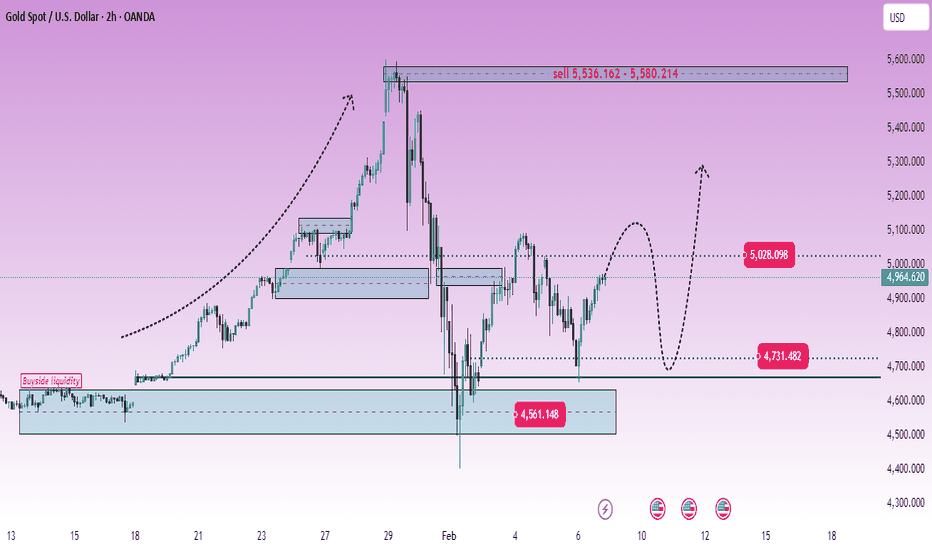

XAUUSD (H2) – Liam's AnalysisXAUUSD (H2) – Liam View

Rally into supply | Volatility risk rising

Gold is rebounding from the 4550–4600 demand base, but the broader H2 structure still points to a selling environment. The current move higher looks corrective, driven by short covering and liquidity rotation rather than a confirmed trend reversal.

From the chart, price is rotating back toward 4900–5030, a zone where previous distribution and liquidity rest. Unless price can accept above this area, rallies should be treated as selling opportunities, not breakout confirmation.

Key technical zones

Major selling zone: 5536 – 5580 (HTF supply)

Near-term reaction zone: 5000 – 5030

Key demand / base: 4550 – 4600

Intraday support: ~4730

Market context

Recent US political headlines and institutional reviews add another layer of headline-driven volatility, increasing the risk of sharp swings and liquidity sweeps. In such conditions, gold often reacts erratically intraday, but higher-timeframe structure tends to reassert itself once the noise fades.

Outlook

As long as price stays below 5030, the bias remains sell-side dominant.

Failure to hold above 4730 would reopen downside risk toward the demand base.

Only a clean H2 acceptance above 5030 → 5100 would neutralize the bearish structure.

Execution note

Avoid chasing momentum in news-driven sessions.

Let price come to levels. Trade the reaction, not the headlines.

— Liam

Gann

PATANJALI 1 Day Time Frame 📌 Current price context (recent daily close): ~₹520–₹525 per share range.

🔁 Daily Pivot Levels & Key Zones

Daily Pivot Point

Daily Pivot (central) ~ ₹519–₹522 — this is the average of the prior day’s range; above this suggests bullish bias, below suggests bearish bias on the day.

Resistance Levels (Upside Targets)

R1: ~ ₹525–₹527 — first resistance turnaround zone.

R2: ~ ₹527–₹530 — next barrier if price sustains above R1.

R3: ~ ₹530+ — higher breakout level in strong buying conditions.

Support Levels (Downside Holds)

S1: ~ ₹511–₹513 — first intraday support zone.

S2: ~ ₹507–₹508 — deeper pullback support.

S3: ~ ₹504–₹505 — more significant zone where buyers could re-enter.

📈 Interpretation for Today’s Trading

Bullish bias intraday if price stays above the pivot (~₹520).

Break and hold above R1–R2 could signal continuation toward R3.

Break below S1–S2 suggests risk of short-term pullback deeper toward S3.

RSI and moving averages can confirm momentum but are secondary to listed levels.

⚠️ These are informational pivot/level estimates based on recent data and common pivot calculations — not buy/sell recommendations.

Emerging Market Impact: Shaping the Global Economic Landscape1. Defining Emerging Markets

Emerging markets are economies transitioning from low-income, agrarian systems toward industrialized, market-driven structures. They typically show:

Rapid GDP growth compared to developed economies

Expanding middle classes

Increasing industrial and service-sector output

Developing financial markets and institutions

However, they also face challenges such as income inequality, infrastructure gaps, regulatory uncertainty, and vulnerability to global shocks. This mix of high growth potential and elevated risk is what defines their global impact.

2. Contribution to Global Economic Growth

Emerging markets now account for more than half of global GDP in purchasing power parity (PPP) terms. Over the past two decades, they have driven the majority of incremental global growth.

Growth Differential: While developed economies often grow at 1–2% annually, emerging markets can sustain growth rates of 4–7% over long periods.

Demographic Advantage: Younger populations in India, Southeast Asia, and Africa support productivity growth and consumption.

Urbanization: Massive migration from rural to urban areas boosts demand for housing, infrastructure, transportation, and services.

During periods when developed markets slow down—due to debt cycles, aging populations, or monetary tightening—emerging markets often act as stabilizers for global growth.

3. Impact on Global Trade and Supply Chains

Emerging markets have transformed global trade dynamics.

Manufacturing Powerhouses

China’s rise as the “world’s factory” reshaped supply chains, while countries like Vietnam, Bangladesh, and Mexico are gaining importance due to supply-chain diversification and “China+1” strategies.

Resource Suppliers

Brazil, Russia, Indonesia, South Africa, and several African economies are major exporters of commodities such as oil, metals, agricultural products, and rare earths. This gives emerging markets pricing power and strategic influence in global markets.

Trade Rebalancing

Emerging markets are increasingly trading with each other, reducing reliance on developed economies. South–South trade is now a key driver of global commerce.

4. Financial Market Influence

Emerging markets have become integral to global capital markets.

Capital Flows

Foreign direct investment (FDI) into emerging markets supports infrastructure, manufacturing, and technology transfer. Portfolio investments in equities and bonds provide liquidity but can be volatile.

Currency Dynamics

Emerging market currencies are sensitive to global interest rates, especially U.S. Federal Reserve policy. Dollar strength often leads to capital outflows, currency depreciation, and inflationary pressure in EMs.

Stock and Bond Markets

Many global indices now have significant emerging market exposure. Indian and Chinese equities, for example, influence global investor sentiment, while EM bonds affect global yield dynamics.

5. Role in Commodity Cycles

Emerging markets are central to commodity demand and supply.

Demand Side: Rapid industrialization and infrastructure spending increase demand for steel, copper, oil, and energy.

Supply Side: Many emerging economies are major producers of oil, gas, coal, metals, and agricultural goods.

Commodity supercycles are often driven by emerging market growth. For instance, China’s infrastructure boom fueled a decade-long rally in metals and energy prices, impacting inflation and monetary policy worldwide.

6. Technological Leapfrogging and Innovation

Contrary to the belief that innovation is confined to developed economies, emerging markets are becoming hubs of technological advancement.

Digital Payments: India’s UPI system and Africa’s mobile money platforms like M-Pesa have leapfrogged traditional banking models.

E-commerce and Fintech: Companies in China, India, and Southeast Asia are scaling rapidly, serving millions of new consumers.

Cost Innovation: Emerging markets often develop low-cost, scalable solutions that can be exported globally.

This technological leapfrogging improves productivity and accelerates financial inclusion, reshaping global business models.

7. Geopolitical and Strategic Impact

Emerging markets are increasingly shaping global geopolitics.

Multipolar World: The rise of China and India is shifting the balance of power away from a U.S.-centric system.

Global Institutions: Emerging economies demand greater representation in institutions like the IMF, World Bank, and UN.

