GBPUSD NEW ANALYSISTrade Idea: BUY

PAITENTLY WAIT TO SAFEPLAY

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 : 4

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!

Gbpusdlong

GBPUSD LONGTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risK BCOZ ITS AN part of trading word .

gbpusd long + shortTrade Idea:

📍 Entry: 🎯 Target: ⛔ Stop Loss: (MARKED IN CHART)

💡 RISK REWARD 1 :1.5 , 1:

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!AND IF YOU WANT TO LEARN ITOR DOUBT WHAT STOPPING YOU TO ASK HOW ?

GBPUSD - LONG Trade Idea: buy

📍 Entry: 🎯 Target: ⛔ (MARKED IN CHART)

💡 RISK REWARD 1 : 2.5

💰 Risk 1% of your trading capital.

⚠️ Markets can be unpredictable; research before trading.Disclaimer: This trade idea is based on Elliott Wave analysis and is for informational purposes only. Trading involves risks; seek professional advice before making any financial decisions.Informational onLY !!!!AND IF YOU WANT TO LEARN IT WHAT STOPPING YOU TO ASK HOW ?

FOMC Minutes in the Charts: EUR/USD & GBP/USD FOMC Minutes in the Charts: EUR/USD & GBP/USD

During their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

Resistance at 1.267: Key Level to Watch After BoE Rate Decision

The UK continues to struggle with high inflation, as demonstrated once again this morning when headline inflation exceeded expectations at 8.7%, surpassing the projected 8.4%. Core inflation also outperformed, registering a 7.1% figure compared to the expected 6.8%. This divergence emphasizes the contrast between the UK and its counterparts in the US and Europe.

Tomorrow, the Bank of England is set to announce its interest rate decision, and there are expectations of further tightening from the central bank. Given the elevated level of inflation, the bank may have little choice but to maintain a hawkish stance.

Last week, the GBPUSD initially tested the support level at the previous resistance of 1.250. However, that brief decline was followed by four consecutive days of significant gains, ultimately reaching a new high for the year.

There was a temporary resistance encountered at a critical level of 1.267. Following tomorrow's rate decision, this level could potentially act as a support area, particularly considering the slight pullback observed in recent days and the elevated RSI (Relative Strength Index).

On the other side of the trade, we have Federal Reserve Chair Jerome Powell's comments on the central bank's ongoing battle against inflation falling short of the market's more hawkish expectations.

During his testimony to lawmakers, Powell acknowledged that inflation remains significantly above the Fed's target and indicated that raising rates could still be a sensible course of action, albeit at a more moderate pace. Traders particularly took note of the term "moderate," which Powell used to qualify the potential rate increases. We still have one more day of testimony from Powell.

#GBPUSD Uptrend Movement With rish:reward=3.5#trading stratergy

#GBPUSD Uptrend Movemet

time frame 3 hours.

breakout from parallel channel.

Buy at 1.20718, Target 1.22331, SL 1.20257

HOPE our analysis is adding value to your site trading Journey.

If yes, Hit like button or boost our ideas. Thank you.

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading

GBPUSD Expected Move 1hr/4hrHello Traders!

1. We see GBPUSD taking curved support with all the bullish scenarios. The market has been in consolidation for a long time.

2. Most expected targets have been marked on the chart.

3. The suggestion is to keep stops tight but definitely not too tight. Do take some buffer.

Do use proper risk management.

Happy Trading!

Profits,

Market's Mechanic.

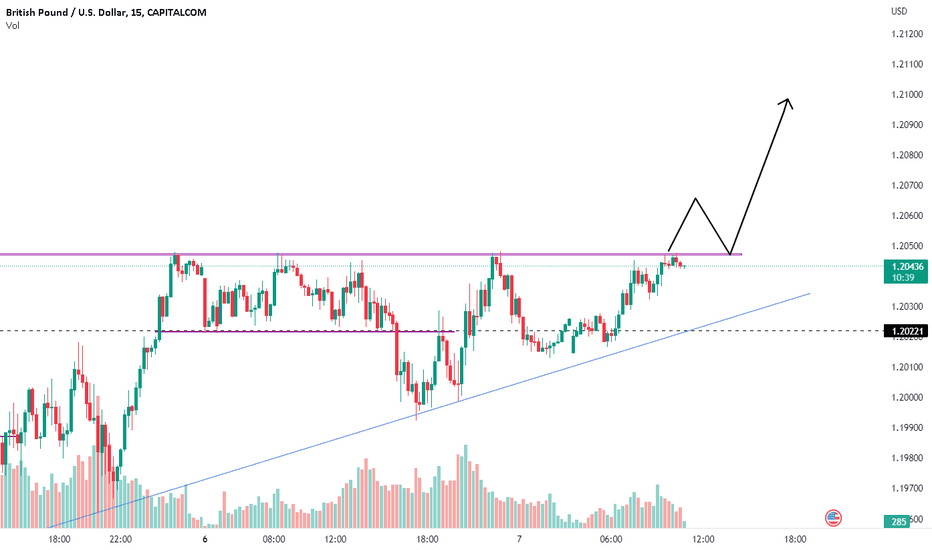

GBPUSD - 15M PROJECTIONDISCLAIMER: The Company accepts no accountability or obligation for your trading and speculation results, and you consent to hold the Company innocuous for any such outcomes or misfortunes. We are not financial advisers or account managers; We are Forex traders. The recordings on this channel are rigorously for educational and amusement purposes. Trading Forex implies dangers, and you can lose all your venture ; consequently, you exclusively must take a chance.

GBPUSD ANALYSIS OVER 30M CHART.GBPUSD is oscillating in a 1.20000-1.2126 range for the past 10 trading sessions.

The 200-EMA around 1.2027 is acting as a major cushion for the cable.

A 40.00-60.00 range oscillating by the RSI indicates of a Potential Trigger.

Looking for Buying Opportunities in it, Proper Risk Management Strategies Suggested.