$ASTER PRICE FORECAST | CAN ASTER HIT $10–$15? | ANALYSIS BY CPBINANCE:ASTERUSDT | Breakout Structure From HTF Accumulation | TA By CryptoPatel

ASTER is trading at a high-timeframe accumulation base following a prolonged corrective phase. Price compression near demand indicates trend exhaustion with increasing probability of a bullish expansion.

Technical Structure

Accumulation range holding: 0.65 – 0.75

Descending trendline pressure building

Strong demand reaction inside accumulation zone

Volatility contraction → expansion setup

Key Levels

Bullish While Above: 0.65

Invalidation: Daily close below 0.60

Upside Targets: $1.50/$2.00/$5.00/$10.00/$15.00

If price accepts above the range high, structure supports a multi-leg continuation move.

😄 Fun Note: Market whispers say even CZ might be quietly watching ASTER, accumulation phases tend to attract smart eyes.

Disclaimer: This is technical analysis, not financial advice. Markets are probabilistic. Manage risk accordingly.

Harmonic Patterns

HINDPETRO 1 Week Time Frame 📌 Latest Price (Reference)

HPCL is trading around ₹474 – ₹490 on NSE recently.

📊 Key Weekly Technical Levels (Support & Resistance)

🟩 Support Levels (Buy Zones)

These are levels where the price may find buying interest this week:

Strong Support: ₹469 – ₹472

Secondary Support: ₹466

Lower Weekly Support: ₹460

Deeper Support (if extended pullback): ₹454 – ₹449 (weekly pivot zone)

👉 If price stabilizes above ₹469, weekly trend remains bullish.

🟥 Resistance Levels (Sell / Barrier Zones)

Levels where upward moves may slow or reverse:

Immediate Resistance: ₹478 – ₹481

Next Resistance: ₹484 – ₹486

Stretch Resistance: ₹490 – ₹494 (near recent 52‑week high)

👉 A weekly close above ₹481–₹484 signals continuation toward ₹490+.

📍 Weekly Pivot & Structure

Weekly Pivot (central reference): ~₹448.9 — above this level is short‑term bullish structure.

📈 Trend & Momentum Indicators (Confirming the Setup)

RSI and Moving Averages on short/mid timeframes are signaling bullish bias currently, indicating strength on weekly charts.

📌 Summary – Weekly Level Table

Level Type Price Zone

Major Support ₹469–₹472

Weekly Pivot ~₹449

Initial Resistance ₹478–₹481

Higher Resistance ₹484–₹486

Stretch Target ₹490–₹494

TORNTPOWERTORNTPOWER

bullish trend is Showing on the chart.

buy signals in

technical indicators and

1- Bouncing back from support

2- Holding up well

3- Tightness Breakout.

BUYING RANGE 1335/1345

1188 / 1200 Major demand Zone

1400 /1421 Mid-range acceptance

1630 / 1650 Range high / neckline

1,950 / 2,030 Measured move / pattern target

BAJAJ-AUTO 1 Week Time Frame 📈 Current Price Context (Approx)

Bajaj Auto trading around ₹9,000–9,600 range recently (data from live quotes).

🔹 Weekly Resistance Levels

These are key upside levels where price may face selling pressure on a weekly chart:

1. ~₹9,650–₹9,700 — First major resistance zone

2. ~₹9,800–₹9,920 — Stronger resistance band

3. ~₹10,000+ — Higher breakout zone if trend continues up

(above this, momentum can accelerate)

Weekly resistance summary (approx):

R1 ~ ₹9,650

R2 ~ ₹9,800–9,920

R3 ~ ₹10,000+

🔻 Weekly Support Levels

These are key downside levels that might act as support in a correction on the weekly timeframe:

1. ~₹9,331–₹9,380 — Short-term weekly support

2. ~₹9,150–₹9,200 — Important weekly zone

3. ~₹9,000 — Psychological and minor weekly support

4. ~₹8,800–₹8,900 — Stronger lower support (break here could weaken trend)

Weekly support summary (approx):

S1 ~ ₹9,330

S2 ~ ₹9,150–₹9,200

S3 ~ ₹9,000

Lower support ~ ₹8,800–₹8,900

📊 Trend & Momentum Indicators

Weekly/daily technical indicators broadly show buy signals / positive trend structure (moving averages mostly below price) — suggesting upside continuation if major resistance zones are taken out.

(HFT): Speed, Strategy, and Structure in Modern Financial Market1. Introduction to High-Frequency Trading

High-Frequency Trading (HFT) is a specialized form of algorithmic trading that uses powerful computers, ultra-fast data connections, and complex algorithms to execute a very large number of trades within extremely short timeframes—often in microseconds or nanoseconds. The core idea behind HFT is not long-term investment or fundamental valuation, but exploiting tiny price discrepancies, liquidity gaps, and order-flow dynamics that exist for fractions of a second in modern electronic markets.

2. Evolution of HFT

HFT emerged with the digitization of stock exchanges and the shift from floor-based trading to electronic order books.

The introduction of electronic communication networks (ECNs) and decimalization of prices created smaller spreads, which favored speed-based strategies.

Over time, advancements in hardware, co-location services, and fiber-optic networks accelerated HFT growth globally.

Today, HFT firms are among the most technologically advanced participants in financial markets.

3. Core Characteristics of HFT

Ultra-low latency: Execution speed is the primary competitive advantage.

High order-to-trade ratio: Thousands of orders may be placed and canceled to execute a few profitable trades.

Short holding periods: Positions are often held for seconds, milliseconds, or even less.

Automation: Human intervention is minimal once systems are live.

Scale-driven profits: Individual trade profits are tiny, but cumulative volume generates returns.

4. Key Technologies Behind HFT

Algorithmic engines: Sophisticated models analyze market data and make instant trading decisions.

Co-location: Servers are placed physically close to exchange servers to reduce transmission time.

High-speed networks: Microwave, laser, and fiber-optic communication links minimize latency.

Specialized hardware: Field-programmable gate arrays (FPGAs) and GPUs accelerate data processing.

Market data feeds: Direct feeds are preferred over consolidated feeds for faster and richer information.

5. Common HFT Strategies

Market Making:

Continuously quoting buy and sell prices to capture bid-ask spreads.

Requires rapid adjustment to inventory risk and volatility changes.

Statistical Arbitrage:

Exploits short-term pricing inefficiencies between correlated securities.

Relies heavily on quantitative models and real-time data.

Latency Arbitrage:

Profits from being faster than other market participants in reacting to price changes.

Often controversial due to fairness concerns.

