Predictions and analysis

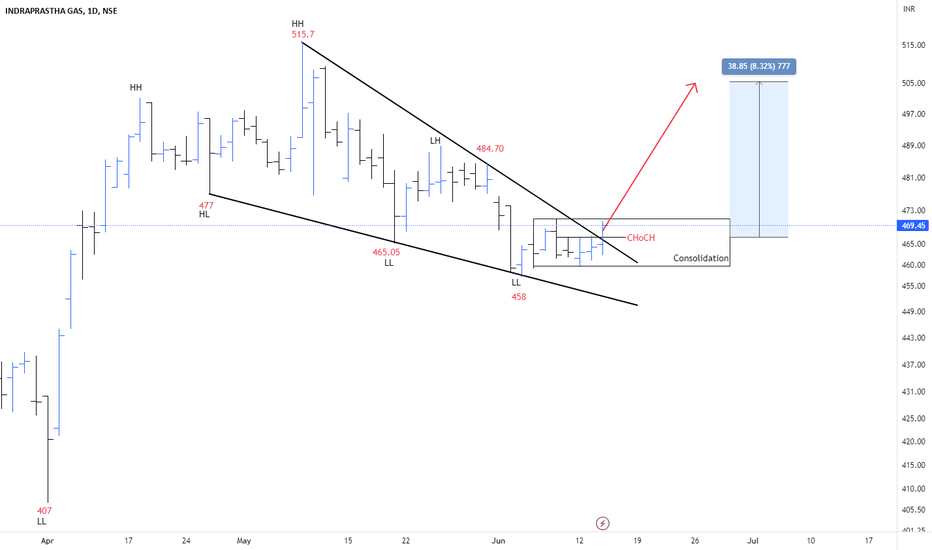

IGL has constructed a falling wedge on the 1-day chart in which it has made continuous lower lows and lower highs. The trend can change from bearish to bullish after the breakout of the resistance trendline. Buyers can expect a bullish move with the following targets: 483 & 504 . IGL Is Bearish below 458 . Buyers have to break and stay above 504 to increase...

IGL is looking good for a break out trade as it has been forming an inverted head and shoulder pattern and consolidating near the break out levels. On the daily time frame, the stock has given a lower wick rejection after testing 20 DMA. The stock on the weekly time frame has given a bullish moving averages cross over and good targets can be booked in the stock...

IGL has formed a flag and pole pattern on the daily time frame. Nifty oil and gas index has been trading around the recent high and IGL stock can give a good moment following the index. There is bullish moving average cross over on the daily time frame. 3 point confirmation. 1. Flag and pole pattern. 2. Bullish cross over. 3. Index trading near the recent...

Seems volatile compression seen Flag and and pole pattern Weekly already given Breakout and consolidating

NSE:IGL #IGL symmetrical triangle, BO may show good momentum. Happy LEarning !!

NSE:IGL Observations: 1) On Daily time frame it has closed above 200DMA which is placed at 529.62 level. Please refer below chart : Daily Time Frame. 2) On Daily time frame, it made morning star candlestick pattern. For positional long trade for short/mid term, one can take positon on breakout of 535 level for target of 558,571,590 with SL of 520. ...

IGL 15 min time frame analysis Traders can go for swing trade for this one . See the movement and Go long and follow proper stop loss *We are not SEBI registered This is only for educational purpose. Please consult your advisor before making any trade or investment

✺----------------Drop a follow here: @Averoy_Apoorv_Analysis ✺ I post Good and potential trading ideas on daily basis on this page of mine :) ✺✺ Target: 1000 Followers ✺✺ $$ Important logic used: Symmetrical triangle on the resistance of monthly zones = signs of accumulation of price to make the sellers go away and break it, symmetrical triangle showed that both...

IGL stock trapped in a channel pattern and now it's in a bearish trend, so give an entry with appropriate Stop loss Since it's a FO stock shorting, You shall prefer for intraday shorting in the intraday equity cash market or going short in the Future and option market Aggressive traders enter at the breakout and conservative traders may give entry after...

After today's breakout, It is in the bullish momentum. It has faced a resistance at 514.10 . I think, it may break this resistance tomorrow and it can proceed higher.

Hello, this is my analysis for IGL. Not recommendation for Buy & Sell.

![Simple Trade Setup | IGL | 04-10-2021 [INTRADAY] IGL: Simple Trade Setup | IGL | 04-10-2021 [INTRADAY]](https://s3.tradingview.com/a/a5HiNfRK_mid.png)