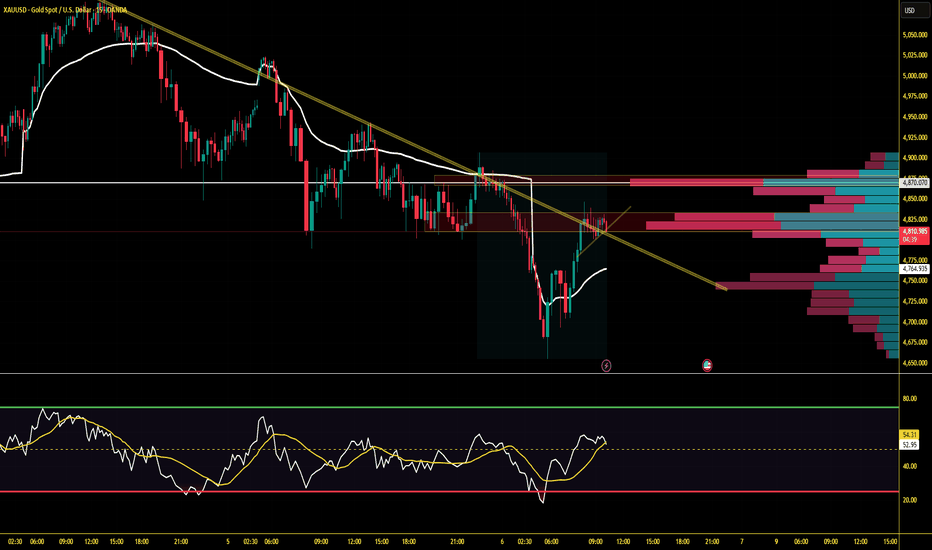

XAUUSD | 15-Minute Intraday Analysis | Sell on Rise(Intraday)XAUUSD | 15-Minute Intraday Analysis | Sell on Rise(Intraday)

Symbol: XAUUSD

Timeframe: 15 Minutes

Bias: Bearish (Intraday)

🧠 Trade Logic

In a bearish trend, pullbacks are for selling, not buying.

Wait for rejection confirmation near resistance.

🔍 Technical Breakdown

The market is respecting a strong descending trendline

EMA cluster acting as a dynamic resistance

Price is currently testing EMA + trendline + volume resistance

VoLume Profile shows heavy supply around 4830–4860

RSI recovered from oversold but stuck near 50–55, no trend reversal confirmation

🔴 Sell Scenario (High Probability)

📍 Sell Zone: 4830 – 4860

📉 Targets:

TP1: 4800

TP2: 4765

TP3: 4720

🛑 Invalidation:

Strong 15M candle close above 4880

🟢 Buy Scenario (Only if Condition Met)

⚠️ Counter-trend setup

Buy only if 15M closes above 4880

EMA Structure must flip bullish

Targets: 4910 → 4950

📌📌📌 Notes📌📌📌

Best suited for intraday traders

Avoid emotional entries inside the range

Trade with confirmation, not prediction

📊 Indicators Used

EMA (Multi)

RSI

Volume Profile

Trendline Structure

GOOD

Option chain in trading What is Implied Volatility (IV)? Implied Volatility (IV) uses an option price to determine and calculate what the current market is talking about, the future volatility of the option's underlying stock. Implied volatility is one of the six essential factors used in options pricing models.

The Nifty Option Chain provides a listing of all the available options contracts for the Nifty 50 Index; including the strike prices, expiry dates, and the corresponding premiums. The list shows all call and put options that are available against a specific underlying.

GOOD --BUY -- HINDALCO GOOD - BUY-- HINDALCO --DAILY CHART SETUP .

1. Hindalco trading at upper channel on daily chart .

2. Currently stock trading at lower support at upper channel , at near strong support line. so as GOOD BUY LEVEL at risk reward ratio.

3. DAILY CHART trix line shows at oversold level as well as at positive crossover

4. one can initiate BUY 420-425 for target 450-480-500 + short to mid term STOP LOSS 399 bellow strong support line

5. RISK REWARD RATIO 1.4 fom current level

** THIS IDEA IS FOR EDUCATIONAL PURPOSE ..trade at own risk !!

HAPPY TRADING. !!

IEX -- Good days ahead .IEX -- Monthly chart --look like good days ahead,

1. After sharp fall from 300 sub level stock seen above 21 HMA after many months as current month candle . if this candle manage to close above 21 HMA , stock again will be positive zone

2. Rounded Bottom cup form seen , bottom formation seen 125-30 sub level .

3. Near RSI , ema Positive crossover, this crossover will confirm trend reversal .

4, Potential upside 100% From current level ENTRY .. 135-138 target 150-180-200-220 stop loss bellow support level at 115

5. RISK REWARD ratio 1:4 from current level

** THIS IDEA IS FOR EDUCATIONAL PURPOSE .. ** TRADE AT OWN RISK !!

* HAPPY TRADING .!!

STOCK WITH FUNDAMENTALS---IT'S TATA.(BIG MOVE CAN BE EXPECTED)Dear Traders,

Please find this fundamentally strong stock a huge winner in short term. As it is consolidating after giving goods returns. Also, after breakout selling pressure is minimal in front of bulls. Put your stop loss as per your risk capacity. I would personally wait for good RR ratio.

next year target above 49 finalized ?Yes , Now it is consolidating in it's range but once it breaks its trend line with volume and remains there ,

It wont take time to reach 49+...

NOW , FUNDAMENTALS::

Indian Railway Finance Corporation (IRFC) will raise up to Rs 3,000 crore through issuance of unsecured,

redeemable, taxable non-convertible debentures (NCD) maturing in 10-year.

The NCDs have a base issue of Rs 500 crore, with retain oversubscription of Rs 2,500 crore.

I've completed my analysis of IRFC . My target is that it will go down to 23 or 1 or 2 rupees dip more..

rupees in these days if market takes correction otherwise it will start it's rally till 50 rupees.

TARGET OF PRICE RALLY IN IRFC FOR 1-2 YEARS

Upside target 124.05

Upside target 112.77

Upside target 24.28

Downside Target 23.99

Downside Target 23.64

Downside Target 23.3

Downside Target 23.24

Downside Target 20.92

Bond 8.00% Pa Tax Free S1 IRFC Opened at 24.85 & Closed at 24.15 and moved inside a range of 24.05-24.95

PRICE ALLY IN IRFC FOR LONG TERM NVESTMENT

Upside Price target 1224.55

Upside Price target 1165.00

Upside Price target 1151.00

Upside Price target 1140.01

Upside Price target 25.46

Upside Price target 25.11

Upside Price target 24.64

Downside Price target 23.89

GUYS I LOVE THIS STOCK FOR INVESTMENT F YOU WANT TO DOUBLE OR TRIPPLE YOUR MONEY JUST INVEST ALL YOUR MONEY ...

(as per your knowledge )