flag Pattern: A Bullish Flag is a continuation pattern that forms after a strong upward price move "flagpole", followed by a period of consolidation in a narrow downward or sideways channel "flag". It typically signals a pause before the uptrend resumes.

Infosys recently broke out of a bullish flag pattern and crossed above ₹1580 with a strong closing on higher volume, indicating renewed buying interest.

Price is currently trading above the 50-day Exponential Moving Average (EMA), confirming the continuation of the mid-term uptrend.

However, the zone around ₹1650 remains a strong and key resistance level to monitor closely.

🧩 3. Potential Bullish Head and Shoulders Pattern Above ₹1650

Should Infosys break decisively above ₹1650, it is likely to form another significant bullish pattern known as the Bullish Head and Shoulders.

This pattern signals a trend reversal from bearish to bullish and is considered highly reliable.

Trend: Appears after a downtrend or consolidation, signaling reversal

Touchpoints: Three lows – left shoulder, head (lowest point), and right shoulder, roughly at similar levels

Neckline: The resistance line connecting the highs between shoulders and head

Timeframe: Medium-term, often forming over weeks up to 6 months

Volume: Typically higher volume on left shoulder and head formation, volume dips on right shoulder, and surges on breakout

⚠️ 4. Key Concerns in Infosys Chart Pattern

Price-Volume Divergence: During the head formation, volume increased sharply as price fell — indicating strong selling pressure. However, volume was low when price approached the neckline — suggesting weak buying interest to confirm breakout. This divergence signals potential caution.

Resistance Zone: Price remains below the key resistance at ₹1650, which has acted as a ceiling multiple times. A decisive breakout is required to sustain further upside momentum.

⚠️ Disclaimer

This report is intended solely for educational and training purposes and does not constitute investment advice. Traders and investors should conduct their own research and consult financial advisors before making trading decisions.

Flag

Infosys Technical Research- Flag and Head and shoulders🔍 1. Infosys Current Price Range and Key Levels

Since January 2021, Infosys has been trading in a broad range between ₹1300 and ₹2000, consolidating for over 4 years. Within this range, there are three key support and resistance levels to watch closely:

Support: ₹1300 (major floor)

Intermediate Resistance/Support Zone: ₹1600 – ₹1650

Strong Resistance: ₹2000 (upper bound)

📈 2. Bullish Flag Pattern: A Bullish Flag is a continuation pattern that forms after a strong upward price move "flagpole" , followed by a period of consolidation in a narrow downward or sideways channel "flag". It typically signals a pause before the uptrend resumes.

📊 2. Infosys Recent Technical Development

Infosys recently broke out of a bullish flag pattern and crossed above ₹1580 with a strong closing on higher volume, indicating renewed buying interest.

Price is currently trading above the 50-day Exponential Moving Average (EMA), confirming the continuation of the mid-term uptrend.

However, the zone around ₹1650 remains a strong and key resistance level to monitor closely.

🧩 3. Potential Bullish Head and Shoulders Pattern Above ₹1650

Should Infosys break decisively above ₹1650, it is likely to form another significant bullish pattern known as the Bullish Head and Shoulders (Inverse Head and Shoulders).

Bullish Head and Shoulders

This pattern signals a trend reversal from bearish to bullish and is considered highly reliable.

Trend: Appears after a downtrend or consolidation, signaling reversal

Touchpoints: Three lows – left shoulder, head (lowest point), and right shoulder, roughly at similar levels

Neckline: The resistance line connecting the highs between shoulders and head

Timeframe: Medium-term, often forming over weeks up to 6 months

Volume: Typically higher volume on left shoulder and head formation, volume dips on right shoulder, and surges on breakout

⚠️ 4. Key Concerns in Infosys Chart Pattern

Price-Volume Divergence: During the head formation, volume increased sharply as price fell — indicating strong selling pressure. However, volume was low when price approached the neckline — suggesting weak buying interest to confirm breakout. This divergence signals potential caution.

Resistance Zone: Price remains below the key resistance at ₹1650, which has acted as a ceiling multiple times. A decisive breakout is required to sustain further upside momentum.

⚠️ Disclaimer

This report is intended solely for educational and training purposes and does not constitute investment advice. Traders and investors should conduct their own research and consult financial advisors before making trading decisions.

TATAPOWER - Go LongFor Educational Purpose..

⚠️ I'm not a SEBI REGISTERED analyst & my view can be biased

⚠️ No Buy Sell recommendation, do your own Analysis.

#TATAPOWER IS READY TO BUY LONG

- Near 52W High

- Monthly Chart Flag n Pole

Waiting Time 3-6 Months

Long Above - 275

SL - 250

Target - 300, 325, 350 & More...

