GBPUSD bears flex muscles despite recent reboundGBPUSD confirmed a rising wedge bearish chart pattern on Friday, despite posting another weekly gain and marking an intraday run-up of late. However, the absence of an oversold RSI suggests that the Cable pair could drift lower. That said, the 50-SMA and a two-month-old previous resistance line, respectively near 1.2200 and 1.2170, can restrict the short-term downside of the pair before directing it to the 200-SMA support level surrounding 1.2070. It’s worth noting that the quote’s weakness past 1.2170 makes it vulnerable to visit the multiple supports marked since mid-February around 1.1920-10, a break of which won’t hesitate to approach the theoretical target near 1.1730.

Meanwhile, GBPUSD recovery remains elusive unless the quote stays below the stated wedge’s lower line and 78.6% Fibonacci retracement level of the pair’s fall between late January and early March, around 1.2300 by the press time. Following that, the monthly high of around 1.2345 could test the Cable pair buyers. In a case where the quote remains firmer past 1.2345, multiple hurdles could test between 1.2400 and 1.2430 will precede the yearly high of around 1.2450 to challenge the pair’s upside momentum.

Overall, GBPUSD is likely to witness further downside but the road toward the south appears long and bumpy.

GBPUSD

GBPUSDAnalysis: 27th march

Liquidity:-(buyside)

Internal: taken

External: not yet

Volume profile:- (buyside)

in/out bulge: in

Bulge rejection: yes

VWAP:-

Quaterly St. deviation: 1(buy)

monthly St. deviation: 1-1.5 (buy)

Scenarios:-

i)buy most probability after taking liquidity.

ii)price may move sell side after taking buy side liquidity.

Important note:

Trade with only confirmations & news.

GBPUSD runs into key resistance as BoE rate hike loomsGBPUSD pokes a 10-month-old descending resistance line as the Cable bulls brace for the Bank of England (BoE) updates. Given the pair’s successful trading above the key DMAs and a clear rebound from the 61.8% Fibonacci retracement of the May-September 2022 downturn, the buyers are likely to overcome the stated trend line resistance, currently around 1.2340. The same, if backed by the hawkish BoE updates, could allow the buyers to cross the multiple hurdles near the 1.2445-50 region. Following that, the May 2022 peak surrounding 1.2665 could gain the market’s attention.

On the flip side, the 50-DMA and the 200-DMA restrict short-term GBPUSD downside near 1.2140 and 1.1900 respectively. Also acting as immediate support is the 1.2000 psychological magnet, as well as the 61.8% Fibonacci retracement level of 1.1775. In a case where the Cable bears keep the reins past 1.1775, joined by the BoE’s disappointment, tops marked in September and October of the last year, around 1.1735 and 1.1645 in that order, could act as intermediate halts during a likely fall towards the 50% Fibonacci retracement level around 1.1500.

To sum up, GBPUSD is likely to rise further and has a price-positive technical set-up but the upside momentum needs validation from the BoE.

Rising Wedge Chart Pattern On All TF - GBPUSDIt's important to note that the behavior of the GBPUSD pair can be influenced by a wide range of factors such as global economic conditions, political developments, supply and demand, and market sentiment. Therefore, it's important to do your own research, analyze the market conditions, and consult with a qualified financial advisor before making any investment decisions.

However, I can provide an explanation of the chart pattern you mentioned, which is the rising wedge pattern. A rising wedge is a bearish chart pattern that occurs when an asset's price is trading within an upward sloping channel but with a contracting range. This pattern is characterized by a series of higher highs and higher lows that form two converging trendlines that slope upward.

The rising wedge pattern is formed when the price reaches a resistance level and starts to consolidate, with the highs getting lower and lower while the lows maintain their level, indicating that the buyers are losing momentum. Once the price breaks below the lower trendline of the wedge pattern, it can indicate a trend reversal, and traders may consider shorting the asset.

However, it's important to note that the rising wedge pattern is not foolproof, and false breakouts can occur. Additionally, it's essential to use risk management techniques, such as setting stop-loss orders, to limit potential losses if the trade does not go as expected.

In summary, the rising wedge pattern is a bearish chart pattern that can occur in the GBPUSD pair or any other asset, and it indicates a potential trend reversal. However, investors should conduct thorough research and analysis and consult with a financial advisor before making any investment decisions based on chart patterns.

