“Still losing? It’s not your system – it’s your state of mind.”Still Losing Money? It's Not Your Strategy – It’s Your Mind That’s Failing You

Let’s be brutally honest.

Have you been repeating the same mistakes over and over… even though you know they’re wrong?

You know you shouldn’t enter trades without confirmation – but you do.

You know your stop-loss should be fixed – yet you keep moving it.

You know your mental state isn’t stable today – but you open the chart anyway and… trade again.

Don’t blame the market.

You’re not losing because it’s “manipulated.”

You’re losing because your emotions are in control – not your logic.

💣 The most dangerous mindset: Knowing it’s wrong… and still doing it

It’s not about lacking knowledge.

It’s not about having a weak strategy.

It’s about being hijacked by your own emotional reactions.

Ask yourself sincerely:

Are you trading to avoid boredom, anxiety, or emotional pain?

Do you open charts just to escape from real-life stress?

Are your trades a form of self-soothing rather than strategic action?

If yes, then it’s no longer about technical skills.

It’s about emotional management – and inner healing.

👹 Three psychological traps that silently ruin your trading every day:

1. FOMO – Fear of Missing Out

You see price running.

You see others winning.

You panic – “I cannot miss this one!”

→ You enter the trade impulsively, not logically.

FOMO means you don’t trust yourself to wait for better chances.

It’s fear-driven, not system-driven.

2. Revenge Trading – You just can’t stand losing

One loss and your ego is bruised.

You want to "get it back" instantly.

So you fight the market like it owes you something.

But the market doesn’t care.

You’re just venting your frustration – and losing even more in the process.

3. Overtrading – You tie your self-worth to every single trade

You feel valuable only when you’re placing trades.

Doing nothing feels like failure.

So you keep clicking – even without a plan.

Overtrading reflects your need to feel in control, even if it costs you your capital.

🔍 Harsh truth: You’re not losing to the market – you’re losing to your expectations

You expect to win fast.

To become rich fast.

To prove something to others – or to yourself.

And when that doesn’t happen, you spiral.

You're not really trading the charts.

You're trading your emotions.

✅ So what’s the solution?

Stop immediately when you feel emotionally unstable – no matter if you're in profit or loss.

Maintain a journal for your thoughts, not just your trades – track what you feel, not just what you did.

Ask yourself honestly:

Am I trading for profit, or to escape something?

Is this setup real, or am I afraid of missing out?

Invest in your inner self: meditation, walks, talking to a coach or mentor, resting properly.

💬 Final message:

Losing is not the problem.

Refusing to confront the real reason behind your losses – that’s the real danger.

You don’t need a new indicator.

You don’t need a magical strategy.

You need one decent system – and a calm, emotionally neutral mind to execute it.

The game is not on the screen.

It’s inside your head.

#TradingPsychologyIndia #MindsetForSuccess #FOMOTrading #RevengeTrading #OvertradingIssues

#ForexIndia #NSETrader #DisciplineInTrading #TradingStruggles #EmotionalAwareness #TradeLikeAPro

#MentalStrengthInMarkets #TradingMindsetMatters #ConsistencyInTrading

Forex

EURUSD: The Rally Was Just a Trap – Bears Are Ready to Strike!After a strong rebound toward the 1.18400 zone driven by short-term optimism, EURUSD is now facing a potential reversal as price stalls within multiple Fair Value Gap zones. The chart reveals weakening bullish momentum, with lower highs forming inside a key resistance area.

Fresh U.S. data: Jobless claims dropped more than expected, giving the USD a solid boost. Meanwhile, the ECB remains hesitant, showing little conviction as Eurozone inflation cools.

A bearish scenario is unfolding: price forms a flag pattern → breaks the ascending channel → targets 1.17300. A break below this level could send EURUSD toward 1.16500 or even lower.

Bulls, beware! This could be a bull trap — and the bears are gearing up for a counterattack.

SELL setup: Look for bearish reversal signals around 1.18300–1.18400. Stop-loss above the high, first target at 1.17300.

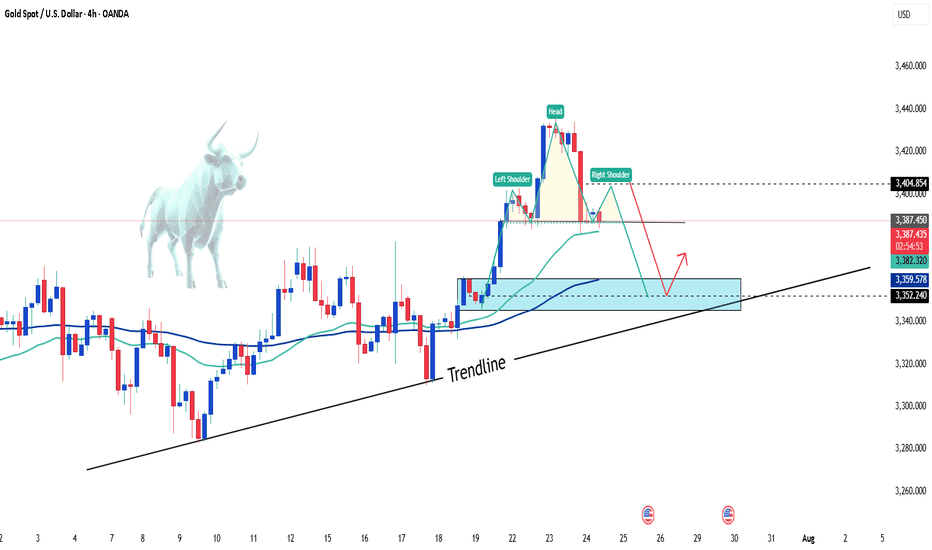

XAUUSD: collapse brewingU.S. data keeps hammering gold: Jobless claims dropped sharply, and manufacturing PMI beat expectations — giving the Fed even more reason to keep rates elevated. This weakens gold’s safe-haven appeal.

On the H4 chart, XAUUSD is hovering just above weak support with a clear distribution pattern. Price has been repeatedly rejected near the FVG zone at 3,390 and is trading below the previous high. If it breaks down from this confluence zone, strong selling pressure could drive it down to 3,311 — where the major trendline intersects a previous green FVG zone.

Strategy: Look to SELL if price fails at 3,390 and confirms a breakdown. Target a failed retest and a drop toward 3,311.

One sharp drop could trigger a deeper wave — are you ready?

USDCAD Bullish Setup-Shift from Accumulation to ExpansionPrice has broken above recent accumulation range marked by Liquidity Control Boxes.

SignalPro long setup activated with:

🔶 Smart accumulation zone breakout

🔁 Minor retest at 1.361 area holding

🎯 Targeting upper liquidity levels around 1.37139

Price structure shows a bullish microtrend reversal with risk capped below last demand block.

Key Elements on Chart:

📦 Leola Lens SignalPro's control zones provided context for consolidation and breakout

📈 Breakout aims toward untested supply zones above

⏳ Timeframe: 15-min

🧠 Educational Use Only – No financial advice.

Tool used: Leola Lens SignalPro

Small Account Scalping / Challenge Trading🔍 What is Small Account Scalping?

Scalping means taking very short, quick trades — entering and exiting the market in a matter of seconds to a few minutes — to capture small price moves.

Now combine this with a small account — typically ₹1,000 to ₹10,000 (or $100 to $500). You're looking at a trading style where:

Tiny profits are taken quickly

High discipline and speed are critical

Risk-to-reward ratios are tight

Compounding is the core idea (small wins stack up)

Scalping with a small account is not just about earning big money quickly — it's often done as a "challenge" to prove skill, build discipline, or simply to show that trading isn’t about how much money you have, but how well you manage it.

🎯 What is Challenge Trading?

Challenge Trading is when a trader publicly sets a goal, like:

Turning ₹5,000 into ₹50,000

Growing $100 to $1,000 in 30 days

Doubling capital in 10 trades

These challenges are usually:

Documented daily (on YouTube, Telegram, or Instagram)

Done with full transparency

Focused on scalping or intraday setups

Built around strict rules and money management

Why do people do it?

For credibility

To learn discipline

To inspire beginners

To prove skill without needing big capital

📉 Why Most Traders Fail with Small Accounts

Let’s be honest — 90% of small account traders blow their capital within days or weeks.

Here’s why:

1. Overleveraging

Trying to turn ₹1,000 into ₹5,000 in one day? Most traders overtrade, use max quantity, and take unnecessary risks.

2. No Risk Management

They don’t respect stop-losses. One bad trade wipes 50% or more of their account.

3. Emotional Trading

Small capital = High emotions. Losing ₹300 from ₹1,000 hurts more than ₹3,000 from ₹1,00,000.

4. No Consistency

They jump from strategy to strategy. From breakout trading to option buying to indicator-based setups — nothing sticks.