Thank you

NOVAAGRINOVAAGRI giving classical VCP breakout. Recently given 2 times flag pattern breakout with high volume. And then again consolidation with dried volume. Today again formed a pole of flag with decent volume. Now as long as it is closing above resistance line which is around 51 then I think its good accumulation zone. Up side its open for large space! Track it closely.

YESBANK: Riding the Bullish WaveYes Bank has exhibited a notable breakout above the resistance level established in December 2024. This breakout is accompanied by a classic flag pattern formation, which has resolved to the upside—typically interpreted by technical analysts as a continuation signal within an existing trend.

A significant increase in trading volume during the breakout phase adds weight to the move, suggesting heightened market participation. Furthermore, the 20-day EMA has crossed above the 200-day EMA, a crossover often referred to as a "Golden Cross" , which is generally viewed as a bullish signal indicating potential for continued upward momentum.

The RSI is currently positioned above 60, reflecting sustained buying interest without yet entering overbought territory.

From a structural perspective:

Immediate resistance may be encountered near the 24.75 level.

A secondary resistance zone appears around 28.54.

On the downside, the stock seems to have established a support base near 19.54, which could act as a cushion in the event of a pullback.

Disclaimer:

This analysis is intended solely for informational and educational purposes. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Market conditions can change rapidly, and all trading involves risk. Individuals should conduct their own due diligence or consult with a qualified financial advisor before making any investment decisions.

Is Bluedart Gearing Up for a Breakout? A Technical PerspectiveA good consolidation in there in the stock and on the monthly chart the stock has reconfirmed the support zone.

Major buying in happening there around 5500-5670 zone.

Weekly charts are showing consolidation phase around the very closing level as the price is trading between the various Moving averages.

A buying opportunity around 6200 levels can be initiated with a proper SL.

Technical Indicators:-

1. Stochastic : The weekly charts are trading around the oversold zone and on monthly charts its showing some lower levels coming on the charts.

2. Relative Strenght Indicator : On the monthly charts the stock has formed a bearish divergence and can be purchased once a 'W' formation is there in the RSI or price chart.

The stock has respected the support level since August 2021, a bearish trade can only be initiated once the major support level of 5500 is taken out. Avoid shorting till these levels.

Blue dart owning the logistic market can benefit from the E-commerce growth.

Long term buying opportunity can be seen in the stock with a potential returns of around 33-35% with a risk of 12-13% in coming years.

Watch the price action and enter only when the setup/pattern is formed on the charts.

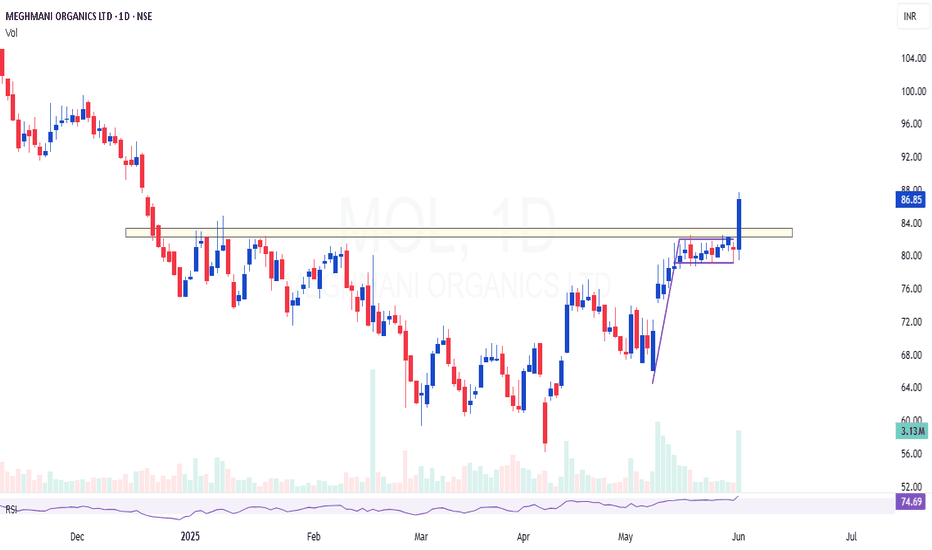

MOL | Breakout Above Supply Zone | Flag + 200 EMA ConfluenceMOL | Strong Breakout Above Supply Zone | Flag + 200 EMA Confluence

Previously shared around the ₹70 level — now showing clear strength with a decisive breakout above the supply zone, backed by strong volume.

