GBPUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARDGBPUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

Gbpusdsetup

GBP/USD Forming Descending Triangle – Breakdown or Bounce Ahead?GBP/USD on the 15-minute chart is forming a descending triangle pattern, indicating potential bearish continuation pressure. The pair is currently trading around 1.3017, testing the strong horizontal support zone near 1.3010, while lower highs are being capped by a descending trendline resistance.

The 9-period SMA is trending slightly downward, reinforcing short-term bearish momentum. A break below 1.3010 could trigger a sharper move toward the 1.2990–1.2980 area. Conversely, if bulls manage to defend this support and push above the descending trendline, we could see a relief rally toward 1.3035–1.3050.

Trading Plan:

📉 Sell below 1.3010 with targets at 1.2990 / 1.2975, stop loss above 1.3025.

📈 Buy above 1.3035 with targets at 1.3055 / 1.3070, stop loss below 1.3015.

Bias: Bearish while below trendline resistance.

Pattern: Descending Triangle

Timeframe: 15M

📊 Keep an eye on the breakout — the next candle could confirm direction.

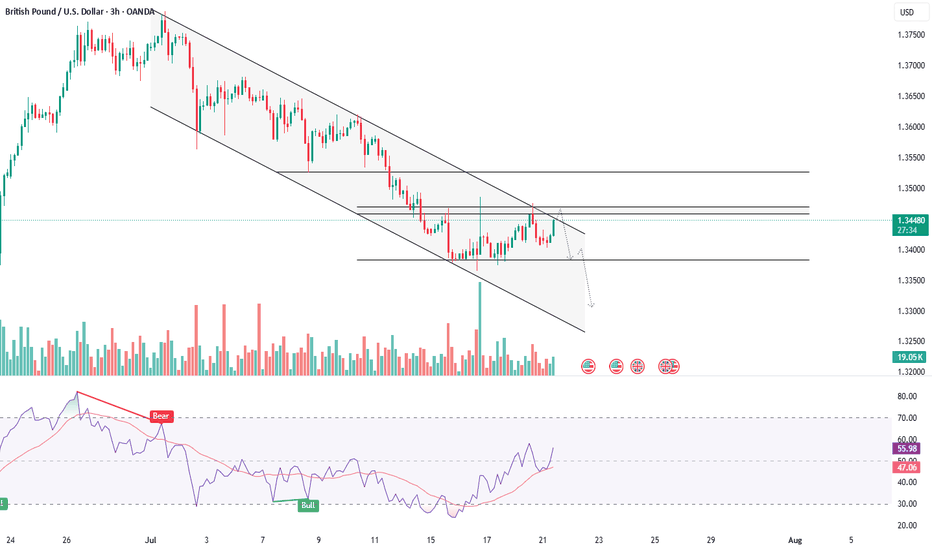

GBPUSD - NEAR RESISTANCE, BEARISH CONTINUATION IN SIGHTSymbol - GBPUSD

CMP - 1.3460

The GBPUSD currency pair is currently undergoing a countertrend correction, aligning with a broader retracement in the US dollar. This movement presents an opportunity for the pair to test the prevailing trend resistance and consolidate within a key liquidity zone. Market participants should closely monitor the immediate resistance level at 1.3467, which coincides with a significant concentration of liquidity pool relative to the local trend structure.

Given the prevailing bearish market sentiment, a confirmed breakout above the 1.3467 resistance level could serve as a potential catalyst for a reversal or short-term pullback, reflecting a reassertion of the dominant downtrend.

Key Resistance Levels: 1.3467

Key Support Levels: 1.3370

Should the pair fail to sustain upward momentum during a retest of the aforementioned liquidity zone, and if the price subsequently falls back below 1.3467, it could signal a renewed opportunity to engage in short positions aligned with the broader trend direction.

GBP/USD Potential Bullish ReversalGBP/USD Potential Bullish Reversal 📈🦾

📊 Technical Analysis Overview:

The chart showcases a well-defined horizontal range between the support (~1.31900) and resistance (~1.36200) zones. The price action has respected these levels multiple times, forming a clear accumulation zone at the bottom and rejection at the top.

🔄 Pattern Formation:

A Rounded Bottom (Cup) structure is visible forming from the June low.

The price made a bullish bounce near the key support level at 1.33930, marked by an orange circle, suggesting a potential higher low formation.