Event-Based Trading:

Reacts instantly to news releases, economic data, or order book changes.

Speed of information processing is crucial.

Cross-Market Arbitrage:

Takes advantage of price differences across exchanges or asset classes.

6. Role of HFT in Market Liquidity

HFT firms contribute significantly to daily trading volume in equities, futures, and FX markets.

By constantly placing bids and offers, they often narrow bid-ask spreads.

Improved liquidity can reduce transaction costs for other participants.

However, liquidity provided by HFT can be fragile, disappearing during periods of extreme volatility.

7. Impact on Price Discovery

HFT accelerates the incorporation of new information into prices.

Prices adjust more rapidly to supply-demand imbalances.

Short-term efficiency improves, but long-term price discovery still depends on institutional investors and fundamentals.

Some critics argue HFT amplifies noise rather than meaningful signals.

8. Risks Associated with HFT

Systemic risk:

Automated strategies can interact unpredictably, leading to market instability.

Flash crashes:

Sudden, severe price drops caused by feedback loops among algorithms.

Technology failures:

Software bugs or hardware glitches can cause massive losses in seconds.

Operational risk:

Errors scale rapidly due to high trade frequency.

Regulatory risk:

Changing rules can quickly render strategies unviable.

9. Regulatory Environment

Regulators globally monitor HFT closely due to its market impact.

Measures include:

Circuit breakers to halt trading during extreme moves.

Order-to-trade ratio limits to discourage excessive cancellations.

Tick size regulations to control minimum price movements.

In India, SEBI has introduced controls like algorithm approval, mock testing, and stricter surveillance.

The regulatory balance aims to encourage innovation while protecting market stability.

10. Ethical and Fairness Debate

Critics argue HFT creates an uneven playing field favoring firms with superior technology.

Concerns exist over front-running-like behavior and information asymmetry.

Supporters claim HFT improves efficiency, lowers costs, and modernizes markets.

The debate centers on whether speed alone should be a source of profit.

11. Economics of HFT Firms

High fixed costs: infrastructure, data feeds, talent, and compliance.

Low marginal costs per trade once systems are established.

Profitability depends on scale, consistency, and risk control.

Competition is intense, with margins shrinking as strategies become crowded.

12. Skills Required to Operate in HFT

Quantitative finance: Probability, statistics, and stochastic modeling.

Computer science: Low-level programming (C++, Java), systems optimization.

Market microstructure knowledge: Understanding order books, liquidity, and flow.

Risk management: Real-time monitoring and kill-switch mechanisms.

Discipline and testing: Extensive backtesting and simulation before deployment.

13. HFT vs Traditional Trading

Traditional trading focuses on fundamentals, technical analysis, and longer horizons.

HFT focuses on microstructure inefficiencies and speed.

Time horizon, data usage, and risk profiles differ significantly.

Both coexist, serving different roles in the market ecosystem.

14. Future of High-Frequency Trading

Margins are likely to continue shrinking due to competition.

Innovation will shift toward:

Machine learning for adaptive strategies.

Alternative data sources.

More efficient risk controls.

Regulatory scrutiny will remain high.

HFT will evolve rather than disappear, becoming more integrated with broader quantitative trading.

15. Conclusion

High-Frequency Trading represents the cutting edge of modern financial markets, where technology, speed, and quantitative intelligence converge. While it enhances liquidity and efficiency under normal conditions, it also introduces complexity, ethical questions, and systemic risks. Understanding HFT is essential for anyone seeking a deep insight into how today’s electronic markets truly function—beyond charts and fundamentals—at the microsecond level where prices are actually formed.

How Digital Businesses Build Sustainable and Scalable EarningsUnderstanding the Nature of E-Commerce Profits

Unlike traditional brick-and-mortar businesses, e-commerce operates with lower physical infrastructure costs but higher digital and logistics complexity. Profits are derived from the difference between revenue and total costs, which include product sourcing, platform maintenance, marketing, fulfillment, customer service, and technology investments. The key advantage of e-commerce lies in scalability: once systems are built, businesses can increase sales volume without a proportional increase in fixed costs, allowing profit margins to expand over time.

However, this scalability is offset by intense competition and price transparency. Consumers can compare prices instantly, pressuring sellers to operate efficiently. As a result, e-commerce profits depend less on simple markups and more on optimizing the entire value chain—from supplier negotiations to last-mile delivery.

Revenue Drivers in E-Commerce

E-commerce profits begin with strong revenue generation. This is driven by multiple factors, including product selection, pricing strategy, customer acquisition, and repeat purchases. Successful e-commerce companies focus on high-demand products with favorable margins, whether through private labeling, exclusive sourcing, or differentiated offerings.

Pricing strategies play a crucial role. Dynamic pricing, bundling, subscription models, and personalized discounts help maximize revenue per customer. Additionally, increasing average order value through cross-selling and upselling directly improves profitability without increasing marketing costs. Repeat customers are particularly valuable, as the cost of acquiring them is already sunk, making subsequent purchases more profitable.

Cost Structure and Margin Management

Managing costs is central to e-commerce profitability. The main cost components include cost of goods sold (COGS), digital marketing expenses, logistics and fulfillment, platform fees, and customer support. Businesses that can negotiate better supplier terms, source directly from manufacturers, or build strong private brands often enjoy higher gross margins.

Marketing costs are one of the largest challenges. Paid advertising on search engines and social media has become increasingly expensive, compressing margins. Profitable e-commerce businesses balance paid acquisition with organic channels such as search engine optimization (SEO), content marketing, email marketing, and community building. Over time, reducing dependency on paid ads significantly improves net profits.

Logistics efficiency is another major profit lever. Optimizing warehousing, inventory management, packaging, and shipping reduces costs and improves delivery speed, which in turn boosts customer satisfaction and retention. Companies that master supply chain efficiency often outperform competitors even in low-margin categories.

Role of Technology and Data in Profit Optimization

Technology is a powerful driver of e-commerce profits. Advanced analytics help businesses understand customer behavior, forecast demand, manage inventory, and personalize marketing. Data-driven decision-making allows firms to allocate resources more efficiently, reduce waste, and improve conversion rates.

Automation also plays a critical role. Automated order processing, inventory updates, customer support chatbots, and AI-driven recommendations lower operational costs while enhancing the customer experience. As automation increases, profit margins improve due to reduced labor dependency and fewer operational errors.

Customer Lifetime Value and Profit Sustainability

Long-term e-commerce profits depend on maximizing customer lifetime value (CLV). Rather than focusing solely on one-time sales, successful businesses build relationships that encourage repeat purchases and brand loyalty. Loyalty programs, personalized communication, excellent customer service, and consistent product quality all contribute to higher CLV.

