Gbpusdtrade

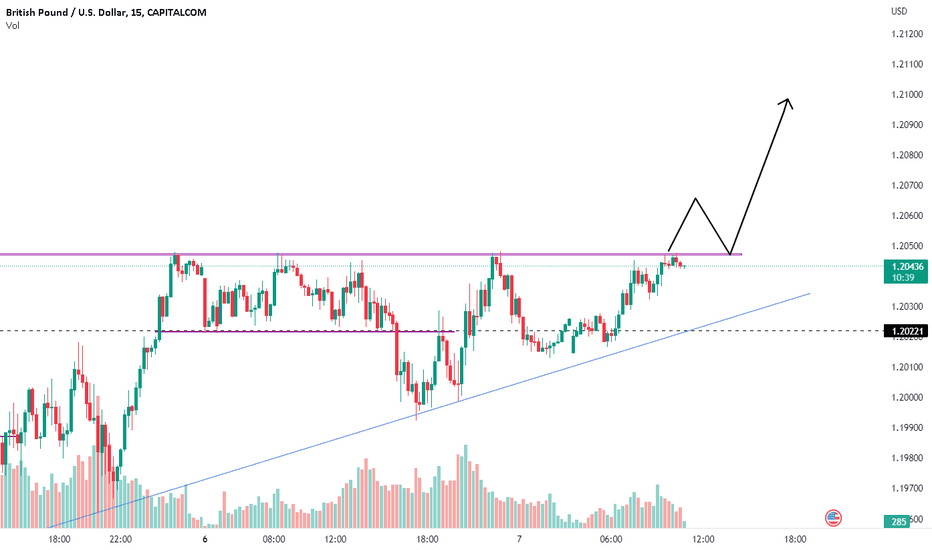

GBPUSD R:R 1:4 SetupIt just reacted the imbalance zone and the zone already created the EQL High behind that.

And CMP were already created the EQL Low and now creating trendline liquidity.

Wait for CHOCH while reached the Sell zone. Then Enter the market.

Please do your own research before entering the trade

GBPUSD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD GBPUSD SHOWING A GOOD UP MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the market potential for break

C. also its resisting from a strong neckline the neckline also got weeker ald the price is ready to break in the outer region

all of these reason are indicating the same thing its ready for breakout BREAKOUT trading are follws good risk reward

please dont use more than one percentage of your capitalfollow risk reward and tradeing rules

that will help you to to become a bettertrader

thank you

GBPUSD SETUP TRADE WIH 1:5 RISK REWARDGBPUSD SETUP TRADE WIH 1:5 RISK REWARD

A good selling setup detected on GBPUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD SETUP TRADE WIH 1:5 RISK REWARD

A good selling setup detected on GBPUSD

It's showing a BEAR MOVE due to these reason

1. It's following THE 60 M trendline here

2. It's ready to break the neckline

3. In day chat it's showing the heavy BEARISH pressure

Just grab out will your own risk

With a small amount

Stay connected

Stay happy

Bande mataram

GBPUSD Order Block | SWING TRADEGBPUSD 4 hr Order Block | SWING TRADE

Hi traders,

This GBPUSD 4 hr Order block.

According to smc concept we can see Buying from this level.

Best time to take this trade after 15 CHoCH.

Note - Only for education purpose

If you like my anaylsis then you should like and follow me.

GBP/USD - Liquidity Trap the price has started mitigating the unmitigated bearish order block from higher time frame

and

it will look like descending triangle pattern with equal lows and and descending price

it just liquidity pool

even if it get breakout still there is resistance at 1.2900 - 1.2950 - 1.3000

SUPPORT range between 1.2550 - 1.2500 but is weak

1.2300 and 1.2200 hold more potential to get buyer's order limits

FOMC Minutes in the Charts: EUR/USD & GBP/USD FOMC Minutes in the Charts: EUR/USD & GBP/USD

During their June meeting, minutes released on Wednesday indicated that almost all Federal Reserve officials expect further tightening in the future. Despite the majority's belief in upcoming rate hikes, policymakers chose not to increase rates due to concerns about over-tightening. They acknowledged the delayed impact of previous policies and other factors, which led them to skip the June meeting after implementing ten consecutive rate increases.