The blue downtrend line from the recent high (red arrow) has been broken, indicating a trend reversal attempt.

📍 Current Price: 1.34494

🎯 Target Zone: 1.35734

🛑 Support to Watch: 1.33930

📈 Bullish Confirmation:

A break above the minor neckline (around current price) would confirm a cup & handle breakout with a projected target of 1.35734.

Strong buying pressure and higher lows are reinforcing bullish strength.

⚠️ Risk Management Tip:

A breakdown below 1.33930 would invalidate the bullish setup and could retest the major support zone (~1.31900).

✅ Bias: Bullish, unless price closes below 1.33930

🕒 Outlook: Short- to Mid-term Upside Potential

GBP/USD Technical Analysis – Bearish Setup Developing!GBP/USD Technical Analysis – Bearish Setup Developing! 🔻

Chart Breakdown (H4):

📌 Resistance Zone (🔴 1.35800 – 1.36000):

The pair has been rejected multiple times from this strong resistance area, marked by multiple upper wicks and bearish pressure. Most recent price action shows another rejection, forming a lower high.

📌 Support Level (🟣 1.34732):

This key horizontal level has acted as a strong support multiple times (highlighted with 🟠 circles), suggesting bulls are attempting to defend this zone.

📉 Bearish Structure Formation:

Price recently tested resistance again and was rejected sharply.

A potential double-top or lower high structure is forming.

A break and close below the 1.34732 support will likely confirm bearish momentum.

📍 Next Target (🔻):

If support breaks, price may fall towards the support demand zone around 1.34150 – 1.34300, aligning with the marked red support box.

📈 Invalidation Point:

A clean breakout and hold above 1.36000 would invalidate this bearish bias and potentially signal continuation higher.

⚠️ Summary:

🔼 Resistance Rejection at 1.36000

🔽 Watching for break below 1.34732

🎯 Bearish target: 1.34300 zone

🔄 Invalidation: Break above 1.36000

Bias: 📉 Bearish Below 1.34732

GBP/USD Short Trade Setup: Reversal from 1.34370 with Target at Entry Point:

Marked at 1.34370, where the analyst anticipates a reversal or price rejection.

Stop Loss:

Positioned above at 1.34975, covering a 2.62% risk margin. This is a protective level in case the price moves against the trade.

Target (Take Profit):

Set at 1.31015, just above a strong support zone around 1.30818. This is where the analyst expects the price to eventually fall.

Resistance Point:

Noted around 1.33007 – 1.32859, acting as an intermediate level of interest and possible price reaction zone.

"GBP/USD Bullish Setup: Eyeing 1.35656 Target "Trend: Bullish 📈

🔵 Price Channel

Price is moving inside an ascending channel 🔼

Top Line: Resistance

Bottom Line: Support

Multiple touchpoints confirm channel validity ●●●●●

📍Current Price: 1.34094

Above the 70 EMA (📉 EMA: 1.33510) ➡️ Bullish Bias ✅

📦 FVG (Fair Value Gap)

Zone: Potential support 🔵 Demand area

Expecting price to dip into this box before going up ⬇️🔵⬆️

🔒 Resistance Zone

Just above the FVG

Price faced rejection here 🚫

🎯 Target Point: 1.35656

Major bullish target for this setup 🚀

Clear sky above if price clears resistance ☁️➡️🌤️

🧠 Trade Idea

Wait for retracement into FVG zone 🔽

Enter Long (Buy) if support holds 💰

TP: 1.35656 🎯

SL: Below the FVG zone ❌

⚠️ Upcoming USD News Events

GBP/USD Bearish Reversal Setup – Targeting 1.27451 (April 2025)"GBP/USD Sell Setup – Bearish Reversal Opportunity

⚙️ Trade Setup Summary

Entry Point (Sell Zone): Around 1.31668

Stop Loss: 1.32638

Take Profit (EA Target Point): 1.27451

Risk-Reward Ratio (R:R):

Risk: 1.32638 – 1.31668 = ~97 pips

Reward: 1.31668 – 1.27451 = ~422 pips

R:R ≈ 1:4.35 – very favorable

📊 Technical Analysis

Supply Zone (Resistance):

The purple zone near 1.31668–1.32638 is likely a key supply area where price previously reversed.

A small rejection wick is already forming near the entry, suggesting potential exhaustion.

Bearish Setup Expectation:

Anticipated reversal at resistance.