Retention-focused strategies are often more profitable than aggressive acquisition campaigns. A small increase in retention rates can lead to a significant rise in profits, as repeat customers typically spend more and require less marketing investment. Sustainable e-commerce profitability is therefore closely tied to trust, brand reputation, and customer experience.

Scaling Profits Through Market Expansion

One of the most attractive aspects of e-commerce is the ability to scale profits by expanding into new markets. Cross-border e-commerce allows businesses to reach global customers without establishing physical stores. While this introduces complexities such as currency management, taxation, and international logistics, the potential profit upside is substantial.

Additionally, expanding product lines, entering adjacent categories, or offering digital products and services can diversify revenue streams and stabilize profits. Many mature e-commerce companies leverage their existing customer base to introduce higher-margin offerings, further enhancing profitability.

Challenges and Risks to E-Commerce Profits

Despite its potential, e-commerce profitability faces several risks. Intense competition can lead to price wars, shrinking margins. Rising customer acquisition costs, increasing logistics expenses, and platform dependency (such as reliance on large marketplaces) can erode profits.

Regulatory changes, data privacy laws, and taxation policies also impact profitability, particularly for cross-border sellers. Cybersecurity risks and operational disruptions can result in financial losses and reputational damage. Profitable e-commerce businesses actively manage these risks through diversification, compliance, and robust technology infrastructure.

Conclusion

E-commerce profits are the result of a complex interplay between revenue growth, cost control, technology adoption, and customer relationship management. While the digital nature of e-commerce enables rapid scaling and global reach, sustained profitability requires strategic discipline and continuous optimization. Businesses that focus on efficient operations, data-driven decisions, strong branding, and long-term customer value are best positioned to generate consistent and growing profits. In an increasingly competitive digital marketplace, e-commerce success is not just about selling more—but about building smarter, leaner, and more resilient profit engines.

The Principles That Separate Consistent Winners from the Crowd1. Trading Is About Probabilities, Not Certainty

One of the most important trading secrets is accepting uncertainty. Markets are influenced by countless variables—economic data, institutional flows, geopolitics, sentiment, and algorithms. No trader, regardless of experience, can predict outcomes with certainty. Successful traders think in probabilities. They know that even the best setup can fail, and a mediocre setup can succeed.

Instead of asking, “Will this trade work?”, professionals ask, “Does this trade have a statistical edge over many repetitions?” Once trading is approached as a probability game, emotional attachment to individual trades disappears. Losses become part of the business, not personal failures.

2. Risk Management Is More Important Than Entry

Beginners obsess over finding the perfect entry. Professionals obsess over managing risk. This is one of the least glamorous but most powerful trading secrets. Even with an average win rate, a trader can be profitable if losses are controlled and winners are allowed to grow.

Key elements of risk management include:

Fixed risk per trade (often 0.5%–2% of capital)

Predefined stop-loss levels

Favorable risk–reward ratios

Avoiding overexposure and correlation risk

Many traders fail not because their strategy is bad, but because one or two oversized losses wipe out months of gains. Survival is the first objective in trading.

3. Psychology Is the Real Battleground

Markets exploit human emotions—fear, greed, hope, and regret. A major trading secret is that the market doesn’t defeat traders; traders defeat themselves. Emotional decision-making leads to chasing price, revenge trading, holding losing positions, and exiting winning trades too early.

Successful traders cultivate emotional neutrality. They follow their plan whether they feel confident or afraid. This psychological discipline comes from:

Having a clearly defined trading plan

Journaling trades and emotions

Reducing position size to manageable levels

Accepting losses calmly

Consistency in mindset matters more than intelligence or speed.

4. Simplicity Beats Complexity

Many assume that complex strategies are superior. In practice, the opposite is often true. Simple strategies—based on market structure, trend, support and resistance, or momentum—tend to be more robust and easier to execute consistently.

Complex systems increase:

Analysis paralysis

Conflicting signals

Emotional stress

A simple, well-tested strategy applied consistently will outperform a complex strategy applied inconsistently. The real edge comes from execution, not from stacking indicators.

5. The Market Has Different Phases

Another critical trading secret is understanding that markets are not always trending. They cycle through phases:

Accumulation

Markup (trend)

Distribution

Decline

Range-bound consolidation

A strategy that works in a strong trend may fail in a choppy market. Successful traders adapt their approach based on market conditions. Sometimes the best trade is no trade at all. Staying out of unfavorable conditions is itself a profitable decision.

6. Time Frame Alignment Matters

Professional traders know that higher time frames dominate lower ones. A strong resistance on a monthly or weekly chart carries more weight than a signal on a five-minute chart. Aligning trades with higher-time-frame trends significantly improves probability.

This multi-time-frame approach allows traders to:

Trade in the direction of dominant trend

Avoid counter-trend traps

Identify high-quality zones instead of random entries

Ignoring higher time frames is a common mistake that leads to confusion and inconsistency.

7. Discipline Is the Ultimate Edge

Discipline is the hardest and most valuable trading secret. Many traders know what to do but fail to do it consistently. Discipline means:

Taking only planned trades

Respecting stop-losses

Avoiding overtrading

Following position-sizing rules

Stopping after maximum daily or weekly loss

Discipline turns an average strategy into a profitable one. Without discipline, even the best strategy will fail.

8. Losses Are Teachers, Not Enemies

Every successful trader has a long history of losses. The secret is not avoiding losses but learning from them. Each losing trade contains information about:

Market conditions

Execution errors

Psychological weaknesses

Strategy limitations

Keeping a detailed trading journal helps convert losses into lessons. Traders who review and refine their process improve steadily over time, while those who ignore mistakes repeat them.

9. Consistency Comes Before Size

Many traders focus on making big money quickly. Professionals focus on consistency first. Small, steady gains compound over time. Increasing position size without consistency only magnifies mistakes.

Once a trader proves profitability with small risk, scaling becomes logical and controlled. Patience in the early stages separates long-term traders from short-lived ones.

10. Trading Is a Skill, Not a Shortcut

Perhaps the biggest trading secret is that trading is not easy money. It is a performance-based skill, similar to sports or business. It requires:

Continuous learning

Practice and screen time

Self-awareness

Adaptation to changing markets

Those who treat trading as a get-rich-quick scheme usually exit quickly. Those who treat it as a profession develop resilience and longevity.

Conclusion

Trading secrets are not hidden indicators or exclusive information. They are timeless principles centered on probability, risk control, psychology, discipline, and adaptability. The market rewards patience, preparation, and consistency while punishing emotional and impulsive behavior.