Out of the 18 participants, all but two anticipated at least one rate hike to be appropriate within this year, while twelve members expected two or more hikes.

The prevailing consensus that the US central bank will raise borrowing costs by 25 basis points at the end of the July policy meeting has lent some strength to the US Dollar and exerted downward pressure on the GBP/USD and EUR/USD. The DXY (US Dollar Index) surged above 103.30, reaching its highest level of the week.

EUR/USD further declined to the 1.0850 region. The outlook for the Euro has turned negative as the EUR/USD pair dropped below the 20-day simple moving average (SMA).

If the GBP/USD pair falls below 1.2700 and confirms that level as resistance, the next potential bearish targets could be 1.2680, 1.2658, 1.2647 according to fib retracement levels and previously pivot points.

Resistance at 1.267: Key Level to Watch After BoE Rate Decision

The UK continues to struggle with high inflation, as demonstrated once again this morning when headline inflation exceeded expectations at 8.7%, surpassing the projected 8.4%. Core inflation also outperformed, registering a 7.1% figure compared to the expected 6.8%. This divergence emphasizes the contrast between the UK and its counterparts in the US and Europe.

Tomorrow, the Bank of England is set to announce its interest rate decision, and there are expectations of further tightening from the central bank. Given the elevated level of inflation, the bank may have little choice but to maintain a hawkish stance.

Last week, the GBPUSD initially tested the support level at the previous resistance of 1.250. However, that brief decline was followed by four consecutive days of significant gains, ultimately reaching a new high for the year.

There was a temporary resistance encountered at a critical level of 1.267. Following tomorrow's rate decision, this level could potentially act as a support area, particularly considering the slight pullback observed in recent days and the elevated RSI (Relative Strength Index).

On the other side of the trade, we have Federal Reserve Chair Jerome Powell's comments on the central bank's ongoing battle against inflation falling short of the market's more hawkish expectations.

During his testimony to lawmakers, Powell acknowledged that inflation remains significantly above the Fed's target and indicated that raising rates could still be a sensible course of action, albeit at a more moderate pace. Traders particularly took note of the term "moderate," which Powell used to qualify the potential rate increases. We still have one more day of testimony from Powell.

GBPUSD trading setup for next weeks and monthsGBPUSD is right now testing at weekly resistance and also been rising for last 6 weeks . It may seem for correction here at this moment with target at fib. retracement at 61.8 .

Stop loss just above the weekly resistance . You can trade accordingly with proper risk management . Also , this week we have BoE interest rate decision in view and also the GDP report on friday.

Be cautious on these days

Happy trading

GBPUSD CAPITALCOM:GBPUSD

As you can see in GBPUSD pair is in consolidation since Dec 22 (long time ) and now it is near to the resistance, if it rejects the resistance level and come down then we can plan for sell side with the conformation of pull back entries. Plan your trade accordingly.... (4 HR time frame)

GBPUSD Downtrend movement; RISK :Reward Ratio=2.9 #FOREX#GBP #USD #GBPUSD, #NASDAQ, #CURRENCY, #CURREYPAIRS, #FOREX @GBPUSD

#GBPUSD DOWNWARD movement potential with risk: reward ratio 2.9.

SELL at 1.1985 with SL 1.2060 and Target is 1.17750

Hey Traders,

HOPE our analysis is adding value to your Stock market trading Journey.

If yes, cheer us with Thumbs up...

NOTE: Published Ideas are for ‘’EDUCATIONAL PURPOSE ONLY’’ trade at your own risk.

NOTE: RESPECT The risk. SL should not be more than 2% of the capital.

Happy Trading