5. Trying to Get Rich in One Day

Small accounts are not magic lamps. Trying to “flip money” quickly always backfires without a strong base strategy.

✅ How to Actually Win at Small Account Scalping

Let’s now focus on how to do it right — step by step.

✳️ Step 1: Choose the Right Market Instrument

For scalping with small capital, you want:

High liquidity (easy entries & exits)

Fast movement

Low capital requirement

Some good choices:

Index options like Nifty/BankNifty Weekly

FinNifty (Tuesday expiry)

Micro lots in Futures (if margin allows)

USDT/INR scalping on crypto exchanges (Binance, CoinDCX)

Stocks like Reliance, Tata Motors, SBIN – but be cautious

Avoid:

Illiquid stocks

High lot-size contracts

Multi-leg option strategies with high cost

✳️ Step 2: Pick a Scalping Setup That Works

You don’t need 10 strategies. Just 1-2 that work well on a small timeframe.

Examples:

Breakout on 1-min chart

Mark consolidation

Wait for breakout candle with volume

Enter with tight SL, book in 1:1.5 or trail

VWAP Rejection Entry

Wait for price to test VWAP

If rejected, enter in the opposite direction

Small risk, quick reward

Fakeout Trap

Market fakes breakout → reverses

Enter with confirmation of reversal

Common in BankNifty scalping

News-Based Scalping

RBI decisions, GDP data, Budget day

Extreme volatility → use strict stop-loss

✳️ Step 3: Master Position Sizing

Golden rule: Never lose more than 2-3% in one trade.

With ₹2,000 capital:

Risk max ₹40–₹60 per trade

Use option buying, not futures

Focus on quantity control

If you're using 50% of capital in one trade, you’re doing it wrong. That’s not scalping — that’s gambling.

✳️ Step 4: Use a Simple Tool Setup

Keep your charts clean.

Timeframe: 1-min or 3-min

Indicators: VWAP, EMA (9 or 20), Volume

Levels: Draw basic support/resistance

Avoid: Overloaded charts with 6 indicators

✳️ Step 5: Take Only 1–3 Trades a Day

In small account scalping, overtrading kills faster than losing.

Max 3 trades per day

Win 2 out of 3 = Green Day

Lose 2 = Stop trading

Stick to the plan. Live to trade another day.

✳️ Step 6: Focus on % Growth, Not ₹ Profit

Don’t compare yourself to traders making ₹20K/day

If you make ₹150 on ₹2,000 → that’s 7.5% gain

Make 5% a day for 20 days = 100% monthly compounding!

Small wins matter. They build discipline, confidence, and capital.

🧠 Psychology Behind Challenge Trading

To win the small account game, your mindset matters more than your strategy.

Mental Rules:

Treat every rupee as if it’s ₹1,000

Never chase revenge trades

Accept red days calmly — they’re part of the game

Celebrate consistency more than profit

📌 Tracking Your Progress

Make a Trading Journal:

Entry/Exit time

Setup used

Why you entered

How you felt

Profit/Loss

Over 30 days, this builds emotional and strategic control.

🚫 Mistakes to Avoid in Small Account Scalping

❌ Averaging in loss

❌ Trading without stop-loss

❌ Copying random Telegram tips

❌ Overtrading after losses

❌ Ignoring brokerage and slippage

❌ Expecting daily profits

🏁 Final Words: Is Small Account Scalping Worth It?

✅ YES — if:

You want to build confidence and discipline

You want to master trading with risk management

You like fast-paced, quick decision-making

❌ NO — if:

You’re in a hurry to make big profits

You trade emotionally

You don’t journal your trades or follow structure

It’s a journey — not a race.

With patience and process, your ₹2,000 account can one day fund your ₹2 Lakh trading journey.

Zero-Day Options (0DTE)🔍 What Are Zero-Day Options (0DTE)?

The term “0DTE” stands for Zero Days to Expiration. These are options contracts that expire on the same day you buy or sell them.

In simple words, if today is Thursday and you’re trading a weekly Nifty or BankNifty option that expires today — you're trading a 0DTE option.

This type of option:

Has no time left beyond today.

Is highly sensitive to price movement.

Is extremely risky and extremely rewarding.

Earlier, we only had Thursday expiry for weekly options. But now, due to growing popularity, exchanges have introduced:

Nifty 50 expiry: Monday to Friday (Daily)

Bank Nifty expiry: Tuesdays and Thursdays

Fin Nifty expiry: Tuesdays

Sensex expiry: Fridays

This means 0DTE trading can now happen almost every day!

📈 Why 0DTE Trading Has Become So Popular

Zero-Day Options are now one of the most actively traded instruments — both by retail and institutional traders. Here’s why:

1. Small Premiums, Big Potential

Since the option expires today, its price (premium) is very low — sometimes just ₹5 or ₹10. If the market moves in your favor, that ₹10 option can quickly become ₹50 or ₹100.

That’s a 5x to 10x return, sometimes in just 15-30 minutes.

2. No Overnight Risk

You’re in and out the same day. No gap-ups, no global tension ruining your position overnight.

3. Scalping Friendly

Perfect for intraday traders who don’t want to hold positions for long.

4. Lots of Movement Near Expiry

Prices jump fast because time is running out. This gives more opportunities — but also more chances to get trapped.

5. Better Tools & Platforms

With modern brokers offering real-time data, scalping tools, and fast execution — more traders are trying 0DTE.

💼 How Do 0DTE Options Work?

Let’s take a simple example:

Today is Thursday, and Nifty is trading around 22,000.

You think it will rise, so you buy a 22,100 Call Option (CE) at 11 AM for ₹15.

If Nifty rises 50 points in the next 30 minutes, your option may become ₹45.

That’s 200% return.

But… if Nifty remains flat or falls, your option may go to ₹0 by the end of the day.

What Makes Them Move So Fast?

There are 3 reasons:

Time Decay (Theta): Since it's the last day, every minute that passes reduces the option's value if there's no movement.

Volatility: Even small market moves can cause big percentage changes in premium.

Greeks Sensitivity: Delta, Gamma, and Vega — all move faster near expiry.

🔁 Most Common 0DTE Strategies

1. Directional Option Buying

Buy a Call or Put based on price action.

Works best when there's momentum or breakout.

Example: Buy 22,100 CE at ₹10 → Nifty moves up → Exit at ₹50.

👍 High reward

👎 High risk (can go to zero)

2. Straddle/Strangle Selling (Non-Directional)

Sell both Call and Put at the same or nearby strikes.

You win if the market stays in range.

Example: Sell 22,000 CE and 22,000 PE → Market closes at 22,000 → Both go to zero.

👍 Profit from time decay

👎 If market breaks out in any direction, huge loss

3. Iron Condor

Sell OTM Call and Put spreads to capture decay in a defined range.

Lower risk, but also lower return.

👍 Safer than naked straddle

👎 Limited reward

4. Scalping with 1-2 Candle Momentum

Monitor breakouts on 1-min or 3-min chart.

Take quick entries and exits with small quantities.

👍 Quick gains

👎 Requires sharp execution and discipline

🏦 Who Uses 0DTE — Institutions or Retail?

🔹 Institutions:

Use algos to sell options in range.

Make profit from premium decay.

Use 0DTE to hedge portfolios or capture intraday IV changes.

🔹 Retail Traders:

Use for quick profits or gambling.

Often go for cheap out-of-the-money options.

Tend to overtrade without understanding risk.

⚠️ Risks Involved in 0DTE Trading

Let’s be honest — 0DTE options are not safe for everyone.

Here are the major dangers:

1. Time Decay (Theta Burn)

Every minute, the option loses value unless the market moves.

2. Fast Premium Erosion

Flat markets = quick loss. A ₹10 option can go to ₹0 in 15 minutes.

3. No Margin for Error

You need to be right on direction, timing, AND speed. All three.

4. Emotional Stress

Prices jump fast. Without discipline, you’ll end up revenge trading.

5. Overtrading

Traders often re-enter after loss without a plan — increasing risk.

🎯 Real-World Example of a 0DTE Trade

Let’s say it's Tuesday, and you’re trading BankNifty (expires today).

10:00 AM: BankNifty at 47,200

You buy 47,300 CE at ₹12

10:30 AM: BankNifty jumps 80 points

Your CE becomes ₹42

You exit — 250% return

But…

If BankNifty remained flat or dropped, that ₹12 option may go to ₹3 or even ₹0.

Same day. Same strike. Two opposite outcomes.

💡 Tips for Beginners to Trade 0DTE Safely

Start with Small Capital

Never risk your full capital on one trade.

Set Hard Stop-Loss

Exit if your option loses 40-50%. No second thoughts.

Trade in Breakout Zones

Avoid choppy ranges — they kill premiums.

Watch Open Interest + Price Action

See where the buyers/sellers are active.

Trade First Hour or Last Hour

That’s when you get big movements and clear setups.