The plan likely involves waiting for a bearish confirmation (e.g., pin bar, engulfing candle) in the zone before shorting.

Moving Averages:

Price is above both the red (short-term) and blue (longer-term) moving averages, indicating current bullish momentum.

However, the trade anticipates a trend reversal or deeper retracement.

Target Zone:

The EA Target Point at 1.27451 is positioned at a prior demand/support zone — a logical level for take-profit.

🧠 Trade Thesis

This is a counter-trend trade aiming to catch a reversal from a resistance zone.

Strong confluence from price action and resistance makes this setup compelling, if proper confirmation appears.

⚠️ Risk Considerations

Bullish momentum is still strong, so aggressive entry without confirmation can be risky.

Monitor closely for rejection signs or bearish divergence before entry.

SL above 1.32638 provides safety buffer against stop hunts or spikes.

✅ Potential Title Suggestions

"GBP/USD Bearish Setup – Reversal from Resistance Targeting 1.2745"

"GBP/USD Short Trade Plan – Sell at 1.31668, Target 1.27451"

"GBP/USD Sell Opportunity – High R:R Bearish Setup

GBPUSD - BULLS NEED TO EXERCISE CAUTION - NEWS AHEADSymbol - GBPUSD

CMP - 1.2937

The GBPUSD pair has shown impressive bullish strength recently, continuing its upward move against the US dollar. This strength can be attributed to aggressive sell-off of the US dollar, which has created a favorable environment for the British pound. The pair is currently trading in a critical zone, with consolidation at the 1.2920 - 1.2940 levels, making it a pivotal point for future price action.

From a technical standpoint, I previously shared my analysis when GBPUSD was trading around the 1.2460 levels, identifying a strong breakout, and I'm pleased to report that all the targets I set have been reached.

However, the current situation remains complex, with crucial economic data due to be released shortly. US JOLTs job openings data is expected later today, followed by CPI data tomorrow. These releases will have a significant impact on the US dollar, which in turn will influence GBPUSD. Given that the US dollar index (DXY) is trading at oversold levels, if the upcoming data comes more than forecast, we could see a strong rebound in the US dollar, potentially pushing GBPUSD lower. However, if the data comes lower than expected reading, it could trigger another corrective move in the DXY & an up move in GBPUSD. Despite this, I believe such a move would be a false breakdown in DXY, with the US dollar likely to recover and strengthen in the medium term.

In the event of weaker than forecast data, the GBPUSD pair could see a push towards the 1.3050-1.3080 levels. These levels represent strong resistance zones, where the pair is likely to encounter selling pressure. Should GBPUSD reach these levels, a reversal back towards lower levels is highly probable.

Key Support Levels: 1.2920, 1.2900

Key Resistance Levels: 1.2950, 1.3000, 1.3060

As key support for the pair is at 1.2920-1.2900, and a strong break below these levels could signal a potential shift in trend. On the other hand, resistance levels lie around 1.2950. If the bulls manage to push past these levels, we may see further price growth till 1.3050-1.3080. However, bulls should exercise caution at current levels. Any reversal could occur sooner than expected, given the prevailing market conditions and upcoming economic data releases.

In conclusion, the fate of GBPUSD heavily depends on the upcoming US economic data. Traders should closely monitor the JOLTs and CPI data, as these will likely dictate the next move for the pair.

GBPUSD - TREND REVERSAL?Symbol - GBPUSD

GBPUSD is attempting to capitalize on a potential trend reversal amid the ongoing correction of the U.S. dollar. The price is currently testing a key resistance level within a consolidation phase, indicating a possible breakout. On the daily timeframe, the price remains above the previously breached trendline, with the effort to surpass the resistance providing insights into market sentiment. A continued correction in the dollar could benefit the British pound, particularly if the U.S. Dollar Index breaks below 107 and moves toward the 106-105 range.

From a technical perspective, attention is centered on the 1.257 level, which acts as a crucial resistance threshold. A sustained break and consolidation above this level may trigger a rally.

Resistance levels: 1.2575, 1.2718

Support levels: 1.250, 1.2377

I do not rule out the possibility of a retest of the 1.250 support level to accumulate liquidity before further upward movement. The dollar is expected to continue its correction following remarks from Trump and Powell regarding potential rate cuts.