Success in trading is less about predicting markets and more about managing oneself. Traders who master their process, respect risk, and stay psychologically balanced gain a sustainable edge over time. In the end, the greatest trading secret is simple: control risk, control emotions, and let probability work in your favor over the long run.

Financial Market Guides1. What Are Financial Markets?

Financial markets are systems that facilitate the buying and selling of financial instruments such as stocks, bonds, currencies, commodities, and derivatives. They connect savers (investors) with borrowers (corporations and governments), enabling efficient allocation of capital. Prices in these markets reflect collective expectations about growth, inflation, risk, and future cash flows.

Financial market guides simplify this complex ecosystem by breaking markets into understandable components, explaining participants’ roles, and highlighting the forces that drive price movements.

2. Purpose of Financial Market Guides

The primary purpose of financial market guides is education and decision support. They help market participants:

Understand market structure and instruments

Analyze risk versus return

Interpret macroeconomic and microeconomic signals

Develop investment or trading strategies

Avoid common behavioral and structural mistakes

For new investors, guides provide foundational literacy. For experienced traders, they offer frameworks to refine strategies and adapt to changing market regimes.

3. Major Types of Financial Markets Covered in Guides

A well-structured financial market guide typically explains the following core markets:

a. Equity Markets

Equity markets involve the trading of company ownership through shares. Guides explain concepts such as market capitalization, earnings, valuation ratios, sector rotation, and corporate actions. They also cover different styles like growth, value, dividend, and momentum investing.

b. Fixed Income Markets

Bond markets focus on debt instruments issued by governments and corporations. Financial guides explain interest rates, yield curves, credit risk, duration, and how monetary policy impacts bond prices. Fixed income is often highlighted as a stabilizing force in portfolios.

c. Foreign Exchange (Forex) Markets

Forex markets determine currency values and are the most liquid markets globally. Guides explain exchange rate mechanisms, currency pairs, central bank policies, and global capital flows. Forex is often linked closely with trade balances and macroeconomic stability.

d. Commodity Markets

Commodity markets include energy, metals, and agricultural products. Guides explain supply-demand cycles, geopolitical influences, inflation hedging, and the concept of commodity supercycles.

e. Derivatives Markets

Derivatives such as futures, options, and swaps derive value from underlying assets. Financial market guides emphasize their dual role—risk management (hedging) and speculation—while also warning about leverage-related risks.

4. Market Participants Explained

Financial market guides clearly define who participates in markets and why:

Retail Investors: Individuals investing personal capital

Institutional Investors: Mutual funds, pension funds, insurance companies

Hedge Funds & Prop Traders: Focused on alpha generation

Central Banks: Manage monetary policy and financial stability

Corporations: Raise capital and hedge risks

Understanding participant behavior helps explain liquidity, volatility, and price trends.

5. Role of Macroeconomics in Financial Market Guides

One of the most critical elements of any financial market guide is macroeconomic analysis. Markets do not move in isolation—they respond to:

GDP growth

Inflation trends

Interest rate changes

Employment data

Fiscal and monetary policy

Guides often explain economic cycles (expansion, peak, recession, recovery) and how different asset classes perform across these phases. This macro lens is essential for long-term investing and global asset allocation.

6. Risk Management and Capital Preservation

Financial market guides emphasize that risk management is more important than returns. Common risk concepts include:

Market risk

Credit risk

Liquidity risk

Leverage risk

Behavioral risk

Guides explain tools such as diversification, position sizing, stop losses, asset allocation, and hedging strategies. The core message is clear: survival comes first, profits come second.

7. Behavioral Finance and Psychology

Modern financial market guides increasingly incorporate behavioral finance. Human emotions—fear, greed, overconfidence, and panic—often drive irrational decisions. Guides help readers recognize cognitive biases such as:

Herd mentality

Loss aversion

Confirmation bias

Recency bias

By addressing psychology, financial market guides aim to improve discipline, consistency, and long-term performance.

8. Trading vs. Investing Frameworks

Financial market guides clearly distinguish between trading and investing:

Trading: Short- to medium-term, price-driven, timing-focused

Investing: Long-term, value-driven, fundamentals-focused

Guides explain various styles such as swing trading, position trading, day trading, and index investing, helping participants choose approaches aligned with their capital, time availability, and risk tolerance.

9. Importance of Market Cycles and Regimes

Markets move in cycles, not straight lines. Financial market guides teach readers how to identify:

Bull and bear markets

High-volatility vs. low-volatility regimes

Risk-on and risk-off environments

Recognizing these regimes helps investors adjust strategies instead of applying one-size-fits-all approaches.

10. Technology, Data, and Modern Markets

Contemporary financial market guides also cover the impact of technology:

Algorithmic and high-frequency trading

Data analytics and quantitative models

Online trading platforms

Artificial intelligence and machine learning

Technology has improved access and efficiency but has also increased competition and speed, making education even more critical.

11. Long-Term Value of Financial Market Guides

The true value of financial market guides lies not in predicting markets, but in building a structured mindset. They teach participants how to think probabilistically, manage uncertainty, and continuously adapt. Markets evolve, but core principles—risk, cycles, discipline, and valuation—remain constant.

For individuals aiming to build wealth, protect capital, or pursue professional trading, financial market guides act as enduring references that grow more valuable with experience.

Conclusion

Financial market guides are essential tools for navigating the complexity of global finance. They combine theory, practical frameworks, and real-world insights to help participants understand how markets function, why prices move, and how risks can be managed. In an environment defined by uncertainty and constant change, a strong foundation built through financial market guides is one of the most powerful advantages any market participant can possess.

Whether you are an investor, trader, student, or professional, mastering the concepts outlined in financial market guides is a critical step toward long-term success in the financial world.

Global Macro Trading: Profits from Big Economic TrendsGlobal macro trading is one of the most intellectually demanding and wide-ranging approaches in financial markets. Unlike strategies that focus on individual stocks or short-term price patterns, global macro trading is built around understanding large-scale economic, political, and monetary forces that shape asset prices across the world. Traders operating in this domain attempt to anticipate how changes in interest rates, inflation, currencies, geopolitics, and global growth cycles will influence markets and then position themselves accordingly across multiple asset classes.

At its core, global macro trading seeks to answer a simple but powerful question: How will major economic events and policy decisions affect global financial markets? The answers, however, require deep analysis, patience, and the ability to manage risk in an uncertain and constantly evolving environment.