Avoid Trading Just for Fun

0DTE is not for boredom. It’s for precision and skill.

Do Not Hold Till 3:30 PM

If you’re an option buyer, premiums usually die in the last 15 minutes.

🧠 Should You Trade 0DTE Options?

✅ YES — if:

You have solid technical analysis

You understand risk management

You can stick to a strict plan

You are okay with losing 100% on a bad trade

❌ NO — if:

You are emotionally reactive

You don’t track charts closely

You trade with borrowed or large capital

You don’t know how option Greeks work

🏁 Final Words

Zero-Day Options are not just another strategy. They are a whole new mindset of trading.

If used with the right knowledge, strict rules, and patience, they can become a powerful weapon in your trading toolbox. But if misused, they are the fastest way to drain your account.

Respect the instrument. Learn the rules. Start small. Scale with confidence.

Meme Stocks & Retail MomentumIn the last few years, the world of stock markets has witnessed something unusual. Stocks of struggling companies suddenly skyrocketed, not because of strong fundamentals or big institutional investments, but because of... memes, social media posts, and retail trader hype.

Welcome to the world of Meme Stocks and Retail Momentum.

This isn’t traditional investing. It’s the new-age, internet-powered way of moving markets — often driven more by emotion and community than by earnings reports or financial analysis.

They are not driven by traditional factors like strong balance sheets, industry leadership, or earnings growth. Instead, they’re driven by community hype and retail investor activity.

Key Features of Meme Stocks:

Sudden, dramatic price surges 🚀

Lots of trading activity by small/retail investors

Heavy buzz on social media & forums

High volatility (prices can jump or crash in hours)

Often targeted by short-sellers

🎯 Real-Life Examples of Meme Stocks

1. GameStop (GME) – USA

In early 2021, GME went from $17 to nearly $483 in weeks. Why?

It was heavily shorted by hedge funds.

Reddit users decided to push back and caused a short squeeze.

Retail investors coordinated buying, sending the price to the moon.

This was a social movement, not just a trade. It became a battle between “small traders” and “Wall Street giants.”

2. AMC Entertainment (AMC)

A struggling cinema chain during COVID saw its stock go up over 1000% in months.

Why?

Meme hype

Reddit army

FOMO (Fear of Missing Out)

3. Bed Bath & Beyond, Blackberry, Nokia

All had their moment as meme stocks even if their business fundamentals were weak.

4. Indian Examples

While India hasn’t seen the exact same meme stock culture, we’ve seen similar retail momentum in:

Zee Entertainment (after merger news & social buzz)

Vodafone Idea (VI) – due to social campaigns and hopes

IRCTC – when people piled in during rapid rallies

👥 What is Retail Momentum?

Now let’s talk about retail momentum — the force behind meme stocks.

Retail Momentum means:

A sudden inflow of buying (or selling) from small, individual investors, usually following trends or hype.

This momentum is usually:

Fast-moving

Emotional

Trend-following

Influenced by influencers, YouTubers, or social forums

Retail traders often follow:

WhatsApp groups

YouTube tips

Trending stocks on Twitter

Telegram pump groups

When thousands (or lakhs) of people chase the same stock, price moves dramatically — even if there's no news or earnings change.

🤖 How Social Media Creates Market Movement

Social media has turned into a financial battleground.

Here’s how a meme stock or retail wave starts:

One user posts a chart, theory, or meme on Reddit, X, or Telegram.

It goes viral. Thousands like or comment.

YouTubers make videos explaining how it can go “5x”.

Traders start piling in.

Price moves rapidly.

News channels pick it up.

Even more retail investors join.

The price spikes even further.

At this point, the stock is not rising on logic. It's rising on human emotion and network effect.

📈 Why Do Meme Stocks Go Up So Fast?

Short Squeezes

Hedge funds or big players short the stock.

Retail investors aggressively buy.

Short sellers are forced to cover — which pushes the price up further.

FOMO (Fear of Missing Out)

When people see others making 100%, 200% in days, they panic and enter at any price.

Retail Buying Power

Today, thanks to apps like Zerodha, Robinhood, Upstox, Groww — it’s easy to buy a stock.

Even a small investor can join in with ₹500.

Community Psychology

People feel like part of a movement.

They hold, buy, and even defend the stock online — often calling it “diamond hands.”

💣 Why Do Meme Stocks Crash?

No Fundamental Support

Eventually, reality hits. The stock isn’t worth the inflated price.

Profit Booking

Early traders book profits → price falls → panic spreads → others sell.

Regulatory Actions

Exchanges might restrict buying (like Robinhood did in GME).

Dilution

Companies issue new shares to cash in on hype → lowers value per share.

🧠 Psychology Behind Meme Stocks

Meme stocks are a human behavior experiment in real-time.

They show:

The power of belief

Herd mentality

Rebellion against institutions

Internet unity

Addiction to risk and gambling thrill

It’s part social movement, part financial play, and part crowd psychology.

🧰 Tips for Trading Retail Momentum Stocks

Enter early or don’t enter at all

Don’t jump in when it's already trending on YouTube.

Use trailing stop-loss

Lock your profits as the stock climbs.

Book profits partially

Don’t wait for the “moon.” Sell in phases.

Avoid margin/leverage

You can be wiped out in one bad move.

Track social buzz

Use tools like Google Trends, Twitter hashtags, Reddit mentions.

Never invest your main capital

Treat it as a speculative side bet, not a long-term investment.

🏁 Final Thoughts: Meme Stocks Are a Mirror of Modern Markets

Meme stocks and retail momentum are not going away. They are part of the new-age investor culture:

Fast-paced

Emotionally charged

Social media influenced

Sometimes logical, often not

They’ve changed how people see the markets. Retail investors now know they can move prices. But with that power comes great risk.

If you want to explore meme stocks, do it with eyes wide open, a small budget, and full acceptance of the risk.

Macro-Driven Risk Planning🔍 What is Macro-Driven Risk Planning?

At its core:

Macro-driven risk planning means managing your investment or trading risks by keeping the larger economic environment in mind.

You don’t just look at a stock or a chart — you ask:

What's happening with interest rates?

Is inflation rising or falling?

What’s the government doing with taxes or spending?

Is the US dollar strong or weak?

What are central banks like the RBI or the Federal Reserve up to?

These macroeconomic factors can make or break entire trades, portfolios, and even industries. So macro-driven risk planning is about aligning your strategies with the economic environment.

🧠 Why Is This Important?

Let’s say you’re trading in India.

If the US increases its interest rates sharply:

Foreign investors might pull money out of Indian markets.

INR might weaken.

Stock market might fall due to FII outflows.

If you're not paying attention to this macro signal, you might be trading blindly — even if your technicals are perfect.

🏦 Key Macro Factors That Drive Risk

Here’s a list of major macroeconomic indicators that smart investors and institutions track:

1. Interest Rates

Central banks (like the RBI or US Fed) control this.

📈 Rising Rates: Borrowing becomes expensive → Business slows → Markets may fall.

📉 Falling Rates: Loans become cheaper → Business expands → Markets may rise.

How to plan risk:

If rates are going up, shift from high-growth, high-debt companies to safer sectors like FMCG, pharma, utilities.

2. Inflation

This measures how fast prices are rising.

Moderate inflation = Normal

High inflation = Dangerous for consumers

Deflation = Danger of recession

Indicators: CPI (Consumer Price Index), WPI (Wholesale Price Index)

Risk Planning Tip:

In high inflation, avoid sectors that depend on raw material prices (like auto, FMCG) and look at commodities or inflation-protected assets (like gold, real estate).

3. GDP Growth (Economic Output)

Gross Domestic Product shows if the economy is expanding or shrinking.

📈 Strong GDP = Business confidence = Higher earnings

📉 Weak GDP = Caution = Lower valuations

Risk Strategy:

During GDP growth, take on slightly higher risk with cyclical stocks (like infra, banks). During slowdown, shift to defensive sectors (like pharma, IT).

4. Currency Movements (INR/USD, etc.)

Currency strength/weakness affects:

Imports/Exports

FII flows

Commodity prices (like oil)

Example: If INR weakens, oil imports become costly → Impacts inflation → May lead to rate hikes.

Plan risk: Export-based sectors (IT, pharma) benefit from weak rupee. Importers (oil, aviation) suffer.

5. Fiscal and Monetary Policies

This includes:

Government budgets (fiscal policy) – Taxes, subsidies, spending

Central bank actions (monetary policy) – Rate changes, money supply

Risk View:

A budget with heavy borrowing = inflation pressure

A tight monetary policy = reduced liquidity in markets

Keep eyes on RBI speeches, Fed meetings, union budgets.

6. Global Events

Even if you only trade in India, global news affects you:

US elections

Crude oil prices

Geopolitical tensions (e.g. China-Taiwan, Russia-Ukraine)

Supply chain issues

US Non-Farm Payroll (NFP) data

Macro-risk planning = Staying alert to these changes.

