Part 3 Institutional Option Trading Vs. Technical Analysis What Are Options?

Options are derivative contracts whose value is derived from an underlying asset like index (Nifty, Bank Nifty), stocks, commodities, currencies, etc.

They give you the right, but not the obligation, to buy or sell the underlying at a fixed price before a specific date.

Options are mainly of two types:

Call Option (CE): Right to BUY

Put Option (PE): Right to SELL

They are widely used by traders for hedging, speculation, income generation, and risk management.

Institutionaltrading

USD/CAD – Liquidity & Structure Based Short IdeaUSD/CAD has been trading inside a well-defined rising channel for a while. Price is now approaching the upper boundary of this channel, a zone where sellers have previously stepped in with strength.

This area is not just resistance, it’s also a liquidity zone, where stop-losses of late buyers are resting above recent highs. Such zones often attract smart money activity before a directional move.

What Price Is Telling Us: Price is currently stalling near resistance instead of expanding higher. We can observe Multiple rejections near the channel top, Overlapping candles showing loss of bullish momentum and Lack of strong follow-through despite previous volume spike.

This behavior often appears before distribution or a corrective move, especially when price is trading at premium levels.

If this analysis helped you, like, follow, and comment for more clean Forex breakdowns.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and past performance does not guarantee future results. Please manage risk responsibly.

Zoom Out: Bitcoin’s 14-Year Structural Expansion Explained!Hey Everyone, let's analyse long term structural view on Bitcoin as it is once again sitting inside the same structural expansion channel it has respected for more than 14 years.

Zooming out removes the noise, what looks random on lower timeframes reveals a very consistent long-term pattern.

Most traders focus on headlines. Long-term moves are built on structure.

Bitcoin has never moved randomly on higher timeframes. Every major cycle since 2011 has expanded inside a rising macro channel driven by demand, time, and liquidity.

Each cycle looks different on the surface, but the internal structure remains the same, higher lows forming on macro support, followed by exponential expansion phases.

Current price is still respecting the long-term rising structure, with buyers consistently stepping in near the lower boundary of the channel.

The upper zone shown is not a prediction. It represents the historical expansion boundary where previous cycles matured and volatility peaked.

As long as the macro structure remains intact, the probability continues to favor structural continuation rather than random collapse.

Key takeaway:

Markets don’t repeat perfectly, but they rhyme .

And Bitcoin has been speaking the same structural language for over a decade.

Conclusion:

This is not about catching tops or bottoms.

It’s about understanding where you are in the cycle , and acting accordingly.

If this structural perspective helped you, like, comment, and follow for more long term market studies.

Analysis By @TraderRahulPal | More analysis & educational content on my profile.

⚠️ DISCLAIMER: This analysis is for educational purposes only and reflects a long term structural view. It is not financial advice. Always manage risk and do your own research before making trading or investment decisions.

Smart Money Liquidity Trap Explained⭐ Smart Money Liquidity Trap Explained

✨ A deep dive into how institutions manipulate price before major moves ✨

In every financial market — Forex, Crypto, Stocks, Indices — price doesn’t simply move at random. Behind the scenes, Smart Money (institutions, banks, hedge funds) engineer setups that allow them to enter positions at the best possible price. One of their most effective tools is the Liquidity Trap.

Let’s break it down beautifully and clearly. 👇

🔥 What Is a Liquidity Trap?

A Liquidity Trap occurs when Smart Money deliberately pushes price into areas loaded with:

❌ Stop-loss orders

📉 Sell-side liquidity

📈 Buy-side liquidity

😰 Emotional retail entries

🔥 Breakout traders placing pending orders

These areas become liquidity pools — perfect fuel for institutions to fill their massive positions.

Retail traders think it’s a breakout…

But Smart Money thinks:

➡️ "Thank you for the liquidity."

🧩 How Smart Money Creates the Trap

1️⃣ Phase 1: Build the Setup

Smart Money guides price slowly toward an obvious level:

A clean high

A clean low

A trendline

A double top/bottom

Retail traders get excited:

📢 “Breakout coming!”

But institutions are simply gathering attention.

2️⃣ Phase 2: The Liquidity Grab ⚡

Price spikes violently above/below the obvious level.

This move triggers:

🟥 Stop-loss hunts

📉 Forced liquidations

💥 Breakouts that fail instantly

This sudden spike gives institutions the liquidity needed to place large buy or sell orders without causing massive slippage.