Foundations of Global Macro Trading

Global macro trading emerged prominently in the late 20th century, especially through hedge funds that capitalized on major macroeconomic shifts. Legendary investors such as George Soros demonstrated how identifying structural imbalances—such as unsustainable currency pegs or misaligned interest rate policies—could lead to outsized profits. The famous trade against the British pound in 1992 is often cited as a classic example of global macro thinking in action.

The foundation of global macro trading lies in macroeconomics. Traders analyze economic indicators such as GDP growth, inflation rates, employment data, trade balances, and fiscal deficits. Central bank policies play a particularly crucial role, as interest rate decisions, quantitative easing, and liquidity conditions directly influence currencies, bonds, equities, and commodities.

Asset Classes Used in Global Macro Trading

One of the defining features of global macro trading is its flexibility across asset classes. A global macro trader is not restricted to equities alone. Instead, positions may be taken in:

Currencies (Forex): Often the most active arena for global macro traders, as exchange rates respond quickly to interest rate differentials, capital flows, and geopolitical developments.

Fixed Income (Bonds): Government bond yields reflect inflation expectations, monetary policy, and economic growth, making them central to macro views.

Equities and Equity Indices: Used to express views on economic expansion, recession risks, or sector-level impacts of macro policies.

Commodities: Assets like oil, gold, and agricultural products are influenced by inflation, supply shocks, geopolitical tensions, and global demand cycles.

Derivatives: Futures, options, and swaps are frequently used to gain leveraged exposure or hedge risks efficiently.

This multi-asset approach allows global macro traders to construct diversified portfolios that reflect a coherent macro thesis.

Top-Down Analytical Approach

Global macro trading follows a top-down approach. Traders begin with the global economy, then narrow their focus to regions, countries, and finally specific instruments. For example, a trader might believe that rising inflation in the United States will force the Federal Reserve to maintain higher interest rates for longer. This macro view could translate into a stronger U.S. dollar, pressure on emerging market currencies, falling bond prices, and sector rotation within equity markets.

Such analysis requires synthesizing information from multiple sources: economic data releases, central bank statements, political developments, and even demographic and technological trends. Unlike short-term trading strategies, global macro positions are often held for weeks, months, or even years, as macroeconomic trends typically unfold over longer time horizons.

Discretionary vs Systematic Global Macro

Global macro trading can broadly be divided into discretionary and systematic approaches. Discretionary macro traders rely heavily on human judgment, experience, and qualitative analysis. They interpret economic narratives, policy intentions, and geopolitical risks, adjusting positions as new information emerges.

Systematic global macro traders, on the other hand, use quantitative models and algorithms to identify macro trends. These models may analyze interest rate differentials, momentum across asset classes, or historical relationships between economic variables. While systematic strategies reduce emotional bias, they still depend on robust data and sound economic logic to remain effective across changing market regimes.

Many large hedge funds combine both approaches, using quantitative models to support or challenge discretionary views.

Risk Management in Global Macro Trading

Risk management is especially critical in global macro trading due to the scale and leverage often involved. Macro trades can be highly profitable, but they can also be volatile, particularly when markets react unexpectedly to political decisions or sudden economic shocks.

Effective risk management includes position sizing, diversification across themes and regions, and the use of stop-losses or options for downside protection. Scenario analysis is also common, where traders evaluate how their portfolios might perform under different economic outcomes, such as recession, stagflation, or financial crisis.

Liquidity risk must also be considered, especially during periods of market stress when correlations rise and exits become more difficult.

Role of Geopolitics and Policy

Unlike many other trading styles, global macro trading places significant emphasis on geopolitics and policy decisions. Elections, wars, trade disputes, sanctions, and international agreements can have profound effects on currencies, commodities, and capital flows. For instance, a sudden escalation in geopolitical tension may drive investors toward safe-haven assets like gold or U.S. Treasury bonds.

Fiscal policy, including government spending and taxation, also plays an increasingly important role. Large stimulus packages, rising public debt, or austerity measures can reshape growth expectations and market sentiment, creating opportunities for macro traders who correctly anticipate these shifts.

Advantages and Challenges of Global Macro Trading

The primary advantage of global macro trading is its broad opportunity set. Because it spans multiple markets and regions, traders are rarely constrained by a lack of ideas. Major economic transitions—such as inflation cycles, energy transitions, or shifts in global supply chains—can create powerful, long-lasting trends.

However, the challenges are equally significant. Macroeconomic forecasting is inherently uncertain, and markets often move ahead of data or react in counterintuitive ways. Timing is a persistent difficulty; a trader may have the correct long-term view but still suffer losses if the market moves against the position in the short term.

Additionally, global macro trading demands continuous learning, as economic structures, policy frameworks, and market dynamics evolve over time.

Conclusion

Global macro trading represents a sophisticated and holistic approach to financial markets. By focusing on the big picture—economic cycles, monetary policy, and geopolitical forces—this strategy aims to capture large, directional moves across asset classes. It rewards deep understanding, disciplined risk management, and the ability to adapt to changing global conditions.

For traders and investors who enjoy analyzing the world through an economic lens and are comfortable with uncertainty, global macro trading offers a powerful framework to navigate and potentially profit from the complex interconnectedness of the global financial system.

Microstructure Trading Edge: Unlocking Profits from Market1. Foundations of Market Microstructure

At its core, market microstructure studies how prices emerge from the interaction of buyers and sellers. Prices do not move randomly; they respond to supply-demand imbalances reflected through orders. These orders are visible (limit orders) or invisible (market orders, hidden liquidity, iceberg orders). The continuous battle between liquidity providers (market makers) and liquidity takers (aggressive traders) determines short-term price movements.

A microstructure trading edge begins with understanding:

Bid-ask spread behavior

Order book depth and imbalance

Trade aggressiveness

Execution priority (price-time priority)

Market impact and slippage

Traders who understand these mechanics can anticipate short-term price changes before they appear on traditional charts.

2. Order Flow as the Core Edge

Order flow is the heartbeat of microstructure trading. It represents the real-time flow of buy and sell orders hitting the market. Unlike indicators derived from historical prices, order flow is leading, not lagging.

A microstructure edge emerges when a trader can:

Identify aggressive buyers or sellers

Detect absorption (large players absorbing market orders)

Spot exhaustion of one side of the market

Read delta divergence (difference between price movement and volume imbalance)

For example, if price is not falling despite heavy selling pressure, it may indicate strong institutional absorption—often a precursor to a reversal. This insight is invisible to standard indicators but clear to order-flow-aware traders.