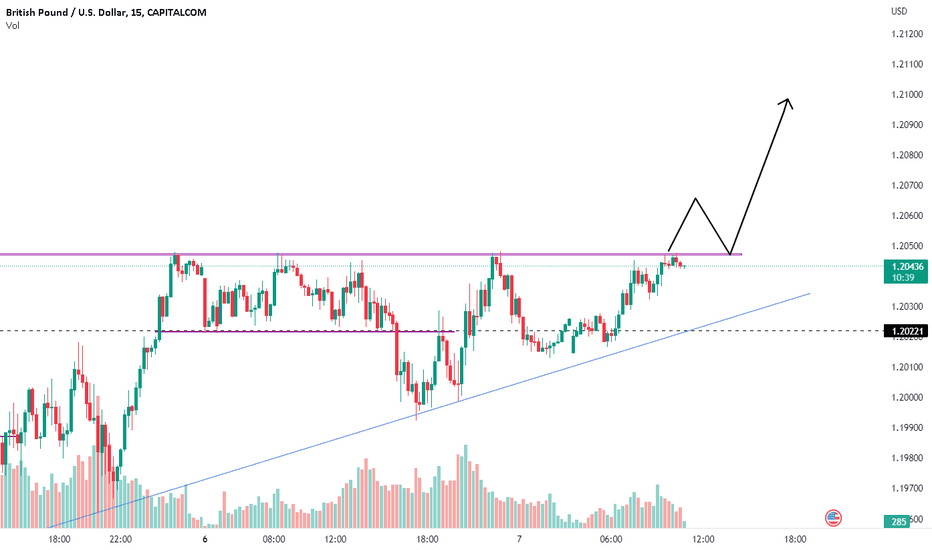

#GBPUSD Uptrend Movement With rish:reward=3.5#trading stratergy

#GBPUSD Uptrend Movemet

time frame 3 hours.

breakout from parallel channel.

Buy at 1.20718, Target 1.22331, SL 1.20257

HOPE our analysis is adding value to your site trading Journey.

If yes, Hit like button or boost our ideas. Thank you.

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

GBPUSD buyers struggle on UK employment, US inflation dayDespite rising in the last four consecutive days, the GBPUSD bulls take a breather ahead of the key UK jobs report and the US Consumer Price Index (CPI) data. That said, the three-week-old descending resistance-turned-support-line, around 1.2140 at the latest, restricts the immediate downside of the Cable pair. Following that, the 200-SMA level surrounding 1.2100 precedes the one-week-old ascending trend line and the 100-SMA, respectively near 1.2040 and 1.2000, to challenge probe the Cable pair sellers. Should the quote remains bearish past 1.2000, a horizontal area comprising multiple levels marked since February 17, between 1.1915 and 1.1925, could try to prod the Cable bears.

Alternatively, the 61.8% Fibonacci retracement level of the GBPUSD pair’s January-March fall, around 1.2200, caps the immediate upside around 1.2100. Following that, a run-up towards the mid-February swing high of around 1.2270 appears safe to expect. It should be noted that the quote’s run-up beyond 1.2270 will be crucial to watch as it holds the key to the pair’s run-up toward the previous monthly peak of 1.2400.

Overall, the pre-data anxiety joins nearly overbought RSI conditions to probe GBPUSD buyers. However, the bullish MACD signals and hopes for further US Dollar weakness keep the bulls hopeful.

GBPUSD eyes further downside ahead of crucial US/UK data GBPUSD holds a confirmed place in the bear’s radar after breaking an important support line from mid-November, as well as the 200-DMA, as traders await the UK data dump and the US jobs report. That said, a daily closing below the 50% Fibonacci retracement level of the Cable pair’s upside from November 2022 to January 2023, near 1.1795, becomes necessary to witness the quote’s further declines amid the nearly oversold RSI and downbeat MACD signals. In that case, the late October 2022 swing high and the 61.8% Fibonacci retracement level, around 1.1645-40, may lure the pair sellers. Should the quote remains bearish past 1.1640, the 78.6% Fibonacci retracement level of 1.1422 and the November 09 bottom of around 1.1330 might act as intermediate halts before directing it to the late 2022 low of 1.1144.

On the contrary, GBPUSD recovery may initially aim for the 200-DMA level of around 1.1910 ahead of challenging the 1.1950 support-turned-resistance comprising the previous support line from November 17 and 38.2% Fibonacci retracement level. Following that, the 1.2000 psychological magnet and a downward-sloping resistance line from late January, near 1.2090, will be in focus. It’s worth observing that the Cable pair’s successful trading beyond 1.2090, as well as crossing the 1.2100 threshold, could help the bulls to retake control.

Overall, GBPUSD is likely to decline further unless crossing the 1.2100 hurdle.

GBPUSD Expected Move 1hr/4hrHello Traders!

1. We see GBPUSD taking curved support with all the bullish scenarios. The market has been in consolidation for a long time.

2. Most expected targets have been marked on the chart.

3. The suggestion is to keep stops tight but definitely not too tight. Do take some buffer.

Do use proper risk management.

Happy Trading!

Profits,

Market's Mechanic.