7. Bond Yields

Especially US 10-year bond yield.

Rising yield = Risk-off = Equities may fall

Falling yield = Risk-on = Equities may rise

Foreign investors use this as a guide. It directly affects FII flows.

📘 Real-Life Example: Macro Risk in Action

Case: COVID-19 Pandemic (2020)

Global economy shut down

Interest rates slashed to zero

Stimulus packages announced

Investors moved money into gold, tech stocks, pharma

Smart traders did this:

Moved into digital, pharma, and FMCG stocks

Stayed away from travel, aviation, real estate

Watched central bank actions daily

Used hedges (like buying puts or moving to cash)

This is macro-driven risk planning in real-time.

⚖️ How to Build a Macro Risk Management Plan

Here’s a step-by-step structure anyone can follow:

Step 1: Define Your Risk Tolerance

Are you a short-term trader or long-term investor?

Can you handle volatility?

Do you rely on leverage or trade with cash?

This tells you how much room you have to play with.

Step 2: Track Macro Indicators Weekly

Use sites like:

RBI website for policy updates

Trading Economics for inflation, GDP, interest rates

Bloomberg, CNBC, or Twitter for global headlines

Set alerts for:

Fed meeting dates

India CPI, GDP, IIP

Crude oil updates

Step 3: Use Hedging Tools

Advanced traders use:

Options (buying protective Puts)

Inverse ETFs (for global markets)

Gold or commodities

Diversification (across sectors, geographies)

Step 4: Stay Flexible

Macro conditions change fast. Stay open to:

Rotating your portfolio

Sitting on cash during uncertain times

Changing strategies with data, not emotions

🧭 Conclusion: Think Bigger, Trade Smarter

Macro-Driven Risk Planning is about being proactive, not reactive.

Markets aren’t moved by charts alone. They’re driven by:

Central banks

Government decisions

Global events

Economic data

So when you plan your next trade or invest in a stock, ask yourself:

“Am I moving with the economic current — or fighting against it?”

The more you understand macro trends, the better you’ll manage your risks and grow consistently.

BTCUSD 1D Timeframe📈 BTC/USD 1D Timeframe Overview (as of Today)

Current Price: Around $116,100

Price Change: Down by approximately 2.1% from the previous close

Day’s High: Around $119,436

Day’s Low: Around $115,002

📊 Chart Analysis (1-Day Candle)

Each candle on the 1D chart represents one full day. Today’s candle shows:

Bearish Momentum: The candle is red, indicating sellers dominated.

Wick at Bottom: Suggests some buying pressure or support near the day's low.

Rejection from Highs: Price tried to go higher but failed, showing resistance near $119,400.

🔍 Key Support and Resistance Levels

Resistance Zone: $119,000 – $120,000 (recent highs)

Support Zone: $115,000 – $113,500 (demand area and previous consolidation)

If BTC breaks below the $115,000 support, it may test lower levels like $112,000 or $110,000. If it bounces, it could reattempt $120,000.

🧠 Technical Perspective (Daily View)

Trend: BTC is currently in a short-term pullback phase after a recent rally.

Structure: Higher lows are intact if it stays above $112,000, which suggests uptrend continuation.

Volume: Decreasing volume on red candles could mean weak selling — possible sign of reversal soon.

🔄 Daily Timeframe Strategy Insight

Swing Traders: Wait for bullish reversal candle or break above resistance to go long.

Breakout Traders: Watch if price breaks and closes above $120,000 for trend continuation.

Risk-averse Traders: Wait for confirmation of direction before entering (like bullish engulfing or hammer candle).

📉 Summary

BTC is showing short-term weakness but remains in a larger range.

$115,000 is the key short-term support, and $120,000 is the key resistance.

Watch for candle patterns, volume, and reaction at support/resistance zones.

BANKNIFTY 1D Timeframe📉 Bank Nifty – Daily Overview (as of July 25, 2025)

Opening Price: Around 57,170

Day’s High: Around 57,170

Day’s Low: Around 56,439

Closing Price: Approximately 56,520

Net Change: Down by around 545 points (–0.95%)

🕯️ Candlestick Pattern (1D Chart)

The daily candle is bearish with a long upper wick and small lower wick.

This indicates strong selling pressure from the opening level.

The index failed to hold the highs and reversed sharply during the session.

🔍 Key Technical Zones

Level Price Range

Support 56,500 – 56,400

Next Support 56,150 – 56,000

Resistance 57,200 – 57,300

Major Resistance 57,500 – 57,650

If Bank Nifty breaks below 56,400, it may slide further toward 56,000 or even 55,800.

A move above 57,300 may invite bullish momentum.

📊 Trend & Technical Outlook

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly positive (if above 56,000)

Price Structure: Lower highs are forming; a descending pattern is developing.

Volume Analysis: Increasing volume on red candles suggests sellers are active.

Indicators (general behavior):

RSI may be near 50–55 range — neutral zone.

MACD likely showing bearish crossover.

Moving averages are flat to slightly negative.

✅ Strategy Suggestions

For Swing Traders:

Look for a bullish reversal pattern near 56,400–56,150 zone for possible long entries. Avoid long positions until price shows strength above 57,200.

For Breakdown Traders:

Wait for a solid close below 56,400 with high volume. Target levels can be 56,150 and 55,800.

For Intraday Traders:

Expect a volatile range between 56,400 and 57,200. Trade breakouts or reversals near these levels with confirmation.

📌 Summary

Bank Nifty is currently weak, with clear selling from resistance levels.

It is trading near key support (56,500–56,400). If this zone breaks, expect further downside.

Bulls need to reclaim 57,200+ for any reversal signals.

Trend remains bearish in short term, neutral in medium term.

NIFTY 1D Timeframe📉 Nifty 1D Snapshot (as of July 25, 2025)

Previous Close: 25,062

Opening Price: 25,010

Intraday High: 25,010

Intraday Low: 24,806

Closing Price: 24,833

Change: Down by approximately 230 points (–0.9%)

🕯️ Candlestick Pattern (Daily Chart)

A clear bearish candle was formed today.

The index opened flat, tested the previous day’s low, and faced selling pressure all day.

Closing is near the day’s low, which shows weakness and no buying support at lower levels.

🔍 Support & Resistance Levels

Level Type Price Range

Immediate Resistance 25,000 – 25,050

Immediate Support 24,800 – 24,750

Next Support Zone 24,650 – 24,600

If Nifty breaks below 24,800, expect a move toward 24,650.

If it reclaims 25,000, a minor pullback or bounce could occur.

📊 Technical Overview

Short-Term Trend: Bearish

Medium-Term Trend: Neutral

Structure: Lower highs forming; prices struggling to hold key supports

Indicators (Typical Behavior):

RSI likely near 50 – neutral but leaning bearish

MACD may have crossed downward

Moving averages (like 5 & 20-day) likely showing bearish crossover

🧠 Market Sentiment Factors

Broad-based sectoral weakness led the fall – especially financials, IT, auto, and energy.

Major stocks like Reliance, HDFC Bank, Infosys, and Bajaj twins contributed heavily to the decline.

Investor mood remains cautious due to:

Weak earnings from select companies

Foreign investor outflows

Global uncertainty (interest rates, trade deals, etc.)

✅ Trading Strategy Insights

For Swing Traders:

Avoid long trades unless there’s a strong reversal candle from 24,750–24,800 zone.

Shorting near 25,000 resistance could offer low-risk entries.

For Intraday Traders:

Watch for consolidation between 24,800–25,000.

Play range until a breakout or breakdown occurs.

For Breakdown Traders:

A confirmed break below 24,750 can lead to quick dips toward 24,600 or lower.

📌 Summary

Nifty dropped 230 points, forming a strong bearish candle.

Bears are in control unless bulls reclaim 25,000+.

Support sits at 24,800, with downside potential toward 24,650–24,600 if broken.

Sentiment remains cautious; short-term trend is bearish.

EURUSD: Bearish Breakdown in SightEURUSD is currently holding above the 1.173 support zone, but the bearish structure is becoming more evident. The downward trendline and nearby resistance have repeatedly rejected price rebounds.

If the support at 1.173 breaks, a sharp move toward the 1.168 target is likely — a key previous low.

Trend: Prefer SELL if a breakdown confirms – low risk, high potential.

Divergence Secrets📌 What is Divergence?

Divergence occurs when the price action of a security moves in the opposite direction of a technical indicator or momentum oscillator.

There are two main types:

Regular Divergence – Signals potential reversal

Hidden Divergence – Signals trend continuation

🔍 1. Regular Divergence (Reversal Signal)

Occurs when:

Price makes a higher high, but the indicator makes a lower high (bearish divergence)

Price makes a lower low, but the indicator makes a higher low (bullish divergence)

✳️ Example:

Bearish divergence: Price is rising, but RSI is falling → Possible upcoming downtrend.