3. Bid-Ask Spread and Liquidity Dynamics

The bid-ask spread reflects the cost of immediacy. When liquidity is abundant, spreads are tight; when liquidity dries up, spreads widen. Microstructure traders exploit this by understanding when liquidity is likely to vanish or surge.

Key liquidity-based edges include:

Trading during spread compression phases

Avoiding periods of liquidity vacuum (news events, market open/close)

Identifying fake liquidity (spoofing-like behavior or pulled orders)

Recognizing thin books that allow small volume to move price significantly

Professional traders often enter positions just before liquidity expands and exit before it contracts, minimizing transaction costs while maximizing price efficiency.

4. Market Participants and Their Footprints

Different market participants leave distinct footprints:

Retail traders: small size, emotional execution, market orders

Institutions: large size, patient execution, iceberg orders

Market makers: spread capture, inventory management

High-frequency traders (HFTs): speed-based arbitrage, queue positioning

A microstructure edge comes from recognizing who is likely active at a given moment. For instance, sudden bursts of small aggressive orders often indicate retail participation, while steady absorption with minimal price movement points to institutional involvement.

Understanding participant behavior helps traders align themselves with stronger hands instead of fighting them.

5. Price Impact and Execution Efficiency

Every order moves the market to some degree. The relationship between trade size and price movement is known as market impact. Microstructure traders aim to minimize adverse impact while exploiting others’ poor execution.

This edge is particularly strong in:

Scalping strategies

High-frequency mean reversion

VWAP and TWAP deviations

Opening range and closing auction trades

Traders who understand execution mechanics can enter positions at optimal times, reducing slippage and improving net profitability—even if their directional bias is only slightly better than random.

6. Information Asymmetry and Short-Term Alpha

Microstructure trading thrives on information asymmetry, not in the illegal sense, but in the structural sense. Some traders react faster, interpret data better, or understand context more deeply.

Sources of microstructure information advantage include:

Faster interpretation of order book changes

Real-time trade classification (buyer-initiated vs seller-initiated)

Contextual awareness (news + order flow alignment)

Knowledge of exchange-specific rules and quirks

Because microstructure edges operate on very short timeframes, they decay quickly—but when executed repeatedly, they compound into meaningful alpha.

7. Microstructure Across Timeframes

Although often associated with scalping, microstructure is relevant across timeframes:

Ultra-short-term: tick-by-tick order flow and queue dynamics

Intraday: liquidity zones, VWAP interactions, session highs/lows

Swing trading: entry timing refinement using lower-timeframe microstructure

Position trading: identifying institutional accumulation/distribution phases

Even long-term traders gain an edge by using microstructure to optimize entries and exits, improving risk-reward without changing their core thesis.

8. Technology and Tools Behind the Edge

Modern microstructure trading relies heavily on technology:

Depth of Market (DOM)

Time & Sales

Volume profile and footprint charts

Order flow analytics

Low-latency execution platforms

However, tools alone do not create an edge. The real advantage comes from interpretation, context, and discipline. Many traders see the same data, but only a few understand what matters and when.

9. Risks and Limitations of Microstructure Trading

While powerful, microstructure trading is not without challenges:

High transaction costs if overtrading

Psychological pressure from fast decision-making

Edge decay due to competition and automation

Overfitting patterns that do not persist

A sustainable microstructure edge requires strict risk management, continuous adaptation, and an understanding that not every market condition is suitable for microstructure-based trades.

10. Conclusion: Why Microstructure Creates a Lasting Edge

The microstructure trading edge lies in seeing the market as a living process rather than a static chart. By focusing on how trades are executed, how liquidity behaves, and how participants interact, traders gain insight into price movements before they fully develop.

In an era where traditional indicators are widely known and arbitraged, microstructure offers a deeper, more nuanced layer of understanding. While it demands skill, discipline, and experience, it rewards traders with precision, timing, and consistency—qualities that define long-term success in modern financial markets.

Ultimately, microstructure trading transforms the trader from a passive observer of price into an active reader of market intent, where every order tells a story and every imbalance creates opportunity.

Technical Analysis MasteryA Complete Guide to Reading, Timing, and Trading Financial Markets

Technical analysis mastery is the art and science of interpreting market price behavior to make informed trading and investment decisions. Unlike fundamental analysis, which focuses on financial statements, economic indicators, and business performance, technical analysis concentrates on price, volume, and time. The core belief behind technical analysis is that all known information—fundamental, economic, political, and psychological—is already reflected in the market price. By mastering technical analysis, traders aim to identify trends, anticipate reversals, and optimize entry and exit points with greater precision.

Foundations of Technical Analysis

At the heart of technical analysis lie three classical assumptions. First, the market discounts everything, meaning price reflects all available information. Second, prices move in trends, and once a trend is established, it tends to continue rather than reverse abruptly. Third, history tends to repeat itself, as market participants often react in similar ways under similar circumstances due to human psychology. These principles form the philosophical backbone of all technical tools and strategies.

Mastery begins with understanding price charts, as they visually represent market behavior. The most commonly used charts are line charts, bar charts, and candlestick charts. Among these, candlestick charts are widely favored because they convey more information, such as open, high, low, and close prices, along with market sentiment. Each candlestick tells a story about the battle between buyers and sellers within a specific time period.

Trend Analysis and Market Structure

Trend identification is a cornerstone of technical analysis mastery. Trends are broadly classified into uptrends, downtrends, and sideways (range-bound) markets. An uptrend is characterized by higher highs and higher lows, while a downtrend shows lower highs and lower lows. Sideways markets reflect consolidation, where price moves within a defined range.

Understanding market structure—such as swing highs, swing lows, breakouts, and pullbacks—helps traders align with the dominant trend. The famous saying, “The trend is your friend,” emphasizes that trading in the direction of the prevailing trend significantly increases the probability of success. Mastery involves not only spotting trends early but also knowing when a trend is weakening or transitioning into another phase.

Support, Resistance, and Key Price Levels

Support and resistance are among the most powerful and widely used concepts in technical analysis. Support refers to a price level where buying interest is strong enough to prevent further decline, while resistance is a level where selling pressure halts upward movement. These levels often act as psychological barriers due to collective trader behavior.

As traders gain mastery, they learn that support and resistance are not exact lines but zones. Former resistance can become new support after a breakout, and vice versa. Identifying these levels across multiple timeframes adds robustness to analysis and helps in setting realistic targets and stop-loss levels.

Indicators and Oscillators

Technical indicators are mathematical calculations derived from price and volume data. They help traders interpret market conditions more objectively. Indicators generally fall into two categories: trend-following indicators and momentum oscillators.