This is why the spike is often fast and dramatic.

3️⃣ Phase 3: The Real Move Begins 🚀

After the liquidity is collected, price reverses sharply.

This is the moment Smart Money actually commits to the real direction.

Retail traders feel:

🤯 “Why did it reverse?!”

😭 “I got stopped out for nothing!”

😵 “The breakout was fake!”

But Smart Money simply executed their strategy perfectly.

🎯 How to Use Liquidity Traps in Your Trading

Study where retail traders commonly place:

⛔ Stops

📌 Breakout orders

❗ Predictable entries

Then wait for the fast liquidity grab followed by:

A displacement 🎇

A sharp wick rejection

A structure shift (CHoCH / BOS)

These signals often reveal the true direction of the upcoming move.

💡 Key Features of a Smart Money Liquidity Trap

✨ Sudden spike into obvious areas

✨ Fast liquidation and stop-hunting behavior

✨ Sharp wick rejections

✨ Structure shift after the spike

✨ Smooth continuation in the real direction

🚀 Why This Concept Is So Powerful

Recognizing liquidity traps allows you to:

❌ Avoid fake breakouts

🛡️ Protect yourself from stop-hunts

🎯 Enter the market at premium/discount levels

🤝 Align with Smart Money

💼 Improve long-term consistency

This is how professional traders stay on the right side of volatility — by understanding why the market moves, not just where it moves.

Order Blocks Simplified — How Institutions Control Price🔥 Order Blocks Simplified — How Institutions Control Price

Order Blocks are one of the most important concepts in modern trading — because they show where institutions place REAL positions, not where retail traders guess. 🏦📊

When you understand Order Blocks, you stop chasing random candles and start reading the footprints of smart money. Let’s simplify it. 👇✨

📌 What Is an Order Block? 🧱💰

An Order Block (OB) is a price zone where big institutions (banks, hedge funds, market makers) place massive orders.

These zones often appear before strong market moves — because that’s where smart money builds positions.

Think of an Order Block as:

🔹 The origin of a powerful move

🔹 A zone where price reacts repeatedly

🔹 A region that creates imbalance and momentum

🔹 A point where institutional orders remain unfilled

Once price returns to that zone, institutions fill the rest of their orders, causing another strong reaction. ⚡📈📉

📌 Why Do Order Blocks Matter? 🧠🔥

Because institutions control 80%+ of market volume — not retail.

So when they accumulate or distribute positions:

📈 Trends are born

📉 Reversals appear

🌊 Momentum shifts

💥 Big candles print

Order Blocks give you insight into:

✔️ Where big players enter

✔️ Where real support/resistance exists

✔️ Why price reverses at specific zones

✔️ Where high-probability trades form

It’s the closest thing to tracking the “big money blueprint.”

📌 How Order Blocks Form 🛠️📊

Order Blocks are created during periods of:

🔸 Accumulation (smart money buys quietly)

🔸 Distribution (smart money sells quietly)

Then price explodes away from that zone, showing that a major order cluster was executed.

This explosive move creates:

🔥 Imbalance (FVG)

🔥 Break of structure (BOS)

🔥 A directional trend

These are all signs of institutional activity.

📌 Types of Order Blocks 🟥🟩

🟥 Bearish Order Block (B-OB)

The last bullish candle before a strong bearish move.

It marks institutional selling.

🟩 Bullish Order Block (B-OB)

The last bearish candle before a strong bullish move.

It marks institutional buying.

Both act as high-probability reaction zones.

📌 How Institutions Use Order Blocks 🎯🏦

Institutions don’t enter all at once — their orders are too large.

So they:

1️⃣ Place part of their order

2️⃣ Push price away

3️⃣ Wait for retracement

4️⃣ Fill the rest at the same zone

That zone = the Order Block.

Price returning to an OB is not random — it’s smart money completing their business. 💼✨

📌 How You Trade Order Blocks 🧘♂️📈

✔️ Identify the strong move

Big displacement = institutional interest. 🚀

✔️ Mark the Order Block candle

The last opposite candle before the move. 🔍

✔️ Wait for price to return

Smart money loves to rebalance orders. 🔁

✔️ Enter with confirmation

Candles + structure + reaction = high probability. 🎯

Order Blocks are not predictions — they are reaction zones with a smart-money edge.