Trade and Energy Security: Control over key resources and trade routes gives emerging markets strategic leverage.

Geopolitical tensions, sanctions, and trade wars often have significant spillover effects on emerging markets, influencing global risk sentiment.

8. Risks and Vulnerabilities

Despite their potential, emerging markets face structural and cyclical risks.

External Debt: Many EMs borrow in foreign currencies, making them vulnerable to exchange-rate shocks.

Political and Regulatory Risk: Policy uncertainty can deter investment and trigger capital flight.

Inflation and Monetary Constraints: Food and energy price volatility disproportionately affects emerging economies.

Climate Risk: Emerging markets are often more exposed to climate change impacts while lacking adequate adaptation resources.

These risks can amplify global financial instability during periods of stress.

9. Impact on Global Investors and Businesses

For investors, emerging markets offer diversification and higher long-term return potential, but with higher volatility. Active risk management, local knowledge, and long-term horizons are critical.

For businesses, emerging markets represent:

Large, untapped consumer bases

Cost-efficient manufacturing and services

Opportunities for brand building and market leadership

However, success requires adapting to local cultures, regulations, and income levels rather than applying developed-market strategies blindly.

10. The Road Ahead

The future impact of emerging markets will depend on structural reforms, technological adoption, and global cooperation. Countries that invest in education, infrastructure, governance, and sustainability are likely to outperform.

As the world faces challenges such as slowing growth, aging populations, climate change, and geopolitical fragmentation, emerging markets will remain central to global solutions and global risks alike. Their evolution will not just influence global GDP numbers—it will define the next phase of globalization and economic power.

Conclusion

Emerging markets are no longer just “catch-up” economies; they are co-authors of the global economic story. Their growth, innovation, and resilience shape trade flows, financial markets, commodity cycles, and geopolitics. While risks remain, their long-term impact is unmistakable. For anyone seeking to understand the future of the global economy, emerging markets are not optional—they are essential.

The Global Shadow Banking System: An In-Depth OverviewWhat Is Shadow Banking?

Shadow banking refers to financial institutions and activities that perform bank-like functions without access to central bank support or deposit insurance. These entities borrow short-term funds and lend or invest in longer-term, often riskier assets—mirroring traditional banking but without the same regulatory oversight.

The Financial Stability Board (FSB) defines shadow banking as “non-bank financial intermediation involving maturity transformation, liquidity transformation, leverage, and credit risk transfer.”

Key Components of the Shadow Banking System

The global shadow banking system consists of a wide range of institutions and instruments:

1. Non-Bank Financial Institutions (NBFIs)

These include:

Hedge funds

Private equity funds

Mutual funds and exchange-traded funds (ETFs)

Money market funds

Pension funds and insurance companies

They mobilize savings and allocate capital but are not subject to banking regulations such as capital adequacy norms.

2. Securitization Vehicles

Securitization involves pooling loans (mortgages, auto loans, credit card receivables) and converting them into tradable securities. Examples include:

Mortgage-Backed Securities (MBS)

Asset-Backed Securities (ABS)

Collateralized Debt Obligations (CDOs)

Special Purpose Vehicles (SPVs) or Structured Investment Vehicles (SIVs) are often used to keep these assets off bank balance sheets.

3. Repurchase Agreements (Repo Markets)

Repos allow institutions to borrow short-term funds using securities as collateral. The repo market is a critical funding source for shadow banks, but it is highly sensitive to market confidence.

4. Peer-to-Peer and Fintech Lending

Digital platforms connect borrowers directly with investors, bypassing traditional banks. While improving financial inclusion, these platforms can amplify credit risk during downturns.

Why Did Shadow Banking Grow?

Several structural factors fueled the expansion of shadow banking globally:

Regulatory Arbitrage

Stricter banking regulations—such as Basel III capital requirements—encouraged financial activity to migrate outside the regulated banking sector, where returns could be higher.

Demand for Credit

Corporations and households sought alternative sources of financing, especially when banks tightened lending standards.

Investor Search for Yield

Low interest rates pushed institutional investors toward higher-yielding products offered by shadow banking entities.

Financial Innovation

Advances in financial engineering and technology enabled complex products that could be structured, traded, and distributed globally.

Role in the Global Economy

Shadow banking plays a dual role—both beneficial and risky.

Positive Contributions

Enhances credit availability, especially to underserved sectors

Improves market liquidity

Encourages financial innovation

Supports economic growth when banks are constrained

In many emerging markets, shadow banking complements traditional banks and helps bridge funding gaps.

Systemic Risks

Despite its benefits, shadow banking introduces several vulnerabilities:

High leverage with limited capital buffers

Liquidity mismatches, borrowing short-term and lending long-term

Opacity, making risk assessment difficult

Interconnectedness with traditional banks, leading to contagion

Shadow Banking and the 2008 Global Financial Crisis

The dangers of shadow banking became evident during the 2008 crisis. Investment banks and shadow entities relied heavily on short-term funding markets. When confidence collapsed:

Repo markets froze

Securitization markets collapsed

Lehman Brothers failed

Governments were forced to intervene

The crisis demonstrated that shadow banks could create bank-like systemic risk without bank-like regulation, forcing policymakers to rethink financial oversight.

Regulatory Response and Oversight

Post-crisis reforms focused on improving transparency and reducing systemic risk without stifling innovation.

Global Efforts

The Financial Stability Board (FSB) monitors global shadow banking trends and publishes annual assessments. Regulatory measures include:

Enhanced disclosure requirements

Liquidity risk management rules

Limits on leverage

Stress testing of non-bank entities

Country-Specific Approaches

United States: Greater oversight of money market funds and repo markets

European Union: Alternative Investment Fund Managers Directive (AIFMD)

China: Tightened controls on wealth management products and off-balance-sheet lending

India: RBI oversight of NBFCs after liquidity crises (e.g., IL&FS collapse)

Shadow Banking in Emerging Markets

In emerging economies, shadow banking often grows faster due to underdeveloped banking systems. While it boosts credit access, weak regulation can magnify financial instability. Sudden capital outflows, currency depreciation, and liquidity shocks pose heightened risks.

The Future of Shadow Banking

The shadow banking system continues to evolve rather than disappear. Key trends shaping its future include:

Greater regulatory convergence between banks and non-banks

Expansion of fintech and digital lending platforms

Increased role of asset managers in credit creation

Tighter global coordination to monitor systemic risk

Central banks now recognize that financial stability depends on monitoring the entire financial ecosystem—not just banks.

Conclusion

The global shadow banking system is a powerful yet fragile pillar of modern finance. It provides liquidity, credit, and innovation that support economic growth, but it also harbors hidden risks that can destabilize the entire financial system if left unchecked. The challenge for policymakers is to strike the right balance—encouraging efficiency and innovation while preventing excess leverage, opacity, and systemic collapse.

Understanding shadow banking is no longer optional for investors, policymakers, or traders—it is essential to navigating today’s interconnected global financial markets.

USDCAD | 1H Market Structure OutlookUSDCAD is currently trading within a well-defined short-term distribution range after engineering a strong impulsive rally from the late-January lows. The recent expansion into the 1.3700 handle appears to have tapped into a premium supply zone, where price printed rejection wicks, signaling the presence of institutional sell-side liquidity.

From an SMC / ICT perspective:

Price swept relative equal highs before showing displacement to the downside, hinting at a classic buy-side liquidity grab.

The rejection from the marked supply suggests smart money may be positioning for a retracement toward inefficiencies left below.

Internal structure is beginning to shift bearish on the lower timeframe, though confirmation would require a decisive break of structure (BOS) beneath the 1.3620 support.

Key Levels to Watch

Supply / Premium: 1.3695 to 1.3710

Intermediate Support: ~1.3620 (range floor)

Higher-Timeframe Demand: 1.3580 to 1.3600, aligning with the visible demand block and potential mitigation zone.

Projected Path

If price fails to reclaim the supply region, the probability favors a corrective move lower, potentially delivering a measured draw on liquidity into the demand zone. A brief pullback into a lower high followed by continuation would further validate bearish order flow.