Trend-following indicators, such as moving averages and the Average Directional Index (ADX), help identify the direction and strength of a trend. Moving averages smooth price data and act as dynamic support or resistance levels. Momentum oscillators, such as the Relative Strength Index (RSI), Stochastic Oscillator, and MACD, help determine whether a market is overbought or oversold.

True mastery does not come from using many indicators but from understanding a few deeply. Overloading charts with indicators often leads to confusion and conflicting signals. Skilled analysts use indicators as confirmation tools rather than primary decision-makers.

Volume Analysis and Market Participation

Volume is the fuel behind price movement. Analyzing volume provides insight into the strength or weakness of a price move. Rising prices accompanied by increasing volume suggest strong buying interest, while price increases on declining volume may indicate a lack of conviction.

Volume analysis also helps in identifying breakout validity, accumulation, and distribution phases. Tools such as volume moving averages, On-Balance Volume (OBV), and Volume Profile enhance a trader’s ability to understand market participation. Mastery involves recognizing when “smart money” is entering or exiting the market.

Chart Patterns and Price Action

Chart patterns represent recurring formations created by price movement over time. Common patterns include head and shoulders, double tops and bottoms, triangles, flags, and wedges. These patterns reflect shifts in supply and demand dynamics and often signal trend continuation or reversal.

Price action trading, a refined form of technical analysis, focuses on raw price behavior without heavy reliance on indicators. Candlestick patterns like doji, engulfing patterns, hammers, and shooting stars offer clues about market sentiment and potential turning points. Mastery in price action requires patience, screen time, and an understanding of context rather than isolated signals.

Risk Management and Trading Psychology

No level of technical analysis mastery is complete without strong risk management. Even the best technical setups can fail. Successful traders focus on probability and consistency, not certainty. This involves defining risk per trade, using stop-loss orders, maintaining favorable risk–reward ratios, and managing position size.

Equally important is trading psychology. Fear, greed, overconfidence, and hesitation can undermine even the most accurate analysis. Master traders develop discipline, emotional control, and the ability to follow a trading plan without deviation. Technical mastery is as much about mindset as it is about charts.

Multi-Timeframe Analysis and Strategy Integration

Advanced technical analysis incorporates multi-timeframe analysis, where traders analyze higher timeframes to identify the primary trend and lower timeframes for precise entries and exits. This approach aligns short-term trades with long-term market direction, improving accuracy.

Technical analysis mastery also involves integrating strategies—such as trend following, breakout trading, mean reversion, and swing trading—based on market conditions. There is no single strategy that works in all environments; adaptability is a hallmark of mastery.

Conclusion

Technical analysis mastery is a continuous learning journey rather than a destination. It combines chart reading, indicator interpretation, pattern recognition, volume analysis, risk management, and psychological discipline into a cohesive skill set. Over time, with consistent practice and reflection, traders develop an intuitive understanding of market behavior.

Ultimately, mastery means simplifying complexity—seeing clarity where others see chaos—and making decisions based on logic, probability, and discipline rather than emotion. In dynamic financial markets, technical analysis mastery empowers traders to navigate uncertainty with confidence and precision.

XAUUSD 1H Price Correction After Strong Rejection at 4550On the 1H chart, XAUUSD is showing a price correction after a sharp sell-off from the 4550 supply area. The rejection from this level clearly highlighted selling pressure from higher timeframes and caused a shift in short-term price structure, with gold unable to hold above higher price levels.

Following the decline, price found support and created a new 1H demand area near 4273, where buyers became active and selling momentum eased. This zone is now acting as a short-term support base. While price remains above 4270, the risk of immediate further downside stays low, and the market may move sideways or attempt a recovery.

From a structure point of view, gold is trying to build a higher low, which opens the possibility of a short-term price rebalance towards nearby liquidity. With stronger session participation and sustained volume, price can move towards the 4330–4380 range, which matches earlier intraday reactions and acts as the first resistance area.

Above this range, 4430 remains a key higher-timeframe level. This zone has seen multiple past reactions and supply presence, making it important for judging whether the correction continues or sellers step back in.

This view is shared for educational purposes only, based on price action and demand–supply behaviour. Always look for confirmation and follow proper risk management.

#NIFTY Intraday Support and Resistance Levels - 05/01/2026A gap-up opening near the 26,500 zone is expected in Nifty, indicating continuation of the recent bullish momentum. The index has moved strongly from lower levels and is currently holding above the 26,250 support, which keeps the short-term trend positive. As long as Nifty sustains above this level, buying interest is likely to remain intact.

On the upside, a decisive hold above 26,550 will open the gates for further upside expansion. In this scenario, fresh long positions can be considered with upside targets placed around 26,650, 26,700, and 26,750+. Any minor dip toward the 26,250–26,300 zone may act as a healthy pullback and provide a buying opportunity, as this area is now turning into a strong demand zone.

On the downside, if the index fails to sustain above 26,250 and slips below this support, short-term profit booking can be expected. A breakdown below 26,250 may drag Nifty toward 26,150, 26,100, and 26,000 levels. Until such a breakdown occurs, the overall bias remains buy-on-dips, with traders advised to trail stop losses and book partial profits at higher levels.

NIFTY- Intraday Levels - 5th Jan 2026* Approx levels Consider +/- buffer in levels*

If NIFTY sustain above 26431/53 then 26510/18 above this more bullish above this wait

If NIFTY sustain below 26257 then 26197/190 then 26161/146/41 below this more bearish then more levels marked on chart

My view :-

"My viewpoint, offered purely for analytical consideration, The trading thesis is: Nifty (bearish tactical approach: sell on rise)

Will be a red candle today? Will it form a top for tomorrows expiry?

This analysis is highly speculative and is not guaranteed to be accurate; therefore, the implementation of stringent risk controls is non-negotiable for mitigating trade risk."

Consider some buffer points in above levels.

Please do your due diligence before trading or investment.