📌 Why Order Blocks Work So Well 🌟

Because they are built on:

💧 Liquidity

🧠 Smart Money Behavior

📊 Market Structure

⚡ Supply & Demand

🔥 Institutional Order Flow

This is why OBs outperform classic support/resistance.

They show institutional reality, not retail imagination.

✨ Final Thoughts: The Power of Order Blocks 🚀

Once you learn Order Blocks, everything becomes clearer:

✔️ You know where big money enters

✔️ You know where to wait for price

✔️ You stop chasing bad trades

✔️ You trade WITH smart money

✔️ You catch cleaner, stronger moves

Order Blocks are the foundation of modern price action — simple, powerful, and deeply effective. 🔥📈

XAU Empire | Bullish FlowXAU Empire | Bullish Flow

The market maintains a bullish structure after confirming a break of structure (BOS). Price is currently retracing into a short-term demand zone near 4,100, showing healthy correction within trend. This zone is acting as accumulation before potential continuation.

Momentum supports a move toward 4,316 – 4,386, aligning with unfilled imbalance and previous supply area. Institutional flow remains on the buy side as long as price holds above 4,080.

---

Market Bias: Bullish

Short-Term Range: 4,100 – 4,386

Key Focus: Retracement for continuation

The Market Doesn’t Hate You — It’s Just Doing Its JobEvery trader at some point feels attacked by the market.

You take a trade, it hits your stop loss by one pip… and then runs perfectly in your direction.

You think, “The market is against me.”

But the truth is — the market doesn’t hate you.

It’s simply doing its job: collecting liquidity before moving to its real destination.

💡 Here’s What’s Really Happening

The market is a liquidity machine.

It moves where money is resting — not where traders wish it would go.

When you see price sweeping highs or lows before reversing, that’s not manipulation against you —

it’s Smart Money doing what it’s built to do:

Hunt liquidity

Fill institutional orders

Create displacement before the next move

Your stop loss isn’t being targeted personally —

it’s sitting where millions of other traders’ stops are clustered.

The market simply clears those levels before delivering the real move.

🧠 The Lesson

Stop trading emotionally and start thinking structurally.

Ask yourself before every setup:

Where is liquidity resting?

Has the market collected it yet?

Is structure confirming the new direction?

When you learn to think like Smart Money, you stop blaming the market and start understanding it.

You’ll realize every loss was a lesson pointing you toward better timing, discipline, and patience.

📊 Final Thought

The market is not your enemy — it’s your teacher.

Once you align with how liquidity and structure truly work,

you’ll stop feeling trapped and start trading with clarity and confidence.

💬 Follow for more institutional-based educational posts.

No signals. No hype.

Just pure trading knowledge and Smart Money insights that help you grow.

Part 6 Learn Institutional Trading Key Terminology in Option Trading

Before diving deeper, let’s understand some crucial terms used in options:

Underlying Asset: The financial instrument (like a stock, index, or commodity) on which the option is based.

Strike Price (Exercise Price): The price at which the underlying asset can be bought (for a call) or sold (for a put).

Expiration Date: The date when the option contract ends. After this date, the option becomes worthless if not exercised.

Option Premium: The price paid by the buyer to the seller for acquiring the option.

Intrinsic Value: The amount by which an option is in profit if exercised immediately.

Time Value: The extra value in the option premium due to time left before expiration.

In-the-Money (ITM): When the option already has intrinsic value (profitable if exercised now).

Out-of-the-Money (OTM): When the option has no intrinsic value.

At-the-Money (ATM): When the strike price equals the current market price of the underlying.

Example:

If a stock is trading at ₹1000 and you buy a call option with a strike price of ₹950, your option is in the money.

If you buy a call with a strike price of ₹1050, it’s out of the money.