Invalidation Scenario:

Sustained acceptance above 1.3710 would negate the bearish premise and open the door for continuation toward higher liquidity pools.

Bias: Short-term bearish while below supply, with expectations of liquidity engineering toward discounted pricing.

XAUUSD – H4 Technical and Macro AnalysisXAUUSD – H4 Technical & Macro Outlook: Liquidity Compression Ahead of Fed Expectations | Lana ✨

Gold is currently trading in a tight compression structure, while macro conditions are beginning to tilt in favour of precious metals. Weak US labour data and a growing probability of Fed rate cuts are putting pressure on the US Dollar, creating an important backdrop for the next move in gold.

At the same time, price action on XAUUSD suggests the market is approaching a key liquidity-driven decision point.

📈 Technical Structure & Price Behaviour

After failing to sustain above the upper supply zone near 5,200–5,300, gold entered a corrective decline and is now trading inside a descending wedge, bounded by falling resistance and rising support.

Price is currently holding around 4,800–4,830, a short-term balance area.

Repeated rejections from descending resistance indicate supply remains active.

At the same time, sell-side liquidity is clearly resting below the structure, near 4,570–4,550.

This behaviour suggests the market is not trending yet, but preparing for a liquidity expansion.

🔍 Key Levels to Monitor

Near-Term Resistance: ~5,070 – 5,130

A key reaction zone aligned with Fibonacci retracement and prior structure.

Compression Pivot: ~4,800 – 4,830

Holding above this area keeps price in consolidation mode.

Sell-Side Liquidity: ~4,570 – 4,550

A likely downside target if the structure breaks lower.

Major Supply (Higher TF): ~5,500

Still the upper boundary for any medium-term bullish continuation.

🎯 Likely Scenarios

Scenario 1 – Liquidity Sweep Lower (Base Case):

If price fails to hold the rising support, gold may dip toward 4,570–4,550 to clear sell-side liquidity. Such a move would likely be corrective, not a trend reversal, especially given the macro backdrop.

Scenario 2 – Bullish Break from Compression:

If price accepts above 5,070–5,130, the descending structure would be invalidated, opening the door for a recovery toward higher resistance zones.

🌍 Macro Context: USD Weakness & Fed Expectations

Recent US labour data has reinforced concerns about economic momentum:

JOLTS job openings fell sharply below expectations.

ADP employment growth slowed significantly.

CME FedWatch now shows a rising probability of a March rate cut, up from earlier in the week.

As a result, the US Dollar Index (DXY) has struggled to extend its weekly gains, trading slightly lower while remaining near recent highs. This environment is typically supportive for gold, especially during corrective phases.

Upcoming NFP data will be a key catalyst and may act as the trigger for the next liquidity expansion.

🧠 Lana’s View

Gold is currently in a waiting phase, balancing between technical compression and shifting macro expectations. The focus should remain on how price reacts at the edges of the structure, rather than predicting direction too early.

Patience is essential here. The next move is likely to be fast and liquidity-driven once the market commits.

✨ Respect the structure, follow the levels, and let the market reveal the next expansion.

Axis Bank | Gann Square of 9 Intraday Observation | 11 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 11 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Alignment)

This post shares a historical intraday observation showing how price interacted with a normal Square of 9 capacity level, leading to a temporary reaction when time and price aligned.

📊 Market Context & Reference Selection

Axis Bank displayed upward momentum after the completion of the first 15-minute candle.

In such market conditions, the low of the first 15-minute candle (~1104) was treated as the 0-degree reference level, following Gann methodology.

This reference point was used to study the session’s expected price expansion.

Correct identification of the reference level is critical for objective Square of 9 analysis.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1104

45 Degree (Observed Normal Capacity): ~1121

The 45-degree level often represents the normal intraday movement range under regular market conditions.

⏱️ Observed Price–Time Behavior

Price approached the 45-degree level well before the later part of the trading session.

Early completion of normal price capacity has historically been associated with short-term trend fatigue.

After interacting with this zone, price showed temporary selling pressure and moved lower.

A minor variation around the calculated level was observed, which is common in live market conditions.

This aligns with a widely observed Gann concept:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Square of 9 helps define logical intraday price limits

Early capacity completion can indicate temporary exhaustion

Time plays a supporting role in validating price-degree levels

Small price deviations are normal and should be viewed structurally

The method promotes rule-based observation over prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 12 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 12 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday observation based on the Gann Square of 9, focusing on how early completion of price capacity can coincide with temporary market pressure.

📊 Market Structure & Reference Selection

Axis Bank opened with upward momentum during the first 15-minute candle.

In such conditions, the low of the opening candle (~1100) was treated as the 0-degree reference level, following Gann methodology.

This level served as the base point for measuring the session’s upward price capacity.

Accurate identification of the reference point is essential for reliable Square of 9 observations.

🔢 Square of 9 Level Mapping

Based on the selected reference:

0 Degree: ~1100

45 Degree (Observed Normal Capacity): ~1117

The 45-degree level often reflects the normal intraday price expansion range under regular conditions.

⏱️ Price–Time Behavior (Observed)

Price interacted with the 45-degree level early in the session (around 9:30 AM).

Completion of normal price capacity well before the later part of the trading day has historically been associated with short-term exhaustion.

After reaching this zone, the market showed temporary selling pressure and downside expansion.

This aligns with a commonly observed Gann principle:

When expected price capacity is completed early in time, the probability of a reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Early completion of price capacity can signal temporary trend fatigue

Time alignment strengthens interpretation of price-degree levels

The method encourages structured observation over prediction

Focus remains on process, not precision

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Part 2 Ride The Big MovesLot Size

Options trade in lots, not single units.

Lot size varies by instrument.

Why Are Options Popular?

Low upfront premium.

Leverage.

Sophisticated hedging.

High liquidity.

European vs American Options

Indian index options are European — can only be exercised on expiry.

Stock options are American — can be exercised any time (but rarely done).

Financial Freedom Through Euro–Dollar DynamicsThe Euro–Dollar Relationship: A Global Financial Barometer

The EUR/USD pair represents the exchange rate between the euro (used by the Eurozone) and the U.S. dollar (the world’s primary reserve currency). Together, these two economies account for a significant share of global GDP, trade, and investment flows. As a result, EUR/USD reflects more than currency strength—it mirrors global economic confidence, monetary policy divergence, and geopolitical stability.

When the U.S. economy outperforms Europe, capital flows toward dollar-denominated assets, strengthening the USD and pushing EUR/USD lower. Conversely, when the Eurozone shows resilience or the Federal Reserve adopts a dovish stance, the euro strengthens. For individuals seeking financial freedom, understanding these shifts helps identify where money is moving—and how to position alongside it.

Interest Rates: The Core Driver of Currency Wealth

At the heart of Euro–Dollar dynamics lie interest rates, set by the European Central Bank (ECB) and the U.S. Federal Reserve (Fed). Interest rate differentials determine where global investors park their money.

Higher U.S. rates attract capital into U.S. bonds and equities, strengthening the dollar.

Higher European rates improve euro demand and reduce dollar dominance.

For traders, this creates long-term trends that can last months or even years. Riding these trends—rather than chasing short-term noise—can generate consistent returns. For investors, understanding rate cycles helps in allocating capital between U.S. stocks, European equities, bonds, and currency-hedged instruments.

Financial freedom is rarely built through random trades; it is built by aligning with long-duration macro trends, and interest rate policy is one of the most reliable trend drivers.

Inflation, Purchasing Power, and Real Wealth

Inflation erodes purchasing power, silently damaging long-term financial security. The Euro–Dollar dynamic reflects how well each region controls inflation relative to growth.

If U.S. inflation is high and the Fed lags in response, the dollar may weaken.

If Europe faces energy-driven inflation shocks, the euro may depreciate.

For individuals, this matters because currency value affects real wealth. Income earned in a weakening currency loses global purchasing power, while assets held in a stronger currency preserve or enhance wealth.