GBPUSD - BULLISH MOMENTUM TO CONTINUESymbol - GBPUSD

The GBPUSD pair has been showing strong bullish momentum, particularly after the reversal from the mid-January low and the recent rise back to 1.2500 The price action suggests potential for further upside, with 1.2700 emerging as the next key resistance level. Buying the dips remains the most favorable strategy in this context.

Currently, the price is attempting a local trend reversal. It has breached the resistance of the descending price channel and is consolidating above this level, within the buying zone. The underlying fundamental conditions, however, remain complex and unstable, influenced significantly by President Trump's policies and the ongoing tariff disputes with various countries. Sudden, sharp statements continue to have a notable impact on market sentiment.

Technically, the price is breaking through the resistance of a prolonged downtrend, offering an opportunity for a shift in the local trend. A breakout above the resistance at 1.2490, followed by consolidation above this level, could encourage further bullish momentum.

Key resistance levels: 1.2490, 1.2600, 1.2750

Key support levels: 1.2415, 1.2380

The price may test the previously broken channel resistance before continuing its upward movement. However, the 1.2490 level remains crucial. Should the bulls maintain support above this area, the currency pair may experience a short-term rally.

GBPUSD - READY FOR ANOTHER FALL ?Symbol - GBPUSD

The GBPUSD is currently testing the resistance level within its downtrend, but the price lacks the momentum to break through this range. Anticipation of upcoming news could further reinforce the downward movement. On the daily chart, the price is also exhibiting a false breakdown at a relatively significant level, reinforcing the notion that the market remains within the selling zone. The upcoming Federal Reserve meeting is expected to maintain the current interest rate, but the key focus will be on Chairman Powell's speech. Should his remarks lean towards a hawkish stance, which seems the most probable scenario, the US dollar may strengthen, potentially exerting downward pressure on the GBP.

From a technical perspective, the most substantial price movements typically occur following false breakouts.

Resistance levels: 1.2490

Support levels: 1.2415, 1.2380

A retest of the trend resistance resulting in a false breakout, followed by consolidation below the resistance line, could lead to further downward momentum. A break below the support level at 1.2415 would likely trigger additional selling. In the absence of unexpected news, the currency pair may decline towards the 1.2240 level.

I will be looking to enter a short trade in the 1.2480 - 1.2520 range, with a stop loss at 1.2550 and a target of 1.2340.

GBPUSD LONG - TRADE IDEA FOR HUGE PROFITSymbol - GBPUSD

GBPUSD is currently trading at 1.2310

I'm seeing a trading opportunity on buy side.

Buying GBPUSD pair at CMP 1.2310

I will be adding more if 1.2270 comes & will hold with SL 1.2240

Targets I'm expecting are 1.2430 - 1.270 & above

Disclaimer - Do not consider this as a buy/sell recommendation. I'm sharing my analysis & my trading position. You can track it for educational purposes. Thanks!

GBPUSD R:R 1:4 SetupIt just reacted the imbalance zone and the zone already created the EQL High behind that.

And CMP were already created the EQL Low and now creating trendline liquidity.

Wait for CHOCH while reached the Sell zone. Then Enter the market.

Please do your own research before entering the trade

GBPUSD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD GBPUSD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

GBPUSD SETUP TRADE WIH 1:20 RISK REWARDGBPUSD SETUP TRADE WIH 1:20 RISK REWARD

A good selling setup detected on EURUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD SETUP TRADE WIH 1:20 RISK REWARD

A good selling setup detected on GBPUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD SETUP TRADE WIH 1:5 RISK REWARDGBPUSD SETUP TRADE WIH 1:5 RISK REWARD

A good selling setup detected on GBPUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD SETUP TRADE WIH 1:5 RISK REWARD

A good selling setup detected on GBPUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD Order Block | SWING TRADEGBPUSD 4 hr Order Block | SWING TRADE

Hi traders,

This GBPUSD 4 hr Order block.

According to smc concept we can see Buying from this level.

Best time to take this trade after 15 CHoCH.

Note - Only for education purpose

If you like my anaylsis then you should like and follow me.

GBP/USD - Liquidity Trap the price has started mitigating the unmitigated bearish order block from higher time frame

and

it will look like descending triangle pattern with equal lows and and descending price

it just liquidity pool

even if it get breakout still there is resistance at 1.2900 - 1.2950 - 1.3000

SUPPORT range between 1.2550 - 1.2500 but is weak

1.2300 and 1.2200 hold more potential to get buyer's order limits