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

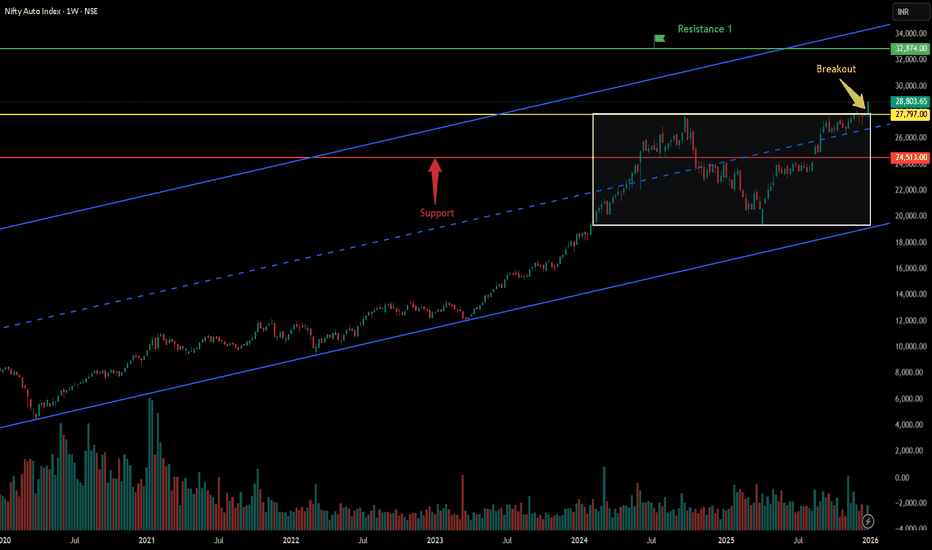

Breakout in Nifty Auto...Chart is self explanatory. Levels of breakout, possible up-moves (where index may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Breakout in CSB Bank Ltd...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

XAUUSD/GOLD WEEKLY SELL PROJECTION 04.01.26Price was moving inside a parallel uptrend channel

That channel is clearly broken, which is the first early warning of trend weakness

After the break, price failed to continue higher → bullish momentum exhausted

2️⃣ Major Reversal Patterns

Double Top Formation

Price tested the same resistance zone twice

Both tops were rejected strongly

This confirms buyers are unable to push price higher

M Pattern Confirmation

After the second top, price breaks below the neckline

This confirms trend reversal

3️⃣ Candlestick Confirmation (Very Strong)

At the resistance zone:

Evening Star (Triple Candlestick Pattern) → Classic reversal signal

Bearish Engulfing Candle → Sellers completely overpower buyers

These patterns together give a high-probability SELL confirmation

4️⃣ Resistance Zones

Resistance R2 → Major rejection zone (double top area)

Resistance R1 → Previous supply zone

Price respected resistance and obeyed the trendline → SELL zone

5️⃣ Entry Logic (SELL)

Sell after:

Trendline break

Double top confirmation

Bearish engulfing close

This is a swing low sell setup

6️⃣ Targets & Risk Management

Support S1 → First target / partial booking zone

Support S2 → Final target

Risk : Reward = 1 : 2

IDBI BANK LTD ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

IDBI BANK- The current price of IDBI is 114.73 rupees

I am going to buy this stock because of the reasons as follows-

1. It has given a breakout of last 11 year resistance with some good volume and looks great.

2. This stock has seen some great buying from mid 2022 to March 2024. Then it went for some time and price correction which was needed.

This stock has been in my watchlist from last weeks.

I am personally more aggressive on Banks as they are holding really well.

3. It is showing better relative strength as it stood strong in volatile times including last few weeks.

4. The risk and reward is favourable.

5. The stock is one of the outperformers in this market. The structure is great as of now. It has also outperformed it's sector in very short term but it was more of a lagging stock in long term and probably it will show better strength in coming days.

6. Another good part- The overall sector has shown some decent strength and have good momentum.

I am expecting more from this in coming weeks.

I will buy it with minimum target of 35-40% and then will trail after that.

My SL is at 100 rupees.

I will be managing my risk.

2026 XAUUSD/GOLD YEARLY ANALYSISXAUUSD / GOLD – 2026 Yearly Buy Plan

With Entry, Stop Loss & Targets

🔹 Market Bias

Gold (XAUUSD) is bullish for 2026 based on:

Global economic uncertainty

Central bank gold accumulation

Expected US interest-rate cuts

Strong long-term bullish structure on the daily chart

🔹 Buy Zones (Entries)

✅ Major Buy Zone (Best Risk–Reward)

Entry: 3,250 – 3,300

This zone is near:

Golden Fibonacci retracement

Yearly swing low

Strong institutional demand area

👉 Suitable for positional & long-term investors

✅ First Confirmation Buy

Entry: 3,950 – 4,050

Buy only if price holds above support and shows bullish candles

👉 Suitable for safe swing traders

🔴 Stop Loss (Risk Control)

🛑 Stop Loss Placement

Stop Loss: Below 3,150

Reason:

Break of yearly structure

Bullish view invalid below this level

📌 Risk should be 1–2% per trade, not more.

🎯 Take Profit Targets (2026)

🎯 Target 1

4,800 – 5,000

Partial profit booking recommended (30–40%)

🎯 Target 2

5,800 – 6,000

Trail stop loss to cost or profit

🎯 Target 3 (Long-Term Extreme Target)

7,500 – 7,800

Only for patient positional holders

🔹 Trade Management Plan

Buy only on pullbacks, not at highs

Book partial profits at each target

Move stop loss gradually as price moves up

Avoid over-leverage

Force Motors Ltd - Breakout Setup, Move is ON...#FORCEMOT trading above Resistance of 21123

Next Resistance is at 30646

Support is at 14435

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

Laurus Labs Limited - Breakout Setup, Move is ON...#LAURUSLABS trading above Resistance of 1091

Next Resistance is at 1512

Support is at 806

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

$XRP Price Forecast | Is $10 Possible?CRYPTOCAP:XRP Is Currently Retesting A Breakout That Took Nearly 8 Years To Form — A Rare, High-Timeframe, Cycle-Level Structure That Typically Precedes Major Market Expansions.

The Last Time This Exact Structure Appeared (2017), XRP Delivered An Extraordinary 40,000% (400x) Move Following The Breakout.

Current High-Timeframe Technical Structure:

✅ Multi-Year Descending Structure Broken

✅ ~57% Corrective Pullback From Recent ATH

✅ Price Holding Within The $2–$1.50 Demand Zone

✅ Strong Macro Support Identified At $1–$0.80

As Long As Price Respects This Support Region, The Primary Technical Projection Remains $8–$10 XRP Over The Cycle, Based On Measured Move And Historical Structure Behavior.

Why Expect Only 5x–10x From Here?

The Previous Multi-Year XRP Breakout Resulted In A 400x (40,000%) Expansion.

Historically, Large Bases Lead To Large Moves — Not Modest Returns.

From A Purely Structural Perspective, A Move Toward $10–$20 Cannot Be Ruled Out In The Next Market Cycle If The Breakout Holds And Momentum Confirms.

Disclaimer:

This Analysis Is For Educational Purposes Only And Does Not Constitute Financial Advice. Technical Analysis Is Probabilistic, Not Predictive. Always Apply Proper Risk Management And Conduct Your Own Research.