Many financially independent individuals diversify income streams across currencies—earning in one currency while investing in another. Understanding EUR/USD trends helps protect savings from inflation and currency depreciation, a crucial but often overlooked step toward financial freedom.

Trading EUR/USD as a Tool for Income Independence

The Euro–Dollar pair is the most liquid currency pair in the world. High liquidity means tighter spreads, lower transaction costs, and smoother price action—ideal conditions for traders aiming to build consistent income streams.

From a financial freedom perspective:

Day traders benefit from predictable volatility during London–New York overlap.

Swing traders exploit macro themes like rate hikes, inflation data, and policy guidance.

Position traders ride multi-month trends driven by monetary cycles.

Unlike equities, forex markets operate nearly 24 hours a day, allowing flexibility for those balancing trading with jobs or businesses. While trading carries risk, disciplined EUR/USD trading—supported by macro understanding—can evolve into a scalable income source, supporting location-independent lifestyles.

Euro–Dollar Dynamics and Global Asset Allocation

Financial freedom is not only about earning more—it’s about allocating capital wisely. EUR/USD movements influence global asset performance:

A strong dollar often pressures emerging markets and commodities.

A weak dollar supports risk assets, global equities, and alternative investments.

Euro strength benefits European exporters and regional stock indices.

By tracking Euro–Dollar trends, investors can adjust portfolios proactively—reducing drawdowns and enhancing long-term returns. This macro-aware allocation reduces reliance on any single market or economy, making wealth more resilient.

Psychological Freedom Through Macro Understanding

One underrated aspect of financial freedom is psychological stability. Many retail investors panic during volatility because they lack context. Understanding Euro–Dollar dynamics provides that context.

When markets move sharply after central bank meetings, inflation reports, or geopolitical events, informed individuals recognize these moves as part of larger cycles—not random chaos. This clarity reduces emotional decision-making, improves discipline, and builds confidence—key traits of financially independent thinkers.

Business, Remittances, and Cross-Border Opportunities

For entrepreneurs, freelancers, and international workers, EUR/USD impacts:

Export and import costs

Overseas earnings

Profit margins on global contracts

Those who understand currency dynamics can time conversions, hedge exposure, or price services strategically. Over time, these small optimizations compound into significant financial advantages—another pathway to independence beyond traditional employment.

Risks and Responsible Use of Currency Dynamics

While Euro–Dollar dynamics offer opportunities, financial freedom requires risk awareness. Leverage misuse, overtrading, and ignoring macro shifts can quickly destroy capital. True freedom comes from risk-adjusted growth, not reckless speculation.

Successful participants treat EUR/USD as a strategic tool—not a gamble—combining technical analysis, macro data, and strict risk management.

Conclusion: Aligning With Global Money Flow

Financial freedom in the modern world is no longer confined to saving salaries or investing locally. It is about understanding how global money moves—and positioning oneself accordingly. The Euro–Dollar dynamic stands at the center of this global system, reflecting interest rates, inflation, economic confidence, and political stability.

By mastering EUR/USD dynamics, individuals gain more than trading profits or investment returns. They gain insight, flexibility, and control over their financial destiny. Whether through trading, investing, currency diversification, or global business, aligning with Euro–Dollar trends can transform money from a source of stress into a tool for long-term independence.

In essence, financial freedom is not about predicting every market move—it is about understanding the forces that shape them. And few forces are as powerful, persistent, and revealing as the Euro–Dollar relationship.

Inter-Market Edge: Mastering Cross-Asset TradesWhat Is Inter-Market Analysis?

Inter-market analysis studies the relationships between major asset classes, primarily:

Equities (stocks and indices)

Bonds (interest rates and yields)

Commodities (energy, metals, agriculture)

Currencies (forex pairs)

Volatility instruments (like VIX)

The core idea is simple: capital constantly rotates between asset classes based on economic conditions, monetary policy, inflation expectations, and risk sentiment. By tracking where money is flowing before it fully shows up in your trading instrument, you gain early insight.

Why Cross-Asset Trading Matters

Single-asset traders often react late. Cross-asset traders anticipate.

Key benefits include:

Early trend detection

Bond yields or currencies often move before equities.

Signal confirmation

A stock market breakout supported by falling bond yields and a weak currency is more reliable.

False signal filtering

If equities rise but bonds and commodities disagree, caution is warranted.

Superior risk management

Inter-market divergence frequently warns of trend exhaustion or reversals.

Broader opportunity set

When one market is range-bound, another may be trending strongly.

Core Inter-Market Relationships

To master cross-asset trades, traders must understand some foundational relationships.

1. Stocks and Bonds: The Risk Barometer

Rising bond prices (falling yields) usually indicate risk aversion.

Falling bond prices (rising yields) often signal economic optimism or inflation concerns.

Classic relationship

Stocks ↑ → Bonds ↓ (risk-on)

Stocks ↓ → Bonds ↑ (risk-off)

Trading edge

If bond yields start rising before equities rally, it often signals an upcoming stock market breakout. Conversely, falling yields during a stock rally can warn of weakness ahead.

2. Interest Rates and Equities

Central bank policy sits at the heart of inter-market analysis.

Low or falling rates support equity valuations and growth stocks.

Rising rates pressure high-valuation stocks, especially technology and small caps.

Cross-asset insight

Rate-sensitive sectors (banking, real estate, utilities) often move before broader indices. Watching rate futures can provide early sector rotation signals.

3. Currencies and Risk Sentiment

Currencies are not just exchange tools; they are risk indicators.

Safe-haven currencies: USD, JPY, CHF

Risk currencies: AUD, NZD, emerging market currencies

Key dynamics

Strong USD often pressures commodities and emerging market equities.

Weak domestic currency can boost exporters but increase inflation risk.

Trading edge

A strengthening USD alongside falling equities often confirms a risk-off environment. Conversely, a weakening USD with rising commodities supports a global risk-on trade.

4. Commodities and Inflation Expectations

Commodities reflect real-world demand and inflation trends.

Crude oil influences inflation, transport, and emerging markets.

Gold reflects real yields, inflation fears, and currency confidence.

Industrial metals signal economic growth.

Inter-market signal

Rising commodities with rising bond yields often indicate inflationary pressure, which can eventually hurt equity valuations.

5. Gold, Dollar, and Real Yields

Gold deserves special attention in cross-asset trading.

Gold rises when real yields fall.

Gold weakens when real yields rise, even if inflation is high.

Edge for traders

If gold rallies while equities rise and the dollar weakens, it often signals excess liquidity. If gold rises while equities fall, it reflects fear and capital preservation.

Volatility as a Cross-Asset Tool

Volatility indices, especially equity volatility, act as early warning systems.

Rising volatility during a price rally signals distribution.

Falling volatility during consolidation supports trend continuation.

Cross-asset traders watch volatility alongside bonds and currencies to judge whether risk appetite is genuine or fragile.

Practical Cross-Asset Trading Strategies

1. Confirmation Strategy

Before entering a trade, ask:

Do bonds agree?

Does the currency support the move?

Are commodities aligned with the macro narrative?

Example:

A stock index breakout supported by falling volatility and stable bond yields has higher probability.

2. Lead-Lag Strategy

Some markets move earlier than others:

Bonds often lead equities.

Currencies often lead commodities.

Commodities often lead inflation data.

Traders can position early in the lagging market once the leading market signals a shift.

3. Relative Strength Across Assets

Instead of predicting direction, compare strength between asset classes:

Equities vs bonds

Growth stocks vs value stocks

Commodities vs currencies

This helps identify capital rotation rather than guessing tops and bottoms.

4. Risk-On / Risk-Off Framework

Create a simple checklist:

Stocks ↑, yields ↑, volatility ↓ → Risk-on

Stocks ↓, yields ↓, volatility ↑ → Risk-off

Trading in alignment with the prevailing regime dramatically improves consistency.

Common Mistakes in Inter-Market Trading

Over-correlation bias: Relationships change over time.