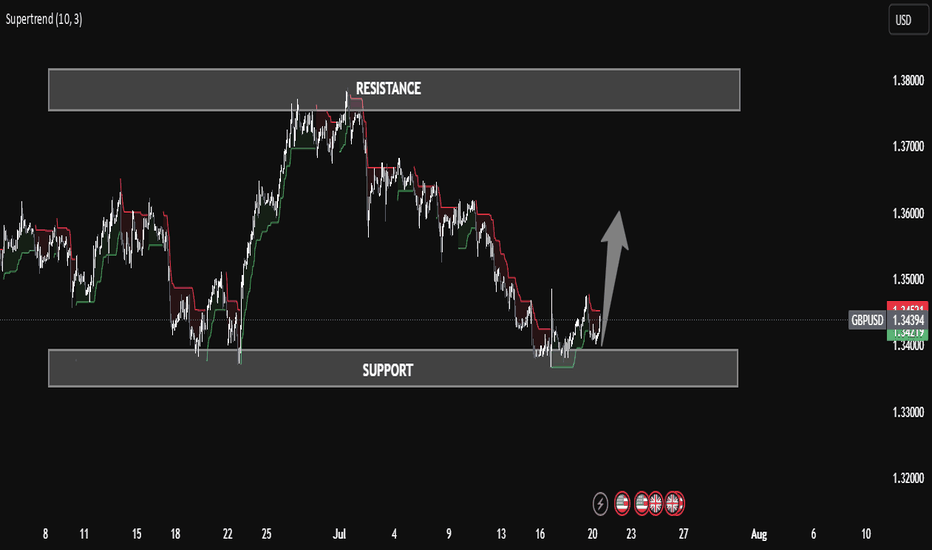

GBP/USD Technical Insight – Reversal Opportunity from Demand GBP/USD Technical Insight – Reversal Opportunity from Demand Zone

The GBP/USD chart showcases a classic liquidity sweep and bullish reaction from a clearly defined support zone (1.3360 – 1.3400). After an extended bearish move, price entered the demand area, rejected strongly, and formed a potential bullish reversal setup, signaling a possible move toward the resistance zone near 1.3740 – 1.3800.

The use of Supertrend Indicator confirms a shift in market structure, supporting the bullish bias. This setup reflects a textbook example of smart money behavior — where price mitigates imbalance, grabs liquidity, and rallies from institutional zones.

⸻

🧠 Educational Key Points:

• Support & Resistance Zones are well-respected.

• Trend Shift confirmed after long accumulation.

• Liquidity Engineering: Market makers swept the lows before reversing.

• Confluence of Structure + Indicator adds high-probability confidence.

📌 Potential Trade Idea:

Buy from the support zone with targets near resistance; manage risk below the support zone for precision.

How to Trade "Mitigation Blocks" – Secret Used by Big Boys!Hello Traders!

Today we’re diving into an advanced Smart Money Concept – the Mitigation Block . If you’ve ever wondered how institutional traders quietly manage their risk and re-enter trades with precision, this is it. Learning to identify and trade Mitigation Blocks can completely change how you see charts — and give you an edge most retail traders miss!

What is a Mitigation Block?

A Mitigation Block is formed when smart money (institutions, banks) enter a position, price reacts strongly, but later returns to the same zone to “mitigate” their risk or add more positions. This block acts as a powerful zone of support or resistance , depending on trend direction.

How to Identify a Mitigation Block

Look for Imbalance + Strong Reaction: A large impulsive candle followed by a return to the origin zone.

Price Fills the Fair Value Gap: Smart money wants to re-enter at the best price — this creates the mitigation block.

Previous Break of Structure: The block should follow a BOS (Break of Structure) that confirms a new trend.

How to Trade the Mitigation Block

Mark the Origin Candle Zone: Identify the candle or small range where the impulse began. This is your block.

Wait for Price to Return: When price comes back to that zone, look for entry confirmation (candlestick rejection, SMC confirmation, etc.).

Use Proper SL and RR: Place stop loss below/above the mitigation zone and target next liquidity level or BOS zone.

Rahul’s Tip

Most traders chase breakouts. Smart money plans for the pullback to mitigation zones. Be patient, wait for confirmation, and strike where big players do — not where the crowd is jumping in.

Conclusion

Mitigation Blocks are not just support/resistance — they are institutional footprints. Learn to spot them, understand the intent behind them, and you’ll start entering where the big boys load up.

Have you ever traded mitigation blocks before? Share your experience in the comments!

BULLISH VIEW ON SATIAHuge momentum is expected in SATIA. Keep it on your watchlist.

Be sure to buy it at an average price. If you buy, please follow risk management & maintain appropriate position sizing.

Disclaimer: This post is for educational purposes and not a recommendation. The analysis posted here is just our view.