✅ Breakout Confirmation: Price has convincingly breached previous resistance, which now acts as support. The volume accompanying this move adds weight to the breakout.

📈 Flag Formation (Daily Timeframe): A clean bull flag is visible on the daily chart — a classic continuation pattern indicating further upside potential.

📉 200 EMA Support: The 200 EMA is holding well and aligns perfectly as a dynamic support, reinforcing the current bullish structure.

🧾 Fundamentals Supporting the Technicals: Recent quarterly results suggest the bottom may already be in place, adding a fundamental tailwind to the technical setup.

🟢 Conclusion: This zone offers an excellent area of value for swing traders and position holders. Watch for sustained momentum and retests as potential entries.

CumminsInd - Desc Broadening Wedge - BullishCumminsInd - Capital goods Non Electrical Equipment

Despite modest Q4 revenue growth, Cummins India expects double-digit growth in FY26 on the back of robust domestic demand, CPCB 4+ tailwinds, and export recovery

Chart is making Bullish flag with descending broadening Wedge bullish pattern in weekly timeframe

Fib level 161.8%, Pivot R1(W), Pivot R2 (W) will hold as resistances

IXIGO : Breakout candidate (swing pick)#IXIGO #chartpatterntrading #flagpattern #breakoutstock #Chartpatternbreakout

IXIGO : Swing Trade

>> Long Range Consolidation Breakout Soon

>> Flag pattern breakout

>> Good Strength in stock

>> Recent Volume buildup is good

>> Good Upside Potential

Swing Traders can lock profit at 10% and keep trailing.

Disc : Stock charts shared are for Learning purpose, not a Trade recommendation.

Consult a SEBI Registered Advisor before taking position in it.

Technical Analysis Report: SMS Pharmaceuticals Ltd1. Bullish Flag with Pole (June–July 2024)

Bullish Flag with Pole: A continuation pattern formed after a strong upward price move (the pole), followed by a short-term consolidation (the flag), signaling the potential for another breakout upward.

Price Action: Strong impulsive rally formed the flagpole, followed by a tight consolidation forming the flag 🚩.

Breakout: Confirmed with a high-volume breakout to the upside.

Target: Achieved a massive 40% gain in under a month.

Analysis: A textbook bullish continuation pattern; traders capitalized on early entry post-breakout.

2. Distribution Phase (August–October 2024)

Distribution Phase: A sideways trading range after an uptrend where smart money or institutions start offloading their holdings. Typically a precursor to a market reversal or downtrend.

Market Structure: After the sharp uptrend, price entered into a horizontal range.

Phase Characteristics: Low volatility, repeated rejections at resistance, high volume on down days—signs of distribution.

Interpretation: Institutions likely booking profits, signaling a potential trend reversal.

Trader Sentiment: Shifted from bullish to neutral/bearish.

3. Triple Top Formation (Within Distribution Phase)

Triple Top Pattern: A bearish reversal pattern marked by three failed attempts to break above a resistance level, indicating weakening momentum and a potential downtrend.

Resistance Level: Same peak tested three times without breaking.

Breakdown: Confirmed after the third top with a decisive drop.

Target: Achieved a "30% downside" move via "short selling", all within a month.

Insight: Classic reversal pattern, effectively timed with distribution.

4. Bearish Flag with Pole (During Triple Top Breakdown)

Bearish Flag with Pole: A continuation pattern during a downtrend. It starts with a sharp decline (pole), followed by a minor upward consolidation (flag), suggesting further downside.

Formation: Sharp decline (pole) followed by a brief upward consolidation (flag).

Breakdown: Continuation to the downside, achieving projected target.

Target: Fully achieved within the same downtrend cycle.

Conclusion: Reinforced the bearish sentiment and amplified the down move.

---

5. Accumulation Phase + Triple Bottom (December 2024–April 2025)

Accumulation Phase: A market phase where a stock trades in a range after a downtrend, as buyers (often smart money) gradually build positions, typically leading to a bullish reversal.

A Triple Bottom is a bullish reversal chart pattern that forms after a downtrend, marked by three equal lows indicating strong support and a potential trend reversal to the upside.

Phase: 5-month Accumulation Phase

Pattern: Triple Bottom during this period indicated strong support and buyer presence.

Breakout: Occurred with a bullish breakout post third bottom.

Target: 20% upside achieved within a month post-breakout.

Observation: Long-term investors and smart money potentially entering positions.

6. Rounding Bottom in Progress (May 2025)

Pattern: Rounding Bottom (Still Forming)

Current Price Action: Gradual curve formation with decreasing volume on the left and increasing volume near the neckline— a bullish sign.

Expectation: Anticipated upside breakout in the coming days.