Ignoring timeframes: Short-term trades may not follow long-term inter-market trends.

Confirmation paralysis: Waiting for every asset to align can lead to missed trades.

Macro blindness: News, policy, and global events matter in cross-asset trading.

Building the Inter-Market Mindset

Mastering cross-asset trades is less about predicting prices and more about understanding flows. Successful inter-market traders think like capital allocators, not just chart readers. They ask:

Where is money coming from?

Where is it going?

What fear or optimism is driving that movement?

By integrating equities, bonds, currencies, commodities, and volatility into one analytical framework, traders gain clarity in noisy markets.

Conclusion

The inter-market edge transforms trading from isolated decision-making into strategic positioning. In a world driven by global liquidity, central banks, inflation cycles, and geopolitical shifts, cross-asset awareness is no longer optional—it is essential.

Traders who master inter-market analysis don’t just react to price; they anticipate behavior, align with capital flows, and trade with context. That context is the real edge—quiet, powerful, and consistently profitable when applied with discipline.

If you want, I can also break this into headings for a blog, PDF notes, or turn it into a trading framework with examples from Indian markets 📈

PFC 1 Day Time Frame 📌 Current Market Price (Approx intraday)

• ~₹414–₹418 on NSE (trading range today: ₹413.10 – ₹420.40) as per real-time quotes.

📊 Key Daily Pivot & Levels (1-Day Timeframe)

🔹 Daily Pivot Reference (CPR / Pivot Zone)

• Central Pivot (CPR) / Pivot area: ~₹406.8 – ₹410.7 (bias reference)

📈 Resistance Levels (Upside)

R1: ~ ₹396–₹402 (initial resistance)

R2: ~ ₹402–₹406 (stronger sell zone)

R3: ~ ₹423–₹432 (higher resistance bands)

➡️ Above these, breakout zones could form if price closes strongly above ₹406–₹410.

📉 Support Levels (Downside)

S1: ~ ₹380–₹386 (first downside support)

S2: ~ ₹365–₹380 (secondary structural support)

S3: ~ ₹358–₹365 (deeper support zone)

➡️ Failure below ₹380–₹386 could tilt short-term bias more bearish.

📌 Daily Bias Interpretation

✔ Bullish bias if price holds above ~₹406–₹410 (CPR/pivot) — expect recovery toward ₹423+ zones.

✔ Neutral / slight bearish bias if price stays below ~₹406–₹410 — likely to test supports near ₹380–₹386.

📌 Context

The stock is trading well above its 20-day and 50-day moving averages, indicating short-term strength (based on recent MA data).

Over the past week/month, it’s shown positive momentum vs prior period.

Quarterly Results: High-Impact Trading Strategies1. Why Quarterly Results Matter So Much

Quarterly earnings influence markets because they:

Update real financial reality versus expectations

Reset valuation assumptions

Alter future growth outlooks

Trigger institutional rebalancing

Create liquidity surges and volatility expansion

Markets do not react to numbers alone. They react to the difference between expectations and reality, known as earnings surprise.

Key drivers of price reaction:

Revenue vs estimates

EPS vs estimates

Guidance upgrades/downgrades

Management commentary tone

Margin expansion or contraction

2. Pre-Earnings Trading Strategies

Pre-earnings trades aim to capture anticipation, positioning, and volatility buildup.

A. Earnings Run-Up Strategy

Many stocks trend upward before results due to:

Analyst upgrades

Institutional accumulation

Positive sector sentiment

Strategy logic

Buy strong stocks 2–4 weeks before earnings

Ride the momentum until just before results

Exit partially or fully before announcement

Best conditions

Strong relative strength vs index

Consistent higher highs and higher lows

Positive earnings history

Risk

Sudden negative leaks or macro shocks

B. Volatility Expansion Play

Implied volatility typically rises before earnings.

Approach

Trade breakout setups near key levels

Use tight stop losses

Target fast momentum moves

Technical focus

Compression patterns (triangle, flag, box range)

Rising volumes into earnings

Narrow daily ranges before expansion

C. Avoid Directional Bets Without Edge

Blindly buying or shorting before results is gambling. Pre-earnings trades should be momentum-based, not prediction-based.

3. Result-Day Trading Strategies (High Risk, High Reward)

Earnings day offers explosive opportunities—but also extreme risk.

A. Gap-Up Continuation Trade

When a stock gaps up strongly and holds above key levels:

Entry

After first 15–30 minutes

Above VWAP or opening range high

Confirmation

Strong volumes

Minimal selling pressure

Price acceptance above gap zone

Target

Measured move or intraday resistance

B. Gap-Up Failure (Fade Trade)

Not all positive results sustain.

Signs of failure

Price rejects opening highs

Heavy selling volume

Break below VWAP

Strategy

Short below VWAP with tight stop

Target gap fill or previous close

This works well when:

Valuations are stretched

Market sentiment is weak

Guidance disappoints despite good numbers

C. Gap-Down Reversal (Dead Cat Bounce or True Reversal)

Large gap-downs can lead to:

Panic selling

Forced institutional exits

Reversal signs

Long lower wicks

Volume climax

Stabilization near support

Only aggressive traders should attempt this strategy.

4. Post-Earnings Trading Strategies (Most Consistent)

Post-earnings trades are statistically safer because uncertainty is removed.

A. Earnings Momentum Continuation

Strong results often lead to multi-week trends.

Ideal setup

Breakout above long-term resistance

Rising volumes post earnings

Analyst upgrades after results

Holding period

Days to weeks

Tools

Moving averages

Trend channels

Trailing stop losses

B. Post-Earnings Drift Strategy

Markets underreact initially and adjust over time.

Characteristics

Gradual trend continuation

Pullbacks bought aggressively

Strong relative strength

This is one of the most reliable earnings-based strategies.

C. Earnings Breakdown Short Trade

Negative earnings surprises can cause:

Structural trend breakdowns

Long-term distribution

Entry

Breakdown below support after results

Failed pullback retests

Target

Next major support zones

Best for:

High-debt companies

Weak cash flows

Deteriorating guidance

5. Sector and Index Influence

Earnings reactions depend heavily on:

Sector sentiment

Index trend (NIFTY, SENSEX, NASDAQ, S&P 500)

Example

Strong results in a weak market may still fail

Moderate results in a bullish sector may outperform

Always align earnings trades with:

Sector momentum

Broader market structure

6. Position Sizing and Risk Management

Quarterly results can move stocks 5–25% overnight.

Key risk rules:

Never risk more than 1–2% of capital per earnings trade

Reduce position size compared to normal trades

Avoid overexposure to multiple earnings trades at once

Respect gap risk—stop losses don’t work overnight

7. Common Mistakes Traders Make

Trading earnings without a plan

Ignoring guidance and commentary

Overtrading on result day

Holding losing trades hoping for reversal

Confusing good numbers with good price action

Remember: Price reaction > numbers

8. Professional Trader’s Earnings Checklist

Before every earnings trade:

Is the stock in a trend?

What is the market expecting?

How has the stock reacted to past earnings?

Where are key support/resistance levels?

What is my predefined risk?

If these answers aren’t clear, skip the trade.

9. Long-Term Perspective

Earnings trading is not about predicting results—it’s about reacting faster and smarter than the crowd. Professionals wait for confirmation, manage risk ruthlessly, and trade only high-quality setups.

The best traders treat earnings as:

Volatility opportunities

Trend accelerators

Risk events to be respected

Conclusion

Quarterly results are among the highest-impact events in financial markets, capable of reshaping trends in minutes and defining direction for months. High-impact earnings trading requires discipline, preparation, technical awareness, and emotional control.

Traders who focus on price behavior, volume confirmation, and post-earnings trends—rather than predictions—consistently outperform those who gamble on numbers alone.

Nifty & Bank Nifty Options: Smart Trading StrategiesIntroduction

Nifty 50 and Bank Nifty options are the most actively traded derivatives in India, offering high liquidity, tight bid-ask spreads, and multiple weekly expiries. These characteristics make them attractive to traders—but also dangerous for those without a structured approach. Smart options trading is not about predicting the market every day; it’s about probability, risk control, and discipline.