Bullish divergence: Price is falling, but MACD is rising → Possible upcoming uptrend.

This tells you the momentum is weakening, even though price appears strong.

🔍 2. Hidden Divergence (Trend Continuation)

Occurs when:

Price makes a higher low, but the indicator makes a lower low → Bullish hidden divergence

Price makes a lower high, but the indicator makes a higher high → Bearish hidden divergence

Hidden divergence shows that momentum is aligning with trend direction and suggests continuation.

📈 Indicators to Spot Divergence

RSI (Relative Strength Index)

Best for spotting overbought/oversold and divergences.

MACD (Moving Average Convergence Divergence)

Great for visualizing momentum divergence.

Stochastic Oscillator

Good for short-term divergence.

On-Balance Volume (OBV)

Helps spot divergence using volume behavior.

CCI (Commodity Channel Index)

🔐 Institutional Secret: Volume Divergence

Institutions look for divergence between price and volume:

Price making higher highs but volume falling? Institutions might be distributing (smart money exiting).

Price making lower lows but volume rising? Could be accumulation.

This is often missed by retail traders!

✅ How to Trade Divergence (Checklist)

🔸 Entry Strategy:

Wait for divergence confirmation on a strong indicator (RSI/MACD)

Use candlestick reversal patterns near divergence zones

Align with support/resistance or trendlines

🔸 Stop-Loss:

Always place below/above recent swing low/high (depending on long or short)

🔸 Take-Profit:

Use Fibonacci levels, previous structure, or trend-based targets

⚠️ Common Mistakes

Trading divergence without price confirmation

Forcing divergence on weak or flat trends

Ignoring higher timeframe context

Using only one indicator

Always confirm with price structure, volume, and multi-timeframe analysis.

🎯 Pro Tip: Combine with Institutional Tools

Use Order Blocks + Divergence = Strong reversal signal

Combine Liquidity Zones + Divergence = Catch smart money traps

Divergence + Imbalance zones = Laser-precise entries.

Learn Institutional Trading🔷 What is Institutional Trading?

Institutional Trading refers to how big players (institutions) like mutual funds, hedge funds, pension funds, insurance companies, and proprietary trading firms operate in financial markets—especially in stocks, futures, and options. These institutions trade with huge capital—often in crores or billions of rupees/dollars—and have access to advanced tools, data, and insider-level insights that retail traders (individual traders like us) do not.

They don’t trade based on tips, YouTube calls, or simple indicators like RSI or MACD. They trade based on order flow, liquidity zones, volume data, and macroeconomic models. Their strategies are often data-driven, algorithmic, and backed by deep research.

🔷 Why is it Important to Learn Institutional Trading?

Because retail traders often lose money by following surface-level analysis. If you want to play against or with the big boys, you need to understand how institutions think, trade, and manipulate the market to create liquidity and trap uninformed traders.

Once you start thinking like an institution, you’ll stop falling for fake breakouts, news-based traps, or retail patterns that no longer work.

🔷 How Do Institutions Trade?

Institutions don’t just click "buy" or "sell" like retail traders. They use strategic and layered approaches to build or unload positions without disrupting the market.

Let’s break down some techniques:

1. Accumulation and Distribution

Accumulation Phase: This is where institutions silently buy large quantities of a stock at lower prices without moving the market too much.

Distribution Phase: After pushing the price up (with smart buying), they start selling slowly to retail traders who are buying out of FOMO.

👉 Retail gets trapped at the top, institutions exit with profit.

2. Order Flow & Liquidity Grabs

Institutions need liquidity to enter or exit. That’s why they often:

Create fake breakouts or false signals to trap retailers.

Induce stop-loss hunting moves to trigger retail orders (that’s their liquidity).

Then, they reverse the market direction, moving it in their favor.

This is often called Smart Money Concepts.

3. Volume Weighted Trading

Institutions monitor VWAP (Volume Weighted Average Price) to decide their entries/exits. They break up large orders into small pieces and execute them using algorithms to stay unnoticed.

4. Use of Derivatives (Options & Futures)

They hedge their large cash market positions using options and futures, which allow them to manage risk efficiently while maximizing profit.

🔷 Institutional Trading Strategies

Here are some strategies that institutions commonly use (simplified for learning):

📌 1. Long/Short Equity

Long on undervalued stock

Short on overvalued stock in the same sector

Reduces risk, aims to profit from relative performance.

📌 2. Arbitrage Trading

Taking advantage of price differences in different markets (e.g., cash-futures arbitrage).

📌 3. Sector Rotation Strategy

Moving capital from underperforming sectors to upcoming ones based on macroeconomic analysis (e.g., rotating from IT to Pharma).

📌 4. Options Hedging

Buying call/put options to protect existing large positions.

Selling premium to generate income (covered calls, iron condors).

📌 5. Event-Driven Trades

Based on earnings, mergers, policy changes (institutions often trade heavily on such events, with better insight and preparation).

🔷 Signs of Institutional Activity

Watch for these clues:

Unusual volume with no news

Sudden reversals after stop-loss hits (classic liquidity grab)

Consolidation near support/resistance with rising volume (accumulation)

Breakouts with heavy volume follow-up (institutional buying confirmation)

Options OI buildup in a particular strike

🔷 How to Learn Institutional Trading (Step by Step)

Understand Market Microstructure

Learn how orders, bid-ask spreads, and liquidity actually work.

Master Price Action and Volume Analysis

Indicators lag. Institutions trade with price and volume.

Learn about Order Blocks, Fair Value Gaps

These are institutional concepts showing where smart money entered.

Study Smart Money Concepts (SMC)

Focus on concepts like:

Liquidity Sweep

Inducement

Mitigation

Imbalance zones

Market Structure Shift

Use TradingView Smart Tools

Explore order block indicators, volume profile, VWAP, etc.

Observe Options Open Interest (OI)

Track institutional options positions using OI analysis.

Backtest and Practice

Use market replay tools to simulate institutional strategies.

🔷 Myths About Institutional Trading

❌ "Institutions only invest, they don’t trade intraday."

→ Truth: They have high-frequency trading (HFT) algorithms that execute millions of trades daily.

❌ "You need crores to trade like an institution."

→ Truth: You can mirror their logic even with small capital—if you understand market structure, liquidity, and volume.

❌ "Retail traders can’t win."

→ Truth: You can’t win if you play their game with your rules. But if you learn how they play, you can follow their footprints.

🔷 Final Thoughts

Institutional Trading is not a “strategy,” it’s a mindset.

It's about understanding:

Where is smart money entering or exiting?

Where is retail being trapped?

Where is liquidity sitting?

Once you start focusing on market structure, volume behavior, price action, and liquidity zones, your trades will become more accurate, logical, and profitable.

Retail indicators lag. Institutions don’t follow them.

They create the moves, while indicators show what already happened.

Institutional Intraday option Trading🔶 What is Institutional Intraday Options Trading?

Institutional Intraday Options Trading is how big players (institutions) like hedge funds, proprietary trading firms, mutual funds, foreign institutional investors (FIIs), and domestic institutional investors (DIIs) actively trade in options markets within the same day to generate quick profits, manage large positions, or manipulate price movements in their favor.

Unlike retail intraday trading (which is usually based on tips, indicators, or scalping), institutional intraday options trading is based on:

Advanced option data (like OI, volume, IV)

Market structure and liquidity

Algo-based executions

Risk-adjusted strategies and fast decision making

Institutions don’t trade for fun or luck—they trade with purpose, plan, and size. Their presence in the market creates price movements, and learning to track their footprints gives retail traders a powerful edge.

🔶 Why Institutions Trade Options Intraday?

Institutions prefer intraday option trading because it allows them to:

✅ Manage Risk & Hedge Positions

Institutions often hold large equity/futures positions. Options allow them to hedge intraday volatility without disturbing their long-term positions.

✅ Scalp Based on Volatility and News

Events like RBI policy, Fed data, results, or global news create fast-moving markets. Institutions use intraday options to take advantage of volatility spikes.

✅ Generate Quick Alpha

Institutional traders are expected to generate consistent returns. Intraday option trades provide high leverage and faster capital rotation.

✅ Exploit Liquidity and Traps

Institutions use fake breakouts, premium decays, and short-covering rallies to trap retailers and make profit intraday.

📌 1. Premium Decay Strategy (Theta Game)

Objective: Sell options when implied volatility is high.

Institutions sell both call and put options (straddle or strangle) around key zones (like CPR, VWAP).

They collect premium and profit from time decay as long as the market stays in range.

✅ Works well in sideways markets (common post-gap days or after big moves).