GBPUSD Downtrend movement; RISK :Reward Ratio=2.9 #FOREX

#GBP #USD #GBPUSD, #NASDAQ, #CURRENCY, #CURREYPAIRS, #FOREX @GBPUSD

#GBPUSD DOWNWARD movement potential with risk: reward ratio 2.9.

SELL at 1.1985 with SL 1.2060 and Target is 1.17750

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up 👍 ...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

GBPUSD Downtrend movement; RISK :Reward Ratio=2.9 #FOREX#GBP #USD #GBPUSD, #NASDAQ, #CURRENCY, #CURREYPAIRS, #FOREX @GBPUSD

#GBPUSD DOWNWARD movement potential with risk: reward ratio 2.9.

SELL at 1.1985 with SL 1.2060 and Target is 1.17750

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

GBPUSD braces for a bull run, falling wedge in focusGBPUSD holds onto the Brexit deal-inspired gains inside a one-month-old bullish chart formation called a falling wedge, following a sustained rebound from a fortnight-old descending trend line. Adding strength to the upside bias are the bullish MACD signals. However, nearly overbought RSI challenges the theoretical north-run targeting 1.2600. That said, the mid-February high and the previous monthly top, respectively around 1. 2270 and 1.2450, could test the buyers. It should be noted that the 100-SMA and aforementioned wedge’s confirmation points, respectively near 1.2060 and 1.12110, could challenge the immediate upside of the quote.

On the flip side, the 100-SMA and previous resistance line from February 14, close to 1.2060 and 1.2020 in that order, precede the 1.2000 psychological magnet to challenge the short-term pullback of the GBPUSD pair. It’s worth noting that the road past 1.2000 appears bumpy with multiple stops near 1.1940 and 1.1900. Also acting downside filters are the lows marked in January and during mid-November 2022, near 1.1840 and 1.1760 respectively.

Overall, GBPUSD is back on the bull’s radar as traders await UK PMI and BOE Governor Andrew Bailey’s speech.

Levels and Zone: 🪙XAUUSD |💱GBPUSD|💱AUDUSD|💱GBPJPY|💱CADCHFOANDA:XAUUSD

1) XAUUSD - GOLD 4HR TF

On 4h TF we can see it made bearish flag and pole pattern and gave breakdown of it.

1865 is critical flip level. And as of now we can see it made clear 1860-1870 range.

As of now major trend is bearish for Gold.

Please refer below 4hr TF chart

________________________________________________________

2) GBPUSD- 2HR TF

Please refer below 2hr TF chart

Chart shows clear two scenario as of now.

________________________________________________________

3) GBPJPY- 4HR TF

We can see clear range on 4hr TF. Breakout of 159.75 will be good opportunity to go long.

Till then it is scenario of sell on resistance and buy on support.

If resistance taken out then it will be long trade and if support taken out then it will be short trade.

Please refer below 4hr TF chart

________________________________________________________

4) AUDUSD- 4HR TF

On 4hr TF it made rising wedge/ bearish flag and pole pattern and gave breakdown of it. It has many supports till 0.6860 level. Breakdown of 0.6850 will be more bearish.

There will be also chance that it will bounce back from that support.

Please refer below 4hr TF chart

________________________________________________________

5) CADCHF- 4HR TF

It as of now it gave breakout of triangle pattern on up side. If it comes down to retest upper line of triangle pattern and makes any bullish candle there on 30 or 1hr TF then go long with SL of low of that bullish candle.

Please refer below 4hr TF chart

*****************************************************************

Hope I made it easy to understand it.

Do comment your doubt or suggestion.

Note: Trade with SL as per your risk appetite and also take position as per your risk capacity.

It may or may not hit all the levels. So one can book profit / loss at respective level considering how price action works near that level.

Ascending triangle teases GBPUSD bears ahead of UK PMIGBPUSD stays defensive inside a three-month-old ascending triangle, following the previous week’s rebound from the 200-DMA. Even so, downbeat oscillators join lower high formations to keep the sellers hopeful ahead of monthly PMI data from Britain. That said, the stated triangle’s lower line precedes the key moving average to challenge the Cable pair bears around 1.1990 and 1.1935 in that order. Following that, lows marked during January and mid-November 2022, close to 1.1840 and 1.1760 respectively, may challenge the bears. Also acting as short-term key support is last September’s peak surrounding 1.1735, a break of which could give a free hand to the pair sellers.

Alternatively, recovery moves could aim for the three-week-old descending resistance line, near 1.2220, followed by the previous weekly high near 1.2270. In a case where GBPUSD buyers manage to cross the 1.2270 hurdle the odds of witnessing a run-up towards the multiple resistance area around 1.2450 can’t be ruled out. It’s worth noting that a successful break of the 1.2450 resistance could propel the Cable pair’s advances to May 2022 high near 1.2665.

Overall, GBPUSD remains on the bear’s radar ahead of the key UK data.