This guide explains smart, repeatable strategies used by professional and experienced retail traders across different market conditions—ranging from intraday momentum to non-directional income setups.

Understanding Nifty vs Bank Nifty Behavior

Before strategies, it’s critical to understand how these indices behave.

Nifty 50

Broader market representation

Lower volatility compared to Bank Nifty

Better for positional options selling, spreads, and calm intraday trades

Moves smoothly and respects technical levels

Bank Nifty

Highly volatile and momentum-driven

Sensitive to RBI policy, bond yields, and banking stocks

Ideal for intraday option buying, scalping, and fast spreads

Requires strict risk management due to sharp swings

Smart traders choose the index based on market conditions, not habit.

Core Principles of Smart Options Trading

1. Trade Probability, Not Prediction

Most professional options traders focus on high-probability setups (60–80%) instead of directional certainty.

2. Risk Defined First

Every trade must have:

Fixed maximum loss

Pre-decided exit

Position size based on capital, not confidence

3. Time Decay Is a Weapon

Theta (time decay) works against buyers and for sellers, especially in weekly options.

Smart Intraday Strategies

1. Opening Range Breakout (ORB) – Option Buying

Best for: Bank Nifty & Nifty (high volatility days)

Setup

Mark high and low of first 15 minutes

Buy Call if price breaks above range

Buy Put if price breaks below range

Choose ATM or slightly ITM options

Why it works

Institutions establish direction early

Volatility expansion favors buyers

Risk management

Stop-loss: 30–40% premium

Partial profit booking recommended

2. VWAP Trend Following

Best for: Trending intraday markets

Rules

Price above VWAP → buy Calls on pullbacks

Price below VWAP → buy Puts on pullbacks

Avoid counter-trend trades

Smart tip

Trade only when VWAP is sloping clearly—flat VWAP = no trade.

Smart Positional Strategies

3. Bull Call Spread / Bear Put Spread

Best for: Directional view with limited risk

Example (Bull Call Spread)

Buy ATM Call

Sell OTM Call (same expiry)

Advantages

Lower cost than naked buying

Reduced time decay impact

Defined risk and reward

Ideal for

Breakouts

News-based positional trades

Budget day, RBI policy days

4. Calendar Spread

Best for: Low volatility → expected volatility expansion

Setup

Sell near-expiry option

Buy same strike next-expiry option

Why it’s smart

Takes advantage of faster decay in weekly options

Lower directional risk

Used by

Experienced traders before events like RBI policy or CPI data.

Smart Non-Directional Strategies (Option Selling)

5. Short Strangle

Best for: Sideways markets, low VIX

Setup

Sell OTM Call

Sell OTM Put

Same expiry

Profit source

Time decay

Range-bound price action

Risk control

Always hedge with far OTM options

Exit if spot breaches sold strike

Works best

In Nifty more than Bank Nifty

When India VIX < 14–15

6. Iron Condor (Hedged Income Strategy)

Best for: Consistent weekly income

Structure

Sell OTM Call + Buy higher Call

Sell OTM Put + Buy lower Put

Advantages

Defined maximum loss

Lower margin requirement

Stress-free compared to naked selling

Professional insight

Iron Condors outperform aggressive selling over long periods.

Expiry Day Smart Strategies

7. Intraday Short Straddle (Advanced)

Best for: Weekly expiry, post 1 PM

Logic

Volatility collapses rapidly on expiry

ATM options lose value quickly

Rules

Only when index is range-bound

Strict stop-loss on combined premium

Not for beginners

8. Directional Expiry Scalping

Best for: Bank Nifty expiry

Setup

Trade ATM options

Quick 5–15 point moves

High frequency, low holding time

Golden rule

One bad trade can wipe 5 good ones—size small.

Risk Management: The Real Edge

Capital Allocation

Risk max 1–2% of capital per trade

Never deploy full margin on one idea

Stop-Loss Discipline

Pre-defined SL beats mental SL

Exit without emotion

Avoid Overtrading

No trade is also a trade

Most losses happen due to boredom trades

Common Mistakes to Avoid

Buying weekly OTM options without momentum

Holding losing positions hoping for reversal

Trading during low-volume midday hours

Ignoring India VIX

Trading every expiry aggressively

Smart Trader’s Checklist (Before Every Trade)

Is the market trending or sideways?

What is India VIX doing?

Am I a buyer or seller today?

Is my risk predefined?

Is this trade worth taking?

If any answer is unclear—skip the trade.

Conclusion

Smart Nifty and Bank Nifty options trading is not about high returns every day, but about survival, consistency, and compounding. The market rewards patience, structure, and risk control far more than excitement.

Successful traders:

Adapt strategies to volatility

Prefer probability over prediction

Protect capital first, profits second

Mastering Advanced Option Trading StrategiesFoundation: What Makes a Strategy “Advanced”

Advanced option strategies differ from basic ones in three key ways:

Multi-leg structures – Using two or more option contracts simultaneously

Risk-defined frameworks – Maximum loss and profit are known in advance

Volatility-based logic – Trades are often placed based on implied volatility (IV), not just price direction

These strategies are designed to optimize probability of profit, time decay (Theta), and volatility shifts, rather than relying solely on price movement.

Understanding the Greeks at an Advanced Level

Before executing advanced strategies, traders must internalize the option Greeks:

Delta – Measures directional exposure

Gamma – Rate of change of Delta (critical near expiry)

Theta – Time decay, a major income driver

Vega – Sensitivity to volatility changes

Rho – Interest rate sensitivity (minor but relevant in long-dated options)

Advanced traders do not avoid Greeks—they engineer trades around them.

Advanced Directional Strategies

1. Bull Call Spread and Bear Put Spread

These are risk-defined directional strategies.

Bull Call Spread: Buy a lower strike call, sell a higher strike call

Bear Put Spread: Buy a higher strike put, sell a lower strike put

Why advanced traders use them:

Lower cost than naked options

Reduced impact of volatility crush

Higher probability of controlled returns

These spreads are ideal when you expect moderate directional movement, not explosive breakouts.

2. Ratio Spreads

A ratio spread involves buying fewer options and selling more at another strike (e.g., buy 1 call, sell 2 calls).

Key characteristics:

Often initiated for low or zero cost

Profitable in a specific price range

Can become risky if price moves aggressively

Ratio spreads are best suited for traders who deeply understand Gamma risk and can actively manage positions.

Non-Directional and Income Strategies

3. Iron Condor

One of the most popular advanced strategies.

Structure:

Sell a call spread

Sell a put spread

Market outlook: Range-bound / low volatility

Advantages:

High probability of profit

Defined risk

Profits from time decay

Iron Condors are volatility trades. Advanced traders deploy them when implied volatility is high and expected to contract.

4. Butterfly Spreads

Butterflies are precision strategies.

Structure (Call Butterfly example):

Buy 1 lower strike call

Sell 2 middle strike calls

Buy 1 higher strike call

Best used when:

Expect price to expire near a specific level

Volatility is expected to fall

Butterflies offer high reward-to-risk ratios, but require accurate price targeting and timing.

Volatility-Based Strategies

5. Straddle and Strangle

These are pure volatility plays.

Straddle: Buy call and put at same strike

Strangle: Buy call and put at different strikes

Used when:

Expect a large move but unsure of direction

Ahead of earnings, events, or policy announcements

Advanced traders focus less on direction and more on whether realized volatility will exceed implied volatility.

6. Calendar Spreads

A calendar spread involves selling a near-term option and buying a longer-term option at the same strike.

Benefits:

Positive Theta

Positive Vega

Limited risk

Calendars work best when:

Short-term volatility is overestimated

Long-term volatility remains stable

They are commonly used by professionals to trade volatility structure, not price.