Outlook: If confirmed, this could mark the start of a new bullish cycle.

📌 Summary:

SMS Pharmaceuticals Ltd. has shown a textbook series of technical patterns—from trend continuations to reversals, distribution to accumulation, and now a potential new uptrend. Each phase was actionable, with clear breakout/breakdown points and well-achieved targets.

Flag and Pole in Styrenix what was the old INEOS StyrolutionOverall the pattern shows that a convergence is happening at this level

When we look at the stock over a long period of time, what I realise is that the patterns are repetitive and it has not participated in the bull market as much as the other stocks.

Looking at the shareholding pattern also we can understand that the no.l of shareholders in this counter are only 45,000 which means only savvy and old timers what knew this counter and IPO investors are there rather than catching the frenzy of FNO and traders and mass allotments.

A leader in Powder MetallurgyNSE:INNOMET Innomatt Advanced Materials: Pioneering Excellence in Powder Metallurgy and Specialised Materials

As a metallurgist with a Ph.D. in Materials Science, I have always been fascinated by the transformative potential of advanced materials in cutting-edge industries. One company that stands out in this domain is Innomatt Advanced Materials, a Hyderabad-based leader in powder metallurgy, sintering, and precision casting. Their expertise caters to some of India’s most prestigious organisations, including the Defence Research and Development Organisation (DRDO) and the Indian Space Research Organisation (ISRO), supplying high-performance materials that meet stringent aerospace and defence requirements.

A Trusted Partner for R&D and Academia

Innomatt’s clientele extends beyond government agencies to premier academic and research institutions such as IITs and NITs, where innovative materials are essential for breakthroughs in engineering and technology. Whether it’s developing intricate components or custom alloys with exacting specifications, Innomatt excels in delivering solutions through powder metallurgy—a process that ensures superior density, strength, and consistency compared to traditional manufacturing methods.

Specialised Applications with Future-Ready Potential

The applications of Innomatt’s materials are vast and continually expanding. From high-temperature alloys for space exploration to wear-resistant components for defence systems, their products are engineered for extreme conditions. As industries increasingly demand lightweight, durable, and high-performance materials, powder metallurgy is poised to play an even greater role in sectors like:

Aerospace & Defence (critical engine parts, armour systems)

Automotive (high-strength, fuel-efficient components)

Energy (materials for nuclear and renewable energy systems)

Medical Technology (biocompatible implants and surgical tools)

A Legacy of Expertise and Reliability

What sets Innomatt apart is its well-established leadership, with promoters who bring over a decade of experience in advanced materials manufacturing. Their deep industry knowledge, combined with a commitment to innovation, ensures that they remain at the forefront of material science advancements.

For researchers, engineers, and industries seeking bespoke material solutions, Innomatt Advanced Materials is not just a supplier—it’s a strategic partner in shaping the future of high-performance materials.

Have you worked with specialised materials in your field? Share your thoughts on how powder metallurgy is transforming modern manufacturing!

#AdvancedMaterials #PowderMetallurgy #DRDO #ISRO #Innovation #MaterialsScience #EngineeringExcellence

PI Industries looking up to reach 4200 in short to long termPI industries has broken the resistance level after a solid consolidation for more than one month. The bullish engulfing candle has come past the resistance level. It should come down to test the same level and progress towards 4200 in short to long term.

Aerospace & Defence bullish flag breakoutCreated custom index with following scrips. BDL, BEL, BEML, COCHINSHIP, DATAPATTNS, HAL, SOLARINDS. These are some major aerospace-defence companies. This custom index gave a bullish flag breakout. Huge upside potential based on flag pole as target. Pivot R1 itself has approximately 34.5% upside potential.

APL Apollo Tubes - Flag & Pole BONSE:APLAPOLLO gave a Flag & Pole Breakout today. Post Q4 Results.

Con-Call Highlights:

MARCH-QUARTER CONSOL TOTAL REVENUE FROM OPERATIONS 55.09 BILLION RUPEES

MARCH-QUARTER CONSOL PROFIT 2.93 BILLION RUPEES

SEES TOTAL CAPACITY OF 6.8 MILLION TONS BY FY28

SEES CAPEX OF 15 BILLION RUPEES IN NEXT 3 YEARS

Keep in the Watchlist.

NO RECO. For Buy/Sell.

Disclaimer: "I am not a SEBI REGISTERED RESEARCH ANALYST AND INVESTMENT ADVISER."

This analysis is intended solely for informational and educational purposes and should not be interpreted as financial advice. It is advisable to consult a qualified financial advisor or conduct thorough research before making investment decisions.