🎯 Focus: Short Straddle / Short Strangle near key levels

📌 2. Directional Option Buying (with Risk Control)

Objective: Ride fast moves using OTM options

Institutions buy deep OTM options when they expect sudden movement due to:

Breakout + OI unwinding

Short covering rally

News trigger or liquidity sweep

But they:

Use tight stop-loss, and

Enter near liquidity zone, not after the breakout

🎯 Focus: Volume + OI Shift + IV Expansion

📌 3. Scalping with Delta-Neutral Strategies

Objective: Profit from small intraday movements without market direction bias.

Example:

Sell ATM Call + Buy slightly OTM Call (Call Ratio Backspread)

Profit when price breaks in either direction and IV increases

🎯 Focus: Neutral strategy + quick reaction to movement

📌 4. Trap and Reverse (Liquidity Play)

Objective: Trap retailers near breakout/fakeout and reverse

Steps:

Identify large open interest buildup at a strike.

Price spikes above that level and then quickly reverses.

Institutions initiate the opposite side—profit from panic exits.

🎯 Focus: Option chain + sudden volume spike + reversal candle

📌 5. Hedged Position for Intraday Spike

Example Setup:

Buy Nifty 22500 CE + Sell 22700 CE

Risk defined, cheap entry, and profits from quick momentum.

Used during:

Event days

News expectations

VIX spikes

🎯 Focus: Defined risk with high reward if breakout happens

🔶 Institutional Footprints in Options

Here’s how to detect institutional presence:

✅ Sudden spike in option volume without news

✅ Aggressive unwinding near key levels

✅ High IV in far OTM options (possible trap)

✅ Large quantity buying/selling in illiquid strikes

✅ Price rejecting exact levels (like round numbers, day high/low)

🔶 Real Example of Institutional Intraday Option Play

Let’s say it’s Thursday (weekly expiry). Nifty is at 22500.

Retailers:

Start buying 22500CE, expecting a breakout.

Institutions:

Let price go up to 22540, triggering all CE entries.

Institutions sell huge lots of 22500CE with rising OI.

Nifty reverses to 22460. CE premium crashes.

Result:

Retailers lose.

Institutions profit via option writing and liquidity sweep.

🔶 How to Learn and Master Institutional Intraday Option Trading?

Step-by-step roadmap:

✅ Learn Option Chain Reading

Focus on OI shifts, strike buildup, and PCR.

✅ Understand Option Greeks

Especially Delta, Gamma, Theta, and Vega.

✅ Master Market Structure

Use price action, VWAP, volume profile, CPR.

✅ Practice Institutional Patterns

Liquidity grabs, stop hunts, traps, and reversals.

✅ Use TradingView or platforms like Sensibull, QuantsApp

For live data, OI heatmap, option analytics.

✅ Backtest with Replay Mode

See how institutions played in past events.

🔶 Bonus Tips for Retailers to Follow Institutional Moves

🧠 Always ask:

Who is trapped right now—buyers or sellers?

Is this a genuine breakout or just a liquidity grab?

What is option chain telling me?

🚫 Avoid:

Blind call/put buying without OI confirmation

Buying high IV options post move

Selling naked options in low capital

Trading Master Class With Experts.

🔶 Who Are These "Experts"?

The “experts” in a trading master class are usually:

✅ Professional traders working with institutions, hedge funds, or prop firms

✅ Full-time independent traders with consistent profit history

✅ Option Greeks and derivatives specialists

✅ Technical and price action experts

✅ Economists and market analysts

They are people who have traded for years, been through different market cycles, and know what works and what fails in the real market.

🔷 What You Will Learn in a Trading Master Class With Experts?

Here is a detailed breakdown of what such a master class includes:

🧠 1. Trading Mindset & Psychology Mastery

“90% of trading is mindset, not charts.”

Experts teach you:

How to control emotions like fear, greed, FOMO

How to build discipline, patience, and consistency

How to handle losses without revenge trading

How to develop a winning mindset like a hedge fund trader

📊 2. Advanced Technical Analysis (Beyond Indicators)

Forget about just MACD, RSI, Bollinger Bands.

Experts teach:

Price Action Secrets

Multi-timeframe analysis

Structure-based trading (HH, HL, LL, LH)

Breakout vs Fakeout patterns

Volume analysis and hidden traps

🎯 You’ll learn to predict moves with logic, not luck.

📈 3. Institutional Concepts (Smart Money Approach)

This is a core part of the class. You will learn how institutions trade, including:

Liquidity Zones & Order Blocks

Stop Loss Hunting Techniques

Fair Value Gaps (FVG)

Break of Structure (BOS)

Mitigation Blocks

Imbalance trading

You’ll finally understand:

"Why price reverses after breakout?”

"Why your stop loss gets hit and then the market moves in your direction?”

Experts teach you how to track institutional footprints and follow their logic.

📉 4. Derivatives & Options Trading Mastery

For advanced traders, especially in India (Nifty/Bank Nifty), the class covers:

✅ Options Chain Interpretation

✅ Open Interest (OI) Strategy

✅ Option Greeks (Delta, Gamma, Theta, Vega)

✅ Directional & Non-Directional Trading

✅ Intraday Option Scalping Techniques

✅ Straddles, Strangles, Spreads, Iron Condors

✅ Event-based strategies (Budget day, RBI day, earnings)

Live examples are shown using tools like Sensibull, QuantsApp, TradingView.

🔐 5. Risk Management Like Professionals

Trading without risk control is gambling.

In the master class, you’ll learn:

Position Sizing Models

Risk-to-Reward (RRR) Strategies

How to protect capital in volatile markets

Importance of trade journaling

When not to trade (which is as important as trading)

🎯 You’ll be taught how to think like a fund manager, not a gambler.

🧾 6. Trading Plan and Strategy Building

By the end of the class, you will have your own trading system, built with guidance from the experts.

Includes:

Entry and exit rules

Setup confirmation techniques

Trade management

Backtesting

Live trading practice

🎯 You’ll no longer depend on Telegram groups or paid signals. You will have your own tested edge.

💡 7. Live Market Sessions and Analysis

One of the most powerful parts of a master class is live sessions with experts, where you:

✅ Watch experts analyze the market in real-time

✅ Learn how they decide trades

✅ Ask questions on-the-spot

✅ See how they manage losses and winners

✅ Get live updates on index, stocks, options strategies

This removes confusion like:

“Should I buy or sell now?”

“Is this a trap or breakout?”

🔧 8. Tools, Platforms & Market Scanners Training

Learn to use:

TradingView Pro with institutional indicators

Option Analytics Tools (Sensibull, Opstra, Quantsapp)

Volume & Order Flow Tools

How to read market depth (Level 2 data)

How to use backtesting software for strategy building

🎯 The goal is to make you fully independent and tool-savvy.

📁 What’s Included in a Master Class Package?

A typical premium expert trading master class includes:

📌 20-30 hours of recorded sessions

📌 Weekly live sessions (Q&A, market review)

📌 Real trade examples (screenshots or live trades)

📌 Market homework and trade journaling

📌 Access to private trading communities

📌 Lifetime access + updates

📌 Strategy PDFs, cheat sheets

📌 Certificate of Completion (optional)

🔑 Benefits of Taking This Master Class

✅ Get direct mentorship from people who actually trade

✅ Save years of trial & error

✅ Learn real strategies, not just theory

✅ Increase accuracy and reduce losses

✅ Learn why you lose money and how to fix it

✅ Build discipline, process, and patience

✅ Join a community of focused traders

👨🏫 Who Should Join?

This class is perfect for:

Traders who lose consistently and don’t know why

Those who want to learn institutional-style trading

Option traders who want to become premium sellers / scalpers

People ready to invest time and discipline—not chasing “quick money”

Anyone who wants to turn part-time trading into serious skill

🔁 Real Case Example:

Imagine a Bank Nifty trader who always loses during breakouts. He joins the master class.

He learns:

How institutions create false breakouts

How to identify order blocks & liquidity grabs

How to position sell options around key zones

How to protect his capital with hedging and RRR control

Now, instead of gambling, he trades with confidence and understands what’s happening behind the candles.

🎓 Final Words

A Trading Master Class With Experts is like getting a direct map to reach consistent profitability in the market.

It is not a magic formula, but it trains your brain to think like a professional, trade like an institution, and manage risk like a fund.

It teaches you to focus not on tips, indicators, or chasing, but on:

Process

Discipline

Data

Edge

Execution.

Master Institutional Trading🔷 What is “Master Institutional Trading”?

Master Institutional Trading refers to mastering the art and science of how big players (institutions) operate in the financial markets—especially in equities, derivatives, and futures. This includes understanding how they think, trade, manage risk, and move money.

Institutions include:

Hedge Funds

Mutual Funds

Foreign Institutional Investors (FIIs)

Domestic Institutional Investors (DIIs)

Proprietary Trading Desks

Investment Banks

These players account for over 80% of the market volume, so understanding how they trade is crucial if you want to trade profitably. Mastering institutional trading means not following retail patterns or lagging indicators—it means learning how to track smart money and align your trades with theirs.