Advanced Hedging and Portfolio Strategies

7. Synthetic Positions

Options can replicate stock positions:

Synthetic Long Stock: Long call + short put

Synthetic Short Stock: Long put + short call

These are capital-efficient and useful for:

Regulatory constraints

Margin optimization

Tax or funding considerations

8. Delta-Neutral Strategies

Advanced traders often aim to remain direction-neutral while earning from Theta and Vega.

Examples:

Delta-neutral Iron Condors

Delta-hedged straddles

Delta neutrality requires active adjustments, especially as Gamma increases near expiry.

Risk Management: The Real Edge

Advanced option trading is less about finding the “best strategy” and more about risk control.

Key principles:

Never risk more than a small percentage of capital per trade

Predefine exit rules (profit targets and stop-losses)

Avoid overtrading during low-liquidity conditions

Adjust positions rather than panic-closing

Professional traders think in probabilities, not predictions.

Psychological Mastery

Options trading amplifies emotions due to leverage and time pressure.

Advanced traders develop:

Patience to let Theta work

Discipline to exit losing trades early

Emotional detachment from individual outcomes

Consistency comes from executing a well-tested process repeatedly—not chasing perfect trades.

Conclusion

Mastering advanced option trading strategies is a journey that blends mathematics, psychology, and market intuition. These strategies allow traders to profit in almost any market environment, but they demand respect for risk, deep understanding of volatility, and strict discipline. Success does not come from complexity alone—it comes from using the right strategy at the right time, for the right reason.

When advanced options trading is approached as a probability business rather than a prediction game, it becomes one of the most powerful tools in modern financial markets.

Axis Bank | Gann Square of 9 Intraday Observation | 15 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 15 March 2024

Time Frame: 15-Minute Chart

Method: Gann Square of 9 (Price Capacity & Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price capacity, trend context, and time alignment can highlight potential intraday reaction zones.

📉 Market Context & Reference Point Selection

Axis Bank showed downside pressure from the opening 15-minute candle.

In such conditions, the high of the first 15-minute candle (~1050) was treated as the 0-degree reference level, following Gann methodology.

This level acts as the starting point for measuring the intraday downward price cycle.

Correct trend identification and reference selection are essential before applying Square of 9 calculations.

🔢 Square of 9 Price Mapping

Based on the selected reference:

0 Degree: ~1050

45 Degree (Observed Normal Capacity): ~1034

The 45-degree level often represents the normal intraday price expansion range under regular market conditions.

⏱️ Price–Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the third 15-minute candle).

Completion of normal price capacity well before the later part of the trading day has historically shown signs of temporary downside exhaustion.

After reaching this zone, the market displayed short-term stabilization followed by upward expansion.

This aligns with a commonly observed Gann concept:

When expected price capacity is completed early in time, the probability of a directional reaction may increase.

📘 Educational Takeaways

Gann Square of 9 helps define intraday price limits in advance

Trend context determines how reference points are selected

Time alignment adds confirmation to price-degree levels

Normal (45-degree) reactions are more frequent than rare cases

The approach encourages rule-based observation over emotional reaction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Axis Bank | Gann Square of 9 Intraday Observation | 18 March 202Disclaimer:

This analysis is for educational purposes only. I am not a SEBI-registered advisor. This is not financial advice.

Symbol: AXISBANK (NSE)

Date Observed: 18 March 2024

Time Frame: 15-Minute Chart

Method Used: Gann Square of 9 (Price–Time Study)

This post documents a historical intraday market observation using the Gann Square of 9, focusing on how price movement capacity and time alignment can highlight potential intraday reaction zones.

📊 Initial Market Structure

Axis Bank displayed upward momentum from the opening 15-minute candle.

The low of the first 15-minute candle (~1043) was treated as the 0-degree reference level.

This reference point marks the start of the intraday price cycle and is used for further Square of 9 calculations.

Correct identification of the 0-degree level is a key requirement for consistent Square of 9 analysis.

🔢 Square of 9 Level Mapping

Using Square of 9 price-degree relationships, the following levels were observed:

0 Degree: ~1043

45 Degree (Observed Normal Capacity): ~1057

The 45-degree level often reflects the normal intraday price expansion range under regular market conditions.

⏱️ Price & Time Interaction (Observed Behavior)

Price interacted with the 45-degree level early in the session (around the second 15-minute candle).

Completion of the normal price capacity well before the later part of the trading day has historically shown temporary price pressure.

After reaching this zone, the market displayed rejection behavior followed by short-term downside expansion.

This observation aligns with a commonly studied Gann principle:

Early completion of expected price capacity may increase the probability of a market reaction.

📘 Educational Takeaways

Gann Square of 9 helps define logical intraday price limits

Normal (45-degree) reactions occur more frequently than exceptional cases

Time context adds important confirmation to price levels

Minor price deviations around calculated levels are part of normal market behavior

The method supports rule-based observation, not prediction

📌 Shared strictly for educational and historical chart-study purposes.

#AxisBank #GannSquareOf9 #WDGann #IntradayAnalysis #MarketEducation #PriceTime #TechnicalAnalysis

Stock Market Trading (Equities)Introduction

Stock market trading, often referred to as equity trading, is the buying and selling of shares of publicly listed companies through a regulated marketplace known as a stock exchange. Equities represent ownership in a company, and shareholders are entitled to a portion of the company's profits in the form of dividends and capital gains. Stock trading serves as a fundamental component of financial markets, providing liquidity, capital formation, and investment opportunities for individuals, institutions, and corporations alike.

The stock market is often perceived as a barometer of the economy, reflecting investor sentiment, corporate performance, and broader macroeconomic trends. Trading in equities is both an art and a science, combining analytical rigor, strategy, and psychological discipline.

Key Participants in Stock Market Trading

Retail Investors: Individual traders who buy and sell stocks for personal investment or short-term trading profits. Retail investors account for a significant portion of trading volume in major stock exchanges.

Institutional Investors: Entities such as mutual funds, hedge funds, insurance companies, and pension funds that invest large sums of money in equities. Their trades can significantly impact stock prices due to the size of their transactions.

Market Makers & Brokers: Market makers provide liquidity by quoting both buy and sell prices, facilitating smoother trading. Brokers act as intermediaries between investors and the exchange, executing orders on behalf of clients.

Regulators: Regulatory authorities like the Securities and Exchange Board of India (SEBI) in India or the U.S. Securities and Exchange Commission (SEC) ensure fair practices, transparency, and protection for investors.

Types of Equity Trading

Equity trading can broadly be categorized into long-term investing and short-term trading, each with distinct objectives and strategies.

Long-Term Investing:

Investors hold stocks for an extended period, usually years, aiming to benefit from dividends and capital appreciation. This strategy is based on fundamental analysis, which evaluates a company's financial health, growth potential, and market position. Long-term investors are less concerned with short-term price fluctuations and focus on the company's intrinsic value.

Short-Term Trading:

Traders aim to profit from price volatility within short periods, ranging from seconds (high-frequency trading) to days or weeks. This category includes:

Day Trading: Buying and selling stocks within the same trading session.

Swing Trading: Holding stocks for several days or weeks to capture intermediate-term trends.

Scalping: Executing multiple trades in a day to profit from small price movements.

Fundamental Analysis

Fundamental analysis involves evaluating a company's underlying financial health and growth potential to estimate its intrinsic value. Key aspects include:

Financial Statements:

Income Statement: Evaluates profitability through revenue, expenses, and net profit.

Balance Sheet: Assesses the company's assets, liabilities, and equity.

Cash Flow Statement: Analyzes liquidity and operational efficiency.

Ratios & Metrics:

Price-to-Earnings (P/E) Ratio: Measures stock valuation relative to earnings.

Return on Equity (ROE): Indicates profitability for shareholders.

Debt-to-Equity Ratio: Shows financial leverage and risk.

Macro & Industry Analysis:

Economic indicators like GDP growth, interest rates, and inflation impact stock performance.

Industry trends, competitive landscape, and regulatory policies influence individual company prospects.

Fundamental analysis is particularly favored by long-term investors seeking stable returns based on sound business fundamentals.

Technical Analysis

Technical analysis focuses on stock price movements and trading volume to predict future price trends. Traders use historical data and chart patterns to identify entry and exit points. Key tools include:

Charts: Line charts, candlestick charts, and bar charts provide visual representations of price movements.

Indicators:

Moving Averages: Identify trends by smoothing out price fluctuations.

Relative Strength Index (RSI): Measures overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Helps detect trend reversals.

Patterns: Head-and-shoulders, double tops/bottoms, and trendlines are common patterns used to anticipate price behavior.

Technical analysis is commonly applied by short-term traders and those seeking to exploit market psychology and price momentum.

Stock Market Orders

Traders and investors execute trades through different types of orders:

Market Order: Executes immediately at the current market price.

Limit Order: Executes only at a specified price or better.

Stop-Loss Order: Automatically sells a stock when it reaches a predetermined price to limit losses.

Stop-Limit Order: Combines stop-loss and limit orders for controlled execution.

Choosing the right type of order is crucial for managing risk and optimizing profits.

Risk Management in Equity Trading

Equity trading carries inherent risks, including market risk, company-specific risk, and liquidity risk. Effective risk management strategies include:

Diversification: Spreading investments across sectors, industries, and asset classes to reduce exposure to a single stock.

Position Sizing: Allocating a fixed portion of capital to each trade based on risk tolerance.

Stop-Loss Strategies: Limiting losses by setting predefined exit points.

Hedging: Using derivatives like options and futures to protect against adverse price movements.

Risk management is essential to survive in volatile markets and preserve capital.

Stock Market Strategies

Traders and investors employ various strategies depending on their objectives:

Value Investing: Buying undervalued stocks with strong fundamentals, aiming for long-term growth.

Growth Investing: Focusing on companies with high growth potential, even if currently overvalued.

Momentum Trading: Capitalizing on strong trends, buying rising stocks and selling before a reversal.

Dividend Investing: Targeting stocks that provide regular income through dividends.

Algorithmic Trading: Using automated systems and algorithms to execute trades at high speed and efficiency.

Behavioral Aspects of Trading

Psychology plays a crucial role in stock trading. Emotional biases such as fear, greed, overconfidence, and herd mentality can impact decision-making. Successful traders cultivate discipline, patience, and emotional control to make rational decisions.

Regulation and Compliance

Stock markets operate under strict regulations to ensure transparency and investor protection. Key regulatory practices include:

Listing Requirements: Companies must meet financial and disclosure standards to be listed on exchanges.

Insider Trading Regulations: Prevent individuals with non-public information from exploiting unfair advantages.

Market Surveillance: Exchanges monitor trading activity to detect manipulation and fraud.

Disclosure Norms: Companies must regularly disclose financial results, material events, and corporate governance practices.

In India, SEBI oversees the functioning of stock exchanges, brokers, and listed companies to maintain a fair and efficient market.

Technological Impact

Modern equity trading is heavily technology-driven. Online trading platforms, mobile apps, and algorithmic trading systems have democratized access, enabling retail investors to participate with ease. Artificial intelligence, machine learning, and data analytics are increasingly used to identify patterns, forecast trends, and automate trading strategies.

Conclusion

Stock market trading in equities is a dynamic and multifaceted activity, offering opportunities for wealth creation and capital growth. Success in trading requires a blend of analytical skills, strategic planning, risk management, and psychological discipline. Understanding fundamental and technical factors, along with macroeconomic and behavioral elements, equips traders and investors to navigate market volatility effectively.

While trading involves risks, disciplined approaches, continuous learning, and adherence to regulatory norms can significantly enhance the probability of long-term success. Whether one aims for long-term investment growth or short-term trading profits, equities remain a cornerstone of financial markets, providing avenues for participation in the wealth generated by companies and economies.

In essence, stock market trading is not merely about buying low and selling high; it is an intricate process of research, analysis, timing, and emotional control, offering immense learning opportunities and financial rewards for those who approach it with knowledge, patience, and strategy.

EUR/USD | 1H | Smart Money OutlookPrice has swept the previous low and is reacting from a key liquidity pocket. Structure remains intact for a potential bullish delivery. With CPI expected to print on the stronger side, we could see a favorable USD reaction — but the market is already pricing in the move, setting up EUR/USD for a liquidity grab before a push higher.

I’m watching for:

Accumulation near 1.1680 zone

Break of internal structure for confirmation

Targeting the 1.1730 region as the next supply area

If CPI comes out as expected, we could get that impulsive leg upward aligning with this setup.

OIL 1 Day Time Frame 📊 Current Approx Price (as per today data): ₹488.90 – ₹514.4 range (varies by platform/time) — OIL has recently traded around this area near daily pivot/major levels.

📈 Daily Pivot & Key Levels (Classic method)

Level Price (₹) Role

R3 (3rd Resistance) 507.45 Strong upside hurdle

R2 499.40 Secondary resistance

R1 491.35 Near-term resistance

Daily Pivot 483.30 Trend bias line

S1 (1st Support) 475.25 Immediate support

S2 467.20 Next downside cushion

S3 459.15 Major support zone

👉 Interpretation (1-day frame):

Price above pivot (~483-484) = bullish bias on the daily.

Near-term resistance cluster: ₹491–₹499–₹507 — watch breakout closes above these for continuation.

Downside support cluster: ₹475 → ₹467 → ₹459 — breakdown below these suggests short-term correction.

📊 Short Summary (Daily Momentum & Indicators)

Technical bias:

• RSI near bullish/neutral zone — showing positive momentum without being extremely overbought.

• MACD / ADX generally leaning bullish indicating trend strength at the moment.

Overall daily structure favors bullish to sideways — supports holding and resistance being tested.

🧠 How to use these levels (Daily)

📍 Bullish setup:

• If price stays above pivot ~483 and holds above R1 (~491) → next target R2 ~499 → R3 ~507.

📍 Bearish setup:

• If price falls below pivot ~483 and breaks S1 (~475) → move down to S2 (467) & potentially S3 (459).

📍 Key breakouts:

• Clear daily close above 507 → strong bull confirmation.

• Close below 459 → negates short-term bull view.

US100 (Nasdaq) – Structure & BiasPrice is currently trading inside a well-defined consolidation range, capped by a major resistance zone near 25,850–25,900 and supported around 25,230–25,250, which has acted as a strong demand flip multiple times.

The recent price action shows:

A liquidity sweep to the downside, followed by a sharp bullish reaction, indicating smart money absorption.

Price reclaiming the mid-range level, suggesting buyers are regaining short-term control.

Compression near support, often a precursor to expansion.

The projected path indicates a minor pullback or sideways consolidation, followed by a bullish continuation toward the upper resistance band. Structure favors upside as long as price holds above the marked support zone.

Key Levels

Support: 25,230 – 25,250

Mid-range equilibrium: ~25,300

Target / Resistance: 25,850 – 25,900

Bias

🟢 Bullish continuation, provided price maintains above the demand zone.

A clean breakout above consolidation could trigger momentum-driven expansion toward the highs.

Bitcoin Bybit chart analysis FEBURARY 2Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 12:00 PM.

We've proceeded as safely as possible, keeping in line with the current market conditions.

*When the light blue finger moves,

Two-way neutral strategy:

1. After touching the purple finger once at the top (autonomous shorting),

Switch to a long position at $77,247.9 at the light blue finger at the bottom.

/Stop-loss price if the light blue support line is broken.

If the price falls immediately without touching the first section,

Place the second section at the bottom as a long position waiting area. / Place the stop-loss price if the green support line is broken.

2. The top section is the target price -> If the price touches the good section repeatedly,

Maintain the long position. / If the price touches the top section and immediately falls,

Place the first section as a confirmation area for re-entry into the long position.

From the bottom, there's a possibility of further lows being broken.

The third section at the very bottom is a double bottom risk zone.

Currently, there's no clear support line, making long positions risky.

A rebound is needed, and I'll focus on this.

*Key criteria for this are a Nasdaq rise or sideways movement, and the XAUUSD gold price should continue to decline.

Please use my analysis to this point for reference only.