🔶 Why is Mastering Institutional Trading Important?

Most retail traders:

Trade based on tips or indicators

Use small capital with high risk

Get trapped by smart money moves (fake breakouts, stop loss hunts)

Lose because they don’t understand the real forces behind price movement

But once you learn institutional trading:

✅ You stop chasing trades

✅ You avoid retail traps

✅ You begin to trade with the trend and understand liquidity behavior

✅ You align your entries with where institutions enter/exit

This is the difference between being a random trader and a skilled, consistently profitable trader.

🔷 Key Institutional Trading Concepts You Must Master

📊 1. Market Structure (Not Just Candles)

Institutions don’t rely on RSI or MACD. They follow market structure, which includes:

Higher Highs & Higher Lows (uptrend)

Lower Highs & Lower Lows (downtrend)

Range & Consolidation Zones

Break of Structure (BOS) – signals direction shift

Change of Character (ChoCH) – where market flips direction

They wait for market structure to align before placing trades. If you don’t understand structure, you’re trading blind.

🔍 2. Liquidity & Smart Money Concepts (SMC)

Institutions need liquidity to place massive orders. But liquidity is created through:

✅ Retail Stop-Loss Orders

✅ Fake Breakouts

✅ News-Based FOMO entries

Institutions purposely trigger these levels to enter or exit quietly.

Key smart money concepts:

Order Blocks – where institutions enter bulk orders

Liquidity Pools – areas where retail stop-losses sit

Imbalance / Fair Value Gaps (FVG) – price moves too fast, returns later

Mitigation Blocks – previous institutional entries revisited

🎯 Learn these areas to enter with institutions, not against them.

📈 3. Volume & Order Flow Analysis

Institutions move in and out using volume. Retail traders don’t understand volume deeply.

Mastering institutional trading means tracking:

Volume Spikes near key zones

Footprint Charts (Volume per candle)

Delta Volume (Buy vs Sell pressure)

Also important: Volume Profile—it shows where the most trading happened, and that’s often where institutions are active.

⚖️ 5. Risk Management Like Institutions

Institutions don’t risk their capital blindly. They:

✅ Use fixed % risk per trade (like 0.5% or 1%)

✅ Use multi-layer hedging techniques

✅ Track correlation between sectors

✅ Don’t overtrade—they wait for high-probability setups

You need to build the same habit:

Never risk more than 1–2% per trade

Define entry, stop loss, target clearly

Avoid overleveraging, especially in options

📉 6. Institutional Options & Derivatives Tactics

Institutions use options for:

Hedging large equity positions

Generating income (selling options)

Directional bets with limited risk

Creating synthetic long/short positions

You’ll learn:

Open Interest Analysis

Option Greeks (Delta, Theta, Gamma, Vega)

Institutional options setups (Short Straddle, Ratio Spread)

Volume-OI Divergence (when data doesn't match the price)

These help you follow institutional footprints in options chain.

📚 7. Economic and Macro Analysis

Institutions also look at:

Interest rates (RBI/FED policies)

Inflation, GDP, Unemployment data

Sector rotation based on economic trends

Mastering institutional trading means learning macro context to know:

Which sectors will rise/fall

Which events move volatility

How FIIs/DIIs flow capital across sectors

🔧 8. Tools Used in Institutional Trading

You won’t find institutions using free websites for trading.

They use:

Bloomberg Terminal / Reuters

Institutional platforms like MetaStock, CQG, NinjaTrader

Order Flow Tools (e.g., Bookmap, Sierra Chart)

Algo + Automation Tools

High-speed execution setups

Retail traders can still mimic them using:

TradingView + Volume Profile tools

Option Analytics tools (Sensibull, Opstra)

Volume/Delta-based indicators

📅 9. Intraday vs Positional – Institutional Styles

Institutions use both styles:

✅ Intraday:

High-frequency strategies

Scalping based on liquidity

Options intraday decay selling

✅ Positional:

Sector rotation plays

Accumulation of stocks over weeks/months

Event-driven strategies (earnings, budget, rate hikes)

You need to choose what style suits your capital, time, and personality.

👣 10. Following Institutional Footprints

You can track them through:

🟩 Bulk Deal & Block Deal Data (NSE site)

🟩 FIIs & DIIs Buying/Selling Activity

🟩 Option Chain + OI shifts

🟩 Price rejection from key supply-demand levels

🟩 Volume spikes with no news

🎯 These are the breadcrumbs smart money leaves behind.

🎓 How to Master Institutional Trading – Step-by-Step Roadmap

Step 1: Master Market Structure

Learn BOS, CHoCH, HH-LL analysis

Study smart money patterns

Step 2: Study Order Blocks & Liquidity Zones

Mark order blocks, gaps, imbalance zones

Use TradingView to practice

Step 3: Learn Volume + OI Analysis

Understand OI buildup, unwinding

Track volume spikes, exhaustion points

Step 4: Study Options Data

Learn options chain interpretation

Practice on Bank Nifty/Nifty with OI analysis

Step 5: Develop Strategy

Build high RRR strategies (minimum 1:2)

Include entry, stop loss, target rules

Step 6: Practice With Real Charts

Use market replay tools

Analyze previous days—“what did institutions do?”

Step 7: Journal Everything

Log trades, reasons, emotions, outcomes

Focus on learning, not just profit

📌 Final Thoughts

Mastering Institutional Trading isn’t about learning 100 strategies.

It’s about learning:

How markets actually move

Why smart money creates traps

How to follow institutional zones

How to manage risk like a professional

You’ll no longer be confused by breakouts or false news.

You’ll start seeing behind the candles—where the real action is happening.

Institution Option Trading📌 1. Multi-leg Strategic Trades

Institutions rarely take single-leg naked options. They use advanced setups like:

✅ Vertical Spreads (Bull Call / Bear Put)

✅ Iron Condor / Iron Butterfly

✅ Calendar / Diagonal Spreads

✅ Ratio Spreads

✅ Box Spreads (riskless arbitrage)

These strategies offer:

Defined risk

Better reward-to-risk ratios

Controlled exposure to market direction and volatility

📌 2. Delta Hedging

Institutions holding large stock or futures positions hedge delta using options.

For example:

Holding ₹50 crore worth of Reliance shares

Buy Reliance PUT options to protect against fall

Or, dynamically sell call options as price rises to adjust exposure

This is called Delta Hedging, and it’s done in real-time using algorithms.

📌 3. Open Interest (OI) Tracking

Institutions use option chain OI to:

Spot support/resistance based on strike activity

Identify traps and short-covering zones

Detect institutional presence via unusual OI spikes

For example:

Sudden OI surge at 22,000 PE in Bank Nifty

Might indicate put writers protecting downside, expecting reversal

📌 4. Time Decay (Theta) Exploitation

Institutions are the real beneficiaries of theta decay.

They sell options (straddles, strangles, spreads) around key levels (like VWAP, CPR) and let time decay eat the premium.

Especially on:

Expiry day (Thursday in India)

After big moves

In range-bound markets

They deploy millions of rupees in premium-selling strategies to generate daily/weekly returns.

🔶 Institutional Option Strategies Explained

Let’s break down some common institutional strategies in real terms:

🔷 1. Short Straddle

Sell ATM Call and ATM Put at same strike

Works in sideways markets

Profits from time decay and low movement

✅ Used heavily by institutions on weekly expiry

✅ Risk: Sharp move in either direction

🔷 2. Bull Call Spread

Buy a lower strike Call

Sell a higher strike Call

Lower cost, limited risk & reward

✅ Used when institutions expect moderate bullish move

✅ Controlled exposure + reduced premium

🔷 3. Iron Condor

Sell OTM Call & Put

Buy further OTM Call & Put

Net credit strategy with limited risk

✅ Best in low volatility, non-trending markets

✅ Profitable if market stays between two levels

🔷 4. Calendar Spread

Sell near-term option

Buy far-month option (same strike)

Used when:

Near-term IV is high

Long-term view is neutral or unclear

✅ Profits from IV difference and time decay advantage

🔷 5. Protective Put

Holding equity or futures

Buy Put Option to insure position

Institutions use this to hedge large portfolios during high uncertainty (e.g., elections, war threats, Fed rate decisions)

🔶 Real Example – How an Institution Trades Nifty Options

Let’s say Nifty is at 22,000.

📊 Scenario:

IV is high

No major event ahead

OI buildup seen at 22000 PE and 22100 CE

📈 Institutional Strategy:

Sell 22000 PE and 22100 CE (Short Straddle)

Buy 21900 PE and 22200 CE (hedge legs)

Result:

If Nifty stays in range → theta decay = profit

If it breaks out → hedge legs protect loss

✅ Low-risk, smart premium capture strategy

🔶 Key Tools Institutions Use in Options Trading

Bloomberg Terminal (real-time global data)

Opstra / Sensibull / QuantsApp (for Greek/OI analysis)

Option Vega/IV scanners

Algo trading engines

Python/R-based custom backtesting engines

Retail traders can start by using TradingView + Sensibull/Opstra.

🔶 How to Learn Institutional Options Trading?

Here’s a step-by-step approach:

✅ Understand Options Basics – Calls, Puts, Moneyness

✅ Study Greeks Deeply – Delta, Theta, Vega, Gamma

✅ Learn Option Chain Analysis – OI, IV, Max Pain

✅ Explore Spreads & Multi-leg Setups

✅ Practice Risk Management & Position Sizing

✅ Track Institutional Behavior via OI shifts & volume

✅ Backtest Your Strategy before going live

🔶 Final Takeaways

Institutional Options Trading is not about guessing. It’s about data, structure, and risk.

Retail traders who try to copy institutions without understanding their objectives often get trapped.

But if you:

Study Smart Money behavior

Use strategic entries based on volume + volatility

Respect risk and capital preservation

…you can trade with the institutions, not against them.

Institutional Objectives in Options Trading🔷 What Are Institutions in the Market?

Before diving into their objectives, let’s first understand who institutions are:

Institutions are large, professional organizations that trade in the financial markets using massive amounts of capital. These include:

Mutual Funds

Hedge Funds

Pension Funds

Insurance Companies

Investment Banks

FIIs (Foreign Institutional Investors)

Proprietary Trading Firms

These players account for over 80-90% of daily turnover in options markets like NSE’s Bank Nifty and Nifty. Unlike retail traders, they don’t trade emotionally or randomly. Every move they make has a calculated reason behind it.

🎯 Why Do Institutions Use Options?

Options are powerful tools. Institutions don’t just trade them for direction; they use options to achieve multiple objectives:

✅ 1. Hedging Portfolios

🔍 Objective:

To protect their large equity/futures holdings from adverse market movements.

Institutions have huge long-term positions in stocks or indices. If the market falls sharply, these positions can suffer big losses. So, they use PUT options to hedge.

📈 Example:

A pension fund holds ₹500 crore worth of Nifty 50 stocks.

It buys Nifty 50 PUT Options at 22,000 strike.

If market crashes, the loss in stocks is offset by profit in PUTs.

📌 Result: Limited downside, peace of mind, capital protection.

✅ 2. Generating Additional Income (Option Writing)

🔍 Objective:

To generate consistent income from existing holdings through Covered Calls, Cash-secured Puts, or Iron Condors.

Institutions write options (sell) to earn premium—especially in sideways markets.

💡 Examples:

Covered Call: Own Reliance shares + Sell OTM Call option to earn income.

Short Strangles: Sell far OTM Put and Call if volatility is high.

Iron Condor: Sell call/put spreads to profit from time decay.

📌 Result: Generates passive income with controlled risk.

✅ 3. Arbitrage and Spread Trading

🔍 Objective:

To lock in risk-free or low-risk profits through price inefficiencies.

Institutions use Calendar Spreads, Box Spreads, or Volatility Arbitrage to exploit inefficiencies in option pricing.

🔧 Example:

Calendar Spread: Buy Nifty 22500 CE in August, sell Nifty 22500 CE in July.

Profit from IV differences or time decay.

📌 Result: Non-directional trading, but consistent profits with high capital.

✅ 4. Taking Directional Bets With Defined Risk

🔍 Objective:

To take high-conviction trades without exposing entire capital like futures.

Institutions use Debit Spreads, Straddles, or Long Options for directional views with limited risk.

💡 Example:

If expecting a bullish breakout, they might:

Buy 22000 CE

Sell 22200 CE

It caps both risk and profit. Perfect for risk-managed directional exposure.

📌 Result: Risk-defined entry into market trends without using futures.

✅ 5. Volatility Trading (Not Price Trading)

Institutions often trade volatility, not just price direction. They use Straddles, Strangles, Calendar Spreads to play IV.

💡 Example:

If implied volatility is low and an event is coming (like RBI policy):

Buy Straddle (ATM Call + Put)

Expect IV spike or a big move

📌 Result: Profit from volatility expansion or collapse, even if price stays in a range.

✅ 6. Managing Fund Exposure / Risk Neutralizing

Large funds have multiple exposures—options help them balance and adjust their overall risk (Delta-neutral, Vega-neutral, etc.).

They regularly:

Adjust positions using Gamma scalping

Balance portfolio Delta using options

Reduce Vega risk in high IV periods

📌 Result: A smooth, hedged, and controlled portfolio with minimal exposure to wild market moves.

✅ 7. Creating Synthetic Positions

Sometimes, instead of using equity or futures, institutions use options to replicate or create synthetic trades.

💡 Example:

Buy Call + Sell Put = Synthetic Long Future

Sell Call + Buy Put = Synthetic Short

This helps institutions:

Avoid STT, slippage

Better margin use

Higher flexibility with position sizing

📌 Result: Capital efficiency and strategic execution

📈 How to Spot Institutional Activity in Options?

You can decode institutional movement using these tools:

🔸 1. Open Interest (OI) Analysis

Spike in OI with price action = smart money at work

Build-up of OI near a strike = possible resistance/support zone

Use tools like Sensibull, Opstra

🔸 2. Volume + Price Movement

Sudden spike in volume in far OTM options = Institutional hedging or setup

Buy-Sell flow data shows positioning

🔸 3. Put-Call Ratio (PCR)

Used to detect market sentiment and institutional net positioning

🔸 4. IV Charts / Skew

Institutional volatility strategies are visible through steep IV skew or unusual IV changes

🔐 Final Thoughts

Institutional trading in options is not speculation. It is a scientific approach to manage:

Capital exposure

Risk control

Income generation

Volatility protection

Their objectives are not just to win trades, but to:

Protect capital

Optimize returns

Stay profitable in all market conditions

Technical Class🧠 Why Learn Technical Analysis?

Because price is king.

All news, fundamentals, and economic data are already reflected in price. Technical analysis teaches you how to read price charts and anticipate movements—giving you the timing advantage.

Institutions, traders, and even algorithms rely heavily on technical levels. So if you want to:

Know when to enter/exit

Understand where big money is active

Manage risk smartly

Improve accuracy

…you need strong technical skills.

🔍 What Will a Good Technical Class Cover?

Let’s break this into 10 structured modules, explained in human-friendly language.

📘 1. Basics of Price Action

What is a chart? (Line, Bar, Candlestick)

Understanding OHLC (Open, High, Low, Close)

Why price is the most important factor

How price creates support, resistance, and trends

👉 Outcome: You’ll read any chart confidently.

📘 2. Candlestick Patterns

Single candlesticks: Doji, Hammer, Engulfing, Marubozu

Dual & triple candle patterns: Morning Star, Evening Star, Three Soldiers

Reversal vs Continuation patterns

👉 Outcome: You’ll know how to identify potential trend reversals or strength.

📘 3. Chart Patterns (Price Structures)

Reversal Patterns: Double Top/Bottom, Head and Shoulders

Continuation Patterns: Triangles, Flags, Pennants, Rectangles

Understanding Breakouts vs Fakeouts

👉 Outcome: You’ll recognize market structures and act before the move begins.

📘 4. Support and Resistance Mastery

How to identify major support/resistance levels

Role of historical price zones

Dynamic support/resistance using moving averages

Price reaction techniques

👉 Outcome: You’ll place entries and exits at the most strategic levels.

📘 5. Trend Analysis

What is a trend? (Uptrend, Downtrend, Sideways)

How to draw trendlines correctly

Role of higher highs & lower lows

Using Multiple Timeframe Analysis

👉 Outcome: You'll align trades with major trends like professionals do.

📘 6. Indicators & Oscillators

Moving Averages (SMA, EMA): Trend confirmation

RSI: Overbought/Oversold signals

MACD: Momentum and divergence detection

Bollinger Bands: Volatility breakout

Volume Profile / VWAP

👉 Outcome: You’ll combine indicators for confluence and higher accuracy.

📘 7. Intraday Technicals

Best indicators for intraday (VWAP, Supertrend)

Time-based chart usage (5m, 15m, 1hr)

Institutional trap zones (fakeouts, liquidity sweeps)

Scalping vs momentum setups

👉 Outcome: You’ll confidently take trades within the day using fast setups.

📘 8. Risk Management and Trade Psychology

Position sizing

Risk-Reward ratio planning

Importance of Stop Loss

Emotional control: Fear, Greed, Impatience

Creating a rule-based system

👉 Outcome: You’ll trade stress-free, without blowing up your capital.

📘 9. Advanced Institutional Concepts

Smart Money Concepts (SMC): Liquidity, Order Blocks, BOS/CHOCH

Institutional Order Flow: Where big money trades

Volume Spread Analysis

Wyckoff Theory (Accumulation/Distribution phases)

👉 Outcome: You’ll learn how institutions move the markets and how to follow them.